The Forex market in Indonesia is regulated by BAPPEBTI authority allowing traders to legally trade currency pairs in this region. However, most traders use offshore brokers due to less restrictive trading conditions and higher leverage up to 1:3000.

Here are the top Forex brokers in Indonesia that traders can choose and begin their Forex and CFD trading journey.

| ActivTrades | |||

| HYCM | |||

| OctaFX | |||

| 4 |  | IUX | ||

| 5 |  | FBS | ||

| 6 |  | Pepperstone | ||

| 7 |  | Fusion Markets | ||

| 8 |  | PU Prime | ||

| 9 |  | IC Markets | ||

| 10 |  | AvaTrade |

Trustpilot Ratings of Forex Brokers in Indonesia

The table below provides the Trustpilot rating of the top Forex brokers in Indonesia:

Broker | Trustpilot Rating | Number of Reviews |

4.8/5 ⭐ | +49500 | |

Fusion Markets | 4.8/5 ⭐ | +5500 |

4.7/5 ⭐ | +11000 | |

Pepperstone | 4.3/5 ⭐ | +3000 |

FBS | 4.3/5 ⭐ | +8000 |

IUX | 4.2/5 ⭐ | +800 |

OctaFX | 4.0/5 ⭐ | +8000 |

3.9/5 ⭐ | +1000 | |

PU Prime | 3.8/5 ⭐ | +1500 |

HYCM | 2.0/5 ⭐ | +100 |

Minimum Spreads of Forex Brokers in Indonesia

Considering the spreads is one of the most important factors when choosing a Forex broker to trade CFDs of various symbols. Here are the minimum spread costs in famous brokers of Indonesia

Brokers | Minimum Spreads |

Vantage | From 0.0 Pips |

Tickmill | From 0.0 pips |

PU Prime | From 0.0 Pips |

Saxo Bank | From 0.0 pips |

XM Group | From 0.0 pips |

Multibank Group | From 0.0 pips |

From 0.1 pips | |

ActivTrades | From 0.5 pips |

SpreadEX | From 0.6 pips |

From 0.6 Pips |

Non-Trading Fees in Forex Brokers of Indonesia

Non-trading fees play a critical role in the overall cost structure of forex brokers operating in Indonesia.

These charges typically include deposit fees, withdrawal fees, and inactivity fees, which can significantly affect long-term trading profitability.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

FBS | $0 | $0 | No |

Fusion Markets | $0 | $0 | No |

$0 | $0 | No | |

Global Prime | $0 | $0 | No |

$0 | $0 | No | |

TastyTrade | $0 | Varies | No |

FP Markets | $0 | Varies | No |

Interactive Brokers | $0 | Varies | No |

HFM | $0 | $0 | $5 |

FxPro | $0 | $0 | $15 |

Number of Tradable Instruments in Forex Brokers of Indonesia

Having access to a wide variety of symbols in various markets, including Forex, cryptocurrencies, stocks, indices, commodities, ETFs, allows Indonesian traders to gain the most profits using brokerage services.

Broker | Number of Tradable Assets |

Saxo Bank | +71000 |

MultiBank Group | +20000 |

FP Markets | +10000 |

Vantage | +1000 |

+1000 | |

Tickmill | +600 |

+550 | |

+250 | |

Iux | +250 |

Exness | +200 |

Top 8 Forex Brokers in Indonesia

The following sections provides detailed information about the top Forex brokers that Indonesian traders can choose to trade with.

ActivTrades

ActivTrades, launched in 2001 with headquarters in London, functions under the supervision of major authorities including the UK Financial Conduct Authority (FCA), as well as international regulators such as SCB, CMVM, BACEN, CVM, CySEC, FSC, and ASIC.

The broker offers exposure to more than 10000CFD instruments spanning Forex, global indices, commodities, equities, ETFs, bonds, and selected cryptocurrencies.

Trading is facilitated through floating spread pricing and market execution, supported by account configurations suitable for retail, professional, demo, and Islamic trading profiles.

The minimum deposit starts from $5, with funding and withdrawals available via bank transfers, payment systems, and credit or debit cards.

Platform coverage includes MetaTrader 4, MetaTrader 5, TradingView integration, and the proprietary ActivTrader terminal, each providing multi-asset trading, advanced charting, and professional order management tools.

The onboarding process, including ActivTrades registration, is designed to align with regulatory requirements while supporting both individual and institutional traders.

Account Types | Standard |

Regulating Authorities | Cyprus Securities and Exchange Commission (CySEC), Financial Services Commission (FSC), Australian Securities and Investments Commission (ASIC) |

Minimum Deposit | From $5 |

Deposit Methods | Bank transfers, payment systems, credit/debit cards |

Withdrawal Methods | Bank transfers, payment systems, credit/debit cards |

Maximum Leverage | Up to 1:3000 (depending on regulatory entity) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), FBS Mobile App |

ActivTrades Pros and Cons

Here are the important notes traders must consider before choosing ActivTrades.

Pros | Cons |

Regulatory coverage across multiple jurisdictions including CySEC, FSA, FSCA, and FSC, providing a layered compliance framework | $10 inactivity fee |

Accessible onboarding with a low capital threshold, as account funding can begin from $10 | - |

Enhanced trading flexibility through high leverage options reaching up to 1:3000 for non-EU entities | - |

Broad platform compatibility supporting MT4, MT5, and mobile trading solutions for multi device access | - |

HYCM

HYCM operates as a globally structured CFD brokerage working under supervision of multiple authorities, including FCA, DFSA and SVG FSA.

Client protections mesures, include segregated funds and negative balance protection.

Trading access extends across Forex, indices, commodities, stocks, cryptocurrencies, metals, and energy markets, exceeding 300 instruments.

HYCM supports Fixed, Classic, and RAW account structures with a minimum deposit of $20 and leverage reaching 1:500.

Platform infrastructure includes MetaTrader 4, MetaTrader 5, and the proprietary HYCM Trader application, offering multi-device compatibility and advanced execution modes for all traders who complete the HYCM registration.

Transaction management supports bank wires, Visa, MasterCard, PayPal, Skrill, Neteller, and crypto deposits including BTC, ETH, USDT, and TRC20 networks all available in the HYCM dashboard.

Cost conditions feature spreads from 0.1 pips on RAW accounts, commissions between $0 and $5, and a $10 monthly inactivity fee after 90 days.

After opening an account with this broker, trades must complete the HYCM verification process to comply with KYC and AML laws.

Account Types | Fixed, Classic, RAW, Demo, Islamic |

Regulating Authorities | Financial Conduct Authority (FCA), Dubai Financial Services Authority (DFSA), Saint Vincent & the Grenadines (Offshore Entity) |

Minimum Deposit | $20 |

Deposit Methods | Bank Transfer, Visa, MasterCard, PayPal, Neteller, Skrill, Perfect Money, Fasapay, WebMoney, Crypto (BTC, BCH, ETH, DASH, LTC, XRP, DOGE, USDT, USDC, BNB, TRX) |

Withdrawal Methods | Bank Transfer, Visa, MasterCard, PayPal, Neteller, Skrill, E-wallets, Crypto |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), HYCM Trader (iOS, Android) |

Pros and Cons of HYCM

Here are the key advantage and disadvantages of trading with HYCM.

Pros | Cons |

Regulation by FCA and DFSA with segregated funds and negative balance protection | Educational resources are limited compared to major competitors |

Multiple account types including Fixed, Classic, RAW, Demo, and Islamic | Monthly inactivity fee of $10 after 90 days of no trading |

Competitive RAW spreads from 0.1 pips with low commissions | - |

Support for MT4, MT5, and HYCM Trader on desktop and mobile | - |

OctaFX

OctaFX is an international Forex and CFD brokerage that has operated in online trading markets since 2011, building a broad client base across more than 180 countries.

After completing the OctaFX registration process, traders gain access to a diversified product range covering Forex pairs, cryptocurrencies, global indices, metals, energy instruments, and equity CFDs.

Trade execution is structured around an ECN/STP framework, emphasizing market execution and limiting dealing desk involvement.

The broker delivers services through multiple corporate entities and remains subject to regulatory supervision FSCA, MISA, and CySEC for European clients.

Platform availability includes MetaTrader 4, MetaTrader 5, and the proprietary OctaTrader interface, with social trading functionality integrated through OctaFX copy trading.

Account models are designed with zero commission pricing and floating spreads that typically begin near 0.6 pips, alongside a modest minimum deposit of $25.

OctaFX deposit and withdrawal operations support bank cards, electronic wallets such as Skrill and Neteller, and digital assets including BTC, ETH, LTC, USDT, and DOGE, with transaction minimums starting from $50.

Account Types | MT4 Account, MT5 Account, OctaTrader Account |

Regulating Authorities | Financial Sector Conduct Authority (FSCA), Mwali International Services Authority (MISA), Cyprus Securities and Exchange Commission (CySEC) |

Minimum Deposit | $25 |

Deposit Methods | Credit and debit cards, bank transfer, e-wallets (Skrill, Neteller), cryptocurrencies (BTC, ETH, LTC, USDT, DOGE) |

Withdrawal Methods | E-wallets (Skrill, Neteller), cryptocurrencies (BTC, ETH, LTC, USDT, DOGE) |

Maximum Leverage | Up to 1:1000 (entity dependent) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), OctaTrader, Octa Copy |

OctaFX Group Pros and Cons

If you are residing in Indonesia and want to choose OctaFX as your broker, here are the key pros and cons you must consider.

Pros | Cons |

Entry barrier remains low with an initial funding requirement starting at $25 | The broker does not provide PAMM accounts or portfolio management services |

Trading environment supports MetaTrader 4, MetaTrader 5, and the in-house OctaTrader terminal | Availability of funding and withdrawal channels may be adjusted over time |

Swap-free (Islamic) conditions are available across all supported account categories | Level of client protection differs depending on the supervising regulatory authority |

Leverage options extend up to 1:1000 based on the operating entity | - |

IUX

IUX is an international derivatives broker established in 2016, operates under various regulatory bodies, including FSC, FSCA, and ASIC.

Trading operations are supported by UAB Woxa Corporation Limited in Lithuania. The broker applies a Straight Through Processing (STP) execution model, providing transparent order routing and low-latency trade execution

The trading environment is designed for active participants in Forex and CFD markets, offering exposure to currencies, crypto CFDs, indices, stocks, commodities, and thematic assets.

Account structures include Standard, Raw, and Pro, with minimum deposits starting from $10 and leverage reaching up to 1:3000 depending on jurisdiction.

Cost conditions feature floating spreads from 0 pips and commissions from $0, combined with margin policies of 30% margin call and 0% stop-out.

Platform access after IUX registration is provided through MetaTrader 5, a browser-based Web Trader, and the IUX Trade App for mobile devices. Transaction handling supports bank transfers, cards, electronic wallets, QR payments, mobile money, and cryptocurrencies.

Account Types | Standard, Raw, Pro, Demo, Islamic |

Regulating Authorities | Financial Services Commission (FSC Mauritius), Financial Sector Conduct Authority (FSCA South Africa), Australian Securities and Investments Commission (ASIC) |

Minimum Deposit | $10 |

Deposit Methods | Bank Transfer, Credit & Debit Cards (Visa, MasterCard), E-wallets, Mobile Money, QR Payment, Virtual Bank, Cryptocurrency |

Withdrawal Methods | Bank Transfer, Credit & Debit Cards, E-wallets, Cryptocurrency |

Maximum Leverage | Up to 1:3000 (entity dependent) |

Trading Platforms & Apps | MetaTrader 5 (MT5), Web Trader, IUX Trade App (iOS, Android) |

IUX Pros and Cons

IUX key benefits and limitations for Forex traders.

Pros | Cons |

Regulation by FSC, FSCA, and ASIC with STP execution model | Investor compensation schemes are not provided by the broker |

High leverage availability up to 1:3000 with low minimum deposit of $10 | Educational content is limited for beginner traders |

Competitive pricing with spreads from 0 pips and commissions from $0 | No PAMM, social trading, or copy trading services offered |

Support for MT5, Web Trader, and IUX Trade App across devices | - |

FBS

FBS is an international Forex and CFD brokerage that has operated since 2009, serving a global client base exceeding 27 million traders.

Trading access spans more than 550 CFD instruments across Forex, indices, commodities, shares, metals, energies, and cryptocurrencies. FBS employs market execution with floating spreads starting from 0.7 pips and zero trading commission.

The company is owned by Tradestone Limited and functions through a multi-entity regulatory structure supervised by CySEC (license 331/17), FSC, and ASIC. European operations are conducted under the CySEC framework, while global services are supported through offshore entities.

Leverage conditions vary by entity, reaching up to 1:3000 for eligible non-EU clients. The platform ecosystem includes MetaTrader 4, MetaTrader 5, and the proprietary FBS Mobile App, which integrates over 90 technical indicators and supports advanced order management.

Account configuration has been streamlined into a single Standard account structure with a minimum deposit of $5, optional Islamic swap-free mode, and demo access. Trading costs can be lowered via FBS rebate.

Funding and withdrawals are supported through bank transfers, cards, regional payment systems, and electronic wallets all available in the FBS dashboard.

Risk controls include negative balance protection and segregated client funds, while overnight financing (swap rates) apply to leveraged positions. FBS registration follows a rapid digital onboarding and verification process aligned with international compliance standards.

Account Types | Standard, Demo, Islamic |

Regulating Authorities | CySEC, FSC, ASIC |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfer, Credit & Debit Cards (Visa, MasterCard, Maestro), E-payment Systems (Skrill, Neteller, Sticpay, Perfect Money, Fasapay), Local Payment Methods |

Withdrawal Methods | Bank Transfer, Credit & Debit Cards, E-payment Systems, Local Payment Methods |

Maximum Leverage | Up to 1:3000 (entity dependent) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), FBS Mobile App |

Pros and Cons of FBS Broker

Consider the following advantages and disadvantages before trading with FBS.

Pros | Cons |

Regulation under CySEC, FSC, and ASIC with segregated client funds | Only 1 live trading account type currently available |

Low entry barrier with minimum deposit starting from $5 | No copy trading or PAMM investment services |

Zero commission trading with floating spreads from 0.7 pips | - |

Support for MT4, MT5, and advanced FBS Mobile App with 90+ indicators | - |

Pepperstone

Pepperstone operates as a globally regulated Forex and CFD maintaining compliance with major international authorities such as ASIC, FCA, CySEC, DFSA, BaFin, CMA, and SCB.

Market participants often evaluate Pepperstone’s scale using key flow indicators, including average daily trading volume of approximately $9.2B and a customer base exceeding 400,000 accounts.

These figures provide insight into liquidity depth and execution capacity before proceeding with the Pepperstone registration process. Account funding and reporting flexibility is supported through ten base currencies, including AUD, USD, GBP, EUR, JPY, CHF, CAD, NZD, SGD, and HKD.

The broker offers two primary live account structures, Standard and Razor, supplemented by demo and Islamic variants.

Trading is available across Forex, commodities, shares, indices, ETFs, cryptocurrencies, and broader CFD markets, with position sizing from 0.01 to 100 lots.

Pricing models differ by account type, with Razor accounts utilizing raw spreads from 0.0 pips plus commission, while Standard accounts apply spread-only pricing. Traders can lowerd these trading costs by leveraging Pepperstone rebates.

Platform access spans MetaTrader 4, MetaTrader 5, cTrader, TradingView, and the proprietary Pepperstone platform. Comprehensive funding and withdrawal channels include bank transfers, cards, digital wallets, and crypto-based methods.

Account Types | Standard, Razor, Demo, Islamic |

Regulating Authorities | ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (Dubai), CMA (Kenya), BaFin (Germany), SCB (Bahamas) |

Minimum Deposit | $1 (technical minimum may apply depending on payment method) |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, UnionPay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, UnionPay, USDT, ZotaPay |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, Pepperstone Proprietary Platform |

Pepperstone Pros and Cons

Pepperstone main limitations and benefits for Forex and CFD traders.

Pros | Cons |

Broad market coverage across Forex, indices, shares, commodities, ETFs, crypto, and CFDs | Razor accounts apply $6 commission per lot in addition to raw spreads, increasing total transaction cost for high-frequency strategies |

Support for MT4, MT5, cTrader, TradingView, and Pepperstone proprietary platform | Client eligibility, product access, and legal protections vary by jurisdiction and regulatory classification |

Wide range of funding channels including PayPal, Skrill, Neteller, UnionPay, USDT, and ZotaPay | - |

FCA, CySEC, DFSA, BaFin, and SCB regulations | - |

Fusion Markets

Fusion Markets operates as a multi-jurisdictional Forex and CFD brokerage under the regulatory oversight of ASIC and VFSC, with corporate registration in Vanuatu (Company No. 40256) under Gleneagle Securities Pty Limited.

Institutional backing from Glen Eagle Securities strengthens its operational foundation, supporting client fund management exceeding $400M.

Client balances are maintained in segregated accounts with HSBC and National Australia Bank (NAB), reinforcing capital security standards.

The broker provides access to over 250 tradable markets, covering Forex, indices, US share CFDs, commodities, metals, energy, and cryptocurrencies.

Trading conditions are structured across three core account models: Zero, Classic, and Swap-Free, each accommodating different pricing preferences. Zero accounts feature raw spreads from 0.0 pips with commission, while Classic accounts apply spread-only pricing from 0.9 pips.

No minimum deposit requirement applies, and leverage reaches up to 1:500 depending on regulatory entity after completing Fusion Markets verification.

Execution infrastructure supports advanced order types including Market, Limit, Stop, Trailing Stop, and Take Profit, alongside integrated Copy Trading, MAM, and PAMM services available on the Fusion Markets dashboard.

Platform availability spans MetaTrader 4, MetaTrader 5, TradingView, and cTrader, with ultra-low execution latency and optional VPS hosting for algorithmic trading environments.

Funding and withdrawals are facilitated through extensive global channels such as VISA, MasterCard, PayPal, Bank Wire, Crypto, Skrill, and Neteller, with zero internal fees applied.

Fusion Markets registration is completed through a rapid digital onboarding and KYC process aligned with international compliance standards.

Account Types | Zero, Classic, Swap-Free, Demo, Islamic |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Visa, MasterCard, PayPal, Skrill, Neteller, Perfect Money, PayID, Crypto |

Withdrawal Methods | Bank Wire, PayPal, Skrill, Neteller, Crypto, Local Bank Transfer |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, cTrader |

Fusion Markets Pros and Cons

Traders must consider the following pros and cons before opening an account with the Fusion Markets broker.

Pros | Cons |

Regulation under ASIC and VFSC with segregated client funds at HSBC and NAB | Limited proprietary research and educational content compared with major global brokers |

Ultra-low trading costs with raw spreads from 0.0 pips and zero minimum deposit | Negative balance protection not available under all regulatory entities |

Support for MT4, MT5, cTrader, and TradingView with VPS and fast execution | Smaller product universe than brokers offering extensive stock CFDs and derivatives |

Copy Trading, MAM, and PAMM solutions available for portfolio management | - |

PU Prime

PU Prime is an international multi-asset Forex and CFD broker established in 2016, delivering access to more than 800 tradable instruments across six major asset classes.

Its market coverage spans Forex, indices, commodities, shares, bonds, metals, ETFs, and cryptocurrencies, allowing traders to construct diversified portfolios within a unified trading environment.

Client onboarding is completed through the PU Prime registration and verification process, which follows standard AML and KYC requirements enforced by regulatory supervision under ASIC, FSCA, SVG FSC, and Mwali FSC.

Trading infrastructure is built around MetaTrader 4, MetaTrader 5, and the proprietary PU Prime mobile app, providing full functionality across desktop, web, and mobile devices all accessible via the PU Prime dashboard.

Account selection includes four primary configurations: Standard, Prime, ECN, and Cent. Prime and ECN accounts feature pricing from 0.0 pips combined with per-lot commissions, while Standard and Cent accounts operate on a spread-only basis.

Entry requirements remain accessible, with a minimum deposit starting from $20 and maximum leverage extending up to 1:1000. The platform ecosystem is complemented by Islamic and demo accounts, as well as integrated copy trading and social trading functionality.

A broad range of PU Prime deposit and withdrawal methods, including cards, e-wallets, cryptocurrencies, and bank transfers, further supports operational flexibility without positioning the broker solely as an execution-centric provider.

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | ASIC, FSCA, SVG FSC, Mwali FSC |

Minimum Deposit | $20 |

Deposit Methods | Credit & Debit Cards, E-wallets, Cryptocurrencies, Local Bank Transfer, International Wire Transfer |

Withdrawal Methods | Credit & Debit Cards, E-wallets, Cryptocurrencies, Local Bank Transfer, International Wire Transfer |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), PU Prime Mobile App |

Pros and Cons of PU Prime

Consider the following pros and cons before opening an account with the PU Prime broker.

Pros | Cons |

Regulation under ASIC, FSCA, SVG FSC, and Mwali FSC with multi-entity compliance framework | Investor compensation schemes are not uniformly available across all regulatory entities |

Broad product coverage with 800+ tradable instruments across Forex, shares, bonds, metals, ETFs, and cryptocurrencies | Trading conditions such as leverage limits and margin rules differ significantly by jurisdiction |

Flexible account structures including Standard, Prime, ECN, and Cent with leverage up to 1:1000 | Educational resources and proprietary research tools remain limited compared with tier-1 global brokers |

Support for MT4, MT5, and PU Prime mobile app with copy trading and social trading integration | - |

Is Forex Trading Legal in Indonesia?

Forex trading is permitted in Indonesia, but its regulatory structure differs from the model used in many Western financial systems.

Rather than being supervised by a central bank or a financial conduct authority, retail Forex activity in Indonesia falls under the authority of Bappebti, formally known as the Commodity Futures Trading Regulatory Agency (Badan Pengawas Perdagangan Berjangka Komoditi).

This institution operates directly under the oversight of the Indonesian Ministry of Trade, placing Forex within the country’s broader commodity and futures regulatory framework.

Because domestic licensing options for retail Forex brokers remain limited, a significant portion of Indonesian trading volume is executed through international brokers that legally offer cross-border services to Indonesian residents.

In this environment, market participants typically prioritize brokers that hold recognized licenses in established regulatory jurisdictions and maintain transparent compliance standards.

Understanding the role of Bappebti is therefore essential for evaluating the legal context of Forex in Indonesia, as it defines how trading activity is classified and integrated into the national financial system, even when execution is conducted through offshore brokerage structures.

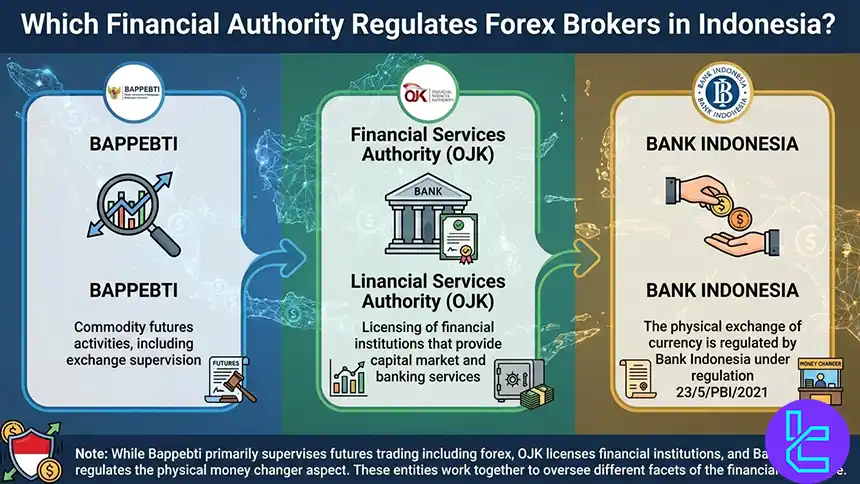

Which Financial Authority Regulates Forex Brokers in Indonesia?

Commodity futures activities, including exchange supervision, are administered by BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi), operating under the Indonesian Ministry of Trade.

Capital markets activity is primarily governed by Law No. 8 of 1995 on Capital Markets, while commodity futures fall under Law No. 10 of 2011, which amended Law No. 32 of 1997.

Licensing of financial institutions that provide capital market and banking services is handled by the Financial Services Authority (OJK), whose supervision mainly covers stock brokers and banks.

The physical exchange of currency is regulated by Bank Indonesia under regulation 23/5/PBI/2021. However, retail spot Forex and most CFD trading from margin accounts are not comprehensively codified within OJK’s regulatory scope, aside from share CFDs.

Traders can see the rank of BAPPEBTI alongside other regulatory bodies in the TF score page.

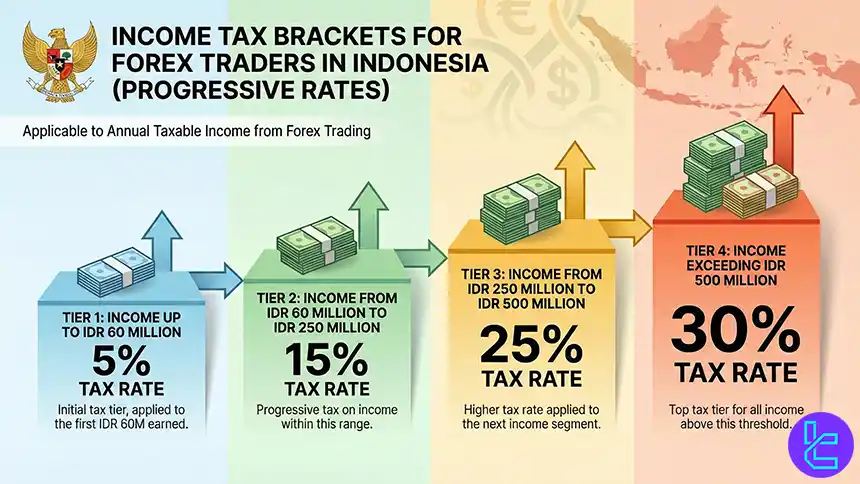

Do I Pay Taxes on My Forex Trading Gains in Indonesia?

In Indonesia, the taxation of retail Forex profits depends on the trader’s personal tax status and the nature of the trading activity.

When trading is conducted by an individual for speculative purposes rather than as part of a commercial enterprise, the responsible authority is the Direktorat Jenderal Pajak (DJP), which classifies Forex gains as personal taxable income.

An individual is typically considered an Indonesian tax resident if they remain in the country for more than 183 days within a twelve-month period, or if they maintain a permanent domicile, employment relationship, or substantial economic interests in Indonesia.

In such cases, Forex profits must be declared as part of annual taxable income and are subject to progressive personal income tax.

The current personal income tax brackets applied by the DJP are:

- Income up to IDR 60 million taxed at 5 percent

- Income from IDR 60 million to IDR 250 million taxed at 15 percent

- Income from IDR 250 million to IDR 500 million taxed at 25 percent

- Income exceeding IDR 500 million taxed at 30 percent

Tax is calculated on gross income after permitted deductions and exemptions. Forex trading losses cannot be offset against personal income tax, which makes accurate reporting and documentation particularly important for Indonesian traders.

Maximum Trading Leverage in Indonesia

In Indonesia, retail trading leverage is regulated by BAPPEBTI, which applies different limits depending on the instrument.

For major Forex pairs, leverage is generally capped at up to 1:100, while minor currency pairs, gold, and major indices are typically restricted to around 1:20. Exact limits may vary by broker and should be confirmed with a locally regulated provider.

Many traders also use international brokers licensed in offshore jurisdictions such as Vanuatu, Seychelles, and the Bahamas, where leverage can reach 1:500, 1:1000, or higher. Although this offers greater flexibility, it also involves higher risk and reduced investor protection compared to domestic regulation.

Is Forex Trading Halal in Indonesia?

In Indonesia, the question of whether Forex trading is permissible under Islamic principles has been formally addressed by the Indonesian Ulema Council (MUI).

Through Fatwa No. 28/DSN-MUI/III/2002, the MUI clarifies the religious framework governing currency transactions and outlines the conditions under which Forex trading may be considered acceptable (mubah).

According to the fatwa, currency trading is permitted when it satisfies several core requirements. Transactions should be conducted on a spot basis, with settlement typically occurring within two days.

Trading activity must be grounded in analysis and legitimate economic purpose, rather than speculative behavior that resembles gambling (maisir).

Most importantly, the structure of the transaction must avoid riba, meaning no interest-based charges may be applied, including the standard overnight swap fees common in conventional Forex trading.

To align with these principles, brokers serving Indonesian traders commonly provide Islamic accounts, also known as Islamic accounts, which remove interest-related charges from overnight positions.

This framework allows Forex participation to coexist with Sharia compliance within the Indonesian market while maintaining adherence to both religious guidance and financial practice.

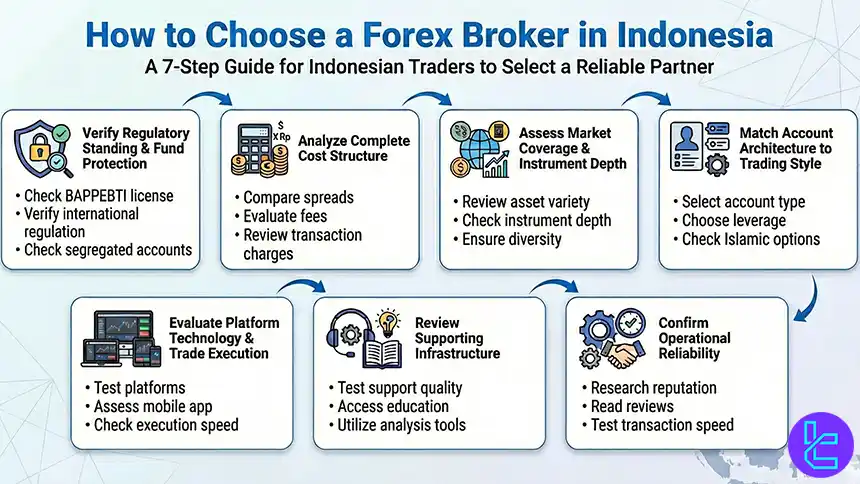

How to Choose a Forex Broker in Indonesia

Choosing a Forex broker in Indonesia is best approached as a structured, multi-step evaluation process. Each stage addresses a different layer of trading performance, risk control, and long-term usability.

#1 Verify Regulatory Standing and Fund Protection

Begin by confirming the broker’s regulatory licenses and the mechanisms used for client fund security, including segregation and dispute resolution frameworks.

#2 Analyze the Complete Cost Structure

Review spreads, commissions, swap rates, and non-trading fees to understand the broker’s true cost of operation over time.

#3 Assess Market Coverage and Instrument Depth

Ensure the broker provides sufficient access to Forex pairs, indices, commodities, shares, and CFDs that match your strategy design.

#4 Match Account Architecture to Trading Style

Examine available account types, execution models, and leverage settings to confirm compatibility with your position sizing and risk management approach.

#5 Evaluate Platform Technology and Trade Execution

Test trading platforms, charting systems, automation features, and order execution stability across desktop and mobile environments.

#6 Review Supporting Infrastructure

Consider the availability of research, educational content, copy trading, VPS services, and advanced risk management tools.

#7 Confirm Operational Reliability

Finally, examine customer support responsiveness, account onboarding procedures, and the speed and consistency of deposit and withdrawal processing.

Following this sequence helps ensure that broker selection is systematic, objective, and aligned with long-term trading performance rather than short-term incentives.

Forex Trading in Indonesia Compared to Other Countries

Forex trading in Indonesia operates within a fragmented regulatory environment that places stronger emphasis on commodity and capital market supervision than on retail Forex standardization.

Oversight from domestic authorities such as BAPPEBTI and the Financial Services Authority (OJK) influences how currency trading activities are classified and monitored, resulting in a framework that prioritizes market control and systemic stability over broad trading flexibility.

Compared to offshore jurisdictions or regions with more permissive margin structures, Indonesia applies comparatively conservative conditions on leverage and product classification, particularly for brokers operating under local regulatory oversight.

As a result, Indonesian traders frequently encounter narrower leverage ceilings and more restricted instrument availability locally, while higher leverage and broader product access are generally found through foreign brokerage structures serving the Indonesian market.

Comparison Factor | Indonesia | |||

Primary Regulator | BAPPEBTI | SEBI | Financial Markets Authority (FMA) | Financial Conduct Authority (FCA) |

Regulatory Framework | Commodity & futures supervision with limited retail Forex standardization | National regulation under SEBI & RBI | National FMA regime with FSPR registration | National FCA framework (post Brexit) |

Retail Leverage Cap Forex Majors | Up to 1:100 (locally); higher via offshore brokers | 1:50 | No fixed cap under FMA | 1:30 |

Investor Protection Level | Medium | Moderate to High | Medium to High | Very High |

Negative Balance Protection | Not mandatory | Mandatory | Not mandatory | Mandatory |

Client Fund Segregation | Required by broker policy; varies by structure | Required for SEBI-regulated brokers | Mandatory under FMA rules | Mandatory |

Broker Transparency Requirements | Regulatory disclosures under BAPPEBTI & OJK oversight | Strict disclosure for SEBI-regulated firms | Disclosure based supervision | Very strict conduct and disclosure standards |

Broker Availability | Predominantly international brokers | SEBI-regulated venues + offshore brokers | Local and international brokers | FCA licensed local and international brokers |

Access to International Brokers | High global access | Moderate to High | High global access | High global broker access |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView, cTrader | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Depends on broker policy | Cannot lose more than deposit | Depends on broker policy | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Progressive income tax under DJP | Taxed as business income or capital gains under Indian tax law | Income tax if trading is a business | Capital gains or income tax depending on activity |

Conclusion

Based on our review of the best brokers in Indonesia we can recommend ActivTrades, FP Markets, Saxo Bank, FBS, IUX, and HYCM as the best available options.

Now traders must review each broker and see if they fit their criteria of trading needs including spreads, commissions, asset variety, regulation, and top-tier customer support.

“All brokers have been reviewed based on the TradingFinder Forex methodology that considers various factors, including regulation, trading costs, customer support methods, and more.”