Monevis has set a maximum daily loss of 5% and a maximum total drawdown of 10% in its evaluation phases. Profit targets in the first and second phase are 10% and 5%, respectively.

You can earn up to $100,000 in funding via this firm. Trading services are provided through the MetaTrader 5 platform.

Company Information Overview

Monvis Funding is a prop firm established in 2024, founded and led by CEO Milos Mosovsky. It is registered in two regions under 2 addresses:

- Monevis Brokers Ltd. with the Company Number 2023-00569, located in the Ground Floor, The Sotheby Building Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia;

- Monevis s.r.o. with the company Number 55215921, located in Podunajská 23/G Bratislava, Slovakia.

Summary of Specifications

Let's have an overview of the specifications and features seen in the prop firm. Summary of Features in Monevis Funding:

Account Currency | USD |

Minimum Price | $19 |

Maximum Leverage | Not Specified |

Maximum Profit Split | 85% |

Instruments | Not Specified |

Assets | Not Specified |

Evaluation Steps | 1-Step, 2-Step, 3-Step, Instant Funding |

Withdrawal Methods | Riseworks |

Maximum Fund Size | $100K |

First Profit Target | 10% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | 10% |

Trading Platforms | Metatrader 5 |

Commission Per Round Lot | Not Specified |

Trustpilot Score | 4.7/5 |

Payout Frequency | Weekly |

Established Country | Slovakia |

Established Year | 2024 |

Pros and Cons

As with any prop firm or companies operating in other fields, Monevis Funding comes with its own set of advantages and disadvantages. Let's weigh them up:

Pros | Cons |

Own Trading Infrastructure | Drawdown Limits May Be Challenging For Some |

High Level Of Profit Splits (Up To 85%) | Prohibits High-Frequency Trading (HFT) |

What is The Funding & Price of Monevis Funding?

Monevis Funding offers various challenges with up to $100,000 trading capital for prop traders.

Account Size | $3,000 | $6,000 | $10,000 | $15,000 | $25,000 | $50,000 | $100,000 |

Instant | $19 | $38 | $64 | $119 | $199 | $399 | - |

One Step | - | $59 | $109 | - | $249 | $355 | $565 |

Two Step | - | $49 | $89 | - | $239 | $340 | $549 |

Three Step | - | $35 | $55 | - | $145 | $245 | $385 |

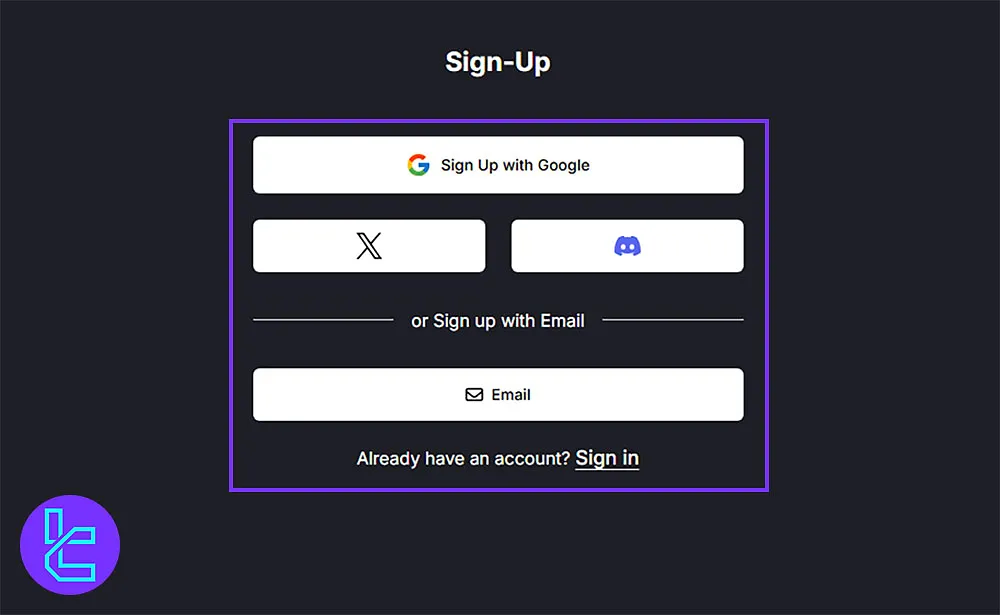

How to Register and Verify Your Account on Monevis Funding

To begin trading on Monevis trading accounts, follow the steps below. Monevis Funding registration:

#1 Select Your Preferred Sign-Up Method

Head over to the official Monevis platform and select your preferred registration method. Monevis supports multiple authentication options, including:

- Discord

- X (Twitter)

We recommend using email for direct account management and platform access.

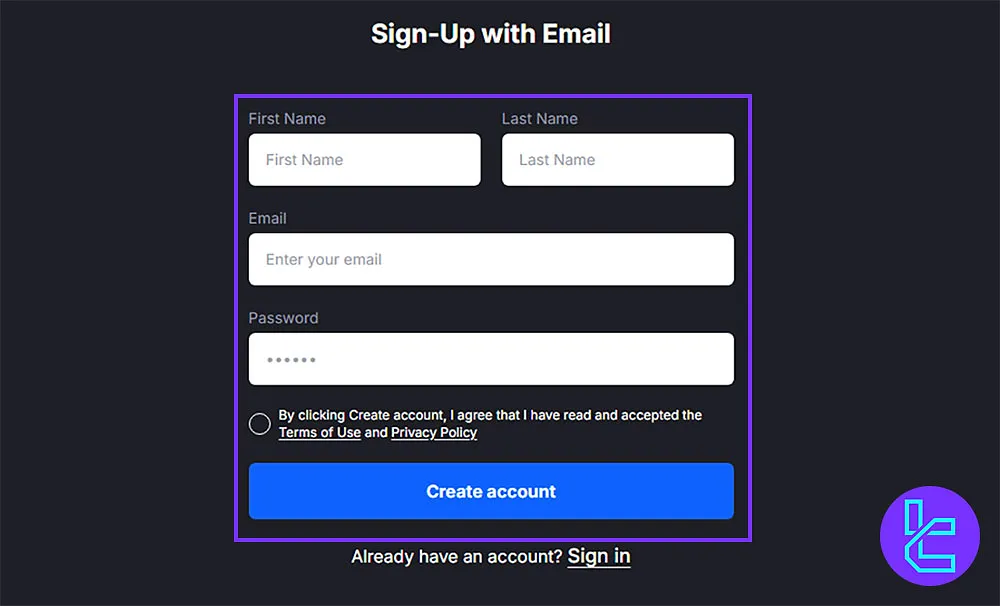

#2 Complete the Account Creation Form

Fill in the required fields:

- First Name

- Last Name

- Email Address

- Password (use uppercase, lowercase, numbers, and symbols for better security)

Agree to Monevis’s terms of use and submit your registration. Once completed, you'll be redirected to your personal dashboard, ready to begin your prop trading journey.

Evaluation Stages and Trading Rules

Monevis challenges are designed to cater to various traders with different risk tolerances and trading objectives. Monvis challenges:

Parameter | Instant Funding | One Step Challenge | Two Step Challenge | Three Step Challenge |

Profit Target | 6% | 10% | 10% | 4% |

Daily Drawdown limit | 2% | 3% | 5% | 4% |

Overall Drawdown Limit | 8% | 6% | 10% | 4% |

Profit Split | Up to 85% | Up to 85% | Up to 85% | Up to 85% |

Minimum Trading Days | 3 Days | 2 Days | 3 Days | 3 Days |

Leverage | Up to 1:75 | Up to 1:75 | Up to 1:75 | Up to 1:75 |

It’s worth noting that for 1-step, 2-step, and 3-step challenges, the profit target, daily drawdown limit, and maximum drawdown limit don’t change after completing each phase.

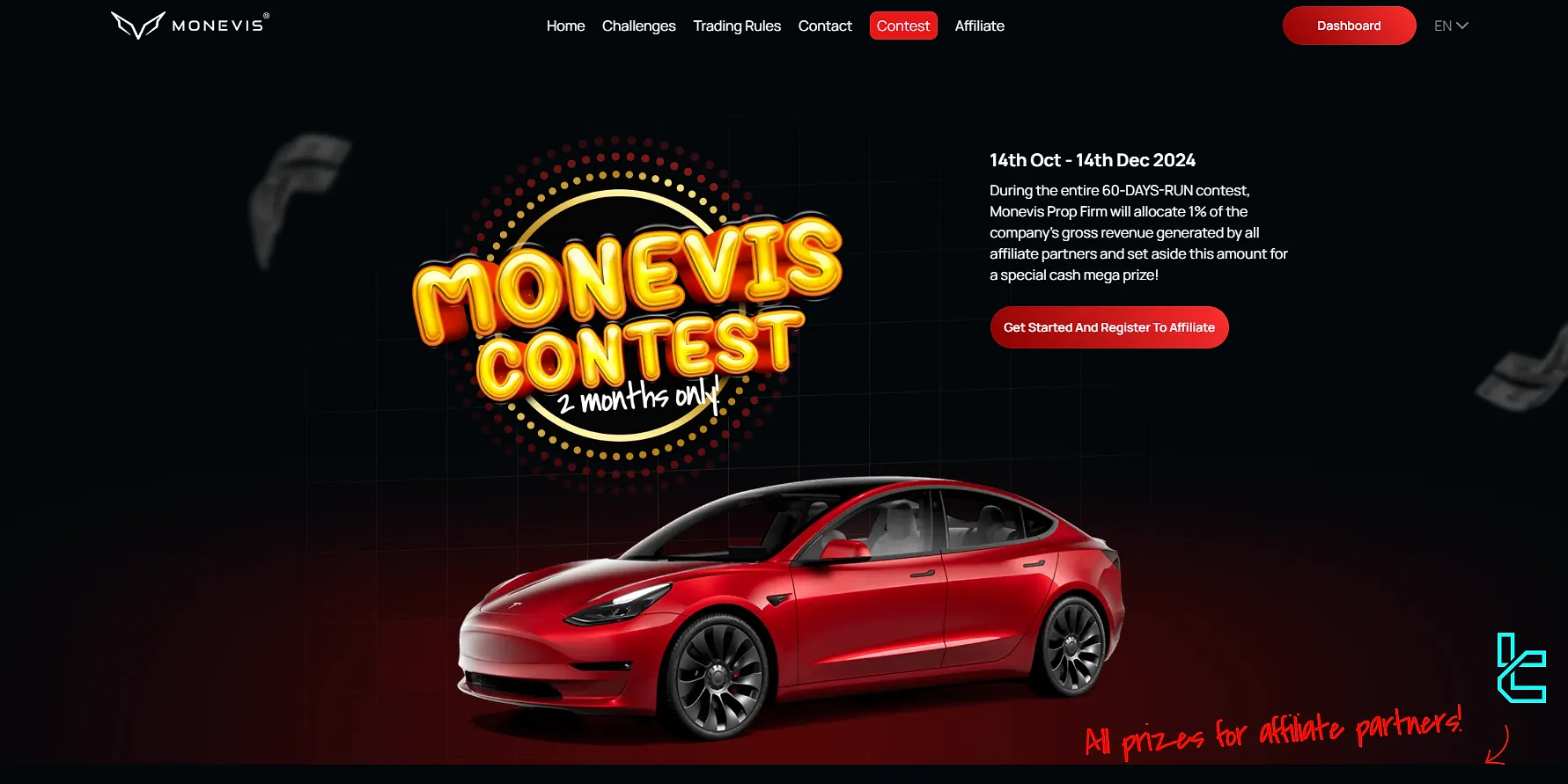

Available Bonuses And Promotions

Monevis Funding keeps things exciting for its traders with various bonuses and promotions. While specific offers may change over time, here are some examples of what you might encounter:

- Discount Codes: Use "FIRST30" to save up to 30% on your chosen Monevis challenge

- Trading Contests: Participate in competitions for a chance to win additional funding or prizes

Currently, there's a 60-DAYS-RUN trading contest, which is for affiliate partners. At the end of the period, 1% of the company's gross revenue generated by all partners will be divided among 3 lucky winners.

Monevis Rules

Monevis safeguards its trading environment by implementing various rules and conditions. Monevis Funding rules:

- VPN/VPS: No official policy disclosed

- Hedging Arbitrage: Not allowed

- Expert Advisors (EAs): Fully allowed.

- Prohibited Strategies: Reverse Arbitrage, HFT, Tick Scalping, Grid, Reverse Trading, Gambling-related behaviors, all forbidden

- News Trading: Allowed during Challenge phases; restricted during Funded phase

VPN & VPS Usage

Monevis has not published any specific guidelines regarding the use of VPNs, proxies, or VPS services. Traders are advised to avoid masked or location-shifting connections unless explicit permission is obtained. Using such tools without authorization may result in disqualification if it is interpreted as circumventing compliance measures.

Hedging Policy

Monevis prohibits hedge arbitrage strategies, commonly known as pairs trading. This method involves taking long and short positions in two correlated assets to exploit temporary price differences. The firm classifies this as a rule violation due to its risk-offsetting nature and its potential to undermine standard drawdown rules.

Expert Advisors (EAs)

Monevis allows the use of Expert Advisors (automated trading systems or bots) on both Challenge and Funded accounts. There are no stated restrictions on commercial or custom EAs, provided that they do not violate other strategic limitations such as latency arbitrage or scalping.

Prohibited Strategies and Risk Violations

Monevis strictly bans the following strategies and behaviors:

- Reverse Arbitrage: Coordinated trading across accounts or firms to bypass risk rules;

- Latency Arbitrage: Exploiting price feed delays for unfair speed advantage;

- High-Frequency Trading (HFT): Not allowed due to reliance on speed over analysis;

- Grid Trading: Banned due to high risk and non-predictive structure;

- Tick Scalping: Prohibited if over 50% of trades close in under 120 seconds;

- Reverse Trading: Opposite trades across accounts/firms to manipulate exposure;

- Gambling Behaviors: Includes overleveraging, overexposure, one-sided bets, and account rolling.

News Trading Policy

Challenge Phase (Step 1 and Step 2):

News trading is allowed without restriction. Traders can open, close, and modify trades during economic announcements.

Funded Accounts:

Monevis enforces a news restriction window on Funded accounts:

- No trade execution is allowed on affected instruments from 2 minutes before until 2 minutes after a high-impact news release.

- "Execution" includes opening or closing trades, placing/modifying pending orders, or adjusting stop loss and take profit levels.

- Trades that were opened at least 2 minutes prior to the news release may remain open during the event.

Trading Platforms

Monevis Funding provides traders with access to the popular MetaTrader 5 (MT5) platform. This advanced trading software offers:

- A convenient interface useful for traders at all levels

- Advanced charting objects and trading tools

- Support for algorithmic trading and expert advisors

- Mobile trading capabilities for iOS and Android devices

- A wide range of financial instruments and trading assets are available

The firm operates its own MetaTrader 5 servers and has a license from MetaQuotes.

Tradable Instruments

Based on our investigations on the website and official sources, there is no specific data available about the trading assets of this prop firm. This is a drawback for the company's website.

Payment Options and Methods

Monevis offers a flexible and user-friendly payment infrastructure, supporting a wide range of deposit options. Traders can fund their accounts using:

- Major cryptocurrencies include Bitcoin, Ethereum, Solana, Litecoin, TRON, USD Coin, and Tether

- Traditional payment methods such as Visa and Mastercard

- Select e-wallets like Revolut

Withdrawals are handled exclusively through the Riseworks platform, with a minimum withdrawal amount of $50 for both challenge profits and affiliate commissions. According to the firm, payout requests are typically processed within one business day, although some may take up to 72 hours depending on transaction volume and blockchain confirmation times.

Currently, Monevis does not offer alternative payout channels beyond Riseworks, but plans to expand its options are reportedly in development.

Commissions And Fees

We examined the website and looked up any information about the trading commissions and spreads. Unfortunately, Monevis does not reveal any data on fees for trading.

Is Enough Education Offered by Monevis Funding?

The firm does not provide any content for the purpose of educating traders. There's only an FAQ section containing common questions with their corresponding answers.

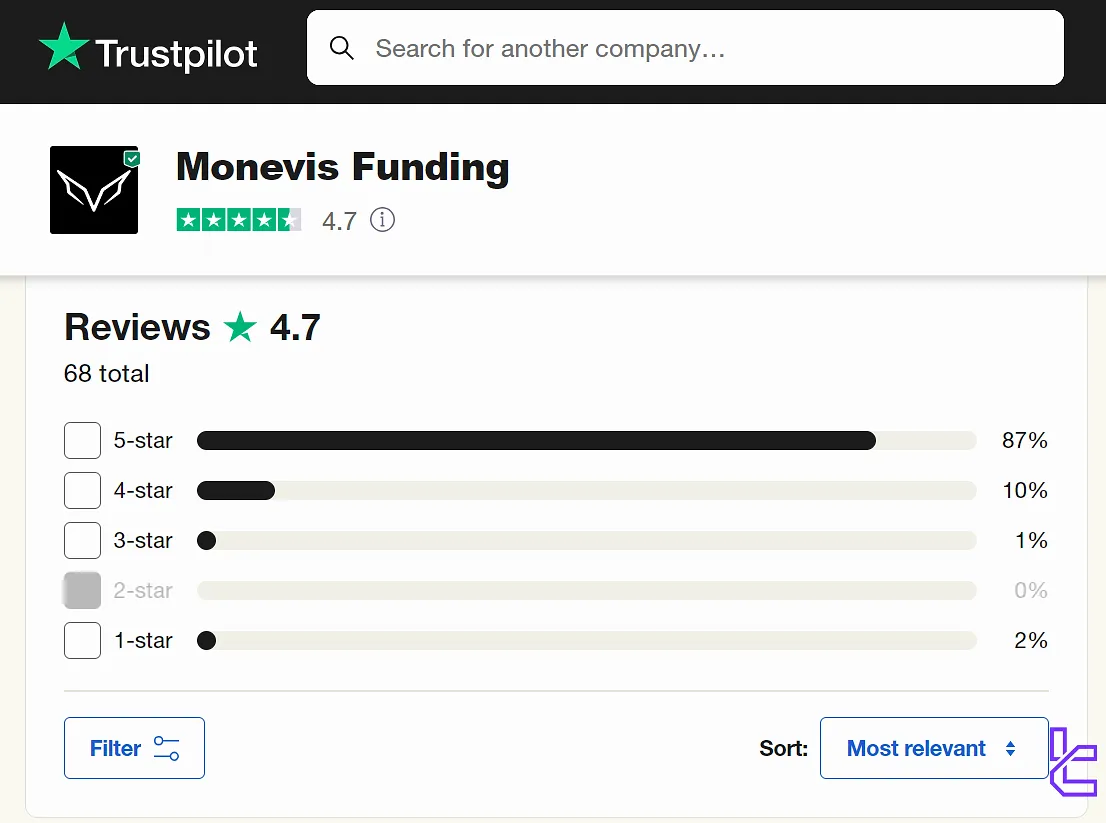

Trust Scores

Websites like Monevis Trustpilot, REVIEWS.io, etc., are good platforms for evaluating the trust scores of prop firms. Trust Score of Monevis Funding:

- Overall Rating: 4.7 out of 5

- Number of Reviews: More than 60

- 5-Star Scores: +85%

Although there are no scores on other websites, which is disappointing, Monevis has achieved a high rating on Trustpilot.

Customer Services and Support Options

Customer support plays a vital role in having a good experience with a company, especially when it comes to financial matters. Monevis takes an approach similar to most other prop firms for customer services. Support channels:

- Live Chat: On the website

- Monevis Discord

The company's website claims that the support team is available for yourinquiries 24/7.

Social Media Accounts

Monevis maintains an online presence on two social media platforms:

- X (Formerly Twitter)

There is also a Discord server, which was mentioned earlier. That server is more like a community or network of traders.

Monevis in Comparison with Other Prop Firms

By using the data in the table below, traders can decide whether Monevis is the right prop firm for their needs.

Parameter | Monevis Funding Prop Firm | |||

Minimum Challenge Price | $19 | $55 | $39 | $33 |

Maximum Fund Size | $100,000 | $200,000 | $250,000 | $400,000 |

Evaluation Steps | 1-Step, 2-Step, 3-Step, Instant Funding | 1-phase, 2-phase | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step, Instant Funding |

Profit Share | 85% | 80% | 100% | 100% |

Max Daily Drawdown | 5% | 4% | 5% | 7% |

Max Drawdown | %10 | 6% | 10% | 14% |

First Profit Target | %10 | 8% | 5% | 6% |

Challenge Time Limit | Unlimited | 5 Days | Unlimited | Unlimited |

Maximum Leverage | 1:75 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Weekly | 2 Times a Month | Bi-weekly | Weekly |

Number of Trading Assets | Not Specified | 200+ | 3000+ | 40+ |

Trading Platforms | Metatrader 5 | Metatrader 5, CFT Platform and Crypto Futures | Metatrader 5 | MetaTrader 5, Match Trader |

Expert Suggestions

Monevis has received a 4.7/5 trust score on the Trustpilot website, based on over 60 reviews. The company provides 24/7 support via 3 channels [live chat, email, and Discord].

This firm, founded by CEO Milos Mosovsky, pays profit shares of up to 85% to its traders on a weekly basis.