Traders with Edge is a prop firm owned by “Swift Trader Ltd”. This Hong Kong firm started its work in 2022 and is managed by CEO “Samuel Junghenn”.

There are 3 challenges [1 PHASE TURTLE, 2 PHASE- HARE, INSTANT] in this prop with up to $1 million funding. Also, in Traders with Edge, 80% of the profit is yours.

Traders with Edge Prop Firm Overview

Founded in February 2022 by CEO “Samuel Junghenn”, Traders with Edge has quickly made a name for itself in the prop trading industry.

Based in the bustling financial hub of Hong Kong, this innovative prop firm offers a range of funding options to suit traders of all experience levels. Key features of Traders with Edge include:

- One-phase "TURTLE" challenges for swift evaluation

- Two-phase "HARE" challenges for a more gradual approach

- Instant funding accounts for experienced traders

- Daily loss limits of 3-10%

- 80% profit split for funded traders

- Bi-weekly payouts

- Leverage up to 1:100

- Allowance for EAs, news trading, and weekend holding

- Scaling plans to grow accounts up to $3 million

What sets Traders with Edge apart is their commitment to flexibility and trader success.

While the firm itself is not regulated as a financial institution, it partners with Eightcap, a broker licensed and supervised by the Australian Securities and Investments Commission (ASIC), to handle trade execution. This partnership ensures that client trades are routed through a trusted and regulated liquidity provider.

Traders With Edge CEO

Samuel Junghenn stands as the visionary force behind Traders With Edge, bringing over 25 years of experience in building, scaling, and innovating tech-driven ventures. As a seasoned entrepreneur and strategist, he has shaped multiple high-growth companies and contributed to the success of hundreds of businesses across diverse industries.

- Founder of Traders With Edge Tech, delivering advanced trading technology to the prop-firm ecosystem;

- CEO of AI Legal Assistant, one of Australia’s most powerful AI-driven legal productivity platforms;

- Over 25 years of expertise in business growth, capital raising, and scaling multi-sector tech firms;

- Known for leadership in software project management, digital strategy, and technological innovation;

- Frequent speaker at industry webinars and events focused on AI, automation, and business transformation;

- Entrepreneurial background includes leading Symbiosis Capital and Bot Profits, specializing in high-return trading technology.

Specifications Summary

Let's break down the key specifications of the prop firm:

Account Currency | AUD, USD, EUR, GBP, NZD, CAD, SGD |

Minimum Price | $55 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 80% |

Instruments | Forex, Cryptocurrency, Commodities, Indices |

Assets | N/A |

Evaluation Steps | 3 [1 PHASE TURTLE, 2 PHASE- HARE, INSTANT] |

Trading Platform | DXTrade, Match Trader |

Withdrawal Methods | Crypto, Bank Transfer, Ideal, Prompt Pay, PayPal, Google Pay, Apple Pay, Bancontact, Giro Pay, Perfect Money, Fasapay |

Maximum Fund Size | $1,000,000 [Scalable to $3M] |

First Profit Target | 10% |

Maximum Daily Loss | 10% |

Challenge Time Limit | Min. 5 Days |

News Trading | Yes |

Maximum Total Drawdown | 20% |

Commission Per Round Lot | N/A |

Trustpilot Score | 4.4 out of 5 |

Payout Frequency | Bi-Weekly |

Established Country | Hong Kong |

Established Year | 2022 |

Traders with Edge offers a compelling package for aspiring and experienced traders alike. However, as with any financial service, it's crucial to thoroughly review the terms and conditions before committing.

Pros & Cons

To give you a balanced view, let's examine the advantages and disadvantages of trading with Traders with Edge:

Pros | Cons |

Fee-free profit withdrawals | Relatively low daily loss limit (3%) |

Swift digital account opening and verification | Slow withdrawal processing (5-10 working days) |

Competitive profit split (up to 80%) | Limited reviews on reputable platforms (e.g., ForexPeaceArmy) |

Up to $1 million funding (excluding the scaled amount) | Occasional website issues reported by users |

News trading and EAs are allowed | - |

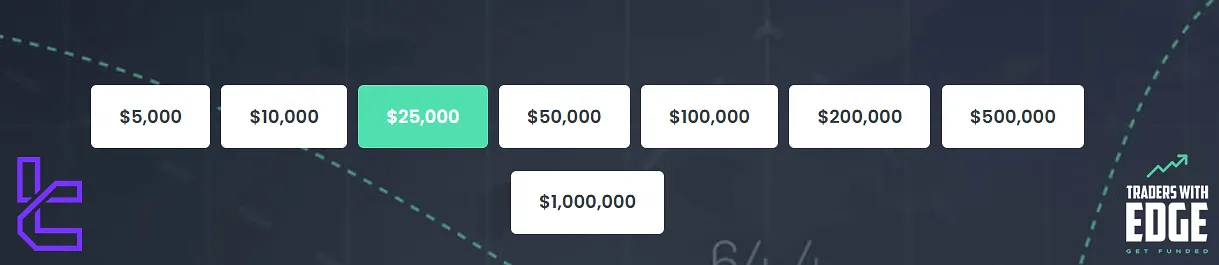

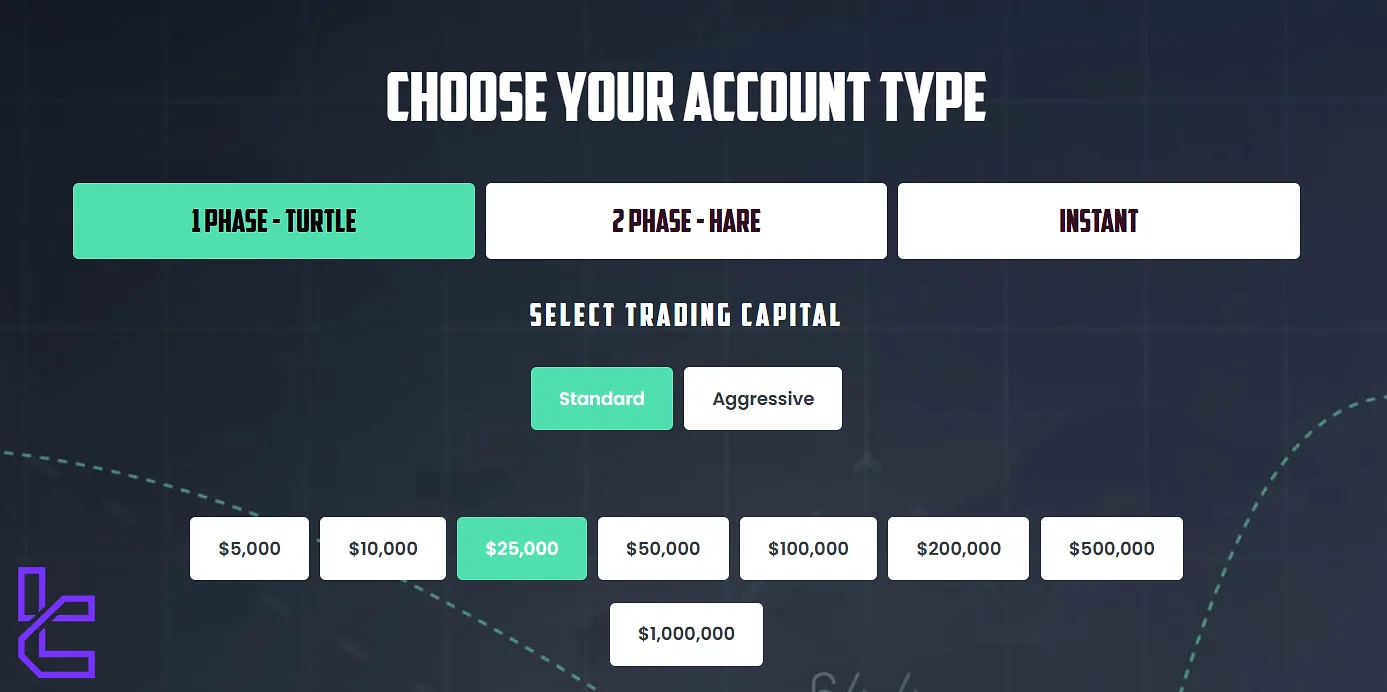

Fundings & Price in Traders with Edge

There are three challenges available in Traders with Edge, and each of them has its own price and funding in two tiers, such as Standard and Aggressive, which you can see in the table below:

Challenge Funding | Price in 1 PHASE - TURTLE (Standard) | Price in 1 PHASE - TURTLE (Aggressive) | Price in 2 PHASE - HARE (Standard) | Price in 2 PHASE - HARE (Aggressive) | INSTANT (Standard) | INSTANT (Aggressive) |

$2500 | - | - | - | - | $125 | $200 |

$5000 | $55 | $88 | $69 | $110 | $250 | $400 |

$10000 | $100 | $160 | $110 | $176 | $500 | $800 |

$20000 | - | - | - | - | $1000 | $1600 |

$25000 | $199 | $400 | $220 | $352 | - | - |

$40000 | - | - | - | - | $2000 | $3200 |

$50000 | $349 | $720 | $330 | $528 | - | - |

$100000 | $549 | $1200 | $550 | $880 | - | - |

$200000 | $997 | $2400 | $997 | $1595 | - | - |

$400000 | - | - | $1994 | $3190 | - | - |

$500000 | $2997 | $5600 | - | - | - | - |

$1000000 | $5997 | $12000 | - | - | - | - |

For traders who prove their mettle in these challenges, Traders with Edge offers a unique opportunity to move to the "Big League" after a minimum of 2 years, potentially accessing funding from larger institutions.

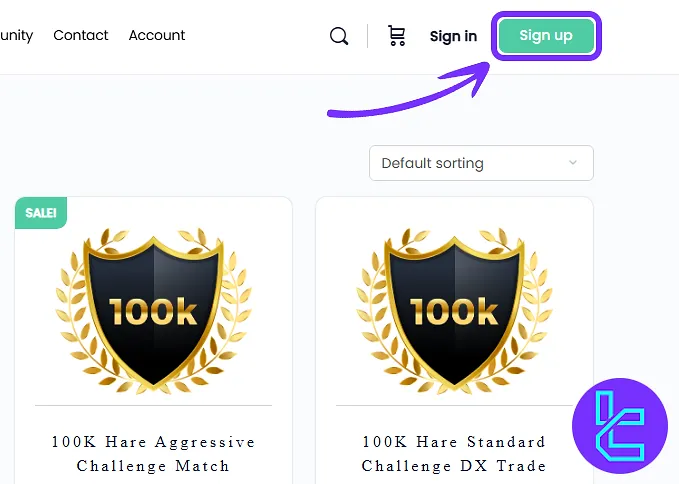

How to Register an Account in Traders with Edge? Complete Guide for Traders!

The Traders with Edge registration process is an easy process that can be done in 4 steps. Each step is explained in detail here. Note that to open an account, you must agree to the platform's terms of use and be at least 18 years old.

#1 Visit the Sign-Up Page

Go to the official Traders with Edge website and click the “Sign Up” button to begin.

#2 Fill Out the Registration Form

Provide your email address, full name, and nickname. Set a password and agree to the terms of service. Then, click “Create Account” to proceed.

#3 Verify Your Email

Check your inbox for a confirmation message. Click the verification link and enter the activation code provided. Once completed, your account will be fully active and ready for login.

#4 Verify Your Identity

For identity verification, you will need to submit the required documents and provide additional information to the prop firm.

Traders with Edge Challenges: Complete Overview

Traders With Edge offers multiple evaluation paths designed for different risk profiles, from disciplined one-phase programs to fast-paced instant funding. With up to 1:100 leverage, scaling to $3M, and EA-friendly conditions, traders gain flexibility while operating under clear and transparent rules.

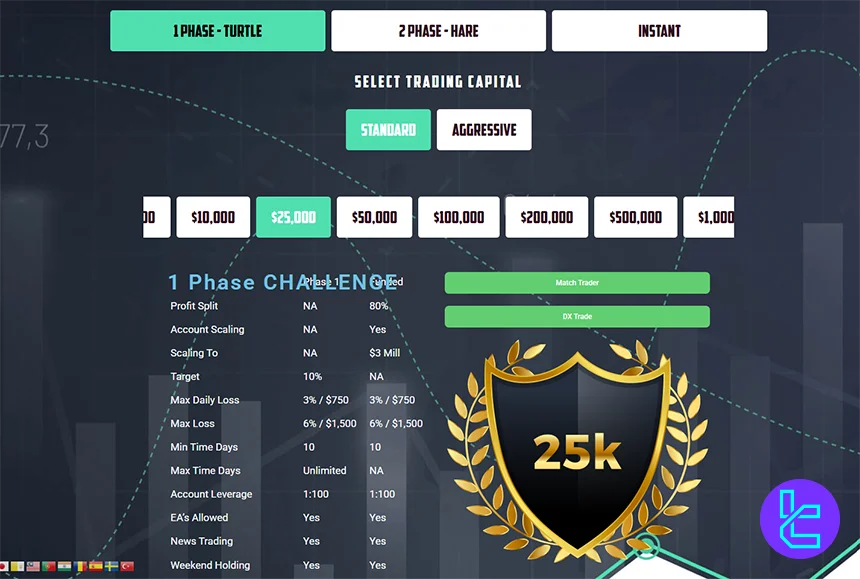

1 PHASE TURTLE (Standard)

The 1-Phase Turtle Standard challenge caters to traders seeking steady growth with moderate risk. It features balanced loss limits, flexible trading time, and full EA support, making it ideal for structured, rule-based strategies.

Specifics | Phase 1 | Funded |

Profit Split | N/A | 80% |

Account Scaling | N/A | Yes, Up to $3M |

First Target | 10% | N/A |

Maximum Daily Loss | 3% | 3% |

Maximum Loss | 6% | 6% |

Minimum Trading Time | 10 Days | 10 Days |

Maximum Trading Time | Unlimited | N/A |

Leverage | 1:100 | 1:100 |

EA | Yes | Yes |

News Trading | Yes | Yes |

Payout | N/A | 2 Weeks |

This model is ideal for disciplined traders who value consistency, long-term growth, and generous scaling opportunities.

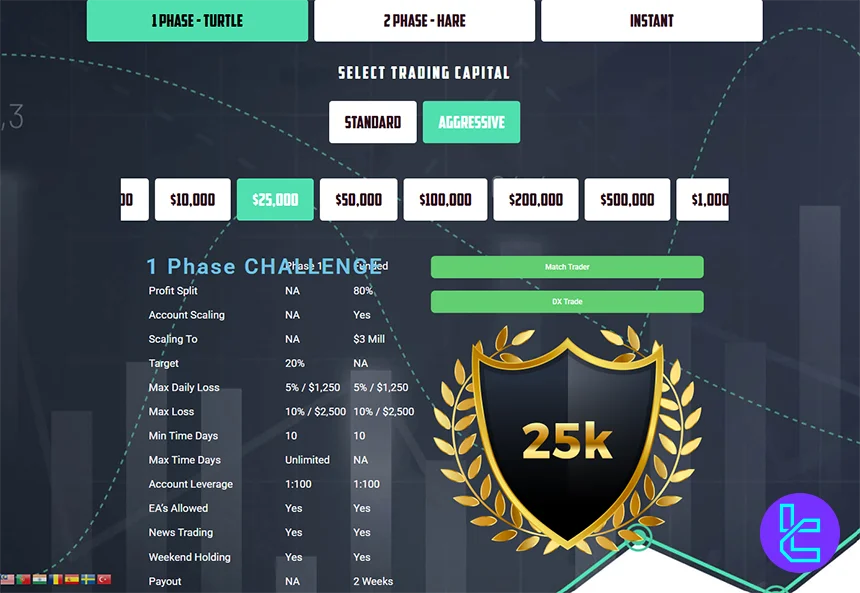

1 PHASE TURTLE (Aggressive)

This aggressive variant suits high-conviction traders ready to navigate higher drawdowns in exchange for rapid scaling and a larger target. It maintains the same flexibility while amplifying risk-reward potential.

Specifics | Phase 1 | Funded |

Profit Split | N/A | 80% |

Account Scaling | N/A | Yes, Up to $3M |

First Target | 20% | N/A |

Maximum Daily Loss | 5% | 5% |

Maximum Loss | 10% | 10% |

Minimum Trading Time | 10 Days | 10 Days |

Maximum Trading Time | Unlimited | N/A |

Leverage | 1:100 | 1:100 |

EA | Yes | Yes |

News Trading | Yes | Yes |

Payout | N/A | 2 Weeks |

This plan empowers confident traders to scale faster while keeping full flexibility in tools and strategy choices.

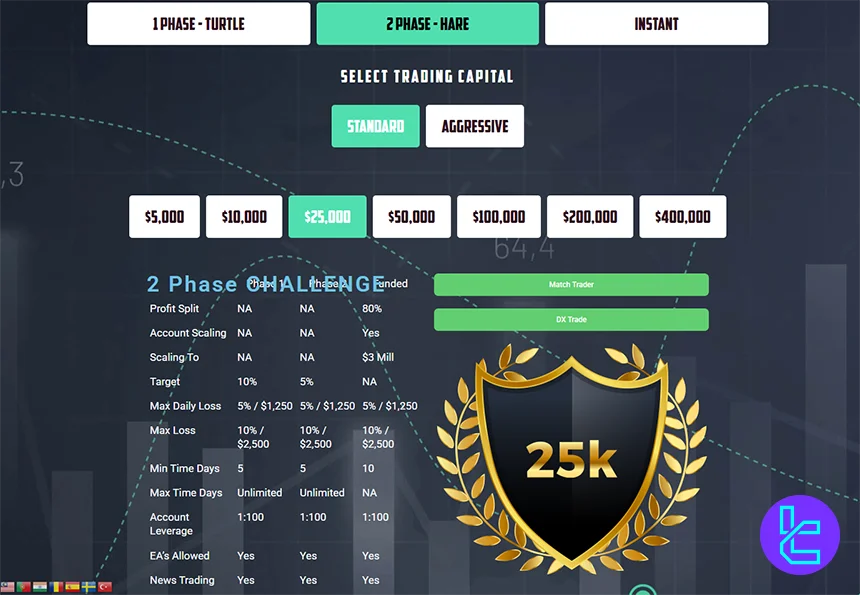

2 PHASE- HARE (Standard)

The 2-Phase Hare Standard challenge offers a balanced evaluation for traders who prefer gradual progression. With moderate targets across two stages, it rewards consistency over aggressive strategy.

Specifics | Phase 1 | Phase 2 | Funded |

Profit Split | N/A | N/A | 80% |

Account Scaling | N/A | N/A | Yes, Up to $3M |

First Target | 10% | 5% | N/A |

Maximum Daily Loss | 5% | 5% | 5% |

Maximum Loss | 10% | 10% | 10% |

Minimum Trading Time | 5 Days | 5 Days | 5 Days |

Maximum Trading Time | Unlimited | Unlimited | N/A |

Leverage | 1:100 | 1:100 | 1:100 |

EA | Yes | Yes | Yes |

News Trading | Yes | Yes | Yes |

Payout | N/A | N/A | 2 Weeks |

Ideal for traders who prefer structured progression without strict time limits.

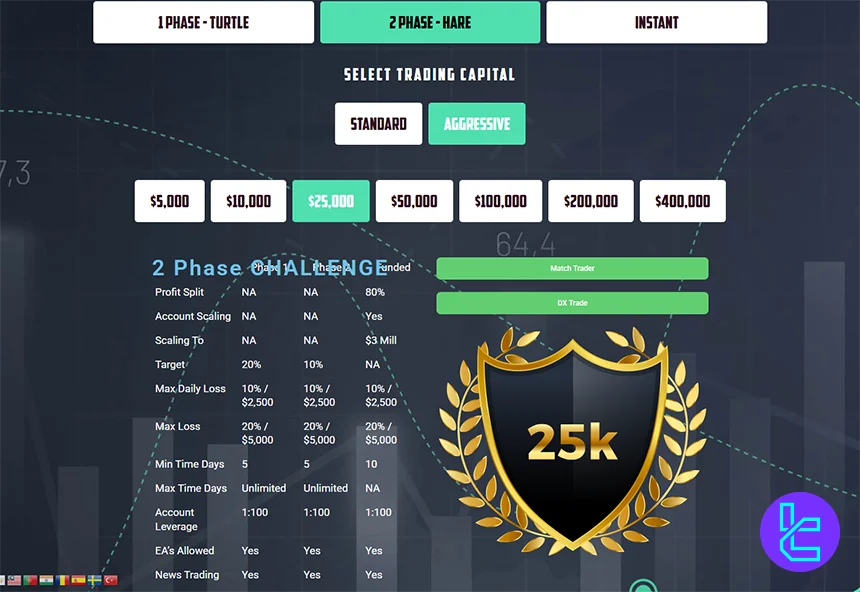

2 PHASE- HARE (Aggressive)

This model targets traders who excel under higher risk thresholds. With increased targets and larger drawdown limits, it enables rapid movement toward funding.

Specifics | Phase 1 | Phase 2 | Funded |

Profit Split | N/A | N/A | 80% |

Account Scaling | N/A | N/A | Yes, Up to $3M |

First Target | 20% | 10% | N/A |

Maximum Daily Loss | 10% | 10% | 10% |

Maximum Loss | 20% | 20% | 20% |

Minimum Trading Time | 5 Days | 5 Days | 5 Days |

Maximum Trading Time | Unlimited | Unlimited | N/A |

Leverage | 1:100 | 1:100 | 1:100 |

EA | Yes | Yes | Yes |

News Trading | Yes | Yes | Yes |

Payout | N/A | N/A | 2 Weeks |

Best suited for aggressive traders aiming for fast evaluation completion.

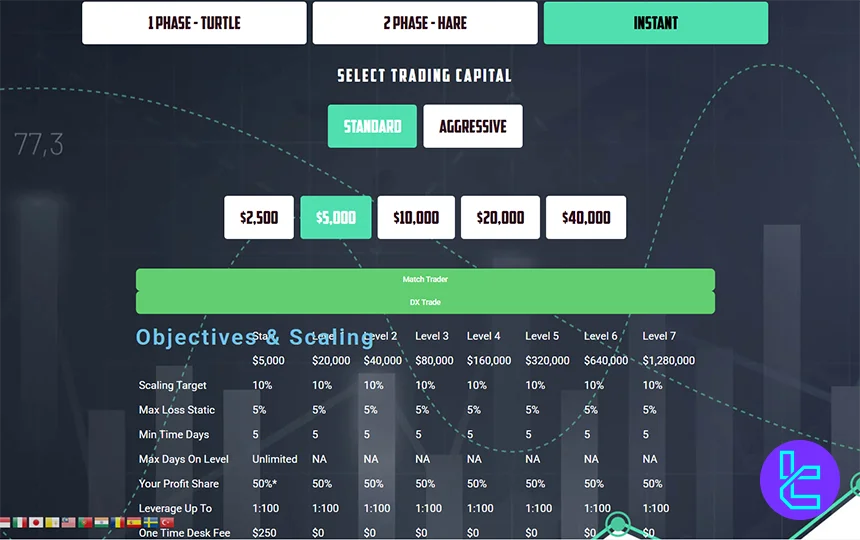

INSTANT (Standard)

Designed for traders who want immediate access to funded capital, the Instant Standard program starts right away—no evaluation needed—while enforcing disciplined static risk controls.

Specifics | Info |

Scaling Target | 10% |

Max Loss Static | 5% |

Minimum Time | 5 Days |

Maximum Days on Level | N/A |

Profit Share | 50% |

Maximum Leverage | 1:100 |

This plan offers an accessible entry point into funded trading while ensuring responsible risk parameters.

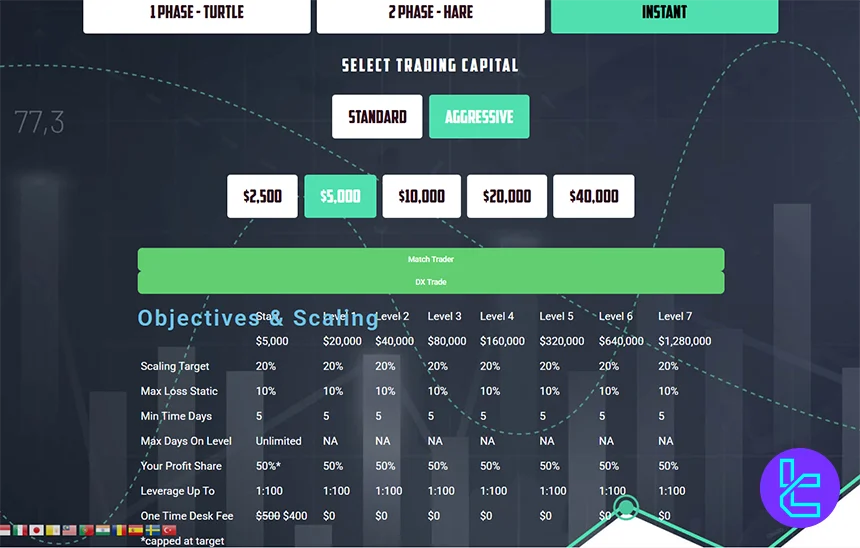

INSTANT (Aggressive)

The Instant Aggressive model is built for traders seeking both immediate capital and higher risk tolerance. With double the loss limits and amplified scaling targets, it creates room for bold strategies.

Specifics | Info |

Scaling Target | 20% |

Max Loss Static | 10% |

Minimum Time | 5 Days |

Maximum Days on Level | N/A |

Profit Share | 50% |

Maximum Leverage | 1:100 |

Each of the funding opportunities offered in the Instant Challenge has the potential to increase in size and attract more capital.

Does Traders with Edge Prop Offer Bonuses and Discounts?

Traders with Edge occasionally offers special promotions to attract new traders and reward existing ones:

50% Extra Account Balance Bonus

This promotion allows traders to boost their trading capital, giving them more flexibility and potential for profit.

Trading Competitions

Traders can win challenge accounts (e.g., a $25,000 account) by sharing their best trade setups, fostering community engagement, and knowledge sharing.

Traders with Edge Rules

This section goes through the Trader With Edge rules that must be taken seriously:

- Hedging: You can hedge trades, but not between two accounts. Keep in mind that hedging could add extra risk to your account, and you are responsible for any violations due to hedging;

- Expert Advisors (EA): You can use an EA for trading, but you are responsible for any violations caused by its usage. EAs are not available for instant funding;

- Arbitrage: Arbitrage is prohibited;

- News Trading: Trading around news is allowed. Unrealistic fills or pricing are violations, and trades must reflect real market conditions;

- Payout: Clear payout rules requiring 10 active trading days, flexible withdrawal methods, and secure processing ensure a fair system for all funded traders.

VPN Usage

The policy regarding VPN usage is not explicitly defined.

Hedging Policy

Traders are permitted to hedge positions within a single account. However, cross-account hedging—executing offsetting trades between two separate accounts—is strictly forbidden. Such activity introduces additional risk and may lead to violations. Ultimately, the trader is fully responsible for all outcomes resulting from hedging strategies.

Use of Expert Advisors (EAs)

Automated trading via Expert Advisors is allowed during evaluations and live accounts. That said, traders must be aware of the following responsibilities:

- They are solely accountable for any rule violations caused by the EA’s behavior, regardless of whether it was intentional or due to faulty coding;

- No justification citing the EA’s malfunction will be accepted;

- If a publicly available or third-party EA is in use, and it’s discovered that another trader on the platform is running the same algorithm, the account may be flagged for potential rule breaches due to trade duplication.

Additionally, EA usage is not permitted in instant funding programs.

Arbitrage and Martingale

Arbitrage trading strategies—exploiting discrepancies in pricing or execution speed—are strictly prohibited. No official position is stated on martingale strategies.

News Trading Rules

Traders are allowed to participate in news-related trades. However, they must exercise caution due to the increased volatility, widened spreads, and risk of slippage during economic announcements. Importantly:

- Trades that attempt to exploit unrealistic fills or artificial pricing conditions will be considered violations;

- All trades must be executable and reproducible on a real server with genuine spreads and slippage. If execution appears artificial or unreplicable under real-market conditions, profits may be voided and accounts flagged for manipulation.

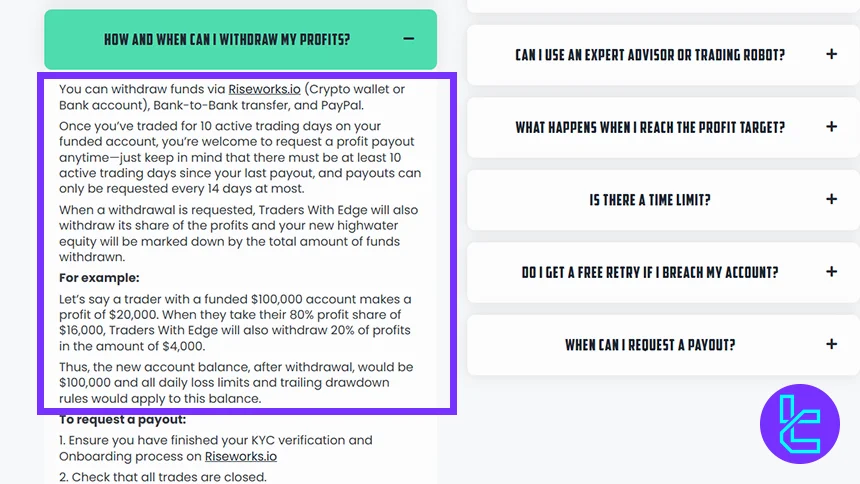

Traders With Edge Payout Rules

Traders With Edge provides a structured, transparent payout system designed to reward consistent performance. With 10 active trading-day requirements, 14-day payout cycles, and multiple global withdrawal methods, traders maintain full control over their earnings while operating within clear risk-management expectations.

- Traders must complete 10 active trading days before their first payout and another 10 days after each subsequent payout. Payouts are available once every 14 calendar days;

- Withdrawals are processed through Riseworks.io, crypto, PayPal, or bank transfer. Minimum payout thresholds vary by method: $50 (bank) and $100 (crypto/PayPal);

- Profit share is deducted simultaneously for the trader and the firm. After withdrawal, the account resets to its initial balance, and all risk rules reapply;

- Deviating from the provided soft risk-management guideline may result in payout denial and profit removal, though the funded account remains active for future growth;

- To request payout: complete KYC, close trades, ensure eligibility, and submit via dashboard. Accounts enter read-only mode until processing is completed;

- Payouts are sent within 5 business days, with an additional 5-day window depending on the chosen payment provider.

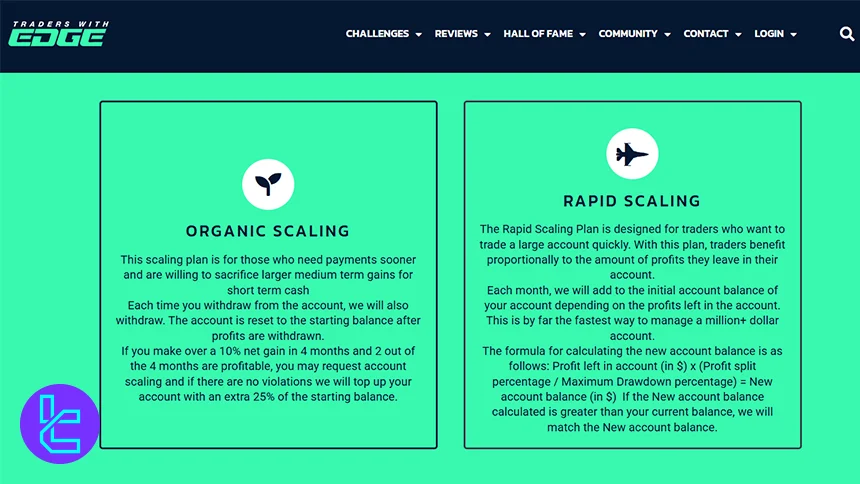

Traders With Edge Scaling Program

Traders With Edge provides a dual-scaling structure to help traders grow their capital over time, either steadily or aggressively:

- Organic Scaling: This method rewards consistency. If a trader achieves a 10% net gain over four months (with two profitable months), their funded account receives a 25% capital increase;

- Rapid Scaling: Tailored for more aggressive traders, this plan allows for capital boosts based on retained profits. The more profit left in the account, the faster the scaling.

What Are the Trading Platforms?

As we discovered in Traders with Edge review, they offer 2 trading platforms [Match Trader, DXTrade] to suit different trader preferences. Traders with Edge Trading Platforms:

- DXtrade: A proprietary platform that provides a user-friendly interface and advanced charting tools;

- Match Trader: Another platform designed for modern traders, offering a seamless trading experience.

These platforms support automated trading, news trading, and weekend holding, providing traders with the flexibility to implement various trading strategies.

What instruments & symbols Are Tradable at Traders with?

Traders with Edge offers 4 tradable instruments including forex, cryptocurrency, commodities, and indices:

- Forex Market: Major, minor, and exotic currency pairs

- Cryptocurrencies: Popular digital assets like Bitcoin, Ethereum, and more

- Commodities: Including gold, silver, oil, and agricultural products

- Indices: Major global stock market indices

This wide array of instruments allows traders to diversify their portfolios and take advantage of various market conditions.

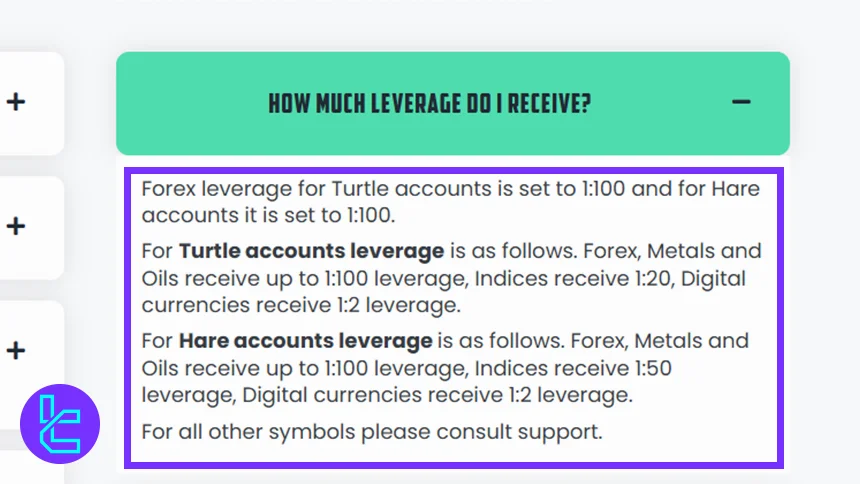

Traders With Edge Leverage Offerings

Traders With Edge provides competitive leverage structures tailored to both Turtle and Hare accounts, ensuring traders can scale exposure efficiently across forex, metals, indices, oils, and digital assets. With maximum leverage reaching 1:100, traders benefit from flexibility while maintaining disciplined risk control.

- Turtle Accounts Leverage: Forex, metals, and oils offer up to 1:100 leverage, enabling strong position efficiency. Indices operate at 1:20, while digital currencies remain conservative at 1:2 leverage;

- Hare Accounts: More aggressive traders benefit from the same 1:100 leverage on forex, metals, and oils. Indices receive a boosted 1:50 leverage, while digital currencies stay at 1:2;

- Traders needing leverage details for additional instruments can contact support for symbol-specific guidance.

What Payment Methods Are Available at Traders with Edge Prop?

Traders with Edge offers 10+ payment options to cater to traders worldwide:

- Crypto

- Bank Transfer

- Ideal

- Prompt Pay

- PayPal

- Google Pay

- Apple Pay

- Bancontact

- Giro Pay

- Perfect Mone

- Fasapay

Commission & Costs

Traders with Edge aims to keep costs competitive for its traders:

- Challenge Fees: Range from $55 to $12000, depending on the account size and challenge type

- Scaling Plans: No additional fees for scaling accounts up to $3 million

- Trading Costs: Low commissions through partnered broker, with competitive ECN rates

Occasionally, Traders with Edge offers promotions such as 10-25% off challenge accounts or increased profit sharing, so keep an eye out for these opportunities to reduce your costs.

Does Traders with Edge Prop Firm Offer Vast Educational Resources?

Unlike some prop firms, Traders with Edge does not offer extensive educational resources. Their focus is primarily on providing funding and a supportive trading environment rather than comprehensive trading education.

Trust Scores & Reviews

The Traders with Edge Trustpilot profile has garnered generally positive reviews, with an overall rating of 4.4 out of 5 stars. Traders praise the firm for its:

- Fair evaluation process

- Competitive profit split

- Excellent scaling options

- Responsive and knowledgeable customer support team

Many traders have shared success stories of passing challenges and transitioning to funded accounts. While there are some negative reviews, the overall sentiment towards Traders with Edge appears to be positive.

Customer Support: Hours & Channels

Traders with Edge offers customer support through two main channels:

Support Method | Availability |

Live Chat | Yes |

Yes (support@traderswithedge.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

The support team is generally praised for being personable and knowledgeable, but there is no information on their working hours!

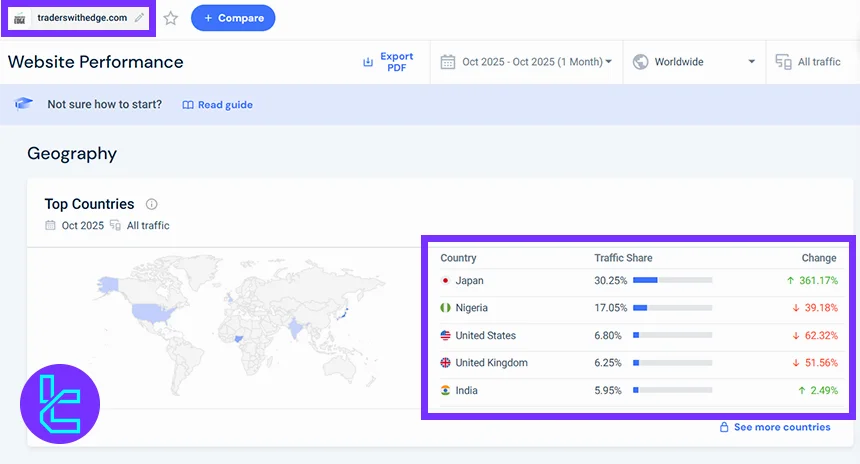

Traders With Edge Client Base

Traders With Edge attracts a globally diverse user base, with notable traction across Asia, Africa, and major Western markets. October 2025 data highlights strong engagement from regions with fast-growing retail-trading communities and rising demand for funded-account programs.

- Japan leads with 30.25%, marking a significant 361.17% increase, reflecting growing interest in prop funding among advanced Asian traders;

- Nigeria contributes 17.05%, despite a 39.18% decline, indicating stable demand in Africa’s rapidly expanding forex community;

- The United States and United Kingdom represent 6.80% and 6.25%, showing steady Western participation even after market-related declines;

- India accounts for 5.95%, supported by a 2.49% increase, driven by rising adoption of prop trading among young traders.

Traders with Edge Prop on Social Media

Traders with Edge maintains an active presence on various social media platforms. Following these channels can help traders stay informed about the latest offerings, promotions, and community events at Traders with Edge.

Social Media | Members/Subscribers |

2309 | |

1500 | |

1544 | |

3250 | |

1950 |

Traders with Edge Compared to Its Competitors

The table below draws a comparison between Traders with Edge and its peers:

Parameters | Traders with Edge Prop Firm | BrightFunded Prop Firm | Blue Guardian Prop Firm | Funding Traders Prop Firm |

Minimum Challenge Price | $55 | €55 | $67 | $100 |

Maximum Fund Size | $3,000,000 | Infinite | $2,000,000 | $2,000,000 |

Evaluation steps | 3-Step [1 PHASE TURTLE, 2 PHASE- HARE, INSTANT] | 2-Step | 1-phase, 2-phase, 3-phase | 1-Step, 2-Step |

Profit Share | 80% | 100% | Up to 90% | 100% |

Max Daily Drawdown | 10% | 5% | 4% | 5% |

Max Drawdown | 20% | 8% | 10% | 10% |

First Profit Target | 10% | 10% | 6% | 10% |

Challenge Time Limit | Min. 5 Days | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:100 | 1:100 |

Payout Frequency | 14 days | 14 Days | 14 Days | 7 Days |

Number of Trading Assets | N/A | 150+ | N/A | N/A |

Trading Platforms | DXTrade, Match Trader | cTrader, DXTrade | MatchTrader, Tradelocker, MT5 | DXTrade, Tradelocker, MT5 |

TradingFinder Expert Opinion and Conclusion

Traders with Edge is a Hongkonger prop firm belonging to “Swift Trader Ltd”. Their journey began in 2022, and since then, they have funded traders with $1 million [scalable to $3 million].

They partner with Swift Trader broker and support 2 trading platforms [DXTrade, Match Trader]. On the contrary, maximum daily loss in this prop is just 5% and there are no educational resources offered by this prop.