The Trading Capital offers a flexible trading environment with a profit split of 90%, 6% MDL, and 12% TDD. Traders can start with accounts ranging from $50,000 to $500,000, benefiting from a simple 2-step evaluation.

The Trading Capital provides leverage options of up to 1:100 across Forex and metals. However, Crypto trading and US Equities are not available. The prop firm offers a 90% profit split with bi-weekly payouts, supporting PayPal and Bitcoin as withdrawal methods.

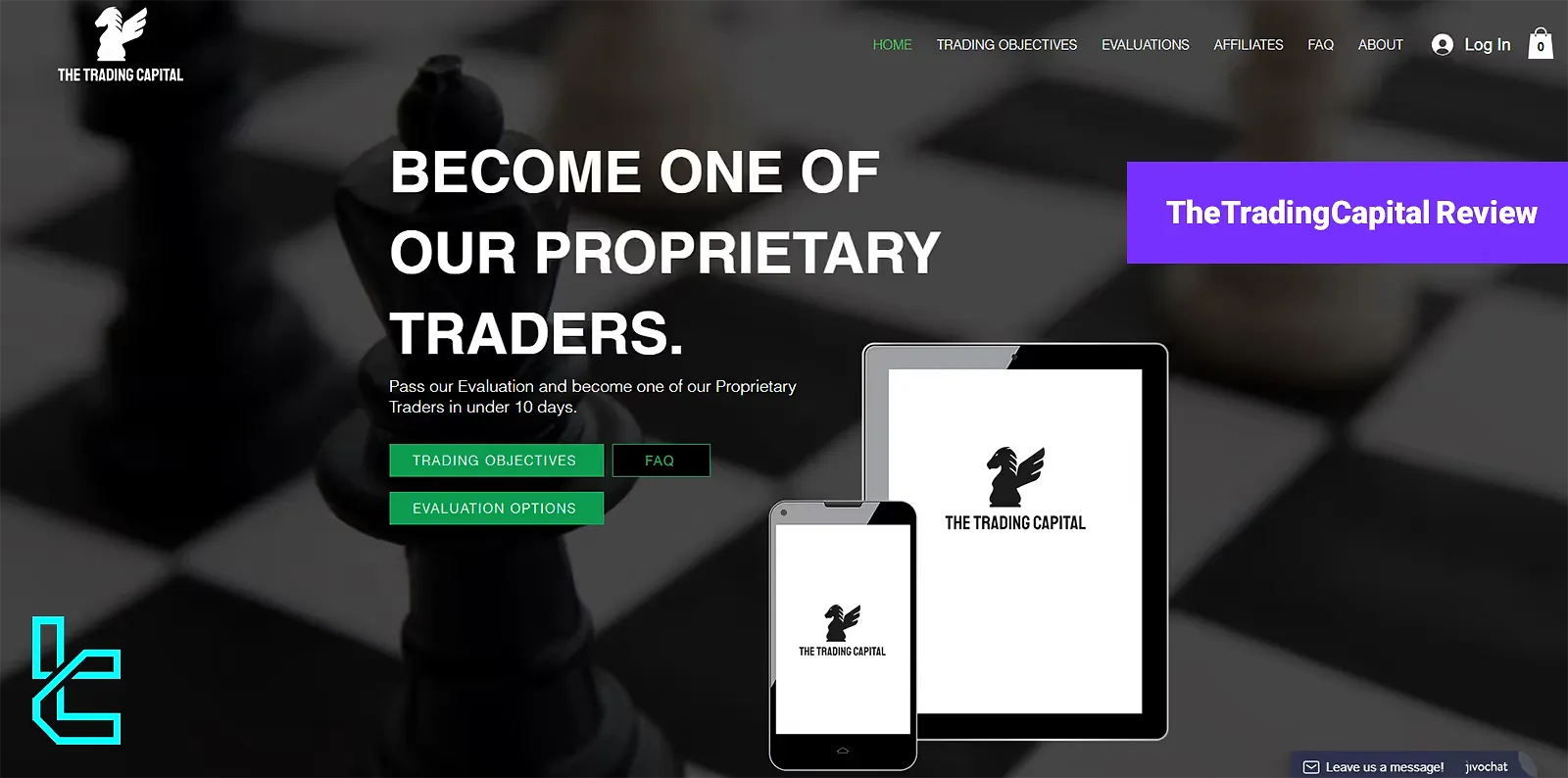

Unlock Your Trading Potential and Discover Opportunities with Our Comprehensive The Trading Capital Review

Unlock Your Trading Potential and Discover Opportunities with Our Comprehensive The Trading Capital ReviewThe Trading Capital Company Overview

Founded in 2019 in Mississauga, Canada, The Trading Capital has quickly made a name for itself in the competitive world of prop trading. What sets this firm apart is its focus on quality over quantity.

It aims to help talented traders achieve financial freedom through a supportive and flexible trading environment. Key highlights of The Trading Capital prop firm include:

- An impressive 8% profit target during evaluation, one of the best in the industry

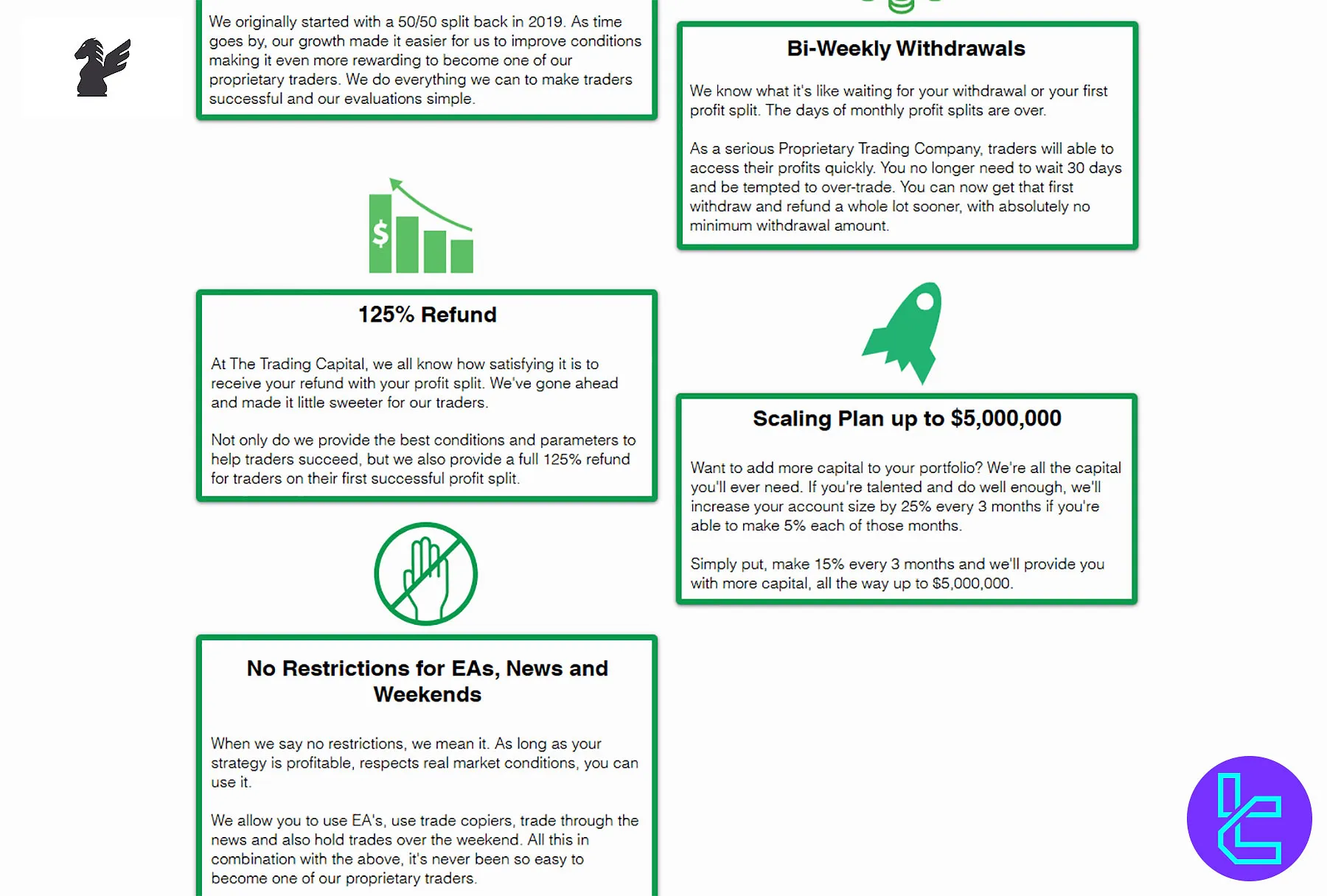

- A generous 90/10 profit split, improved from their original 50/50 split

- 125% refund on the first successful profit split

- Scaling plan to increase account size up to $5 million based on performance

The Trading Capital’s Specifications Summary

Let's break down the key specifications of The Trading Capital's prop firm offering:

Account currency | USD |

Minimum price | $297 |

maximum leverage | 1:100 |

maximum profit split | 90% |

Instruments | Currency Pairs, Indices, Metals, Commodities |

Assets | EUR/USD, GBP/JPY, AUD/CAD, DJ, ND & S&P500, Gold, Silver, Platinum, Oil |

evaluation steps | 2-Step |

Trading platform | MT4 |

Withdrawal methods | Bank/Wire Transfer, PayPal, TransferWise, Bitcoin, Skrill |

maximum fund size | $5,000,000 |

First profit target | 8% |

Max. daily loss | 6% |

Challenge time limit | Unlimited |

news trading | No Limits |

Maximum total drawdown | 12% |

commission per round lot | No |

Trustpilot score | No |

payout frequency | Bi-Weekly |

established country | Canada |

established year | 2019 |

These specifications demonstrate The Trading Capital's commitment to providing traders with flexible and competitive terms, setting them apart from many other prop firms in the industry.

The Trading Capital Pros & Cons

To help you make an informed decision, let's examine the pros and cons of trading with The Trading Capital:

Pros | Cons |

High profit split (90/10) | Limited information available on educational resources |

Low profit target (8%) | Relatively new company |

125% refund on first profit split | Mixed reviews on Trustpilot |

Flexible drawdown limits | - |

Scaling opportunities up to $5M | - |

While The Trading Capital offers many attractive features, it's important to consider the potential drawbacks before deciding.

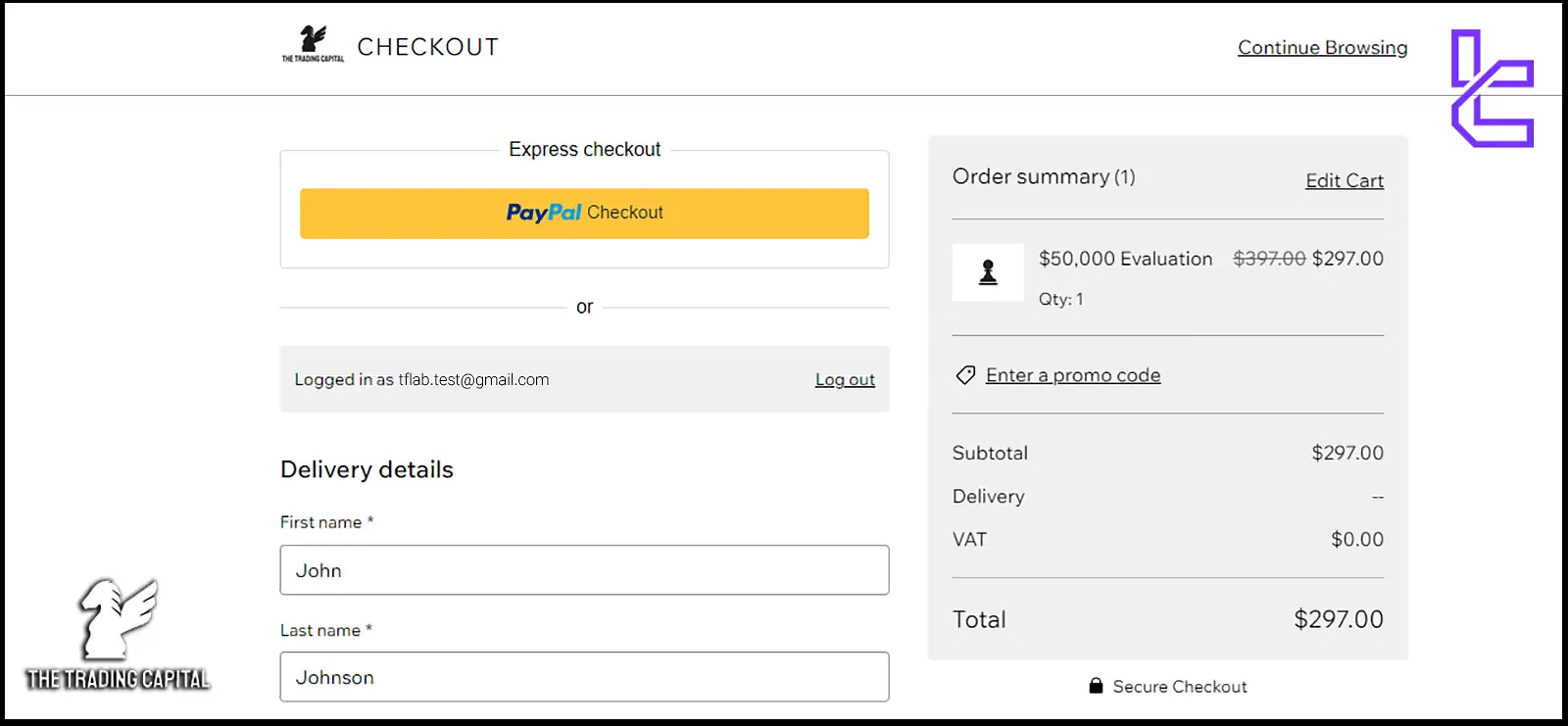

The Trading Capital Funding & Price

The firm offers a range of account sizes to suit different traders' needs and experience levels. Here's a breakdown of their funding options:

Account Size | Original Price | Sale Price |

$50,000 | $397.00 | $297.00 |

$100,000 | $697.00 | $497.00 |

$200,000 | $1,080.00 | $849.00 |

$500,000 | $2,200.00 | $1,849.00 |

The firm's pricing structure is competitive, with an 8% profit target and a 90/10 profit split, making it an attractive option for many traders.

The 125% refund on the first successful profit split adds extra value, giving traders a chance to recoup their initial investment.

There are no recurring charges or hidden costs. While the pricing is slightly above average, it’s offset by the generous refund structure.

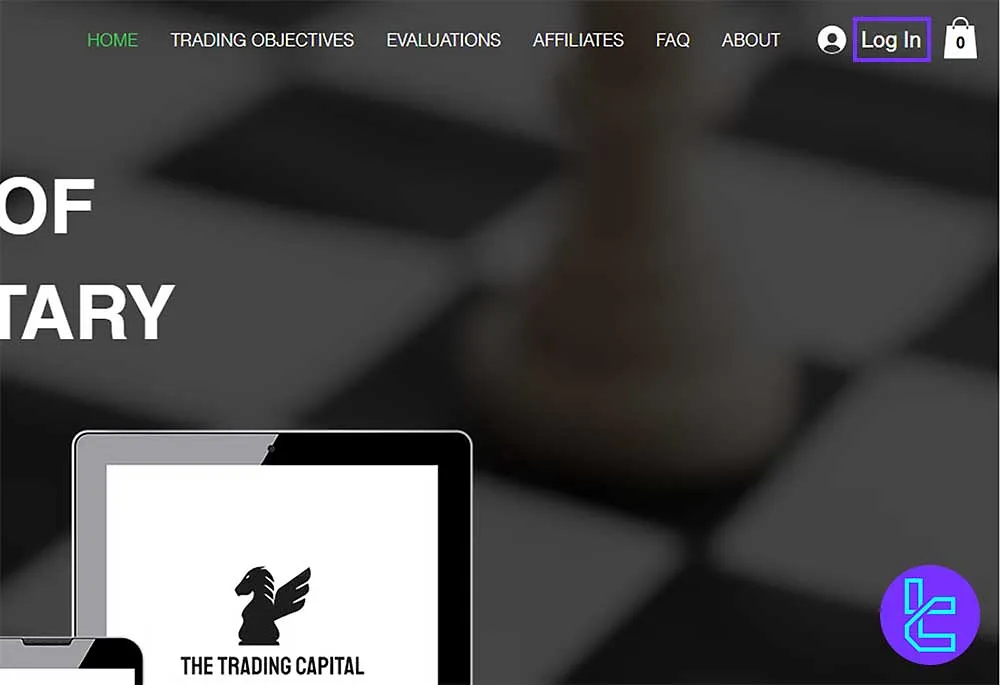

The Trading Capital Registration & Verification process

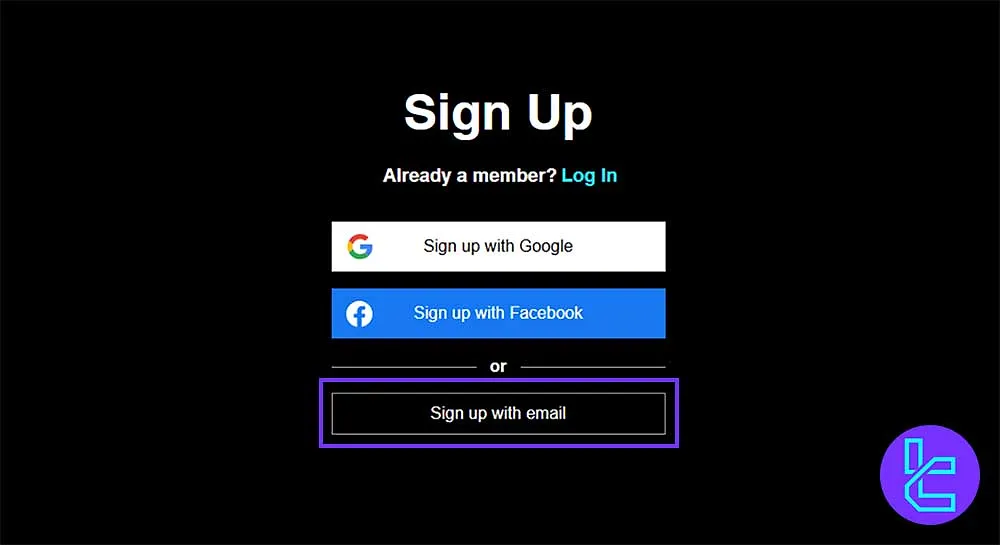

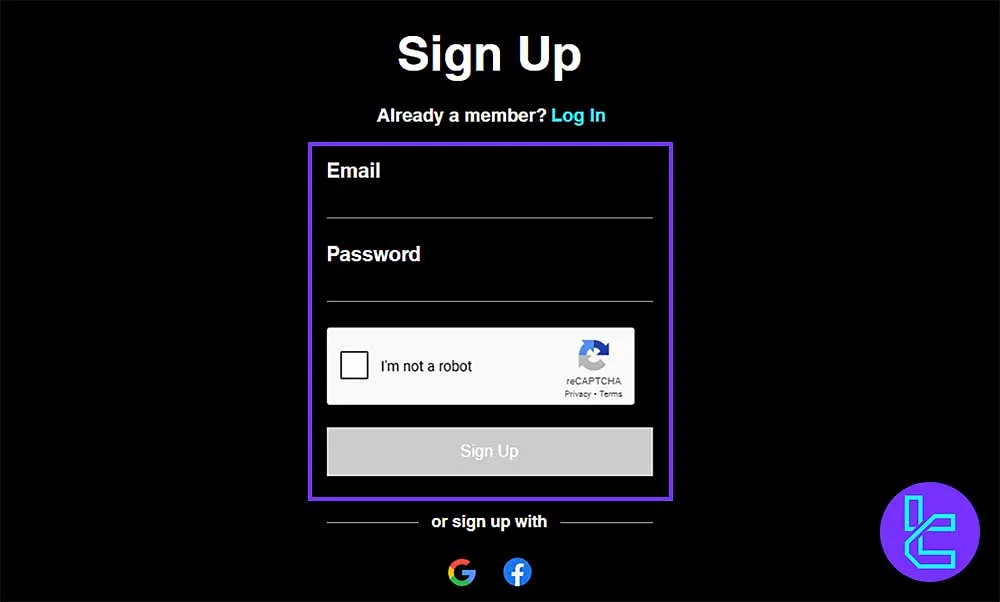

The Trading Capital registration is fast and document-free. Traders can register using an email address or log in via Google or Facebook.

A secure password and simple CAPTCHA are all that’s needed to access the dashboard instantly, ideal for fast onboarding into funded trading programs.

#1 Go to The Trading Capital Registration Page

Click "Login" on the homepage or "Open an Account" to begin registration.

#2 Choose a Registration Method

Select "Sign up with Email" (or use your Google/Facebook account).

#3 Enter Signup Details

Fill in your email, create a strong password, and verify you're not a robot. Click "Sign Up" to proceed.

While the verification process is mandatory to get a funded account, there is no specific mention in this regard on the prop firm's website.

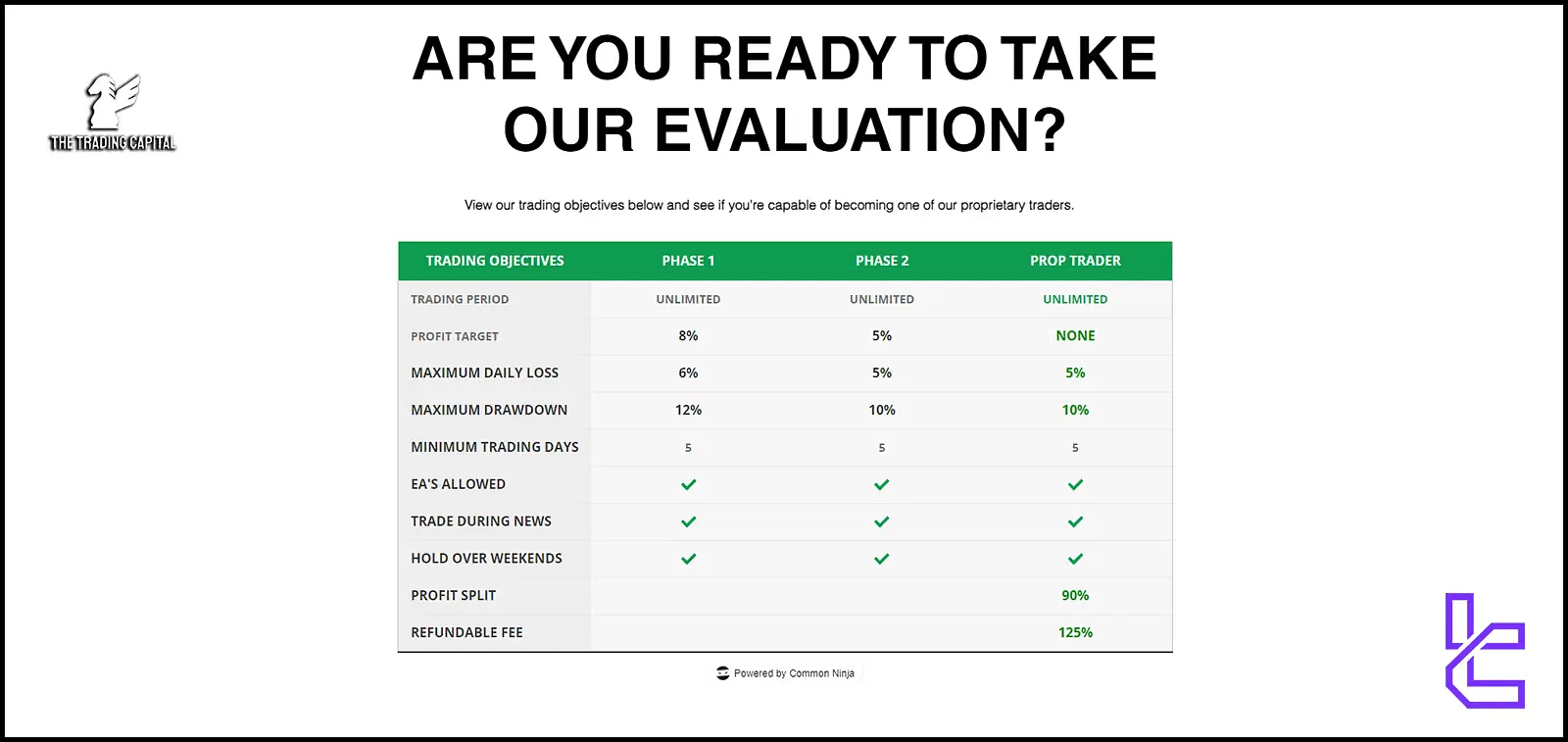

The Trading Capital Evaluation Steps

The Trading Capital's evaluation process consists of three main steps:

Conditions | PHASE 1 | PHASE 2 |

Trading Days | No Limits | No Limits |

Minimum Trading Days | 5 | 5 |

Profit Target | 8% | 5% |

Maximum Daily Loss | 6% | 5% |

Maximum Drawdown | 12% | 10% |

Alongside its adaptable trading conditions, The Trading Capital provides a range of features aimed at empowering traders for success:

- Traders are allowed to implement Expert Advisors (EAs) to automate their trading strategies;

- Trading during news events is permitted, giving traders the chance to take advantage of market volatility;

- Traders have the flexibility to maintain positions over the weekend, supporting long-term trading approaches;

- The firm offers a favorable 90% profit split to traders;

- With a 125% refundable fee, TradeDay adds further value for its traders.

The Trading Capital Profit Split

Traders at The Trading Capital benefit from an attractive 90/10 profit split. Once funded, traders keep 90% of their net profits, with the remaining 10% retained by the firm.

Payouts are issued bi-weekly with no minimum threshold, meaning traders can withdraw any amount they earn on a consistent basis.

The Trading Capital Prop Firm Bonuses and Discounts

The prop firm does not currently offer direct bonuses, but has introduced discounts on challenge fees. Traders can benefit from reduced prices for various account sizes:

- The $50,000 evaluation fee has been reduced from $397 to $297;

- The $100,000 evaluation fee is now $497, down from $697;

- The $200,000 evaluation fee has dropped from $1,080 to $849;

- The $500,000 evaluation fee has been discounted from $2,200 to $1,849;

These discounts make it more affordable for traders to participate in evaluations and potentially secure funding.

The Trading Capital Refund Policy

Once traders pass the evaluation and receive their first funded payout, TheTradingCapital returns 125% of the original evaluation fee, effectively reimbursing the trader and providing a bonus.

This generous refund acts as both a motivator and financial buffer, especially for those starting with higher account sizes. However, no sign-up bonuses or free trial programs are currently available.

The Trading Capital Rules

The Trading Capital provides flexible trading options, allowing hedging, EA usage, and news trading, with strict rules against manipulative practices like arbitrage and scalping.

It ensures all trades reflect real market conditions for evaluation and prop trader accounts. Key points about The Trading Capital rules:

- Hedging: Allowed on Evaluation and Prop Trader accounts

- Using Expert (EA): Permitted once the trader moves to the Prop Trader account, provided risk management is followed and real market conditions are reflected

- Martingale and Arbitrage: Violations, such as retail arbitrage, trades held for under 60 seconds, and other demo manipulation tactics, lead to account termination

- News Trading: Allowed during all news events, both minor and major

VPN Usage

The Trading Capital doesn't disclose any details regarding VPN usage on its website.

Hedging

Hedging trading strategies are allowed on both Evaluation and Prop Trader accounts at The Trading Capital. Traders are permitted to employ these techniques as part of their trading strategy.

Expert Advisors (EA)

Traders can use Expert Advisors (EAs) after successfully completing the evaluation phase and moving to a Prop Trader account. As long as risk is managed appropriately and the results reflect true market conditions, the use of EAs is accepted.

Martingale and Arbitrage

The Trading Capital has strict guidelines concerning trading practices. If any of the following occur, the account will be terminated:

- Arbitrage: Engaging in retail arbitrage or any form of market manipulation will result in disqualification;

- Short-Term Trades: Trades held for less than 60 seconds are not violations, but the profits will not count toward your account balance or equity;

- Carry Trading/Swap Manipulation: Taking advantage of demo conditions or exploiting carry trading is prohibited.

News Trading

Traders at The Trading Capital are free to trade during both major and minor news events. There are no restrictions on trading during these times, offering flexibility for news-driven strategies.

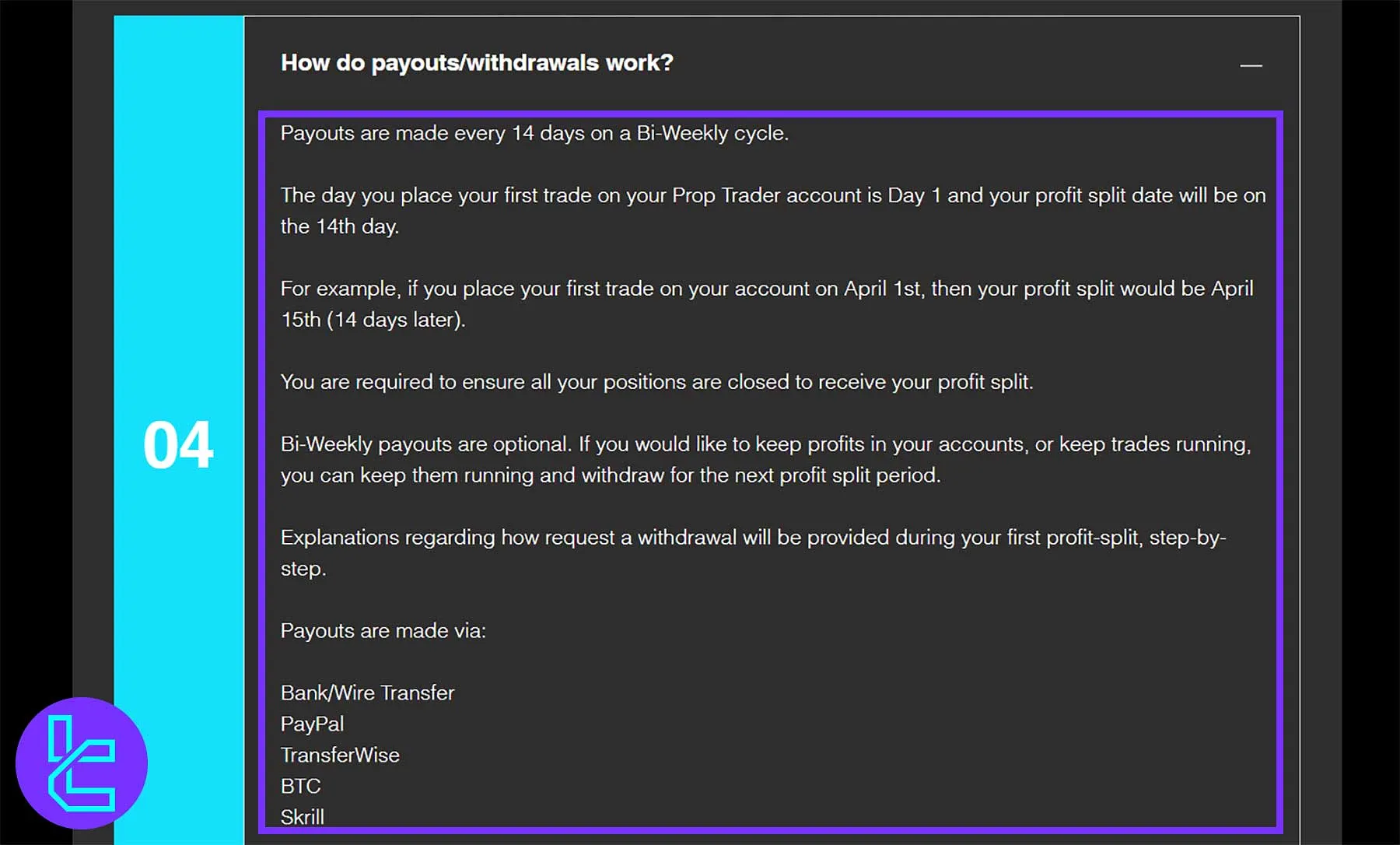

The Trading Capital Prop Firm Payouts

The Trading Capital ensures a transparent and efficient bi-weekly payout system, rewarding traders every 14 days based on their trading performance. Profits can be withdrawn securely through multiple global payment methods, offering flexibility and reliability for both retail and institutional traders.

- Payout Frequency: Every 14 days on a bi-weekly schedule;

- Eligibility: Traders must close all open positions before payout processing;

- Options: Profits can be kept in the account or withdrawn during the next cycle;

- Payment Methods: Bank transfer, PayPal, TransferWise, Bitcoin (BTC), and Skrill.

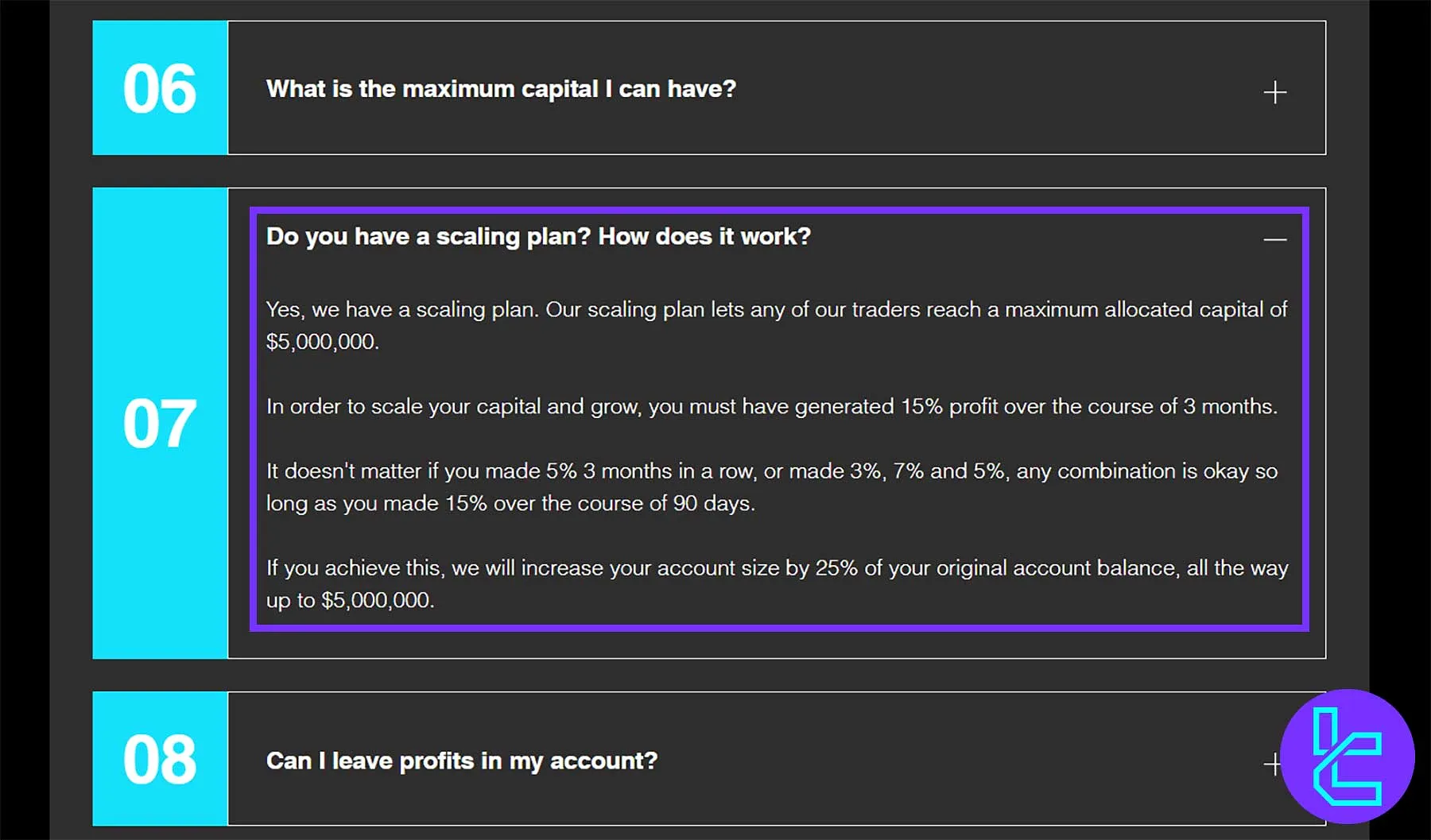

The Trading Capital Scaling Plan

The Trading Capital offers an ambitious scaling plan that allows professional traders to expand their funded capital up to $5,000,000. By maintaining consistent profitability and disciplined risk management, traders can grow their account size by 25% increments every three months.

- Maximum Capital: Up to $5,000,000 in allocated trading funds;

- Scaling Requirement: Generate 15% profit over a 90-day period to qualify;

- Profit Flexibility: Any combination of profits totaling 15% (e.g., 5% per month) meets eligibility;

- Incremental Growth: Account balance increases by 25% each scaling phase upon reaching the target;

- Goal: Encourage consistent performance and reward disciplined trading over time.

The Trading Capital’s Trading Platforms

The Trading Capital exclusively offers the MetaTrader 4 (MT4) platform for all its trading activities. Known for its user-friendly interface and advanced charting tools, MT4 is a widely popular choice among traders.

By focusing solely on MT4, The Trading Capital has many advantages for its traders; MT4 Features:

- Automated trading

- Technical indicators

- Fast, efficient trade execution

The Trading Capital offers MT4 in partnership with FXPRIMUS. However, the lack of alternative platforms may be a limitation for some traders who prefer more modern or specialized platforms like MetaTrader 5 (MT5) or TradingView.

Check TradingFinder's list of MT4 indicators for free and advanced technical tools.

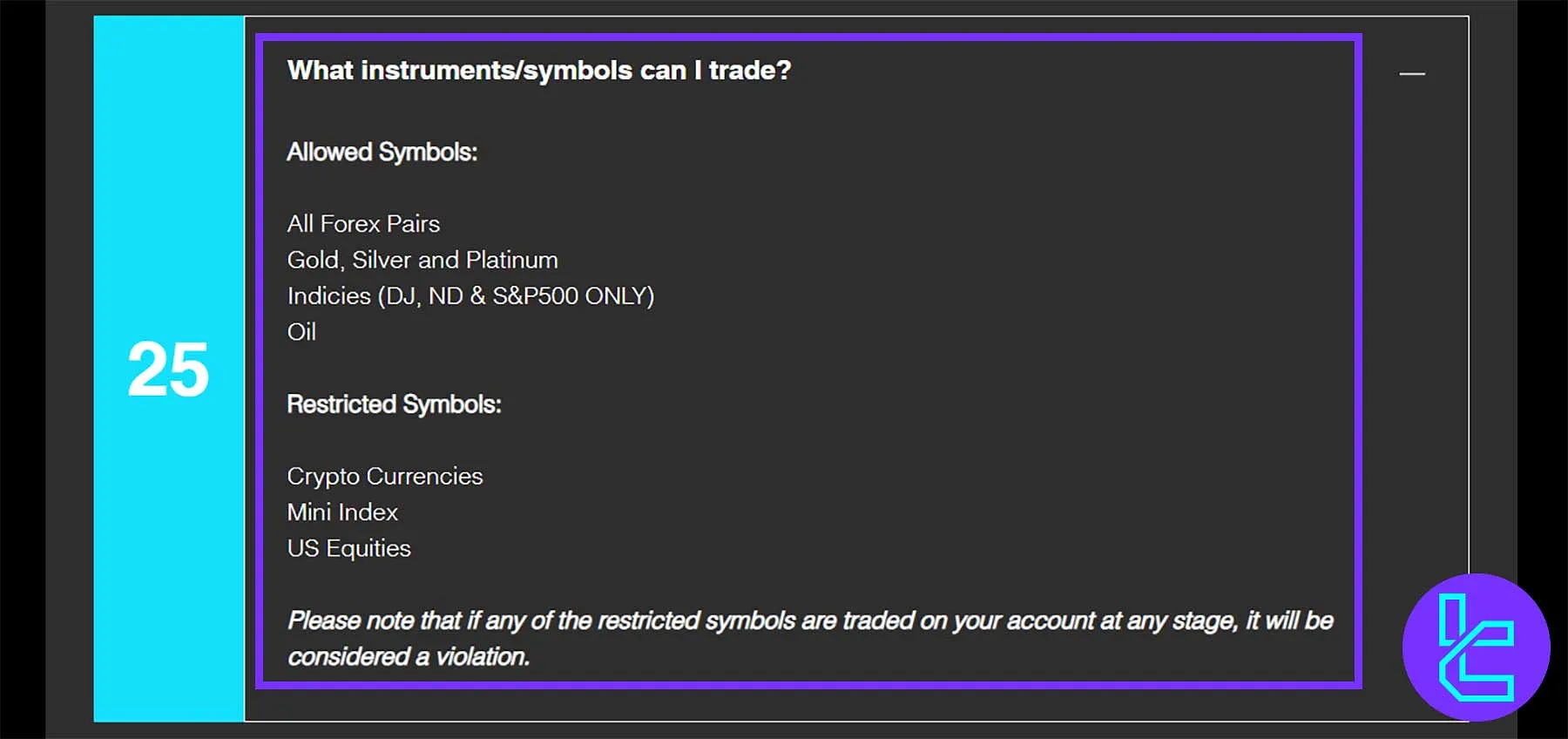

What Instruments & Symbols Can I Trade on The Trading Capital Prop Firm?

The firm offers access to various asset classes, from the Forex market to Metals, enabling traders to implement different strategies based on market conditions. The available instruments include:

- Currency Pairs (including EUR/USD, GBP/JPY, AUD/CAD, etc.)

- Indices (DJ, ND & S&P500)

- Metals (Gold, Silver, platinum)

- Commodities like oil

This diverse selection empowers traders to diversify their portfolios and adapt to various market opportunities.

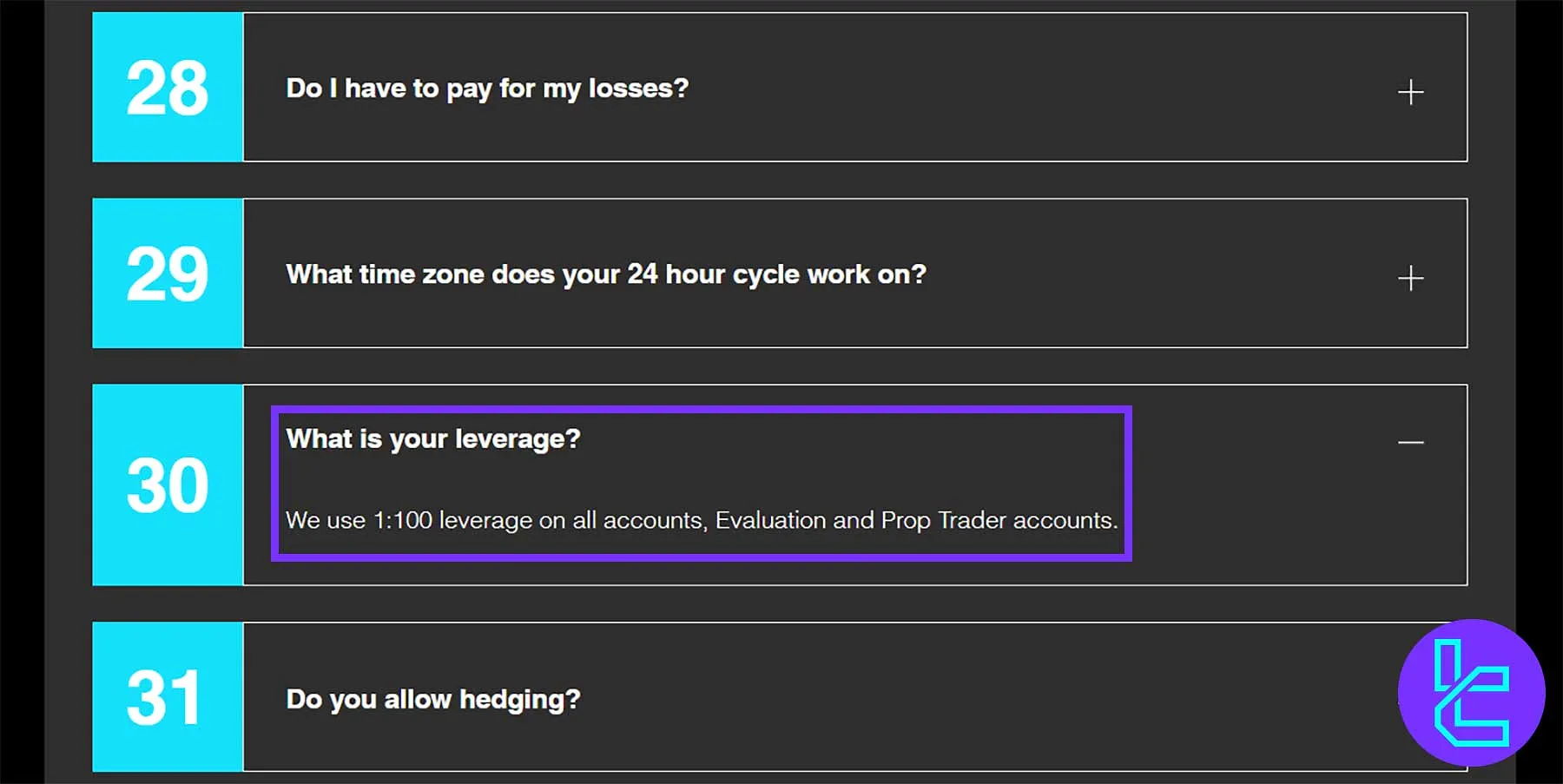

The Trading Capital Prop Firm Leverage Offerings

The Trading Capital Prop Firm provides traders with a competitive 1:100 leverage across all account types, including Evaluation and Prop Trader accounts. This leverage structure empowers traders to maximize their market exposure and trading potential while maintaining disciplined risk management and capital efficiency.

- Leverage Ratio: Fixed at 1:100 for all active and evaluation accounts;

- Coverage: Applies to Forex, commodities, indices, and metals;

- Objective: Enable efficient margin usage and flexibility for both short-term and swing trading strategies;

- Risk Management: Structured leverage ensures balanced risk while enhancing profit opportunities.

The Trading Capital Payment Methods

The Trading Capital Prop Firm offers several convenient payment methods for withdrawals, ensuring traders have flexible options to access their funds. Payouts can be processed Bi-Weekly and through the following methods:

- Bank/Wire Transfer: Secure and direct transfer to your bank account

- PayPal: Quick and easy transactions through one of the most popular online payment platforms

- TransferWise: Cost-effective international transfers with favorable exchange rates

- Bitcoin (BTC): A cryptocurrency option for those who prefer digital currency

- Skrill: Another widely-used online payment service that allows for fast withdrawals

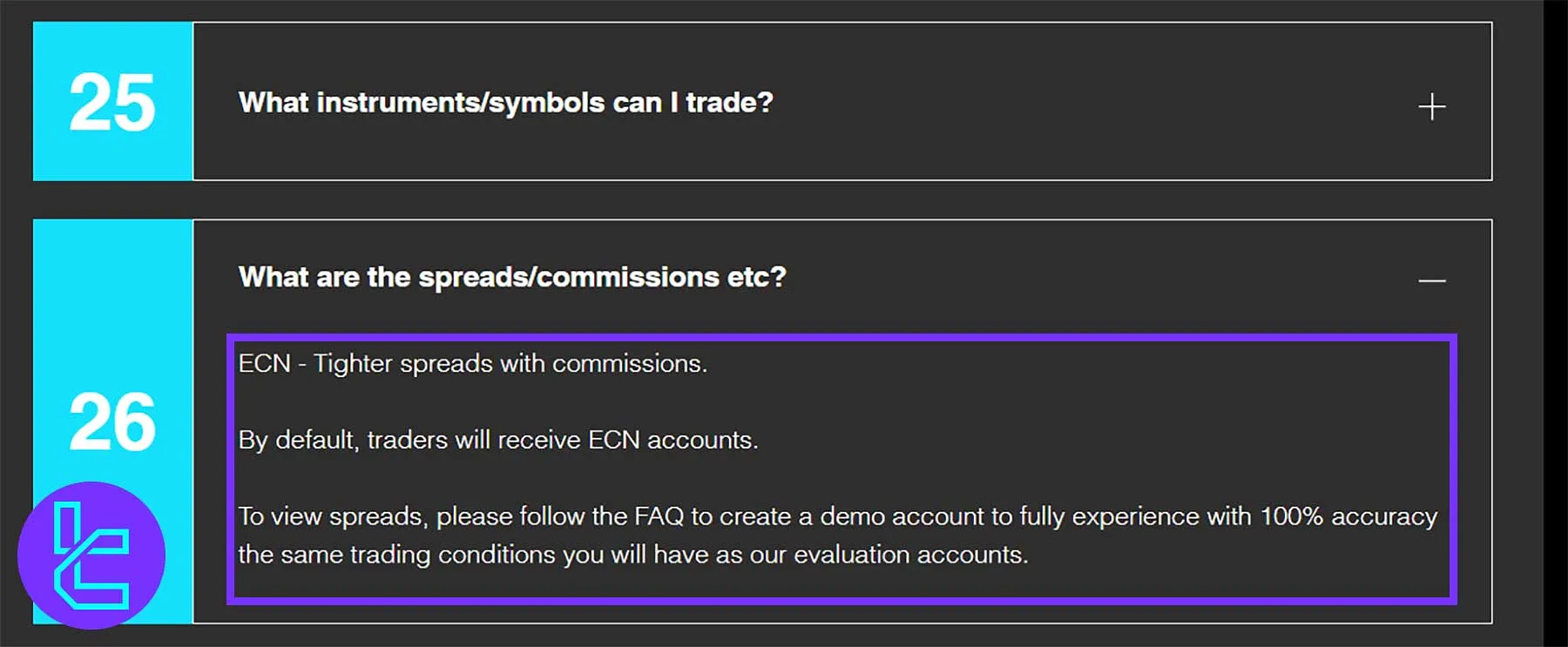

The Trading Capital Commission & Costs

The Trading Capital's commission structure is straightforward and competitive:

- No hidden fees or charges

- Standard spreads on all instruments

- 90/10 profit split in favor of the trader

- No commission on trades

The absence of additional fees and the high-profit split make The Trading Capital prop firm an attractive option for traders looking to maximize their earnings.

Does The Trading Capital Prop Firm Offer Vast Educational Resources?

While Trading Capital focuses primarily on providing capital and favorable trading conditions, its educational resources appear limited compared to other prop firms.

The firm's emphasis seems to be on attracting experienced traders who already possess the necessary skills and knowledge. However, traders can benefit from:

- Market analysis and insights provided by the firm

- Access to a community of fellow prop traders

- Support from the firm's experienced team

Aspiring traders may need to supplement their learning with external resources to fully prepare for The Trading Capital's evaluation process.

You can check TradingFinder's Forex education section for additional resources.

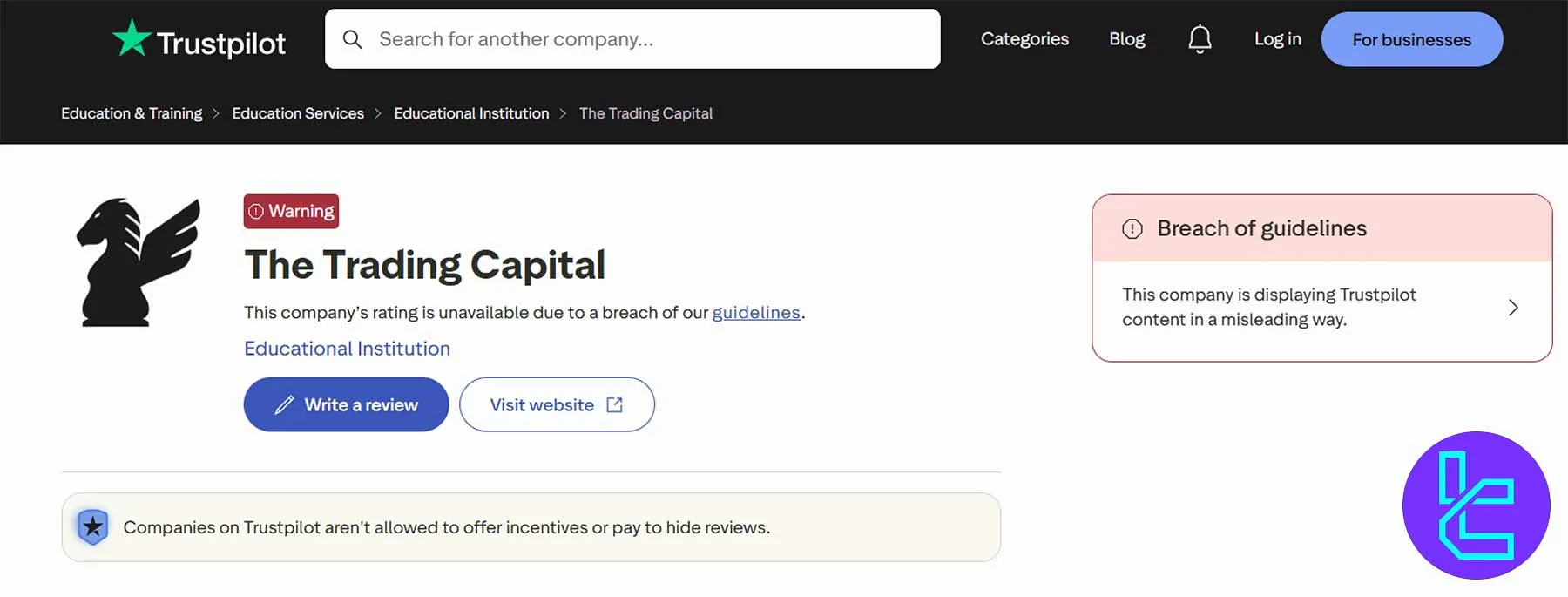

The Trading Capital’s trust score on Trustpilot

The Trading Capital Trustpilot rating is temporarily unavailable due to a guideline breach notice related to content display practices. Despite this, the firm remains recognized within the education and proprietary trading sector, focusing on transparency and continuous compliance with review platform standards.

Positive | Negative |

Some traders report receiving timely payouts | Complaints about poor communication |

Appreciation for the firm's favorable parameters | Long wait times for account credentials |

Positive experiences with customer service | Some traders describe the firm as incompetent |

- | Delays for funding |

It's important to note that online reviews should be considered alongside other factors when evaluating a prop firm. The mixed nature of the reviews suggests that individual experiences may vary.

The Trading Capital’s Customer Support team

The firm provides customer support to assist traders with questions and concerns:

Support Method | Availability |

Live Chat | Yes |

Yes (support@thetradingcapital.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

While some traders report positive experiences with customer support, others have complained about slow response times and unhelpful assistance. The firm may need to improve its support services to enhance the overall trader experience.

The Trading Capital Prop Firm Social Media Channels

The firm maintains a limited presence on social media platforms:

Social Media | Members/Subscribers |

2230 | |

11300 |

The firm's social media activity is relatively low compared to other prop firms, which may limit opportunities for community engagement and real-time updates.

The Trading Capital vs Other Prop Firms

Let's compare The Trading Capital's services with other platforms:

Parameters | The Trading Capital Prop Firm | Crypto Fund Trader Prop Firm | For Traders Prop Firm | FundedNext Prop Firm |

Minimum Challenge Price | $297 | $55 | $49 | $32 |

Maximum Fund Size | $5,000,000 | $200,000 | $1,500,000 | $4,000,000 |

Evaluation steps | 2-Step | 1-phase, 2-phase | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 90% | 80% | 90% | 95% |

Max Daily Drawdown | 6% | 4% | 4% | 5% |

Max Drawdown | 12% | 6% | 8% | 10% |

First Profit Target | 8% | 8% | 6% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:125 | 1:100 |

Payout Frequency | 14 Days | 2 Times a Month | 14 Days | From 5 Days |

Number of Trading Assets | N/A | 200+ | 130 | 78 |

Trading Platforms | MT4 | Metatrader 5, CFT Platform and Crypto Futures | DXTrade, TradeLocker, cTrader | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

The Trading Capital offers competitive conditions like evaluation fee discounts, automated trading, and news trading.

The firm’s scaling opportunities up to $5M, no hidden fees, and flexible rules, including weekend trading, are attractive.

Despite mixed reviews on Trustpilot and limited educational resources, it remains a relatively good choice for experienced traders.