FundedFirm offers 1 Step and 2 Step evaluation challenges with an 8% first profit target, a 5% maximum daily drawdown, and a 10% maximum overall loss. The challenges with account balances from $5K to $100K come with a one-time fee starting from $39.

FundedFirm prop firm provides commission-free trading across Forex, Metals, Crypto, and more with no swaps. The prop firm supports payouts in weekly, bi-weekly, or monthly cycles with a minimum requirement of 1% net profit.

FundedFirm Prop Firm; Company Information and Background

FundedFirm is a leading prop firm delivering free-funded forex accounts, fast payouts, and MT5-powered trading conditions. Positioned among the best prop firms for global and Indian traders, it focuses on transparency, high-impact news trading, and trader-first funding models built for long-term growth.

- Free-Funded Trading Opportunities: FundedFirm provides risk-free access to capital through one-step and two-step funded account challenges with profit targets as low as 10%;

- Advanced Trading Infrastructure: Traders operate on MT5 with ultra-fast execution, low spreads, and no commissions, enhancing performance in volatile forex markets;

- News Trading Enabled: Unlike many firms, FundedFirm allows full news trading, giving traders access to high-impact market moves;

- Fast Payouts: Monthly payouts processed within 24 hours, with multiple payout cycles including weekly and bi-weekly options;

- Trader-Centric Rules: No minimum or maximum evaluation days, 100% profit split on top plans, and transparent scaling options.

FundedFirm stands out as a prop firm offering top-tier trading conditions, unrestricted strategies, and rapid payouts. Its commitment to supporting traders with technology, capital, and reliability makes it a strong choice for both new and experienced forex traders seeking funded opportunities.

FundedFirm Table of Specifications

FundedFirm offers a flexible funding model with MT5 execution, 1:100 leverage, weekly payouts, and 100% profit splits. With unlimited challenge time and an 8 percent profit target, the firm provides trader-friendly conditions for both 1-step and 2-step evaluations.

Account Currency | USD |

Minimum Price | $39 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 100% |

Instruments | Forex, Metals, Indices, Energies, and Cryptocurrencies |

Assets | N/A |

Evaluation Steps | 1 Step, 2 Step |

Withdrawal Methods | UPI, Bank Transfer, Crypto |

Maximum Fund Size | $100,000 |

First Profit Target | 8% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | 10% |

Trading Platforms | MT5 |

Commission | $0 |

Trustpilot Score | 2.5 / 5 |

Payout Frequency | From Weekly |

Established Country | United Kingdom |

FundedFirm Pros and Cons

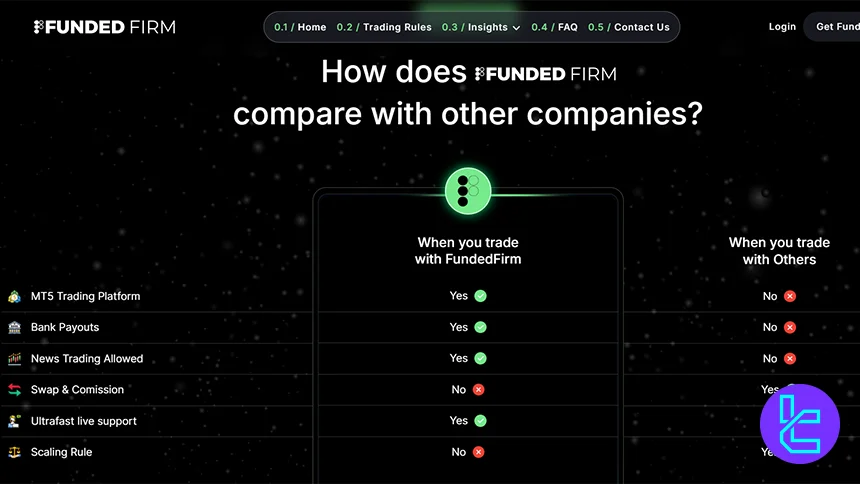

We must mention in this FundedFirm review that the prop firm stands out as a modern platform offering MT5 execution, fast payouts, news-trading permission, and competitive profit splits.

Its trader-centric rules and transparent evaluation model make it appealing, but like any prop program, it has both advantages and limitations.

Pros | Cons |

MT5 access | No scaling plan |

Bank and crypto payout options | Copy trading restrictions |

News trading allowed | No instant funded account |

Ultra-fast live support | Lack of transparency about the firm’s background and its management team |

Zero swaps and commissions | Limited leverage options (up to 1:100) |

With robust features and flexible trading conditions, FundedFirm delivers a strong value proposition. While lacking some scalability features, its advantages make it a compelling choice for traders prioritizing payouts, MT5 access, and transparency.

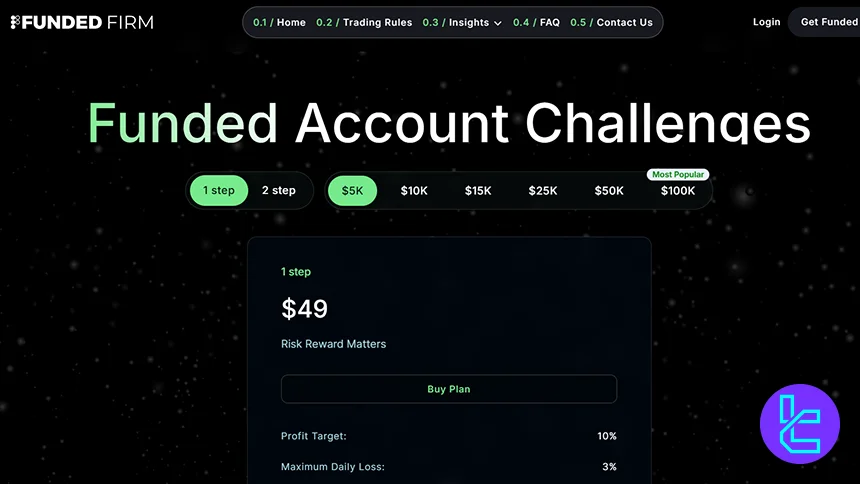

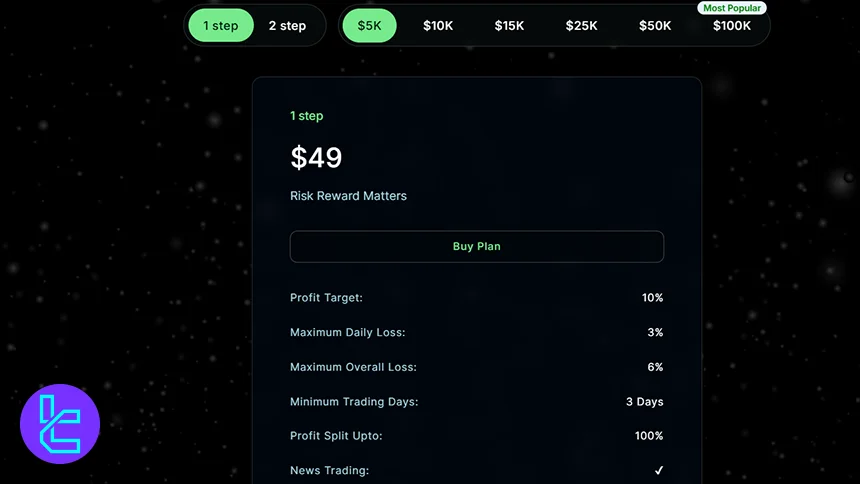

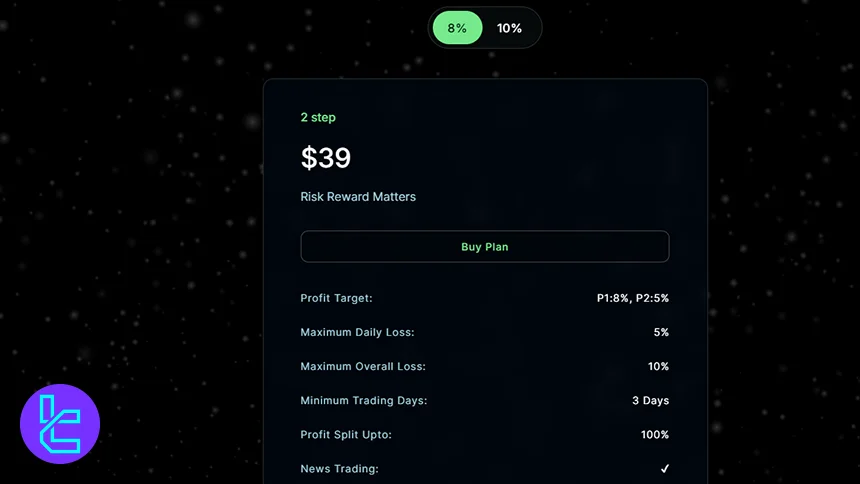

FundedFirm Challenge Pricing

FundedFirm offers one of the most competitive pricing structures in the prop firm industry, giving traders access to funded accounts from $5K to $100K with affordable one-step and two-step evaluation fees.

Account Balance | 1 Step | 2 Step |

$5K | $49 | $39 |

$10K | $89 | $69 |

$15K | $119 | $109 |

$25K | $209 | $189 |

$50K | $319 | $289 |

$100K | $529 | $489 |

The prop firm’s pricing model strikes a balance between accessibility and value, catering to traders at every experience level. With reasonable fees and multiple evaluation paths, it remains a strong choice for cost-efficient funding.

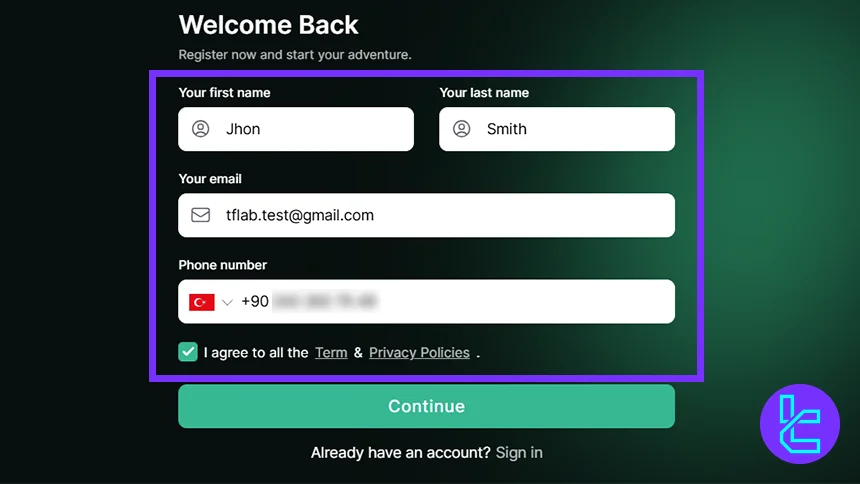

FundedFirm Sign Up and Verification

FundedFirm offers a smooth and modern onboarding experience, allowing traders to register, set up their accounts, and verify essential details within minutes. With streamlined identity checks, fast email verification, and a clean user interface, the platform ensures an efficient start to your funded trading journey.

#1 Accessing the Registration Page

Getting started with FundedFirm begins by visiting the official website, where new users can access the registration form by clicking the “Get Funded” button. The platform’s secure environment ensures every step is protected and user-friendly.

#2 Fill Out the Application Form

The application form collects essential personal information to establish your user profile. FundedFirm keeps this step simple, asking only for basic details required to create and manage your funded account, including:

- First name

- Last name

- Phone number

At the end, accept the Terms and Privacy Policy to proceed.

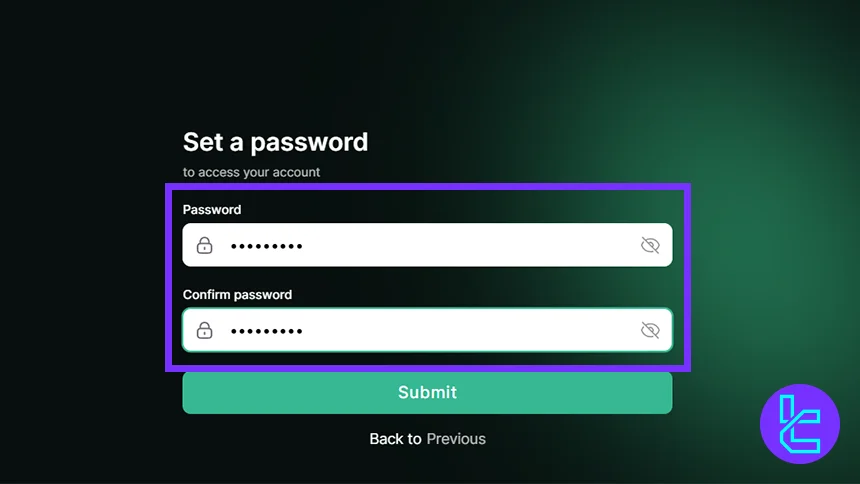

#3 Set a Password

After submitting your details, you'll be prompted to create a secure password for your account. FundedFirm prioritises safety by encouraging strong login credentials to protect your trading data and payout information.

- Choose a strong password with both letters and numbers;

- Re-enter the password for confirmation;

- Submit the form to finalize your login credentials;

- Passwords can be updated later inside the user dashboard.

#4 Verify Your Email Address

Email verification ensures your account is linked to a genuine address for communication, payouts, and security notifications. This step must be completed before accessing the full dashboard.

- Check your inbox for the “Verify Email” message;

- Click the Verify Email button to activate your account;

- If you don’t see the email, check the spam folder;

- Verification must be completed to access dashboard features.

#5 KYC Verification

While FundedFirm does not require documents during a challenge purchase, a basic ID check may be requested before payouts. This ensures withdrawals are securely processed to the correct individual.

- No documents required to buy or start a challenge;

- Basic ID may be requested only before issuing a payout;

- Accepted documents typically include passport, national ID, or driving licence;

- Verification helps prevent fraud and secures user payouts.

FundedFirm Challenge Trading Conditions

FundedFirm offers two streamlined challenge models designed to evaluate traders through transparent rules, flexible time limits, and funding-friendly risk parameters.

Both programs include 1:100 leverage, news trading permissions, and 100% profit share potential, giving Forex market traders an advantage across all evaluation stages.

Feature | 1-Step Challenge | 2-Step Challenge |

Profit Target | 10% | Phase 1: 8% / 10% Phase 2: 5% |

Max Daily Loss | 3% | 5% |

Max Overall Loss | 6% | 10% |

Minimum Trading Days | 3 days | 3 days |

Profit Split | Up to 100% | Up to 100% |

News Trading Allowed | Yes | Yes |

Reward Cycle | Monthly, Bi-Weekly, Weekly | Monthly, Bi-Weekly, Weekly |

FundedFirm 1-Step Challenge Trading Conditions

The 1-Step challenge is designed for traders who prefer a fast, simplified evaluation. With a single phase, tighter risk limits, and a fixed 10% target, it enables skilled traders to qualify quickly while enjoying complete flexibility in trading strategy and timing.

Profit Target | 10% |

Maximum Daily Loss | 3% |

Maximum Overall Loss | 6% |

Minimum Trading Days | 3 Days |

Profit Split | Up to 100% |

News Trading | Allowed |

Reward Cycle | Monthly, Bi-Weekly, Weekly |

Ideal for confident and active traders, the 1-Step model accelerates the journey toward a funded account while maintaining balanced risk controls and unrestricted trading conditions.

FundedFirm 2-Step Challenge Trading Conditions

The 2-Step challenge is structured for traders who prefer a more gradual evaluation with balanced targets across two phases. It offers generous drawdown limits, full news-trading access, and top-tier profit split scaling opportunities after consistency is demonstrated.

Profit Target | Phase 1: 8% or 10% Phase 2: 5% |

Maximum Daily Loss | 5% |

Maximum Overall Loss | 10% |

Minimum Trading Days | 3 Days |

Profit Split | Up to 100% |

News Trading | Allowed |

Reward Cycle | Monthly, Bi-Weekly, Weekly |

The 2-Step Challenge is ideal for traders who prefer realistic growth conditions, smoother evaluation progression, and wide risk management while working toward long-term funded performance.

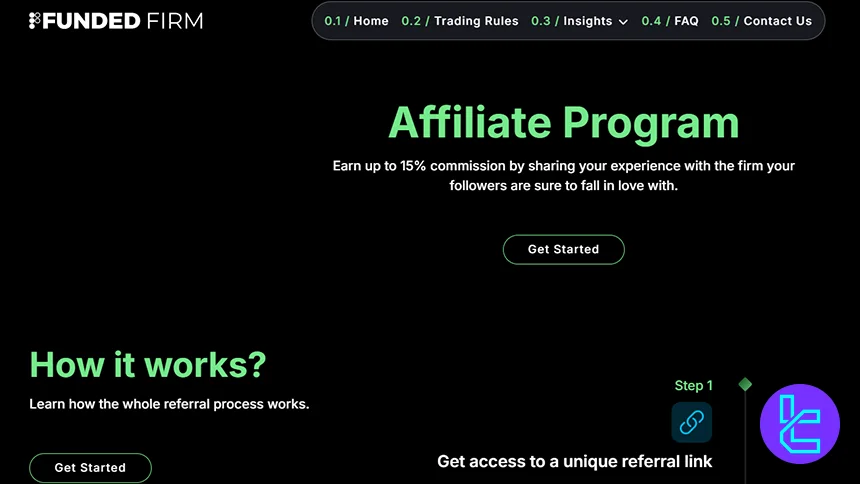

FundedFirm Prop Firm Promotions

FundedFirm currently does not offer any active promotional campaigns or discount-based programs. Instead, its primary promotional opportunity is the Affiliate Program, which rewards traders and content creators with recurring commissions. This setup allows users to earn while promoting a trusted prop firm with strong credibility and consistent payouts.

- Earn up to 15% commission on every user’s first funded account purchase made through your referral link;

- Receive a unique tracking link after purchasing any challenge within the FundedFirm app;

- Share your trading experience on platforms such as X, YouTube, TikTok, Telegram, or blogs;

- Track conversions directly inside the Affiliate Dashboard, offering real-time insights;

- Withdraw earnings once your balance reaches $100, ensuring quick access to your commissions.

FundedFirm Prop Firm Rules

We must explore the prop firm’s rules in this FundedFirm review. The platform maintains a clear and trader-friendly rulebook designed to protect account integrity, maintain fair conditions, and support consistent trading performance.

With strict IP security, transparent payout requirements, and flexible conditions such as allowed news trading, the firm balances trader freedom with professional standards.

- VPN/VPS & IP Consistency: FundedFirm requires a stable IP region from purchase to payout. Any major IP change triggers verification to prevent unauthorized access;

- Use of Expert Advisors (EAs): Automated systems are not allowed on funded accounts to ensure genuine trader skill and manual strategy consistency;

- Hedging Restrictions: Opposite positions on the same instrument simultaneously are prohibited, ensuring clarity in market bias and preventing conflicted trade structures;

- Martingale & Arbitrage Conduct: While not explicitly listed, all forms of gambling behavior are banned to prevent high-risk, exploitative patterns;

- News Trading Freedom: All forms of news trading are fully allowed, empowering traders to capitalize on volatility around macro events;

- Payout Conditions: Traders must generate a minimum 1% net profit and can choose monthly, biweekly, or weekly payout cycles with 100%, 80%, or 60% splits, respectively.

VPN/VPS Usage (IP Rule)

A consistent IP region is required throughout all phases to maintain account security and verify that the approved trader is the one operating the account.

- IP region must remain unchanged across challenge, evaluation, and funded stages;

- Significant IP changes lead to verification requests;

- Inform support before traveling to avoid compliance issues.

Use of Expert Advisors (EAs)

FundedFirm prioritizes manual trading; therefore, EAs and automated bots are prohibited on funded accounts to ensure skill-based performance.

- No automated trading tools allowed;

- All trades must be executed manually;

- Designed to ensure authentic trader performance.

Hedging Policies

FundedFirm restricts hedging by prohibiting opposite trades on the same instrument, ensuring traders maintain directionally consistent strategies.

- No opening buy and sell on the same pair simultaneously;

- Removes artificial neutral exposure;

- Traders must maintain a clear directional bias.

Martingale and Arbitrage Strategies

Although not individually listed, all gambling-like behaviors, including martingale and certain arbitrage strategies, are strictly forbidden.

- Martingale-style doubling is not allowed;

- Arbitrage exploiting price inefficiencies is restricted;

- Risky or exploitative behavior leads to violations.

News Trading Rules

FundedFirm provides full freedom to trade major economic events, acknowledging that volatility is part of market opportunity.

- All news events are tradable;

- Traders can react to macro releases, rate decisions, and market shocks;

- No news trading restrictions during high-impact volatility.

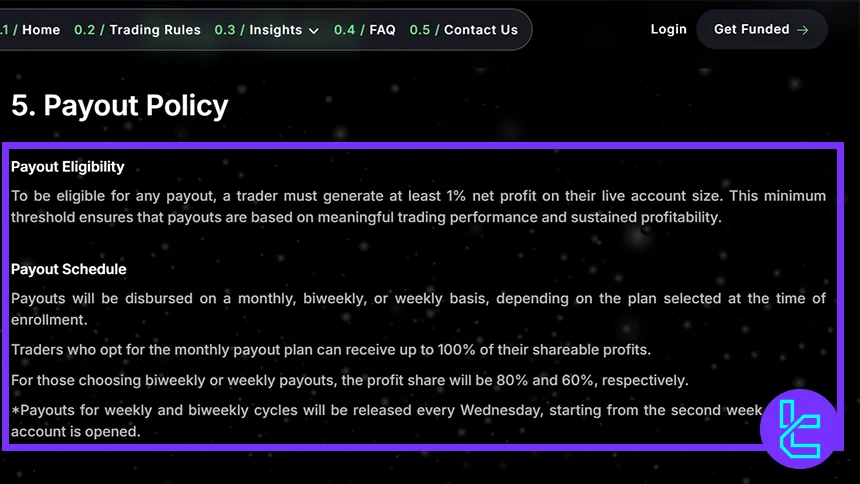

Payout Rules

FundedFirm offers flexible payout cycles, rewarding profitability with industry-leading conditions and fast disbursement schedules.

- Minimum requirement: 1% net profit

- Monthly payout: 100% share

- Bi-Weekly payout: 80% share

- Weekly payout: 60% share

- Weekly/Biweekly payouts release date: Every Wednesday

FundedFirm Prop Firm Trading Platform

FundedFirm operates exclusively on the powerful MetaTrader 5 (MT5) platform, offering traders fast execution speeds, advanced analytical tools, and access to multi-asset markets. MT5’s stability and modern trading environment make it the ideal choice for professional proprietary trading.

- Advanced Charting Tools: MT5 provides multi-timeframe analysis, built-in indicators, drawing tools, and customizable templates for precision trading;

- Ultra-Fast Trade Execution: Optimized order routing ensures minimal delays, especially during volatile market conditions;

- Multi-Device Access: Trade seamlessly on desktop, mobile, or web, with identical account synchronization across all devices;

- Wide Instrument Support: Execute trades across Forex, metals, indices, energies, and cryptocurrencies within a single interface;

- Secure Account Access: Login credentials are issued immediately after signup, ensuring a smooth and secure onboarding experience.

TradingFinder has developed a wide range of MT5 indicators that you can use for free.

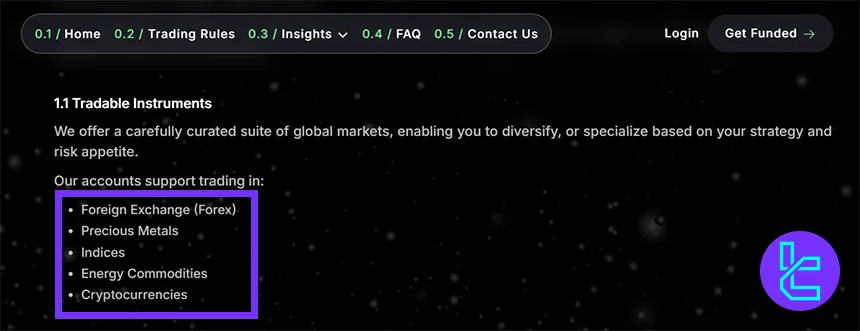

FundedFirm Trading Instruments

The prop firm provides traders with access to a multi-asset environment designed for flexibility and strategic diversity. With coverage across Forex, metals, indices, energies, and cryptocurrencies, traders can capitalize on global market movements with a funded account.

- Forex: Trade major, minor, and exotic currency pairs with competitive spreads and fast execution on MT5;

- Metals: Access popular precious metals like gold and silver, ideal for hedging and volatility-based strategies;

- Indices: Trade leading global indices such as US30, NAS100, and UK100 to capture broad market trends;

- Energies: Participate in energy markets including WTI and Brent crude, benefiting from strong directional movement;

- Cryptocurrencies: Explore digital asset opportunities with pairs like BTCUSD and ETHUSD supported on MT5.

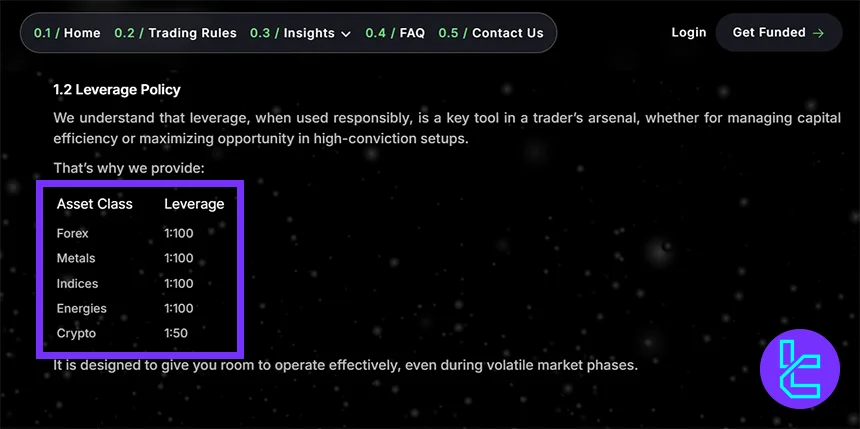

FundedFirm Leverage Offerings

FundedFirm provides traders with high-flexibility leverage designed to enhance capital efficiency and support a variety of trading strategies. With leverages reaching up to 1:100 across major asset classes, traders can optimize position sizing while maintaining disciplined risk management.

Asset Class | Maximum Leverage |

Forex | 1:100 |

Metals | 1:100 |

Energies | 1:100 |

Indices | 1:100 |

Cryptocurrencies | 1:50 |

The prop firm’s leverage model delivers a powerful yet responsible framework that allows traders to operate confidently, even in fast-moving markets.

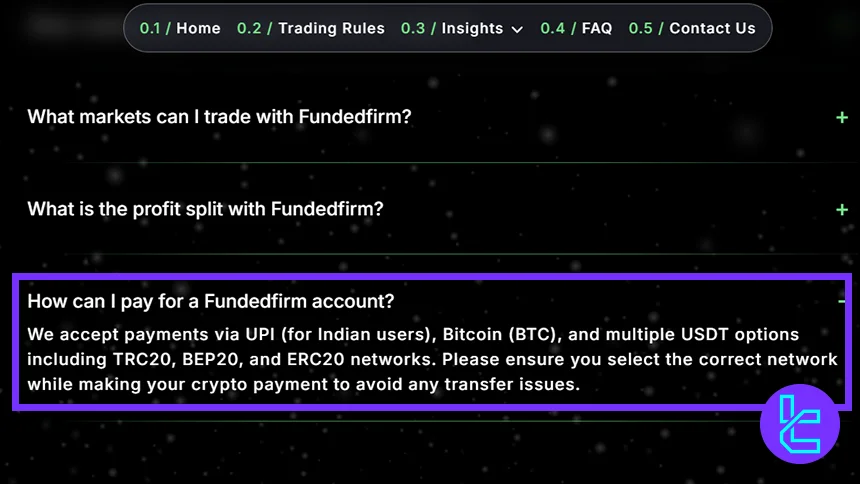

FundedFirm Payment and Payout Structure

FundedFirm offers flexible, global-friendly payment methods and a transparent payout system designed to support traders at every stage. With crypto-based deposits and up to 100% profit share, traders benefit from fast access to funds and industry-leading conditions.

- Multiple Payment Methods: The firm accepts UPI for Indian traders, Bitcoin, and USDT across TRC20, BEP20, and ERC20 networks. Choosing the correct blockchain network ensures smooth and instant deposits;

- Payout Eligibility and Frequency: Traders must generate at least 1% net profit to request a payout. Depending on the chosen plan, payouts can be monthly, biweekly, or weekly. Monthly payouts pay up to 100% profits, biweekly 80%, and weekly 60%;

- Zero Payout Fees: FundedFirm charges no internal withdrawal fees. However, external payment providers may apply conversion or processing costs;

- Profit Split Structure: Traders begin with a 90% profit share, which can scale to 95% and then 100% based on sustained performance;

- Tax Responsibility: FundedFirm does not deduct or file taxes. Traders must comply independently with their local tax regulations.

With seamless deposit options, fast and flexible payouts, and a top-tier profit split model, FundedFirm provides one of the most trader-centric payment systems in the prop firm industry.

FundedFirm Trading Costs

FundedFirm offers a highly cost-efficient trading environment designed to maximize trader profitability. With zero-swap conditions, no commissions, and tight spreads, the platform ensures optimal performance for both short-term and long-term strategies across all supported instruments.

- Zero Swap Fees: Traders can hold positions overnight or through weekends without paying any swap charges, making long-term and swing strategies significantly more cost-effective;

- No Commissions: FundedFirm removes commission fees entirely, allowing traders to focus on pure market performance rather than fee deductions;

- Low Spreads: Ultra-tight spreads enhance precision for scalpers, day traders, and news traders, reducing the cost of frequent entries and exits;

- Fast Execution: Lightning-fast order execution minimizes slippage and maximizes efficiency during volatile market conditions or high-impact news.

FundedFirm Educational Resources

FundedFirm provides a comprehensive educational hubs in the prop-firm industry, featuring weekly market forecasts, in-depth trading guides, real trader success stories, and advanced tool lists. With 97,000+ global traders relying on these resources, the platform offers structured learning for every skill level.

- Weekly Forex Forecasts: Detailed macro analysis, currency-pair outlooks, and market behavior insights for traders preparing their setups;

- Beginner to Advanced Trading Guides: Covers day trading, indicators, slippage, prop-firm strategies, and technical/fundamental education;

- Success Stories & Case Studies: Real payouts and trader journeys (e.g., $12,288 milestone, $9,800 payout story, IIT BHU comeback) offering inspiration and practical lessons;

- Strategy-Focused Resources: XAUUSD strategies, scalping guides, emotional control techniques, and risk-management frameworks;

- Tools & Lists for Traders: Comprehensive lists like “Top 10 Signal Providers,” “Best Commodity Pairs,” and “Best Prop Firms for Indian Traders”;

- Press & Media Coverage: Featured in major outlets including ABP News, Mid Day, Mint, The Hindu, News Stack, and Digital Journal, reinforcing FundedFirm’s industry credibility.

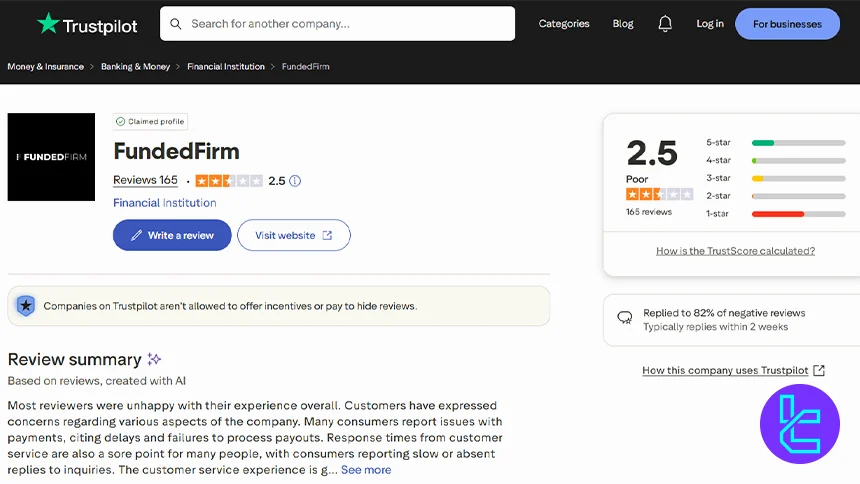

FundedFirm Trust Scores

The FundedFirm Trustpilot profile currently holds a 2.5 TrustScore on based on 165 reviews, reflecting a mixed customer experience. While the firm actively responds to 82% of negative reviews, recurring concerns around payouts and support responsiveness influence its overall rating.

- TrustScore 2.5/5 (Poor): Indicates inconsistent user satisfaction across payout handling, communication, and platform transparency;

- 165 Total Reviews: A moderate volume of feedback providing insight into real trader experiences;

- Primary Complaints: Many users report delays in processing payouts, slow customer service responses, and unresolved inquiries;

- Positive Notes: The company responds to a large share of negative reviews, typically within two weeks, showing ongoing efforts to improve;

- Customer Support Mentioned Frequently: Both in praise for eventual follow-ups and criticism for long waiting times.

FundedFirm Customer Support

We must discuss the support channels in this FundedFirm review. The prop firm provides assistance to its clients via a live chat feature, email, and a WhatsApp number.

Support Method | Availability |

Live Chat | Yes (On the official website) |

Yes (support@fundedfirm.com) | |

Phone Call | Yes (+44 7393 926974) |

Discord | No |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

Whats App | Yes (+44 7393 926974) |

Messenger | No |

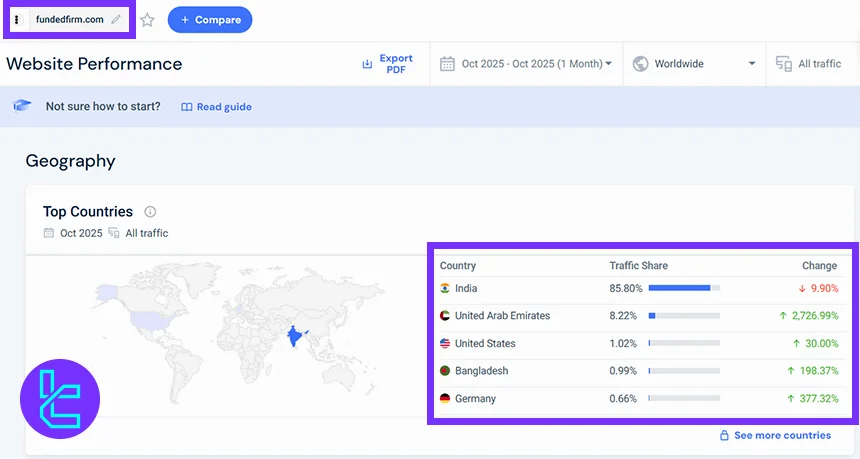

FundedFirm Prop Firm User Base

FundedFirm’s audience is heavily concentrated in South Asia and the Middle East, with India contributing 85.80% of total website traffic in October 2025. Emerging growth markets such as the UAE, Bangladesh, and Germany show rapid expansion, signaling rising global adoption.

- India – 85.80% (-9.90%): The firm’s dominant user base, driven by strong prop trading demand and UPI-supported payments;

- United Arab Emirates – 8.22% (+2,726.99%): Explosive growth indicates rising interest from professional traders and expats;

- United States – 1.02% (+30%): A steadily expanding segment, reflecting broader global reach;

- Bangladesh – 0.99% (+198.37%): Fast-growing community of beginner and intermediate traders;

- Germany – 0.66% (+377.32%): Noticeable traction in the European market, especially among tech-savvy traders.

With strong traction in India and accelerating growth across multiple continents, FundedFirm is quickly evolving into a globally recognized prop trading destination. The firm’s expanding geographic footprint highlights increasing trust and adoption among international traders.

FundedFirm in Social Media

FundedFirm maintains a strong digital presence across major social platforms, engaging over tens of thousands of traders worldwide. Through Instagram, LinkedIn, and YouTube, the firm delivers trading insights, community updates, payout highlights, and educational content that strengthen brand trust and visibility.

Social Media | Members/Subscribers |

67500 | |

19 | |

87 |

FundedFirm in Comparison with Other Prop Firms

FundedFirm stands among the top prop firms by offering unlimited time, up to 100% profit splits, and a high-leverage MT5-based environment. The table below compares its core specifications with Maven Trading, Alpha Capital Group, and BrightFunded across key parameters traders evaluate before choosing a prop firm.

Parameters | FundedFirm Prop Firm | |||

Minimum Challenge Price | $39 | $13 | $97 | €55 |

Maximum Fund Size | $100,000 | $100,000 | $200,000 | Infinite |

Evaluation steps | 1 Step, 2 Step | Instant, 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 2-Step |

Profit Share | Up to 100% | 80% | 80% | 100% |

Max Daily Drawdown | 5% | 4% | 5% | 5% |

Max Drawdown | 10% | 8% | 10% | 8% |

First Profit Target | 8% | 8% | 5% | 10% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:75 | 1:100 | 1:100 |

Payout Frequency | Monthly, Bi-Weekly, Weekly | 10 Days | 14 Days | 14 Days |

Number of Trading Assets | N/A | 400+ | 40 | 150+ |

Trading Platforms | MT5 | Match-Trader, cTrader, MetaTrader 5 | MetaTrader 5, cTrader, Dxtrade | cTrader, DXTrade |

Conclusion and Expert Suggestion

FundedFirm provides funded accounts up to $100K with fees ranging from $39 to $529, supporting various payment methods, including Bitcoin, USDT, and UPI. While the prop firm allows news trading, it doesn’t accept hedging, copy trading, martingale, or arbitrage strategies.

FundedFirm prop firm has a poor Trustpilot score of 2.5 out of 5, and it doesn’t offer a scaling program. However, users can purchase unlimited accounts under one ID number. The company’s clients are mainly from India with an 85.80% share.