ACY Securities provides 2,200 instruments with leverage options of up to 1:5000 for a minimum deposit of $50. The broker boasts an average execution time of under 30ms and spreads from 0.0 pips.

This broker also has multiple branches in different countries, operating under reputable regulations such as ASIC and FSCA with AFSL 403863 and FSCA 51008 license numbers.

Company Information & Regulation

ACY Securities, founded in 2011 and headquartered in Australia, operates through a multi-entity structure with varying levels of regulatory oversight:

- The primary entity, ACY Securities Pty Ltd, is regulated by the Australian Securities and Investments Commission (ASIC), a Tier-1 regulator. It offers strong protections, including segregated client funds, negative balance protection, and professional indemnity coverage up to AUD 2.5 million;

- A second regulated subsidiary, ACY Securities SA Pty Ltd, is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa. This Tier-2 entity also ensures segregated funds and balance protection, with higher leverage allowances (up to 1:500);

- The offshore arm, ACY Capital LLC (St. Vincent and the Grenadines), is unregulated but participates in the same indemnity coverage and offers the highest available leverage of up to 1:5000.

Entity Parameters / Branches | ACY Securities Pty Ltd | ACY Capital LLC | ACY Securities SA Pty Ltd |

Regulation | ASIC (AFSL 403863) | Unregulated | FSCA (51008) |

Regulation Tier | Tier-1 | N/A | Tier-2 |

Country | Australia | St. Vincent & the Grenadines | South Africa |

Investor Protection Fund / Compensation Scheme | Professional indemnity insurance (up to AUD 2.5m) | No | Up to AUD 2.5 million |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:5000 | 1:500 |

Client Eligibility | Australia residents only | All countries except restricted (US, Iran, N. Korea, Russia, Belarus, etc.) | All countries except restricted (US, Iran, N. Korea, Russia, Belarus, etc.) |

All entities operate under strict fund segregation at Commonwealth Bank, and legal documentation is clearly presented to support transparency.

ACY Securities also stands out by publishing weekly spread reports and maintaining a robust regulatory reputation across its Tier-1 and Tier-2 licenses.

Key Specifics

To give you a clear picture of what ACY Securities offers, here's a table summarizing its key specifics:

Broker | ACY Securities |

Account Types | Standard, ProZero, Bespoke |

Regulating Authorities | ASIC, FSCA, SVG FSA |

Based Currencies | USD, AUD, GBP, EUR, CAD, JPY, NZD |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, E-wallets, Bank Wire Transfer, China Union Pay, BTC & USDT, Local Payment Methods (Varies by Region) |

Withdrawal Methods | Credit/Debit Cards, E-wallets, Bank Wire Transfer, China Union Pay, BTC & USDT, Local Payment Methods (Varies by Region) |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:5000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, LogixTrader |

Markets | Forex, Indices, Commodities, Stocks, ETFs, Crypto |

Spread | From Zero on ProZero and Bespoke Accounts |

Commission | From Zero on Standard Account |

Orders Execution | STP |

Margin Call/Stop Out | 100%/50% |

Trading Features | Economic Calendar, Forex VPS |

Affiliate Program | Yes |

Bonus & Promotions | 30% Credit, 10% Credit |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone Call, Ticket |

Customer Support Hours | 24/5 |

Trading Accounts: Features & Comparison

ACY Securities offers a range of account types to support different trading opinions and experience levels. Let's break down the main account types:

Account Type | Standard | ProZero | Bespoke |

Min. Deposit | $50 | $200 | $10,000 |

Max. Leverage | 1:5000 (via LogixTrader) | 1:500 | |

Min. Trading Volume | 0.01 Lot | ||

Each account type is tailored to meet specific trading needs, allowing traders to choose the one that best aligns with their strategy and goals.

The Standard Account is perfect for those just starting out, while the Pro and Zero Accounts suits seasoned traders looking to optimize their trading costs.

Critical Advantages And Disadvantages

Like any broker, ACY Securities has its strengths and weaknesses, and it's important to pay attention to them for making a better choice. Here's a balanced look at what the broker offers:

Advantages | Disadvantages |

ASIC Regulation Ensures High Level Of Security | Higher Minimum Deposits For Advanced Accounts |

High Amount Of Tradable Instruments | 24/5 Support |

Variety In Trading Platforms | - |

Negative Balance Protection | - |

Opening an Account and Verification on ACY Securities

Getting started with this company involves filling out a form. Here's a quick guide to the ACY Securities registration process:

#1 Access the Registration Portal

Visit the official ACY Securities website and click on “Open an Account” to begin your registration process.

#2 Provide Basic Information

Fill in your country, full name, mobile number, and email address. Then, create a secure password (8–20 characters) that includes upper and lowercase letters, numbers, and symbols. Agree to the terms and conditions to proceed.

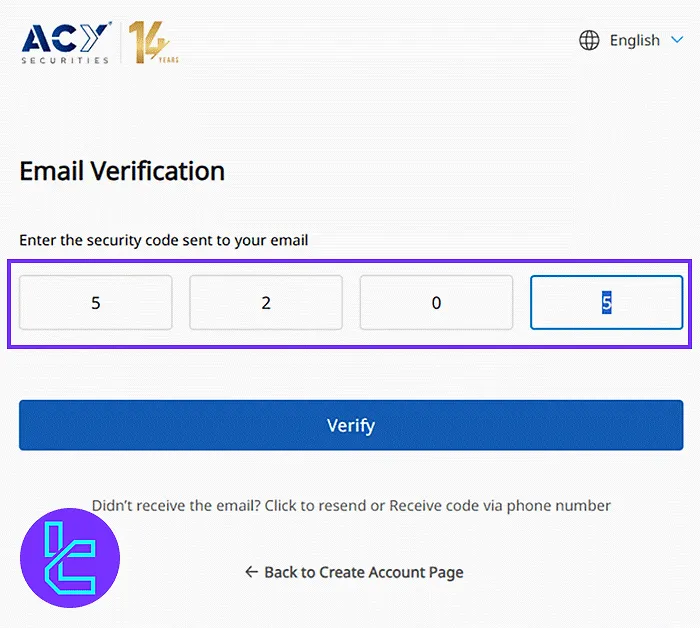

#3 Verify Your Email

Check your inbox for a 4-digit code sent by ACY Securities. Enter it on the verification page to activate your account.

ACY Securities Verification

ACY Securities Verification is a 6-step process designed to ensure security and compliance while granting full access to all trading features.

Traders are required to provide clear images of government-issued ID documents and complete basic personal and trading information.

Verification Steps:

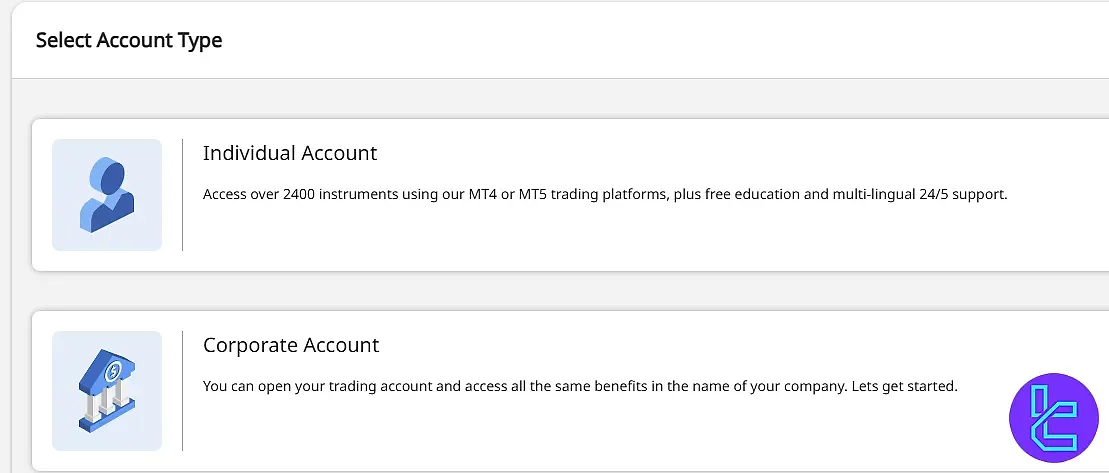

#1 Select Account Type & Residence

Choose between Individual or Corporate accounts and specify your country of residence.

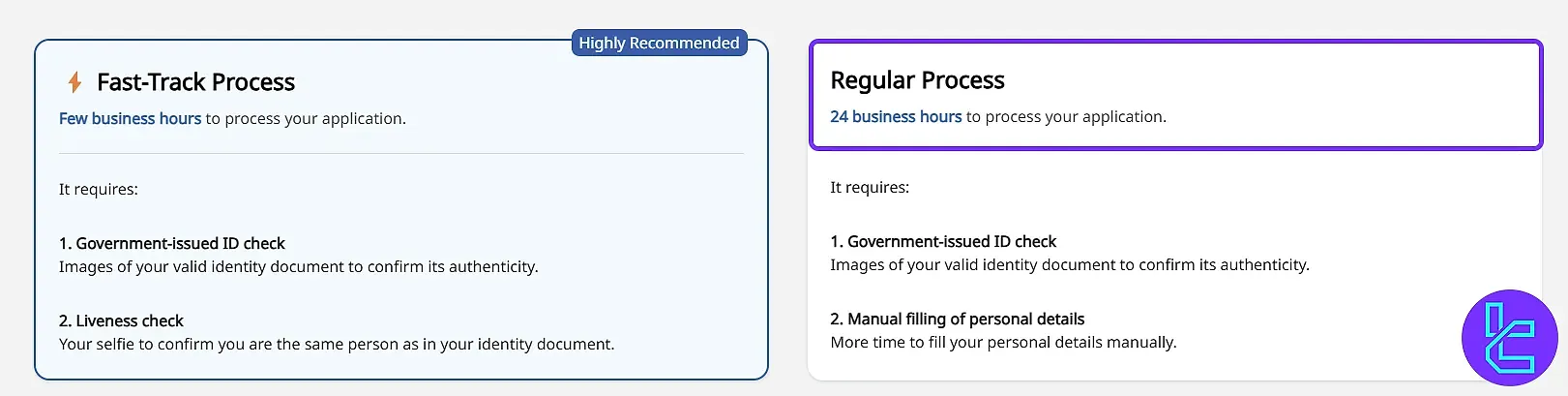

#2 Approval Method

You need to choose Opt for Fast (automated) or Regular (manual, up to 24 hours) document review.

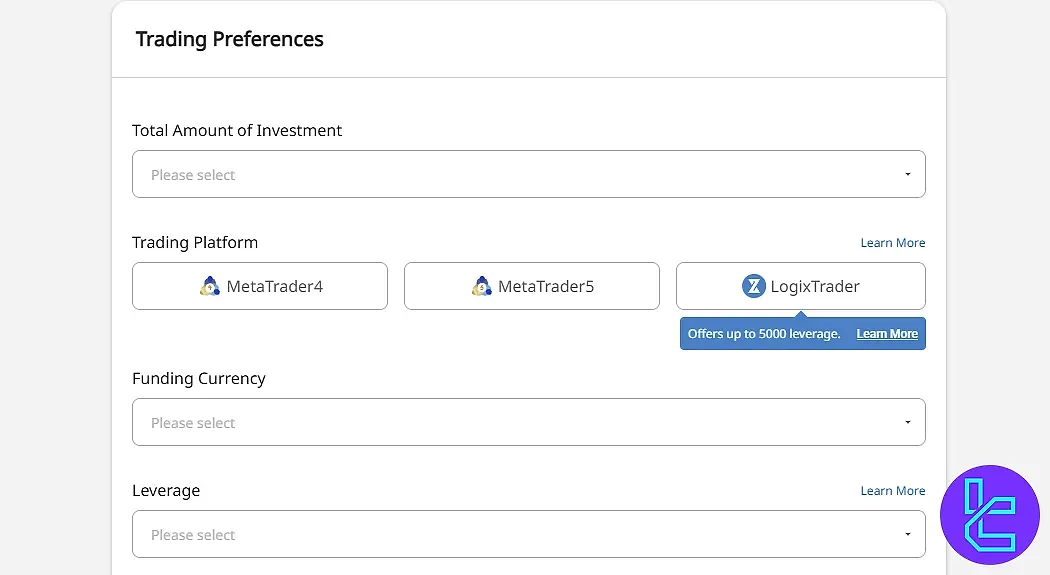

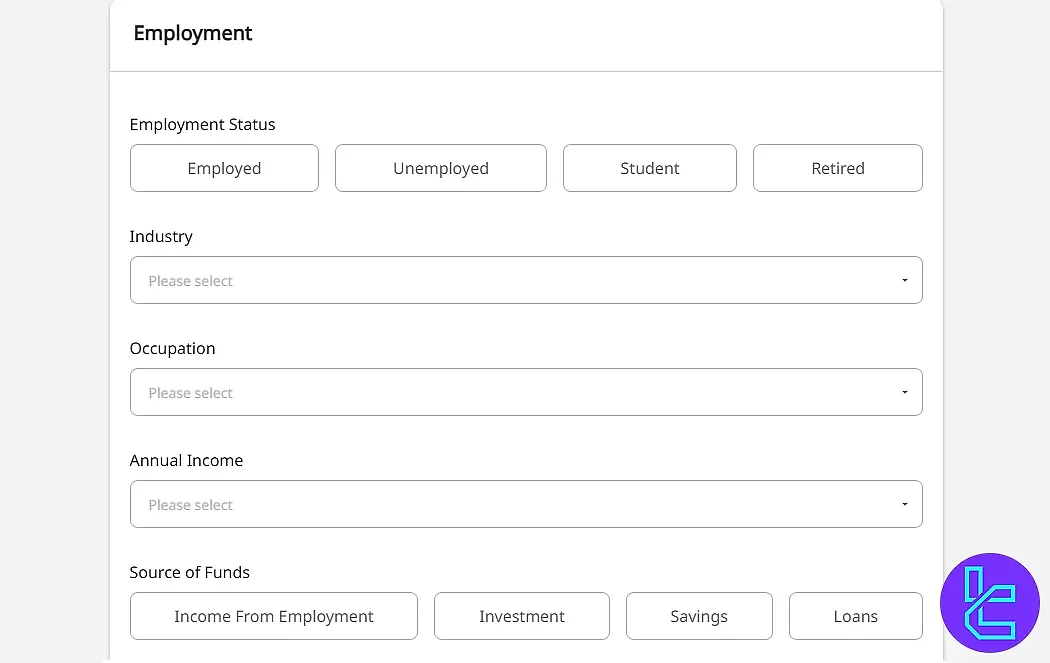

#3 Trading & Employment Details

Enter your investment amount, preferred platform (MT4, MT5, LogixTrader), funding currency, leverage (up to 1:5000), and employment information including occupation and annual income.

#4 Personal Information

Provide full name, date of birth, contact details, nationality, gender, residential address, and government-issued ID number.

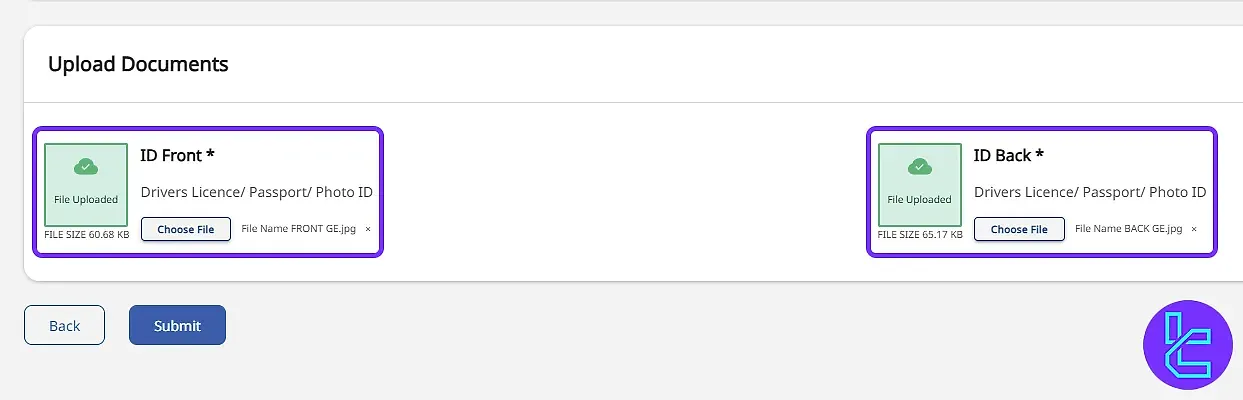

#5 Upload ID Documents

Submit clear images of your ID card, passport, or driver’s license for verification.

#6 Submit & Wait

Click Submit to initiate the review process; approval is usually completed within 24 business hours.

Trading Platforms and Software

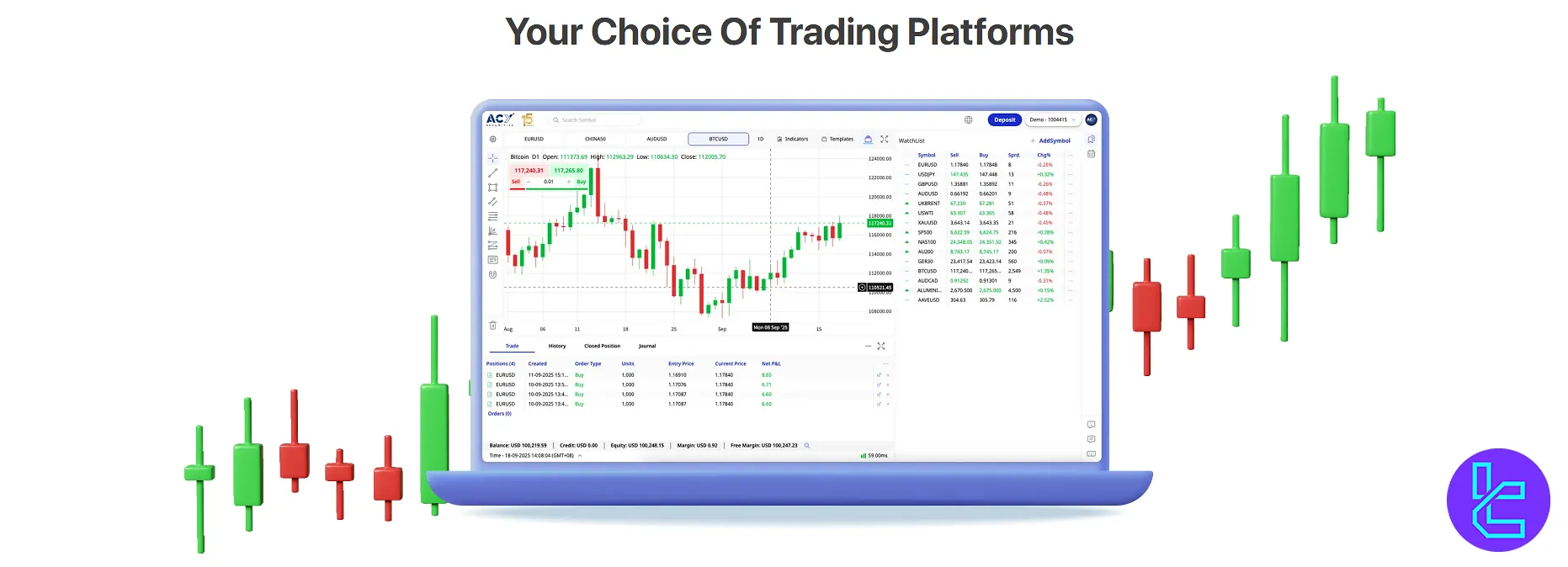

ACY Securities offers three trading platforms, one of them developed by its own team. In this section, we will take a quick look at each:

- MetaTrader 4 (MT4): A very popular trading platform with a customizable dashboard and advanced tools for charts and technical analysis

- MetaTrader 5 (MT5): Next-generation platform for MT4 withLevel II Pricing and 21 trading timeframes

- LogixTrader: Proprietary trading platform, suitable for those looking for higher leverage and helpful features at the same time

Does ACY Securities Work with Fair Spreads and Commissions?

ACY Securities offers a transparent pricing structure across its three core accounts:

- The Standard Account incurs no trading commissions, with spreads averaging 1.0 to 1.7 pips on major forex pairs, such as EUR/USD. For a 1-lot trade, this equates to approximately $10–$17 in cost;

- The ProZero Account features raw spreads from 0.0 pips and a $6.00 commission per round turn. This brings the all-in cost for a 1-lot EUR/USD trade to about $6.00, which is highly competitive;

- The Bespoke Account offers a commission of just $5.00 per lot, appealing to high-volume traders who seek razor-thin spreads and efficient execution.

ACY does not charge any deposit fees, and traders receive three free withdrawals per month.

Additional withdrawals incur a flat fee of $25. Furthermore, there are no inactivity charges, making the broker attractive for occasional traders and portfolio holders.

Swap-Fee at ACY

At ACY Securities, swap fees are charged on positions held overnight, with amounts varying depending on the asset and whether the position is long or short.

For example, a long EUR/USD trade results in a $6.01 cost, while a short trade generates a credit of $3.87.

Additionally, the broker offers Swap‑Free (Islamic) accounts, with some of their key features outlined below:

- Sharia-Compliant: Designed for Islamic finance principles;

- Extended Fee-Free Period: Up to 4 days before any admin (swap-replacement) fee applies;

- Available on MT4 & MT5: Fully supported on both platforms;

- Supports Automated Trading: Expert Advisors (EAs) can be used.

Non-Trading Fees at ACY

At ACY Securities, deposits are free of charge, and clients are entitled to five complimentary withdrawals per month. Any withdrawals beyond this allowance are subject to a flat fee of $25.

The broker does not impose inactivity fees, which can be beneficial for traders who manage their accounts intermittently or maintain diversified portfolios.

Payment Methods and Options

ACY Securities provides an extensive variety of deposit and withdrawal options to cater to its global client base:

- Credit/Debit Cards (Visa, Mastercard)

- Bank Wire Transfer

- E-wallets (Skrill, Neteller, Perfect Money, SticPay, and Bitwallet)

- China Union Pay

- Bitcoin and USDT

- Local payment methods (varies by region)

The broker's diverse range of payment options ensures that traders from different regions can easily fund their accounts and withdraw their profits.

Deposit Methods at ACY

Deposits at ACY Securities are fast and convenient, supporting bank transfers, cards, e-wallets, and cryptocurrencies.

Most methods are processed within 24 hours and incur no deposit fees from ACY (merchant fees may apply).

Supported currencies include USD, EUR, AUD, JPY, PHP, VND, and stablecoins like USDT and USDC.

Below is a table showing the complete information for all deposit methods:

Payment Method | Currency | Minimum Deposit | Maximum Deposit | Deposit Fees | Processing Time |

China Union Pay 4 | CNY | 1000 USD | 26000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

China Union Pay 5 | CNY | 1400 USD | 14000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

China Union Pay 6 | CNY | 100 USD | 7000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Ali Pay | CNY | 150 USD | 1400 USD | No deposit fees charged by ACY Securities | Within 24 hours |

QR Code Pay | CNY | 100 USD | 1300 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Visa/Master | Multi-currencies | 50 USD | 50000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Visa/Master-JPY | JPY | 500 JPY | 500000 JPY | No deposit fees charged by ACY Securities | Within 24 hours |

Pay Trust | IDR, VND | 50 USD | 10000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

FPX Bank Transfer | MYR | 50 USD | 10000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Dragon Pay | PHP | 50 USD | 20000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Bank Wire Transfer | Multi-currencies | 50 USD | N/A | No deposit fees charged by ACY Securities | 1–7 Working Days |

South Africa Local Transfer | ZAR | 50 USD | 25000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Africa Local Transfer | NGN, KES, GHS | 50 USD | 1000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Cryptocurrency | BTC, USDT TRC-20, USDT ERC-20 | 50 USD | 50000 USD | Deposit only. Global except Australia | Within 24 hours |

USDT (ERC-20) | USDT ERC-20 | 1000 USD | 50000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

USDT (TRC-20) | USDT TRC-20 | 200 USD | 50000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

USDC (BEP-20) | USDC BEP-20 | 50 USD | 50000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Skrill | Multi-currencies | 50 USD | 150000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Neteller | USD, EUR | 50 USD | 150000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Bitwallet | JPY, USD, EUR, AUD | 50 USD | 25000 USD | No deposit fees charged by ACY Securities | Within 24 hours |

Withdrawal Methods at ACY

Withdrawing funds at ACY Securities is streamlined to ensure timely access to your money. Traders can use bank transfers, e-wallets, or instant crypto withdrawals.

The broker allows multiple withdrawal options globally, with clear visibility of processing times and associated fees, enabling traders to manage their funds efficiently.

Below is a table showing the complete information for all withdrawal methods:

Payment Method | Currency | Minimum Withdrawal | Maximum Withdrawal | Withdrawal Fees | Processing Time |

Visa/MasterCard | Multi-currencies | 50 USD | 50,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Bank Wire Transfer | Multi-currencies | 50 USD | N/A | First 5 withdrawals per month free, then $25 | 1–7 Working Days |

Cryptocurrency (BTC, USDT TRC-20, USDT ERC-20, USDC BEP-20) | BTC, USDT, USDC | 50–1000 USD | 50,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours (Instant for crypto) |

Skrill | Multi-currencies | 50 USD | 150,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Neteller | USD, EUR | 50 USD | 150,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Bitwallet | JPY, USD, EUR, AUD | 50 USD | 25,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

China Union Pay | CNY | 100 USD | 26,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Ali Pay | CNY | 150 USD | 1,400 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

QR Code Pay | CNY | 100 USD | 1,300 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Pay Trust | IDR, VND | 50 USD | 10,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

FPX Bank Transfer | MYR | 50 USD | 10,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Dragon Pay | PHP | 50 USD | 20,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

South Africa Local Transfer | ZAR | 50 USD | 25,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Africa Local Transfer | NGN, KES, GHS | 50 USD | 1,000 USD | First 5 withdrawals per month free, then $25 | Within 24 hours |

Copy Trading & Investment Methods for Passive Earning

Per our investigations on the website, the discussed brokerdoes not provide any investment options directly.

However, it does offer a copy trading service through its own website in the "SoFinX" platform and another website called "Tradingcup", with these benefits:

- Advanced technology for copy trading in a smooth way

- Transparent performance data on all traders

- Enables becoming either a signal provider or a follower

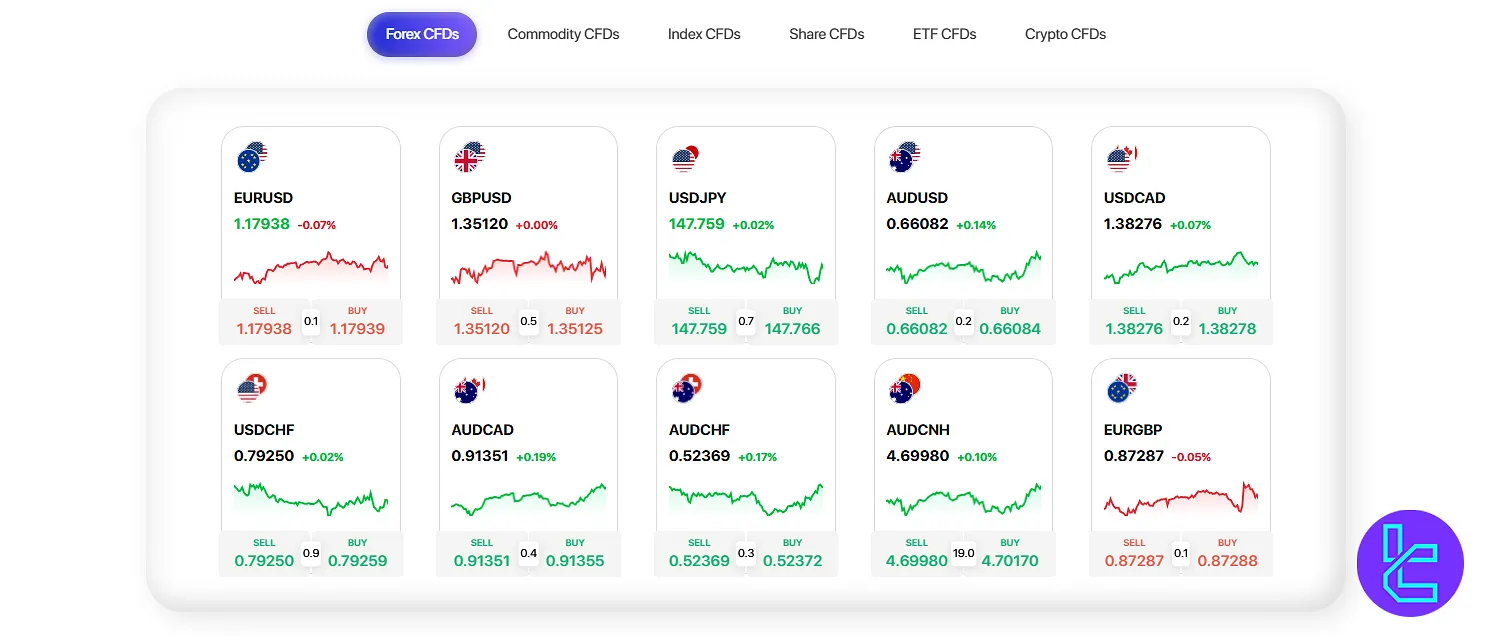

Trading Markets & Instruments

Available trading symbols are important and should be considered for traders who prefer to diversify their portfolios.

Trading Instruments in ACY Securities include the Forex market, cryptocurrencies, and many more:

- Forex: Over 60 currency pairs, including majors, crosses, and exotics

- Indices: Leading global indices like S&P 500, Dow Jones, and Nikkei 225

- Commodities: Including Coper, Aluminum, oil, and more

- Stocks: CFDs on shares from hundreds of biggest global companies

- ETFs: A selection of popular Exchange-Traded Funds such as the SPDR S&P500 ETF Trust

- Crypto: Pairs of BTC, BCH, ETH, LTC, etc. with USD

This diverse range of over 2,200 instruments allows traders to diversify their portfolios and take advantage of opportunities across different markets.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex CFDs | Major, Minor, Exotic Pairs | 60+ | 50–80 | 1:5000 |

Share CFDs | Global Leading Stocks | 1000+ | 500–800 | 1:20 |

Commodity CFDs | Gold, Oil, Agricultural Commodities | 30+ | 25–40 | 1:200 |

Crypto CFDs | Bitcoin, Ethereum, and 18 Others | 20 | 15–25 | 1:20 |

ETF CFDs | SPDR Gold Shares (GLD), VOO, QQQ, and others | 50+ | 40–60 | 1:20 |

Futures CFDs | Commodity, Index, Currency Futures | 21 | 15–25 | 1:5000 |

ACY Securities Bonuses And Promotions

The broker, similar to some of its competitors, offers bonuses and promotions to new clients. However, it's important to note that these offers may vary depending on your region and are subject to change:

- 30% Credit Bonus: Receive a 30% additional credit on up to $1,000 of your initial deposit on the broker;

- 10% Credit on Deposit: Upon depositing between $2,000 to $50,000, a 10% credit bonus will be added to your account.

Always read the terms and conditions carefully before participating in any promotional offer.

Remember that bonuses often come with specific trading volume requirements and other conditions that must be met before you can withdraw the bonus funds or associated profits.

ACY Securities Awards

With spreads starting from 0.0 pips, zero commissions and access to over 2,200 instruments across multiple asset classes, ACY Securities has established itself as a versatile and competitive multi-asset broker.

Thanks to these offerings, ACY has earned recognition in the industry, receiving multiple awards for transparency, service, and trading excellence.

Acy Securities awards list:

- Best Transparent Trading Broker – Smart Vision Investment Expo, Egypt 2022

- Business Excellence Award – Hong Kong Australia Business Association (NSW Chapter), 2022

- Best Overall Broker – Fazzaco Expo, Dubai 2022

- Premium Multi-Asset Broker in Asia – FX168 Brokers Billboard Annual Awards, 2020

- Best Multi-Asset Broker in Australia – Technology Era, 2020

How to Contact Support: When Are They Available?

Typically, there are three main channels to contact the support team on companies. ACY Securities provides these usual contact methods:

- Live Chat: Through the official website for quick queries

- Email: For more detailed inquiries via support@acy.com

- Phone: +61291882999

- Ticket: On the broker's website

Support is available in multiple language, but there's no 24/7 services offered by ACY Securities. This could be considered a drawback in the opinion of some traders.

Which Countries Are Restricted from ACY Securities' Services?

While the broker serves clients globally, there are some restrictions based on local regulations, international sanctions, or other causes. The broker does not accept clients from:

- United States

- New Zealand

- North Korea

- CAR

- Congo

- Iraq

- Lebanon

- Mali

- Somalia

- Sudan

- Yemen

- Iran

- Russia

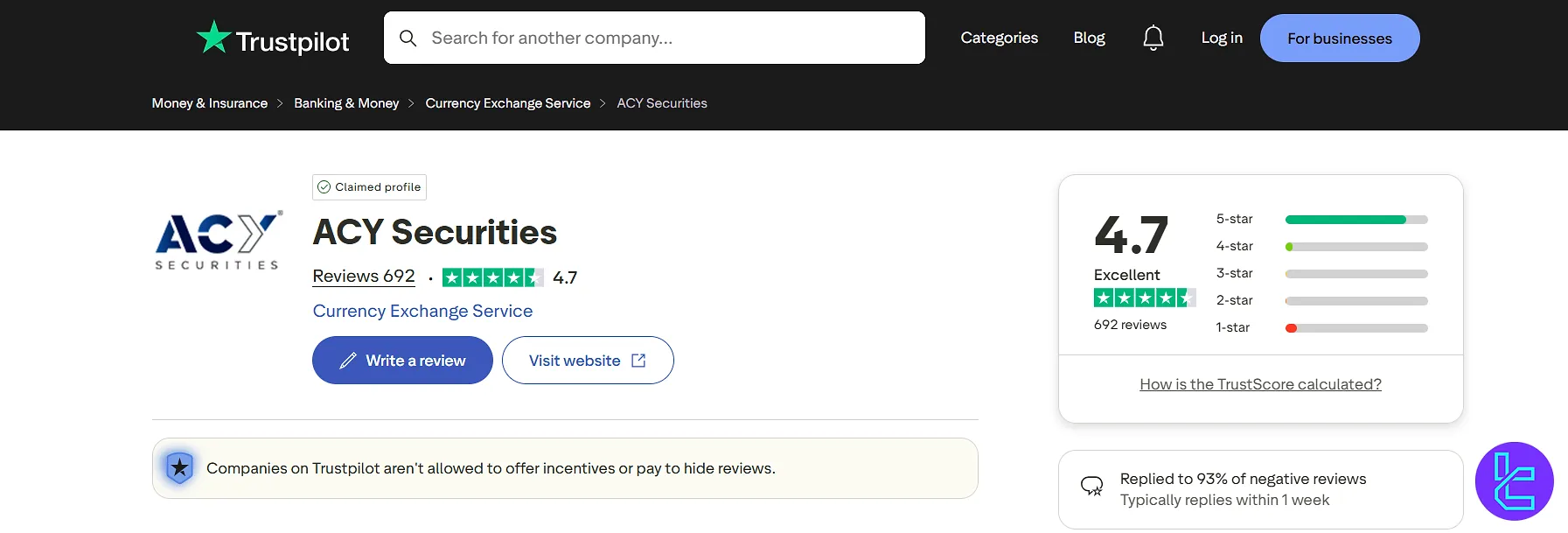

Trust Ratings and Evaluations

ACY Securities has generally received both positive and negative reviews from traders and industry experts on websites such as Trustpilot and ForexPeaceArmy.

Here's a summary of their trust scores and reviews:

- ACY Securities Trustpilot: 4.7 out of 5 with more than 692 reviews and 75% five-star scores

- ForexPeaceArmy: 8/5, based on 60 scores

ACY Securities has received negative reviews on ForexPeaceArmy

While the positive scores outnumber the negative ones, it's important to conduct your own research and consider your personal trading needs when choosing a broker, especially with some complaints about the broker's services.

Education Content and Resources

ACY Securities offers a useful and extensive facility of educational resources to help traders of all levels improve their skills. Here are the key content provided by the broker:

- Webinars and Seminars: Regular sessions covering various trading topics

- Video Tutorials: Step-by-step guides on platform usage and trading strategies

- E-books: In-depth resources on trading fundamentals and advanced concepts

- Market Analysis: Daily and weekly market reviews and forecasts

- Economic Calendar: Important economic events at a glance

Check TradingFinder's Forex education section to access a wide range of free learning materials.

ACY Securities in Comparison with Other Brokers

Let's compare the most essential features of the ACY Securities with those of other well-known Forex brokers.

Parameters | ACY Securities | |||

Regulation | ASIC, SVGFSA, FSCA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From $0 on Zero and BeSpoke Accounts | 0.0 Pips | 0.0 Pips | From 0.6 Pips |

Commission | From $0 on Standard Account | From $0.2 to USD 3.5 | From $0 | None Except On Shares Account |

Minimum Deposit | $50 | $10 | $100 | $5 |

Maximum Leverage | 1:5000 | Unlimited | 1:500 | 1:1000 |

Trading Platforms | MetaTrader 4, MetaTrader 5, LogixTrader | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, Mobile App |

Account Types | Standard, ProZero, Bespoke | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 2200+ | 200+ | 2100+ | 1400+ |

Trade Execution | STP | Market, Instant | Market, Pending | Market, Instant |

Conclusion And Final Words

ACY Securities prrovides access to CFDs across 6 asset classes, including Forex and Crypto, through MT4/5 and LogixTrader platforms.

The company accepts Union Pay, Skrill, and BTC / USDT payments with no commissions. ACY Securities broker doesn't provide service to US clients.