Electronic Communication Network (ECN) is an order execution model employed by Forex brokers for higher speed and lower spreads. There are several high-quality brokerages offering the ECN accounts among their account type options.

Here’s a shortlist of the best brokers providing ECN execution trading and account types.

| BlackBull Markets | |||

| LiteFinance | |||

| TMGM | |||

| 4 |  | Alpari | ||

| 5 |  | Vantage Markets | ||

| 6 |  | PUPRIME | ||

| 7 |  | vt markets | ||

| 8 |  | TeleTrade |

Trustpilot Ratings in ECN Brokerages

The table in this section ranks nominated brokers based on Trustpilot reviews and scores. The website is a reliable source for evaluating user experiences.

Broker Name | Trustpilot Rating | Number of Reviews |

BlackBull Markets | 3,104 | |

Vantage Markets | 11,759 | |

2,400 | ||

LiteFinance | 531 | |

836 | ||

PU Prime | 3.8/5 ⭐ | 1,783 |

Alpari | 2.6/5 ⭐ | 300 |

TeleTrade | 67 |

Minimum Spreads in ECN Brokers

Spreads are the most effected factor when going through with an ECN account or execution model. Below is a ranking of mentioned brokers based on the minimum spread.

Broker Name | Min. Spread |

BlackBull Markets | 0 Pips |

Vantage Markets | 0 Pips |

IFC Markets | 0 Pips |

0 Pips | |

FXCC | 0 Pips |

PU Prime | 0 Pips |

D Prime | 0 Pips |

0.2 Pips |

Account Types Variety in ECN Brokerages

The table in this section covers the account types available in abovementioned brokers. Usually, ECN brokerages offer at least one ECN account. Also, available leverage is covered for each brand.

Broker Name | Account Types | Max. Leverage |

ECN Standard, ECN Prime, ECN Institutional | 1:500 | |

Vantage Markets | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free | Up to 1:1000 |

Standard, ECN, Pro ECN, Demo | 1:3000 | |

Grand Capital | Standard, MT5, Micro, ECN Prime, Swap Free | 1:1000 |

PU Prime | Standard, Prime, ECN, Cent | 1:1000 |

IFC Markets | Standard, Micro, ECN | 1:400 |

D Prime | Cent, STP, ECN | 1:1000 |

TeleTrade | ECN, NDD, CENT | 1:500 |

Tradable Instruments Offered by ECN Brokerages

This ranking demonstrates the number of tradable assets and markets in select brokers, and ranks them based on this parameter.

Broker Name | Number of Instruments |

BlackBull Markets | 26,000+ |

D Prime | 10,000+ |

1,000+ | |

800+ | |

Alpari | 750+ |

IFC Markets | 650+ |

Grand Capital | 500+ |

TeleTrade | 500+ |

Top 6 ECN Brokers in Detail

In the next sections, six of the best brokers mentioned above are reviewed in detail around trading fees, platforms, regulatory licenses, and other parameters.

BlackBull Markets

Founded in 2014 in New Zealand, BlackBull Markets has grown into a multi-award-winning ECN broker, earning more than seven international awards. The broker provides access to over 26,000 tradable instruments across six major asset classes, combining institutional-grade liquidity with retail accessibility.

As an ECN-focused provider, BlackBull Markets offers ECN Standard, ECN Prime, and ECN Institutional accounts with raw spreads starting from 0.0 pips. These accounts are designed for scalpers, high-frequency traders, and professionals seeking fast execution via Equinix servers and deep liquidity pools.

From a regulatory perspective, BlackBull Markets operates under Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles. Client funds are held in segregated accounts with tier-1 banking partners, alongside negative balance protection across supported regions.

Platform diversity is another defining feature. Traders can operate through MetaTrader 4, MetaTrader 5, cTrader, and TradingView, while investors gain access to BlackBull Invest and BlackBull CopyTrader. Combined with 24/7 multilingual support, the infrastructure targets both active traders and long-term market participants.

Table of Specifics and Details

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros & Cons

Overall, BlackBull Markets stands out among ECN forex brokers due to its execution speed, platform variety, and large instrument selection. However, its advanced environment and regional restrictions may not suit every trader. The following pros and cons summarize its overall profile. Check it out before BlackBull Markets registration.

Pros | Cons |

ECN spreads from 0.0 pips with fast execution | Advanced features may overwhelm beginners |

26,000+ instruments across global markets | Not available in several major jurisdictions |

Supports MT4, MT5, cTrader, and TradingView | Offshore regulation applies to some accounts |

No minimum deposit on ECN Standard & Prime | Institutional account requires high capital |

Vantage Markets

Founded in 2009 and headquartered in Sydney, Vantage Markets has expanded into a global brokerage with 30+ offices worldwide. The broker serves retail and professional traders by combining multi-asset access with ECN-style execution across international markets.

Vantage Markets supports five trading platforms, including MetaTrader 4, MetaTrader 5, TradingView, ProTrader, and a proprietary mobile app. This platform diversity allows traders to deploy manual, algorithmic, and advanced chart-based strategies within a single brokerage ecosystem.

As an ECN-focused broker, Vantage Markets offers Raw ECN and Pro ECN accounts with spreads from 0.0 pips and market execution. With a minimum deposit starting at $20 and leverage up to 1:1000, it accommodates both low-capital traders and high-volume professionals.

Regulation is a core strength of Vantage Markets, with licenses from ASIC, FCA, FSCA, CIMA, and VFSC. Client funds are segregated, negative balance protection is available under most entities, and insurance coverage reaches up to $1,000,000 via Lloyd’s.

For a guide on Vantage Markets registration, check out our article. Here’s a table of the broker’s specifics.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FSCA, VFSC, FCA, CIMA |

Minimum Deposit | $20 |

Deposit Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Withdrawal Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application |

Vantage Markets Pros and Cons

Overall, Vantage Markets balances flexible account structures, strong regulatory coverage, and competitive ECN pricing. The following pros and cons summarize where the broker stands out and where limitations may apply, especially for traders seeking specific regional access or premium account tiers.

Pros | Cons |

Regulated by multiple tier-1 authorities (ASIC, FCA) | Pro ECN account requires a high minimum deposit |

ECN accounts with spreads from 0.0 pips | No proprietary desktop trading platform |

Wide platform support including TradingView | Restricted access for traders in some countries |

Copy trading via ZuluTrade, DupliTrade, Myfxbook | Offshore entities use higher-risk leverage tiers |

VT Markets

VT Markets is a global ECN forex broker facilitating over 30 million trades per month for more than 400,000 active traders. The broker provides access to 1,000+ instruments across 7 asset classes, combining deep liquidity with fast market execution. You may go to our VT Markets dashboard page for a review on the broker’s user interface.

Founded in Australia, VT Markets operates through multiple regulated entities, including oversight by the Australian Securities and Investments Commission (ASIC), Financial Sector Conduct Authority (FSCA), and Financial Services Commission (FSC Mauritius), offering varied regulatory coverage for global clients.

For ECN-focused traders, VT Markets delivers RAW ECN and Cent ECN accounts with spreads from 0.0 pips, market execution, and commission-based pricing. Supported base currencies include USD, EUR, GBP, AUD, CAD, and HKD, enhancing flexibility for international traders.

The broker supports MetaTrader 4, MetaTrader 5, and Webtrader+, alongside copy trading and PAMM solutions. With leverage up to 1:500 under non-ASIC entities, VT Markets caters to both active ECN traders and diversified CFD investors.

Table of Features and Details

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros and Cons

As with any multi-jurisdiction broker, VT Markets presents a balance of strengths and limitations. Below is a clear overview of the key pros and cons, helping traders evaluate its suitability within the ECN broker landscape.

Pros | Cons |

RAW ECN accounts with spreads from 0.0 pips | ASIC entity limited to wholesale clients |

Strong ASIC and FSCA regulatory presence | No excess loss insurance beyond regulation |

Wide range of platforms (MT4, MT5, Webtrader+) | Offshore entities raise transparency concerns |

Copy trading and PAMM investment options | Restricted availability in several countries |

LiteFinance

Founded in 2005, LiteFinance is a long-standing forex broker serving over 3.01 million clients worldwide. With an average daily trading volume exceeding $24 billion, the broker has built a strong presence across currency pairs, stocks, metals, indices, and commodities.

LiteFinance operates under multiple regulatory entities, including CySEC for EU clients and the Financial Services Commission of Mauritius for global traders. This structure allows it to combine Tier-1 oversight with flexible trading conditions outside the EU.

From an ECN perspective, LiteFinance offers zero-spread trading on its ECN account with commissions from $5 per lot on major FX pairs, while Classic accounts feature spreads from 1.8 pips with no commission. Leverage reaches up to 1:1000, depending on jurisdiction.

The broker supports MT4, MT5, cTrader, and a proprietary mobile app, alongside LiteFinance copy trading and PAMM services. Its recognition as Best ECN Broker Asia 2023 and Best Forex Brokerage Company MENA 2023 highlights its focus on execution speed and trading technology. Here’s a summary of specifics.

Account Types | CLASSIC, ECN |

Regulating Authorities | FSC |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, cTrader, Mobile App |

LiteFinance Pros and Cons

The following pros and cons, which are especially important for those willing to go through LiteFinance registration, summarize its key strengths and limitations for ECN-focused traders.

Pros | Cons |

High leverage up to 1:1000 | Commission applies on ECN accounts |

ECN access with spreads from 0.0 pips | No 24/7 customer support |

Multiple platforms (MT4, MT5, cTrader) | Limited account type variety |

Copy trading and PAMM services | Investor compensation not available under FSC |

TMGM

Founded in 2013, TMGM (TradeMax Global Markets) is an Australian forex and CFD broker offering access to 12,000+ tradable instruments. The broker operates ECN-style pricing through its EDGE account, combining raw spreads, fast execution, and deep liquidity for active and professional traders.

TMGM’s regulatory backbone is led by ASIC, a Tier-1 authority overseeing its primary Australian entity. Additional licenses from VFSC, FSC Mauritius, and CMA Kenya enable global reach with leverage up to 1:1000, balancing flexibility and market accessibility.

From a trading infrastructure standpoint, TMGM supports MT4, MT5, IRESS, and a proprietary mobile app. ECN execution, minimum spreads from 0.0 pips, and commissions as low as $3.5 per lot position the broker competitively among high-volume and strategy-driven traders.

Beyond execution, TMGM integrates copy trading and social trading via HUBx, alongside a rewards program that converts trading volume into redeemable points. This combination of institutional-grade tools and retail accessibility defines TMGM’s hybrid market positioning.

To learn about the TMGM deposit and withdrawal methods, visit the related article. Check out the broker’s specifics in the table below.

Account Types | EDGE/ECN, CLASSIC |

Regulating Authorities | ASIC – Australia, VFSC – Vanuatu, CMA -Kenya, FSC-Mauritius, FSA - |

Minimum Deposit | $100 |

Deposit Methods | VISA, MasterCard, Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Union Pay, Fasapay, Crypto (USDT, USDC) |

Withdrawal Methods | Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Crypto (USDT, USDC) |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, IRESS, TMGM Mobile App |

TMGM Pros and Cons

TMGM’s strengths and limitations become clearer when evaluating its trading conditions, regulatory mix, and fee structure. Check out the following pros and cons before TMGM registration.

Pros | Cons |

ASIC Tier-1 regulation with segregated funds | Inactivity fee after prolonged non-use |

ECN pricing with spreads from 0.0 pips | Educational content less comprehensive |

12,000+ instruments across multiple markets | Offshore entities offer lower investor protection |

MT4, MT5, and IRESS platform support | Trust scores vary across review platforms |

TeleTrade

Founded in 1994, TeleTrade is a long-established Forex and CFD broker with a presence in 26 countries. With nearly three decades of operation, the company has built a recognizable footprint in global retail trading markets.

TeleTrade offers ECN trading conditions with spreads starting from 0.2 pips and commissions from 0.007%, positioning it among cost-efficient brokers for active traders. A low $10 minimum deposit and 0.01-lot order size make market access flexible for different trading styles.

The broker operates under Cyprus Securities and Exchange Commission (CySEC) with license number 158/11, providing Tier-1 regulatory oversight. Client funds are segregated, negative balance protection is enabled, and eligible EU clients are covered up to €20,000 by the Investor Compensation Fund (ICF).

TeleTrade supports MetaTrader 4 and MetaTrader 5, offering access to forex, indices, metals, energies, shares, and cryptocurrencies. Its proprietary Synchronous Trading feature allows users to follow and copy experienced traders directly within the platform.

For a review of the user interface, check out our TeleTrade dashboard article. Here’s a summary of the broker’s parameters.

Account Types | ECN, NDD, CENT |

Regulating Authorities | CySEC |

Minimum Deposit | $10 |

Deposit Methods | Bank Transfers, Credit/Debit Cards, E-Payment Systems, Local Payment Options |

Withdrawal Methods | Bank Transfers, Credit/Debit Cards, E-Payment Systems, Local Payment Options |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5 |

TeleTrade Pros & Cons

TeleTrade combines long market experience, regulated ECN execution, and copy-trading functionality. However, factors such as regional restrictions and limited fee transparency should be weighed alongside its strengths, which are summarized below, before going through Teletrade registration.

Pros | Cons |

Nearly 30 years of industry presence | Not available in several major countries |

CySEC Tier-1 regulation with ICF protection | Limited transparency on some non-trading fees |

ECN spreads from 0.2 pips | Stock CFD range smaller than some competitors |

MT4 & MT5 plus built-in copy trading | No PAMM or managed account solutions |

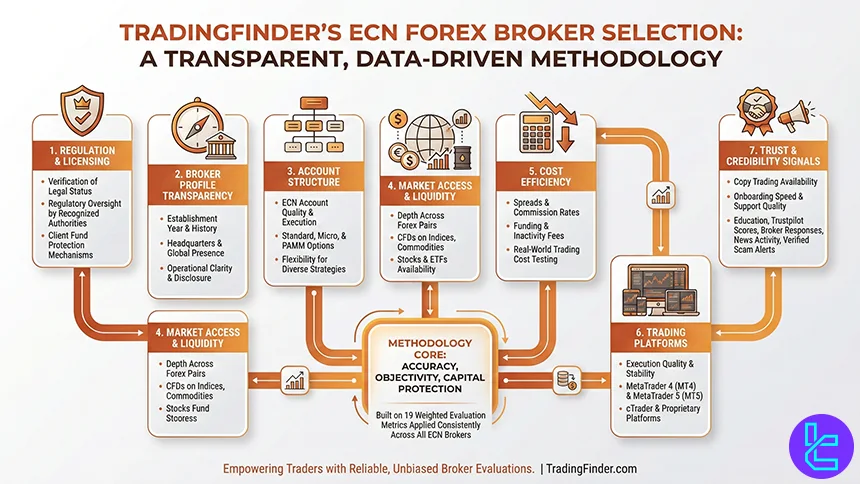

How We Selected the Best ECN Forex Brokers

Choosing the Best ECN Forex Brokers requires more than surface-level comparisons. At TradingFinder, broker selection is driven by a transparent, data-based review methodology designed to protect traders’ capital and decision-making.

Our analysts apply a structured framework built on 19 weighted evaluation metrics, ensuring every ECN broker is assessed objectively and consistently.

Regulation and licensing form the foundation of our analysis. We verify each broker’s legal status, regulatory oversight, and client fund protection mechanisms under recognized financial authorities.

This is followed by a detailed broker profile review, including establishment year, headquarters, and operational transparency.

Account structure is another core criterion. TradingFinder evaluates the availability and quality of ECN accounts, alongside standard, micro, and PAMM options, to ensure flexibility for different trading strategies. We also examine the range of tradable instruments, prioritizing brokers that offer deep liquidity across forex pairs, CFDs, stocks, and ETFs.

Cost efficiency plays a decisive role. Our team analyzes spreads, commissions, deposit and withdrawal fees, and inactivity charges by reviewing broker disclosures and testing services directly. Platform support is equally critical; brokers offering stable access to MetaTrader 4, MetaTrader 5, and cTrader score higher for execution quality and usability.

Beyond trading conditions, we assess copy trading availability, account opening and verification speed, customer support responsiveness, educational resources, and data transparency. External credibility is reinforced through Trustpilot scores, news activity, broker responses to user issues, and verified scam alerts.

This methodology allows TradingFinder analysts to identify ECN brokers that deliver fair pricing, institutional-grade execution, and a reliable trading experience; criteria that truly matter in competitive forex markets.

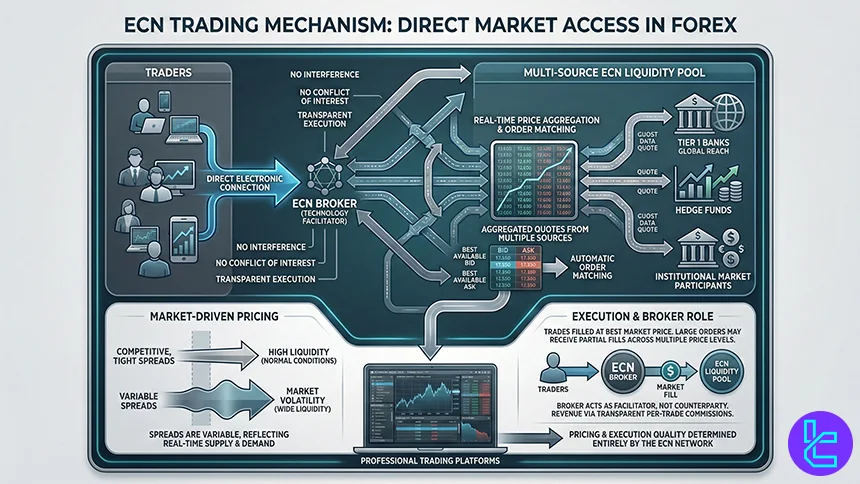

What is ECN?

ECN (Electronic Communication Network) is a trading model that directly connects market participants, such as traders, banks, liquidity providers, and financial institutions, within a shared electronic marketplace.

In the forex market, ECN technology allows buy and sell orders to be matched automatically without a traditional dealing desk acting as a counterparty.

Unlike market maker models, ECN brokers do not set prices internally. Instead, they aggregate real-time bid and ask quotes from multiple liquidity providers and display the best available prices to traders.

This structure results in variable spreads, which can tighten significantly during periods of high liquidity and widen during volatile or low-volume market conditions.

ECN trading is known for its high execution speed and transparency. Orders are executed at market price with minimal intervention, making this model particularly suitable for scalpers, algorithmic traders, and high-frequency strategies.

Because ECN brokers earn revenue primarily through fixed commissions rather than spread markups, their interests are structurally aligned with traders’ trading volume, not their losses.

Today, ECN access is commonly provided through advanced platforms such as MetaTrader 4, MetaTrader 5, and cTrader, allowing retail traders to participate in institutional-style trading environments once reserved for professional market participants.

What Are the Common Pros and Cons of ECN Brokers?

ECN brokers offer direct market access by connecting traders to a network of liquidity providers within the forex market. This model is valued for transparent pricing, fast execution, and reduced conflicts of interest.

However, ECN trading also involves variable costs and technical requirements that may not suit all trading styles, especially for beginners or low-volume traders.

Pros | Cons |

Direct access to interbank liquidity with no dealing desk intervention | Trading commissions are charged per lot |

Tighter, market-driven spreads during high liquidity periods | Spreads can widen significantly during volatility or low liquidity |

High execution speed suitable for scalping and algorithmic trading | Requires stable internet and fast execution infrastructure |

Reduced conflict of interest between broker and trader | Less predictable trading costs compared to fixed-spread models |

How Does ECN Operate?

An ECN operates by electronically linking traders directly to a pool of liquidity providers, including banks, hedge funds, and other institutional participants, within the forex market. When a trader places an order, it is routed into the ECN system, where it is matched automatically with the best available opposing order based on price and volume.

Prices shown on ECN platforms are aggregated in real time from multiple liquidity sources. The system continuously ranks bid and ask quotes, allowing traders to access competitive, market-driven pricing rather than broker-defined rates.

As a result, spreads are variable and reflect actual market conditions, tightening during high liquidity and widening during volatile periods.

ECN brokers act as technology facilitators, not market counterparties. They do not take the opposite side of client trades or manually intervene in execution. Instead, trades are executed at market price, often with partial fills if large order sizes exceed available liquidity at a single price level.

Retail traders typically access ECN infrastructure through platforms such as MetaTrader 4, MetaTrader 5, and cTrader. In this model, the broker earns revenue via transparent commissions per trade, while execution quality and pricing are determined by the underlying ECN network itself.

Are Spreads Wide in ECN Brokers?

Spreads in ECN brokers are not fixed and are not inherently wide. In an ECN environment, spreads are market-driven, meaning they reflect real-time supply and demand within the forex market rather than prices set by the broker.

During periods of high liquidity, such as major session overlaps, spreads on major currency pairs can narrow to near-zero levels.

However, ECN spreads can widen temporarily under certain conditions. Low-liquidity periods, major economic news releases, or heightened market volatility may reduce the number of available orders in the liquidity pool, causing bid-ask gaps to expand.

This behavior is a natural result of transparent price discovery rather than a broker-imposed adjustment.

It is also important to evaluate total trading cost, not spreads alone. ECN brokers typically charge a fixed commission per lot, which means that even with very tight spreads, overall costs depend on both spread width and commission structure.

When liquidity is strong, the combined cost of spread plus commission is often lower than that of fixed-spread or market maker models.

In summary, ECN spreads fluctuate with market conditions: they are usually tight and competitive in liquid markets but can widen during volatile or thin trading periods, accurately reflecting real interbank pricing dynamics.

Do ECN Brokers Charge High Non-Trading Fees?

ECN brokers generally do not rely heavily on non-trading fees as a primary revenue source. Since their main income comes from commissions per trade, costs such as deposits, withdrawals, and account maintenance are often kept competitive to attract active traders in the forex market.

That said, non-trading fees can still exist. Some ECN brokers charge withdrawal processing fees, especially for international bank wires or third-party payment services.

Inactivity fees may also apply if an account remains unused for an extended period, although this varies by broker and account type. These charges are typically disclosed in the broker’s fee schedule and are not unique to the ECN model.

Deposit fees are less common, particularly when using standard funding methods, but external payment providers may impose their own costs beyond the broker’s control. Importantly, ECN brokers are generally less likely to apply hidden or discretionary fees, as pricing transparency is a core characteristic of the ECN structure.

Overall, ECN brokers do not systematically charge higher non-trading fees than other broker models. Traders should instead review each broker’s full fee policy to assess how deposits, withdrawals, and inactivity rules may impact their long-term trading costs.

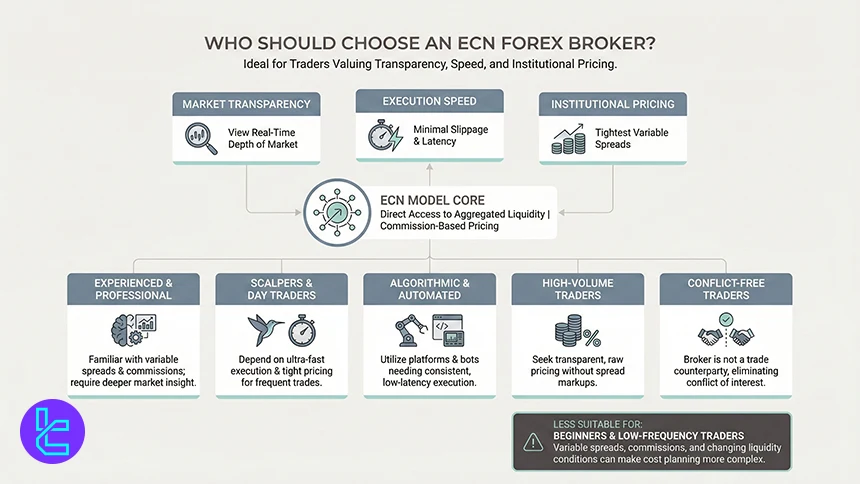

Who Should Choose an ECN Forex Broker?

An ECN forex broker is best suited for traders who prioritize market transparency, execution quality, and institutional-grade pricing in the forex market.

Because ECN brokers provide direct access to aggregated liquidity and charge commission-based fees, they tend to favor traders with specific experience levels, strategies, and trading volumes.

ECN brokers are particularly suitable for:

- Experienced and professional traders who understand variable spreads, commission structures, and real-time market dynamics;

- Scalpers and day traders who rely on fast execution speeds and tight spreads during high-liquidity sessions;

- Algorithmic and automated traders using expert advisors or trading bots on platforms such as MetaTrader 4, MetaTrader 5, or cTrader;

- High-volume traders who benefit from transparent pricing and reduced spread markups compared to market maker models;

- Traders seeking minimal conflict of interest, as ECN brokers do not act as counterparties to client trades.

On the other hand, ECN brokers may be less suitable for beginners or low-frequency traders. Variable spreads, commission calculations, and fluctuating liquidity conditions can make cost forecasting more complex, especially for those new to forex trading.

Why do ECN Forex Brokers Need to be Regulated?

Regulation is critical for ECN forex brokers because they provide direct access to institutional liquidity within the forex market. Without regulatory oversight, the transparency and execution advantages of the ECN model can be undermined, exposing traders to operational, financial, and legal risks.

Regulated ECN brokers are required to comply with strict rules imposed by recognized financial authorities such as Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), and Cyprus Securities and Exchange Commission (CySEC).

Key reasons regulation is essential for ECN brokers include:

- Client fund protection: Regulators typically require segregated accounts, ensuring client deposits are held separately from broker operating funds;

- Execution integrity: Oversight helps prevent price manipulation, execution delays, or unfair order handling in fast-moving ECN environments;

- Operational transparency: Licensed brokers must disclose pricing models, commissions, and liquidity arrangements clearly;

- Risk management standards: Regulators enforce capital adequacy requirements to reduce insolvency risk during market stress;

- Dispute resolution mechanisms: Regulated brokers must provide formal complaint-handling processes and, in some jurisdictions, access to compensation schemes.

Do ECN Brokers Offer Islamic or Swap-Free Account Options?

Yes, many ECN brokers offer Islamic (swap-free) account options, but availability depends on the broker’s regulatory structure and account policies. Swap-free accounts are designed to comply with Sharia law, which prohibits earning or paying interest on overnight positions in the forex market.

In an ECN environment, providing Islamic accounts is more complex than in market maker models. Since ECN brokers pass trades directly to liquidity providers, overnight rollover costs still exist at the interbank level.

To accommodate swap-free trading, brokers typically remove overnight swaps and instead apply an alternative fixed fee or markup after a position is held beyond a specified period. This approach allows compliance with religious principles while maintaining access to real market liquidity.

Islamic ECN accounts usually retain the same core features as standard ECN accounts, including variable spreads, direct market access, and commission-based pricing. However, restrictions may apply.

Some brokers limit the number of days a trade can remain open without swaps, restrict certain instruments, or reserve the right to review accounts for misuse of swap-free conditions.

Not all ECN brokers provide Islamic accounts, and terms can vary significantly. Traders seeking swap-free ECN trading should carefully review account disclosures, fee structures, and regulatory approvals to ensure the account aligns with both Sharia compliance and transparent ECN execution standards.

What Should I Consider When Choosing an ECN Broker?

Selecting the right ECN broker requires evaluating factors that directly affect execution quality, costs, and capital safety in the forex market. Because ECN pricing is market-driven, differences between brokers can materially impact results; especially for active strategies.

Key considerations include:

- Regulation and licensing: Prioritize brokers supervised by reputable authorities such as the FCA, ASIC, or CySEC to ensure fund segregation, transparency, and dispute resolution;

- Liquidity providers: Deeper and more diverse liquidity pools generally deliver tighter spreads and more consistent execution, especially during volatile periods;

- Total trading costs: Assess both variable spreads and commissions per lot. The combined cost matters more than headline spreads alone;

- Execution quality: Look for fast order routing, minimal requotes, and clear policies on slippage and partial fills, which are critical for scalping and algorithmic trading;

- Trading platforms: Reliable ECN access via MetaTrader 4, MetaTrader 5, or cTrader supports advanced order types and automation;

- Account conditions: Check minimum deposits, leverage limits, Islamic (swap-free) options, and any restrictions on instruments or holding periods;

- Non-trading fees and support: Review withdrawal costs, inactivity fees, and the responsiveness of customer support, especially during market events.

ECN Brokers vs. Dealing Desk Brokers vs. STP Brokers

When comparing ECN, Dealing Desk (Market Maker), and STP execution models, it's important to focus on how each processes trades, the costs involved, and transparency.

ECN brokers provide direct access to the interbank market with raw spreads and transparent commissions, making them appealing for high-frequency and professional traders.

Dealing Desk brokers set prices internally and may act as counterparties, potentially creating conflicts of interest. STP brokers fall between these models by routing orders to external liquidity providers but without the full interbank transparency of ECNs.

Parameter | ECN | Dealing Desk (Market Maker) | STP |

Order Routing | Direct to interbank liquidity; orders matched on network | Internal execution; may take opposite side | Routed to liquidity providers (banks, brokers) |

Spread Type | Raw/variable spreads | Fixed or variable spreads set by broker | Variable spreads (aggregated) |

Commission | Yes (per trade) | Often none; profit via spreads | Sometimes none; markup in spreads |

Conflict of Interest | Minimal | Potential (broker may be counterparty) | Minimal |

Transparency | High (real market pricing) | Lower (broker-set quotes) | Moderate |

Execution Speed | Fast (direct matching) | Fast (internal) | Fast |

Market Access | Full interbank access | Limited | Access via LPs |

Conclusion

Those looking for low or raw spreads in brokers (under normal market conditions) will most likely find the ECN brokers as optimal options, given their direct connection to liquidity providers for clients. Based on our examinations, BlackBull Markets, Vantage Markets, VT Markets, and LiteFinance appear as best candidates in this regard.

If you are eager to know about the details of our evaluation, check out our Forex methodology article.