The Cyprus Securities and Exchanges Commission (CySEC) is a tier-1 financial authority that supervises the Forex brokers in the EU under the MiFID II rules. Brokers regulated by the CySEC are usually considered some of the most secure and trustworthy choices in the industry.

The list below includes the best brokerages supervised by mentioned authority.

| FP Markets | |||

| Pepperstone | |||

| XM | |||

| 4 |  | IC Markets | ||

| 5 |  | FxPro | ||

| 6 |  | easyMarkets | ||

| 7 |  | AvaTrade | ||

| 8 |  | FXCM |

CySEC Forex Brokers Ranked by Trustpilot Ratings

The table in this section ranks the top CySEC brokerages according to their ratings on “Trustpilot” with respective number of reviews.

Broker Name | Trustpilot Rating | Number of Reviews |

50,764 | ||

FP Markets | 9,873 | |

11,748 | ||

FXCM | 838 | |

Pepperstone | 3,151 | |

easyMarkets | 1,762 | |

FxPro | 802 | |

XM | 2,907 |

Lowest Spreads in CySEC Forex Brokers

The table below ranks the brokers based on the minimum spread across all account types and instruments.

Broker Name | Min. Spread |

IC Markets | 0 Pips |

0 Pips | |

AvaTrade | 0 Pips |

Admirals | 0 Pips |

0 Pips | |

eToro | 0 Pips |

Plus500 | 0.5 Pips |

easyMarkets | 0.7 Pips |

Non-Trading Fees in Brokers Regulated by CySEC

Commissions other than trading can include deposit/withdrawal fees, inactivity costs, and more. This section mentions the non-trading fees for each brokerage.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

IC Markets | $0 | $0 | $0 |

easyMarkets | $0 | $0 | $0 |

AvaTrade | $0 | $0 | $10 per Month |

$0 | $0 | $15 | |

$0 | $0 | $50 | |

Admirals | $0 | 1 Free per Month | 10 EUR per Month |

eToro | $0 | $5 | $10 per Month |

Libertex | $0 | Varies | 10 EUR per Month |

Instruments and Tradable Assets in CySEC Brokers

Each Forex broker has a select range of tradable assets for its clients. Here’s a comparison between them in this regard.

Broker Name | Number of Instruments |

FP Markets | 10,000+ |

eToro | 6,000+ |

Plus500 | 2,800+ |

IC Markets | 2,200+ |

1,400+ | |

AvaTrade | 1,250+ |

Axi | 220+ |

200+ |

Top 6 CySEC Forex Brokers in Detail

In the following sections, 6 of the best brokers mentioned above based on Trustpilot ratings are reviewed in a detailed summary.

IC Markets

IC Markets is a global multi-asset broker established in 2007, offering access to Forex, indices, commodities, stocks, bonds, and crypto CFDs. The broker supports 10 base currencies and requires a $200 minimum deposit, catering to both retail and professional traders.

For European clients, IC Markets operates through IC Markets (EU) Ltd, regulated by CySEC, where traders benefit from negative balance protection and coverage under the Investor Compensation Fund up to €20,000. The broker also holds licenses from ASIC and the FSA Seychelles, ensuring multi-jurisdictional oversight.

IC Markets is known for its institutional-grade pricing, with Raw Spread accounts from 0.0 pips and an average commission of $1.5–$3.5 per lot. Standard accounts are commission-free, while execution is handled via market execution with deep liquidity access.

For a reduction on spreads and trading commissions, you can participate in IC Markets rebate.

Platform availability includes MetaTrader 4, MetaTrader 5, cTrader, and mobile apps, supporting scalping, algorithmic trading, and Expert Advisors. With over 2,100 stock CFDs and 24/7 live chat support, IC Markets remains a strong choice among Best CySEC Forex Brokers.

Summary of Specifications

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros & Cons

IC Markets combines strict CySEC regulation, low-latency execution, and competitive spreads, making it particularly attractive for active traders and algorithmic strategies. Below is a clear summary of its main advantages and limitations.

Pros | Cons |

CySEC regulation with €20,000 investor protection | Leverage capped at 1:30 under CySEC |

Raw spreads from 0.0 pips | $200 minimum deposit may be high for beginners |

Wide platform selection (MT4, MT5, cTrader) | No PAMM account support |

2,100+ tradable instruments | Bonuses not available for EU clients |

FP Markets

FP Markets, officially known as First Prudential Markets, is a multi-asset forex and CFD broker founded in 2005. Headquartered in Australia, the broker has built a strong global presence by offering institutional-grade pricing, deep liquidity, and access to more than 10,000 tradable instruments.

FP Markets operates under multiple regulatory frameworks, with its European operations supervised by CySEC (license number 371/18). This CySEC oversight enforces strict standards such as client fund segregation, negative balance protection, and participation in the Investor Compensation Fund (ICF) up to €20,000.

The broker offers two core account types, Standard and RAW, both requiring a minimum deposit of $50. RAW accounts feature spreads from 0.0 pips with a $3 commission per lot, while Standard accounts provide commission-free trading with spreads starting from 1.0 pip, suitable for different trading styles.

FP Markets supports MT4, MT5, and cTrader, enabling algorithmic trading, copy trading, and advanced charting. Combined with fast execution, multiple base currencies, and leverage aligned with CySEC rules (up to 1:30), the broker caters well to both active and professional EU traders. The table below demonstrates a summary of broker’s specifics.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros & Cons

Before going through with FP Markets registration, here is a balanced overview of the broker’s main strengths and limitations, helping traders assess whether it fits their trading objectives.

Pros | Cons |

Regulated by CySEC and other top-tier authorities | Not available to U.S. clients |

RAW spreads from 0.0 pips with low commissions | No proprietary trading platform |

Access to MT4, MT5, and cTrader | Leverage capped at 1:30 under CySEC |

Wide range of markets and base currencies | Educational content less extensive than some peers |

AvaTrade

AvaTrade is a globally regulated forex and CFD broker holding 9 licenses, including CySEC, CBI (Ireland), ASIC (Australia), FSCA (South Africa), FSA (Japan), ADGM, ISA, and BVI FSC. Its CySEC entity complies with MiFID II, offering EU/EEA traders strong regulatory oversight.

Under CySEC rules, AvaTrade applies 25% margin call and 10% stop-out levels, alongside negative balance protection and segregated client funds. EU clients benefit from the Investor Compensation Fund (ICF) coverage of up to €20,000.

With a $100 minimum deposit, AvaTrade supports Retail, Professional, Islamic, and Demo accounts. Traders access MT4, MT5, WebTrader, Mobile App, and AvaOptions, trading Forex, indices, stocks, commodities, metals, and crypto CFDs.

Funding is flexible via cards, bank wire, Skrill, Neteller, WebMoney, and PayPal (region-based). AvaTrade charges no deposit or withdrawal commissions, operates on spread-based pricing, and maintains a 24/5 multilingual support desk. For more information on AvaTrade deposit and withdrawal methods, check out our detailed article.

Summary of Parameters

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros & Cons

Below is a balanced snapshot of AvaTrade’s strengths and limitations to help readers quickly assess whether its regulatory depth, platforms, and pricing align with their trading needs.

Pros | Cons |

Multi-jurisdiction regulation incl. CySEC & MiFID II | No PAMM/MAM account offering |

Strong risk controls & ICF coverage for EU clients | Inactivity fees after prolonged non-use |

Broad platform suite (MT4/MT5/Web/Mobile/AvaOptions) | Leverage capped for EU retail clients |

Diverse funding methods with no broker fees | Bonuses unavailable in many regions |

FXCM

FXCM (Forex Capital Markets) is a veteran Forex and CFD broker founded in 1999, operating under multiple top-tier regulators, including CySEC, FCA, ASIC, FSCA, and ISA. Its EU entity holds CySEC license 392/20, positioning FXCM among established CySEC-regulated brokers.

FXCM provides three main account types, CFD, Active Trader, and Corporate, with a $50 minimum deposit and floating spreads from 0.2 pips. Trading is commission-free on CFDs, with market execution and access to Forex, indices, commodities, shares, and crypto CFDs from a single account.

Furthermore, the FXCM rebate program enables discounts on spreads and trading costs.

Platform diversity is a core strength. Clients can trade via MT4, TradingView, and TradeStation, supporting algorithmic trading, advanced charting, and social trading integrations. Depending on the regulatory entity, leverage can reach up to 1:1000, while EU clients operate under ESMA-aligned limits.

On the safety side, FXCM applies segregated client funds, negative balance protection, and investor compensation where applicable (up to €20,000 under ICF for CySEC clients). Despite past regulatory issues and a 2017 restructuring, FXCM maintains a broad global footprint and ongoing regulatory oversight. Here’s a summary of the broker’s parameters and features.

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

FXCM Pros and Cons

Before going through with the FXCM registration procedure, the following pros and cons summarize what traders typically evaluate when comparing this broker with other CySEC-licensed Forex providers.

Pros | Cons |

Regulated by multiple top-tier authorities (CySEC, FCA, ASIC) | History of regulatory fines and 2017 bankruptcy |

Long operating history since 1999 | $50 annual inactivity fee after 12 months |

Multiple advanced platforms (MT4, TradingView, TradeStation) | $40 fee on bank wire withdrawals |

Low minimum deposit ($50) with tight spreads | Product range smaller than some multi-asset competitors |

Pepperstone

Pepperstone is a high-volume global brokerage processing $9.2B+ in daily trades for 400,000+ clients. Founded in 2010 in Melbourne, it supports 10 base currencies and flexible order sizes from 0.01 to 100 lots, appealing to both retail and active traders.

Under its CySEC-regulated EU entity, Pepperstone operates within a strong compliance framework alongside oversight from FCA, ASIC, BaFin, DFSA, and CMA. Client funds are segregated, negative balance protection applies, and EU leverage is capped at 1:30, aligning with ESMA standards.

The broker offers Standard and Razor accounts with spreads from 0.0 pips and commissions from $0. Also, a Pepperstone rebate program is provided for discount on trading fees.

Traders can access MT4, MT5, cTrader, TradingView, and proprietary platforms, with support for EAs, scalping, and hedging across Forex, indices, commodities, crypto, shares, and ETFs.

Pepperstone stands out for its payment flexibility and no inactivity fees, accepting options like Visa, PayPal, Skrill, Neteller, Apple Pay, Google Pay, and USDT. With 24/7 support and copy-trading integrations, it targets cost-efficient execution rather than promotions.

Summary of Features and Specifics

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

Pepperstone Pros & Cons

Below is a concise snapshot of Pepperstone’s strengths and limitations, helping readers quickly assess whether the broker fits their trading needs.

Pros | Cons |

CySEC-regulated EU entity with multi-tier global oversight | No bonuses or promotions |

Tight spreads from 0.0 pips on Razor accounts | No PAMM or managed accounts |

Wide platform choice incl. MT4/MT5, cTrader, TradingView | Leverage capped at 1:30 for EU retail clients |

No inactivity or account maintenance fees | Demo account availability can be limited |

easyMarkets

easyMarkets is a Cyprus-based forex and CFD broker regulated by CySEC, making it a compliant choice for EU and EEA traders. The broker combines investor protection, segregated funds, and negative balance protection across all regulated entities.

Founded in 2001 and led by CEO Nikos Antoniades, easyMarkets operates through multiple licensed branches under ASIC, FSCA, FSA Seychelles, and FSC BVI. This multi-jurisdiction structure allows flexible leverage while maintaining core regulatory standards.

easyMarkets gained strong industry recognition, winning “Best Forex/CFD Broker” at the TradingView Broker Awards and “Leading Broker of the Year” at Forex Expo Dubai. The brand is also known as the official trading partner of Real Madrid C.F..

The broker offers commission-free trading with a minimum deposit of just $25 and leverage up to 1:2000 for non-EU clients. Traders can access MT4, MT5, TradingView, and a proprietary platform featuring unique tools like dealCancellation and Freeze Rate.

Summary of Features

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Minimum Deposit | $25 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, TradingView, Proprietary platform |

easyMarkets Pros and Cons

Below, its main strengths and limitations are summarized to help evaluate whether it fits different trading styles and risk profiles, recommended to be considered before easyMarkets registration.

Pros | Cons |

Regulated by CySEC, ASIC, FSCA, and offshore authorities | Limited number of tradable instruments compared to some competitors |

Commission-free trading with low $25 minimum deposit | No copy trading or investment plans |

Unique tools like Guaranteed Stop Loss and dealCancellation | No 24/7 customer support |

Multiple platforms including TradingView and proprietary app | Geo-restrictions in several countries |

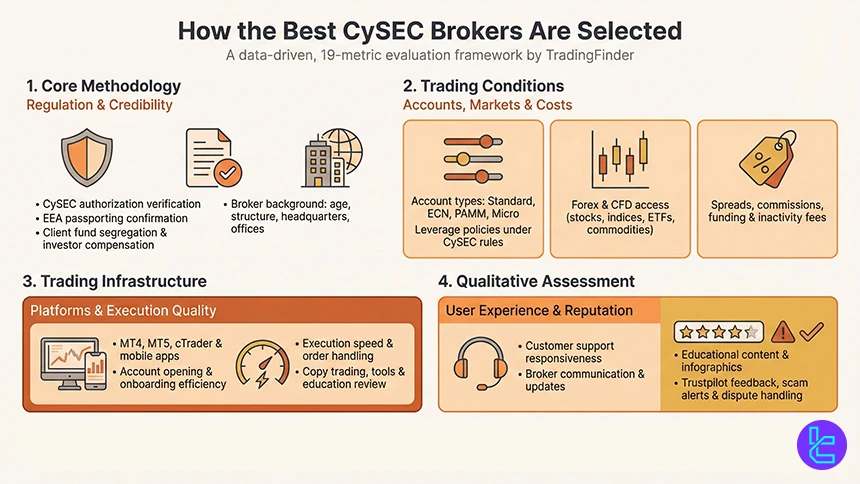

How Were The Best CySEC Brokers Selected?

Selecting the best CySEC-regulated forex brokers requires more than surface-level comparisons. At TradingFinder, each broker featured in this article is assessed using a 19-metric evaluation framework designed to reflect real trading conditions and investor protection standards under CySEC oversight.

Regulation and licensing sit at the core of our methodology. We verify CySEC authorization, cross-check passporting rights within the EEA, and assess client-fund protection mechanisms such as segregation policies and investor compensation schemes.

Beyond compliance, we analyze broker background data including establishment year, corporate structure, headquarters, and global office presence to ensure operational credibility.

Account structure and market access are equally critical. Our analysts examine the diversity of account types (Standard, ECN, PAMM, Micro), leverage policies, and the range of tradable instruments, from major forex pairs to CFDs on stocks, indices, ETFs, and commodities. Trading costs are reviewed in detail, covering spreads, commissions, deposit and withdrawal fees, and inactivity charges.

We also test trading infrastructure firsthand. Platform availability, including MetaTrader 4, MetaTrader 5, cTrader, and mobile apps, execution quality, and account-opening workflows are evaluated for efficiency and user experience. Copy trading, investment tools, and educational resources are assessed for depth, transparency, and cost.

Finally, qualitative factors complete the picture. We review customer support responsiveness, broker communications, infographics, and updates, while factoring in verified user feedback from Trustpilot, scam alerts, and dispute handling.

What is the CySEC?

The Cyprus Securities and Exchange Commission is the financial regulatory authority responsible for supervising investment services and capital markets in Cyprus. Established in 2001, CySEC operates under the framework of European Union financial law and plays a key role in enforcing MiFID II, which governs investment firms across the European Economic Area (EEA).

CySEC’s primary mandate is to license, regulate, and monitor forex and CFD brokers, ensuring compliance with strict standards related to client fund segregation, capital adequacy, transparency, and risk disclosure.

Brokers regulated by CySEC are required to keep client funds in segregated accounts and participate in the Investor Compensation Fund (ICF), which may compensate eligible retail clients up to €20,000 if a broker becomes insolvent.

As an EU regulator, CySEC-authorized brokers can “passport” their services to other EEA countries, making CySEC regulation particularly relevant for European forex traders. While often classified as a mid-to-high-tier regulator, CySEC’s alignment with EU law and continuous regulatory updates make it a central authority in the global forex industry.

What are the Advantages and Disadvantages CySEC Regulation in Forex Brokers?

CySEC regulation provides a structured legal framework for forex brokers operating in the EU. It enforces investor protection rules, transparency standards, and capital requirements, while enabling brokers to passport services across the EEA. However, some limitations exist compared to stricter Tier-1 regulators.

Pros | Cons |

Investor Compensation Fund ICF coverage up to €20,000 per client | Lower compensation limit than FCA or FSCS schemes |

Mandatory client fund segregation | Perceived as less strict than some Tier-1 regulators |

MiFID II compliance and EEA passporting rights | Slower enforcement actions in complex disputes |

Leverage caps and negative balance protection for retail traders | Not all CySEC brokers maintain the same operational quality |

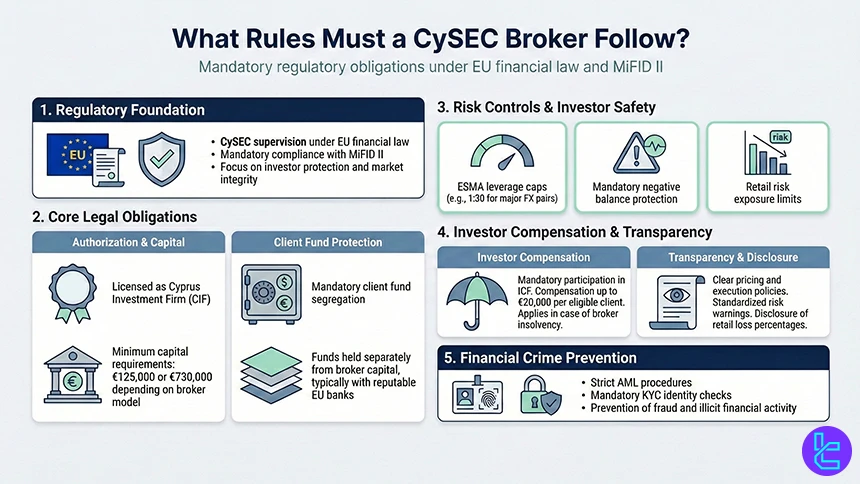

What Rules Must a CySEC Broker Follow?

Forex and CFD brokers regulated by the CySEC are required to comply with a strict regulatory framework derived from EU financial law. These rules are designed to protect retail traders, ensure market integrity, and promote transparency across investment services.

Key regulatory obligations for CySEC-regulated brokers include:

- Authorization under MiFID II: Brokers must be licensed as Cyprus Investment Firms (CIFs) and fully comply with MiFID II, which governs conduct of business, investor protection, and reporting standards across the EEA;

- Client Fund Segregation: All retail client funds must be held in segregated accounts, separate from the broker’s own operating capital, typically with reputable EU banks;

- Capital Adequacy Requirements: Brokers are required to maintain minimum regulatory capital (starting from €125,000 or €730,000, depending on the business model) to ensure financial stability and operational resilience;

- Leverage and Risk Controls: In line with ESMA guidelines, CySEC brokers must apply leverage caps (e.g., 1:30 for major forex pairs) and provide negative balance protection for retail clients;

- Investor Compensation Scheme: Participation in the Investor Compensation Fund (ICF) is mandatory, offering potential compensation of up to €20,000 per eligible client in case of broker insolvency;

- Transparency and Disclosure: Brokers must clearly disclose trading risks, pricing structures, execution policies, and publish standardized risk warnings, including the percentage of retail clients who lose money;

- AML and KYC Compliance: Strict anti-money laundering (AML) and know-your-customer (KYC) procedures are enforced to prevent fraud, identity abuse, and illicit financial activity.

How to Check if A Broker is CySEC-Regulated

Verifying whether a broker is genuinely regulated by the CySEC is a critical step before opening a trading account. The process is straightforward, but it must be done carefully to avoid cloned or misleading claims.

- Check the Broker’s Legal Information on Its Website: Reputable brokers clearly display their regulatory status in the website footer or legal documents;

- Visit the Official CySEC Website: Go directly to CySEC’s official registry and access the list of licensed Cyprus Investment Firms. Avoid clicking links provided by the broker; instead, navigate independently to ensure accuracy;

- Search by License Number or Company Name: Enter the broker’s CIF license number or legal entity name exactly as stated on the broker’s website. A valid result should display the firm’s authorization status, approval date, and permitted investment services;

- Confirm the Domain and Brand Association: Ensure the trading website domain you are using is explicitly listed under the licensed entity. Some firms operate multiple brands, and only the approved domains fall under CySEC protection;

- Verify EEA Passporting (If Applicable): If the broker claims to operate across Europe, check whether it has passporting rights under MiFID II, which should also appear in CySEC records;

- Look for Investor Protection Details: A legitimate CySEC-regulated broker must reference participation in the Investor Compensation Fund, confirming eligibility for compensation in case of insolvency.

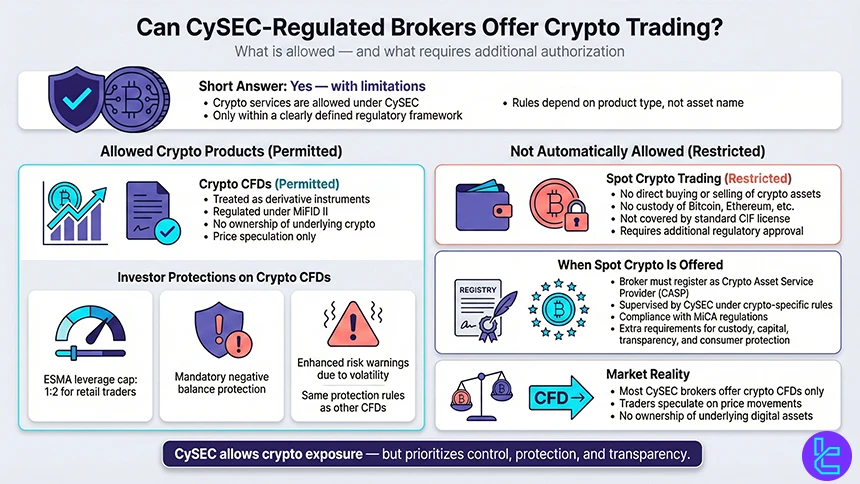

Are CySEC-Regulated Brokers Allowed to Offer Crypto Trading Services?

Yes, CySEC-regulated brokers are allowed to offer crypto-related trading services, but only within a clearly defined regulatory framework. The key distinction lies in how cryptocurrencies are offered and which regulatory regime applies to each product type.

Under CySEC supervision, brokers are permitted to provide cryptocurrency CFDs, which are treated as derivative financial instruments rather than direct ownership of digital assets.

These products fall under MiFID II and are therefore subject to the same investor-protection standards as other CFD instruments.

This includes strict leverage limits imposed by ESMA, where retail leverage on crypto CFDs is typically capped at 1:2, along with mandatory negative balance protection and enhanced risk disclosures due to high volatility.

However, CySEC authorization does not automatically allow brokers to offer spot cryptocurrency trading, meaning the direct buying, selling, or custody of digital assets such as Bitcoin or Ethereum.

Providing custodial wallets or holding crypto assets on behalf of clients requires additional regulatory approval and falls outside the scope of a standard Cyprus Investment Firm (CIF) license.

To offer spot crypto services, brokers must register as Crypto Asset Service Providers (CASPs) with CySEC and comply with evolving EU-wide crypto regulations, increasingly governed by MiCA. These rules introduce specific requirements for custody, transparency, capital reserves, and consumer protection in the crypto sector.

In practice, most CySEC-regulated forex brokers limit their crypto exposure to CFD products, allowing traders to speculate on price movements without owning the underlying assets.

What Customer Protections Do CySEC-Regulated Brokers Offer?

Brokers regulated by the CySEC are required to implement multiple layers of customer protection aimed at reducing financial risk and increasing transparency for retail traders across the European market. These protections are rooted in EU financial law and are enforced through continuous regulatory supervision.

One of the most important safeguards is client fund segregation. CySEC-regulated brokers must keep retail client funds separate from their own operational capital, typically in accounts held with reputable EU banks. This separation helps protect traders’ money if a broker faces financial difficulties.

Another key protection is negative balance protection, which ensures that retail traders cannot lose more than the funds deposited in their trading accounts. This rule, introduced under ESMA product intervention measures, is mandatory for all CySEC-regulated brokers offering leveraged products such as forex and CFDs.

CySEC also enforces leverage limits to reduce excessive risk exposure. For retail clients, leverage is capped at 1:30 for major forex pairs and lower for more volatile instruments, helping to limit rapid losses during high market volatility.

In the event of broker insolvency, eligible retail clients may be covered by the Investor Compensation Fund (ICF). This scheme can provide compensation of up to €20,000 per client, subject to eligibility conditions and claim approval.

Additionally, CySEC-regulated brokers must adhere to strict transparency and disclosure requirements, including standardized risk warnings, clear pricing information, and best-execution policies.

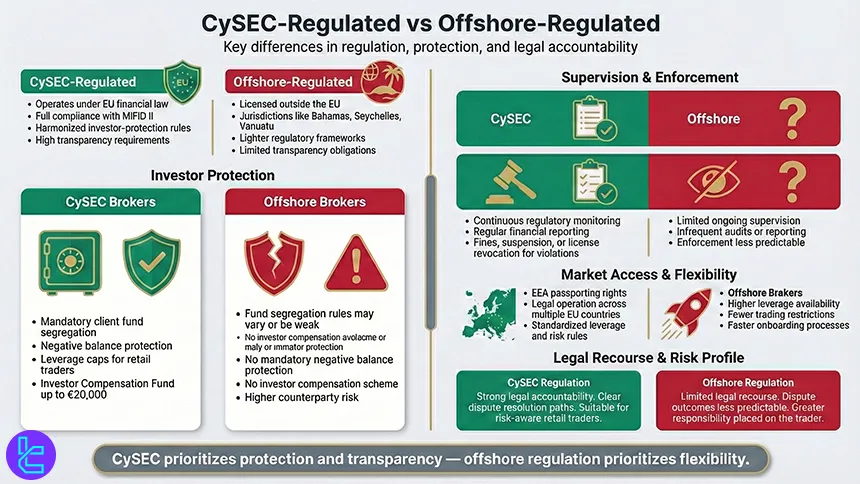

CySEC-Regulated vs Offshore Regulated Brokers: What are The Differences?

The differences between CySEC-regulated brokers and offshore-regulated brokers stem mainly from the strength of regulatory oversight, investor protection standards, and legal accountability.

Brokers authorized by the CySEC operate within the European Union’s financial framework and must comply with harmonized rules derived from MiFID II, which prioritizes retail trader protection and transparency.

CySEC-regulated brokers are subject to strict requirements such as client fund segregation, negative balance protection, leverage caps, regular financial reporting, and participation in the Investor Compensation Fund, which may compensate eligible clients up to €20,000 in the event of insolvency.

Their activities are continuously monitored, and violations can result in fines, license suspension, or revocation. In addition, CySEC brokers benefit from EEA passporting, allowing them to legally offer services across multiple European countries under a single license.

In contrast, offshore-regulated brokers are typically licensed in jurisdictions such as the Bahamas, Seychelles, or Vanuatu, where regulatory requirements are lighter and enforcement is less rigorous.

While these brokers may offer higher leverage, fewer trading restrictions, and faster onboarding, they usually lack mandatory investor compensation schemes and enforce weaker rules on fund segregation and risk controls. Legal recourse for clients is often limited, and regulatory intervention in disputes or insolvency cases is less predictable.

From a risk perspective, CySEC regulation emphasizes capital protection, transparency, and legal safeguards, making it more suitable for risk-aware retail traders. Offshore regulation, while sometimes appealing for flexibility, generally places greater responsibility on the trader to assess counterparty risk and operational reliability.

CySEC in Comparison to Other Top-Tier Regulating Authorities

When choosing a forex broker, the regulatory authority behind it defines how your funds are protected, what leverage is allowed, and how strict compliance standards must be met.

Top regulators like the UK’s FCA, Australia’s ASIC, and Japan’s FSA each enforce different requirements around capital, client-fund segregation, leverage limits, and compensation schemes. This table compares key parameters of these regulators against CySEC to help you understand how they differ in protecting traders and overseeing broker conduct.

Parameter | CySEC (Cyprus) | FCA (UK) | ASIC (Australia) | FSA (Japan) |

Minimum Capital Requirement | €750,000+ depending on firm type | £125,000–£730,000+ depending on model | Not Specified | Based on net capital and exposure (strict supervision) |

Client Fund Segregation | Required | Required | Required | Required |

Compensation Scheme | Investor Compensation Fund (~€20,000) | FSCS (~£85,000) | No statutory compensation fund | Japan Investor Protection Fund exists |

Leverage Limits | Set under MiFID (often 1:30 for retail in EU) | Retail max ~1:30 on majors | Retail up to ~1:30 under ASIC reg. | Strict cap ~1:25 for retail |

Negative Balance Protection | Often required | Required | Common but not statutory | Required |

Reporting & Audits | Ongoing financial reporting | Ongoing reporting standard | Regular compliance reporting | Frequent reporting and compliance monitoring |

Conclusion

CySEC is considered a top-tier regulatory authority in the global Forex industry, supervising brokers in Cyprus and other countries of the EEA. IC Markets, FP Markets, AvaTrade, and FXCM are some of the best choices that are regulated by the Cypriot organization.

To learn about the framework and approach regarding the way each broker was chosen, visit our Forex methodology page.