Online Forex Brokers offer trading services of foreign exchange, the largest and most liquid market in the world. Traders can execute orders in CFDs, commodities, indices, and bonds in these brokerages.

Here is a list of the best Forex brokers that offer online trading services to their customers allowing them to trade on MT4, MT5, cTrader, or other trading platforms.

| eToro | |||

| taurex | |||

| FBS | |||

| 4 |  | OctaFX | ||

| 5 |  | OQtima | ||

| 6 |  | alpari | ||

| 7 |  | pepperstone | ||

| 8 |  | PUPRIME | ||

| 9 |  | TeleTrade | ||

| 10 |  | TMGM |

Trustpilot Ratings of Online Forex Brokers

Traders can check the trustworthiness of the top online Forex brokers in the table below.

Broker | Trustpilot Rating | Number of Reviews |

4.5/5 ⭐ | 100+ | |

FBS | 4.3/5 ⭐ | 8500+ |

eToro | 4.2/5 ⭐ | 30000+ |

Pepperstone | 4.2/5 ⭐ | 3000+ |

OctaFX | 3.9/5 ⭐ | 9000+ |

Taurex | 3.9/5 ⭐ | 300+ |

800+ | ||

PU Prime | 3.2/5 ⭐ | 1500+ |

Alpari | 3.1/5 ⭐ | 300+ |

TeleTrade | 1.9/5 ⭐ | 50+ |

Minimum Spreads in Online Forex Brokers

Having access to inter-bank liquidity allows brokers to offer low spreads from 0.0 pips. Here are the minimum spreads in the best online Forex brokers.

Brokers | Minimum Spreads |

0.0 Pips | |

HFM | 0.0 Pips |

XM | 0.0 Pips |

0.0 Pips | |

IC Markets | 0.0 Pips |

LiteFinance | 0.0 Pips |

PrimeXBT | 0.1 Pips |

0.2 Pips | |

AvaTrade | 0.6 Pips |

IG | 0.6 Pips |

Account Types and Leverage in Online Forex Brokers

Having access to a wide-variety of account types and high leverage is one of the key factors when choosing an online Forex broker. The table below provides a comparison of these to aspects in well-known brokers.

Broker | Account Types | Maximum Leverage |

Standard | 1:3000 | |

FXTM | Advantage, Advantage Plus, Advantage Stock | 1:3000 |

Taurex | Standard Zero, Pro Zero, Raw | 1:2000 |

TMGM | Classic, Edge | 1:1000 |

Admirals | Zero, Invest, Trade | 1:1000 |

Tickmill | Classic, Raw | 1:1000 |

Standard, Razor | 1:500 | |

Elev8Trader, MT4, MT5 | 1:500 | |

Eightcap | Standard, Raw | 1:500 |

OANDA | Standard, Elite Trader | 1:300 |

Number of Tradable Instruments in Online Forex Brokers

The table below shows the number of tradable instruments in the top Online Forex brokers.

Broker | Number of Tradable Assets |

CMC Markets | 12000+ |

5000+ | |

Forex.com | 4500+ |

IC Markets | 2250+ |

1500+ | |

XM | 1400+ |

FBS | 550+ |

HFM | 500+ |

Fusion Markets | 250+ |

Exness | 200+ |

Top 8 Online Forex Brokers

The following paragraphs offer traders a deeper insight into the each of the best online Forex broker that traders can choose from.

These brokers are regulated by top financial authorities such as FCA, CySEC, ASIC, or CFTC and offer leveraged trading services for Forex, CFDs, commodities, indices, bonds, ETFs, and more.

eToro

Founded in 2007 by David Ring, Ronen Assia, and Yoni Assia, eToro operates as a multi-asset brokerage headquartered in Tel Aviv under the legal entity eToro Ltd.

The broker provides market access across Stocks, ETFs, Forex, Commodities, Indices, and Cryptocurrencies through a proprietary trading platform.

The firm supports several investment frameworks, including CopyTrader, Smart Portfolios, and Crypto Staking, enabling portfolio diversification beyond conventional CFD-based trading.

From a regulatory perspective, eToro functions through multiple licensed entities under FCA, CySEC, and ASIC. Additional oversight is provided by the FSRA in Abu Dhabi, the MFSA in Malta, and the GFSC in Gibraltar.

Investor protection schemes such as FSCS in the UK (up to £85,000) and the Investor Compensation Fund (ICF) in Cyprus (up to €20,000) apply depending on the jurisdiction.

After completing the eToro registration, The broker offers four primary account categories including Personal, Professional, Corporate, and Islamic accounts, with minimum deposits starting from $10.

Funding infrastructure supports payment channels such as PayPal, Skrill, Neteller, Trustly, credit or debit cards, and bank transfers.

Trading conditions vary across asset classes, with leverage typically capped at 1:30 for retail clients in regulated regions and extended up to 1:400 for eligible professional accounts.

While the platform integrates portfolio tracking tools such as ProCharts and supports order management features including Stop Loss and Take Profit, it does not offer MetaTrader 4 or MetaTrader 5 compatibility.

Customer assistance is delivered through email, live chat, and ticket systems, without direct phone-based support.

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA, ASIC, FSA, Gibraltar FSC |

Minimum Deposit | From $10 |

Deposit Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Trustly, iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Trustly, iDEAL, Sofort, Przelewy24 |

Maximum Leverage | Up to 1:30 (Retail) / Up to 1:400 (Professional) |

Trading Platforms & Apps | Proprietary Web Platform, eToro Mobile App (iOS & Android) |

eToro Pros and Cons

Here are the benefits and drawbacks of trading with the eToro broker.

Pros | Cons |

Regulated by multiple financial authorities including FCA, CySEC, and ASIC | No support for MetaTrader 4 or MetaTrader 5 platforms |

Access to social trading features such as CopyTrader and Smart Portfolios | Customer support does not include phone assistance |

Offers Islamic (swap-free) account option | Inactivity fee of $10 after 12 months of no activity |

Wide range of tradable assets including stocks, ETFs, Forex, and crypto | Withdrawal fee of $5 on USD-based transactions |

Taurex

Taurex is a multi-asset Forex and CFD broker established in 2017 by Nick Cooke and headquartered in Seychelles, operating through Zenfinex Global Limited and Zenfinex Limited.

Its UK-based entity is authorized by the Financial Conduct Authority (FCA), while international services are supervised by the Financial Services Authority (FSA Seychelles) under license SD092. All entities require complete Taurex verification.

The broker offers access to more than 1,500 tradable instruments after completing the Taurex registration across key markets, including Forex, indices, commodities, stocks, cryptocurrencies, and ETFs.

Clients can trade via widely adopted platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or Taurex’s proprietary mobile and web-based applications, all of which support algorithmic strategies and manual execution environments.

Taurex provides three primary account structures (Standard Zero, Pro Zero, and Raw) with a minimum deposit starting from $100. Trading conditions vary by account type, with spreads from 1.6 pips on Standard Zero and commission-based pricing up to $4 per lot on Raw accounts.

The broker supports multiple base currencies, including USD, EUR, and GBP, and enables Copy Trading and PAMM investment solutions via the features in the Taurex dashboard.

Depending on jurisdiction, leverage can reach up to 1:1000, with a margin call level of 100% and a stop-out threshold at 30%.

FCA-regulated clients benefit from segregated funds, negative balance protection, and eligibility for the Financial Services Compensation Scheme (FSCS) of up to £85,000.

Funding methods include bank transfers, credit/debit cards, Skrill, Neteller, and cryptocurrencies, while support is available through email, live chat, phone, and ticketing systems on a 24/5 basis.

Account Types | Standard Zero, Pro Zero, Raw, Islamic, Demo |

Regulating Authorities | Financial Conduct Authority (FCA), Financial Services Authority (FSA) |

Minimum Deposit | From $100 |

Deposit Methods | Bank Transfer, Credit/Debit Card, Skrill, Neteller, Cryptocurrencies |

Withdrawal Methods | Bank Transfer, Credit/Debit Card, Skrill, Neteller, Cryptocurrencies |

Maximum Leverage | Up to 1:1000 (Retail), Up to 1:30 under FCA regulation |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), Taurex Proprietary App |

Pros and Cons of Taurex

Traders must consider the following benefits and drawbacks before opening an account with Taurex.

Pros | Cons |

Regulated by FCA (Tier-1 Authority) | Higher minimum deposit on Pro/Raw |

Access to leverage up to 1:1000 | Limited investor protection offshore |

Supports MetaTrader 4 and MetaTrader 5 | Inactivity fee after 90 days |

Over 1,500 tradable instruments across multiple markets | FCA leverage capped at 1:30 |

OQtima

OQtima is a Cyprus-based Forex and CFD broker established in 2023, operating through two regulated entities: OQtima EU Ltd under CySEC and OQTIMA INT LTD under the Seychelles Financial Services Authority (FSA).

This dual-entity structure enables regional differentiation in leverage, capped at 1:30 for EU clients and extending up to 1:1000 for international users.

The broker provides access to more than 1,000 tradable CFD instruments across asset classes such as Forex, Indices, Shares, Metals, Energies, ETFs, and Cryptocurrencies.

Trading is conducted exclusively via MetaTrader 4 and MetaTrader 5, both of which support automated strategies through Expert Advisors (EAs), scalping, and hedging under a standardized margin call and stop-out framework of 80% and 20%, respectively.

All trading platforms can be download in the OQtima dashboard. OQtima offers two account types, ECN+ and ONE, each requiring a minimum deposit of $100.

The ECN+ account operates with raw spreads starting from 0.0 pips and a commission of $3 per side, while the ONE account follows a commission-free model with spreads from 1.0 pip.

Both configurations are available with Islamic (swap-free) options upon request and allow trading in eight base currencies, including USD, EUR, GBP, JPY, CAD, CHF, SGD, and ZAR.

Additional infrastructure after finalizing OQtima registration includes VPS hosting for high-volume clients and analytical tools integrated through Trading Central, such as Market Buzz, Alpha Generation, and Trading Calendar.

While OQtima maintains segregated client funds and negative balance protection across both entities, compensation coverage under the Investor Compensation Fund (ICF) up to €20,000 is limited to accounts registered under the CySEC-regulated branch.

Traders must note that cashing out profits requires completing the OQtima verification process to comply with AML and CFT laws.

Account Types | ECN+, ONE |

Regulating Authorities | CySEC, FSA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Crypto, International Bank Wire, UK Bank Wire, Local Banking, STICPAY, PIX, E-Wallets |

Withdrawal Methods | Credit/Debit Cards, Crypto, International Bank Wire, UK Bank Wire, Local Banking, STICPAY, PIX, E-Wallets |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

OQtima Pros and Cons

The table below provides a look on the benefits and drawbacks of trading with OQtima.

Pros | Cons |

Raw spreads from 0.0 pips on ECN+ account | Limited operational history (founded in 2023) |

Access to MetaTrader 4 and MetaTrader 5 | No dedicated copy trading services |

Leverage up to 1:1000 (FSA entity) | Inactivity fee after 6 months of no activity |

Segregated client funds and negative balance protection | - |

OctaFX

OctaFX operates as a multi-asset Forex and CFD brokerage established in 2011, offering online trading access to global markets through an ECN/STP execution framework.

The company provides exposure to asset classes such as Forex currency pairs, stock CFDs, indices, metals, cryptocurrencies, and energy products in various platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary OctaTrader environment.

From a regulatory standpoint, OctaFX maintains oversight through entities authorized by FSCA, MISA, and CySEC. Depending on jurisdiction, investor protection mechanisms such as the Investor Compensation Fund (ICF) may apply, while negative balance protection is available across supported entities.

Trading conditions typically include floating spreads starting from 0.6 pips, commission-free pricing models, and market execution for retail clients. The broker supports a minimum trade size of 0.01 lots and offers leverage levels that may reach up to 1:1000 outside EU-regulated environments.

Available account infrastructures accessible after OctaFX registration are built around MT4, MT5, and OctaTrader, all of which support automated trading through Expert Advisors (EAs).

In terms of functionality, OctaFX dashboard integrates copy trading via the Octa Copy application, enabling strategy replication based on performance metrics.

OctaFX deposit and withdrawal channels include bank transfers, credit or debit cards, e-wallets such as Skrill and Neteller, and selected cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

Swap-free trading is also supported across account types, aligning with Islamic finance requirements under Shariah-compliant conditions.

Account Types | MT4 Account, MT5 Account, OctaTrader Account |

Regulating Authorities | FSCA, MISA, CySEC |

Minimum Deposit | $25 |

Deposit Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, Cryptocurrencies (BTC, ETH, LTC, USDT) |

Withdrawal Methods | E-wallets (Skrill, Neteller), Cryptocurrencies (BTC, ETH, LTC, USDT) |

Maximum Leverage | Up to 1:1000 (Retail, Non-EU Entities) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), OctaTrader, Octa Copy App |

OctaFX Pros and Cons

The table below offers deeper insight into the benefits and drawbacks of trading with OctaFX broker.

Pros | Cons |

Commission-free trading on all account types | Limited Tier-1 regulatory coverage outside EU entity |

Supports MetaTrader 4, MetaTrader 5, and OctaTrader platform | Fewer tradable instruments compared to multi-asset brokers |

Maximum leverage up to 1:1000 on global accounts | Payment method availability may vary by region |

Copy trading available via Octa Copy app | Not available to traders from some jurisdictions |

PU Prime

PU Prime is a multi-asset Forex and CFD brokerage established in 2016, offering access to more than 800 tradable instruments across major financial markets, including Forex, indices, commodities, shares, ETFs, bonds, and cryptocurrencies.

The broker supports multiple execution environments through ECN/STP infrastructure with market execution, enabling order placement from 0.01 lots across both retail and higher-volume trading strategies.

From a regulatory perspective, PU Prime operates under several supervisory bodies, including ASIC, FSA of Seychelles, FSC of Mauritius, and FSCA in South Africa.

Client capital is maintained in segregated accounts, while negative balance protection mechanisms are implemented to mitigate exposure beyond deposited funds.

Trading conditions are structured around four primary account types: Standard, Prime, ECN, and Cent. Traders can open any of them without restrictions by completing the PU Prime registration.

These accounts provide floating spreads starting from 0.0 pips depending on the pricing model, with commissions applied on selected configurations from $1 per lot per side.

A minimum deposit threshold of $20 allows access to leveraged trading up to 1:1000 in the PU Prime dashboard, subject to jurisdictional limitations.

Platform availability includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary PU Prime mobile application, which integrates copy trading and social trading functionalities.

PU Prime deposit and withdrawals are supported through credit cards, e-wallets, cryptocurrencies, and bank transfers, with most deposit and withdrawal processes executed without broker-side commission, aside from potential third-party banking charges.

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | ASIC, FSCA, FSA, FSC |

Minimum Deposit | $20 |

Deposit Methods | Credit Card, E-wallets, Cryptocurrencies, Local & International Bank Transfer |

Withdrawal Methods | Credit Card, E-wallets, Cryptocurrencies, Local & International Bank Transfer |

Maximum Leverage | Up to 1:1000 |

Trading Platform& Apps | MetaTrader 4, MetaTrader 5, PU Prime Mobile App |

PU Prime Pros and Cons

The table below contains the pros and cons of trading with the PU Prime broker.

Pros | Cons |

Supports MT4 and MT5 along with a proprietary PU Prime mobile app | Not available to clients from certain jurisdictions such as the USA |

Offers up to 1:1000 leverage depending on the regulatory entity | Offshore regulation under FSA Seychelles for some global entities |

Provides access to 800+ tradable instruments across multiple asset classes | International bank withdrawals may incur additional fees |

Negative balance protection and segregated client funds | - |

FxPro

Established in 2006, FxPro operates as a multi-asset Forex and CFD brokerage offering access to more than 2,100 tradable instruments across markets such as currencies, indices, shares, metals, futures, energies, and cryptocurrencies.

The firm supports execution speeds reported below 12 milliseconds, which can be relevant for latency-sensitive strategies including scalping and algorithmic trading via Expert Advisors.

FxPro maintains regulatory oversight through multiple authorities, including the FCA, CySEC, FSCA, and SCB. All entities require traders to complete the FxPro verification process.

Depending on the legal entity, clients may benefit from mechanisms such as fund segregation, negative balance protection, and compensation schemes like FSCS (up to GBP 85,000) or ICF (up to EUR 20,000).

The broker provides three primary account types after finalizing FxPro registration, Standard, Raw+, and Elite, each structured with different spread and commission models.

Trading is supported across widely used platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, WebTrader, and proprietary mobile applications. All platforms can be easily download from the FxPro dashboard.

These environments allow market and instant execution modes, compatibility with automated strategies, and integration of tools such as stop-loss and take-profit orders.

Funding options include bank wire transfer, Visa, Mastercard, Skrill, Neteller, and PayPal, with a minimum deposit typically starting from $100. FxPro also offers copy trading functionality through its FxPro CopyTrade service on MT4 and MT5.

While deposits are generally free, inactivity fees may apply after six months without account activity, alongside conditional withdrawal-related charges depending on payment method and usage history.

Account Types | Standard / Raw+ / Elite |

Regulating Authorities | FCA / CySEC / FSCA / SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa / Mastercard / Bank Wire Transfer / Skrill / Neteller / PayPal |

Withdrawal Methods | Visa / Mastercard / Bank Wire Transfer / Skrill / Neteller / PayPal |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4 / MetaTrader 5 / cTrader / WebTrader / Mobile App |

FxPro Pros and Cons

Traders should check the benefits and drawbacks of FxPro before opening an account with this broker.

Pros | Cons |

Multiple regulatory licenses including FCA and CySEC | Some regional restrictions on CFD trading |

Access to MT4, MT5, and cTrader platforms | No 24/7 customer support availability |

More than 2,100 tradable instruments across asset classes | - |

Fast order execution with support for EAs and scalping | - |

TeleTrade

Founded in 1994, TeleTrade operates as a Forex and CFD brokerage under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), holding license number 158/11 through its European entity, Top Markets Solutions Ltd.

The firm provides access to multiple asset classes including Forex, metals, indices, energies, shares, cryptocurrencies, and soft commodities via leveraged CFD instruments.

Trading is facilitated through MetaTrader 4 (MT4) and MetaTrader 5 (MT5) after completing TeleTrade registration, supporting both discretionary and algorithmic strategies.

Clients can select from ECN, NDD, and CENT account types, each allowing a minimum order size of 0.01 lot and leverage up to 1:500.

Retail clients under CySEC jurisdiction may be eligible for compensation coverage of up to €20,000 through the Investor Compensation Fund (ICF), alongside segregated funds and negative balance protection.

Traders must complete the TeleTrade verification to ensure they get the investor protection measures. Pricing structures vary by account configuration, with ECN spreads starting from 0.2 pips and commissions from approximately 0.007%.

Overnight swap rates apply across instruments such as EURUSD, XAUUSD, and GBPUSD, depending on position direction and holding duration. A demo environment is available for strategy testing without capital exposure.

TeleTrade integrates a proprietary copy trading infrastructure known as Synchronous Trading, enabling users to replicate selected trading strategies based on performance metrics and risk parameters.

Funding options in the TeleTrade dashboard include bank transfers, Visa and Mastercard, as well as selected e-wallets and cryptocurrencies such as Bitcoin and USDT across ERC20, TRC20, and BEP20 networks.

Customer support is accessible through live chat, callback requests, ticketing systems, and email on a24/7 basis.

Account Types | ECN, NDD, CENT |

Regulating Authorities | CySEC |

Minimum Deposit | $10 |

Deposit Methods | Bank Transfer, Visa, Mastercard, Neteller, FasaPay, Bitcoin, USDT |

Withdrawal Methods | Bank Transfer, Visa, Mastercard, Neteller, FasaPay, Bitcoin, USDT |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

Pros and Cons of TeleTrade

The table below offers a complete look on the advantages and disadvantages of the TeleTrade broker.

Pros | Cons |

Regulated by CySEC | Limited transparency on non-trading fees |

Low minimum deposit starting from $10 | Swap fees vary across asset classes |

Supports MetaTrader 4 and MetaTrader 5 | - |

Access to copy trading via Synchronous Trading | - |

Alpari

Established in 1998 in Kazan, Russia, Alpari operates as a Forex and CFD brokerage offering access to multi-asset markets across more than 150 jurisdictions.

The firm is regulated by the Mwali International Services Authority (MISA) and the National Bank of the Republic of Belarus (NBRB) through its entities, including Parlance Trading Ltd and Alpari Evrasia LLC. Traders must complete the Alpari verification process to trade safely in this Forex broker.

Alpari provides several live trading environments, including Standard, ECN, and Pro ECN accounts, alongside a demo option.

The Standard account requires a minimum deposit of $50, supports order sizes from 0.01 lots, and offers leverage up to 1:1000, with spreads typically beginning from 1.2 pips.

Traders can lower costs by using the Alpari rebate program offered by TradingFinder. Islamic (swap-free) conditions are available across all live accounts in compliance with Sharia-based trading frameworks.

Trading is facilitated through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader, enabling access to instruments such as Forex pairs, Commodities, Metals, Indices, Stock CFDs, and Crypto CFDs.

Market execution is used across account types, with margin call and stop-out levels starting from 50% and 20%, respectively, depending on the account structure. Funding methods include credit/debit cards, e-wallets, local payment solutions, bank wire transfers, and selected cryptocurrency channels.

One of the easiest funding methods is Alpari USDT TRC20 deposit which allows traders to fund their accounts in a simple 5-step process.

Additionally, Alpari offers investment services through PAMM accounts, enabling capital allocation to managed trading strategies. Customer support is available via phone, live chat, and email on a 24/5 schedule, aligning with standard global trading hours.

Account Types | Standard, ECN, Pro ECN, Demo |

Regulating Authorities | MISA, NBRB |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller), Local Payment Solutions, Cryptocurrencies |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller), Local Payment Solutions, Cryptocurrencies |

Maximum Leverage | Up to 1:1000 (Standard Account) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, Alpari Mobile App |

Alpari Pros and Cons

The table below offers a deeper look at the benefits and drawbacks of trading with the Alpari broker.

Pros | Cons |

Supports MT4 and MT5 trading platforms | Limited Tier-1 regulatory oversight |

Offers PAMM investment accounts | No investor compensation scheme |

Multiple account types (Standard, ECN, Pro) | Inactivity fee after 3 months |

Leverage up to 1:1000 on Standard accounts | Limited stock CFD coverage vs competitors |

What is an Online Forex Broker?

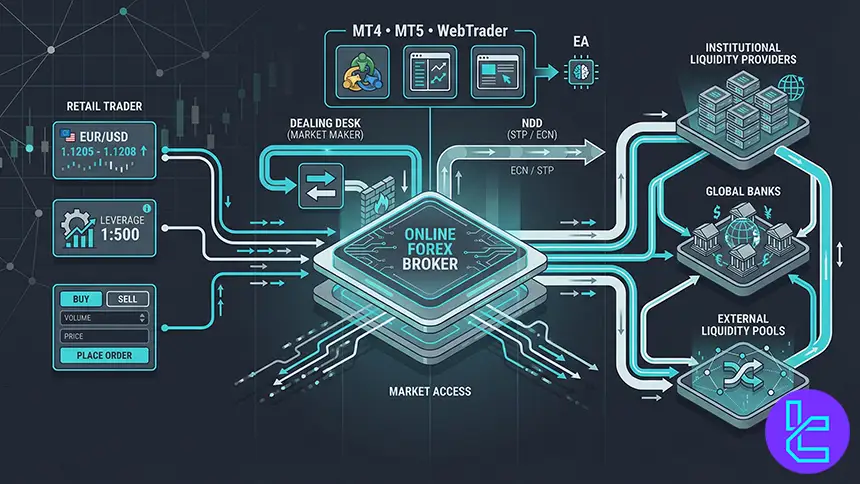

An online Forex broker functions as an intermediary infrastructure that connects retail participants to the decentralized global foreign exchange market, enabling the electronic trading of currency pairs on a 24/5 basis.

Through proprietary or third-party trading platforms, these firms facilitate order placement, leverage utilization, and real-time market interaction, generating revenue primarily from spreads, commissions, and transaction-related fees.

A core operational role of such brokers is to bridge the structural gap between individual traders and institutional liquidity providers, including global banks and financial institutions.

Depending on their execution model, brokers may operate under a Dealing Desk framework (commonly referred to as Market Makers) where internal liquidity is provided and bid/ask pricing is determined in-house.

Others process trades through Non-Dealing Desk (NDD) environments such as STP (Straight Through Processing) and ECN (Electronic Communication Network), where trade orders are routed directly to external liquidity pools.

In terms of trading infrastructure, online brokers typically offer access to widely adopted platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or browser-based WebTrader interfaces.

These environments support advanced charting modules, integrated technical analysis tools, and automated trading through algorithmic scripts like Expert Advisors (EAs).

From a regulatory standpoint, credible Forex brokers operate under financial supervisory bodies that enforce compliance standards related to capital adequacy, client fund segregation, and execution transparency.

This regulatory oversight contributes to maintaining fair trading conditions and mitigating counterparty risk within the leveraged CFD and Forex trading ecosystem.

What Are the Trading Fees in Online Forex Brokers?

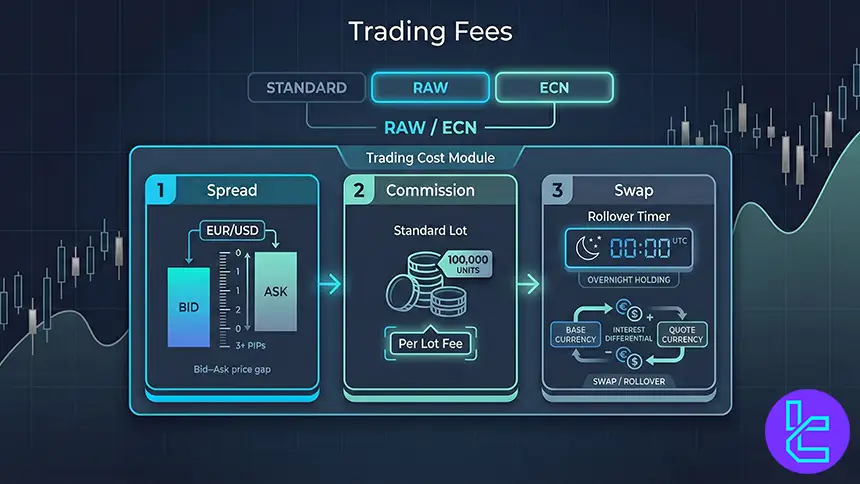

In the retail Forex market, trading costs are generally structured around three core components: spreads, commissions, and overnight swap (rollover) charges.

The spread represents the difference between the bid and ask price of a currency pair such as EUR/USD and functions as the most immediate execution cost.

Depending on market conditions and account configuration, variable spreads on major pairs may fluctuate between 0.0 and 1.3 pips.

Commission-based pricing is typically associated with ECN or Raw Spread accounts, where market access is provided with minimal markups on price quotes.

In these environments, brokers often apply a fixed fee per traded standard lot (100,000 units), commonly ranging from $3.50 to $7 per transaction. This cost model is frequently adopted by traders seeking tighter execution rather than bundled pricing.

Swap or rollover rates apply when leveraged positions remain open beyond the daily market close.

These adjustments are calculated based on the interest rate differential between the base and quote currencies within the traded pair and may result in either a credit or a debit to the trading account.

From a structural standpoint, Standard accounts usually incorporate trading expenses entirely within wider spreads, whereas RAW or ECN accounts separate execution costs into low spreads plus transparent commissions.

Evaluating these pricing mechanisms is essential, as fee structures can significantly influence net performance, particularly in high-frequency or high-volume trading strategies.

What are Non-Trading Fees in Online Forex Brokers?

In the Forex market, broker-related expenses are not limited to spreads or commissions tied to trade execution. Many firms apply non-trading fees, which are operational charges associated with account usage rather than market participation.

These costs may arise from account inactivity, payment processing, or auxiliary financial services linked to maintaining a live trading profile.

One of the most common examples is the inactivity fee, typically imposed when no trading activity occurs within a predefined timeframe (often between three to twelve months).

Depending on the broker’s internal policy, this charge can range from approximately $5 to $50 per month.

Additionally, deposit and withdrawal fees may apply when transferring capital via bank wire, credit card, or e-wallet, although some providers absorb these costs under specific conditions.

Another frequently encountered expense is the currency conversion fee, which is triggered when funds are deposited or withdrawn in a denomination that differs from the account’s base currency.

In such cases, brokers apply a markup to the exchange rate during the conversion process.

Less common charges may include administrative fees for account maintenance, access to premium analytical tools, or the use of specialized account types such as swap-free (Islamic) accounts.

Ancillary costs (such as transaction fees for international bank transfers, requests for physical account statements, or subscriptions to institutional-grade market research) may also be introduced depending on the broker’s service model.

Awareness of these non-trading fees is essential for evaluating the total cost structure of a trading account, particularly for long-term participants or traders who operate intermittently across the Forex and CFD markets.

How to Check if an Online Forex Broker is Legit?

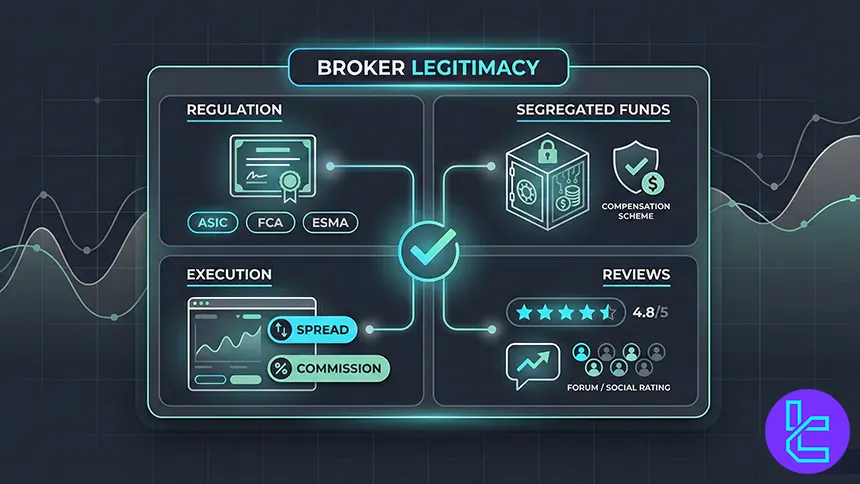

Assessing the credibility of a Forex broker begins with verifying its regulatory status under recognized financial authorities.

Entities supervised by organizations such as ASIC, ESMA, FCA, or CFTC and SEC are typically required to comply with operational standards related to client fund segregation, capital adequacy, and periodic financial reporting.

A broker operating within a regulated framework is generally expected to disclose licensing details, jurisdictional oversight, and investor protection measures on its official website.

These may include participation in compensation schemes designed to mitigate client losses in the event of insolvency. However, regulatory claims should not be accepted at face value;

Confirming license numbers and registration details through the official databases of the relevant supervisory authority is a necessary due diligence step.

Market perception also plays a role in evaluating legitimacy. Independent user feedback on trading forums, review aggregators, and social media channels can provide insight into operational reliability.

Repeated concerns related to delayed withdrawals, inconsistent execution, or platform stability may indicate underlying risks. Finally, transparent disclosure of trading conditions (such as spreads, commissions, available instruments, and supported platforms).

Access to detailed information about execution models, fee structures, and customer support channels contributes to an environment where trading decisions can be made with a clearer understanding of associated risks.

How to Choose the Best Online Forex Broker

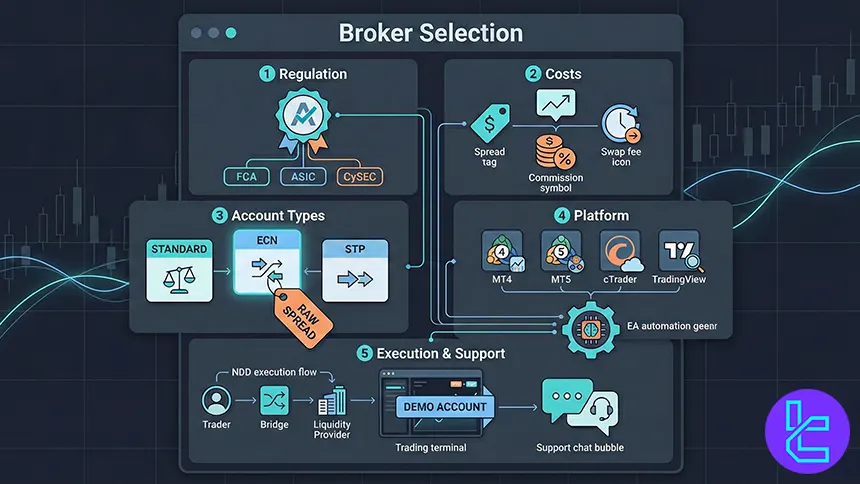

Selecting an appropriate online Forex broker involves evaluating multiple structural and operational factors that directly affect capital safety, execution quality, and transaction efficiency within leveraged trading environments.

A primary consideration is regulatory oversight from recognized financial authorities such as FCA, ASIC, CySEC, which enforce compliance standards related to fund segregation and operational transparency.

From a cost perspective, traders should assess the broker’s pricing model, including variable or fixed spreads, per-lot commissions, and potential non-trading expenses such as inactivity charges, swap or rollover rates, or withdrawal fees.

Account structures, particularly Standard versus ECN or STP models, also influence execution pathways, where Raw spread accounts typically provide tighter bid ask differentials in exchange for commission-based pricing.

Platform infrastructure is another critical dimension. Access to established environments such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or integration with TradingView can impact analytical capability and compatibility with algorithmic trading.

Execution quality, especially under No Dealing Desk (NDD) frameworks, may also reduce latency in volatile market conditions. Additional variables include leverage availability, minimum deposit thresholds, and access to responsive customer support channels during active trading sessions.

Independent performance reviews from platforms such as Trustpilot, Forex Peace Army, or Myfxbook, combined with real time testing through demo accounts, can further assist in evaluating platform stability and order execution reliability.

Trading Account Comparison in Online Forex Brokers

The table below helps you compare the trading accounts in online Forex Brokers.

Parameters | Pro Account | Standard Account | ECN Account |

Balance Denomination | Base currency | Base currency (USD, EUR, etc.) | Base currency |

Typical Minimum Deposit | $200 - $1,000+ | $50 - $200 | $100 - $500 |

Lot Size Structure | Standard lots with optimized execution | Mini & standard lots (0.01-1.0) | Raw lot sizes with direct liquidity |

Spreads (Major Pairs) | 0.1 - 0.8 pips (floating) | 0.8 - 1.5 pips (floating) | 0.0 - 0.3 pips (raw) |

Commission Model | Low or zero commission (broker-dependent) | Usually spread-only | Commission per lot ($3–$7 RT typical) |

Execution Model | STP / Hybrid | Market Maker / STP | True ECN / NDD |

Max Leverage (Offshore) | 1:200 - 1:500 | 1:500 - 1:1000 | 1:200 - 1:500 |

Max Leverage (Tier-1 Reg.) | 1:200 - 1:500 | 1:30 | 1:30 |

Instrument Availability | Full offering | Full retail offering | Full offering with deeper liquidity |

Target Trader Profile | Experienced discretionary traders | Retail traders | Scalpers, high-volume traders |

Typical Stop-Out Level | 20% - 30% | 20% - 50% | 20% - 30% |

Slippage Sensitivity | Lower | Moderate | Lower (direct liquidity access) |

Conclusion

To choose the best online Forex brokers, traders have various options, including eToro, Taurex, OQtima, FxPro, Alpari, PU Prime, and TeleTrade.

Now you must compare the minimum spreads, maximum leverage, regulatory status, funding and payouts, and customer support to choose the best broker that aligns with you personal goals and visions.

All brokers have been assessed based on various factors mentioned in the TradingFinder Forex methodology.