Instant Funding is a British prop firm serving to more than 25,000 traders. This prop has received 8 industry awards, including "Fastest Growing Firm" in 2023 from "Global Brand Magazine". Also, it has a high score of4.6 out of 5 on Trustpilot. The maximum fund size of Instant Funding is $1.28M and you can achieve it via 3 challenges [Instant Funding, One-Phase, and Two-Phase]

Instant Funding Prop Firm Company Overview

Instant Funding is a trading firm with a short history alongside a good reputation, serving over 25,000 traders across more than 180 countries. What makes them stand out is their commitment to providing traders with immediate access to capital, allowing them to start trading almost instantly. The company boasts a team of 50 professionals, bringing expertise from top firms in the industry. Instant Funding Features:

- Launched in 2021

- No license from any regulators

- 8 Industry awards as of now

- Over 25000 users worldwide

Instant Funding CEO

Lewis Mansbridge has been leading Instant Funding as CEO since July 2020, bringing more than 5 years of executive experience in the proprietary trading and funding industry. Under his leadership, Instant Funding has established itself in the London financial hub, offering traders rapid access to capital and efficient payout solutions.

With a strong focus on innovation and transparency, Mansbridge has positioned Instant Funding as a trusted prop trading firm, helping thousands of traders scale their strategies without personal risk. His role emphasizes creating growth opportunities for traders while ensuring Instant Funding maintains a competitive edge in the global market.

Here's a link for you to check out Lewis Mansbridge's LinkedIn for more details about the Instant Funding CEO.

Specifications Summary

To give you an overview of Instant Funding, let's break down its key specifications:

Account Currency | USD |

Minimum Price | $44 |

Maximum Leverage | Up To 1:100 |

Maximum Profit Split | Up to 90% Through Scaled Profit Split |

Instruments | Forex, Commodities, Indices, Crypto |

Assets | 40+ |

Evaluation Steps | 1-Phase, 2-Phase, Instant |

Withdrawal Methods | Bank Transfer And Crypto Via Rise Platform |

Maximum Fund Size | $200000 |

First Profit Target | From 10% |

Max. Daily Loss | Up To 5% |

Challenge Time Limit | None |

News Trading | Prohibited For Pairs Related To The News |

Maximum Total Drawdown | Up To 10% |

Trading Platforms | Ctrader, Dxtrade, Platform 5 |

Commission Per Round Lot | From $1 |

Trust Pilot Score | 4.6 Out Of 5 |

Payout Frequency | On-demand |

Established Country | United Kingdom |

Established Year | 2021 |

Pros & Cons

Like any trading solution, Instant Funding has its strengths and potential drawbacks. Let's impartially examine these to help you see if this broker's worth it:

Pros | Cons |

Instant access to trading capital | Holding positions on weekends not available on instant funding evaluation |

Multiple account types and sizes to choose from | Limited payment method |

High profit split (up to 90%) | News trading is prohibited on related trading pairs. |

Transparent payout process | - |

Wide range of tradable instruments | - |

Various evaluation models | - |

Funding & Price

There are usually different funding levels and models for prop firms. Instant Funding prop is no different and offers a variety of funding options. Here's a breakdown of their offerings:

Account Size | Instant Funding | One-Phase | Two-Phase |

$625 | $44 | - | - |

$1250 | $79 | - | - |

$2500 | $120 | - | - |

$5000 | $225 | $49 | $49 |

$10000 | $440 | $89 | $89 |

$20000 | $870 | - | - |

$25000 | - | $189 | $199 |

$40000 | $1735 | - | - |

$50000 | - | $289 | $299 |

$80000 | $3460 | - | - |

$100000 | - | $489 | $549 |

$200000 | - | $977 | $1049 |

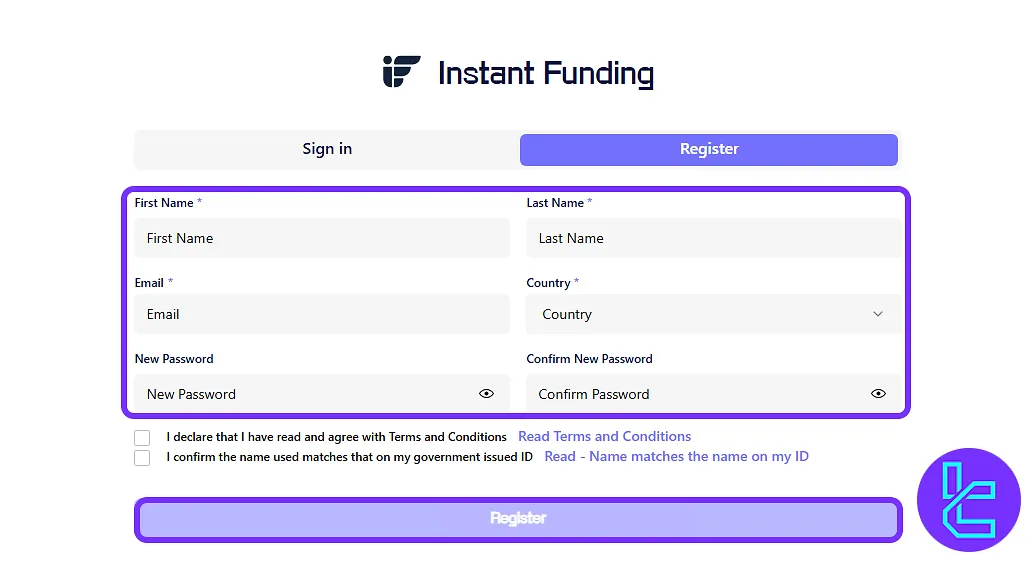

Firm Registration & Verification

To open an account and begin trading in the Instant Funding prop firm, follow the steps below. Instant Funding registration:

#1 Access the Website

Visit the Instant Funding homepage and click on “Start Trading” to begin.

#2 Fill in Personal Details

Complete the registration form with yourfirst and last name, email address, residential country, and choose a strong password. Agree to the terms and click “Register”.

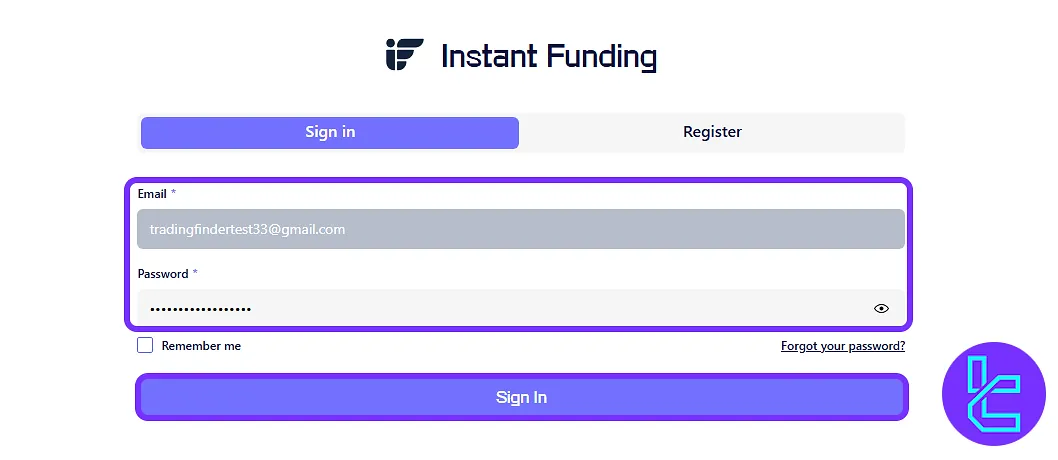

#3 Sign In to Access the Dashboard

Use your registered email and password to log in and instantly access your trading dashboard, with no verification delays.

For withdrawals, traders must provide Know Your Customer (KYC) documents, including proof of identity and proof of address.

Evaluation Steps

Each challenge has its profit target, maximum drawdown, and profit split, designed to encourage traders to employ risk-managed strategies and earn profits in the long term. Instant Funding evaluation:

Parameters | Instant Funding | One-Phase | Two-Phase (First Step) | Two-Phase (Second Step) |

Profit Target | - | 10% | 10% | 5% |

Maximum Drawdown Limit | 10% | 10% | 10% | 10% |

Maximum Daily Drawdown | - | 3% | 5% | 5% |

Profit Split | 80% | Up to 90% | Up to 90% | Up to 90% |

Minimum Trading Days | - | 3 Days | 3 Days | - |

Leverage | Currencies 1:100 Commodities 1:20 Indices 1:20 Crypto 1:2 | Currencies 1:100 Commodities 1:20 Indices 1:20 Crypto 1:2 | Currencies 1:100 Commodities 1:20 Indices 1:20 Crypto 1:2 | Currencies 1:100 Commodities 1:20 Indices 1:20 Crypto 1:2 |

Instant Funding offers two distinct scaling models, depending on the program type, both built to reward consistent profitability with automatic capital increases.

Instant Funding Evaluations

The Instant Funding Evaluation offers traders a straightforward pathway to capital without strict profit targets or minimum trading days.

Payouts are available 14 days after the first trade and continue on a weekly basis, giving traders consistent cash flow.

Parameters | Instant Funding Evaluations |

Profit Target | - |

Maximum Drawdown Limit | 10% |

Maximum Daily Drawdown | - |

Minimum Trading Days | No Minimum Requirement |

Instant Funding One-Phase Evaluation

The One-Phase Evaluation at Instant Funding is tailored for traders who want direct access to funded accounts with flexible conditions. Payouts are processed on demand, allowing traders to withdraw profits anytime.

To pass, traders must hit a 10% profit target while managing a 3% daily drawdown and an 8% max drawdown.

Parameters | Instant Funding Evaluations |

Profit Target Phase 1 | 10% |

Maximum Drawdown Limit | 10% |

Maximum Daily Drawdown | 3% |

Minimum Trading Days | 3 |

Instant Funding Two-Phase Evaluation

The Two-Phase Evaluation at Instant Funding is built for traders who want a structured challenge with realistic targets and growth potential.

Payouts are available on demand, ensuring fast access to profits. Traders must achieve 8% in phase one and 5% in phase two, while staying within a 5% daily drawdown and a 10% max drawdown.

Parameters | Instant Funding Evaluations |

Profit Target Phase 1 | 10% |

Profit Target Phase 2 | 5% |

Maximum Drawdown Limit | 10% |

Maximum Daily Drawdown | 5% |

Minimum Trading Days | 3 |

Bonuses and Discounts

Instant Funding occasionally offers promotions similar to those of other brokers. However, at the time of writing this article, it seems like there are no bonuses available on the website. However, you can check their webpage and official social media channels to get those promo codes before everyone else.

Here are some coupon codes for use on the firm. Examine them and see if they still work:

- FIRST30: 30% discount on trading fees

- BESTSPLIT: 20% discount with 90% profit split

Instant Funding Rules

The Instant Funding rules encourage traders to manage their risk and only use unrestricted strategies to earn profits on funded accounts.

- VPN and VPS: No specific information provided regarding VPN or VPS usage;

- Hedging: Simultaneously opening long and short positions on the same market is allowed, but taking opposite positions on multiple accounts is prohibited;

- Expert Advisors: Publicly available EAs, algorithms, or bots are not allowed;

- Gambeling and risk strategies: The platform prohibits excessive risk-taking and speculative strategies that could result in significant losses;

- News trading: Trades executed within a 4-minute window before or after a major news event are restricted;

- Payout Rules: First withdrawal 14 days after your initial trade, then every 7 days after your next trade; One-/Two-Phase: use On-Demand Payouts whenever eligible; Processing time: within 48 business hours (+1 business day on weekends/UK bank holidays).

VPN and VPS Rules

No details are currently available about the use of VPNs or VPS for trading on this platform.

Hedging Conditions

Traders have the flexibility to open long and short positions on the same market. However, utilizing multiple accounts to execute opposing positions (known as reverse trading or group hedging) is strictly forbidden.

Such actions will result in the immediate closure of the accounts without a refund. Examples:

- Reverse Trading: Taking a long position on one account and a short position on another for the same asset, such as EURUSD

- Group Hedging: When multiple traders coordinate their positions across accounts to mitigate risk by hedging

These tactics distort the individual evaluation process and are prohibited to ensure fairness across the platform.

Are Expert Advisors Allowed?

The use of third-party EAs, algorithms, or trading bots is prohibited. Traders are encouraged to develop their custom strategies within the platform's guidelines. Only first-party automated tools are supported to maintain fairness among users.

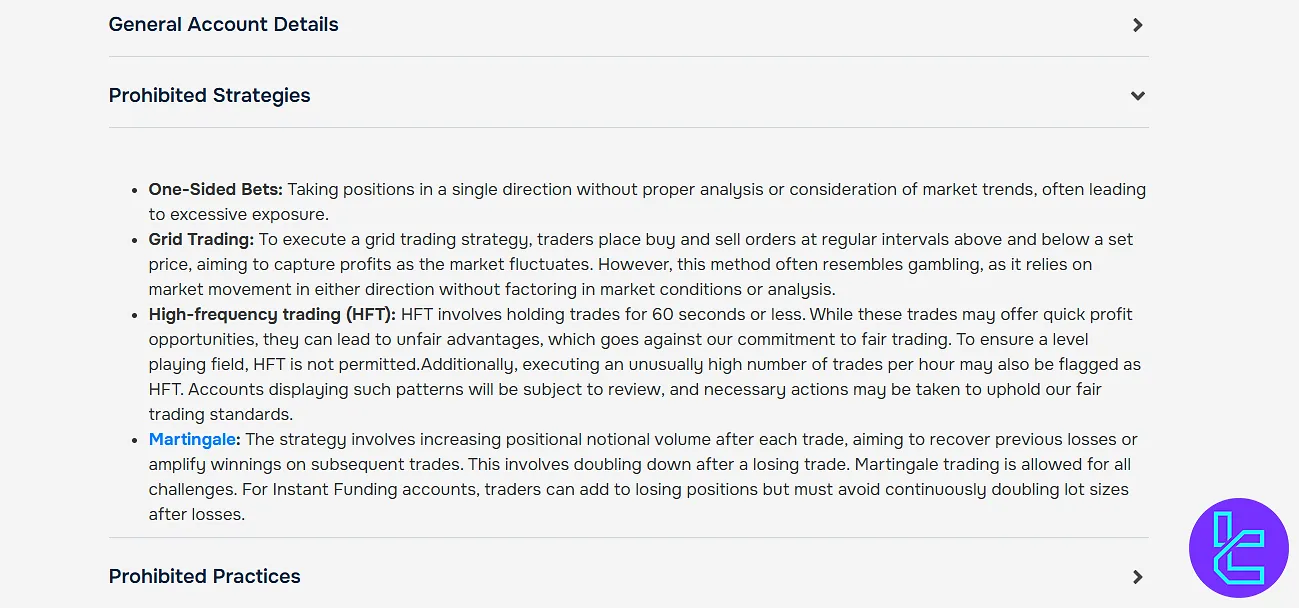

Profibited Strategies

The platform does not support high-risk trading behaviors or speculative approaches. These include:

- One-Sided Bets: Taking positions in a single direction without adequate analysis, often leading to excessive exposure;

- Grid Trading: Relying on price fluctuations by placing buy and sell orders at fixed intervals without considering market conditions;

- Overleveraging: Exceeding the allowable lot size for your account type in one trade, increasing the likelihood of significant risk and potential account wipeout;

- Gambling: Engaging in trades without strategy or analysis, placing random positions or risking large portions of the account;

- Martingale strategy:Doubling down after losses in an attempt to recover or amplify profits. For Instant Funding accounts, traders may add to losing positions, but they should avoid continuously doubling lot sizes after each loss;

Its also worth noting that copy trading is banned in this prop firm.

Prohibited Strategies:

- High-Frequency Trading (HFT): Holding trades for 60 seconds or less, or executing an unusually high number of trades per hour. This leads to unfair advantages and is prohibited on the platform;

- Unethical Practices: Including latency arbitrage, tick scalping, and account arbitrage, all of which are considered unfair practices that manipulate the system.

News Trading Rules

Trading within 4 minutes before or after a major news event is prohibited. Such trades may lead to unpredictable outcomes that do not align with responsible trading practices. This rule applies only to instruments directly impacted by the news event. Trades that are opened before the news event and closed afterward are allowed.

The rule also does not apply to accounts with the major news trading add-on or to the challenge phases (one and two) of any trading challenge.

Full details about the events affected by this rule are available. Examples of such events include major macroeconomic announcements and high-impact news releases (such as Non-Farm Payrolls, CPI, FOMC, and interest rate decisions).

Payout Rules

For Instant Funding accounts, the first withdrawal becomes available 14 days after your initial trade. After that, payouts can be requested every 7 days following your next trade.

For One-Phase and Two-Phase simulated funded accounts, you can use On-Demand Payouts, allowing you to withdraw profits anytime you qualify, the need to wait for fixed dates. Processing Times:

- Standard processing: within 48 business hours.

- Requests made during weekends or UK bank holidays: add one extra business day.

Scaling Plan

Once a Challenge is completed, traders may gradually expand their account size. By generating at least a 10% gain within a 90-day period, the account becomes eligible for a 25% increase based on the original starting balance. Steps:

- Reach a minimum of 10% growth and ensure 90 days have elapsed since activation.

- Submit a scaling request to support@instantfunding.comwith “Scaling Request” in the subject line, including the Account ID and proof of performance.

- After verification, the account balance is adjusted with the additional 25% increment.

This process may be repeated every 90 days until the account doubles the initial starting amount.

Instant Funding Program Scaling

Participants in the Instant Funding program can scale their accounts up to $1,280,000. Each scaling step requires a 10% gain, and upon eligibility, the account can instantly double in size. In this model, only 5% of the initial balance is allocated for scaling, while any remaining profits are retained by the trader. Steps:

- Record at least a 10% profit and close all active trades.

- Use the scaling button in the dashboard once it becomes available.

- The balance is doubled immediately.

Trading Platforms

Instant Funding primarily supports 3 trading platforms unfamiliar to some traders, but good enough for trading:

- DXtrade: accessible through the web, no need for an account number, no mobile application;

- cTrader: A trading platform with access to indicators and other market tools;

- MetaTrader 5: Available for Windows, Android, iOS, and WebTrader.

What Instruments & Symbols Can I Trade?

Instant Funding offers a diverse range of tradable instruments, providing the option to pass challenges with different assets:

- Forex: Major and minor currency pairs

- Commodities: Gold, silver, oil, and more

- Indices: US30, US100, IK100 ASX200, etc.

- Cryptocurrencies: Bitcoin, Ethereum, and Litecoin

This firm offers over 40 trading assets.

Instant Funding Leverage

Instant Funding provides flexible leverage across multiple asset classes, with conditions adjusted for normal trading and during major news events. Standard Leverage:

- Currencies: Up to 1:100

- Commodities: Up to1:20

- Indices: Up to 1:20

- Crypto: Up to 1:2

Leverage with Major News Add-On

- Currencies: Up to 1:30

- Commodities: Up to 1:8

- Indices: Up to1:10

- Crypto: Up to 1:1

This tiered structure allows traders to maintain higher exposure in stable market conditions, while reducing risk during periods of increased volatility triggered by significant economic news.

Payment Methods

For payouts, "Instant Funding" supports only 1 method and it's through Rise. Users need to sign up on this platform in order to use it. The choice limit to only one option might be a big obstacle for many traders. However, they have 2 options for the asset type. Both of these are done via Rise:

- Crypto

- Bank transfer

Commission & Costs

Paying attention to commission and fees on a prop firm is necessary since it could cause additional costs. Here's what you need to know about Instant Funding's fees:

- One-time Account Fee: Varies based on account size and type

- Commissions: Round turn commissions apply, varying by asset class, starting from $1 per lot for cryptocurrencies

- Payout Fees: May apply depending on the chosen payout method

Here are the commissions of various instruments in Raw spread accounts in Instant Funding:

- Forex: $5/lot

- Metals: $2/lot

- Commodities: $2/lot

- Indices: ~$2/lot

- Crypto: $1/lot

Does Instant Funding Offer Vast Educational Resources?

While Instant Funding's primary focus is on providing trading capital, they do offer some educational resources to support their traders:

- Blog Articles: Covering various trading topics and market analysis

- Webinars: Occasional online sessions with trading experts, tutorial videos

- FAQ Section: Comprehensive answers to common trading questions

However, compared to some traditional prop firms, Instant Funding's educational offerings are not as extensive. They prioritize rapid access to capital over comprehensive trader development programs. Traders looking for in-depth educational resources might need to supplement with external sources.

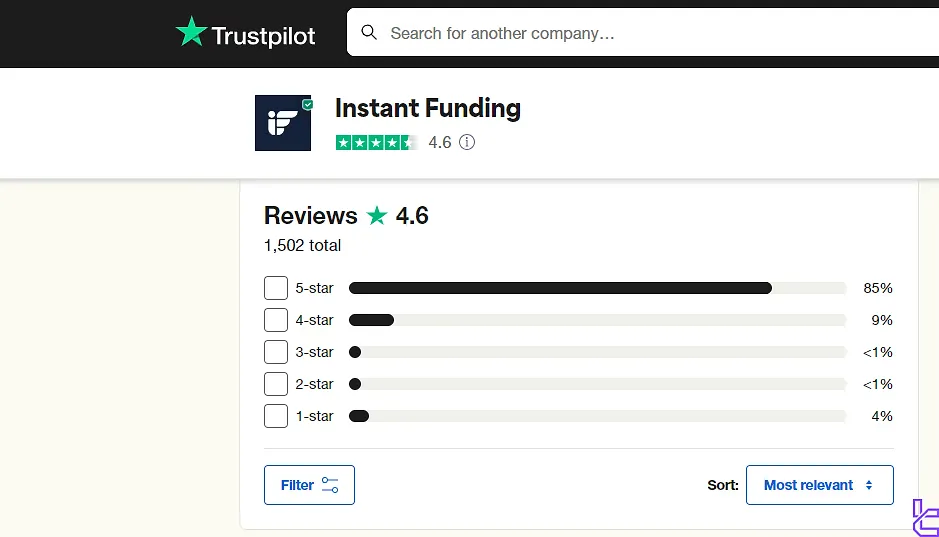

Trust Scores

Trust is paramount in the prop trading industry, and "Instant Funding" has built a solid reputation. In this section, we discuss its score on the Trustpilot platform.

- Users Rating: 4.6 out of 5, over 1,500 reviews

- Around 85% of scores are 5

- About 9% of the ratings are 4

- Less than 1% for each of 3 and 2

- And around 4% of ratings are 1

According to Trustpilot's data, the firm's team responds to negative comments within less than a month. However, in the last 12 months, Instant Funding has only replied to 7 out of 72 negative reviews.

Customer Support

A prop firm without quality customer service is not recommended at all, as it is a vital part of every financial firm and platform.

Instant Funding provides a limited range of channels and ways for contacting support:

Support Method | Availability |

Live Chat | Yes (Available on the Website) |

| support@instantfunding.io | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | Yes |

| No | |

Messenger | No |

Instant Funding Userbase

Since its launch in 2021, Instant Funding has built a strong trader community of 50,000+ active users across more than 180 countries. The largest share of its traffic comes from India (59.36%), followed by Nigeria, the United States, Pakistan, and Morocco—showcasing its truly global reach in prop trading.

Social Media Channels

Staying connected with their trader community is a priority for Instant Funding. They maintain several active pages on social media platforms:

Social Media | Members/Subscribers |

Over 82,000 | |

Over 40,000 | |

Over 19,000 | |

Over 42,000 | |

Over 3,000 | |

Over 20,000 | |

| Over 4,000 |

Comparing Instant Funding with Other Prop Firms

Comparing Instant Funding services with other famous prop firms will help you understand the pros and cons of trading with this platform.

Parameters | Instant Funding Prop Firm | |||

Minimum Challenge Price | $44 | $33 | $50 | $49 |

Maximum Fund Size | $200,000 | $400,000 | $2,000,000 | $1,500,000 |

Evaluation steps | 1-Phase, 2-Phase, Instant | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 90% | 100% | 90% | 90% |

Max Daily Drawdown | 5% | 7% | 4% | 4% |

Max Drawdown | 10% | 14% | 6% | 8% |

First Profit Target | 10% | 6% | 5% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:5 | 1:125 |

Payout Frequency | On-demand | Weekly | Bi-weekly | 14 Days |

Number of Trading Assets | 40+ | 40+ | 100+ | 130 |

Trading Platforms | cTrader, Dxtrade, Platform 5 | MetaTrader 5, Match Trader | Proprietary platform | DXTrade, TradeLocker, cTrader |

Expert Suggestions

Instant Funding process weekly payout and offers a 90% profit split to trade 40+ assets. 3 Trading platforms [MetaTrader 5, DXTrade, cTrader] are available to use in Instant Funding. On the contrary, some strategies, including news trading, are not allowed in this prop.