Cyprus is widely recognized as one of the leading forex trading hubs in Europe, driven by its advanced regulatory structure and strong connection to EU financial institutions.

As an EU and EEA member state, Cyprus grants CySEC regulated brokers passporting rights to offer services throughout Europe. Investor safeguards include negative balance protection, strict capital adequacy requirements, and coverage under the Investor Compensation Fund ICF.

| Pepperstone | |||

| FP Markets | |||

| XM Group | |||

| 4 |  | AvaTrade | ||

| 5 |  | Tickmill | ||

| 6 |  | Libertex | ||

| 7 |  | Eightcap | ||

| 8 |  | IC Markets | ||

| 9 |  | FxGrow | ||

| 10 |  | FxPro |

Comparison of Best CySEC Forex Brokers Based on Trustpilot Rating

Although all these brokers are the best forex trading providers in Cyprus and whole Europe, but the table below provide a better view of their trust scores in Trustpilot:

Broker | Trustpilot Rating | Number of Reviews |

IC Markets | 4.8/5 ⭐️ | 49701 |

FP Markets | 4.8/5 ⭐️ | 9730 |

AvaTrade | 4.7/5 ⭐️ | 11460 |

Pepperstone | 4.3/5 ⭐️ | 3195 |

4.1/5 ⭐️ | 3352 | |

FxGrow | 3.4/5 ⭐️ | 4 |

3.9/5 ⭐️ | 9561 | |

FxPro | 3.8/5 ⭐️ | 862 |

Tickmill | 3.6/5 ⭐️ | 1047 |

XM Group | 3.5/5 ⭐️ | 2825 |

Comparison of Forex Brokers in Cyprus Based on Spreads

In Cyprus, CySEC regulated brokers compete by offering tight spreads across major currency pairs under transparent pricing models.

The table below highlights the top forex brokers in Cyprus, ranked based on their average spreads and cost efficiency:

Broker | Min. Spread |

IC Markets | 0 pips |

FP Markets | 0 pips |

0 pips | |

0 pips | |

Tickmill | 0 pips |

0.00001 pips | |

OctaFX | 0.6 pips |

TeleTrade | 0.6 pips |

FBS | 0.7 pips |

OctaFX | 0.6 pips |

Non-Trading Fees of the Forex Brokers in Cyprus

Non trading fees can significantl affect long term profitability, particularly for traders who deposit or withdraw funds frequently.

CySEC regulated forex brokers in Cyprus apply different policies for charges such as inactivity fees, deposit fees, and withdrawal costs.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

$0 | $0 | No | |

$0 | $0 | No | |

AvaTrade | $0 | $0 | Yes |

Pepperstone | $0 | $0 | No |

Eightcap | $0 | $0 | Yes |

Libertex | $0 | $0 | Yes |

Tickmill | $0 | $0 | Yes |

FxGrow | $0 | $0 | No |

FxPro | $0 | $0 | Yes |

XM Group | $0 | $0 | Yes |

Number of Tradable Instruments of the Forex Brokers in Cyprus

The number of tradable instruments reflects the overall market access offered by a forex broker.

CySEC regulated brokers in Cyprus typically provide a wide range of assets, including forex pairs, indices, commodities, shares, and CFDs.

Broker | Number of Instruments |

FP Markets | 10K+ |

IC Markets | 2.25K+ |

2100+ | |

1400+ | |

Pepperstone | 1350+ |

AvaTrade | 1250+ |

Eightcap | 800+ |

600+ | |

Libertex | 300+ |

FxGrow | 600+ |

Top 10 Forex Brokers in Cyprus

Many internationally recognized forex brokers operate through Cyprus based entities, benefiting from MiFID II passporting rights across the European Economic Area. Best forex brokers on Cyprus offer access to global markets, competitive pricing model. Each of these brokers will be introduced in the following sections.

FP Markets

FP Markets, officially known as First Prudential Markets, is a multi-regulated forex and CFD broker established in 2005. The broker operates under several financial authorities, including ASIC in Australia, CySEC in Cyprus with license number 371/18, FSCA in South Africa, FSC, and FSA jurisdictions.

FP Markets offers two main account types, Standard and RAW, with spreads starting from 1.0 pips and 0.0 pips respectively, and a low minimum deposit of $50. Traders can access more than 10,000 instruments across forex, stocks, indices, commodities, ETFs, and cryptocurrencies via MetaTrader 4, MetaTrader 5, and cTrader platforms.

By going through FP Markets registration, you will have access to advanced trading solutions such as copy trading, algorithmic trading, PAMM, and MAM accounts.

Investor protection measures include segregated client funds and negative balance protection. FP Markets is widely recognized for its competitive pricing, fast execution, and strong global regulatory coverage, making it a popular choice among both retail and professional traders.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros and Cons

The table below highlights the main advantages and disadvantages of FP Markets.

Pros | Cons |

Regulation by multiple authorities including ASIC and CySEC | Not available for US clients |

Tight spreads starting from 0.0 pips on RAW accounts | No proprietary trading platform |

Access to over 10,000 tradable instruments | Lower trust scores on ForexPeaceArmy and Reviews.io |

Support for MetaTrader 4, MetaTrader 5, and cTrader | Leverage restrictions for EU retail traders |

Low minimum deposit of $50 | No fixed spread account option |

Availability of Islamic swap free accounts | Limited in house educational depth compared to some competitors |

Advanced trading options including copy trading, PAMM, and MAM accounts | Bonuses are limited and subject to change |

IC Markets

IC Markets is a multi-asset forex and CFD broker established in Australia in 2007, offering 10 base currencies including USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

The broker operates through regulated entities such as IC Markets EU Ltd under CySEC and International Capital Markets Pty Ltd under ASIC, while Raw Trading Ltd is regulated by the FSA in Seychelles. Key safeguards include segregated client funds, external audits, AML procedures, and Investor Compensation Fund coverage up to €20,000 for CySEC clients.

IC Markets provides access to MetaTrader 4, MetaTrader 5, cTrader, cTrader Web, and IC Markets Mobile, with account options including Standard, Raw Spread, and Islamic.

Pricing is designed for active traders, with spreads from 0.8 pips on Standard accounts, raw spreads from 0.0 pips on MT4 and MT5 or cTrader, and commissions around $3 to $3.50 per lot side depending on platform (with IC Markets rebate program also available).

Traders can access 2,250+ instruments including 2,100+ stock CFDs, plus indices, bonds, commodities, and crypto CFDs, and the broker holds a Trustpilot score of 4.8 out of 5.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros and Cons

Below, you can find a detailed overview of IC Markets’s strengths and weaknesses.

Pros | Cons |

Strong regulation across CySEC and ASIC with an additional FSA entity for global access | Leverage is capped at 1:30 for EU and ASIC retail clients |

Deep platform suite including MT4, MT5, cTrader, cTrader Web, and IC Markets Mobile | $200 minimum deposit may be high for beginners |

Very competitive pricing with raw spreads from 0.0 pips and tight average EUR/USD spreads | Negative balance protection is not available under the FSA Seychelles entity |

Large market coverage with 2,250+ symbols and 2,100+ stock CFDs | Bonus programs are region limited and currently unavailable or expired |

Designed for scalping and algorithmic trading with fast market execution | Reviews.io score is relatively low compared to Trustpilot |

CySEC investor coverage up to €20,000 via the Investor Compensation Fund | Not available in several jurisdictions including the US and Iran |

No inactivity fees and typically no deposit or withdrawal commissions | Some third-party fees can apply depending on payment rails and usage conditions |

FxGrow

FxGrow is a Cyprus based forex and CFD broker established in 2008 and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license 214/13. Operating under a true ECN execution model, FxGrow provides access to over 600 tradable instruments, including Forex pairs, indices, commodities, metals, energies, futures CFDs, and cryptocurrencies.

FxGrow dashboard exclusively supports MetaTrader 5, offering advanced charting, algorithmic trading, and multi asset functionality across desktop, web, and mobile devices.

FxGrow offers multiple account types such as ECN, ECN Plus, and ECN Elite, with spreads starting from ultra tight levels and fixed commissions depending on the account tier. Leverage is available up to 1:300, subject to regulatory conditions.

Client funds are fully segregated, negative balance protection is applied, and no inactivity or withdrawal fees are charged after FxGrow registration. While FxGrow delivers strong execution quality and flexible trading conditions, its educational content and platform variety remain limited compared to larger global brokers.

Account Types | ECN, ECN Plus, ECN Elite, Demo |

Regulating Authorities | CySec, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Deposit | $100 |

Deposit Methods | Skrill, Neteller, Bank Wire |

Withdrawal Methods | Skrill, Neteller, Bank Wire |

Maximum Leverage | 1:300 |

Trading Platforms & Apps | MetaTrader 5 |

FxGrow Pros and cons

Table below provides a better look on FxGrow pros and cons.

Pros | Cons |

Regulated by CySEC with EU compliance | Only MetaTrader 5 platform available |

ECN execution with fast order processing | No MetaTrader 4 support |

Wide range of 600+ tradable instruments | Limited educational resources |

No inactivity, deposit, or withdrawal fees | No stocks or ETFs as real assets |

Supports copy trading and automated strategies | Payment methods are relatively limited |

FxPro

FxPro is a globally recognized forex and CFD broker founded in 2006, known for its fast execution speed of under 12 milliseconds and a strong institutional trading infrastructure. The broker provides access to over 2,100 tradable instruments across forex, shares, indices, futures, metals, energy, and cryptocurrencies.

FxPro operates under multiple regulatory authorities, including the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Securities Commission of The Bahamas.

These licenses ensure high standards of regulatory compliance, transparency, and client protection.

Traders can choose from four account types including Standard, Pro, Raw+, and Elite in FxPro dashboard, with spreads starting from 0.0 pips on Raw+ and Elite accounts and leverage up to 1:500 depending on jurisdiction.

FxPro broker supports MetaTrader 4, MetaTrader 5, cTrader, WebTrader, and a proprietary mobile application, offering flexibility for manual, algorithmic, and copy trading strategies.

With more than 125 international awards and a long operating history, FxPro remains a solid choice for traders seeking reliability, platform diversity, and deep market access.

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA, FSCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader, Web Trader, Mobile App |

FxPro Pros and Cons

The following table outlines the key pros and cons associated with FxGrow.

Advantages | Disadvantages |

Strong multi tier regulation including FCA and CySEC | Not available in some countries such as USA, Canada, and Iran |

Very fast execution speed under 12 milliseconds | Customer support is not available 24/7 |

Access to 2,100+ tradable instruments across multiple markets | Higher minimum deposit compared to some competitors |

Wide range of platforms including MT4, MT5, cTrader, WebTrader, and mobile app | Limited bonus and promotional offerings |

Tight spreads from 0.0 pips on Raw+ and Elite accounts | Inactivity fees apply after extended periods of no trading |

Segregated client funds and negative balance protection | Trustpilot score is moderate compared to some top rivals |

Copy trading and support for EAs and scalping strategies | PAMM and broader investment solutions are limited |

XM Group

XM Group is a global brokerage founded in 2009 that reports 15 million clients and nearly 14 million trades per day, with operational hubs in Cyprus, South Africa, Dubai, and Belize.

The broker is regulated across multiple jurisdictions, including CySEC in Cyprus under Trading Point of Financial Instruments Ltd license 120/10 and FSCA in South Africa under XM ZA (Pty) Ltd license 49976.

Additional oversight comes from the DFSA in Dubai under Trading Point MENA Limited license F003484, FSC Belize under XM Global Limited license 000261/27, FSC Mauritius under XM International MU Limited license GB23202700, and the FSA in Seychelles under XM (SC) Limited license SD190.

Execution policies such as guaranteed fills up to 50 lots and negative balance protection aim to support both new and experienced traders.

While the broker remains popular due to its broad global reach, low entry threshold, and frequent promotions such as the XM copy trading.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Sechelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Group Pros and Cons

XM Groups’s main benefits and drawbacks are summarized in the table below.

Pros | Cons |

Very low minimum deposit starting from $5 | Inactivity fees apply on dormant accounts |

Multi jurisdiction regulation including CySEC, FSCA, DFSA, and FSC entities | Restricted in several countries including the US and Canada, and also Iran |

1,400+ CFDs with 55+ forex pairs and 1,200+ stock CFDs | MetaTrader only environment with no cTrader option |

Negative balance protection and risk controls across retail accounts | Trust scores are moderate on Trustpilot and ForexPeaceArmy |

Guaranteed fills for orders up to 50 lots under stated execution policy | Shares account requires a high minimum deposit of $10,000 |

Strong support coverage with 24/7 multilingual channels | Some user feedback mentions slippage, delays, or account limitation issues |

Promotions such as loyalty points, contests, and referral programs | No true investment options such as PAMM or managed portfolios |

Pepperstone

Pepperstone is a globally recognized forex and CFD broker founded in 2010 in Melbourne, Australia, processing an average daily trading volume of $9.2 billion for more than 400,000 active clients.

The broker supports 10 base currencies including USD, EUR, GBP, AUD, JPY, CHF, CAD, NZD, SGD, and HKD.

Pepperstone broker operates under a strong multi-jurisdiction regulatory framework, holding licenses from top tier authorities such as ASIC in Australia, FCA in the UK, CySEC in Cyprus, BaFin in Germany, DFSA in Dubai, CMA in Kenya, and SCB in the Bahamas.

Client funds are kept in segregated bank accounts, negative balance protection is applied across entities, and EU clients are covered by investor compensation schemes up to €20,000 or £85,000 depending on jurisdiction.

The broker offers two main account types after completing Pepperstone registration, with spreads starting from 0.0 pips on Razor accounts and commission-based pricing for active traders.

Pepperstone provides broad platform support including MetaTrader 4, MetaTrader 5, cTrader, TradingView, and proprietary web and mobile platforms, alongside copy trading solutions via Signal Start, DupliTrade, and MetaTrader Signals.

With over 1,200 tradable CFDs across forex, shares, indices, commodities, ETFs, and cryptocurrencies, Pepperstone is widely regarded as a strong choice for professional, algorithmic, and high-frequency traders.

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros and Cons

The table presented below offers a clear comparison of Pepperstone’s pros and cons.

Pros | Cons |

Regulation by multiple top tier authorities including ASIC, FCA, CySEC, and BaFin | No bonuses or promotional incentives |

Very tight spreads from 0.0 pips on Razor accounts | No PAMM or managed account solutions |

Wide platform selection including MT4, MT5, cTrader, TradingView, and proprietary apps | Demo account access may be limited for some users |

High execution quality with deep liquidity and fast order processing | Leverage is restricted to 1:30 for most EU retail clients |

Over 1,200 tradable instruments across major asset classes | Limited passive investment options beyond copy trading |

No inactivity fees or account maintenance charges | Restricted availability in several countries including US, Canada, Iran |

Strong trust profile with Trustpilot score of 4.4 out of 5 | Some advanced features may be complex for beginners |

AvaTrade

AvaTrade is a multi-asset brokerage that requires a $100 minimum deposit and supports six main payment methods including credit and debit cards, bank wire transfers, Skrill, Neteller, WebMoney, and PayPal.

AvaTrade operates under a broad regulatory structure with nine licenses, including the Central Bank of Ireland (CBI), CySEC in Cyprus, ASIC in Australia, FSCA in South Africa, JFSA in Japan, ADGM in Abu Dhabi, ISA in Israel, and BVI FSC, while also aligning with MiFID II requirements in Europe.

Client protection measures include segregated funds and negative balance protection, and EU clients can benefit from compensation coverage up to €20,000 under the Investor Compensation Fund through CySEC and CBI linked entities.

Trading access is delivered through MetaTrader 4, MetaTrader 5, WebTrader, a mobile app, and the AvaOptions platform, with markets spanning forex, stocks, indices, commodities, metals, and crypto CFDs.

AvaTrade dashboard also provides copy trading through DupliTrade and AvaSocial, alongside an affiliate and referral program, but its non-trading fee model can penalize long periods of inactivity.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

A breakdown of AvaTrade’s advantages and limitations is shown in the table below.

Pros | Cons |

Very strong regulatory coverage including CBI, CySEC, ASIC, FSCA, JFSA, ADGM, and ISA | Limited account type variety compared to brokers with more granular pricing tiers |

Segregated funds and negative balance protection across entities | Inactivity fees apply after two months, plus an annual administration fee after 12 months |

Solid platform range including MT4, MT5, WebTrader, mobile app, and AvaOptions | Support is 24/5 rather than 24/7 |

Copy trading options via DupliTrade and AvaSocial | Restricted in several jurisdictions including the United States, Belgium, and Iran |

Broad multi asset coverage with 1,250+ instruments across CFDs | Spreads are primarily fixed and can be less competitive for high frequency scalping |

Clear margin controls with 25 percent margin call and 10 percent stop out | Bank wire deposits may require a higher minimum compared to card or e wallet funding |

No broker fees on standard deposits and withdrawals in most cases | Promotions and bonuses are limited and region dependent |

Eightcap

Eightcap is a Melbourne based forex and CFD broker founded in 2009 that offers access to six tradable markets including forex, commodities, metals, crypto, indices, and shares, with maximum leverage up to 1:500.

Spreads start from 1.0 pip on Standard and TradingView accounts, while Raw pricing can start from 0 pips with a commission model alongside Eightcap rebate.

Eightcap operates under a multi jurisdiction regulatory structure, with oversight from ASIC in Australia through Eightcap Pty Ltd, FCA in the United Kingdom through Eightcap Group Ltd, CySEC in Cyprus through Eightcap EU Ltd, and SCB in the Bahamas through Eightcap Global Limited.

Client protection measures include segregated funds and negative balance protection across entities, with compensation coverage up to £85,000 under FSCS for the FCA entity and up to €20,000 under ICF for the CySEC entity.

Trading access is delivered through MetaTrader 4, MetaTrader 5, and TradingView, supported by add on tools such as Capitalise.ai for code free automation, FlashTrader for rapid order execution and position sizing, and an AI powered economic calendar for macro event impact tracking.

Eightcap broker also reports a Trustpilot score of 4.3 out of 5 based on 2,300+ reviews, while keeping its product stack focused on third party platform integration rather than proprietary investment services.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

The table below provides a concise summary of Eightcap’s positive and negative aspects.

Pros | Cons |

Strong regulation across ASIC, FCA, and CySEC plus SCB for global coverage | No Islamic swap free account option listed |

Platform flexibility with MT4, MT5, and direct TradingView access | Educational resources can feel basic for advanced traders |

Competitive pricing on Raw accounts with spreads from 0 pips | Platform and feature availability varies by entity and region |

Helpful trading tools including Capitalise.ai, FlashTrader, and AI powered economic calendar | Minimum deposit of $100 may be high compared to brokers offering $5 or $1 entry |

Broad CFD coverage with 800+ symbols and strong crypto CFD depth | No PAMM, MAM, or built in passive investment programs |

Solid trust profile with 4.3/5 on Trustpilot | Crypto CFDs are restricted for UK retail traders due to regulation |

Segregated funds and negative balance protection | Customer support is 24/5 rather than 24/7 |

Tickmill

Tickmill is a multi-asset forex and CFD broker founded in 2014 that reports 785,000+ registered users, operates in 180+ countries, and averages more than $129 billion in monthly trading volume.

With pricing that can start from 0.0 pips and leverage that can reach up to 1:300 or higher depending on the regulated entity.

Tickmill runs a no dealing desk (NDD) execution model, routing orders directly to liquidity providers to support fast fills and reduced dealing desk interference.

The group is regulated across several jurisdictions, including CySEC in Cyprus through Tickmill Europe Ltd, FCA in the UK through Tickmill UK Ltd, FSCA in South Africa under license FSP 49464, and FSA in Seychelles through Tickmill Ltd, alongside LFSA oversight in Labuan and DFSA coverage for its UAE presence.

For accounts, Tickmill broker mainly offers Classic and Raw, where Classic is spread based and Raw combines tight spreads with a commission model, with MetaTrader 4, MetaTrader 5, MetaTrader Web, and mobile apps available.

The broker also provides Tickmill Social Trading in eligible regions, runs promotions such as the $30 Welcome Account, NFP Machine, Trader of the Month and Tickmill rebate. (All bonuses are available after Tickmill registration)

Tickmill also applies a quarterly inactivity fee only after 12 months of no activity when the balance stays below $50.

Account Types | Classic, Raw |

Regulating Authorities | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Deposit | $100 |

Deposit Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Withdrawal Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Tickmill Pros and Cons

You can review Tickmill’s core strengths and potential downsides in the table below.

Pros | Cons |

Multi jurisdiction regulation including FCA, CySEC, FSCA, FSA, LFSA, and DFSA coverage | Low variety of account types compared to brokers with more tiered pricing models |

NDD model with direct liquidity provider routing | Product breadth is solid but can feel lighter than some multi asset leaders |

Tight pricing with spreads from 0.0 pips on Raw accounts | Trustpilot score is relatively low at 3.2 out of 5 based on 500+ reviews |

High leverage availability outside EU and UK entities | Leverage is restricted to 1:30 for CySEC and FCA retail clients |

MetaTrader ecosystem with MT4, MT5, web, and mobile plus VPS and API options | Copy trading availability depends on entity, with some third party options discontinued |

Islamic swap free accounts available | Quarterly inactivity fee can apply after 12 months if balance is below $50 |

Social Trading option and periodic promos like $30 Welcome and NFP Machine | Some regions have restricted access, including the US and Iran |

Libertex

Libertex is a CySEC-regulated financial broker operating under the Libertex Group. Founded in 1997, the company serves over 3 million clients across more than 120 countries and provides access to five major markets: Forex, Cryptocurrencies, Commodities, Stocks, and Indices.

The broker offers four live account types including Real, Invest, MT4, and MT5, alongside a demo account for practice. Orders are executed through Market and Instant Execution models.

Libertex broker follows MiFID II compliance standards and applies strict client fund segregation policies to enhance trader protection. The broker supports copy trading services, allowing users to mirror professional strategies.

Retail clients are capped at 1:30 leverage, while Professional accounts can access leverage up to 1:600. The minimum deposit starts from €100, with funding available via e-payments, credit or debit cards, and bank wire transfers.

Libertex dashboard and its proprietary platform focuses on simplicity and fast execution, making it suitable for both short-term traders and long-term investors.

Account Types | Demo, Real, Invest, MT4, MT5 |

Regulating Authorities | CySEC |

Minimum Deposit | 100 EUR |

Deposit Methods | E-payments, Credit/Debit Card, Bank Wire Transfer |

Withdrawal Methods | E-payments, Credit/Debit Card |

Maximum Leverage | Up To 1:30 For Retail Clients Up To 1:600 For Professional Accounts |

Trading Platforms & Apps | MT4, MT5, Proprietary Platform |

Libertex Pros and Cons

The following table gives a structured overview of Libertex’s pros and cons.

Pros | Cons |

Regulated by Cyprus Securities and Exchange Commission (CySEC) under CIF 164/12 | Not available in several countries including the US, UK, Canada, and Iran |

Investor Compensation Fund (ICF) coverage up to €20,000 | Limited educational materials compared to top-tier competitors |

Segregated client funds and Negative Balance Protection | No bonuses or promotional programs |

Supports MT4, MT5, and a proprietary trading platform | No Islamic or PAMM accounts |

Spreads from 0.1 pips with professional leverage up to 1:600 | Commission structure varies by asset and market conditions |

Copy trading availability and built-in tools such as Auto-Trading, Economic Calendar, and Quick Take Profit | Customer support hours are not clearly stated |

What Is the CySEC Regulation?

The Cyprus Securities and Exchange Commission (CySEC) is the primary financial regulator overseeing forex and CFD brokers operating from Cyprus. As an EU authority, CySEC enforces MiFID II and ESMA rules, ensuring standardized investor protection across the European Economic Area.

CySEC regulation requires brokers to maintain minimum capital thresholds, segregate client funds, apply negative balance protection, and follow strict reporting and audit procedures. Regulated brokers must also comply with best execution policies, conflict of interest rules, and transparent pricing frameworks.

CySEC supervision allows licensed brokers to passport their services across EU member states, making Cyprus a strategic regulatory hub for European forex operations.

Important Factors for Choosing the Best Forex Brokers in Cyprus

Choosing a forex broker in Cyprus requires a structured review beyond pricing alone.

TradingFinder forex methodology evaluates CySEC regulated brokers using data driven criteria that focus on trader safety and execution quality.

- Regulation and Client Protection: including CySEC licensing, fund segregation, and investor compensation

- Trading Costs: such as spreads, commissions, and non trading fees

- Account Types and Market Coverage: across forex and CFD instruments

- Platforms and Execution: including MT4, MT5, cTrader, and liquidity access

- Deposits, Withdrawals, and Onboarding: efficiency and transparency

- Customer Support and Trust Signals: based on responsiveness and verified reviews

This methodology ensures Cyprus brokers are ranked on measurable factors that directly impact real trading conditions.

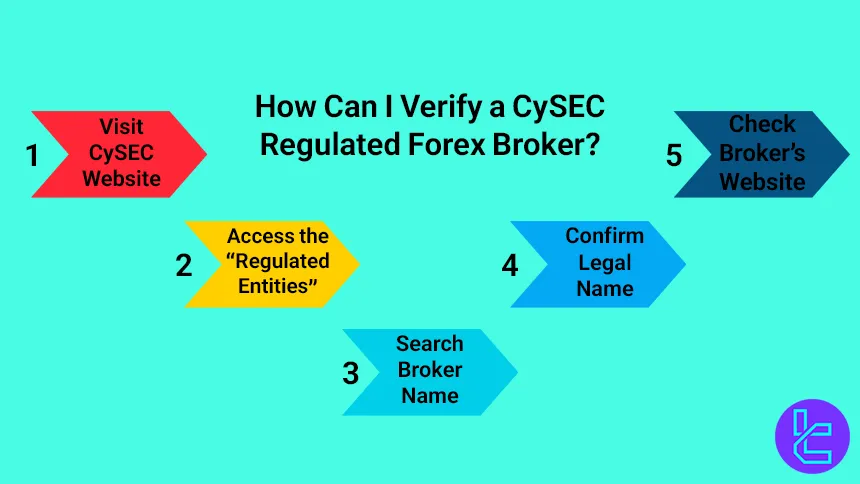

How Can I Verify a CySEC Regulated Forex Broker?

Verifying a CySEC regulated forex broker is a straightforward process that helps traders confirm regulatory legitimacy and avoid clone entities.

Steps to verify a broker:

- Visit the official CySEC website

- Access the “Regulated Entities” or CIF register section

- Search by broker name or CIF license number

- Confirm the legal entity name, license status, and authorized services

- Cross-check the broker’s website domain with the registered entity

CySEC also publishes warnings for unlicensed or impersonating brokers, which provides an additional layer of due diligence for traders.

Is Forex Trading Legal in Cyprus?

Forex trading is fully legal in Cyprus and operates under a clear European regulatory framework. As an EU and EEA member state, Cyprus applies MiFID II rules to forex and CFD trading activities, with CySEC acting as the national supervisory authority.

Traders are permitted to trade leveraged (up to 1:30) products through licensed investment firms. Brokers must comply with ESMA restrictions, marketing rules, and investor protection standards.

Cyprus based brokers can legally offer services across Europe via passporting rights, while non-EU clients may also access CySEC brokers, subject to onboarding and compliance checks defined by each firm.

What is the Maximum Leverage Offered by CySEC Forex Brokers?

CySEC regulated forex brokers must comply with ESMA leverage limits for retail traders, which cap maximum leverage to reduce excessive risk exposure. CySEC structure for offering leverage:

Asset Class | Maximum Retail Leverage |

Major Forex Pairs | 1:30 |

Minor Forex Pairs | 1:20 |

Gold & Major Indices | 1:20 |

Other Commodities | 1:10 |

Individual Equities | 1:5 |

Cryptocurrencies | 1:2 |

Do CySEC Forex Brokers Offer Negative Balance Protection?

Negative balance protection is mandatory for all retail clients trading with CySEC regulated forex brokers. This rule ensures that traders cannot lose more than their deposited capital, even during extreme market volatility or gap events.

If account equity falls below zero, the broker must reset the balance to zero at no cost to the client. This protection applies across forex and CFD products offered under the CySEC entity.

Professional clients, however, are not entitled to negative balance protection, as they are classified as experienced traders who accept higher risk exposure under EU regulatory definitions.

Taxation of CySEC Regulated Forex Brokers

Cyprus offers a highly favorable tax environment for CySEC regulated forex brokers, which plays a key role in its position as a European brokerage hub.

The corporate income tax rate in Cyprus is set at 12.5%, one of the lowest within the European Union, making it attractive for financial services companies operating at scale.

In addition, Cyprus provides various tax exemptions, double taxation treaties, and international agreements that help reduce overall tax burdens for resident brokerage firms.

This tax-efficient framework supports cross-border investment activity, encourages international entrepreneurship, and allows forex brokers to operate efficiently while remaining fully compliant with EU regulatory and reporting standards.

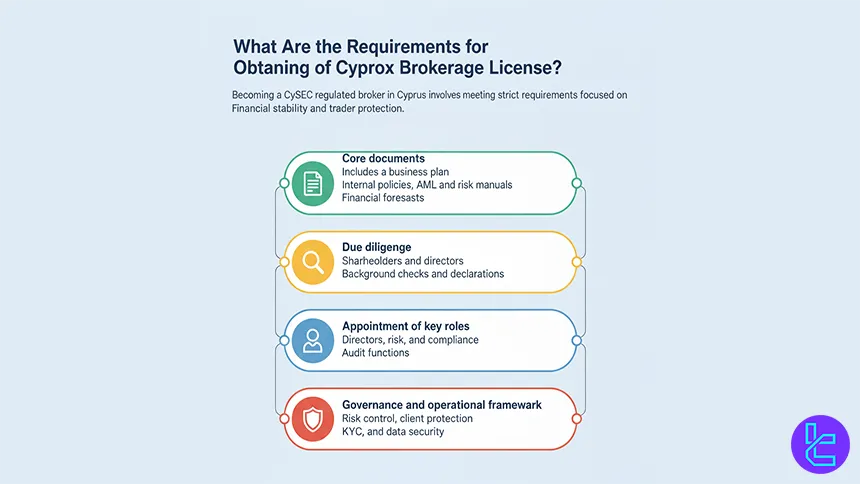

What Are the Requirements for Obtaining a CySEC Forex Brokerage License?

Forex brokerage licensing in Cyprus is regulated by the Cyprus Securities and Exchange Commission (CySEC), which defines strict authorization and governance standards for Cyprus Investment Firms.

Applicants must demonstrate operational transparency, financial stability, and robust internal controls before approval is granted.

Key documentation and structural requirements include:

- Core Application Documents: such as an organizational structure report, business plan, corporate procedures manual, AML and risk control manual, and a three-year financial forecast;

- Shareholder and Director Due Diligence: including questionnaires, criminal record certificates, and bankruptcy declarations for all shareholders and directors;

- Mandatory Key Appointments: requiring four directors including a managing director, as well as approved risk manager, compliance control manager, and internal and external auditors;

- Governance and Operational Framework: covering board composition, client protection procedures, risk management functions, activity monitoring mechanisms, customer identification processes, and client data security protocols.

Forex Trading in Cyprus Compared to Other European Countries

Forex trading in Cyprus operates under the same MiFID II and ESMA rules applied across Europe, ensuring consistent leverage limits, client fund protection, and negative balance protection.

Compared to countries like Germany and France, Cyprus offers a broader range of licensed brokers and more flexible market access. This balance between strict regulation and broker availability makes Cyprus one of the most popular Forex hubs in Europe.

Comparison Factor | Cyprus | |||

Primary Regulator | Cyprus Securities and Exchange Commission (CySEC) | Autorité des Marchés Financiers (AMF) | Federal Financial Supervisory Authority (BaFin) | Financial Conduct Authority (FCA) |

Regulatory Framework | EU wide MiFID II and ESMA compliance | EU wide MiFID II and ESMA compliance | EU wide MiFID II and ESMA compliance | National FCA framework post Brexit |

Retail Leverage Cap Forex Majors | 1:30 | 1:30 | 1:30 | 1:30 |

Investor Protection Level | High | Very high | Very high | Very high |

Negative Balance Protection | Mandatory | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Mandatory under CySEC rules | Mandatory | Mandatory | Mandatory |

Broker Transparency Requirements | Strict EU disclosure rules | Strict EU disclosure rules | Strict EU disclosure rules | Very strict conduct and disclosure standards |

Broker Availability | Broad EU access via passporting | Broad EU access via passporting | Broad EU access via passporting | FCA licensed local and international brokers |

Access to International Brokers | High via EU passporting | High via EU passporting | High via EU passporting | High global broker access |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Capital gains tax applies | Flat tax PFU or progressive option | Capital gains tax with limited offsets | Capital gains tax or income tax depending on activity |

Conclusion

Cyprus is a leading European hub for Forex and CFD trading, where CySEC enforces MiFID II under ESMA oversight. EU and EEA membership grants passporting rights to regulated brokers across Europe. Investor protection includes negative balance protection, strict capital adequacy, and Investor Compensation Fund ICF coverage up to €20,000.

Rankings typically compare brokers like IC Markets, FP Markets, Pepperstone, and XM using spreads, fees, platforms, liquidity, Trustpilot scores, execution, transparency

Broker rankings are determined by assessing multiple critical elements, including fees, regulatory status, and available account options, all defined within TradingFinder forex methodology.