Forex trading in the UAE is regulated by the DFSA within the DIFC, offering leverage up to 1:50, mandatory fund segregation, and tax-free trading. Compared with Singapore, France, and South Africa, the UAE balances strong oversight, high broker access, flexible protections, and popular platforms like MT4, MT5, and TradingView.

The UAE stands out as one of the most influential Forex markets, with Dubai positioned as a key financial gateway between Asia and Europe. Leading brokers serving UAE traders typically operate under DFSA or SCA oversight, offer swap-free Islamic accounts, support AED as a base currency, and provide Arabic language services with transparent local or regional operations.

Strong offerings usually include MetaTrader-based platforms, advanced charting tools, risk management features, and clear fee structures designed to meet the expectations of both retail and professional traders.

| Exness | |||

| AvaTrade | |||

| Eightcap | |||

| 4 |  | FBS | ||

| 5 |  | Octa | ||

| 6 |  | IC Markets | ||

| 7 |  | Moneta Markets | ||

| 8 |  | FxPro | ||

| 9 |  | FXTM | ||

| 10 |  | XM Group |

UAE Forex Brokers’ Trustpilot Ratings

Trust scores play an important role in evaluating Forex brokers operating in the UAE. Independent ratings from platforms such as Trustpilot reflect real user experiences, service quality, and transparency, offering valuable insight into broker reliability before opening a trading account.

Broker | Trustpilot Score (Out of 5) | Number of Reviews |

IC Markets | 4.8 ⭐️ | 49,634 |

4.8 ⭐️ | 25,753 | |

AvaTrade | 4.7 ⭐️ | 11,431 |

| FBS | 4.3 ⭐️ | 7,979 |

| Moneta Markets | 4.3 ⭐️ | 451 |

Eightcap | 4.1 ⭐️ | 3,348 |

| Octa | 4.0 ⭐️ | 8,476 |

FxPro | 3.8 ⭐️ | 859 |

XM Group | 3.5 ⭐️ | 2,818 |

FXTM | 2.6 ⭐️ | 1,076 |

Best UAE Forex Brokers in Spreads

The UAE brokers with the lowest spreads include IC Markets, AvaTrade, Exness, and Eightcap, all offering minimum spreads from 0.0 pips. A zero spread means no broker mark-ups and pure market pricing. Spreads vary by account type and trading instrument, and the values shown represent the lowest available conditions.

Broker | Minimum Spread |

0.0 pips | |

LiteForex | 0.0 pips |

AvaTrade | 0.0 pips |

0.0 pips | |

Capital.com | 0.0 pips |

JustMarkets | 0.0 pips |

Exness | 0.0 pips |

Eightcap | 0.0 pips |

0.7 pips | |

Axi | 0.9 pips |

Forex Brokers in the UAE with the Lowest Non-Trading Fees

The top UAE brokers in non-trading fees focus on cost transparency by eliminating deposit and withdrawal charges while keeping inactivity fees minimal. Brokers such as IC Markets, Exness, AvaTrade, and Capital.com stand out for UAE traders by reducing hidden costs that directly affect long-term trading efficiency.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

IC Markets | No | No | No |

Exness | No | No | No |

LiteForex | No | No | €3/month |

JustMarkets | No | No | $5/month |

No | No | $10/month | |

Axi | No | No | $10/month |

Capital.com | No | No | €10/month |

No | No | $10/month | |

FBS | No | Up to 2.5% | No |

FXTM | No | Up to $30 for bank wire | $10/month |

Best UAE Forex Brokers with the Most Trading Instruments

The UAE Forex brokers’ trading instruments category highlights platforms offering broad market access across the forex market, CFDs, stocks, indices, commodities, and cryptocurrencies.

Brokers such as Saxo, Swissquote, Capital.com, and IC Markets stand out by providing thousands of tradable instruments, supporting diversified strategies and multi-asset trading for UAE-based investors.

Broker | Number of Trading Instruments |

Swissquote | 3M+ |

Saxo | 71,000+ |

Capital.com | 3,200+ |

Plus500 | 2,800+ |

IC Markets | 2,250+ |

2,100+ | |

1,400+ | |

FXTM | 1,000+ |

Eightcap | 800+ |

277+ |

Top 8 Forex Brokers in the UAE

The UAE Forex market features globally regulated brokers offering access to over 3 million instruments, DFSA or SCA oversight, advanced platforms like MT4, MT5, TradingView, and competitive trading conditions.

Leading names such as XM Group, IC Markets, Moneta Markets, and Octa serve UAE traders with diverse account types and risk-controlled environments

Moneta Markets

Moneta Markets is a global Forex and CFD broker founded in 2020, offering access to over 1,000 tradable instruments across Forex, indices, shares, commodities, bonds, and cryptocurrencies, all available by completing the Moneta Markets registration process. With a low minimum deposit of $50 and leverage up to 1:1000, it appeals to both retail and active traders.

The broker is regulated by the Financial Sector Conduct Authority (FSCA) and operates internationally through additional registrations. This structure allows Moneta Markets to serve traders from the Middle East, including the UAE, with flexible trading conditions, segregated client funds, and negative balance protection.

Moneta Markets supports multiple trading platforms, including MetaTrader 4, MetaTrader 5, Pro Trader with TradingView integration, and a mobile App Trader. Account types include Direct STP, Prime ECN, and Ultra ECN, with spreads starting from 0.0 pips and competitive commission models.

From a trading environment perspective, the Moneta Markets dashboard offers Islamic swap-free accounts, copy trading, PAMM solutions, and a wide range of funding methods. Fast execution, no deposit or withdrawal fees, and support for professional tools make it suitable for traders seeking flexibility and advanced features. Traders must comply with Moneta Markets verification policies to use its services.

Account Types | Direct, Prime, Ultra |

Regulating Authorities | FSCA, FSRA, FCA |

Minimum Deposit | $50 |

Deposit Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Withdrawal Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Pro Trader, App Trader |

Moneta Markets Pros and Cons

Below is a focused overview of Moneta Markets’ main pros and cons, highlighting factors UAE traders should consider before choosing this broker.

Pros | Cons |

Islamic swap free accounts compliant with Sharia principles | FSCA regulation considered mid tier compared to top global regulators |

Low $50 minimum deposit suitable for retail traders | Relatively new brand compared to long established brokers |

Wide platform choice including MT4, MT5, and TradingView based Pro Trader | High leverage increases risk if unmanaged |

Copy trading and PAMM investment options available | - |

XM Group

Operating since 2009, XM Group has grown into a global Forex and CFD broker serving more than 15 million clients worldwide and executing nearly 14 million trades daily. The broker provides access to 55+ currency pairs and over 1,400 CFDs through MetaTrader 4 and MetaTrader 5 platforms.

From a regulatory angle, XM Group maintains a broad international footprint with oversight from DFSA Dubai, CySEC, FSCA, FSC Belize, FSC Mauritius, and FSA Seychelles. This multi-entity structure enables the broker to deliver region-specific protections, including negative balance protection across retail accounts.

Trading conditions at XM are designed for accessibility, with a minimum deposit of just $5 and leverage reaching up to 1:1000 depending on the entity. By completing the XM Group registration process, UAE traders benefit from DFSA-regulated operations, Islamic swap-free accounts, and guaranteed execution for orders up to 50 lots.

In terms of market coverage, XM offers forex, indices, commodities, shares, precious metals, and crypto CFDs. Pricing starts from 0.6 pips on Ultra Low accounts, with no deposit or withdrawal fees charged by the broker, supporting cost-efficient trading environments. XM Group rebate program offers forex cashbacks up to $37.5 per lot.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Sechelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Group Pros and Cons

Reviewing the following pros and cons helps UAE traders clearly evaluate the broker’s strengths in services like XM Group copy trading, accessibility, and regulation, alongside potential limitations related to costs and regional restrictions.

Pros | Cons |

Islamic swap free accounts compliant with Sharia principles | FSCA regulation considered mid tier compared to top global regulators |

Low $50 minimum deposit suitable for retail traders | Relatively new brand compared to long established brokers |

Wide platform choice including MT4, MT5, and TradingView based Pro Trader | High leverage increases risk if unmanaged |

Copy trading and PAMM investment options available | - |

FXTM

FXTM (ForexTime) is a global Forex and CFD broker founded in 2011, serving over 1 million traders across more than 150 countries. The broker offers access to 1,000+ tradable assets covering Forex, stocks, indices, commodities, metals, and cryptocurrencies, with leverage reaching up to 1:3000 on eligible accounts.

FXTM operates primarily under the Financial Services Commission of Mauritius and provides international services with region based restrictions. For UAE traders, FXTM focuses on flexible trading conditions, segregated client funds, and access to Islamic swap-free accounts aligned with Sharia principles.

FXTM dashboard allows access to MetaTrader 4, MetaTrader 5, and its proprietary FXTM Trader App, enabling trading across desktop and mobile devices. Account options include Advantage, Advantage Plus, and Advantage Stocks, with spreads starting from 0.0 pips and market execution across all instruments.

From a usability standpoint, FXTM combines high leverage availability, copy trading through FXTM Invest, and a strong educational ecosystem. Features such as multilingual support, flexible funding methods, and low minimum trade sizes make it accessible to both new and experienced traders in the UAE.

FXTM deposit and withdrawal methods include FasaPay, TC Pay, Google Pay, Skrill, Neteller, and many more. you can also fund your account using cryptocurrencies.

Account Types | Advantage, Stocks Advantage, Advantage Plus |

Regulating Authorities | FSC |

Minimum Deposit | $200 |

Deposit Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Withdrawal Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, FXTM Trader App |

FXTM Pros and Cons

Below is a concise overview of FXTM’s main pros and cons, highlighting important considerations for UAE based traders evaluating this broker.

Pros | Cons |

Islamic swap-free accounts available | Regulation limited to offshore authority |

High leverage options for advanced traders | No PAMM account structure |

Strong educational resources and copy trading | Higher minimum deposit compared to some competitors |

Support for MT4, MT5, and mobile trading app | Trust scores lower than top-tier regulated brokers |

Eightcap

Founded in Melbourne in 2009, Eightcap operates as a global Forex and CFD broker delivering access to forex, indices, commodities, metals, shares, and crypto CFDs. By completing the Eightcap registration process, traders get access to MT4, MT5, and TradingView platforms, leverage up to 1:500, and a minimum deposit of $100.

From a regulatory standpoint, Eightcap maintains licenses with ASIC, FCA, CySEC, and the SCB, ensuring compliance across multiple jurisdictions. Client funds remain segregated, negative balance protection applies across entities, and eligible traders benefit from investor compensation schemes reaching €20,000 or £85,000.

Eightcap's market coverage represents another core strength, with more than 800 tradable instruments available, including 56 forex pairs and over 200 cryptocurrency CFDs. UAE traders can select between Standard, Raw, and TradingView accounts, with Raw pricing starting from 0.0 pips under market execution conditions.

Technology-driven features further distinguish Eightcap through integrations such as Capitalise.ai for automation, FlashTrader for rapid execution, and an AI-powered economic calendar. Combined with native TradingView access, these tools support data-focused trading strategies and active decision making.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

Evaluating the following pros and cons provides UAE traders with a clearer view of Eightcap’s strengths and structural limitations before selecting an account type or trading setup.

Pros | Cons |

Regulated by ASIC, FCA, and CySEC | No Islamic swap-free account |

Eightcap rebate program with up to $3.6 per lot cashback | Inactivity fee after 3 months |

TradingView integration with automation tools | No copy trading or PAMM services |

Leverage up to 1:500 via an offshore entity | No local DFSA-regulated entity |

FBS

FBS is a global Forex and CFD broker established in 2009, serving more than 27 million users worldwide. By completing the FBS registration process, users can trade over 550 trading instruments across Forex, indices, commodities, shares, metals, and cryptocurrencies, with a very low minimum deposit starting from $5.

FBS operates through multiple regulated entities, including CySEC in Cyprus, ASIC in Australia, and FSC in Belize. This structure allows FBS to serve international traders, including those in the UAE, with segregated client funds, negative balance protection, and flexible trading conditions based on jurisdiction.

FBS dashboard provides access to MetaTrader 4, MetaTrader 5, and its proprietary mobile trading app, offering more than 90 built-in technical indicators. Trading is commission-free on standard accounts, with floating spreads starting from 0.7 pips and fast market execution suitable for both beginners and active traders.

From a usability perspective, FBS emphasizes accessibility and simplicity. Features such as Islamic swap-free accounts, demo trading, micro lot sizing, FBS deposit bonus, and 24/7 multilingual customer support make it attractive to UAE traders seeking flexible entry conditions and mobile-first trading solutions.

Account Types | Standard |

Regulating Authorities | FSC, CySEC, ASIC |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

FBS Pros and Cons

Below is a balanced overview of FBS pros and cons, highlighting key points UAE traders should consider before choosing this broker.

Pros | Cons |

Very low minimum deposit suitable for beginners | Limited to one main live account type |

Islamic swap-free accounts available | No copy trading or PAMM investment options |

Commission-free trading with competitive spreads | Regulatory strength varies by entity |

User-friendly mobile app with advanced indicators | High leverage may increase trading risk |

IC Markets

Founded in 2007, IC Markets operates as a global Forex and CFD broker delivering institutional-grade trading conditions across multiple asset classes. Traders gain access to forex, indices, stocks, commodities, bonds, and crypto CFDs through MetaTrader 4, MetaTrader 5, and cTrader, with minimum deposits starting from $200.

IC Markets functions under several international entities supervised by ASIC, CySEC, and the FSA. Client funds are held in segregated accounts, external audits are applied, and EU clients receive Investor Compensation Fund coverage up to €20,000, supporting a high standard of operational security.

In terms of market access, the broker offers more than 2,250 tradable instruments, including over 60 currency pairs and 2,100+ stock CFDs. UAE traders can use leverage up to 1:500 via offshore entities and access Islamic swap-free accounts across MT4, MT5, and cTrader environments.

Pricing structure remains one of IC Markets’ strongest attributes. Raw Spread accounts provide market-based pricing from 0.0 pips with commissions starting at $3 per lot, while Standard accounts include spreads from 0.8 pips with no commission. Deposit and withdrawal fees are not charged. IC Markets rebate program offers $3 per lot cashback for Forex trading.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros and Cons

Understanding the broker’s pros and cons is essential for UAE traders evaluating execution quality, cost efficiency, regulatory scope, and account flexibility before committing capital.

Pros | Cons |

Raw spreads from 0.0 pips with market execution | $200 minimum deposit may not suit all beginners |

Islamic swap-free accounts across MT4, MT5, cTrader | No locally regulated DFSA entity |

High-speed execution for scalping and algorithmic trading | Negative balance protection varies by entity |

Broad instrument range with 2,250 plus symbols | No proprietary trading platform |

Octa

Octa is a global Forex and CFD broker established in 2011, serving more than 40 million registered accounts worldwide. The broker offers access to Forex, indices, commodities, stocks, and cryptocurrencies, with a low minimum deposit of $25 and floating spreads starting from 0.6 pips, all available via the OctaFX registration process.

The broker operates through multiple international entities regulated by authorities such as FSCA and MISA, allowing Octa to serve traders across the Middle East. For UAE traders, this structure provides flexible leverage options, segregated client funds, and negative balance protection across accounts.

Octa supports MetaTrader 4, MetaTrader 5, and its proprietary OctaTrader platform. Trading is commission-free, execution follows an ECN/STP model, and leverage can reach up to 1:1000 depending on the entity, making it suitable for both beginners and active traders.

From a feature standpoint, Octa emphasizes technology and trader accessibility. It offers Islamic swap-free accounts on all account types, copy trading via Octa Copy, AI-powered analytics tools, and 24/7 multilingual customer support, aligning well with the preferences of UAE-based traders.

Octa deposit and withdrawal methods include cryptocurrencies (Bitcoin, Ethereum, and Tether), credit cards, bank transfers, and e-wallets.

Account Types | MT4, MT5, OctaTrader |

Regulating Authorities | FSCA, MISA |

Minimum Deposit | $25 |

Deposit Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Withdrawal Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, proprietary OctaTrader, and Copy trading app |

Octa Pros and Cons

Below is a balanced overview of Octa’s pros and cons, highlighting key considerations for UAE traders evaluating this broker.

Pros | Cons |

Islamic swap-free accounts available on all accounts | Regulatory coverage not fully top-tier globally |

Low $25 minimum deposit suitable for new traders | Smaller instrument range than large ECN brokers |

Commission-free trading with competitive spreads | Frequent changes in payment methods |

Copy trading and proprietary analytics tools | High leverage increases risk if unmanaged |

Exness

Exness is a global Forex and CFD broker founded in 2008, serving millions of traders with monthly trading volumes exceeding $4 trillion. The broker offers access to over 200 trading instruments, including Forex and CFD contracts on indices, commodities, stocks, and cryptocurrencies, with spreads starting from 0.0 pips and commissions as low as $0.2.

Exness operates under multiple regulatory entities, including FCA, CySEC, FSCA, CMA, FSA, and FSC, providing a strong multi-jurisdiction compliance framework. For UAE traders, this structure enables flexible leverage options, segregated client funds, and mandatory negative balance protection across supported entities.

The broker supports a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trade mobile app, and a Social Trading platform. Account types on the Exness dashboard range from Standard and Standard Cent to Raw Spread and Zero, catering to beginners, scalpers, and professional traders alike.

From a trading conditions perspective, Exness is known for ultra-fast execution, instant withdrawals, and flexible leverage that can reach very high levels under specific conditions. The broker charges no deposit, withdrawal, or inactivity fees and offers Islamic swap-free accounts suitable for UAE-based traders. Traders can earn cashback of up to $112.5 per lot for Forex trading through the Exness rebate program.

Exness deposit and withdrawal options range from cryptocurrencies like Bitcoin and USDT to e-wallets like PerfectMoney, Neteller, and Skrill.

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros and Cons

Below is a focused overview of Exness pros and cons, highlighting key strengths and limitations that UAE traders should consider before opening an account.

Pros | Cons |

Instant withdrawals with no broker fees | Educational resources less extensive than top tier peers |

Very low spreads and competitive commissions | Some instruments unavailable on certain account types |

Strong multi regulator oversight and fund segregation | Restricted availability in specific countries |

Islamic swap free accounts and flexible leverage | High leverage increases risk if unmanaged |

Is Forex Trading Legal in the UAE?

Forex trading is legal in the United Arab Emirates when brokers and traders operate under approved regulatory frameworks. Residents can trade global FX and CFD markets through brokers authorized by local or recognized international regulators such as the DFSA, FCA, or ASIC.

In the UAE, legality depends on compliance rather than the activity itself. Trading through unregulated or blacklisted platforms exposes traders to legal and financial risks, making broker authorization a critical first step.

Important Regulations That UAE Traders Must Know

Forex trading in the UAE is governed by a multi-authority regulatory structure rather than a single regulator.

Oversight depends on the broker’s legal location and licensing framework, with supervision shared between the Dubai Financial Services Authority (DFSA), Central Bank of the UAE (CBUAE), Securities and Commodities Authority (SCA), and the Dubai International Financial Centre (DIFC).

The DFSA regulates brokers operating inside the DIFC, enforcing international standards on capital adequacy, conduct of business, and client fund protection. Outside the DIFC, retail trading activity may fall under the SCA, while the CBUAE oversees monetary policy, banking institutions, and systemic financial stability.

The DIFC itself functions as an independent financial free zone with its own legal and regulatory ecosystem.

- DFSA oversight for brokers licensed in the DIFC

- SCA supervision for onshore securities and CFD providers

- CBUAE authority over banks, payments, and financial stability

- DIFC legal framework independent from federal courts

- Mandatory client fund segregation and disclosure rules

- Enforcement actions and public warning lists

What Are DFSA Regulations for Forex Brokers?

The Dubai Financial Services Authority (DFSA) oversees Forex and CFD brokers operating within the Dubai International Financial Centre (DIFC). Brokers must obtain DFSA authorization before offering leveraged trading services to UAE or international clients.

Licensing requires meeting strict capital adequacy and liquidity standards, establishing effective risk management and governance systems, and appointing approved senior management. These requirements align with international regulatory frameworks and IOSCO principles.

Once authorized, brokers are subject to continuous supervision, including regular financial and compliance reporting, independent audits, and regulatory inspections. The DFSA enforces client fund segregation, transparent risk disclosures, and fair conduct rules.

Strong AML and KYC obligations are also mandatory, following FATF standards, requiring identity verification, transaction monitoring, and reporting of suspicious activity. These measures ensure market integrity and enhance protection for traders using DFSA-regulated Forex brokers.

DFSA’s Warning Lists for Online Traders

The DFSA publishes warning lists identifying firms falsely claiming authorization or targeting UAE traders illegally. These lists are updated regularly and serve as a first defense against scams. Checking the warning list before opening an account significantly reduces fraud risk.

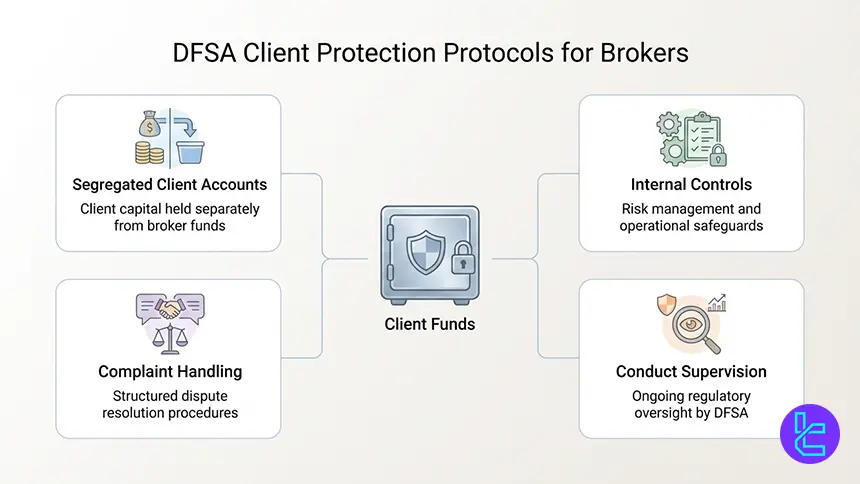

What Are DFSA Client Protection Protocols for Brokers?

DFSA requires strict segregation of client funds, ensuring trader capital is kept separate from broker operating funds. This reduces insolvency and misuse risks. Additional protocols include conducting supervision, complaint handling, and dispute resolution mechanisms.

- Segregated client accounts

- Mandatory internal controls

- Complaint handling standards

- Conduct supervision

How to Verify DFSA Authorization?

Traders can verify broker authorization through the DFSA public register. This database confirms license status, permitted activities, and legal entity details. Verification should be done before registering or funding any trading account.

- Open the DFSA Public Register and access the search page;

- Search the exact legal entity name shown in the broker’s footer, terms, or disclosure page;

- Confirm the firm status shows an active authorization, not expired, withdrawn, or suspended;

- Open the firm profile and review the permitted activities to confirm it can offer the services you plan to use, such as CFD or leveraged FX trading;

- Check the DIFC location details in the record, including the listed address and any branch information, and compare it with the broker’s website;

- Verify identifiers and matching details, including the firm’s legal name spelling, trading name, and website domain if shown;

- Review any public notices, warnings, or enforcement-related information linked from the DFSA site, if available;

- Screenshot or save the register result before you sign up, then repeat the check right before you deposit funds, since authorization status can change.

How to Start Forex Trading in the United Arab Emirates?

Starting Forex trading in the UAE requires selecting a regulated broker, completing KYC verification, and choosing a suitable account type. Most brokers support online onboarding within minutes.

Traders should align leverage, platform choice, and funding methods with their risk profile and experience level.

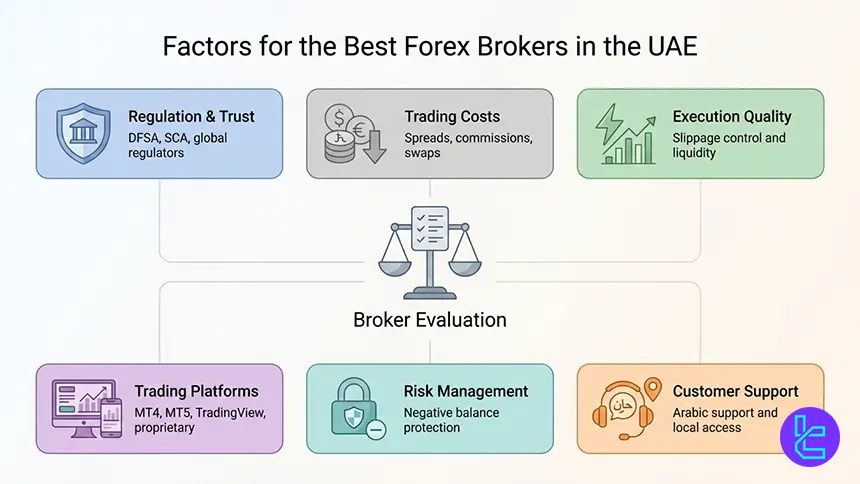

What Factors Are Important in Selecting the Best Forex Brokers in the UAE?

Choosing the best Forex broker in the UAE requires a structured evaluation based on regulatory strength, cost transparency, execution quality, and technology. Brokers operating under recognized authorities such as the DFSA or SCA, or reputable global regulators, offer higher levels of legal protection and operational reliability.

Beyond regulation, trader experience is shaped by pricing models, spreads, execution speed, and platform stability. UAE traders also benefit from brokers that provide Arabic language support, region-specific payment methods, and clear disclosures. Comparing brokers using objective and measurable criteria reduces the risk of being influenced by aggressive marketing or promotions.

Is Forex Trading Suitable for UAE Beginner Traders?

Forex trading can be suitable for beginner traders in the UAE when approached with structured learning, controlled risk exposure, and realistic expectations. Many UAE-focused brokers offer demo accounts, educational materials, and low entry requirements, allowing beginners to practice market execution and platform use without financial pressure.

However, Forex trading carries a high level of risk, especially for new traders lacking discipline or money management skills. Without proper education, emotional control, and position sizing rules, beginners may experience rapid losses. Starting gradually and prioritizing capital protection remains essential.

Is Swap-Free Islamic Trading Available for UAE Traders?

Swap-free Islamic accounts are commonly offered by Forex brokers serving UAE traders, ensuring compliance with Sharia principles by eliminating interest-based overnight swap charges. These accounts are structured to support traders who avoid riba, while still allowing access to global Forex and CFD markets.

Although swaps are removed, some brokers apply alternative holding or administrative fees on positions kept open for extended periods. These charges differ by broker, account type, and instrument, making it essential to review the full Islamic account terms before trading.

Does UAE Brokers Offer Negative Balance Protection?

Negative balance protection is a risk control mechanism that prevents traders from losing more than the funds deposited in their trading account. When this feature applies, losses are capped at the account balance, even during extreme volatility or market gaps, which is especially relevant in leveraged Forex trading.

In the UAE, negative balance protection is entity-dependent. Brokers regulated under EU-style frameworks typically apply it automatically to retail clients, while DFSA-regulated or offshore entities may not offer it by default. UAE traders should always verify whether this protection applies to their specific account and regulatory entity.

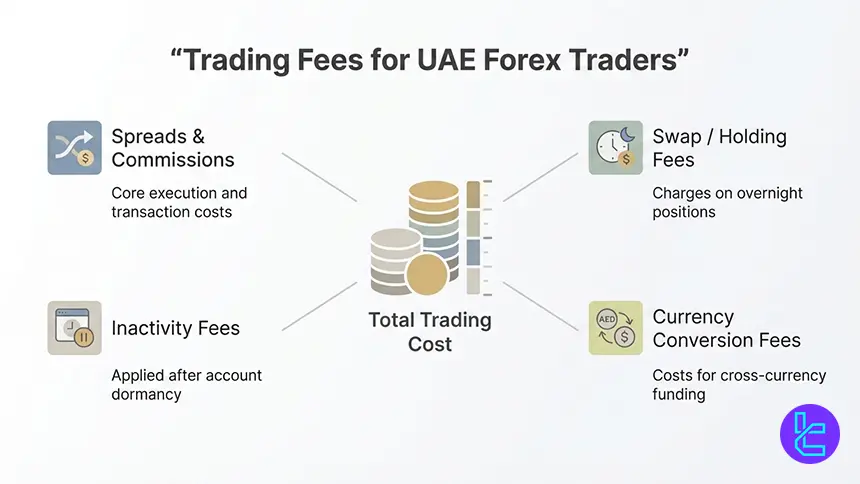

What Trading Fees Should UAE Traders Expect?

Forex trading costs for UAE traders consist of both trading and non-trading fees, which together determine the true cost of executing and maintaining positions. These costs typically include spreads, commissions, overnight swaps or holding fees, and administrative charges such as inactivity or currency conversion fees.

While low spreads are often highlighted in broker promotions, they do not always translate into lower overall costs. Commission structures, swap rates, execution quality, and non-trading fees can significantly affect long-term profitability, making full fee transparency essential.

- Spreads and commissions form core trading costs;

- Swap or holding fees apply to overnight positions;

- Inactivity fees may apply after dormancy;

- Currency conversion charges impact cross-currency funding.

What Is the Minimum Capital Required for Forex Trading in the UAE?

There is no legal minimum capital requirement set by UAE regulators for Forex trading. Instead, each broker determines its own minimum deposit threshold, which commonly ranges from $5 to $1,000, depending on the broker, account type, and regulatory entity.

While low minimum deposits make Forex trading accessible, risk-based position sizing plays a far more important role than account size. Effective risk management, realistic leverage use, and controlled exposure help traders protect capital regardless of their starting balance.

Forex Trading Tax in the UAE

The United Arab Emirates does not levy personal income tax or capital gains tax on foreign exchange trading profits earned by individual traders. This tax-free environment makes the UAE an attractive jurisdiction for active, high-volume, and professional Forex traders operating on a personal basis.

Different rules may apply when Forex trading is conducted through a company or business structure. Corporate entities can be subject to UAE corporate tax regulations depending on licensing, turnover, and jurisdiction, while offshore income for individuals remains unaffected under the current tax policy.

DFSA Leverage Restrictions for UAE Traders

DFSA-regulated Forex brokers apply conservative leverage limits to reduce excessive risk for retail traders in the UAE. Under DFSA rules, maximum leverage is typically capped at 1:50, depending on the instrument and client classification, aligning with global risk control standards.

Higher leverage levels are available only through professional client classification or via offshore broker entities, where regulatory protections may be reduced. Since leverage amplifies both gains and losses, understanding these limits is critical for managing exposure in volatile market conditions.

What Trading Platforms Are Popular Among UAE Brokers?

Trading platforms used by UAE Forex brokers are dominated by MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and broker proprietary systems. Platform selection directly affects execution speed, charting depth, order control, and the ability to deploy automated or algorithmic strategies.

Rather than popularity alone, UAE traders benefit most from platforms that align with their trading style. Scalping, swing trading, and algorithmic trading often require different execution models, indicators, and automation support, making platform compatibility more important than brand recognition.

Professional Forex Accounts for UAE Traders

Professional Forex accounts are designed for experienced UAE traders seeking higher leverage, advanced tools, and institutional style execution. These accounts operate under different regulatory classifications and often waive certain retail protections to provide greater trading flexibility.

Eligibility typically depends on trading experience, portfolio size, and transaction volume. While professional accounts unlock advanced features, they carry higher risk exposure and are not suitable for beginners or undercapitalized traders.

Helpful Links for UAE Traders

Accessing official regulatory and government resources helps UAE traders verify broker legitimacy, understand tax policies, and stay compliant with local financial regulations. These sources provide direct, up-to-date information without commercial bias.

Relying on verified institutions reduces exposure to misinformation, unlicensed brokers, and misleading promotional content.

Forex Trading in the UAE vs Other Regions

Comparison Factor | United Arab Emirates | |||

Primary Regulator | Dubai Financial Services Authority (DFSA), Dubai International Financial Centre (DIFC) | Monetary Authority of Singapore (MAS) | Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI) | Financial Sector Conduct Authority (FSCA) |

Regulatory Framework | National framework | National framework under MAS (non-EU) | National regulation under SEBI | National regulation under FSCA (non-EU) |

Retail Leverage Cap (Forex Majors) | 1:50 | 1:20 | 1:50 | Not strictly capped; higher leverage common |

Investor Protection Level | High | High (prudential & conduct-based) | Moderate to high | High |

Negative Balance Protection | Not mandatory; applied by many brokers | Not mandatory; applied by many brokers | Mandatory | Commonly applied by brokers |

Client Fund Segregation | Mandatory | Mandatory under MAS rules | Required for SEBI-regulated brokers | Required under FSCA rules |

Broker Transparency Requirements | Transparent risk disclosures | Strict disclosure, capital, and reporting standards | Strict disclosure for SEBI-regulated Firms | Strong conduct and disclosure standards |

Broker Availability | DFSA-regulated and international | MAS-licensed local and global brokers | Limited to SEBI-regulated brokers on NSE and BSE; offshore brokers are widely used | Mix of FSCA-licensed and international brokers |

Access to International Brokers | Yes | High (regional financial hub) | Moderate to high | High (global brokers target ZA market) |

Typical Trading Platforms | MT4, MT5, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView, cTrader | MT4, MT5, cTrader, proprietary platforms |

Maximum Loss Protection | Entity-dependent | Entity-dependent | Cannot lose more than the deposit | Often applied but entity-dependent |

Tax Treatment of Forex Profits | Tax-free | Taxable as income depending on activity (IRAS rules) | Taxed as business income or capital gains under Indian tax law | Taxed as income or capital gains |

Conclusion and Expert Suggestions

The UAE remains one of the most attractive Forex trading hubs globally, supported by DFSA and SCA regulation, tax-free trading for individuals, and advanced financial infrastructure.

Leading brokers offer swap-free Islamic accounts, competitive spreads from 0.0 pips, MetaTrader and TradingView platforms, and access to thousands of global instruments.

Selecting the best Forex broker in the UAE requires comparing measurable factors such as regulation, trading costs, execution quality, platform reliability, and trust scores.

Brokers like IC Markets, AvaTrade, XM, Exness, Capital.com, Plus500, Swissquote, and IG stand out by combining strong oversight with trader-focused conditions for both retail and professional traders.

We select top brokers in the UAE according to TradingFinder’s Forex methodology with a focus on measurable factors such as trading costs, spread stability, execution quality, and platform performance.