Traders who reside in Kenya can trade with the brokers that are regulated by the Capital Markets Authority (CMA), which has oversight on Forex brokers' activities and gives them official licenses to provide currency trading services (with a maximum leverage cap of 1:400).

Brokers that offer services in this region often provide Swahili-language support paired with trading accounts that operate in Kenyan Shillings. This helps traders to deposit and withdraw funds from their brokers via local banks with no international money transfer hassles.

| IC Markets | |||

| XM Group | |||

| Exness | |||

| 4 |  | HFM | ||

| 5 |  | Fusion Markets | ||

| 6 |  | AvaTrade | ||

| 7 |  | Pepperstone | ||

| 8 |  | OctaFX | ||

| 9 |  | Scope Markets | ||

| 10 |  | Global Prime |

Trustpilot Ratings of Forex Brokers in Kenya

The table below helps traders compare the Trustpilot ratings of these top brokers that are favored by most Kenyan traders.

Broker | Trustpilot Rating | Number of Reviews |

| IC Markets | 4.8/5 ⭐ | +49000 |

Exness | 4.8/5 ⭐ | +25000 |

| Fusion Markets | 4.8/5 ⭐ | +5000 |

Ava Trade | 4.7/5 ⭐ | +11000 |

Global Prime | 4.6/5 ⭐ | 375 |

4.6/5 ⭐ | +3000 | |

| Pepperstone | 4.3/5 ⭐ | +3000 |

4.0/5 ⭐ | +8000 | |

| XM Group | 3.5/5 ⭐ | +2500 |

2.8/5 ⭐ | +50 |

Forex Brokers in Kenya Comparison Based on Minimum Spreads

Trading fees, including commissions, spreads, swaps, currency conversions, etc. They are the most important factor that traders must consider when choosing a Forex broker. Here are the trading fees of reputable Forex brokers in Kenya:

Brokers | Minimum Spreads |

Pepperstone | From 0.0 Pips |

Scope Markets | From 0.0 Pips |

From 0.0 pips | |

From 0.0 pips | |

Axi | From 0.0 pips |

Global Prime | From 0.0 pips |

Vantage | From 0.0 pips |

From 0.6 pips | |

OctaFX | From 0.6 pips |

Capital.com | From 0.67 pips |

Kenya Forex Brokers Comparison Based on Non-Trading Fees

The top Forex brokers in Kenya provide a no-fee and commission environment for traders to attract new users and fresh capital to grow thier ecosystem. Here's a comparison of non-trading fees in the well-known Forex brokers in Kenya.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

$0 | $0 | No | |

Vantage | $0 | $0 | No |

Fusion Markets | $0 | $0 | No |

Global Prime | $0 | $0 | No |

Pepperstone | $0 | $0 | No |

AvaTrade | $0 | Varies | No |

Interactive Brokers | $0 | Varies | No |

HFM | $0 | Varies | $5 |

Forex.com | $0 | $0 | $15 |

$0 | $0 | $15 |

Variety of Instruments in Forex Brokers in Kenya

The availability of various tradable symbols and markets, including Forex, cryptocurrencies, metals, commodities, ETFs, bonds, stocks, indices, etc. allows traders to diversify their portfolio when trading with the brokers that offer services in Kenya.

Broker | Number of Tradable Instruments |

Scope Markets | +40000 |

IC Markets | +2250 |

+1400 | |

XM Group | +1400 |

Ava Trade | +1250 |

FXTM | +1000 |

OctaFX | +300 |

Axi | +290 |

Fusion Markets | +250 |

+100 |

Top 8 Forex Brokers in Kenya

Reliable Forex brokers for the Kenyan market are expected to offer competitive trading fees, flexible account structures, a wide range of trading platforms, and responsive client service. Traders in Kenya typically look for brokers that operate transparently, support local payment methods, and comply with recognized regulatory standards, whether domestic or international.

In the sections below, we take a closer look at the leading Forex brokers that serve Kenyan traders, examining their key features, trading conditions, and overall suitability for different trading styles.

Exness

Established in 2008, Exness operates as a global forex and CFD broker with multiple regulated entities, including Exness (KE) Limited, which falls under the oversight of the Capital Markets Authority (CMA) of Kenya.

Exness supports trading across major markets such as Forex, indices, commodities, cryptocurrencies, and stocks, with access to MT4 and MT5 platforms via the Exness dashboard.

The broker offers multiple account types, including Standard, Standard Cent, Pro, Raw Spread, and Zero, accommodating a wide range of trading styles and Exness deposit and withdrawal methods, including cryptocurrencies, bank cards, and electronic wallets.

Cost structures vary by account, with spreads starting from 0.0 pips on certain accounts and commissions ranging between $0 and $3.5 per lot.

Additional features such as negative balance protection, swap-free trading on selected instruments, and flexible leverage conditions contribute to its overall profile for all traders who complete the Exness registration.

Account Types | Standard, Standard Cent, Pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBSC, FSC BVI, CMA (Kenya) |

Minimum Deposit | $10 |

Deposit Methods | Bank Cards, Neteller, Skrill, Perfect Money, SticPay, Cryptocurrencies (USDT, BTC, USDC), Binance Pay |

Withdrawal Methods | Bank Cards, Neteller, Skrill, Perfect Money, SticPay, Cryptocurrencies, Internal Transfers |

Maximum Leverage | Unlimited (subject to account type and conditions) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), Exness Trade (Mobile), Exness Terminal (Web), MultiTerminal |

Exness Pros and Cons

The table below outlines the key advantages and disadvantages of Exness for Kenyan users.

Pros | Cons |

Regulated by CMA (Kenya), FCA, CySEC, FSCA, FSA, FSC BVI | Some features depend on the selected regulatory entity |

Operates locally via Exness (KE) Limited for Kenyan traders | Not all instruments are available on every account type |

Multiple account types: Standard, Standard Cent, Pro, Raw Spread, Zero | Educational resources are relatively limited |

Supports MT4, MT5, Exness Trade, Exness Terminal, MultiTerminal | No deposit or trading bonuses offered |

IC Markets

IC Markets KE is the entity that provides services to the Kenyan traders. The broker supports trading across Forex CFDs, Index CFDs, Commodity CFDs, Crypto CFDs, Bond CFDs, and an extensive range of Stock CFDs, exceeding 2,100 equities.

Account structures include Standard, Raw Spread, and Islamic accounts, each designed to suit different trading styles such as discretionary trading, scalping, and algorithmic strategies.

The minimum deposit is set at $200, with a minimum trade size of 0.01 lot.

IC Markets provides access to industry-standard platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, cTrader Web, and IC Markets Mobile, supporting Expert Advisors (EAs), automated systems, and advanced charting.

Pricing varies by account type, with Standard accounts offering commission-free trading and raw spread accounts featuring spreads from 0.0 pips plus fixed commissions. Swap fees apply depending on the instrument, with defined rollover schedules. traders This broker allows traders to use the IC Markets rebate program to lower trading costs up to 3$ per lot for major Forex pairs.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | Asic, CySEC, SCB, FSA, CMA |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards (Visa, MasterCard), Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal), Local and regional payment solutions |

Withdrawal Methods | Bank Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal) |

Maximum Leverage | Up to 1:500 (subject to trading conditions) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, cTrader Web, IC Markets Mobile |

Pros and Cons of IC Markets for Kenyan Users

The following pros and cons summarize IC Markets' key strengths and limitations.

Pros | Cons |

Operates via IC Markets KE, relevant for traders seeking Kenya-focused Forex brokers | Minimum deposit of $200 may be high for entry-level traders |

Access to 2,100+ Stock CFDs alongside Forex, indices, commodities, and crypto | No PAMM account offered |

Support for MT4, MT5, cTrader, cTrader Web, IC Markets Mobile platforms | Raw accounts require commission-based pricing |

Raw Spread accounts with a 0.0 pips pricing model | - |

XM Group

XM Group is often reviewed in roundups of the best Forex brokers in Kenya because Kenyan residents can typically access its services via the broker’s international setup, even though XM does not hold a CMA license.

Established in 2009, the broker offers multi-asset CFD coverage across Forex, commodities, indices, shares, cryptocurrency, and precious metals, with more than 55 currency pairs and 1,200-plus stock CFDs depending on the platform.

Traders can earn passive income by using this brokerage service, including the XM Group copy trading feature with a minimum investment amount of just $50.

Trading is MetaTrader-based through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the XM Mobile app for all traders who have completed the XM Group verification, with features tied to MQL5 Signal Service and Expert Advisors (EAs).

Regulation is distributed across FSC Belize, CySEC, FSCA, DFSA, FSC Mauritius, and FSA Seychelles.

Account options include Micro, Standard, Ultra Low Standard, Shares, and Demo, with a $5 minimum deposit. Maximum leverage reaches 1:1000, while margin call and stop out levels sit at 50% and 20%.

Traders who face problems during the XM Group registration process can contact the support team via live chat, email, or phone call 24/7.

Account Types | Micro, Standard, Ultra Low Standard, Shares, Demo |

Regulating Authorities | FSC (Belize), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSC (Mauritius), FSA (Seychelles) |

Minimum Deposit | $5 (Micro, Standard, Ultra Low) |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller, Perfect Money), Apple Pay, Google Pay, local methods |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets |

Trading Platforms & Apps | MT4, MT5, XM App |

XM Group Pros and Cons

Here are some of the pros and cons of trading with XM Group as Kenyan trader.

Pros | Cons |

Multiple regulators: FSC Belize, CySEC, FSCA, DFSA, FSC Mauritius, FSA Seychelles | Shares account has a much higher minimum deposit requirement |

MetaTrader ecosystem support through MT4, MT5, XM Mobile, MQL5 Signal Service | Swap fees apply on overnight positions depending on instrument |

High leverage availability up to 1:1000 with 0.01 lot minimum order | - |

Islamic account availability and negative balance protection for retail clients | - |

Pepperstone

Pepperstone is commonly assessed among the best Forex brokers in Kenya because it operates through a Kenya-focused arm under the Capital Markets Authority (CMA) while maintaining a broad global compliance setup.

Active traders often look at its daily flow metrics, including an average of $9.2B in daily volume and a client base exceeding 400,000, to gauge scale and liquidity conditions and decide to open an account by compliting the Pepperstone registration process..

The broker supports 10 base currencies, including AUD, USD, GBP, JPY, EUR, CAD, CHF, NZD, SGD, and HKD, which can matter for account funding and reporting.

Pepperstone provides two core account types, Standard and Razor, with access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and a proprietary platform.

Trading access spans Forex, commodities, crypto, shares, indices, ETFs, and CFDs more broadly, with typical order sizing from 0.01 to 100 lots. Leverage can reach up to 1:500 under the Kenya pathway, while other jurisdictions may enforce lower caps.

Pricing differs by account type, with Razor using raw spreads from 0.0 pips plus a commission model, and Standard relying on spread-only pricing. Traders can also use the Pepperstone rebate program to decrease their trading costs.

Account Types | Standard, Razor, Demo, Islamic |

Regulating Authorities | ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (Dubai), CMA (Kenya), BaFin (Germany), SCB (Bahamas) |

Minimum Deposit | $1 (technical minimum may apply depending on payment method) |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, UnionPay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, UnionPay, USDT, ZotaPay |

Maximum Leverage | Up to 1:500 (available under CMA Kenya and selected entities) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, Pepperstone Proprietary Platform |

Pepperstone Pros and Cons

The table below is the key factors that traders must consider before choosing Pepperstone as their broker.

Pros | Cons |

Multi-regulation framework across ASIC, FCA, CySEC, DFSA, BaFin, SCB | Leverage limits vary by regulator, with lower caps under FCA, CySEC, BaFin, ASIC |

Platform range includes MT4, MT5, cTrader, TradingView, proprietary platform | No PAMM account offering |

10 base currencies, including USD, EUR, GBP, JPY, AUD, CHF, CAD, NZD, SGD, HKD | Bonuses and promotions are not offered |

Razor model offers raw spreads from 0.0 pips with transparent commission pricing | - |

HF Markets

HFM, also known as HF Markets, has operated since 2010 and reports more than 2,500,000 live accounts, with client support available in 27 languages.

Trading access covers Forex, metals, commodities, indices, cryptos, ETFs, bonds, stocks, and energies, with floating spreads that can start from 0.0 pips on the Zero model and commission-free Forex pricing on most other accounts.

Account choices include Cent, Zero, Pro, and Premium, alongside Islamic availability and investment features such as PAMM-style management and HFM copy trading.

Platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a mobile app, supported by tools like Autochartist, SMS market notifications, VPS, calculators, and an economic calendar are accessible after HFM registration.

Oversight depends on the selected jurisdiction, with regulation tied to CySEC, FCA, DFSA, FSCA, and FSA Seychelles, and key protections include segregated funds and negative balance protection.

Funding methods available for all the traders who have completed the HFM verification process include wire transfer, cards, e-payments, and crypto, while inactivity fees can apply after prolonged dormancy. Keu details about this broker.

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC (Europe), FCA (UK), DFSA (UAE), FSCA (South Africa), FSA (Seychelles) |

Minimum Deposit | From $0 |

Deposit Methods | Wire Transfer, Credit/Debit Cards, E-payments (Skrill, Neteller, Perfect Money, FasaPay), Crypto (TRC20, ERC20) |

Withdrawal Methods | Wire Transfer, Credit/Debit Cards, E-payments, Crypto |

Maximum Leverage | Up to 1:2000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), HFM Mobile App |

HFM Pros and Cons

Like any other Forex broker, HFM also has its own pros and cons. Here are the key factors Kenyan traders must consider:

Pros | Cons |

Multi regulator coverage across CySEC, FCA, DFSA, FSCA, FSA Seychelles | Geo restrictions apply, including the United States and other jurisdictions |

Diverse account lineup: Cent, Zero, Pro, Premium, Islamic | Limited platform range compared with brokers offering cTrader or TradingView |

Forex pricing is commission-free on most accounts. Zero uses commission | Reports of occasional technical issues from users |

Floating spreads can start from 0.0 pips on a Zero account | - |

Fusion Markets

Fusion Markets is a cost-focused Forex and CFD broker founded in 2019 by Phil Horner, designed for traders who prioritize ultra-low trading expenses and fast execution.

This brokerage is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC), combining a Tier 1 and Tier 3 regulatory structure. These entities require all traders to complete the Fusion Markets verification to comply with AML and KYC laws.

Client funds are held in segregated accounts with top-tier banks, including HSBC and National Australia Bank, reinforcing operational transparency and capital safety.

Fusion Markets is widely recognized for its zero minimum deposit policy, raw spreads from 0.0 pips, and commission-free trading on Classic accounts.

It supports professional-grade platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView, alongside advanced features like copy trading, MAM accounts, VPS hosting, and algorithmic trading support in the Fusion markets dashboard.

With leverage up to 1:500, over 250 tradable instruments, and no deposit or withdrawal fees, Fusion Markets positions itself as a competitive option for active traders, scalpers, and cost-sensitive market participants.

Account Types | Zero, Classic, Swap Free |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu) |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, PayPal, Bank Wire, PayID, Crypto, Skrill, Neteller, Perfect Money, Interac, BinancePay |

Withdrawal Methods | Bank Wire, PayPal, Crypto, Skrill, Neteller, Interac, Jetonbank, DragonPay |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

Before choosing Fusion Markets as your preferred Forex broker, we suggest considering the following pros and cons.

Pros | Cons |

Ultra-low trading costs with raw spreads from 0.0 pips | Limited educational resources compared to large brokers |

No minimum deposit requirement for all account types | No proprietary trading platform |

Regulated by ASIC and VFSC with segregated client funds | No investor compensation scheme |

Access to MT4, MT5, cTrader, and TradingView platforms | Relatively new broker founded in 2019 |

Scope Markets

Scope Markets is a multi-asset broker launched in 2014 under Rostro Group, offering 40,000-plus tradable instruments across Forex, Metals, Energies, Indices, Shares, Fractional Stocks, Futures market, and Commodities.

Trading is built around MetaTrader 4 (MT4) and MetaTrader 5 (MT5), with additional market data access via CQG, IRESS, and Bloomberg feeds for traders who rely on deeper pricing and analytics.

From a regulatory perspective, the brand operates through RS Global Ltd under the Financial Services Commission of Belize (FSC, license 000274/325) and also maintains an EU route via SM Capital Markets Ltd, regulated by CySEC.

The Scope Markets dashboard provides various features, including internal transfers, Forex market hours, deposit and withdrawal option, and and access to the ticketing system.

Leverage can reach 1:1000 under the Belize entity, while EU conditions cap leverage at 1:30, which traders must consider during the Scope Markets registration process.

The product set includes real stock investing through the Scope Invest account, where fractional shares can be accessed with a minimum budget of $50, and a cashback model via the Scope Elite account with rebates up to $8 available after completing the Scope Markets verification.

Account Types | One, Islamic, Scope Invest, Scope Elite |

Regulating Authorities | Financial Services Commission (FSC), Belize, Cyprus Securities and Exchange Commission (CySEC) |

Minimum Deposit | $10 |

Deposit Methods | VISA, MasterCard, Skrill, Neteller, International Bank Transfer, Local Bank Transfer, VietQR, MoMo, ZaloPay, UnionPay, DC/EP, AliPay |

Withdrawal Methods | VISA, MasterCard, Skrill, Neteller, International Bank Transfer, Local Bank Transfer, VietQR, MoMo, ZaloPay, UnionPay, DC/EP, AliPay |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

Pros and Cons of Scope Markets Broker

Kenyan traders must consider the following benefits and limitations before choosing Scope Markets as their broker.

Pros | Cons |

Very large instrument list at 40,000 plus symbols | Belize FSC entity is typically considered lower tier than UK or EU oversight |

MT4 and MT5 support for standard trading workflows | No crypto trading availability |

Access to CQG, IRESS, and Bloomberg data feeds | No investor compensation under the FSC Belize entity |

Fractional Stocks via Scope Invest with a minimum $50 budget | Scope Elite has a high entry barrier at $20,000 minimum deposit |

OctaFX

OctaFX operates as a global Forex and CFD broker that has provided online trading services since 2011, serving millions of clients across more than 180 countries.

Traders who complete the OctaFX registration can access to multiple asset classes, including Forex, cryptocurrencies, indices, metals, energy instruments, and stock CFDs, while applying an ECN/STP execution model focused on market execution rather than dealing desk intervention.

The broker functions through several international entities and maintains regulatory oversight from authorities such as the Financial Sector Conduct Authority (FSCA), Mwali International Services Authority (MISA), and the Cyprus Securities and Exchange Commission (CySEC) for its European operations.

OctaFX supports MetaTrader 4, MetaTrader 5, and its proprietary OctaTrader platform, alongside copy trading via OctaFX Copy Trading.

Account structures remain commission-free, with floating spreads starting from 0.6 pips and a relatively low minimum deposit requirement of $25. Leverage availability varies significantly by jurisdiction, ranging from EU retail limits to higher ratios under offshore entities.

Various OctaFX deposit and withdrawal methods are available to traders, including cryptocurrencies, bank cards, and electronic wallets with a minimum amount of just $50.

Account Types | MT4 Account, MT5 Account, OctaTrader Account |

Regulating Authorities | Financial Sector Conduct Authority (FSCA), Mwali International Services Authority (MISA), Cyprus Securities and Exchange Commission (CySEC) |

Minimum Deposit | $25 |

Deposit Methods | Credit and debit cards, bank transfer, e-wallets (Skrill, Neteller), cryptocurrencies (BTC, ETH, LTC, USDT, DOGE) |

Withdrawal Methods | E-wallets (Skrill, Neteller), cryptocurrencies (BTC, ETH, LTC, USDT, DOGE) |

Maximum Leverage | Up to 1:1000 (entity dependent) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), OctaTrader, Octa Copy |

OctaFX Pros and Cons

Here are the benefits and drawbacks of choosing OctaFX as your primary Forex broker.

Pros | Cons |

Low minimum deposit requirement of $25 | No PAMM or managed account solutions offered |

Supports MT4, MT5, and proprietary OctaTrader platform | Payment methods and availability may change periodically |

Swap-free (Islamic) trading available on all account types | Investor protection level varies by regulatory entity |

High leverage availability up to 1:1000 (entity dependent) | - |

Is Forex Trading Legal in Kenya?

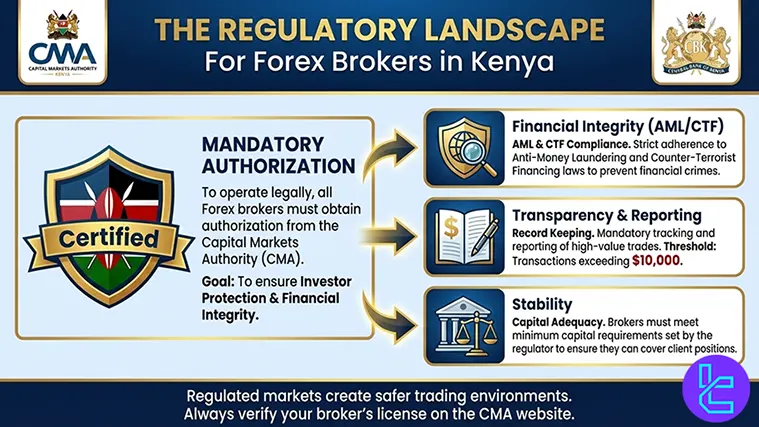

Forex trading is legal in Kenya, provided it is conducted under the country’s formal regulatory framework. The market is supervised primarily by the Capital Markets Authority (CMA Kenya), with additional oversight coordination from the Central Bank of Kenya (CBK).

In response to the growth of online Forex trading, these institutions have issued public notices and enforcement actions since 2020 to curb the activities of unlicensed brokers operating outside the Capital Markets Act.

Legally operating forex brokers must obtain authorization from CMA Kenya and comply with regulatory obligations tied to investor protection and financial integrity.

These obligations include Anti-Money Laundering (AML) and Counter Terrorist Financing (CTF) compliance, transaction record keeping for high value trades (over $10k), and meeting minimum capital adequacy requirements set by the regulator.

Which Financial Authority Regulates Forex Brokers in Kenya?

Forex brokers in Kenya operate under the supervision of the Capital Markets Authority of Kenya (CMA Kenya), the statutory regulator established by the Capital Markets Act (Cap 485A).

CMA Kenya, as a tier-2 regulatory body based on TF score, functions as an independent public agency responsible for regulating, licensing, and supervising capital market activities, including online forex trading, securities dealing, derivatives, and commodities markets.

CMA Kenya oversees licensed market intermediaries such as forex brokers, investment banks, fund managers, collective investment schemes, and the Nairobi Securities Exchange (NSE). Its mandate focuses on maintaining market integrity, ensuring fair dealing, and strengthening investor confidence through strict compliance monitoring and enforcement mechanisms.

Forex brokers offering services to Kenyan residents must either hold a CMA-issued license or operate under a regulatory structure explicitly approved by the Authority.

Investor protection is reinforced through multiple entities and systems, including collaboration with the Central Depository and Settlement Corporation (CDSC), public alerts on unlicensed entities, and anti-corruption oversight.

CMA also supports transparency through digital services, policy publications, and continuous market surveillance.

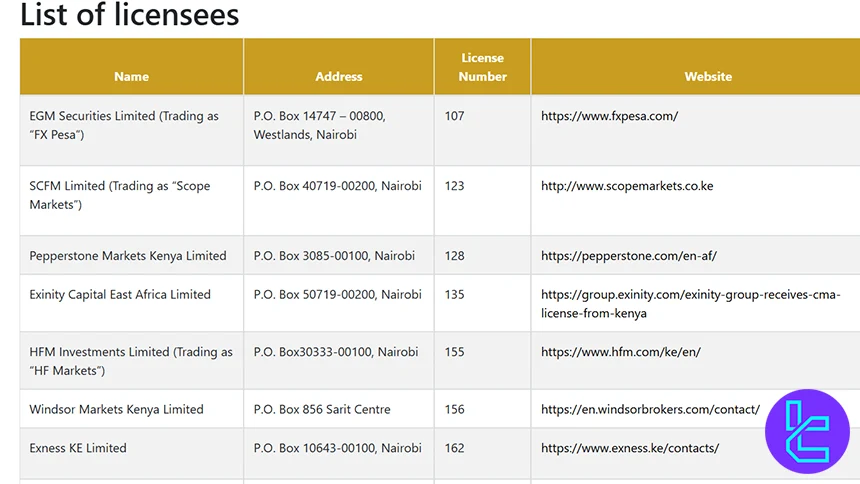

What are the Best Forex Brokers Regulated by the CMA Financial Authority?

The table below contains details about the top brokers that are licensed and regulated by the Capital Markets Authority in Kenya.

Name | Address | License Number |

Exness KE Limited | P.O. Box 10643-00100, Nairobi | 162 |

Pepperstone Markets Kenya Limited | P.O. Box 3085-00100, Nairobi | 128 |

HFM Investments Limited (Trading as “HF Markets”) | P.O. Box 30333-00100, Nairobi | 155 |

EGM Securities Limited (Trading as “FX Pesa”) | P.O. Box 14747 – 00800, Westlands, Nairobi | 107 |

IC Markets (KE) Limited | P.O. Box 41392-00100, Nairobi | 199 |

Admirals KE Limited | P.O. Box 39258-00623, Nairobi | 178 |

Ingot KE Limited | P.O. Box 111-00606, Nairobi | 173 |

Windsor Markets Kenya Limited | P.O. Box 856 Sarit Centre | 156 |

SCFM Limited (Trading as “Scope Markets”) | P.O. Box 40719-00200, Nairobi | 123 |

FP Markets Limited | P.O. Box 5144-01002, Madaraka | 193 |

Exinity Capital East Africa Limited | P.O. Box 50719-00200, Nairobi | 135 |

ANZO CAPITAL LIMITED | P.O. Box 1043-00100, Nairobi | 219 |

TPXMGLOBAL Kenya Limited | P.O. Box 39258-00623, Nairobi | 233 |

Visit the CMA Forex Broker Licensees page to see a full list of regulated brokers.

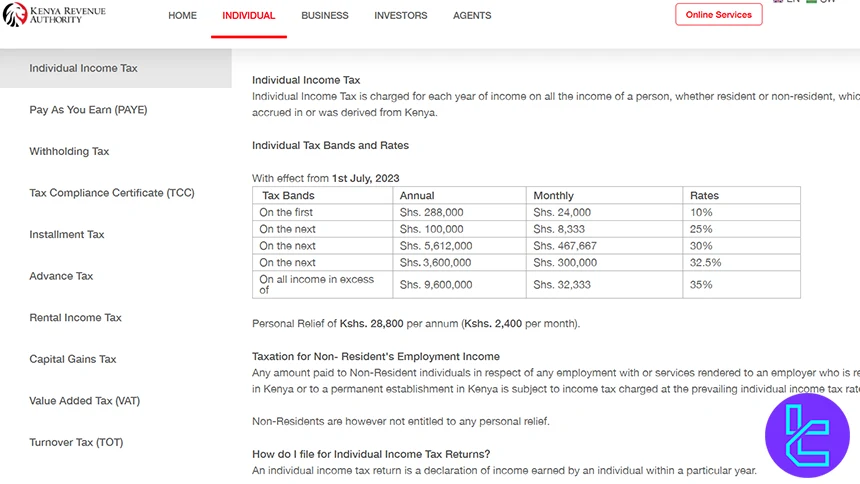

Do I Pay Taxes on My Forex Trading Gains in Kenya?

When Forex trading generates regular, recurring profits, the Kenya Revenue Authority (KRA) may classify those earnings as taxable income, especially if trading activity resembles a business or professional operation.

Under Kenyan tax law, income tax applies to all income accrued in or derived from Kenya, whether earned by residents or non-residents.

For Forex traders, this typically becomes relevant when profits are:

- Withdrawn consistently from Forex brokers into Kenyan bank accounts or mobile money services;

- Generated through frequent trading activity rather than occasional speculation;

- Treated as a primary or secondary source of livelihood.

In such cases, Forex trading profits may fall under individual income tax, not PAYE, but self-declared income filed through the KRA iTax system.

Traders are required to file annual income tax returns between 1 January and 30 June of the following year, even if no income was earned, in which case a NIL return applies. Here are the individual tax rates in Kenya:

Tax Bands | Annual | Monthly | Rates |

On the first | Shs. 288,000 | Shs. 24,000 | 10% |

On the next | Shs. 100,000 | Shs. 8,333 | 25% |

On the next | Shs. 5,612,000 | Shs. 467,667 | 30% |

On the next | Shs. 3,600,000 | Shs. 300,000 | 32.5% |

On all income in excess of | Shs. 9,600,000 | Shs. 32,333 | 35% |

What is the Maximum Leverage in Kenya?

Under the current regulatory framework, locally licensed forex brokers are generally required to cap leverage at 1:400 for retail clients.

This limit aligns with CMA’s investor protection mandate under the Capital Markets Act and applies to margin trading offered within Kenya.

Factors to Consider When Choosing the Best Forex Broker in Kenya

Considering the following factors help traders choose the best Forex trading broker based on their experience level, trading capital, and risk tolerance:

- Regulatory Authorization & Jurisdiction: Verify that the broker is licensed by credible regulators such as the Capital Markets Authority (CMA Kenya) or internationally recognized bodies like the FCA, ASIC, or FSCA;

- Market Access & Tradable Instruments: Assess the range of available markets, including Forex pairs, CFDs on indices, commodities, metals, and equities;

- Trading Platforms & Execution Infrastructure: Prefer brokers offering robust platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or proprietary web terminals with low-latency execution, stable pricing feeds, and access to deep liquidity pools;

- Pricing Model & Trading Costs: Analyze spreads, commissions, swap rates, and execution models (STP, ECN, or hybrid);

- Account Structure & Funding Flexibility: Examine account types, minimum deposit requirements, base currency options, and funding methods. Support for local payment systems and segregated client accounts improves accessibility and financial security;

- Client Protection & Operational Transparency: Ensure the broker applies client fund segregation, negative balance protection, and internal compliance policies aligned with anti-money laundering (AML) and know-your-customer (KYC) standards;

- Education, Research & Support Services: Consider the availability of educational resources, economic calendars, market analysis tools, and responsive customer support channels.

Forex Brokers Supporting M-PESA in Kenya

M-PESA is a mobile money ecosystem introduced in Kenya in 2007 by Safaricom, designed to facilitate peer-to-peer transfers, merchant payments, and access to digital financial services via mobile phones. Due to its nationwide agent network and integration into daily financial activity, M-PESA has become a practical funding channel for online Forex trading in Kenya.

Within the local Forex market, only a limited number of brokers support M-PESA as a deposit and withdrawal method, usually through Kenya-based operations or payment setups aligned with local regulations. These brokers typically combine mobile money access with standard retail trading infrastructure.

Forex Brokers Supporting M-PESA in Kenya:

- HFM: Operates with local payment options in Kenya, allowing M-PESA transactions alongside access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms;

- Scope Markets (Kenya): Supports M-PESA payments through its local operations and holds regulatory authorization from the CMA;

- FXPesa: A Kenya-based broker regulated by the Capital Markets Authority of Kenya (CMA), offering M-PESA as a core local payment method;

- XM: While XM does not maintain a CMA-licensed Kenyan entity, it facilitates M-PESA transactions for Kenyan traders through regional payment processors and alternative local transfer solutions.

How to Begin Trading Forex in Kenya?

Entering the Forex market in Kenya requires a structured approach that aligns with local regulation, market infrastructure, and individual risk tolerance.

Below is a practical, step-by-step framework designed for Kenyan residents who want to start trading currencies in a compliant and informed way.

#1 Understand the Regulatory Framework

Begin by familiarizing yourself with Kenya’s regulatory environment. Forex trading activities are overseen by the Capital Markets Authority of Kenya (CMA Kenya) under the Capital Markets Act.

Awareness of rules related to leverage limits, client protection, and licensed intermediaries helps you avoid unregulated platforms and potential fraud.

#2 Select a Suitable Forex Broker

Evaluate brokers based on regulatory authorization, execution model (STP, ECN, or hybrid), available trading instruments, and operational transparency.

Key entities to consider include the Capital Markets Authority (CMA), as well as international regulators such as the FCA, ASIC, or FSCA, depending on the broker’s structure.

#3 Open and Verify a Trading Account

Complete the account application process through the broker’s official website. This stage typically involves Know Your Customer (KYC) verification, including identity and proof of residence checks, in line with Anti Money Laundering (AML) standards.

#4 Use a Demo Trading Environment

Before risking capital, practice in a demo account that mirrors real market conditions. Demo platforms, often powered by MetaTrader 4 (MT4) or MetaTrader 5 (MT5), allow you to understand order execution, spreads, margin, and risk management tools without financial exposure.

#5 Fund Your Account via Local Payment Systems

Choose a funding method that fits your needs, such as bank transfers, cards, or mobile money solutions like M-PESA. Local currency funding in Kenyan Shillings (KES) can simplify transactions and reduce conversion costs.

#6 Develop a Trading and Risk Management Plan

Define your trading strategy, position sizing rules, stop loss placement, and profit objectives. Consistent risk control, rather than trade frequency, is the foundation of long-term participation in the Forex market.

What Are Forex Trading Hours in Kenya?

Forex trading hours in Kenya are synchronized with the global Forex market and follow East Africa Time (EAT), which is UTC+3. Trading activity moves across major financial centers, with each session contributing different liquidity and volatility characteristics.

- Sydney Session: 2:00 AM to 11:00 AM EAT

- Tokyo Session: 4:00 AM to 1:00 PM EAT

- London Session: 10:00 AM to 7:00 PM EAT

- New York Session: 3:00 PM to 12:00 AM EAT

The highest trading activity for Kenyan traders usually occurs during session overlaps, particularly the London–New York overlap from 3:00 PM to 7:00 PM EAT, when liquidity, volatility, and execution quality are typically at their peak.

Forex Trading in Kenya Compared to Other Countries

Forex trading in Kenya operates within a rapidly evolving regulatory framework that strikes a balance between market accessibility and effective oversight. Unlike tightly controlled financial hubs, the Kenyan market places greater weight on broker authorization, local compliance, and transparency practices, while offering broader flexibility in leverage and account structures for active traders.

The table below provides a comparison of the trading conditions in Kenya, including leverage, investor protection, negative balance protection, and other relevant factors, with those of other countries and regions.

Comparison Factor | Kenya | |||

Primary Regulator | Capital Markets Authority (CMA) | Canadian Investment Regulatory Organization (CIRO) | Australian Securities and Investments Commission (ASIC) | Cyprus Securities and Exchange Commission (CySEC) |

Regulatory Framework | National regulation under CMA | National Tier-1 framework under CIRO | National framework under ASIC | EU-wide MiFID II under ESMA |

Retail Leverage Cap (Forex Majors) | Up to 1:400 | Up to 1:50 | 1:30 | 1:30 (EU retail under MiFID II) |

Investor Protection Level | Medium | High | High | High |

Negative Balance Protection | Mandatory | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Required under CMA rules | Required under CIRO rules | Required under ASIC rules | Mandatory under CySEC rules |

Broker Transparency Requirements | Not Strict | Strict compliance and disclosure standards | Licensing and conduct rules under ASIC | Strict disclosure and capital adequacy requirements |

Broker Availability | CMA-regulated local and international brokers | CIRO-authorized brokers and international brokers | ASIC-licensed brokers | CySEC-licensed brokers with EU passporting |

Access to International Brokers | Yes | Yes | Yes | Yes |

Typical Trading Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader, TradingView, ProRealTime | MT4, MT5, cTrader, TradingView, NinjaTrader | MT4, MT5, cTrader |

Maximum Loss Protection | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Taxable income by Kenya Revenue Authority | Gains are treated as capital gains with 50% taxable | Generally treated as assessable income and must be reported to the Australian Taxation Office | For Cyprus residents, forex trading profits may be treated as personal or business income, |

Conclusion

Based on TradingFinder’s expert reviews, Exness, IC Markets, XM Group, and Pepperstone are some of the best brokers in Kenya.

Traders must consider trading costs, deposit and withdrawal methods, maximum leverage, and the regulatory status of each broker before choosing a suitable one to trade Forex in Kenya.

Every broker receives a weighted score based on essential metrics like trading costs, regulatory status, and account variety, as detailed within our Forex methodology framework.