Neteller is one of the most widely used e-wallets in the forex industry. Many top-tier forex brokers support Neteller to provide instant deposits, efficient withdrawals, and reduced reliance on traditional banking systems.

The best Neteller forex brokers combine seamless payment processing with strong regulation, competitive trading costs, and reliable execution across major platforms.

| Fusion Markets | |||

| FxGlory | |||

| FXGT | |||

| 4 |  | TMGM | ||

| 5 |  | ERRANTE | ||

| 6 |  | FxPro | ||

| 7 |  | Pocket Option | ||

| 8 |  | FXTM |

Neteller Forex Brokers Ranking in Trustpilot

In this ranking, Neteller forex brokers are compared according to their Trustpilot scores, and total number of reviews.

Broker Name | Trustpilot Rating | Number of Reviews |

Fusion Markets | 5937 | |

65 | ||

FXGT | 1528 | |

TMGM | 11,634 | |

8,343 | ||

FxPro | 870 | |

Pocket Option | 25 | |

FXTM | 1074 |

Neteller Payment Fees Charged by Forex Brokers

Neteller payment fees vary across brokers and can directly affect overall trading costs. While Neteller itself may apply currency conversion fees, brokers can impose additional charges depending on their internal payment policies.

Broker Name | Deposit Fee | Withdrawal Fee |

0 | 0 | |

FxGlory | 0 | 0 |

Fusion Markets | 0 | 0 |

TMGM | 0 | 0 |

Tickmill | 0 | 0 |

0 | 0 | |

AvaTrade | 0 | 0 |

Errante | 0 | 1% |

Waiting Time for Neteller Deposits and Withdrawals

Neteller deposits are usually processed instantly or within a few minutes once the transaction is approved, allowing traders to fund their accounts and enter the market without delay.

Broker Name | Deposit Time | Withdrawal Time |

Instant | Instant | |

FxGlory | Instant | Instant |

Pocket Option | Instant | Instant |

FXGT | Instant | Instant |

Errante | Instant | Instant |

Instant | Instant | |

OctaFX | Instant | Instant |

Pepperstone | Instant | Within 24 Business Hours |

Minimum Neteller Deposit and Withdrawal in Forex Brokers

Neteller minimum deposit and withdrawal limits vary across Forex brokers and are influenced by account type, regional rules, and the broker’s internal payment policies.

Broker Name | Min. Deposit Amount | Min. Withdrawal Amount |

FXGT | $5 | $5 |

$100 | $5 | |

TMGM | $100 | $10 |

FxGrow | $100 | $10 |

FBS | $5 | $4 |

OctaFX | $25 | $5 |

$200 | $0 | |

Tickmill | $100 | $25 |

Top 6 Neteller Forex Brokers

In the following list, you will find six Forex brokers that stand out for their Neteller compatibility, competitive trading environments, and proven reliability.

Errante

Errante is a Forex and CFD broker founded in 2018, offering trading services to both retail and professional clients through a multi-platform environment.

The broker operates under CySEC regulation for its EU entity and FSA Seychelles for international clients, allowing broader market access and higher leverage.

Errante supports advanced trading conditions, including up to 1:1000 leverage, EA compatibility, ECN execution, and zero commission on most account types.

Traders can access over 150 tradable instruments across Forex, metals, indices, energy, stocks, and cryptocurrencies after compeliting Errante verification. Investment features such as Copy Trading, PAMM, Errante rebate and MAM accounts make it suitable for both self-directed traders and passive investors.

With a $50 minimum deposit, multiple Neteller-supported funding methods, Islamic accounts, and 24/7 multilingual support, Errante positions itself as a flexible broker for global traders, despite its relatively short operational history.

Account Types | Standard, Premium, VIP, Tailor Made |

Regulating Authorities | CySEC, FSA Seychelles |

Minimum Deposit | $50 |

Deposit Methods | Bank Wire, Visa, MasterCard, Skrill, Neteller, SticPay, Volet, Crypto |

Withdrawal Methods | Bank Wire, Visa, MasterCard, Skrill, Neteller, SticPay, Volet, Crypto |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

Errante Pros and Cons

The following table summarizes the main advantages and disadvantages of Errante.

Pros | Cons |

Regulated by CySEC and FSA | Short operational history |

High leverage up to 1:1000 | No Cent account |

Multiple platforms including TradingView | Limited swap-free duration |

Copy Trading, PAMM, and MAM available | Trustpilot score relatively low |

Zero commission on most accounts | — |

FXGT

FXGT is a multi-asset broker launched in 2019, designed around flexible account selection and high-leverage trading conditions.

It operates through several entities regulated by FSA Seychelles, FSCA South Africa, VFSC Vanuatu, and CySEC for institutional clients, while maintaining segregated funds and negative balance protection across its regulated structure.

Trading costs can be very competitive with FXGT rebate, also spreads start from 0 on the ECN Zero account and commissions are $3 per side for FX pairs and up to $5 for metals.

Entry requirements are low, with deposits starting from $5 to $10 depending on the method and account.

FXGT also includes features like copy trading, an economic calendar, Islamic accounts on request, and 24/7 support, but you should note that to access all these features, you need to do FXGT registration.

Account Types | Standard+, ECN Zero, Mini, Optimus, Pro |

Regulating Authorities | FSA, FSCA, VFSC, CySEC (institutional only) |

Minimum Deposit | $5 (varies by method and account) |

Deposit Methods | Visa, Mastercard, Bitwallet, Sticpay, Instant Local Bank Transfers or QR, Neteller, Apple Pay, Google Pay |

Withdrawal Methods | Visa, Mastercard, Bitwallet, Sticpay, Neteller, Apple Pay, Google Pay |

Maximum Leverage | Up to 1:5000 |

Trading Platforms and Apps | MetaTrader 4, MetaTrader 5 |

FXGT Pros and Cons

In this section, the main pros and cons of FXGT are reviewed to support informed decision-making for traders and investors.

Pros | Cons |

Low minimum deposit from $5 | Limited tradable symbols in some categories |

High leverage up to 1:5000 | Limited advanced educational video content |

Multiple regulatory licenses across regions | No dedicated trading signals |

MT4 and MT5 support | Not available for U.S. clients |

Tight pricing on ECN Zero with low commissions | Relatively new broker since 2019 |

Pocket Option

Pocket Option is an online broker launched in 2017 by Gembell Limited and registered in the Marshall Islands, operating under Mwali International Services Authority (MISA) regulation with license T2023322.

It offers Forex and CFD trading on MetaTrader 4 and MetaTrader 5 with floating spreads from about 1.0 pips, leverage up to 1:1000, and zero commissions on trades in its MT4 and MT5 environment.

The broker also runs its own Pocket Option platform for quick trading, mainly built around binary options, alongside a shares trading option via MT5.

Minimum deposit starts at $5 and typical withdrawals start from $10, with many methods processed within 24 hours. It provides tools such as social trading, a signal bot, demo access, and frequent promotions.

A key limitation is regulation, since MISA is considered an offshore tier 4 authority, and the broker is restricted in many regions.

Account Types | Quick Trading, MT4, MT5, Shares Trading, Demo |

Regulating Authorities | MISA (Mwali International Services Authority) |

Minimum Deposit | $5 |

Deposit Methods | Visa, MasterCard, USDT, bank wire, Perfect Money, Skrill, Neteller, WebMoney, crypto and more |

Withdrawal Methods | Visa, MasterCard, USDT, bank wire, Perfect Money, WebMoney, crypto, Skrill, Neteller and more |

Maximum Leverage | Up to 1:1000 |

Trading Platforms and Apps | MetaTrader 4, MetaTrader 5, Pocket Option platform |

Pocket Option Pros and Cons

Below, you will find a clear and easy-to-follow summary of Pocket Option advantages and disadvantages for everyday traders.

Pros | Cons |

Low minimum deposit from $5 | Offshore regulation with limited top tier oversight |

MT4 and MT5 support with $0 commissions | Limited variety in traditional Forex account structures |

1:1000 maximum leverage | Not available in many countries and regions |

50+ payment methods with low broker-side fees | Trustpilot profile removed, reducing public review visibility |

Wide range of instruments across CFDs and shares | VPN use is prohibited and can trigger restrictions |

FxGlory

FxGlory is a Forex broker established in 2011 and headquartered in Saint Lucia. It focuses on a narrow product list including currencies, metals, and oil, but compensates with aggressive trading conditions such as leverage up to 1:3000, micro lot trading from 0.01 lot, and commission free trading across its accounts.

FxGlory trading platforms supports MetaTrader 4 and MetaTrader 5, offers both Market Execution and Instant Execution, and provides swap free (Islamic) accounts.

FxGlory bonus offers a 50% deposit bonus on deposits, plus incentives such as a crypto deposit discount, and it allows access with a $1 minimum deposit.

Funding options in FxGlory dashboard include multiple e wallets and cards, alongside crypto and wire transfers.

The main concern is credibility, since FxGlory is not licensed by major regulators and is only registered in Saint Lucia, which does not equal regulatory supervision.

Traders should also note reported withdrawal fees and a limited number of tradable instruments compared with multi asset brokers.

Account Types | Standard, Premium, VIP, CIP |

Regulating Authorities | None (registered in Saint Lucia) |

Minimum Deposit | $1 |

Deposit Methods | Wire transfer, credit and debit card, PayPal, Neteller, Skrill, WebMoney, Sticpay, Perfect Money, crypto, Zelle, plus others |

Withdrawal Methods | Wire transfer, credit and debit card, PayPal, Neteller, Skrill, WebMoney, Sticpay, Perfect Money, crypto, Zelle, plus others |

Maximum Leverage | Up to 1:3000 |

Trading Platforms and Apps | MetaTrader 4, MetaTrader 5 |

FxGlory Pros and Cons

This section outlines the main advantages and disadvantages of FxGlory in a concise and structured format.

Pros | Cons |

Very low minimum deposit ($1) | No regulation by major financial authorities |

High leverage up to 1:3000 | Limited tradable markets and symbols |

MT4 and MT5 support with EA compatibility | No copy trading, PAMM, or managed investment options |

Commission free trading and fixed or low spread structure | High minimum deposits for Premium, VIP, and CIP tiers |

Swap free account availability and 24/7 support | Withdrawal fee structure can be expensive depending on method |

TMGM

TMGM (TradeMax Global Markets) is an Australia based Forex and CFD broker that launched in 2013 and offers multi asset access across Forex, stocks, indices, commodities, energies, and crypto.

It operates under a multi jurisdiction framework led by ASIC for Australian residents, alongside offshore entities regulated by VFSC, FSC, and CMA that can offer higher leverage up to 1:1000.

In TMGM dashboard, Traders can choose between CLASSIC and EDGE/ECN accounts, with spreads from 1.0 pips in Classic and from 0.0 pips in Edge, where commission is $3.5 per lot.

Platforms include MT4, MT5, IRESS, and the TMGM mobile app. The broker supports copy trading and social trading via HUBx and runs a rewards program that lets users redeem points for TMGM rebate or gifts.

Account Types | EDGE/ECN, CLASSIC, plus IRESS tiers (Standard, Premium, Gold) for eligible users |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu), FSC (Mauritius), CMA (Kenya), plus FSA (Seychelles) mentioned in broker summary |

Minimum Deposit | $100 |

Deposit Methods | VISA, MasterCard, bank transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Union Pay, Fasapay, crypto (USDT, USDC) |

Withdrawal Methods | Bank transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, crypto (USDT, USDC) |

Maximum Leverage | Up to 1:1000 (varies by entity, 1:30 under ASIC) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, IRESS, TMGM Mobile App |

Pros and Cons of TMGM

The following summary presents TMGM strengths and weaknesses in a clear and professional manner.

Pros | Cons |

Tier 1 regulation via ASIC for the main entity | Inactivity fee applies after a period of dormancy |

Very large product list, including 12,000 plus stocks | Low diversity in standard account types (Classic, Edge) |

Tight pricing on EDGE/ECN with spreads from 0.0 pips | Protection terms vary by offshore entity |

MT4, MT5, IRESS, and mobile app support | MetaTrader experience can feel dated for some users |

Copy trading and social trading with rewards program | Restricted in several jurisdictions such as USA and Japan |

Fusion Markets

Fusion Markets is a multi-jurisdiction Forex and CFD broker founded by Phil Horner and backed by Glen Eagle Securities. It operates through ASIC in Australia and VFSC in Vanuatu, offering segregated client funds held with HSBC and National Australia Bank.

Fusion Markets dashboard supports three account types, Zero, Classic, and Swap Free, with $0 minimum deposit and trade sizes from 0.01 lots.

Pricing is built around low spreads, with Zero spreads from 0.0 pips and a $4.5 commission per lot, while Classic starts from 0.9 pips with $0 commission.

Fusion Markets supports MetaTrader 4, MetaTrader 5, TradingView, and cTrader, and offers copy trading via Fusion+ plus MAM and PAMM style options.

After going through Fusion Markets verification leverage reaches 1:500 under VFSC, while ASIC accounts are capped at 1:30 and include negative balance protection.

Key limitations include no proprietary platform, limited educational materials, and no investor compensation scheme.

Account Types | Zero, Classic, Swap Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, bank wire, crypto, Skrill, Neteller, and more |

Withdrawal Methods | PayPal, Perfect Money, bank wire, crypto, Skrill, Neteller, and more |

Maximum Leverage | Up to 1:500 (VFSC), up to 1:30 (ASIC) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

Here is a focused overview of Fusion Markets pros and cons for traders seeking balanced and reliable insights.

Pros | Cons |

$0 minimum deposit and low entry barrier | No investor protection fund or compensation scheme |

Very competitive pricing and raw spread option | Limited educational resources |

ASIC and VFSC regulatory coverage | No proprietary trading platform |

MT4, MT5, TradingView, and cTrader support | Product list is smaller than multi asset giants |

Copy trading, Fusion+, MAM and PAMM options | Negative balance protection depends on entity |

What is Neteller?

Neteller is a globally recognized digital wallet and online payment service widely used in Forex, CFD, and online trading industries. It allows traders to deposit and withdraw funds without directly sharing bank or card details with brokers, which significantly enhances transaction privacy.

Neteller operates as an intermediary between the trader and the broker, processing payments securely and efficiently.

Originally launched as a solution for online merchants, Neteller has evolved into a preferred payment method among active traders due to its speed, multi currency support, and broad broker acceptance.

Most Neteller Forex brokers support instant deposits, making it suitable for traders who require fast market access.

Key characteristics of Neteller include:

- Operates as an e wallet linked to bank cards or bank accounts

- Supports multiple base currencies including USD, EUR, and GBP

- Widely accepted by regulated and offshore Forex brokers

- Enables instant deposits and fast withdrawals

- Offers integration with prepaid cards for fund access

For traders, Neteller functions as a flexible bridge between traditional banking systems and online trading platforms, reducing friction in funding and cashing out trading accounts.

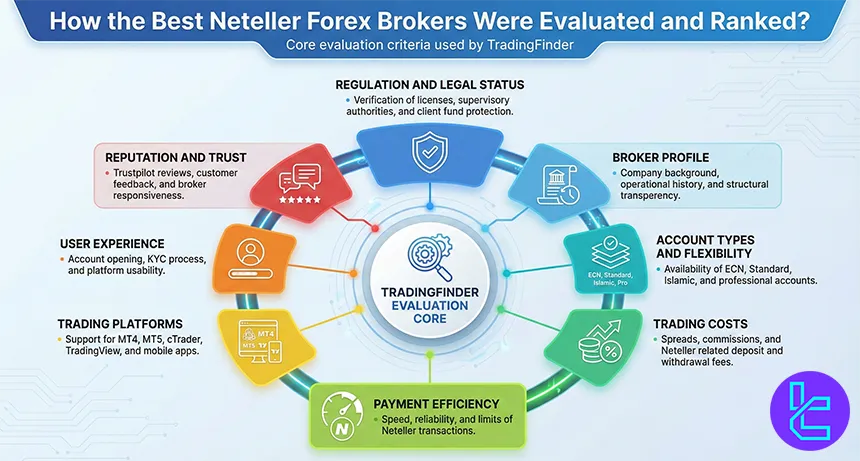

How the Best Neteller Forex Brokers Were Evaluated and Ranked?

Evaluating Forex brokers requires precision, transparency, and deep market understanding, as traders entrust real capital to these platforms.

TradingFinder applies a structured Forex methodology to rank the best Neteller Forex brokers, using data driven analysis rather than promotional claims. This process is handled by experienced Forex specialists who test broker services in real trading environments.

The ranking framework is built on 19 internal metrics, with final scores reflecting the most impactful factors for Neteller based trading.

Core evaluation criteria used by TradingFinder include:

- Regulation and legal status: Verification of licenses, supervisory authorities, and client fund protection;

- Broker profile: Company background, operational history, and structural transparency;

- Account types and flexibility: Availability of ECN, Standard, Islamic, and professional accounts;

- Trading costs: Spreads, commissions, and Neteller related deposit and withdrawal fees;

- Payment efficiency: Speed, reliability, and limits of Neteller transactions;

- Trading platforms: Support for MT4, MT5, cTrader, TradingView, and mobile apps;

- User experience: Account opening, KYC process, and platform usability;

- Reputation and trust: Trustpilot reviews, customer feedback, and broker responsiveness.

Each factor is weighted based on its real impact on traders’ costs, safety, and execution quality. Final rankings represent a balanced assessment rather than strength in a single area.

All evaluations are conducted by TradingFinder analysts, whose goal is to provide objective, practical, and experience based broker comparisons aligned with real trading conditions.

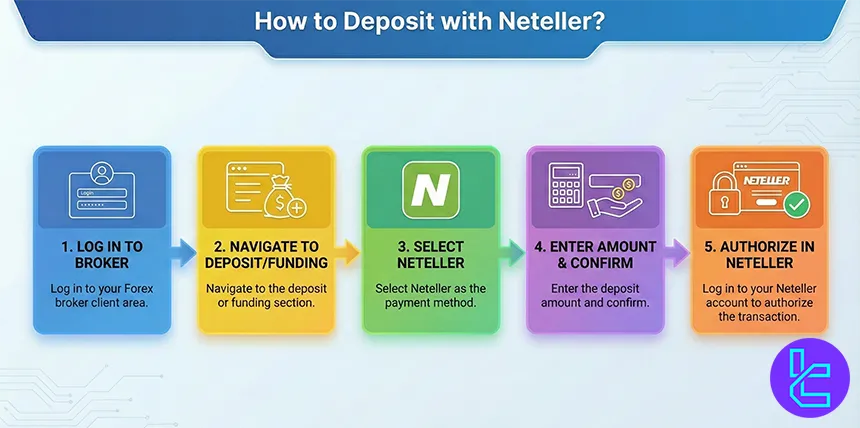

How to Deposit with Neteller?

Depositing funds with Neteller into a Forex trading account is a straightforward process designed for speed and convenience.

Most brokers that support Neteller enable instant deposits, allowing traders to fund their accounts and start trading within minutes.

The typical Neteller deposit process follows these steps:

- Log in to your Forex broker client area

- Navigate to the deposit or funding section

- Select Neteller as the payment method

- Enter the deposit amount and confirm

- Log in to your Neteller account to authorize the transaction

Once confirmed, funds are usually credited to the trading account instantly or within a few minutes.

Brokers often define minimum and maximum deposit limits, which may vary depending on account type and regulatory jurisdiction.

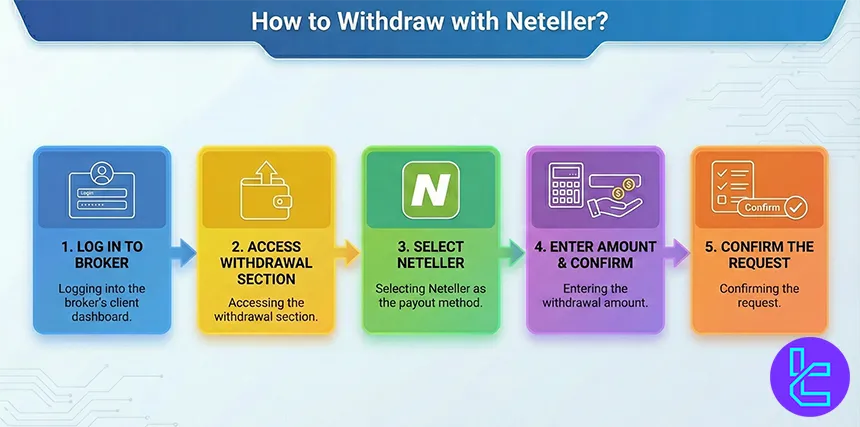

How to Withdraw with Neteller?

Withdrawing funds via Neteller is generally fast and efficient, provided that the trader has completed account verification requirements.

Most Forex brokers require withdrawals to be processed through the same payment method used for deposits, making Neteller a common choice for consistent fund management.

The standard Neteller withdrawal process includes:

- Logging into the broker’s client dashboard

- Accessing the withdrawal section

- Selecting Neteller as the payout method

- Entering the withdrawal amount

- Confirming the request

After broker approval, funds are transferred to the Neteller wallet, typically within 24 to 48 hours. From there, traders can hold funds in their Neteller balance, transfer them to a bank account, or use a linked card.

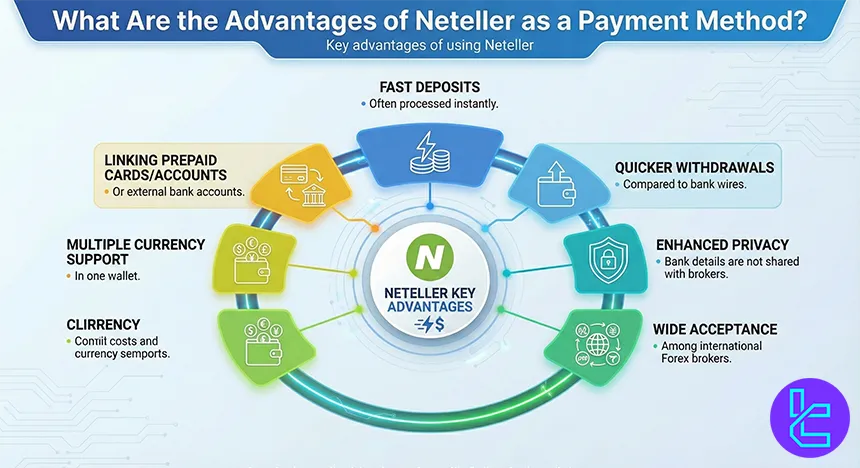

What Are the Advantages of Neteller as a Payment Method?

Neteller offers several advantages that make it a preferred payment solution among Forex traders, especially those operating across multiple brokers or regions. Its structure reduces reliance on traditional banking systems while offering flexibility and speed.

Key advantages of using Neteller include:

- Fast deposits, often processed instantly

- Quicker withdrawals compared to bank wires

- Enhanced privacy since bank details are not shared with brokers

- Wide acceptance among international Forex brokers

- Support for multiple currencies in one wallet

- Ability to link prepaid cards or external bank accounts

For traders who frequently move capital between brokers or trading accounts, Neteller simplifies fund management by centralizing transactions. It also helps reduce delays caused by international banking procedures.

Additionally, Neteller’s global availability makes it suitable for traders in regions with limited access to international bank transfers.

Overall, it serves as a practical solution for both short term traders and long term investors seeking efficiency and control over their trading funds.

Neteller Safety; Is it Safe?

Neteller is considered a secure payment method and operates under strict financial and technological security standards. The platform employs advanced encryption protocols to protect user data and transaction details, ensuring confidentiality across all operations.

Safety features provided by Neteller include:

- Two factor authentication for account access

- Encrypted data transmission

- Continuous fraud monitoring systems

- Segregation of client funds

- Regulatory oversight in multiple jurisdictions

In addition to platform level security, Neteller minimizes risk by acting as an intermediary, meaning traders do not expose their banking details directly to Forex brokers.

However, overall safety also depends on user behavior. Traders should enable all security features, avoid public networks, and ensure they only transact with regulated Forex brokers.

When used correctly, Neteller is widely regarded as a reliable and safe payment solution within the online trading ecosystem.

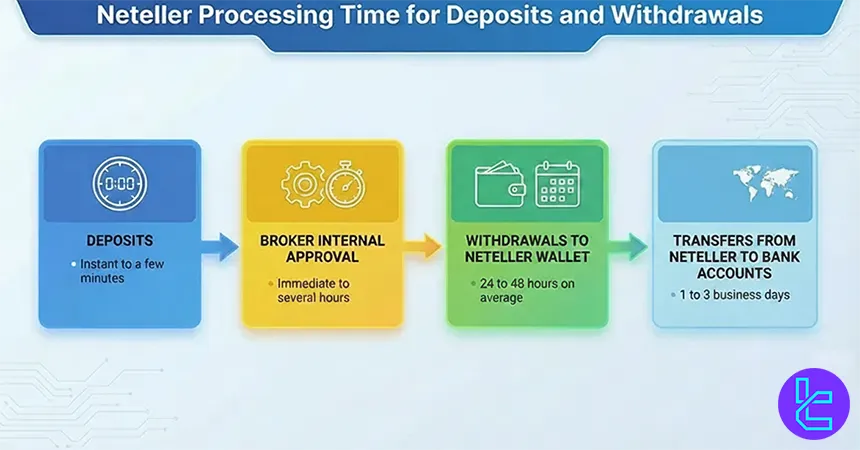

Neteller Processing Time for Deposits and Withdrawals

Processing speed is one of Neteller’s strongest advantages in Forex trading environments. Deposits made via Neteller are usually instant, allowing traders to react quickly to market opportunities without waiting for bank confirmation.

Typical processing times are as follows:

- Deposits: Instant to a few minutes

- Broker internal approval: Immediate to several hours

- Withdrawals to Neteller wallet: 24 to 48 hours on average

- Transfers from Neteller to bank accounts: 1 to 3 business days

While Neteller itself processes transactions rapidly, the overall withdrawal timeline largely depends on the broker’s internal review procedures. Regulated brokers may take longer due to compliance checks.

Factors that can affect processing time include account verification status, withdrawal amount, and regional regulations.

Despite these variables, Neteller remains significantly faster than traditional wire transfers, making it a practical choice for active Forex traders.

Neteller Fees for Payments

Neteller applies a structured fee model that varies based on transaction type, funding method, currency, and account tier.

For Forex traders, understanding these costs is essential because most fees are applied at the wallet level rather than by brokers.

Key Neteller payment fees include:

- Wallet funding fees: Deposits made via credit or debit cards usually incur a fee of around 2.5%, especially for amounts below $20,000. Larger deposits may qualify for reduced or zero fees depending on the region and payment method;

- Broker deposits: Most Forex brokers do not charge additional fees for Neteller deposits, meaning costs mainly depend on how the Neteller wallet itself is funded;

- Withdrawal fees: Bank withdrawals typically involve a fixed fee of approximately $10, while card withdrawals can range between 0% and 7.5%, depending on the card issuer and country;

- Transfers to other wallets: Sending funds from Neteller to another e-wallet may cost around 3.49% of the transferred amount;

- Currency conversion costs: Neteller applies a foreign exchange markup of up to 4.49%, which can be reduced to nearly 1% for VIP account holders;

- Inactivity fee: Accounts with no activity for six months may be charged a $5 monthly maintenance fee.

Neteller Vs Other Payment Methods; Which is Better?

Choosing the right payment method for Forex trading depends on speed, broker acceptance, fees, and regional accessibility. Neteller is widely used in the Forex industry due to its fast processing times and strong integration with international brokers.

Compared with alternatives like Skrill and PayPal, Neteller offers broader broker support, especially among offshore and high leverage brokers.

Parameter | Neteller | Skrill | PayPal | Sticpay | Wise | Revolut |

Broker Acceptance | Very high among Forex brokers | Very high | Medium | Medium | Low | Low |

Deposit Speed | Instant | Instant | Instant | Instant | 1-2 business days | Instant to 1 day |

Withdrawal Speed | Instant to 24 hours | Instant to 24 hours | 1-2 business days | Instant to 24 hours | 1-3 business days | 1-2 business days |

Transaction Fees | Medium | Medium | High | Medium | Low | Low |

Supported Currencies | 25+ | 40+ | 25+ | 10+ | 50+ | 30+ |

Security & Compliance | High, regulated | High, regulated | Very high | Medium | Very high | Very high |

Typical Forex Deposit Limits | From $10 | From $10 | From $10–$20 | From $5 | From $50 | From $10 |

Regional Availability | Global, some restrictions | Global | Global | Limited regions | Global | Global |

Conclusion

Throughout this guide, brokers were compared using Trustpilot scores, Neteller fees, processing times, and minimum deposit and withdrawal limits.

Top ranked brokers such as Fusion Markets, TMGM, Errante, and FXGT demonstrate that strong Neteller support often goes hand in hand with competitive spreads, flexible leverage options, and access to major platforms like MT4, MT5, cTrader, and TradingView.

Overall, Neteller proves to be a practical and efficient payment solution for active Forex traders who value speed, flexibility, and global accessibility.

For more information about our broker evaluation framework, please visit our TradingFinder Forex methodology page.