Skrill is considered one of the most important and convenient payment options for brokers in Forex. Operating since 2001 as a digital wallet, this solution supports various currencies and cryptocurrencies.

The list below mentions some of the top Forex brokerages supporting Skrill as one of their main options.

| XM | |||

| Vantage Markets | |||

| FP Markets | |||

| 4 |  | Fusion Markets | ||

| 5 |  | HFM | ||

| 6 |  | FBS | ||

| 7 |  | Tickmill | ||

| 8 |  | Errante |

Skrill Forex Brokers Ranked by Trustpilot Reviews

Trustpilot is a reliable source for learning about the user experiences with a company or its services. The abovementioned brands have received these ratings from users.

Broker Name | Trustpilot Rating | Number of Reviews |

FP Markets | 9,850 | |

5,919 | ||

HFM | 3,006 | |

Vantage Markets | 11,634 | |

8,343 | ||

Tickmill | 1,082 | |

XM | 2,882 | |

Errante | 39 |

Forex Brokers Fees in Skrill Payments

Some brokers might charge clients with commissions for making payments or withdrawing money using specific solutions. Note that the fees noted below are separate from any potential charges by the payment provider itself.

Broker Name | Deposit Fee | Withdrawal Fee |

IUX | 0 | 0 |

0 | 0 | |

Pepperstone | 0 | 0 |

Tickmill | 0 | 0 |

XM | 0 | 0 |

0 | 1% | |

FP Markets | 0 | 1% + Country Fees |

BlackBull Markets | 0 | $5 per Transaction |

Skrill Deposit/Withdrawal Time in Forex Brokers

In some cases, the process is completed instantly, but other cases require some time for it to be done.

Broker Name | Deposit Time | Withdrawal Time |

Instant | Instant | |

IUX | Instant | 5–10 minutes (up to 24 hours) |

HFM | Up to 10 minutes | Instant |

eToro | Instant | Up to 2 Business Days |

Tickmill | Instant | Within 1 Working Day |

Instant | Within 24 Hours | |

Eightcap | Instant | 1 Business Day |

Vantage Markets | Within 24 business hours | Within 24 Business Hours |

Minimum Amount for Skrill Deposits/Withdrawals in Brokers

Most Forex brokers have a minimum deposit amount for account opening. Additionally, there is usually a minimum based on the funding option.

Broker Name | Min. Deposit Amount | Min. Withdrawal Amount |

XM | $5 | $5 |

FP Markets | 50 USD/EUR/GBP | 5 USD/EUR/GBP |

IUX | $10 | $5 |

HFM | $10 | $5 |

Capital.com | 20 USD/EUR/GBP | ~10–20 USD/EUR/GBP |

eToro | $50 | $30 |

$50 | $30 | |

$100 | $25 |

Top 6 Forex Brokers Supporting Skrill

Each of the following sections include a summary introduction of a broker offering Skrill as a payment option.

FP Markets

FP Markets, legally known as First Prudential Markets, is an Australian brokerage established in 2005 with a strong global footprint. The broker serves multi-asset traders with institutional-grade conditions, offering access to Forex, CFDs, ETFs, commodities, indices, stocks, and cryptocurrencies from a single account.

FP Markets operates under multiple regulatory frameworks, including ASIC (Australia) and CySEC (Cyprus) as top-tier authorities, alongside FSCA, FSC, and FSA entities.

This multi-regulated structure enforces client fund segregation, negative balance protection, and regular compliance audits across jurisdictions.

The broker provides two core account types, Standard and RAW, with a low $50 minimum deposit. Spreads start from 1.0 pips on Standard accounts and from 0.0 pips on RAW accounts, paired with a $3 commission per lot, making FP Markets suitable for both cost-sensitive and high-frequency strategies.

It’s worth noting that there’s a FP Markets rebate program available for reduced costs.

FP Markets supports MetaTrader 4, MetaTrader 5, and cTrader, enabling manual, algorithmic, and copy trading. Additional services such as PAMM, MAM, social trading, and professional accounts with leverage up to 1:500 enhance flexibility for experienced traders. For FP Markets registration, you can go through our account opening guide.

Summary of Specifics

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros and Cons

FP Markets presents a balanced profile with competitive pricing, broad market access, and strong regulatory backing. However, like any broker, it also comes with certain limitations that traders should weigh carefully before opening an account.

Pros | Cons |

Regulated by ASIC and CySEC (tier-1) | No proprietary trading platform |

Tight RAW spreads from 0.0 pips | Not available to US clients |

10,000+ tradable instruments | Educational content less extensive than some peers |

MT4, MT5, and cTrader support | Bonuses and promotions are limited |

Fusion Markets

Fusion Markets is a low-cost, multi-asset broker offering access to seven markets, including forex, indices, shares, commodities, metals, and energy. With $0 minimum deposit and $0 commission on Classic accounts, it targets traders seeking flexible entry and competitive pricing.

Founded by Phil Horner, Fusion Markets operates under a dual-license framework with Australian Securities and Investments Commission (ASIC) and Vanuatu Financial Services Commission (VFSC). This structure supports both retail protection in Australia and global access via offshore registration.

Note that you must go through the Fusion Markets verification process to access all features.

The broker trades under Gleneagle Securities Pty Limited, backed by an Australian group managing $400M+ in client funds. Client money is held in segregated accounts with top-tier banks, including HSBC and National Australia Bank.

Fusion Markets delivers 0.0-pip raw spreads on majors like EUR/USD, ultra-fast execution (~0.02 ms), and a broad platform suite, including MT4, MT5, TradingView, and cTrader. It also supports copy trading, MAM/PAMM, VPS, and US share trading with $0 commission.

Fusion Markets Specifics Summary

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros & Cons

Fusion Markets stands out for pricing transparency, platform breadth, and fast execution, while trade-offs include lighter educational coverage and limited investor compensation under offshore regulation.

The table below summarizes the key advantages and limitations traders typically consider before Fusion Markets registration.

Pros | Cons |

Ultra-low trading costs; raw spreads from 0.0 pips | No investor compensation fund under VFSC |

$0 minimum deposit; accessible account opening | Limited proprietary research/education |

Full platform suite: MT4, MT5, TradingView, cTrader | No proprietary trading platform |

Segregated funds with top-tier banks; fast execution | Instrument depth lower than some multi-asset peers |

HFM

HFM (formerly HotForex Markets) is a global multi-asset broker serving traders since 2010. With over 2.5 million live accounts and support in 27+ languages, HFM delivers commission-free Forex trading (except Zero accounts) and floating spreads starting from 0.0 pips.

HFM operates under a multi-regulatory framework, holding licenses from CySEC (EU), FCA (UK), DFSA (UAE), FSCA (South Africa), and FSA Seychelles. This structure enables regional compliance, investor protection where applicable, and strict operational standards across different jurisdictions.

The broker offers Cent, Zero, Pro, and Premium accounts with a $0 minimum deposit, base currencies in USD, EUR, and USC, and leverage up to 1:2000 (entity-dependent).

Trading is available on MT4, MT5, and the HFM mobile app, covering Forex, stocks, indices, commodities, ETFs, bonds, and crypto CFDs.

Beyond trading, the broker provides Autochartist, VPS, economic calendars, calculators, and SMS market alerts. HFM copy trading, crypto deposits and withdrawals, PAMM accounts, bonuses, and a high-paying affiliate program (up to $650 per referral) complete its feature set. The table below demonstrates the broker’s specifics.

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Deposit | From $0.00 |

Deposit Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Withdrawal Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

HFM Pros and Cons

Before going through with HFM registration, check out the following pros and cons table which summarizes the broker’s most notable advantages and potential drawbacks for different trader profiles.

Pros | Cons |

Multi-regulated across EU, UK, MENA, Africa | Geo-restrictions in several countries |

$0 minimum deposit and diverse account types | Commission on Zero account |

Wide market coverage and high leverage options | Limited proprietary platform |

Crypto payments, copy trading, and strong tools | Mixed customer support feedback |

Vantage Markets

Vantage Markets is a global multi-asset broker founded in 2009 and headquartered in Sydney, Australia. With a 4.3/5 Google rating and more than 30 international offices, the broker has built a strong footprint across major trading regions.

The broker supports five trading platforms, including MetaTrader 4, MetaTrader 5, TradingView, ProTrader, and a proprietary mobile app. This broad platform mix allows traders to combine algorithmic trading, advanced charting, and mobile execution within one ecosystem.

Vantage Markets also stands out in social and passive investing, offering ZuluTrade, DupliTrade, and Myfxbook AutoTrade. These integrations enable access to thousands of strategy providers, making the broker suitable for both active traders and hands-off investors.

From a regulatory perspective, Vantage Markets operates under multiple licenses, including ASIC, FCA, FSCA, VFSC, and CIMA. Client protection features such as segregated funds, negative balance protection, and Lloyd’s insurance up to $1,000,000 are available across several entities.

To open an account, you can check out our Vantage Markets registration guide.

Parameters and Specifics

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FSCA, VFSC, FCA, CIMA |

Minimum Deposit | $20 |

Deposit Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Withdrawal Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application |

Vantage Markets Pros and Cons

The following table summarizes the broker’s key strengths and potential limitations, helping traders quickly assess whether Vantage Markets aligns with their trading needs.

Pros | Cons |

Regulated by multiple tier-1 authorities (ASIC, FCA) | High minimum deposit for Pro ECN account |

Access to MT4, MT5, TradingView, and ProTrader | No proprietary desktop platform |

Very low spreads on ECN accounts (from 0.0 pips) | Services restricted in several countries |

Copy trading via ZuluTrade, DupliTrade, Myfxbook | Leverage capped at 1:30 under FCA/ASIC |

FBS

Founded in 2009, FBS is a global Forex and CFD broker serving more than 27 million registered users. The company focuses on accessible trading conditions, combining low entry requirements with modern platforms for retail traders worldwide.

FBS provides access to 550+ CFD instruments, covering forex pairs, indices, commodities, shares, and cryptocurrencies. Trading costs remain competitive, with floating spreads from 0.7 pips and zero commission on Standard accounts, making the broker attractive for cost-conscious strategies.

Regulation is handled through multiple entities, including Cyprus Securities and Exchange Commission (license 331/17) and the Financial Services Commission Belize, alongside ASIC oversight for its Australian branch. Client funds are segregated, and negative balance protection applies across entities.

Traders can use MT4, MT5, or the proprietary FBS mobile app, which includes 90+ technical indicators and fast execution. With a minimum deposit from $5 and leverage up to 1:3000, FBS supports beginners while still offering flexibility for experienced traders.

Overall, FBS balances accessibility, regulation, and platform diversity. Here are the broker’s specifics.

Account Types | Standard |

Regulating Authorities | FSC, CySEC |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

FBS Pros and Cons

Below, the main strengths and limitations are summarized to help evaluate whether this broker aligns with different trading styles and risk preferences before opening an account through FBS registration.

Pros | Cons |

Very low minimum deposit ($5) | Only one main live account type |

Regulated by CySEC and FSC | Services unavailable in several major regions |

Commission-free trading model | No PAMM or copy trading solutions |

Feature-rich proprietary mobile app | Wider index spreads compared to peers |

Tickmill

Tickmill is a global multi-asset broker serving more than 785,000 registered traders across 180+ countries. Founded in 2014, the company delivers Forex and CFD trading with spreads from 0.0 pips, fast execution, and access to deep institutional liquidity.

Operating under a no-dealing-desk (NDD) model, Tickmill routes orders directly to liquidity providers, minimizing conflicts of interest. The broker reports an average monthly trading volume exceeding $129 billion, positioning it among high-liquidity brokers for active and professional traders.

Tickmill follows a multi-jurisdictional regulatory framework, holding licenses from FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and LFSA (Labuan). Client funds are segregated, protected by negative balance protection, and covered by compensation schemes such as FSCS up to £85,000.

The broker supports MetaTrader 4, MetaTrader 5, WebTrader, and mobile apps, offering Classic and Raw accounts with a $100 minimum deposit. Accounts are available in six base currencies, USD, EUR, GBP, ZAR, PLN, and CHF. For a guide on account opening, check out the Tickmill registration page.

Tickmill Specifications

Account Types | Classic, Raw |

Regulating Authorities | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Deposit | $100 |

Deposit Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Withdrawal Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Tickmill Pros and Cons

The following pros and cons highlight its strongest advantages and potential limitations, helping traders assess whether this broker aligns with their trading style and regulatory needs.

Pros | Cons |

Regulated by multiple top-tier authorities (FCA, CySEC) | Limited number of account types |

Raw spreads from 0.0 pips with low commissions | Fewer Forex pairs than some competitors |

Strong investor protection and segregated funds | PAMM accounts not available |

Fast execution with NDD liquidity model | Educational content less extensive than industry leaders |

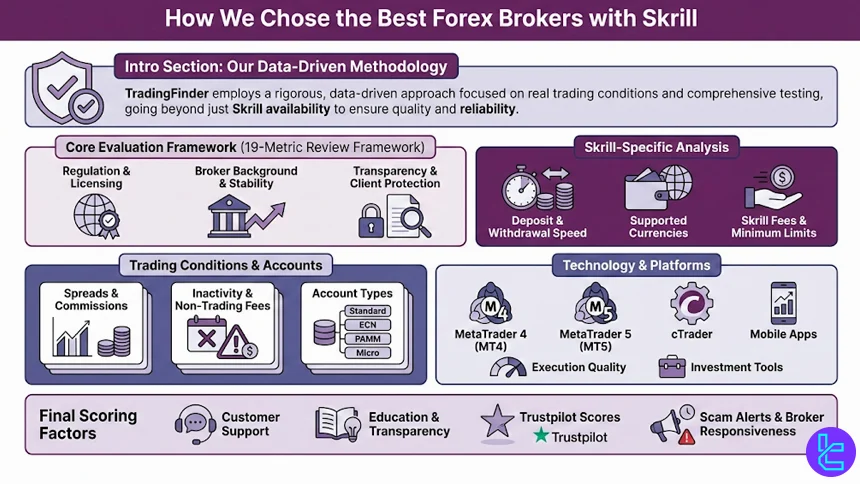

How We Chose the Best Forex Brokers with Skrill

Selecting the best Skrill Forex brokers requires more than checking payment availability. At TradingFinder, brokers are evaluated using a structured, data-driven methodology designed to reflect real trading conditions, operational transparency, and long-term reliability. This approach ensures that Skrill-supported brokers meet both technical and regulatory standards, not just payment convenience.

Our review framework is built on 19 core metrics, starting with regulation and licensing. TradingFinder verifies that each forex broker operates under recognized authorities and applies client protection measures. We then assess broker background data, including establishment year, headquarters, and global presence, to understand operational maturity and stability.

For Skrill-based trading, deposits and withdrawals receive special attention. We analyze processing speed, supported currencies, Skrill-related fees, and minimum transaction limits.

Alongside payments, we examine trading costs, such as spreads, commissions, inactivity fees, and non-trading charges, as these directly affect profitability. Account type diversity, including Standard, ECN, PAMM, and Micro accounts, is reviewed to ensure suitability for different risk profiles.

Technology is another key pillar. Brokers are assessed on platform support, including MetaTrader 4, MetaTrader 5, cTrader, mobile apps, and overall execution quality. We also evaluate copy trading, investment tools, and the clarity of the account opening and verification process.

Finally, TradingFinder incorporates customer support quality, educational resources, Trustpilot scores, news transparency, infographics, broker responsiveness, and scam alerts into the final rating. This holistic methodology ensures that every Skrill forex broker listed delivers security, efficiency, and a consistently reliable trading experience.

What is Skrill?

Skrill is a global digital wallet that allows users to pay online, send money, and receive funds without relying directly on traditional banking systems. Used by millions worldwide, Skrill enables instant transactions, making it a preferred payment method in online trading, gaming, and international payments.

One of Skrill’s core advantages is speed and flexibility. Users can transfer funds globally in more than 40 currencies using just an email address, with transactions processed almost instantly. Withdrawals are equally efficient; funds can be moved from Skrill to a linked bank account within seconds, depending on the region.

Skrill is widely accepted across hundreds of online platforms, including many forex brokers, offering a secure way to fund trading accounts and withdraw profits. Accounts can be funded via bank transfer, debit/credit cards, or local payment methods, adding to its convenience.

For frequent users, Skrill offers a VIP program, unlocking benefits such as lower fees, higher transaction limits, priority support, and exclusive member rewards.

What Are the Benefits and Drawbacks of Using Skrill in Brokers?

Using Skrill as a payment method with forex brokers offers a balance of speed, accessibility, and cost considerations. Skrill is widely favored for fast deposits and withdrawals, especially in international trading. However, like any e-wallet, it also comes with limitations that traders should weigh against their trading volume and cost sensitivity.

Benefits | Drawbacks |

Instant or near-instant deposits to trading accounts | Withdrawal and currency conversion fees may apply |

Faster withdrawals compared to traditional bank transfers | Not supported by all forex brokers |

No need to share bank card details with the broker | Fee structure can be costly for frequent transfers |

Supports multiple currencies for global trading | Account verification required for higher limits |

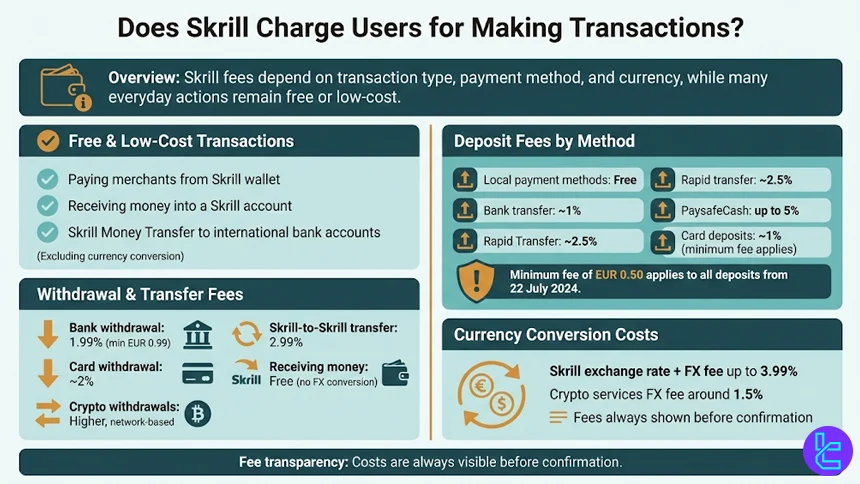

Does Skrill Charge Users for Making Transactions?

Skrill applies transaction fees depending on the type of activity, payment method, and currency used, but many everyday actions remain low-cost or even free. Paying merchants directly from a Skrill wallet, receiving money into a Skrill account, and sending funds via Skrill Money Transfer to an international bank account can carry zero transaction fees, excluding currency conversion.

Deposit fees vary by method. For example, in the UK, Local payment methods are typically free, while bank transfers usually cost around 1%, Rapid Transfer 2.5%, and PaysafeCash up to 5%. Card deposits (Visa, Mastercard, Maestro, and others) generally incur about 1%, with a minimum fee applied.

From 22 July 2024, all deposit methods are subject to a minimum fee of EUR 0.50 (or equivalent).

Withdrawal fees also differ. Bank withdrawals usually cost 1.99% (minimum EUR 0.99), while card withdrawals are around 2%. Crypto-related withdrawals involve higher fees, including network costs. Skrill-to-Skrill transfers typically incur a 2.99% fee, while receiving money remains free when no currency conversion is involved.

Currency conversion is a key cost factor. Skrill applies its own exchange rate plus a foreign exchange fee of up to 3.99%, or 1.5% for cryptocurrency services. All applicable fees are clearly displayed before confirmation.

Is Skrill a Safe Payment Method for Forex Trading?

Yes, Skrill is widely considered a safe and reliable payment method for forex trading when used with reputable, regulated brokers. Its security framework and operational controls are designed to protect users’ funds and personal data.

Key safety advantages of using Skrill:

- Uses advanced encryption and fraud-prevention systems to secure transactions;

- Does not share bank or card details directly with forex brokers;

- Supports two-factor authentication (2FA) and account-level security controls;

- Operates under regulated financial frameworks in multiple jurisdictions.

What traders should still be aware of:

- Safety also depends on the broker’s regulation and compliance, not Skrill alone;

- Account verification is essential to prevent delays, limits, or freezes;

- Using Skrill on unregulated or offshore brokers increases risk.

When combined with a properly regulated forex broker, Skrill provides a secure payment layer that minimizes exposure to banking details while enabling fast, traceable transactions.

How to Deposit/Withdraw Funds to/from Brokers through Skrill

Depositing funds through Skrill is a straightforward process designed for speed and security. Most forex brokers supporting Skrill enable instant funding with minimal steps, making it an efficient choice for traders who want quick account access without relying on traditional bank transfers.

- Create and verify a Skrill account: Sign up with Skrill using your email address and complete identity verification to unlock higher limits and full functionality;

- Log in to your broker’s client area: Access the broker’s dashboard and navigate to the “Deposit” or “Funds” section;

- Select Skrill as the payment method: Choose Skrill from the list of available deposit options supported by the broker;

- Enter the deposit amount and currency: Specify how much you want to fund and confirm the currency to avoid unnecessary conversion fees;

- Authorize the payment via Skrill: You’ll be redirected to Skrill to log in and approve the transaction securely;

- Confirm and start trading: Once approved, funds are usually credited instantly or within minutes.

For withdrawals, a similar route should be taken. You can follow the steps after 2, but instead of choosing the deposit options, select those related to withdrawals.

What Should I Do if I Do Not See Any Money from the Broker After Depositing/Withdrawing via Skrill?

If funds do not appear after a deposit or withdrawal via Skrill, the first step is to check the transaction status in both the broker’s client area and your Skrill account. Most Skrill transactions are instant, but processing delays can occur due to verification checks or internal reviews.

Next, confirm that the transaction was completed successfully and not marked as pending, reversed, or failed. Currency mismatches, exceeded limits, or incomplete account verification on either the broker or Skrill side are common causes of delays.

If the issue persists, contact the broker’s customer support with your transaction ID and timestamp.

If the broker confirms the transaction was processed, reach out to Skrill support with the same details. In most cases, discrepancies are resolved quickly once both sides verify the transaction trail.

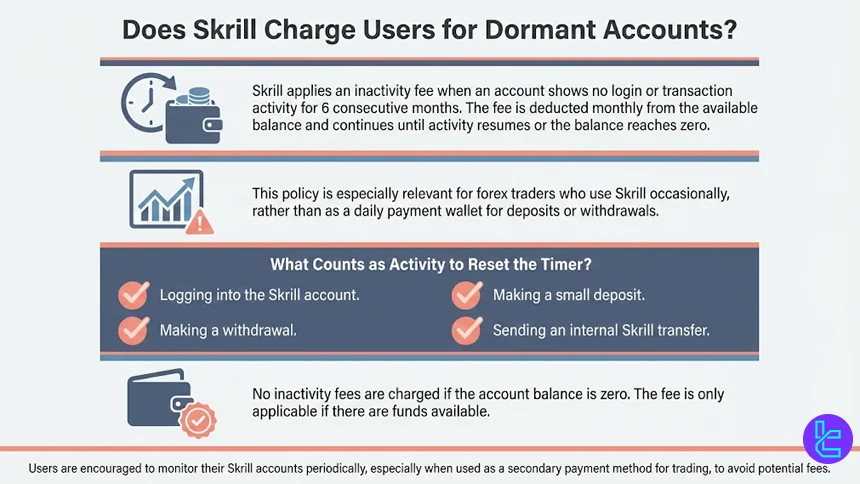

Does Skrill Charge Users for Dormant Accounts?

Yes, Skrill charges an inactivity (dormant account) fee when an account remains unused for an extended period. If there is no login or transaction activity for 6 consecutive months, Skrill may begin deducting a monthly inactivity fee directly from the available balance. This fee continues until the account becomes active again or the balance reaches zero.

For traders who use Skrill with forex brokers only occasionally, this policy is especially important.

Even if funds are not actively being transferred, simply logging into the Skrill account can be enough to reset the inactivity timer. Making a small deposit, withdrawal, or internal transfer also counts as activity.

If the account balance is already zero, Skrill will not charge additional fees. To avoid unnecessary charges, users are advised to monitor their Skrill account periodically, especially when using it as a secondary payment method for trading rather than a daily wallet.

Does Skrill Require Specific Regulatory Licenses for Eligible Forex Brokers?

Skrill does not publish a single, fixed list of regulatory licenses that every forex broker must hold. However, in practice, Skrill applies strict compliance and risk-based requirements before allowing brokers to integrate its payment services.

Also, it’s worth noting that the payment solution is regulated by the Financial Conduct Authority (FCA) of the United Kingdom.

How Skrill evaluates broker eligibility:

- Brokers are typically required to be licensed or regulated by a recognized financial authority;

- Skrill performs KYC, AML, and business due-diligence checks before approval;

- The broker’s operating jurisdiction, client base, and transaction flow are reviewed;

- Ongoing monitoring is applied to detect fraud, abuse, or regulatory breaches.

What this means for traders:

- Skrill-supported brokers are usually not unregulated or anonymous entities;

- Well-known regulators (e.g., EU, UK, Australia, offshore frameworks) are commonly accepted;

- Skrill approval adds an extra compliance layer, but it does not replace broker regulation.

In short, Skrill acts as a compliance gatekeeper, favoring regulated forex brokers, while final responsibility for trading safety still rests on the broker’s licensing and oversight.

How Does Skrill Compare to Other Payment Methods?

When funding a Forex trading account, e-wallets such as Skrill, PayPal, Neteller, and WebMoney are widely used due to faster processing times and reduced reliance on traditional banking.

Skrill and Neteller are especially popular among Forex brokers thanks to instant transfers and broad broker acceptance. PayPal offers strong consumer protection and brand trust but is less commonly supported by brokers, while WebMoney remains region-focused with low-cost, instant transactions.

Parameter | Skrill | Neteller | PayPal | WebMoney |

Broker Acceptance | Widely accepted by Forex brokers | Widely accepted, similar to Skrill | Moderate; fewer Forex brokers support it | Limited; region-specific |

Deposit Speed | Instant to a few minutes | Instant | Instant to same day | Instant |

Withdrawal Speed | Same day to 24 hours | Same day to 24 hours | Fast, bank withdrawals may take longer | Instant to same day |

Transaction Fees | Low to moderate; broker-dependent | Low to moderate | Moderate to high in some cases | Generally low |

Supported Currencies | 40+ fiat currencies | Multiple fiat currencies | 25+ fiat currencies | Digital WM units (WMZ, WME, etc.) |

Security & Compliance | Strong KYC, FCA-regulated provider | Strong KYC under Paysafe Group | High consumer protection, strong fraud control | Strong authentication, passport system |

Typical Forex Deposit Limits | Low minimums; broker-defined caps | Low minimums; flexible limits | Often higher minimums and limits | Low minimums; depends on WM type |

Regional Availability | Global, strong in EU & Asia | Global, strong in Forex-friendly regions | Global but broker-limited | Strong in Eastern Europe & CIS |

Conclusion

Skrill is a popular and reputable payment option that is accepted by most well-known Forex brokers in the industry. The solution, authorized by the UK’s FCA, enables fast transactions for traders.

FP Markets, Fusion Markets, HFM, and Vantage Markets are some of the best Forex brokerages offering Skrill with top-tier financial supervisors (ASIC, CySEC, and other notable mentions) in addition to high user scores on Trustpilot.

To learn more about the details of our broker selection framework, check out our Forex methodology page.