Many leading Forex brokers now support crypto deposits and withdrawals, allowing traders to fund accounts using digital assets such as Bitcoin and stablecoins with reduced processing times and fewer geographic restrictions.

This guide highlights the best Forex brokers that support crypto payments, focusing on transaction costs, supported coins, execution quality, and overall trading conditions.

| AMARKETS | |||

| ERRANTE | |||

| alpari | |||

| 4 |  | TICKMILL | ||

| 5 |  | octafx | ||

| 6 |  | deriv | ||

| 7 |  | FIBO GROUP | ||

| 8 |  | IFC MARKETS | ||

| 9 |  | FXCC | ||

| 10 |  | FXPRIMUS |

Best Crypto Forex Brokers Ranked by Trustpilot

Trustpilot ratings offer a transparent view of real trader experiences with crypto-friendly Forex brokers. In this section, brokers are ranked based on their Trustpilot scores, reflecting user satisfaction with crypto deposits, withdrawals, trading conditions, and overall reliability.

Broker Name | Trustpilot Rating | Number of Reviews |

3522 | ||

Deriv | 70,416 | |

118 | ||

8,343 | ||

OctaFX | 8,980 | |

FXPrimus | 94 | |

Tickmill | 1060 | |

FiboGroup | 16 |

Crypto Transaction Fees at Forex Brokers

Crypto transaction fees play a critical role when choosing a Forex broker that supports cryptocurrency payments. These fees directly affect the net amount deposited or withdrawn and can vary based on the blockchain network, broker policy, and transaction size.

Unlike traditional banking fees, crypto costs are usually more transparent but also more volatile due to network congestion.

Broker Name | Deposit Fee | Withdrawal Fee |

$0 | $0 | |

$0 | $0 | |

Deriv | $0 | $0 |

Fibo Group | $0 | $0 |

IFC Markets | $0 | $0 |

Exness | $0 | $0 |

HFM | $0 | $0 |

FxGlory | $0 | $0 |

Note: Although brokers do not charge fees for deposits and withdrawals with crypto, the network fee still exists and you have to pay it.

Waiting Period for Crypto Deposits and Withdrawals

Crypto payments at Forex brokers are generally faster than traditional banking methods, but the exact waiting time depends on the blockchain network,number of confirmations, and the broker’s internal processing rules.

Broker Name | Deposit Time | Withdrawal Time |

AMarkets | Typically instant to 30-60 min | 30 min to 2 hours on most crypto networks |

Instant for cryptocurrencies | Within 1 working day or faster | |

Fibo Group | Varies by asset and network-most cryptos within 30-60 min | 30 min to several hours |

Internally processed within 24 hours | Within 24 hours | |

Instant for crypto deposits | 1-3 hours for most crypto withdrawals | |

FXCC | Instant to 30-60 min on supported blockchains | Usually 30-120 min |

FXPrimus | Instant to a few hours for crypto funding | Instant to a few hours |

HFM | Instant | Up to 24 hours |

Crypto Minimum Transaction Amounts in Forex Trading

Minimum crypto transaction amounts vary across forex brokers and are mainly influenced by blockchain network limits, internal risk policies, and supported cryptocurrencies.

In most cases, deposits have lower minimums than withdrawals, while withdrawal thresholds are set higher to cover network fees and processing costs.

Broker Name | Min. Deposit Amount | Min. Withdrawal Amount |

Errante | $50 | $20 |

OctaFX | $25 | 0.00096 BTC |

$15 | $100 | |

$1 | $10 | |

Alpari | $30 | $10 |

Exness | $10 | $1 |

HFM | $5 | $5 |

FxGlory | $1 | $5 |

Top 8 Crypto Payments Forex Brokers

Below are six well-established Forex brokers that support cryptocurrency deposits and withdrawals, selected based on reliability, crypto payment support, trading conditions, and overall trader demand.

AMarkets

AMarkets is a multi-asset Forex and CFD broker established in 2007, serving 2,000,000 plus clients across Latin America, Asia, and CIS regions.

It operates through several entities and is associated with multiple supervisory bodies including FSA Saint Vincent and the Grenadines, FSC Cook Islands, and MISA Comoros, while also being a member of The Financial Commission (FinaCom) with compensation coverage up to €20,000 per case.

AMarkets dashboard highlights client protection features such as segregated funds, negative balance protection, and monthly execution audits by Verify My Trade.

After completing AMarkets registration, traders can choose between Standard, ECN, Fixed, and Crypto accounts, plus a demo, with a $100 minimum deposit for most accounts and leverage up to 1:3000 depending on the instrument and entity.

Platforms include MetaTrader 4, MetaTrader 5, and a proprietary mobile app, with additional features like AMarkets copy trading and Autochartist. While AMarkets offers competitive conditions and a long track record, it is not regulated by top-tier regulators such as FCA or CySEC and is restricted in several jurisdictions including the U.S. and most EU countries.

Account Types | Standard, ECN, Fixed, Crypto, Demo |

Regulating Authorities | FSA, FSC, MISA, Financial Commission (FinaCom) |

Minimum Deposit | $100 |

Deposit Methods | Credit and Debit Cards, Crypto, Bank Transfer |

Withdrawal Methods | Credit and Debit Cards, Crypto, Bank Transfer |

Maximum Leverage | Up to 1:3000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Proprietary Mobile App |

AMarkets Pros and Cons

The following table highlights the most important benefits and potential drawbacks of using AMarkets.

Pros | Cons |

Long track record since 2007 | Not regulated by tier 1 authorities like FCA or CySEC |

Multiple entities and Financial Commission membership | Restricted in multiple regions including U.S. and EU |

Leverage up to 1:3000 across key accounts | ECN account requires higher minimum deposit ($200) |

Account variety including Crypto denominated option | Withdrawal fees may apply depending on method |

MT4, MT5, and proprietary mobile app | Some protections depend on entity and jurisdiction |

Errante

Errante is a Forex and CFD broker launched in 2018, operating through a dual-entity structure that targets both EU and international traders.

The broker’s EU arm runs under CySEC oversight, while its offshore branch is regulated by the FSA Seychelles, enabling broader global onboarding and higher leverage conditions.

Errante combines multi-platform access with a prop style trading environment, offering MetaTrader 4, MetaTrader 5, cTrader, and TradingView integration for chart-based execution.

After Errante registration, account selection includes Standard, Premium, VIP, and Tailor Made, with a $50 minimum deposit and 0.01 lot minimum order size.

For pricing, Standard, Premium, and VIP accounts are structured with $0 commission, while Tailor Made applies a $3 per lot commission with tighter spreads.

Beyond self-directed trading, they offer Errante rebate and supports copy trading plus managed allocation tools such as PAMM and MAM.

Funding and withdrawals cover bank wire, Visa, MasterCard, Skrill, Neteller, Volet, SticPay, and major cryptocurrencies including BTC, ETH, USDT, and XRP, with fees and processing times varying by method.

Client protection features include segregated funds and negative balance protection, with compensation coverage tied to the entity and applicable scheme.

Account Types | Standard, Premium, VIP, Tailor Made |

Regulating Authorities | CySEC, FSA Seychelles |

Minimum Deposit | $50 |

Deposit Methods | Bank Wire Transfer, Visa, MasterCard, Skrill, Neteller, Volet, SticPay, Bitcoin, Ethereum, Tether, Ripple |

Withdrawal Methods | Bank Wire Transfer, Visa, MasterCard, Skrill, Neteller, Volet, SticPay, Bitcoin, Ethereum, Tether, Ripple |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

Errante Pros and Cons

The table below compiles the most relevant advantages and disadvantages of Errante from a practical perspective.

Pros | Cons |

Dual regulation via CySEC and FSA Seychelles | Relatively short operating history since 2018 |

Multi-platform access: MT4, MT5, cTrader, TradingView | No Cent account option |

High leverage availability up to 1:1000 by plan and entity | Swap-free duration is limited on Islamic accounts |

Copy Trading plus PAMM and MAM support | Some key protections depend on entity and jurisdiction |

$0 commission on Standard, Premium, VIP accounts | Higher entry requirements for VIP and Tailor Made tiers |

Alpari

Alpari is a long standing Forex and CFD broker founded in 1998, serving traders in 150 plus countries with more than 1 million clients.

The brand operates through multiple entities, including Parlance Trading Ltd under Mwali International Services Authority (MISA) supervision and Alpari Evrasia LLC under the National Bank of the Republic of Belarus (NBRB) and that’s why Alpari verification is mandatory.

The broker offers Standard, ECN, and Pro ECN accounts plus a demo environment, with a $50 minimum deposit and 0.01 lot minimum order size.

On the Standard account, maximum leverage reaches 1:1000 with spreads that commonly start around 1.2 pips, while higher tier accounts can provide tighter pricing with different commission structures.

Alpari supports MetaTrader 4, MetaTrader 5, and WebTrader, covering browser based trading without installation. Market coverage includes Forex pairs, metals, commodities, indices, stock CFDs, and crypto CFDs, positioning Alpari as a multi asset CFD venue for retail and intermediate traders.

Funding and withdrawals are available through local payment solutions, bank transfers in some regions, cards, e wallets, and crypto payments, with method dependent fees and processing times.

Additional features include Alpari rebate, PAMM investment accounts, Islamic swap free options across live accounts, trading signals, and a cashback program.

Support is provided via phone, live chat, and email on a 24/5 schedule.

Account Types | Standard, ECN, Pro ECN, Demo |

Regulating Authorities | MISA, NBRB |

Minimum Deposit | $50 |

Deposit Methods | Local payment solutions, credit and debit cards, e wallets, bank wire transfers in some regions, crypto payments |

Withdrawal Methods | Local payment solutions, credit and debit cards, e wallets, bank wire transfers in some regions, crypto payments |

Maximum Leverage | Up to 1:3000 overall, 1:1000 on Standard account |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, WebTrader |

Alpari Pros and Cons

The following table presents a balanced overview of the key pros and cons to consider when evaluating Alpari.

Pros | Cons |

Established broker since 1998 with a global footprint | Limited top tier regulatory coverage |

Multiple account types including Standard, ECN, Pro ECN | Investor compensation scheme is not listed for these entities |

MT4, MT5, and WebTrader availability | Trust scores on review sites appear mixed and low volume |

Broad CFD market coverage including Forex and crypto CFDs | Inactivity fee applies after 3 months of dormancy |

PAMM and Islamic account support | Regional restrictions apply, including US, UK, Japan, Canada, and EU |

Tickmill

Tickmill is a multi asset Forex and CFD broker founded in 2014 that serves clients in 180 plus countries and reports an average monthly trading volume above $129B.

In Tickmill registration, they offer two live account types, Classic and Raw, plus a demo account, with a $100 minimum deposit and 0.01 minimum lot size. Trading costs can start from 0.0 pips on the Raw account with a $3 per lot per side commission, while the Classic account is commission free with spreads that can start around 1.6 pips.

The platform suite includes MetaTrader 4, MetaTrader 5, MetaTrader Web, and a mobile app, alongside extra tools such as VPS access and trading signal integrations.

Alongside Tickmill rebate, they offer six account base currencies, USD, EUR, GBP, ZAR, PLN, and CHF, which can reduce conversion costs for many traders.

Regulation is multi jurisdictional via FCA, CySEC, FSCA, LFSA, and FSA Seychelles, with client protections such as segregated funds and negative balance protection.

Funding and withdrawals are available through bank transfers, cards, e wallets, and crypto, generally with fast processing and low minimums.

Tickmill also provides social trading for eligible clients and periodic promotions such as the $30 Welcome Account and trading contests, while maintaining 24/5 customer support via live chat, email, and phone.

Account Types | Classic, Raw, Demo |

Regulating Authorities | FCA, CySEC, FSCA, LFSA, FSA Seychelles |

Minimum Deposit | $100 |

Deposit Methods | Crypto, payment systems, credit and debit cards, bank transfers |

Withdrawal Methods | Crypto, payment systems, credit and debit cards, bank transfers |

Maximum Leverage | Up to 1:1000 by entity, 1:30 under FCA and CySEC |

Trading Platforms and Apps | MetaTrader 4, MetaTrader 5, MetaTrader Web, Tickmill Mobile App |

Tickmill Pros and Cons

The following table provides a comprehensive summary of the main advantages and disadvantages of Tickmill based on key evaluation factors.

Pros | Cons |

Strong multi regulation coverage including FCA and CySEC | Only 2 main live account types |

Spreads from 0.0 pips on Raw account | Forex pair variety can feel limited versus some competitors |

MT4, MT5, web trading, and mobile app support | Some features depend on entity and region eligibility |

Six base currencies, USD, EUR, GBP, ZAR, PLN, CHF | Trustpilot rating is mid range compared with top brokers |

NDD execution model with direct liquidity routing | Inactivity fee can apply after 12 months under conditions |

Social trading option for eligible clients | Restricted countries apply, including US and Iran |

OctaFX

OctaFX is a global Forex and CFD broker that has operated since 2011 and reports more than 40 million accounts created, alongside over $33M paid in bonuses.

OctaFX dashboard broker supports trading in Forex, cryptocurrencies, indices, metals, energy CFDs, and stock CFDs using an ECN STP style execution setup with market execution.

Trading is commission free, swap free conditions apply across all account types, and the broker states it reimburses payment processor costs rather than charging deposit or withdrawal fees directly.

Platform access includes MetaTrader 4, MetaTrader 5, and the proprietary OctaTrader web platform, plus Octa Copy for social trading.

Regulation coverage includes FSCA and MISA as core labels in the summary, while the group also lists entities under CySEC and other offshore structures depending on region.

Client safeguards vary by entity, with segregated funds and negative balance protection generally stated, plus investor compensation schemes available only in specific jurisdictions.

OctaFX deposit and withdrawal offers multiple funding channels such as bank transfer, cards, e wallets, and crypto, but payment availability can change by country.

Support is available 24/7 via live chat, ticket, email, and phone, with multilingual coverage.

Overall, OctaFX targets cost sensitive traders who want simple pricing, strong automation compatibility through MT4 and MT5, and a proprietary platform layer for analytics and OctaFX copy trading.

Account Types | MT4, MT5, OctaTrader |

Regulating Authorities | FSCA, MISA, CySEC by entity |

Minimum Deposit | $25 |

Deposit Methods | E wallets, credit and debit cards, bank transfer, crypto |

Withdrawal Methods | E wallets, credit and debit cards, bank transfer, crypto |

Maximum Leverage | Up to 1:1000 by entity, 1:30 under CySEC entity |

Trading Platforms and Apps | MetaTrader 4, MetaTrader 5, OctaTrader, Octa Copy app |

OctaFX Pros and Cons

The table presents a structured comparison of the primary advantages and limitations of OctaFX across different performance aspects.

Pros | Cons |

Low minimum deposit at $25 | Regulation is lighter than some top tier brokers in many regions |

Commission free trading with spreads from 0.6 pips | Tradable asset range is smaller than some multi asset competitors |

MT4, MT5, and OctaTrader platform access | Payment options can change based on country and time |

Swap free conditions across all accounts | Some major countries are restricted, including US and UK |

Copy trading via Octa Copy | Protections and compensation depend on the entity |

High leverage up to 1:1000 by entity | Offshore entities may not offer the same safeguards as EU entities |

Deriv

Deriv is a multi product derivatives broker that traces back to Binary.com and the Regent Markets Group established in 1999, then rebranded as Deriv in 2020.

It reports more than 2.5M users, 187M plus monthly executed trades, about $46M in monthly withdrawals, and a monthly volume near $650B.

Deriv focuses on complex products such as Options and Multipliers alongside CFD trading across major markets, including Forex, stocks, indices, commodities, cryptocurrencies, and ETFs, with floating spreads from 0.24 pips and $0 commission on its core CFD offering.

Deriv registration is multi entity rather than top tier only, with branches under MFSA in Malta plus offshore oversight via BVI FSC, Labuan FSA, and VFSC.

Investor protection depends on the entity, with up to EUR 20,000 under ICF in Malta and Financial Commission coverage stated for other branches, plus segregated funds and negative balance protection across entities.

Accounts on Deriv dashboard include Standard, Financial, and Swap Free, starting from a $5 minimum deposit, with leverage up to 1:1000 by branch and 1:30 under the Malta entity.

Deriv deposits and withdrawals support cards, online banking, mobile payments, e wallets, crypto, vouchers, and Deriv P2P, with 24/7 support via live chat, email, and WhatsApp.

Account Types | Standard, Financial, Swap Free, Demo |

Regulating Authorities | MFSA, Labuan FSA, VFSC, BVI FSC |

Minimum Deposit | $5 |

Deposit Methods | Credit and debit cards, online banking, mobile payments, e wallets, crypto, voucher, Deriv P2P |

Withdrawal Methods | Credit and debit cards, online banking, mobile payments, e wallets, crypto, voucher, Deriv P2P |

Maximum Leverage | Up to 1:1000 by entity, 1:30 under MFSA entity |

Trading Platforms and Apps | MT5, cTrader, Deriv X, Deriv Trader |

Deriv Pros and Cons

Below is a table that summarizes the core pros and cons of Deriv, focusing on usability, features, and practical considerations.

Pros | Cons |

Options, Multipliers, and CFD access across multiple asset classes | Products can be complex for beginners |

Floating spreads from 0.24 pips with $0 commission on CFDs | No top tier only regulatory profile across all entities |

Low minimum deposit of $5 | Limited support channels, no phone support listed |

MT5, cTrader, and Deriv X platform availability | Interface can feel complex compared to simple retail platforms |

Segregated funds and negative balance protection stated | No PAMM or MAM accounts |

Many deposit and withdrawal routes including crypto and P2P | Leverage and protections vary by entity and region |

Fibo Group

Fibo Group is a Forex and CFD broker founded in 1998 that serves clients across Europe and Asia through a multi entity structure.

Its EU facing branch operates under CySEC license 118/10 and provides retail safeguards such as segregated funds, negative balance protection, and ICF coverage up to €20,000, with leverage capped at 1:30 for eligible EU clients.

For non EU jurisdictions, the BVI entity operates under FSC license SIBA L 13 1063 and can offer higher leverage, reaching up to 1:1000 on major FX pairs for eligible traders, but without an investor compensation fund.

The broker supports MetaTrader 4, MetaTrader 5, and cTrader on desktop and mobile, covering discretionary and algorithmic workflows, plus NDD style execution options on several account types.

Traders can access 60 plus currency pairs alongside indices, metals, commodities, cryptocurrencies, and US stock CFDs.

Account selection includes MT4 Cent for small balance testing, MT4 Fixed for spread stability, and MT5 NDD or cTrader NDD for raw spread style pricing with commissions.

Deposits start from $0 on Cent and $50 on most other accounts, with funding via bank transfer, cards, e wallets, and crypto. Fibo Group also offers PAMM and copy trading, swap free options for eligible clients, and 24/5 support.

Account Types | MT4 Cent, MT4 Fixed, MT4 NDD, MT4 NDD No Commission, MT5 NDD, cTrader NDD |

Regulating Authorities | CySEC; BVI FSC |

Minimum Deposit | $0 on Cent; $50 on most other accounts |

Deposit Methods | Bank transfer, Visa, MasterCard, Neteller, Skrill, crypto, e wallets |

Withdrawal Methods | Bank transfer, Visa, MasterCard, Neteller, Skrill, crypto, e wallets |

Maximum Leverage | Up to 1:30 under CySEC for retail EU; up to 1:1000 under BVI for eligible clients |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, desktop and mobile |

Fibo Group Pros and Cons

The following table delivers a balanced overview of Fibo Group’s core strengths and weaknesses, centered on usability, feature availability, and practical application.

Pros | Cons |

Long operating history since 1998 | Investor compensation not available under BVI entity |

CySEC regulation with ICF up to €20,000 for EU clients | Negative balance protection may vary by entity and client status |

MT4, MT5, and cTrader supported | Higher commissions on some NDD accounts |

Multiple account types including Cent, Fixed, and NDD options | No weekend support, 24/5 only |

Spreads from 0.0 pips on NDD accounts | Regional restrictions including no U.S. clients |

PAMM and copy trading available | Promotions are limited and vary by region |

IFC Markets

IFC Markets is a multi asset Forex and CFD broker operating since 2006, serving 210,000 plus clients and offering access to 650 plus instruments across 9 markets.

The broker runs a multi entity structure regulated by Labuan FSA and BVI FSC, and it also references protections such as segregated funds and negative balance protection across its branches.

One entity is linked to Financial Commission coverage up to €20,000, while the Labuan branch states no compensation scheme. In IFC Dashboard traders can choose Standard, Micro, or ECN accounts with a very low entry point, as the minimum deposit starts from $1.

Platform support includes MetaTrader 4, MetaTrader 5, and the proprietary NetTradeX, which also enables unique features such as the Portfolio Quoting Method, Continuous CFDs, and synthetic instruments through the GeWorko and PCI concepts.

Pricing depends on account type, with floating spreads commonly starting around 0.4 pips on major pairs, fixed spreads from 1.8 pips on some setups, and raw spreads from 0.0 pips on the ECN model.

The ECN account applies a 0.005% commission on transaction volume and focuses on fast execution with deep liquidity. IFC Markets deposit and withdrawal options options are broad and include cards, bank transfer, e payments, local transfers, and crypto, with examples like USDT ERC20 deposits from $20 and USDT TRC20 withdrawals with a fixed $3 fee.

IFC Markets also offers PAMM and copy trading via IFCM Invest, Islamic accounts, and 24/7 multilingual support, but it lacks top tier regulation and has geo restrictions including the USA and Russia (residents of these countries can’t complete IFC Markets registration.

Account Types | Standard, Micro, ECN |

Regulating Authorities | Labuan FSA, BVI FSC |

Minimum Deposit | $1 |

Deposit Methods | Credit and debit cards, bank transfer, e payments, local transfer, crypto, plus regional options like WebMoney, TopChange, ADVCash, Mobile Money |

Withdrawal Methods | Credit and debit cards, bank transfer, e payments, local transfer, crypto, plus internal transfer and regional options |

Maximum Leverage | Up to 1:400 in the specifications table, some entities list up to 1:2000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, NetTradeX |

IFC Markets Pros and Cons

The table below compiles the most important pros and cons of IFC Markets, focusing on ease of use, platform features, and practical trading considerations.

Pros | Cons |

Minimum deposit from $1 | No top tier regulation like FCA or ASIC |

650+ instruments across 9 markets | Spreads on some popular pairs can be higher than average |

MT4, MT5, and NetTradeX supported | Crypto offering is limited to about 14 pairs |

ECN with raw spreads from 0.0 pips | Geo restrictions including USA and Russia |

PAMM and copy trading via IFCM Invest | Compensation scheme differs by entity, not uniform |

24/7 support with many channels | Minimum order size listed as 0.1 lots |

How the Best Forex Brokers for Crypto Payments Were Selected and Ranked?

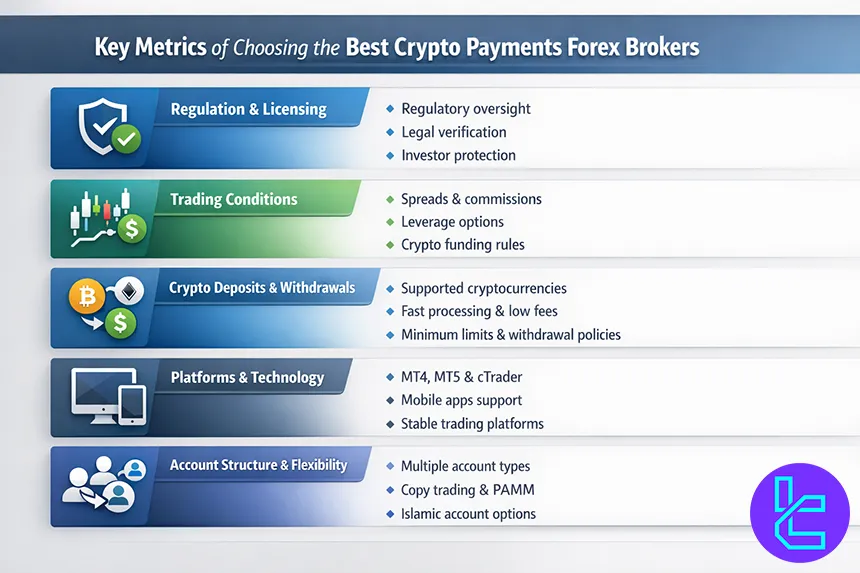

Selecting the best Forex brokers for crypto payments requires more than comparing deposit options.

At TradingFinder, brokers are evaluated using a data-driven and transparent methodology designed to reflect real trading conditions and user experience.

Our analysts assess each broker using 19 key metrics, grouped into several critical categories:

- Regulation and licensing: Verification of legal entities, regulatory oversight, and investor protection schemes;

- Trading conditions: Spreads, commissions, leverage, execution model, and crypto-friendly funding rules;

- Crypto deposits and withdrawals: Supported cryptocurrencies, processing speed, network fees, minimum limits, and withdrawal policies;

- Platforms and technology: Availability of MT4, MT5, cTrader, mobile apps, and platform stability;

- Account structure and flexibility: Variety of account types, copy trading, PAMM services, and Islamic accounts.

Additional trust factors include:

- Trustpilot user ratings and verified reviews

- Quality of customer support and response time

- Transparency of fees, disclosures, and risk warnings

- Scam reports, compliance history, and public reputation

Each metric is weighted based on its impact on capital safety, transaction efficiency, and long-term trading usability, ensuring rankings reflect practical value rather than marketing claims.

How to Deposit a Forex Trading Account Using Cryptocurrency?

Depositing funds into a Forex trading account using cryptocurrency is a straight forward process, but accuracy is critical to avoid irreversible errors. Most brokers follow a similar workflow:

- Log in to your broker’s client area: Access the dashboard and navigate to the “Deposit” or “Funds” section;

- Select cryptocurrency as the deposit method: Choose the supported asset such as Bitcoin, Ethereum, or USDT. If available, also select the blockchain network (ERC20, TRC20, BEP20);

- Generate the broker’s wallet address: The broker will provide a unique wallet address or QR code tied to your account;

- Send funds from your crypto wallet: Open your personal wallet or exchange account, paste the address, enter the exact amount, and confirm the transaction;

- Wait for blockchain confirmations: Deposits are credited after the required number of network confirmations, typically within minutes to an hour.

Always double-check the wallet address and network. Sending funds on the wrong blockchain usually results in permanent loss.

How to Withdraw Funds with Crypto from Forex Brokers?

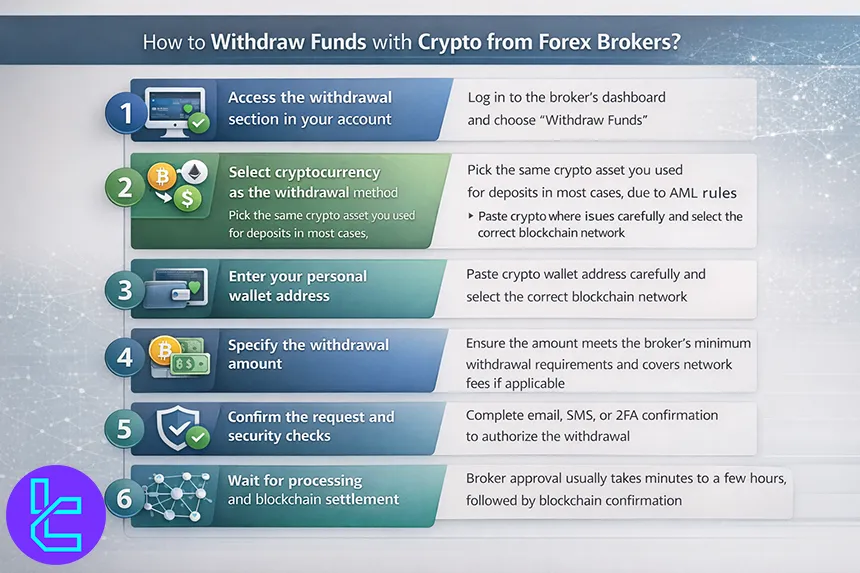

Crypto withdrawals from Forex brokers are designed to be fast and flexible, but they still follow compliance and security checks. The standard withdrawal process includes these steps:

- Access the withdrawal section in your account: Log in to the broker’s dashboard and choose “Withdraw Funds”;

- Select cryptocurrency as the withdrawal method: Pick the same crypto asset you used for deposits in most cases, due to AML rules;

- Enter your personal wallet address: Paste crypto wallet address carefully and select the correct blockchain network;

- Specify the withdrawal amount: Ensure the amount meets the broker’s minimum withdrawal requirements and covers network fees if applicable;

- Confirm the request and security checks: Complete email, SMS, or 2FA confirmation to authorize the withdrawal;

- Wait for processing and blockchain settlement: Broker approval usually takes minutes to a few hours, followed by blockchain confirmation.

Once processed, transactions cannot be reversed, so wallet accuracy is essential.

Do Forex Brokers Require KYC for Crypto Deposits?

Most Forex brokers require some level of KYC verification, even when deposits are made using cryptocurrency. The extent of KYC depends on regulation, deposit size, and withdrawal activity.

Common KYC scenarios for crypto deposits:

- No KYC for small deposits: Some offshore brokers allow limited crypto deposits without identity verification;

- KYC required before withdrawals: Even if deposits are allowed, withdrawals usually trigger verification;

- Full KYC for regulated brokers: Tier-1 and Tier-2 regulated brokers require identity checks regardless of payment method.

Typical documents requested:

- Government-issued ID (passport or national ID)

- Proof of address (utility bill or bank statement)

- Selfie or liveness verification

KYC requirements are enforced to comply with AML and CTF regulations, prevent fraud, and ensure fund security. Traders using crypto should always expect verification before withdrawing profits.

How Fast Are Crypto Deposits and Withdrawals in Forex Trading?

Crypto transactions are generally faster than traditional banking methods, but speed depends on several technical and broker-side factors.

Blockchain Network | Average Speed |

TRC20 (USDT) | Very fast (1–5 min) |

BEP20 | Fast (1–10 min) |

ERC20 | Slower (10–40 min) |

Bitcoin | Variable (10–60+ min) |

While blockchain confirmations are quick, broker-side compliance checks can slow withdrawals. Using stablecoins on low-fee networks usually results in the fastest transfers.

Trading Fees for Crypto-Based Deposits and Withdrawals

Crypto payments reduce banking fees, but they are not always fee-free. Costs come from two main sources: the broker and the blockchain network.

Crypto | Typical Network Fee |

USDT (TRC20) | Low |

USDT (ERC20) | High |

Bitcoin | Medium–High |

Ethereum | High |

Most brokers do not control network fees, but traders should always factor blockchain costs into frequent deposits or withdrawals. Possible fee types of cryptocurrencies in forex brokers are as below.

- Broker deposit fees: Usually 0%

- Broker withdrawal fees: Fixed or percentage-based

- Blockchain network fees: Variable, paid to miners or validators

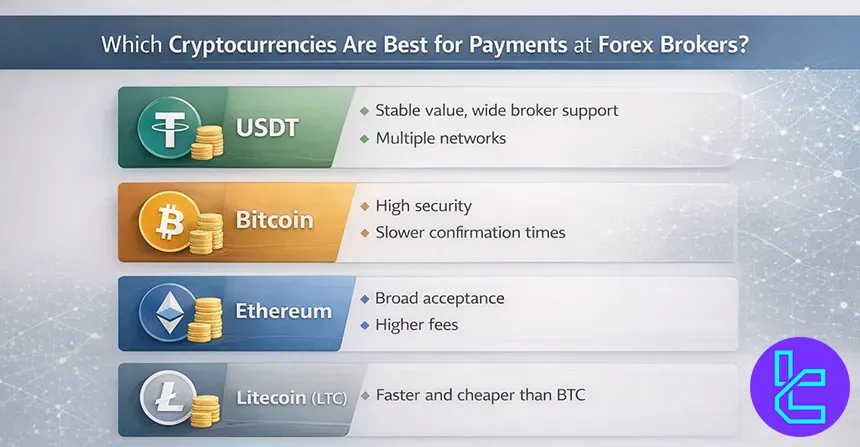

Which Cryptocurrencies Are Best for Payments at Forex Brokers?

Not all cryptocurrencies are equally suitable for forex payments. The most practical options combine low volatility, fast confirmation times, and minimal transaction costs.

Stablecoins are generally preferred. USDT on the TRC20 network is widely regarded as the most efficient option due to its low fees and fast processing.

USDT on ERC20 is also common but can be more expensive. USDC is another stable alternative with strong transparency standards.

Bitcoin remains accepted by many brokers but is less ideal due to higher fees and price volatility. Ethereum is popular for platform compatibility but may suffer from network congestion. Litecoin and other low-fee coins are occasionally supported.

Stablecoins reduce the risk of value fluctuations between sending and account crediting. For most traders, using USDT on a low-cost network provides the best balance between speed, cost, and stability. Most commonly used cryptocurrencies can be seen in the list below.

- USDT: Stable value, wide broker support, multiple networks

- Bitcoin: High security, slower confirmation times

- Ethereum: Broad acceptance, higher fees

- Litecoin (LTC): Faster and cheaper than BTC

Are Forex Brokers Regulated by Tier-1 Authorities Allowed to Accept Crypto?

Under strict conditions, Tier-1 regulated Forex brokers can accept cryptocurrency only if compliance requirements are met.

Key regulatory conditions:

- Mandatory KYC and AML verification

- Transaction monitoring and reporting

- Use of licensed crypto payment processors

- Restrictions on anonymous wallets

These brokers usually treat crypto as a payment method, not a tradable asset. Direct crypto custody is rare under Tier-1 regulation, but deposits and withdrawals via crypto gateways are permitted.

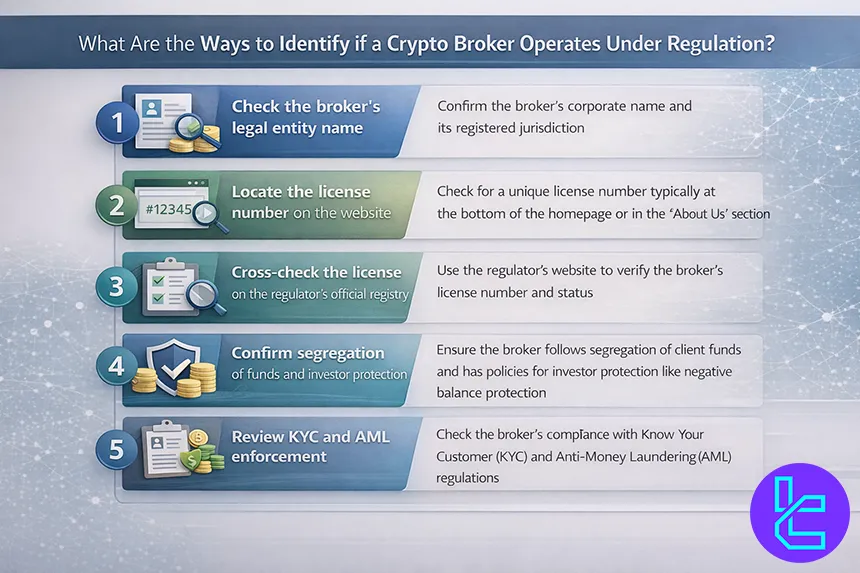

What Are the Ways to Identify if a Crypto Payments Broker Operates Under Regulation?

Identifying whether a crypto-supporting Forex broker operates under regulation requires careful verification of several key factors. The most reliable indicator is the presence of a verifiable license issued by a recognized financial authority.

Regulated brokers clearly display their license number, legal entity name, and regulator on their website. These details should be cross-checked directly on the regulator’s official registry.

Transparency in company address, ownership structure, and legal documentation is another strong signal. Steps to verify broker regulation:

- Check the broker’s legal entity name

- Locate the license number on the website

- Cross-check the license on the regulator’s official registry

- Confirm segregation of funds and investor protection

- Review KYC and AML enforcement

Cryptocurrencies Vs Other Payment Methods

Below is a direct comparison of Cryptocurrencies vs traditional e-wallet payment methods used by Forex brokers, focusing on practical trading considerations.

Parameter | Crypto | Skrill | PayPal | Neteller |

Broker Acceptance | Widely accepted by offshore and many global brokers | High acceptance among regulated brokers | Limited acceptance in Forex industry | High acceptance among Forex brokers |

Deposit Speed | Near-instant to 30 minutes (blockchain dependent) | Instant | Instant | Instant |

Withdrawal Speed | 10 minutes to a few hours | Same day to 24 hours | Same day to 24 hours | Same day to 24 hours |

Transaction Fees | Network fee only (varies by blockchain) | Medium to high | Medium to high | Medium |

Supported Currencies | BTC, ETH, USDT, USDC, LTC, others | Major fiat currencies | Major fiat currencies | Major fiat currencies |

Security & Compliance | Blockchain-based, wallet-level security | Centralized, KYC-based | Centralized, strict compliance | Centralized, KYC-based |

Typical Forex Deposit Limits | Low minimums, high maximums | Medium limits | Medium limits | Medium limits |

Regional Availability | Global, minimal restrictions | Region-dependent | Strong regional restrictions | Region-dependent |

Conclusion

Crypto payments have become a core funding option among modern Forex brokers, offering faster processing, broader access, and lower friction compared to traditional methods. Platforms reviewed by TradingFinder were assessed based on regulation, fees, speed, and supported assets like Bitcoin and USDT.

While crypto improves efficiency, proper regulation, KYC enforcement, and transparent withdrawal policies remain essential for long-term trading security and capital protection.

You can find full details of our broker evaluation framework on the TradingFinder Forex methodology page.