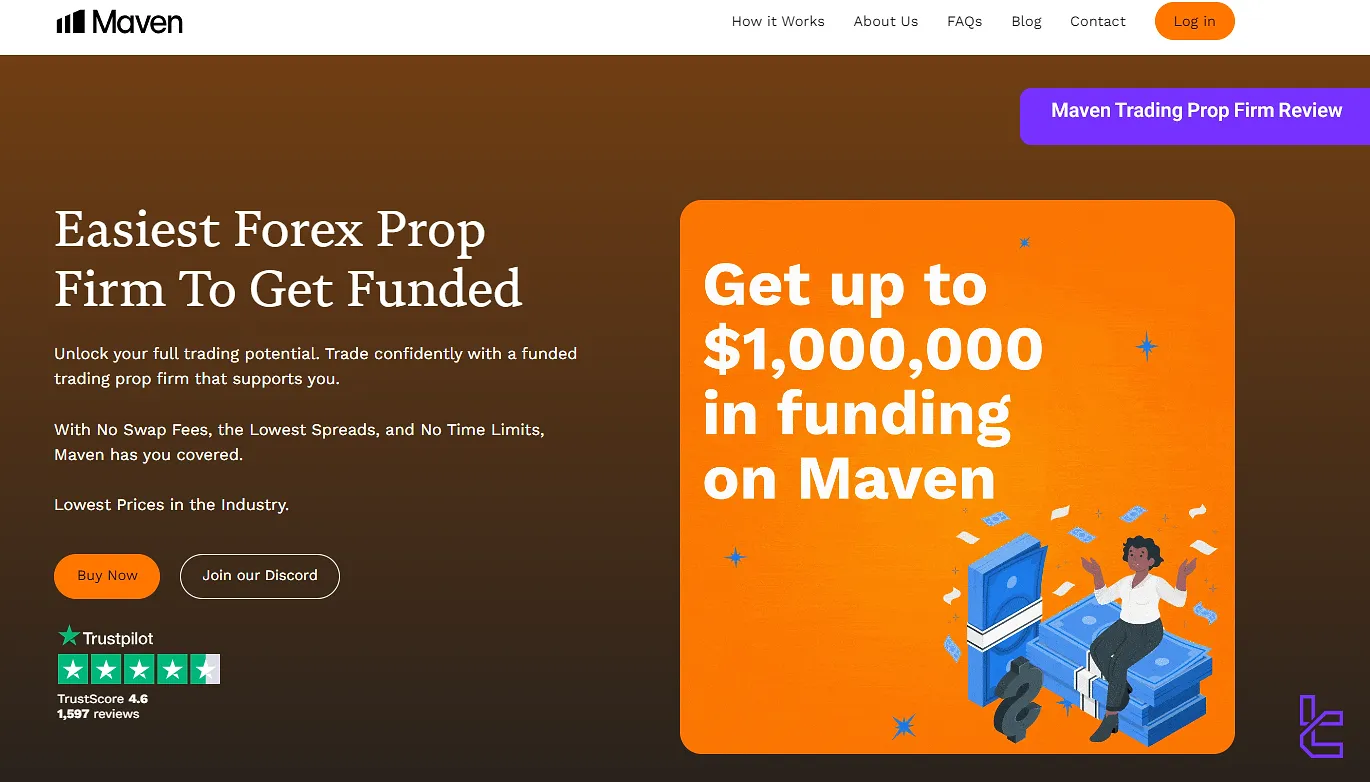

Maven trading prop firm has a high score of 4.6 out of 5 on Trustpilot. They provided $60M funding for more than 5,000 traders through 2 challenges [1-step, 2-step.] This prop firm has no limits on trading time, and the profit split is 85%.

Maven Trading Company Information

Maven Trading is a relatively new player in the prop trading industry, but they've quickly made a name for themselves. Founded in 2022 and Headquartered in Canada, Maven Trading offers a unique proposition for traders looking to prove their skills and gain access to funded accounts. Maven Trading's claimed mission is clear: to empower traders by providing them with the opportunity to trade with significant capital without risking their own money. Maven Trading Overview:

- Established in 2022

- Not regulated by any jurisdiction

- Over 5000 active traders as of now

- $1M payouts in 2023

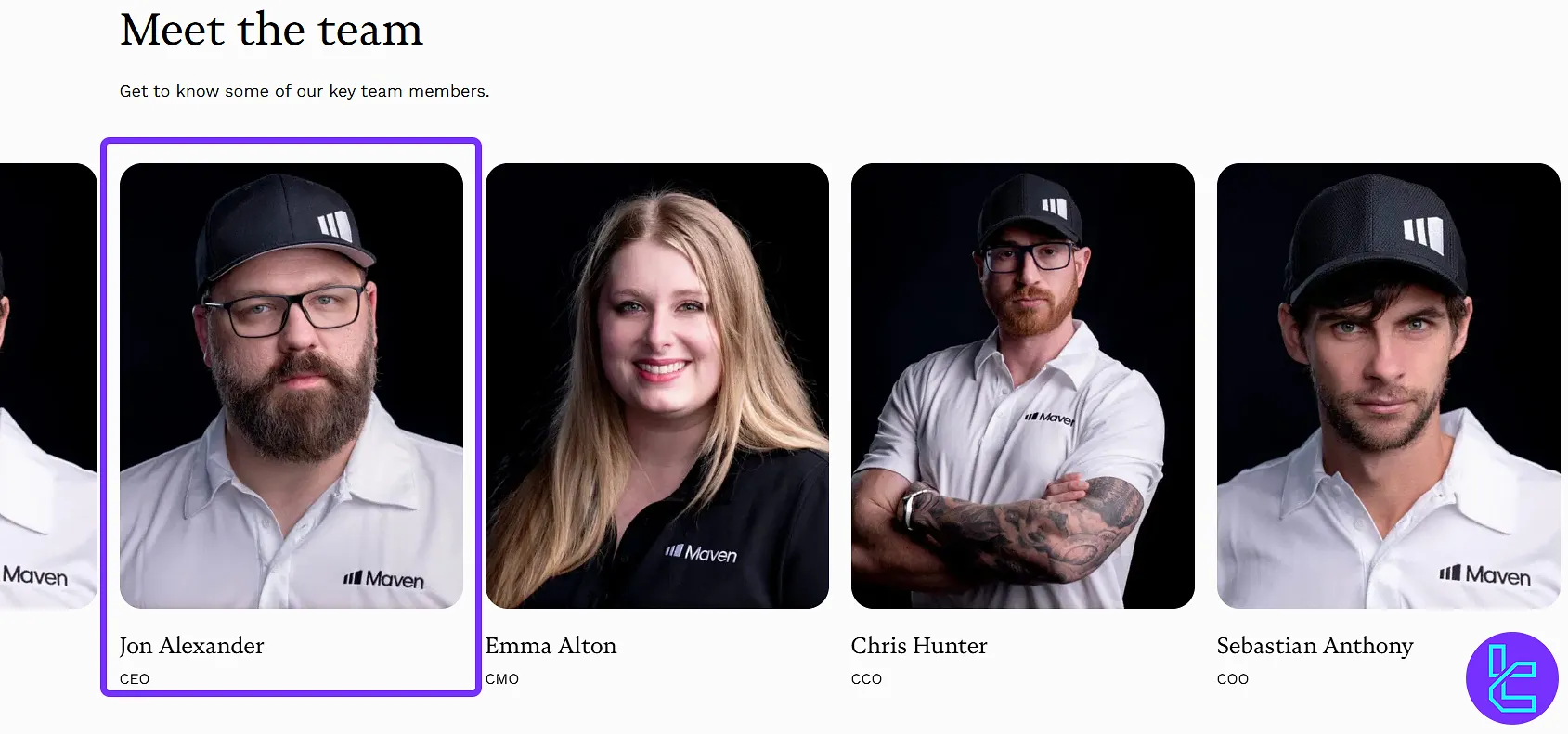

Maven Trading CEO

Jon Alexander is the Founder and CEO of the Maven Trading prop firm. Emma Alton, Sebastian Anthony, and Chris Hunter serve alongside Jon and are the core members of the Maven Trading prop firm. Learn more about the founder of this prop firm by checking Jon Alexander's LinkedIn profile.

Summary of Specifications

To give you a clearer picture of what Maven Trading offers, here's a summary of their key specifications:

Account Currency | USD, EUR |

Minimum Price | $13 |

Maximum Leverage | 1:75 |

Maximum Profit Split | 85% |

Instruments | Forex, Indices, Commodities, ETFs and Crypto |

Assets | +400 |

Evaluation Steps | Instant Funding, 1-step, 2-step, 3-Step, Mini |

Withdrawal Methods | Crypto, bank transfers, credit/debit cards |

Maximum Fund Size | Up to $1M through scaling |

First Profit Target | 8% |

Max. Daily Loss | Up to 4% |

Challenge Time Limit | No limits |

News Trading | Yes (under specific conditions) |

Maximum Total Drawdown | Up to 8% |

Trading Platforms | Match-Trader, cTrader |

Commission Per Round Lot | $4 (Forex), zero (other instruments) |

Trustpilot Score | 4.6/5 |

Payout Frequency | Every 10 business days |

Established Country | Canada |

Established Year | 2022 |

Benefits & Drawbacks

Like any prop trading firm, Maven Trading comes with its own set of advantages and potential drawbacks. Let's break them down:

Pros | Cons |

Low spreads and instant execution, allowing for precise trade entries and exits | Potential trading restrictions |

Flexible account sizes ranging from $2,000 to $100,000 | Limited payment options |

Competitive pricing and a generous 80% min. profit split | Low amount of assets |

No swap fees |

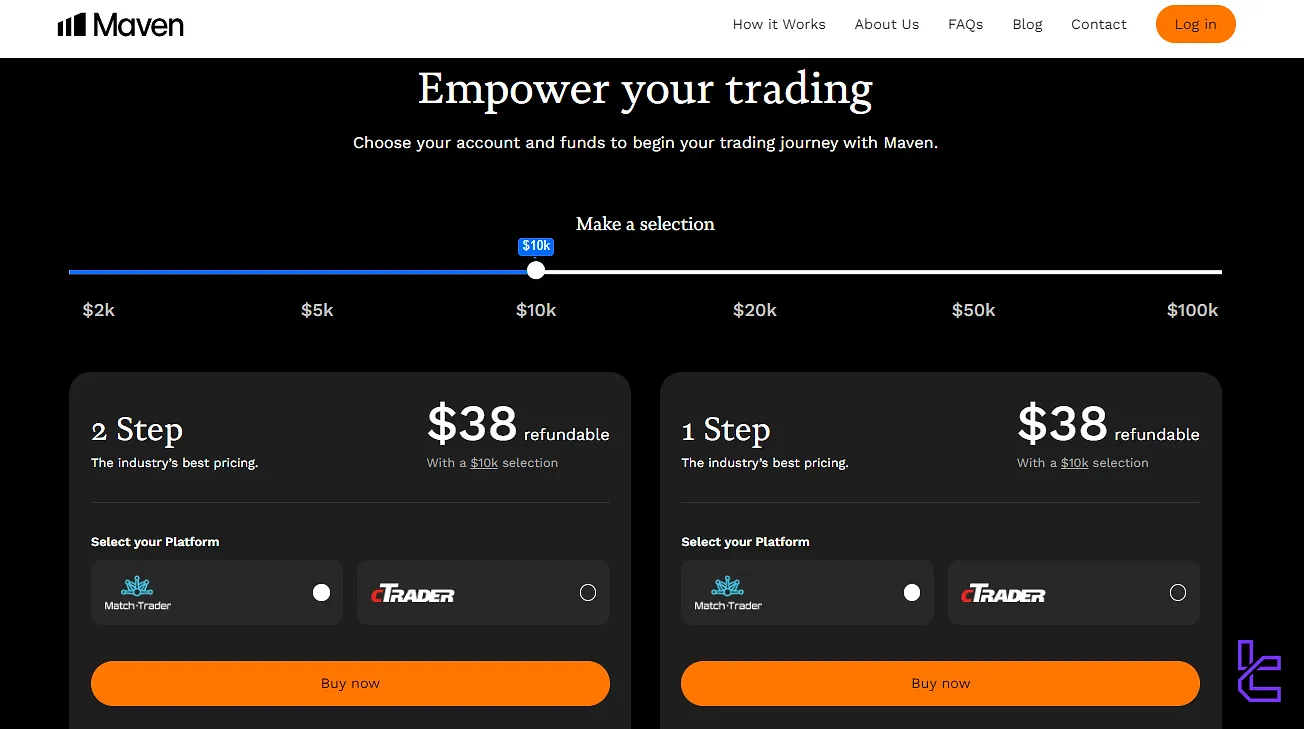

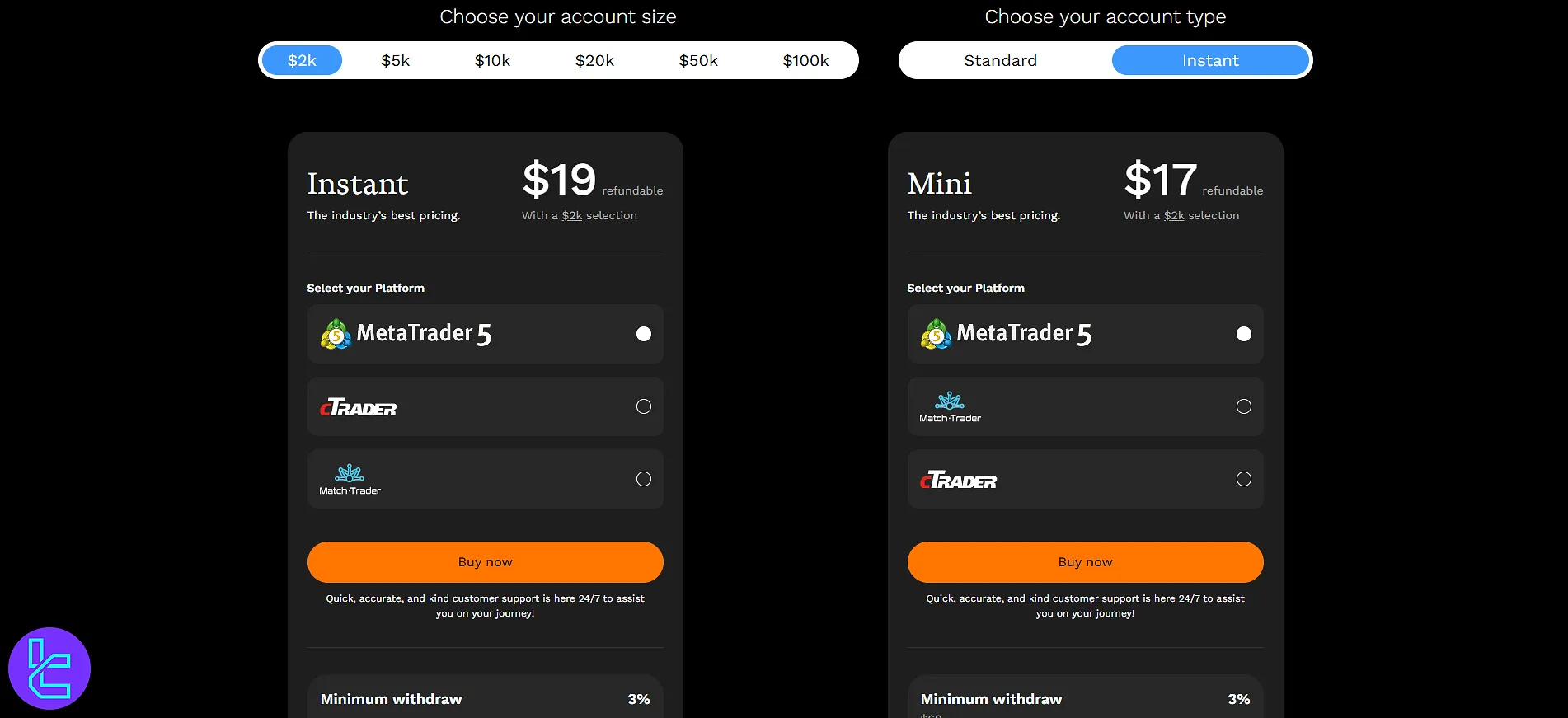

Funding & Price in Maven Trading

Maven Trading Prop Firm offers a wide range of capital acquisition challenges tailored to traders with different budgets.

The prices for Maven Trading challenges are as follows:

Funding Size | Instant | One-Step | Two-Step | 3-Step | Mini |

$2,000 | $19 | $15 | $19 | $13 | $17 |

$5,000 | $29 | $19 | $22 | $17 | $22 |

$10,000 | $58 | $38 | $44 | $34 | $44 |

$20,000 | $116 | $76 | $88 | $68 | $88 |

$50,000 | $290 | $190 | $220 | $170 | $220 |

$100,000 | $549 | $380 | $440 | $299 | $440 |

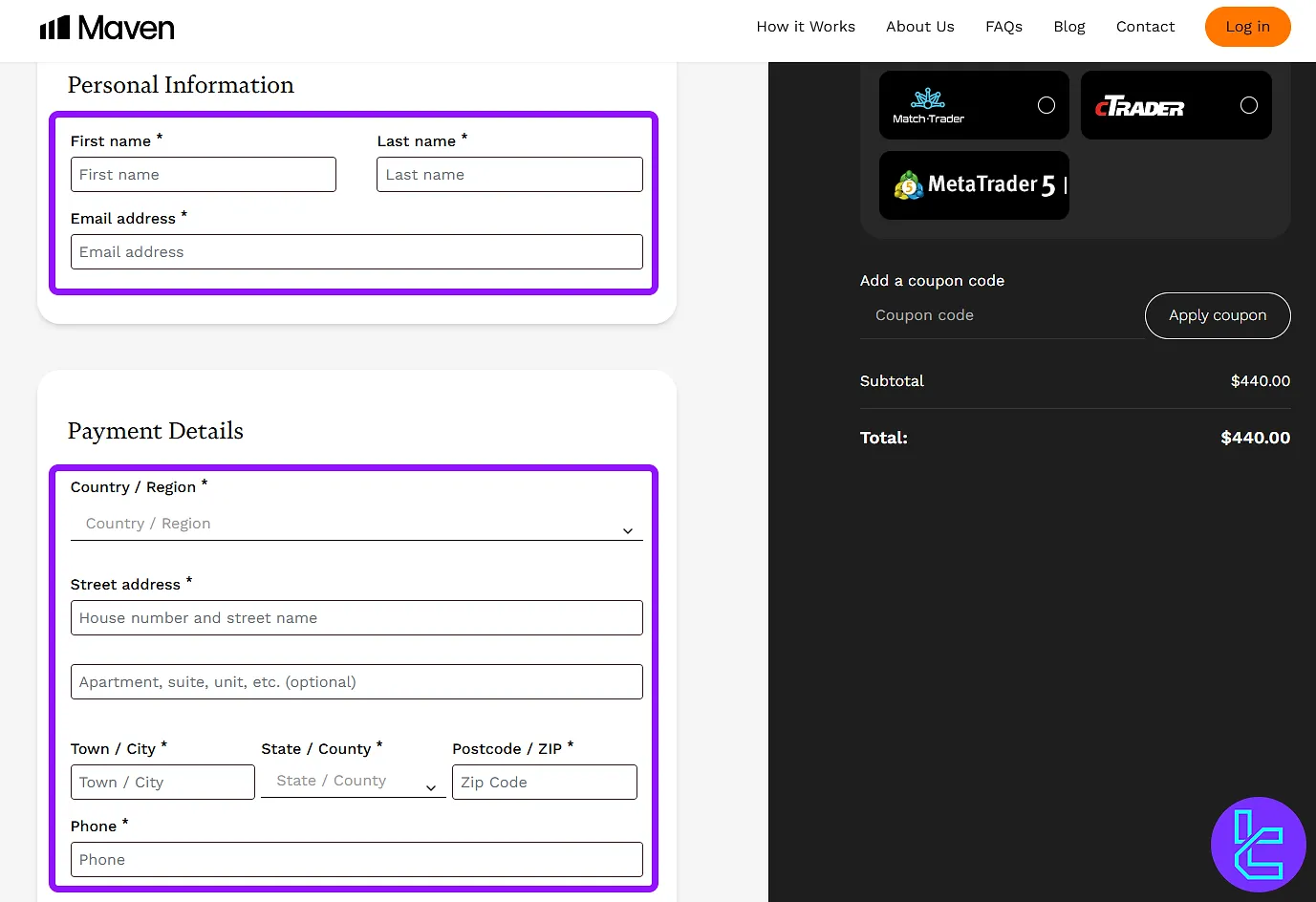

Step-by-Step Registration and Verification Guide on Maven Trading

Traders must follow the steps below to create an account, purchase a challenge, and complete identity verification on the Maven Trading prop firm:

#1 Accessing the Maven Trading Website and Selecting a Challenge

First, find the official website of Macen Trading on your browser. Once you enter, select your desired challenge and click the "Buy Now" button.

#2 Filling Out the Challenge Purchase Form

At this stage, you need to enter your personal details in the checkout form of this prop firm. These details include:

- Full Name

- Country of Residence

- City

- Full Address

- Postal Code

- Mobile Phone Number

At the end, you must also choose your payment method for the challenge fee and your preferred trading platform.

After the challenge fee is paid, your account information will be sent to you. At this point, you must successfully complete your challenge..

To withdraw funds from funded accounts, you must first complete the identity verification process. The documents required for KYC on Maven Trading include:

- Identity Verification: Passport, Driver’s License, National ID Card

- Proof of Residence: Utility bill (water, electricity, gas, phone) or Bank Statement

Evaluation Stages

Understanding the trading conditions and objectives in both challenges and real accounts at Maven Trading Prop Firm helps traders choose the best challenge that aligns with their trading strategy.

Challenge Type | Instant | One-Step | Two-Step | 3-Step | Mini |

Profit Target Phase 1 | - | 8% | 8% | 3% | - |

Profit Target Phase 2 | - | - | 5% | 3% | - |

Profit Target Phase 3 | - | - | - | 3% | - |

Maximum Daily Drawdown | 2% | 3% | 4% | 2% | - |

Maximum Total Drawdown | 3% | 5% | 8% | 3% | 3% |

Payout Frequency | 10 Days | Immediate | |||

Profit Split | 80% | 80% | |||

Maven Trading 1-Step Evaluation

The 1-step program offers the fastest route to funding, ideal for traders confident in their strategy and execution skills.

Challenge Type | 1-Step |

Profit Target Step 1 | 8% |

Maximum Daily Drawdown | 3% |

Maximum Total Drawdown | 5% |

Payout Frequency | 10 Days |

Profit Split | 80% |

Maven Trading 2-Step Evaluation

This plan requires an 8% profit in Phase 1 and 5% in Phase 2. The 8% drawdown limit supports balanced growth while ensuring disciplined risk management.

Challenge Type | 2-Step |

Profit Target Step 1 | 8% |

Profit Target Step 2 | 5% |

Maximum Daily Drawdown | 4% |

Maximum Total Drawdown | 8% |

Payout Frequency | 10 Days |

Profit Split | 80% |

Maven Trading 3-Step Evaluation

This refundable account sets a 3% profit target for each phase. The multi-stage design allows traders to demonstrate consistency over time while managing risk progressively.

Challenge Type | 3-Step |

Profit Target Step 1 | 3% |

Profit Target Step 2 | 3% |

Profit Target Step 3 | 3% |

Maximum Daily Drawdown | 2% |

Maximum Total Drawdown | 3% |

Payout Frequency | 10 Days |

Profit Split | 80% |

Maven Trading Instant Funding

The Instant Funding challenge offers immediate funding without a traditional evaluation phase. Traders must meet a minimum withdrawal target of 3%, with a 3% trailing drawdown and a 2% daily drawdown limit to ensure disciplined risk management.

Challenge Type | Instant Funding |

Maximum Daily Drawdown | 2% |

Maximum Total Drawdown | 3% |

Payout Frequency | 10 Days |

Profit Split | 80% |

Maven Trading Mini Challenge

The Mini plan includes a 3% minimum withdrawal requirement and a 3% trailing drawdown.

Challenge Type | Mini |

Maximum Drawdown | 2% |

Consistency Score | 20% Intraday |

Payout Frequency | Immediate |

Profit Split | 80% |

A Consistency Score (Intraday) metric is applied to evaluate stable performance across trading days.

Bonuses and Discounts

Maven Trading does not offer any bonuses similar to those provided by Forex brokers and crypto exchanges. However, you can find discount codes & coupons on third-party websites, as well as official pages and channels. Here's some of these codes:

- MATCH: 8% off on all challenges

- WOW50: 50% off on Standard 2-step challenge

- INVEST: 10% discount

We do not know whether these codes are real. Check them out for yourselves.

Maven Trading Prop Firm Rules

Maven has established specific regulations for both the Challenge Phase and Real Accounts, creating a fair trading environment for talented traders. Maven Trading rules:

- The IP address must remain consistent with the same geographic region throughout all phases;

- Hedging and the use of trading robots (EA/Bot) are strictly prohibited;

- No trades may be opened or closed 2 minutes before or after red folder news releases;

- Use of Martingale or gambling-like strategies at any stage leads to disqualification;

- News trading restrictions apply to demo accounts, real accounts, and instant funding plans;

- A comprehensive list of economic news and indicators subject to strict rules is defined.

- Payouts require at least 3% profit; Instant pays every 10 business days with a ≤20% consistency score, while Maven Mini gives a one-time 24-hour payout upon target hit

IP Address Regulations

All users during the initial challenge phase, the second phase, and also on funded accounts, are required to connect to their accounts from a specific geographic location. This is to ensure the authenticity of trading activity and to prevent any form of external assistance.

If a change in IP location is detected, the company will request the trader to provide valid documentation justifying the change. These documents may include flight tickets, live location confirmation, or any other verification method deemed acceptable by the evaluation team.

Hedging Policy

Executing trades fully based on hedging is prohibited in both demo and live accounts. The reason for this ban is the widespread use of bots attempting to bypass the rules and exploit the testing environment. In case of identifying pure hedging, the trader must provide the expert file used (if any).

Use of EA (Expert Advisors) and Bots

The use of any automated trading system is strictly prohibited throughout all stages of activity at Maven, whether on the Match Trader platform or C-Trader. Any sign of algorithmic or bot involvement in trade execution—even if disguised as manual execution—will be considered a violation of the rules.

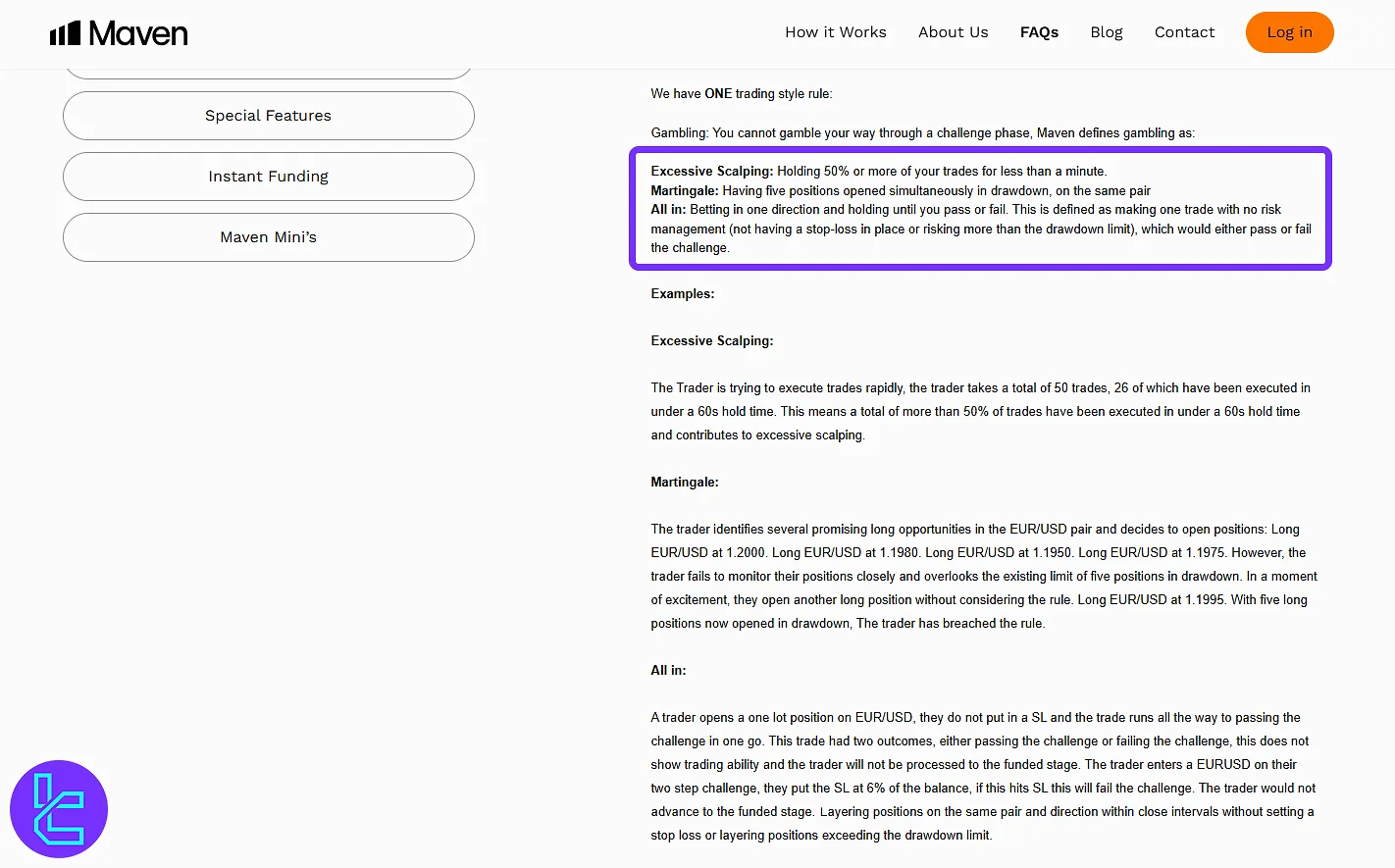

Arbitrage and Martingale Rules

Maven Trading strictly prohibits any form of gambling or exploitative trading behavior. The following actions fall under this category:

- Excessive scalping Strategies: If 50% or more of trades are closed within less than 60 seconds;

- Martingale strategy: Opening five or more positions simultaneously in drawdown on a single currency pair;

- All-In betting: Entering a trade without a stop-loss, risking the entire challenge in a single move;

- Arbitrage Trading: Exploiting price discrepancies across sources or brokers.

Restrictions on Trading During Major News Releases (Red Folder)

Traders are strictly forbidden from opening or closing any trades within 2 minutes before or after the release of major economic news (Red Folder). This restriction includes the following actions:

- Trade reaching Take Profit (TP)

- Pending orders are being triggered

- Manually closing a trade

Even if a trade is opened before the news release but closed within this time window, it will still be considered a violation. If the auto-close system closes a trade during this time, it will also result in a breach of the rules.

Maven Trading Payout Rules

Maven Trading processes payouts every 10 business days, with the transfer completed the day after the trading period ends. A 3% minimum profit and a maximum 20% consistency score are required, where the score is calculated as (Largest Winning Day ÷ Total Profit) × 100%. The Mini plan grants a one-time payout within 24 hours of reaching the 3% profit target, after which the account is closed.

Only one open trade is allowed at any time, making it a focused, short-term opportunity for disciplined traders.

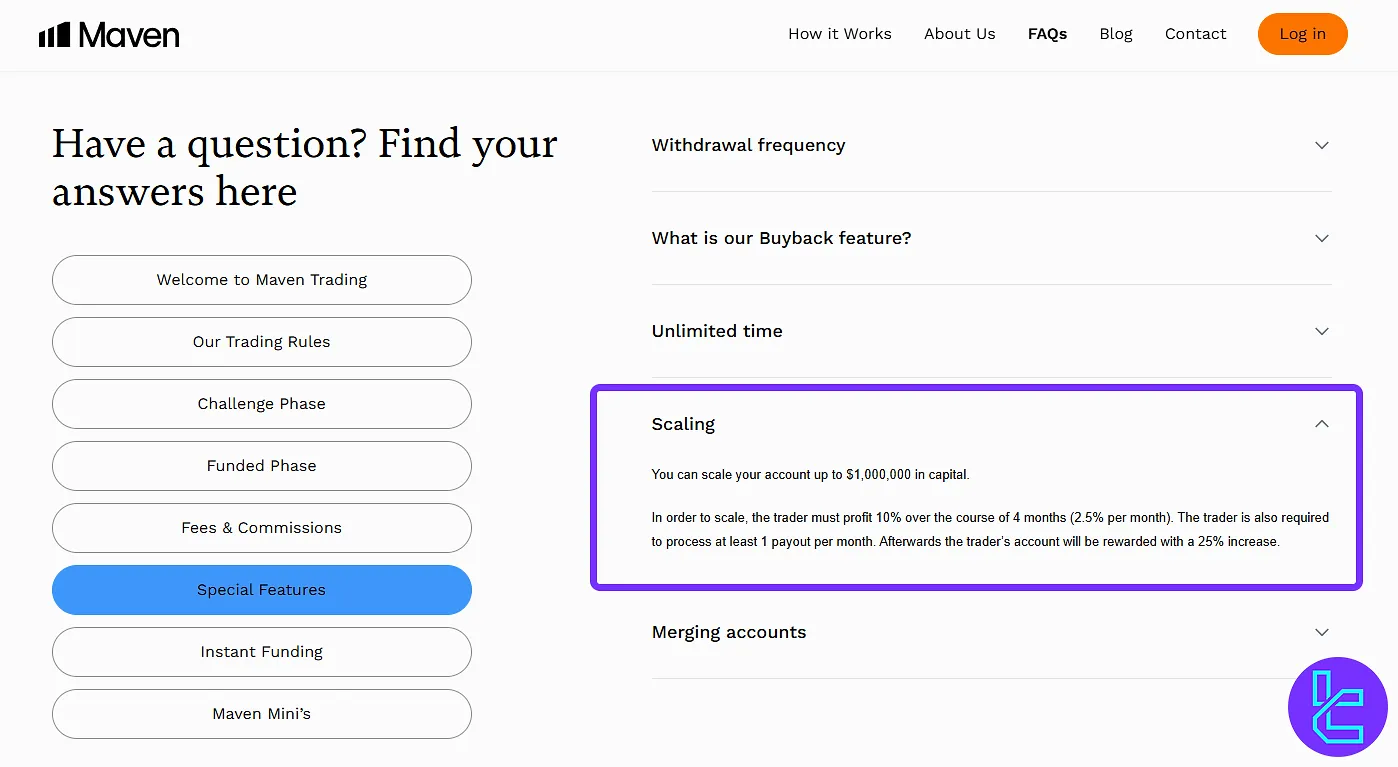

Maven Trading Scaling Plan

Traders have the opportunity to expand their account balance up to $1,000,000. To qualify for a scale-up, a minimum net gain of 10% must be achieved within a four-month period (equivalent to 2.5% per month), with at least one payout processed in each month. Upon meeting these requirements, the account balance is increased by 25%.

Available Trading Platforms

Maven Trading supports three trading platforms for users. You can use either of those based on your preferences and needs. The prop firm's platforms:

- Match-Trader

- cTrader

- MetaTrader 5

These platforms are available for all account sizes with both evaluation models.

Tradable Instruments and Symbols

Maven Trading offers a vast range of tradable instruments, including:

- Major Forex pairs: e.g., EURUSD, GBPUSD

- Commodities: e.g., XAUUSD - Gold

- Stock indices: e.g., US30, UK100, FRA40, EU50)

- ETFs: on Cryptocurrencies BTCEUR, BTCUSD, ETHBTC, ETHUSD

Currently, this firm provides over 400 assets for trading, which is more than enough for most traders.

Maven Trading Leverage

Here are the Maven Trading leverage options for different instruments:

- Forex: 1:75

- Commodities: 1:20

- Indices: 1:20

Payment Options

This section of Maven Trading review is about the methods for withdrawal and payments. This firm offers limited options for it, but it might change in the future. Therefore, check the official website for any updates and changes. Maven payment methods:

- Credit/Debit cards

- Bank transfers

- Cryptocurrencies

Maven Trading Commission

This firm offers competitive pricing and commission structures to its traders:

- Forex trades: $4 per round lot commission

- Other instruments: No commission (spread only)

This commission structure, paired with tight spreads, is designed to be transparent and straightforward, allowing traders to calculate their trading costs easily. Regarding fees, Maven does not charge traders with any swap fees across any accounts.

Educational Resources Overview

Maven Trading understands the importance of trader education and provides a range of resources to help traders succeed:

- Trading guides and tutorials in the form of articles

- Regular webinars on YouTube channels

- Market analysis and trading ideas are shared on their blog

Maven Trading Has an Educational Blog with More Than 100 Articles

Maven Trading Has an Educational Blog with More Than 100 Articles

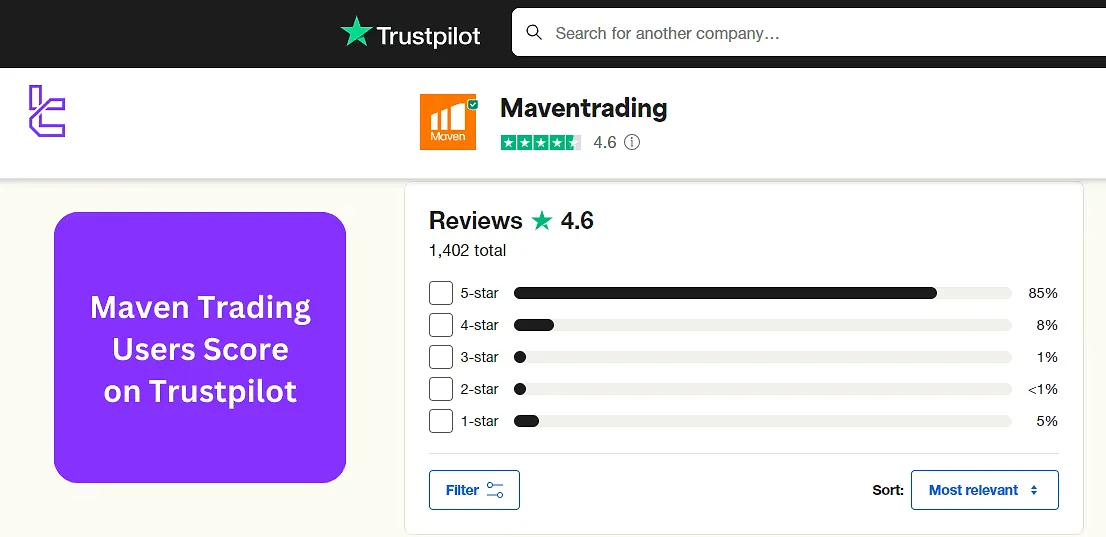

Trust Scores

Maven Trading has quickly established a reputation in the prop trading industry, as evidenced by their impressive Trustpilot ratings:

- Achieved a 4.6 out of 5 score based on more than 1,400 reviews

- Ranked 51 out of 150 best companies in the Alternative Financial Service category

- Ranked 36 out of 96 best companies in the Financial Institution category

Traders on the mentioned website have consistently praised Maven Trading for:

- Affordable pricing

- Responsive customer support

- Timely payouts

- Transparency in operations

- Fair trading conditions

Maven Trading Support

Customer support is a crucial aspect of any prop trading firm. As discussed above, users are generally satisfied with the quality of customer service.

Check the table below to understand all the support methods:

Support Method | Availability |

Live Chat | No |

Yes (support@maventrading.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

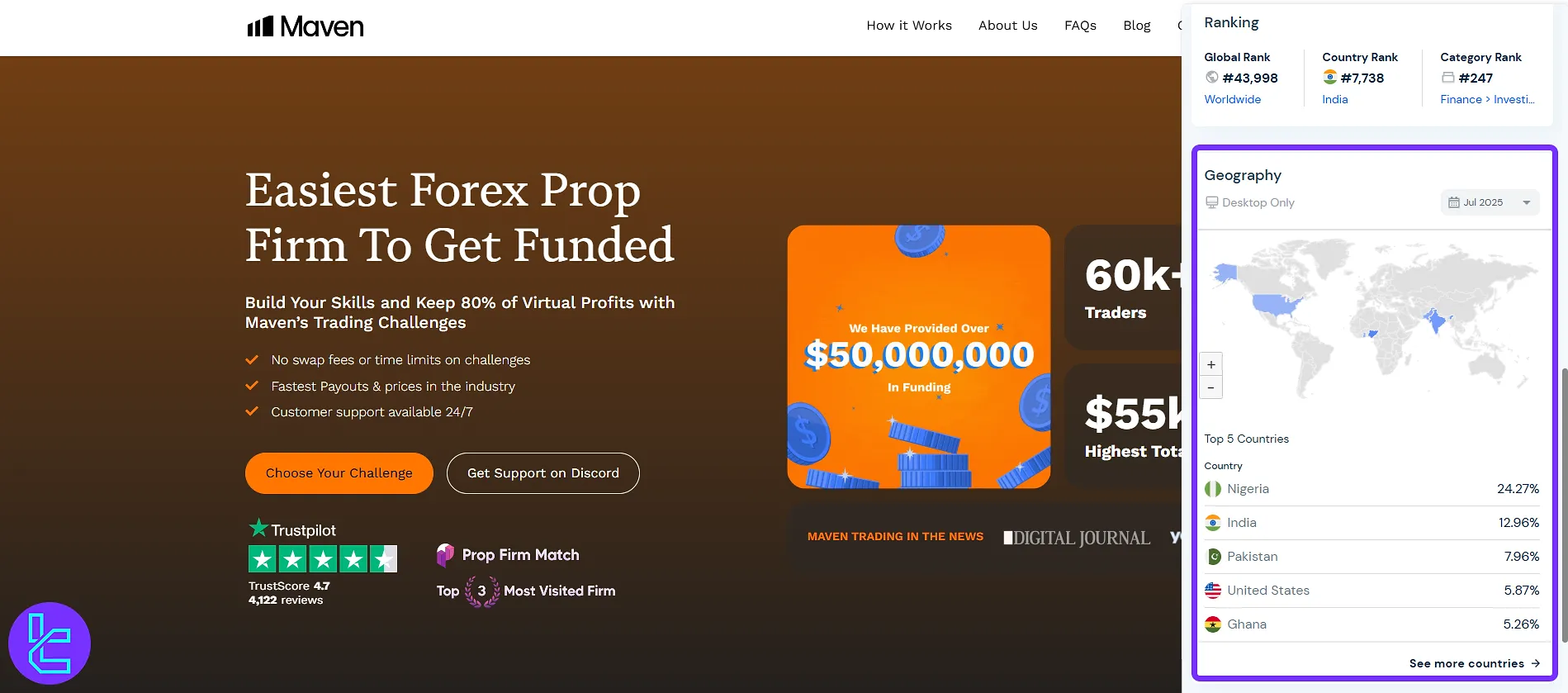

Maven User Base

Maven Trading has established a strong presence in the global prop trading market, attracting traders from multiple continents. The firm’s flexible funding programs, competitive profit splits, and quick payouts have drawn a highly diverse client base. Currently, the largest share of website traffic comes from the following countries:

- Nigeria: 24.27%

- India: 12.96%

- Pakistan: 7.96%

- United States: 5.87%

- Ghana: 5.26%

Social Media Channels & Pages

Maven Trading maintains an active presence on various social media platforms, allowing traders to stay updated and engaged:

Social Media | Members/Subscribers |

3900 | |

76619 | |

73000 | |

22000 | |

893 | |

8700 |

Maven Trading Comparison with Other Prop Firms

The table below outlines the key advantages and disadvantages of trading with MAven Trading in comparison to other prop firms.

Parameters | Maven Trading Prop Firm | Alpha Capital Group Prop Firm | ||

Minimum Challenge Price | $13 | $39 | $97 | $33 |

Maximum Fund Size | $100,000 | $250,000 | $200,000 | $400,000 |

Evaluation steps | Instant, 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding |

Profit Share | 80% | 100% | 80% | 100% |

Maximum Daily Drawdown | 4% | 5% | 5% | 7% |

Maximum Drawdown | 8% | 10% | 10% | 14% |

First Profit Target | 8% | 5% | 5% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:75 | 1:100 | 1:100 | 1:100 |

Payout Frequency | 10 Days | Bi-weekly | Bi-weekly | Weekly |

Number of Trading Assets | 400+ | 3000+ | 40 | 40+ |

Trading Platforms | Match-Trader, cTrader, MetaTrader 5 | Metatrader 5 | MetaTrader 5, cTrader, Dxtrade | MetaTrader 5, Match Trader |

Trading Finder Expert Suggestions

Maven Trading cites the minimum price of $13 and its unique feature is 60% buyback. Beside that, this Canadian prop firm offers 1:75 maximum leverage to use on over 400 assets. On the other hand, they only support 3 payment methods.