Australia holds a distinct position in the global forex market due to the combination of a developed financial system, a comparatively small population, and a strong regulatory framework. All forex brokers operating from Australia are required to obtain authorization from the Australian Securities and Investments Commission (ASIC).

| Eightcap | |||

| Fusion Markets | |||

| IC Markets | |||

| 4 |  | XM Group | ||

| 5 |  | easymarkets | ||

| 6 |  | Pepperstone | ||

| 7 |  | FXCM | ||

| 8 |  | FP Markets | ||

| 9 |  | AvaTrade | ||

| 10 |  | Global Prime |

Trustpilot Ratings of Forex Brokers in Australia

The table below helps traders compare the Trustpilot ratings of these top brokers that are favored by most Australian Traders.

Broker | Trustpilot Rating | Number of Reviews |

| IC Markets | 4.8/5 ⭐ | +49000 |

4.8/5 ⭐ | +8000 | |

FP Markets | 4.8/5 ⭐ | +9500 |

AvaTrade | 4.7/5 ⭐ | +11000 |

Global Prime | 4.6/5 ⭐ | 375 |

FXCM | 4.6/5 ⭐ | +800 |

Pepperstone | 4.3/5 ⭐ | +3000 |

4.1/5 ⭐ | +3000 | |

easymarkets | 4.1/5 ⭐ | +1500 |

3.5/5 ⭐ | +2000 |

Comparison of Forex Brokers in Australia Based on the Minimum Spreads

Trading costs play a decisive role in broker selection, as expenses such as spreads, commissions, swap charges, and currency conversion fees directly affect overall profitability. Here are the minimum spreads in the best brokers in Australia.

Brokers | Minimum Spreads |

Fusion Markets | From 0.0 pips |

XM Group | From 0.0 pips |

BlackBull Markets | From 0.0 pips |

From 0.0 pips | |

Global Prime | From 0.0 pips |

Eightcap | From 0.0 pips |

FP Markets | From 0.0 pips |

IC Markets | From 0.0 pips |

Pepperstone | From 0.0 Pips |

From 0.6 pips |

Non-Trading Fees for the Forex Brokers of Australia

The following brokers are recognized for maintaining minimal non-trading expenses, such as low or no deposit, withdrawal, and inactivity fees, making them cost-efficient choices for Australian users.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Eightcap | $0 | $0 | No |

$0 | $0 | No | |

Blackbull Markets | $0 | $5 | No |

Interactive Brokers | $0 | Varies | No |

Ava Trade | $0 | Varies | No |

Plus500 | $0 | $0 | $10 |

eToro | $0 | Varies | $10 |

Forex.com | $0 | $0 | $15 |

XM Group | $0 | $0 | $15 |

$0 | Varies | $50 |

Number of Tradable Instruments in Forex Brokers of Australia

The diversity and variety of tradable instruments allow Forex traders to hedge their trades by using non-correlated assets. Having access to more assets also means that traders can use every opportunity they find and gain the best profits from various markets.

Broker | Number of Tradable Assets |

IG Markets | +17000 |

| City Index | +13500 |

+10000 | |

Forex.com | +7000 |

+2250 | |

Pepperstone | +1400 |

Eightcap | +800 |

AvaTrade | +250 |

Fusion Markets | +250 |

+150 |

Top 8 Forex Brokers in Australia

TradingFinder analysts have conducted an in-depth evaluation of multiple well-known brokerage firms to identify the most reliable options for traders in Australia.

The selection process considered key criteria such as trading costs, leverage conditions, range of available markets, funding and withdrawal flexibility, commission models, and overall trading environment.

Eightcap

Eightcap is a multi-asset Forex and CFD broker that provides access to leveraged trading with maximum leverage up to 1:500, depending on the regulatory entity and client classification.

The broker offers trading across six core markets, including Forex, commodities, metals, cryptocurrencies, indices, and shares, primarily through CFD instruments for all traders who complete the Eightcap registration.

Account options are structured around Standard, Raw, and TradingView accounts, alongside a Demo environment, with pricing models that range from spread-only execution to raw spreads combined with fixed commissions. Traders could use the Eightcap rebate program from TradingFinder IB to lower their trading costs up to $3.6 per traded lot.

Founded in 2009 in Melbourne, Eightcap operates under a multi-jurisdiction regulatory framework that includes ASIC in Australia, FCA in the United Kingdom, CySEC in Cyprus, and SCB in The Bahamas.

Eightcap supports MetaTrader 4, MetaTrader 5, and TradingView, catering to all trading styles.

Additional tools such as Capitalise.ai, FlashTrader, and an AI-driven economic calendar extend functionality without introducing proprietary execution layers.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC (Australia), FCA (United Kingdom), CySEC (Cyprus), SCB (Bahamas) |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards (Visa, Mastercard), Bank Wire Transfer, E-wallets (Skrill, Neteller), PayPal, Cryptocurrencies (BTC, ETH, USDT) |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets, PayPal, Cryptocurrencies |

Maximum Leverage | Up to 1:500 (depends on regulatory entity) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView |

Eightcap Pros and Cons

The table below outlines the key advantages and disadvantages of Eightcap for Australian users.

Pros | Cons |

Multi-regulation under ASIC, FCA, CySEC, and SCB | Islamic (swap-free) account not available |

Access to MT4, MT5, and native TradingView integration | No PAMM or copy trading investment solutions |

Raw spreads from 0.0 pips on the Raw account | Educational resources are relatively basic |

Broad market coverage across Forex, crypto, indices, commodities, metals, and shares | - |

IC Markets

IC Markets is a global multi-asset Forex and CFD broker that supports 10 base account currencies, including USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD, with a minimum deposit requirement of $200.

Trading is conducted primarily through CFD instruments, covering Forex, indices, commodities, bonds, cryptocurrencies, and more than 2,100 stock CFDs. The company was established in Australia in 2007 and operates through multiple regulated entities, including ASIC, CySEC, and FSA.

Depending on the regulatory entity, different leverage limits, client protections, and eligibility rules apply, including Investor Compensation Fund coverage of up to €20,000 for EU clients.

Across its entities, IC Markets applies client fund segregation, external audits, and anti-money laundering procedures.

Account structures at IC Markets include Standard, Raw Spread, and Islamic (swap-free) accounts, designed for different execution styles such as discretionary trading, scalping, and algorithmic strategies.

Standard accounts offer spread-based pricing with minimum spreads from 0.8 pips and no commission, while Raw Spread accounts provide pricing from 0.0 pips combined with fixed commissions per lot. These amounts can be lowered by leveraging IC Markets' rebates.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | Asic, CySEC, SCB, FSA, CMA |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards (Visa, MasterCard), Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal), Local and regional payment solutions |

Withdrawal Methods | Bank Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal) |

Maximum Leverage | Up to 1:500 (subject to trading conditions) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, cTrader Web, IC Markets Mobile |

Pros and Cons of IC Markets for Australian Users

The following pros and cons summarize IC Markets' key strengths and limitations.

Pros | Cons |

Operates through the IC Markets Australia entity, making it suitable for traders looking for locally oriented Australian brokerage services | The $200 initial funding requirement can be a barrier for beginner or low-capital traders |

Provides exposure to more than 2,100 equity CFDs in addition to Forex, indices, commodities, and cryptocurrency markets | Does not support PAMM or managed investment account structures |

Compatible with multiple trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, cTrader Web, and the IC Markets mobile app | Raw pricing accounts rely on a commission-based cost model |

Raw pricing accounts offer ultra-tight spreads starting from 0.0 pips | - |

easymarkets

easyMarkets is a multi-asset Forex and CFD broker that provides commission-free trading with a relatively low entry threshold, requiring a minimum deposit of $25. Leverage availability varies by regulatory entity, reaching up to 1:2000 for international clients, while stricter limits apply under EU and Australian regulations.

The company operates through a multi-jurisdictional structure and is supervised by several regulatory authorities, including CySEC in Cyprus, ASIC in Australia, the FSCA in South Africa, the FSA in Seychelles, and the FSC in BVI.

The broker supports trading across several markets, including Forex, indices, metals, commodities, cryptocurrencies, and shares, using both fixed and variable spread pricing models.

Client funds are held in segregated accounts, and negative balance protection is applied across entities for all easymarkets registrations. easyMarkets supports multiple trading platforms, including MetaTrader 4, MetaTrader 5, TradingView, and its proprietary web and mobile platform.

Distinctive features, such as deal cancellation, Freeze Rate, and guaranteed stop-loss, are integrated into the proprietary environment.

Account types include standard and Islamic swap-free options, while investment services such as PAMM or copy trading are not offered.

Account Types | easyMarkets Web/App & TradingView, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

Regulating Authorities | CySEC (Cyprus), ASIC (Australia), FSCA (South Africa), FSA (Seychelles), FSC (BVI) |

Minimum Deposit | $25 |

Deposit Methods | Visa, MasterCard, Maestro, Bank Wire Transfer, Local Bank Transfer, Skrill, Neteller |

Withdrawal Methods | Visa, MasterCard, Maestro, Bank Wire Transfer, Local Bank Transfer, Skrill, Neteller |

Maximum Leverage | Up to 1:2000 (varies by regulatory entity) |

Trading Platforms & Apps | Proprietary easyMarkets Platform (Web & Mobile), MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView |

easymarkets Pros and Cons

The table below helps you understand the pros and cons of trading with easymarkets for Australian traders.

Pros | Cons |

Regulated in Australia under ASIC, alongside CySEC, FSCA, FSA Seychelles, and FSC BVI | Cryptocurrency funding is not supported for deposits or withdrawals |

Commission-free trading model with fixed and variable spread options | Customer support is not available on a 24/7 basis |

Access to proprietary easyMarkets platform plus MT4, MT5, and TradingView | - |

Built-in risk management tools such as guaranteed stop loss, deal cancellation, and Freeze Rate | - |

XM Group

XM Group is an international Forex and CFD broker with a long operating history, having been established in 2009.

The broker provides access to more than 55 currency pairs and over 1,200 stock CFDs, alongside commodities, indices, cryptocurrencies, and precious metals for all the traders who complete the XM Group registration process.

Trading activity is primarily conducted through the MetaTrader ecosystem, including MetaTrader 4, MetaTrader 5, and the XM mobile application.

XM operates through multiple regulated entities and is supervised by authorities such as CySEC in Cyprus, FSCA in South Africa, DFSA in Dubai, FSC in Belize and Mauritius, and FSA in Seychelles. All entities require traders to complete the XM Group verification process for anti-money laundering and KYC purposes.

The broker supports trading across several markets, including Forex, indices, metals, commodities, cryptocurrencies, and shares, using both fixed and variable spread pricing models.

Account options include Micro, Standard, Ultra Low, and Shares accounts, as well as Islamic swap-free variants in the XM Group dashboard. Pricing is largely spread-based, with spreads starting from around 0.6 pips and no commissions on most accounts.

Account Types | Micro, Standard, Ultra Low Standard, Shares, Demo |

Regulating Authorities | FSC (Belize), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSC (Mauritius), FSA (Seychelles) |

Minimum Deposit | $5 (Micro, Standard, Ultra Low) |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller, Perfect Money), Apple Pay, Google Pay, local methods |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets |

Maximum Leverage | Up to 1:1000 (depends on account type and entity) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), XM Mobile App |

XM Group Pros and Cons

Here are some of the pros and cons of trading with XM Group as an Australian trader.

Pros | Cons |

Operates under multiple regulatory bodies, including FSC Belize, CySEC, FSCA, DFSA, FSC Mauritius, and FSA Seychelles | The Shares account requires a significantly higher initial deposit compared to other account types |

Full MetaTrader environment support via MT4, MT5, XM Mobile App, and MQL5 Signal Service integration | Overnight swap charges are applied to positions held beyond the trading day, depending on the asset |

Offers elevated leverage levels reaching up to 1:1000, with trade sizes starting from 0.01 lot | - |

Provides Islamic swap-free account options along with negative balance protection for retail traders | - |

AvaTrade Broker

AvaTrade is a Forex brokerage operating under a broad regulatory framework that includes licenses from ASIC, CySEC, the Central Bank of Ireland (CBI), FSCA, FSA Japan, ADGM, ISA, and BVI FSC. All entities require AvaTrade verification to comply with international rules.

This multi-jurisdiction structure places the broker under both Tier 1 and regional regulators, with client fund segregation and negative balance protection applied across entities.

Trading conditions include a margin call level of 25% and a stop out level of 10%. Leverage varies by entity, reaching up to 1:400 in selected jurisdictions, while EU and Australian clients are subject to lower caps in line with local rules.

AvaTrade registration provides traders access to multiple platforms, including MetaTrader 4, MetaTrader 5, WebTrader, a mobile trading app, and the AvaOptions platform for options trading.

The broker requires a minimum deposit of $100 and supports several funding methods, including credit and debit cards, bank wire transfers, Skrill, Neteller, WebMoney, and PayPal, depending on the region.

Available markets cover Forex, stocks, indices, commodities, metals, and cryptocurrencies. Account options include retail, professional, Islamic swap-free, and demo accounts available to open in the AvaTrade dashboard.

In addition, AvaTrade offers copy trading through DupliTrade and AvaSocial, positioning itself as a regulated broker with a wide platform and asset offering rather than a high-leverage-focused provider.

Account Types | Retail, Professional, Islamic (Swap Free), Demo |

Regulating Authorities | Central Bank of Ireland (CBI), ASIC (Australia), CySEC (Cyprus), FSCA (South Africa), FSA (Japan), ADGM (Abu Dhabi), ISA (Israel), BVI FSC |

Minimum Deposit | $100 |

Deposit Methods | Credit and Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Withdrawal Methods | Credit and Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Maximum Leverage | Up to 1:400 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTrade WebTrader, AvaTrade Mobile App, AvaOptions |

Pros and Cons of AvaTrade Broker

Like any other broker, AvaTrade has it’s own pros and cons. The table below provides more information on that subject:

Pros | Cons |

Regulated by multiple top-tier authorities, including CBI, ASIC, CySEC, FSCA, FSA Japan, and ADGM | Leverage limits are relatively low for retail traders under EU and Australian regulation |

Wide selection of trading platforms such as MT4, MT5, WebTrader, Mobile App, and AvaOptions | No PAMM or managed account services available |

Access to diverse markets, including Forex, stocks, indices, commodities, metals, and cryptocurrencies | - |

Availability of Islamic (swap-free) accounts and negative balance protection | - |

Global Prime Broker

Global Prime is an Australian-founded brokerage that offers access to more than 150 tradable instruments across Forex, indices, commodities, cryptocurrencies, and bonds.

Trading conditions are built around low-cost execution, with Raw accounts providing spreads from 0.0 pips and a commission of $3.5 per side, while Standard accounts apply spread-based pricing with no commission. The Global Prime rebate is also available via the TradingFinder IB, allowing traders to reduce spreads up to 44.44%.

There is no minimum deposit requirement, and position sizes start from 0.01 lots, making the broker accessible to different trading styles.

From a regulatory perspective, Global Prime operates under ASIC in Australia and VFSC in Vanuatu, covering both domestic and international clients, allowing traders to complete Global Prime registration with ease of mind.

Australian retail traders are subject to a maximum leverage of 1:30, while eligible international clients can access leverage up to 1:500. Client funds are held in segregated accounts with institutions such as HSBC and National Australia Bank, supporting fund protection practices.

Deposits and withdrawals are commission-free and supported through more than 20 payment methods, including cards, bank transfers, e-wallets, and cryptocurrencies.

Account Types | Standard, Raw |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu) |

Minimum Deposit | No minimum deposit requirement |

Deposit Methods | Credit and Debit Cards, Bank Wire Transfer, PayPal, Skrill, Neteller, Crypto, AstroPay, Perfect Money, FasaPay, and other local payment gateways |

Withdrawal Methods | Credit and Debit Cards, Bank Wire Transfer, PayPal, Skrill, Neteller, Crypto, AstroPay, Perfect Money |

Maximum Leverage | Up to 1:500 (1:30 for Australian retail clients under ASIC) |

Trading Platforms & Apps | MetaTrader 4 (MT4) |

Global Prime Pros and Cons

The table below helps traders outline the key advantages and disadvantages of trading with Global Prime broker.

Pros | Cons |

Regulated by ASIC and VFSC, providing coverage for both Australian and international clients | MetaTrader 4 is currently the only fully supported trading platform |

Raw account pricing with spreads from 0.0 pips and a transparent commission structure | No Islamic (swap-free) account option available |

No minimum deposit requirement and trade sizes from 0.01 lots | Limited promotional offers compared to high-bonus brokers |

Fast execution with reported latency around 10 ms and access to institutional liquidity | Platform variety is narrower compared to brokers offering MT5 or cTrader |

Pepperstone

Pepperstone is frequently highlighted as a leading Forex broker for Australian traders, operating under a strong regulatory framework supervised by the Australian Securities and Investments Commission (ASIC) while also maintaining wide international compliance coverage.

Many active market participants evaluate the broker scale through its reported trading activity, which includes around $9.2B in average daily volume and a global client base of more than 400,000 accounts, reflecting deep liquidity conditions.

From an account management perspective, Pepperstone supports 10 base currencies such as AUD, USD, GBP, JPY, EUR, CAD, CHF, NZD, SGD, and HKD, which simplifies deposits, withdrawals, and performance reporting for traders in different regions.

The broker offers two main account structures, Standard and Razor, and provides access to widely used platforms, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, along its own proprietary solution, making Pepperstone registration appealing for traders with varied platform preferences.

Trading instruments cover Forex, commodities, cryptocurrencies, shares, indices, ETFs, and a broad range of CFDs, with position sizes generally available from 0.01 up to 100 lots depending on the market. Leverage limits are determined by the applicable regulatory jurisdiction, with ASIC rules applying for Australian clients.

Cost structure varies by account type, as the Razor account applies raw spreads starting from 0.0 pips combined with a commission model, while the Standard account integrates all costs into the spread, a distinction that also influences the attractiveness of Pepperstone's rebate programs for high-volume traders.

Account Types | Standard, Razor, Demo, Islamic |

Regulating Authorities | ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (Dubai), CMA (Kenya), BaFin (Germany), SCB (Bahamas) |

Minimum Deposit | $1 (technical minimum may apply depending on payment method) |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, UnionPay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, UnionPay, USDT, ZotaPay |

Maximum Leverage | Up to 1:500 (available under CMA Kenya and selected entities) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, Pepperstone Proprietary Platform |

Pepperstone Pros and Cons

Here’s a detailed table of the benefits and drawbacks of Pepperstone for Australian traders.

Pros | Cons |

Regulatory oversight across multiple authorities, including ASIC, FCA, CySEC, DFSA, BaFin, and SCB | Leverage caps differ by regulator, with tighter limits under FCA, CySEC, BaFin, and ASIC |

Wide platform coverage with MT4, MT5, cTrader, TradingView, and a proprietary trading platform | No PAMM or managed account services available |

Support for 10 base currencies such as USD, EUR, GBP, JPY, AUD, CHF, CAD, NZD, SGD, and HKD | Trading bonuses and promotional offers are not provided |

Razor account pricing based on raw spreads from 0.0 pips with a transparent commission structure | - |

Fusion Markets

Fusion Markets is a multi-asset Forex and CFD broker established in 2019, operating under a dual regulatory structure that includes ASIC in Australia and VFSC in Vanuatu.

Client funds are held in segregated accounts with tier-one banks such as HSBC and National Australia Bank, supporting operational transparency.

The broker offers access to more than 250 tradable instruments across Forex, indices, commodities, metals, energy products, cryptocurrencies, and US share CFDs. Details of the contract size, spreads, and variety of symbols are available in the Fusion Markets dashboard.

Trading conditions are built around cost efficiency, with the Zero account providing raw spreads from 0.0 pips and a commission of $4.5 per standard lot, while the Classic account features spreads from 0.9 pips with zero commission.

There is no minimum deposit requirement, and position sizing starts from 0.01 lots. Fusion Markets supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView, combined with average execution speeds reported around 0.02 milliseconds.

Maximum leverage reaches 1:500 under the VFSC entity and 1:30 under ASIC rules for all traders who complete the Fusion Markets verification. Additional services include copy trading, MAM/PAMM accounts, VPS hosting, and an economic calendar.

While the broker emphasizes ultra-low trading costs and platform diversity, its educational resources remain relatively limited compared with larger global competitors.

Account Types | Zero, Classic, Swap Free |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu) |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, PayPal, Bank Wire, PayID, Crypto, Skrill, Neteller, Perfect Money, Interac, BinancePay |

Withdrawal Methods | Bank Wire, PayPal, Crypto, Skrill, Neteller, Interac, Jetonbank, DragonPay |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

Here are some of the benefits and drawbacks of trading with Fusion Markets for Australian traders.

Pros | Cons |

No minimum deposit requirement, suitable for small and new accounts | No investor compensation scheme for Australian clients |

Raw spreads from 0.0 pips on Zero account with low commission ($4.5 per lot) | Educational content is limited compared to large global brokers |

Access to MT4, MT5, cTrader, and TradingView platforms | No proprietary trading platform |

Segregated client funds held with HSBC and National Australia Bank (NAB) | Fewer tradable instruments than some multi-asset competitors |

Is Forex Trading Legal in Australia?

Forex trading is fully legal in Australia and operates within a clearly defined regulatory and legal framework.

The market is supervised by the Australian Securities and Investments Commission (ASIC), which was formally established in 1998 and derives its authority from the Australian Securities and Investments Commission Act 2001 and the Corporations Act 2001.

Based on TF scores, ASIC is a top-tier regulatory entity alongside FCA, CySEC, or SEC.

From a tax perspective, Forex trading profits are generally treated as assessable income and must be reported to the Australian Taxation Office (ATO), regardless of whether trading is conducted with domestic or offshore brokers.

Which Financial Authority Regulates Forex Brokers in Australia?

Forex brokers operating in Australia are regulated by the Australian Securities and Investments Commission (ASIC). This financial authority was formally established in 1998, with its powers and responsibilities defined under the Australian Securities and Investments Commission Act 2001.

Any broker offering Forex or CFD services to Australian residents must hold an Australian Financial Services License (AFSL) issued by ASIC.

Brokers must fully segregate client funds from company capital, typically in Australian Tier-1 banks, and comply with minimum capital adequacy standards set under AFSL rules. Promotional incentives such as trading bonuses are prohibited, and brokers must publish standardized risk warnings, including the percentage of retail traders who lose money.

Negative Balance Protection is mandatory for retail clients, ensuring losses cannot exceed deposited funds. ASIC also enforces transparency through Product Disclosure Statements (PDS) and ongoing reporting obligations.

In cases of misconduct, ASIC has the authority to impose financial penalties, suspend licenses, or revoke AFSLs entirely. Dispute resolution is handled through AFCA, providing an independent complaints framework for Australian traders.

How to Verify ASIC Regulation?

The most reliable way to confirm ASIC regulation is by cross-checking the broker’s legal entity name and AFSL number against ASIC’s official public registers.

These databases list all licensed financial service providers, along with their authorization scope, current status, and any historical regulatory actions. A mismatch between the broker’s marketing claims and ASIC records is a clear warning sign.

In addition to the main ASIC register, traders can consult ASIC MoneySmart, which publishes verified information on licensed firms and maintains resources related to investment risks and financial scams.

MoneySmart also allows users to report suspicious activity linked to unlicensed or misleading brokers.

What are the Best Forex Brokers Regulated by the ASIC Financial Authority?

Here’s a list of the top Forex and CFD brokers in Australia that operate under ASIC supervision.

Broker | AFSL License Number |

IG | 515106 |

XM Group | 443670 |

Admirals | 410681 |

Pepperstone | 414530 |

Plus500 | 417727 |

Eightcap | 391441 |

FP Markets | 286354 |

Fusion Markets | 385620 |

AvaTrade | 406684 |

FXCM | 309763 |

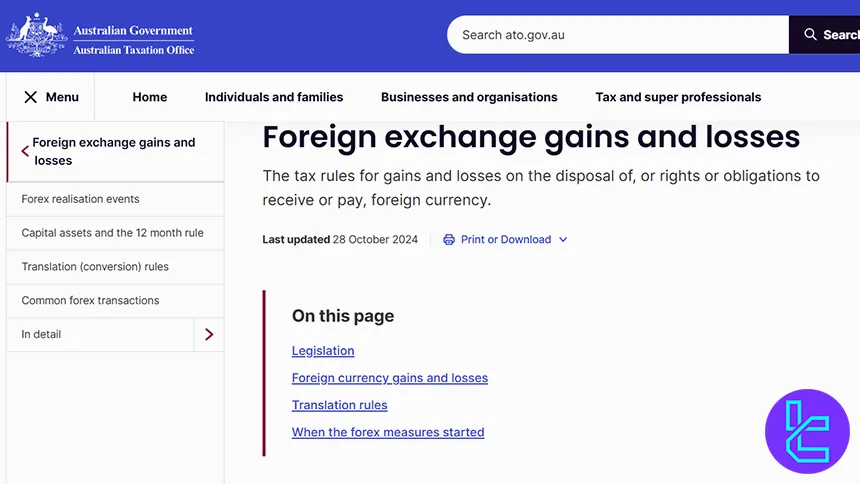

Do I Pay Taxes on My Forex Trading Gains in Australia?

Yes, Forex trading profits in Australia can be subject to tax, depending on how the activity is classified under Australian tax law.

The taxation framework is primarily governed by the Income Tax Assessment Act 1997 (ITAA 1997), specifically Division 775 and Subdivisions 960-C and 960-D, which deal with foreign currency gains, losses, and translation rules.

Under Division 775, Forex gains or losses become taxable when a defined Forex Realisation Event (FRE) occurs.

These events include the disposal of foreign currency, the cessation of a right to receive foreign currency, or the end of an obligation to pay or receive foreign currency.

Importantly, taxation can apply even if the funds are not converted into Australian dollars (AUD), as long as the gain or loss is considered “realised” under the Act.

Traders can learn more about the details Forex taxation process by checking the Australian Government Taxation Office website.

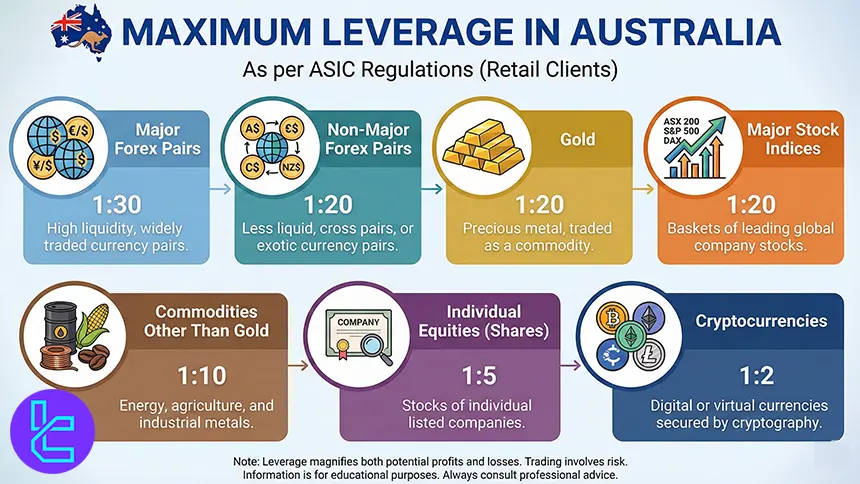

What is the Maximum Leverage in Australia?

In Australia, maximum leverage for retail traders is strictly regulated by the Australian Securities and Investments Commission (ASIC) under its Product Intervention Order.

These limits apply to Contracts for Difference (CFDs) and are designed to reduce excessive risk exposure for retail clients.

While some international or offshore brokers may advertise higher leverage levels such as 1:100 or 1:500, ASIC-regulated brokers operating locally are legally bound to these limits for retail accounts.

Higher leverage is only accessible to traders who qualify as professional or sophisticated investors, a status that involves meeting defined financial and experience thresholds and waiving certain retail protections.

Below is an overview of the maximum leverage allowed for retail traders in Australia, based on ASIC rules.

Asset Type | Maximum Leverage | Approximate Margin Requirement |

Major Forex pairs | 1:30 | 3.33% |

Non-major Forex pairs | 1:20 | 5% |

Gold | 1:20 | 5% |

Major stock indices | 1:20 | 5% |

Commodities other than gold | 1:10 | 10% |

Individual equities (shares) | 1:5 | 20% |

Cryptocurrencies | 1:2 | 50% |

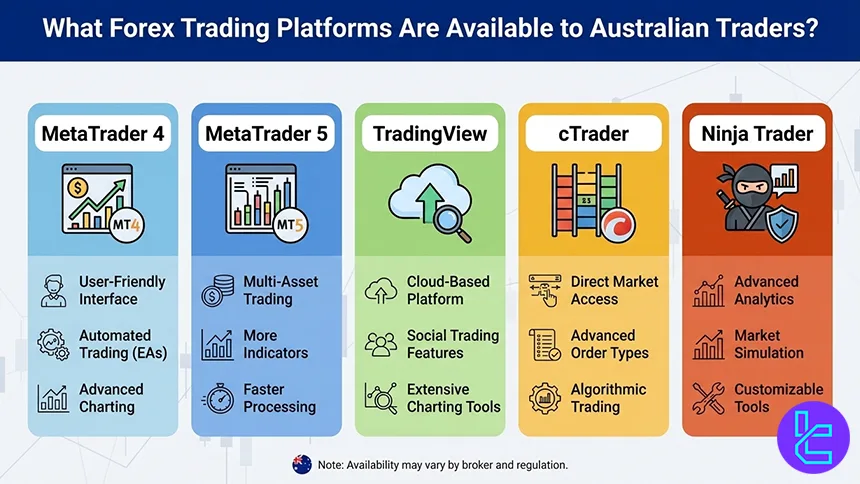

Forex Trading Platforms Available to Australian Traders

Aussie traders have access to a variety of trading platforms based on their chosen broker’s offerings. The most notable options include:

MetaTrader 4

MetaTrader 4 is designed with a streamlined interface and core Forex functionality, making it suitable for traders who prioritize simplicity, automated strategies via Expert Advisors (EAs), and stable execution.

MetaTrader 5

MetaTrader 5 expands asset coverage to include cryptocurrencies and shares CFDs, while offering additional order types, timeframes, and built-in indicators, which appeal to more experienced market participants.

TradingView

TradingView has become increasingly popular among Australian traders due to its cloud-based architecture, advanced charting engine, and access to over 15 chart types and +100 indicators.

Its integrated social features allow users to share market ideas and technical setups directly within the platform.

cTrader

cTrader, formerly associated with cMirror for copy trading, is known for its depth-of-market visibility, advanced order execution, and professional-grade charting tools, often favored by ECN and algorithmic traders.

NinjaTrader

NinjaTrader is available through select brokers, particularly for traders focused on futures, order-flow analysis, and advanced strategy development, offering robust backtesting and customization capabilities.

How to Begin Trading Forex in Australia

Entering the Australian Forex market requires more than opening an account. Traders must understand the regulatory structure, platform environment, and risk controls that govern Forex and CFD trading in Australia.

A structured entry process helps align trading activity with ASIC standards and real market conditions.

#1 Learn the Australian Forex Regulatory Landscape

Forex trading in Australia operates under the supervision of the Australian Securities and Investments Commission (ASIC), enforced through the Corporations Act 2001.

ASIC regulations define leverage limits, client fund segregation rules, and mandatory risk disclosures. Familiarity with this framework helps traders avoid unlicensed providers and regulatory violations.

#2 Assess and Shortlist ASIC-Regulated Brokers

Rather than choosing a broker solely based on spreads or platforms, traders should review AFSL licensing status, execution structure (ECN, STP, or hybrid), product coverage, and operational transparency.

Comparing ASIC-regulated brokers with internationally regulated alternatives such as FCA or CySEC entities can also provide a broader context.

#3 Complete Account Registration and Compliance Checks

Account onboarding is completed through the broker’s official platform and includes Know Your Customer (KYC) and Anti Money Laundering (AML) verification. Identity documentation and proof of residence are required before live trading access is granted.

#4 Simulate Market Conditions Using a Demo Account

Demo account environments, commonly powered by MetaTrader 4 (MT4) or MetaTrader 5 (MT5), allow traders to test order execution, margin behavior, and risk parameters without financial exposure. This stage is critical for platform familiarity.

#5 Activate the Account Using Approved Funding Channels

Once verified, traders can fund accounts using local and international payment options such as bank transfers, cards, or supported digital wallets. Depositing in Australian Dollars (AUD) helps reduce conversion costs and settlement friction.

#6 Establish a Structured Trading and Risk Framework

Before entering live positions, traders should define a clear trading methodology, position sizing rules, stop loss placement, and maximum risk per trade. Long-term participation in the Forex market depends on disciplined risk control rather than trade volume.

Forex Trading in Australia Compared to Other Countries

Forex trading in Australia operates within a tightly regulated and compliance-focused framework designed to protect retail participants and maintain market stability. Oversight by ASIC places strong emphasis on broker licensing, transparency standards, and controlled leverage, creating a safe trading environment.

Compared to more flexible jurisdictions, Australian traders typically face stricter leverage limits (1:30) but gain access to higher levels of investor protection, including negative balance safeguards and clearer regulatory enforcement.

The following comparison highlights how Australia's trading conditions differ from those of other countries across key regulatory and structural factors.

Comparison Factor | Australia | |||

Primary Regulator | Australian Securities and Investments Commission (ASIC) | Canadian Investment Regulatory Organization (CIRO) | Capital Markets Authority (CMA) | Cyprus Securities and Exchange Commission (CySEC) |

Regulatory Framework | National framework under ASIC | National Tier 1 framework under CIRO | National regulation under CMA | EU wide MiFID II under ESMA |

Retail Leverage Cap (Forex Majors) | 1:30 | Up to 1:50 | Up to 1:400 | 1:30 (EU retail under MiFID II) |

Investor Protection Level | High | High | Medium | High |

Negative Balance Protection | Mandatory | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Required under ASIC rules | Required under CIRO rules | Required under CMA rules | Mandatory under CySEC rules |

Broker Transparency Requirements | Licensing and conduct rules under ASIC | Strict compliance and disclosure standards | Not strict | Strict disclosure and capital adequacy requirements |

Broker Availability | ASIC licensed brokers | CIRO authorized brokers only | CMA regulated local and international brokers | CySEC licensed brokers with EU passporting |

Access to International Brokers | Yes | Yes | Yes | Yes |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView, NinjaTrader | MT4, MT5, cTrader, TradingView, ProRealTime | MT4, MT5, cTrader | MT4, MT5, cTrader |

Maximum Loss Protection | Cannot lose more than the deposit | Cannot lose more than the deposit | Cannot lose more than deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Generally treated as assessable income and must be reported to the Australian Taxation Office | Gains are treated as capital gains with 50% taxable | Taxable income by Kenya Revenue Authority | For Cyprus residents, forex trading profits may be treated as personal or business income |

Conclusion

This detailed review of the best brokers in Australia showed us that Eightcap, IC Markets, AvaTrade, XM Group, Fusion Markets, and easymarkets are the top Forex brokers in this region.

Traders must consider spreads, leverage, commissions, ASIC regulations, trust scores, and many other factors before finalizing their decision.

Each broker is evaluated through a weighted scoring system that factors in key elements such as trading expenses, regulatory standing, and the range of available account types, all structured within our Forex methodology framework.