Baxia Global Limited is a Forex and CFD broker with offices in multiple jurisdictions, including Seychelles, Bahamas, Indonesia, and Cyprus. This broker has 3 main account types, with a minimum deposit of $10 and a maximum leverage of 1:1000.

For Forex traders, Baxia Markets offers more than 50 currency pairs covering majors and minors, including EUR/USD, GBP/USD, and USD/JPY. Indices trading includes leading benchmarks such as the S&P 500, FTSE 100, and DAX 30.

Baxia Markets Company Information & Regulation

Baxia Markets Forex broker has established itself as a reputable entity by securing regulatory licenses from multiple jurisdictions. This multi-faceted approach to regulation demonstrates the company's commitment to maintaining high standards of operational integrity and client protection.

Here's a breakdown of Baxia Markets' regulatory landscape:

- Regulated by the Financial Services Authority (FSA) of Seychelles

- Authorized by the Securities Commission of the Bahamas (SCB) [license number SIA-F234]

- Global presence with offices in Seychelles, Bahamas, Indonesia, and Cyprus

- Servicing over 70,000 client accounts worldwide

While Baxia Markets doesn’t have licenses from top-tier regulatory bodies, including FCA, ASIC, or CySEC, having SCB and FSA regulations provide traders with an added layer of security.

Here are the regulatory details of Baxia Markets:

Parameter | Baxia Global Ltd (Seychelles) | Baxia Ltd (Bahamas) |

Regulation | Financial Services Authority (FSA) of Seychelles, License SD104 | Securities Commission of The Bahamas (SCB), License SIA-F234 |

Regulation Tier | N/A | Tier 4 |

Country | Seychelles | Bahamas |

Investor Protection / Compensation | No official investor protection scheme disclosed | No official investor protection scheme disclosed |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:1000 | Up to 1:1000 |

Client Eligibility | Global clients except restricted jurisdictions (e.g., USA, North Korea, Iran, Syria, etc.) | Global clients except restricted jurisdictions (e.g., USA, North Korea, Iran, Syria, etc.) |

Baxia Markets Broker Summary of Specifications

To give you a comprehensive overview of what Baxia Markets offers, here's a detailed table summarizing the broker's key features:

Broker | Baxia Markets |

Account Types | Zero, Standard |

Regulating Authorities | SCB, FSA |

Based Currencies | USD, EUR, JPY, GBP |

Minimum Deposit | $10 |

Deposit Methods | Visa/MasterCard, Stickpay, Bank wired, Neteller, Skrill, cryptocurrencies, Fasapay |

Withdrawal Methods | Visa/MasterCard, Stickpay, Bank wired, Neteller, Skrill, cryptocurrencies, Fasapay |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | MT4, MT5 EAs |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, indices, commodities, shares, cryptocurrencies, metals, energies |

Spread | Floating from 0.0 pips |

Commission | From $2.5 |

Orders Execution | Market |

Margin Call/Stop Out | 90%/20% |

Trading Features | Demo account, Forex calculator, crypto and currency converter, economic calendar, free VPS |

Affiliate Program | Yes |

Bonus & Promotions | N/A |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, the USA, and more |

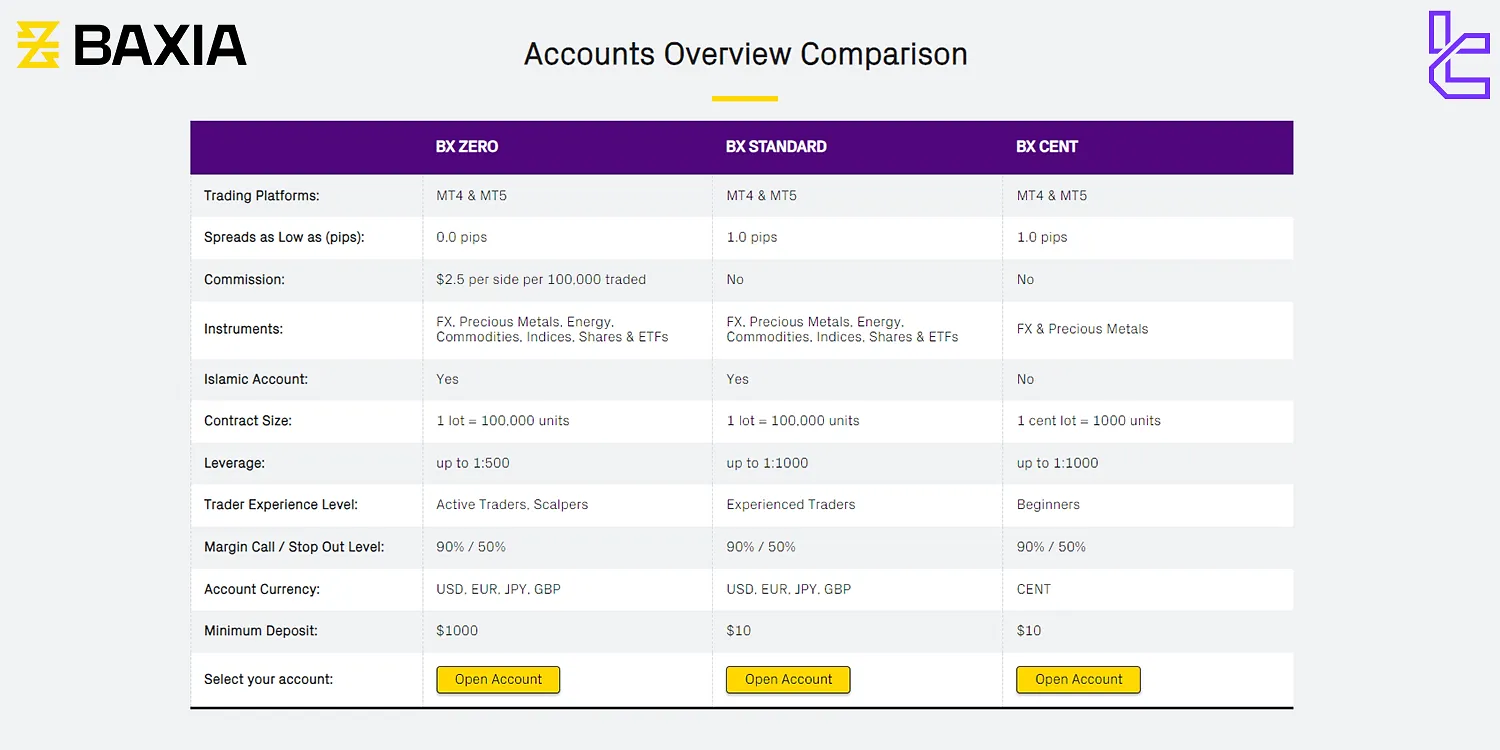

Baxia Markets Broker Account Types Overview

Baxia Markets offers 3 distinct account types, each tailored to meet different trading needs and preferences:

Account types | Standard | Zero | Cent |

Minimum deposit | $10 | $1000 | $10 |

Maximum Leverage | 1:1000 | 1:500 | 1:1000 |

Spreads | Floating from 1.0 pips | Floating from 0.0 pips | Floating from 1.0 pips |

Commission | 0 | $2.5 per side per 100,000 traded | 0 |

Trading platform | MT4, MT5 | MT4, MT5 | MT4, MT5 |

Each account type is designed to cater to different trading styles, risk appetites, and experience levels, ensuring that Baxia Markets can accommodate a wide range of traders.

It’s worth mentioning that Traders can open Islamic Standard and zero accounts for swap-free trading. Baxia Markets also offers a demo account for beginner traders to learn market analysis and trading risk-free.

Baxia Markets Broker Pros and Cons

To provide a balanced view of Baxia Markets, let's examine its strengths and potential drawbacks:

Advantages | Disadvantages |

Competitive spreads starting from 0.0 pips | No Top-tier regulation |

High leverage up to 1:1000 | Not available to US citizens |

Various deposit and withdrawal methods | Relatively new broker (founded in 2020) |

EAs and hedging are allowed | - |

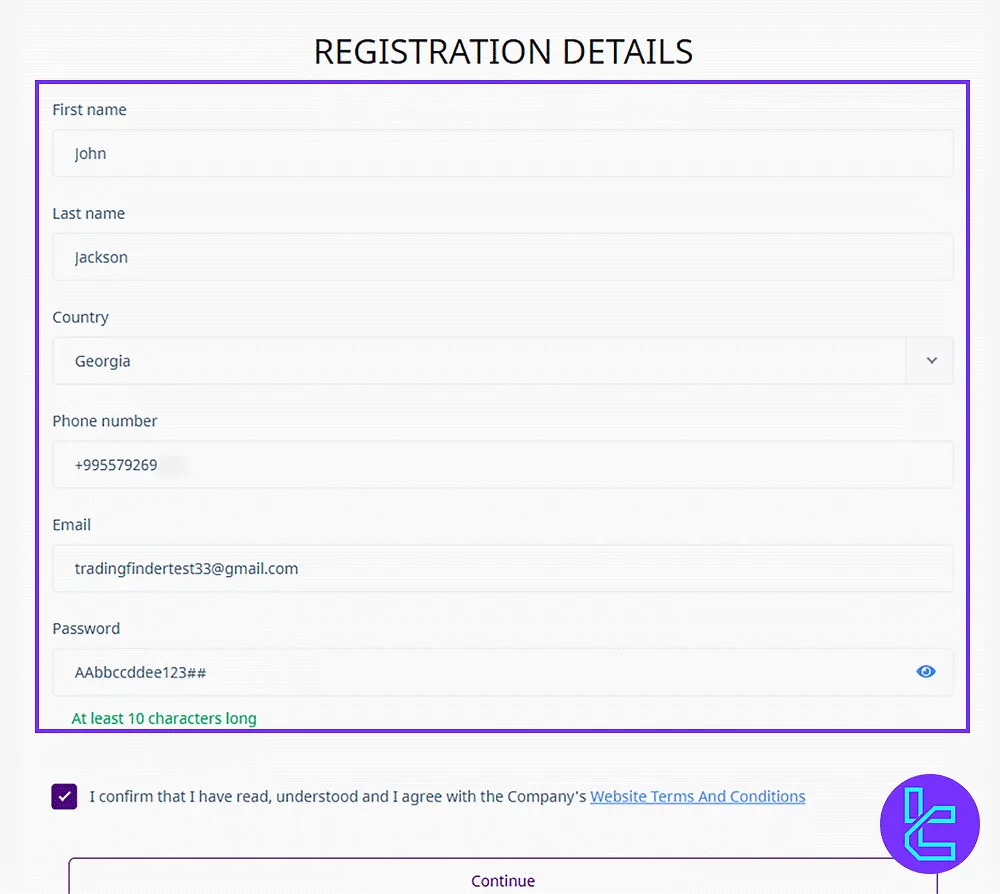

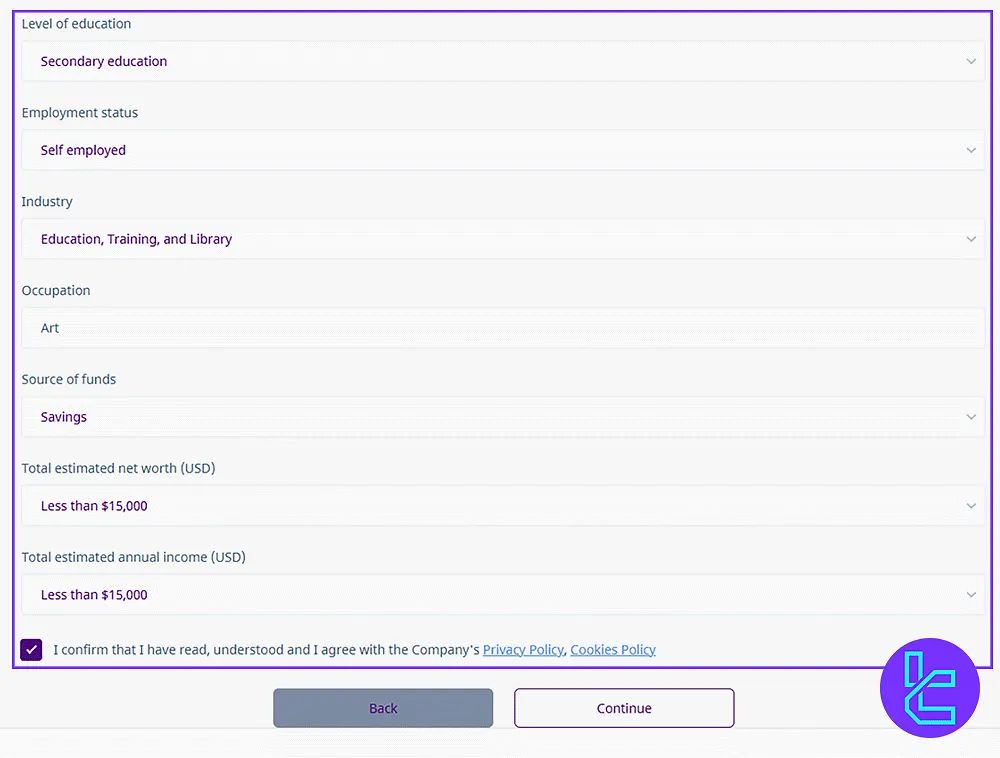

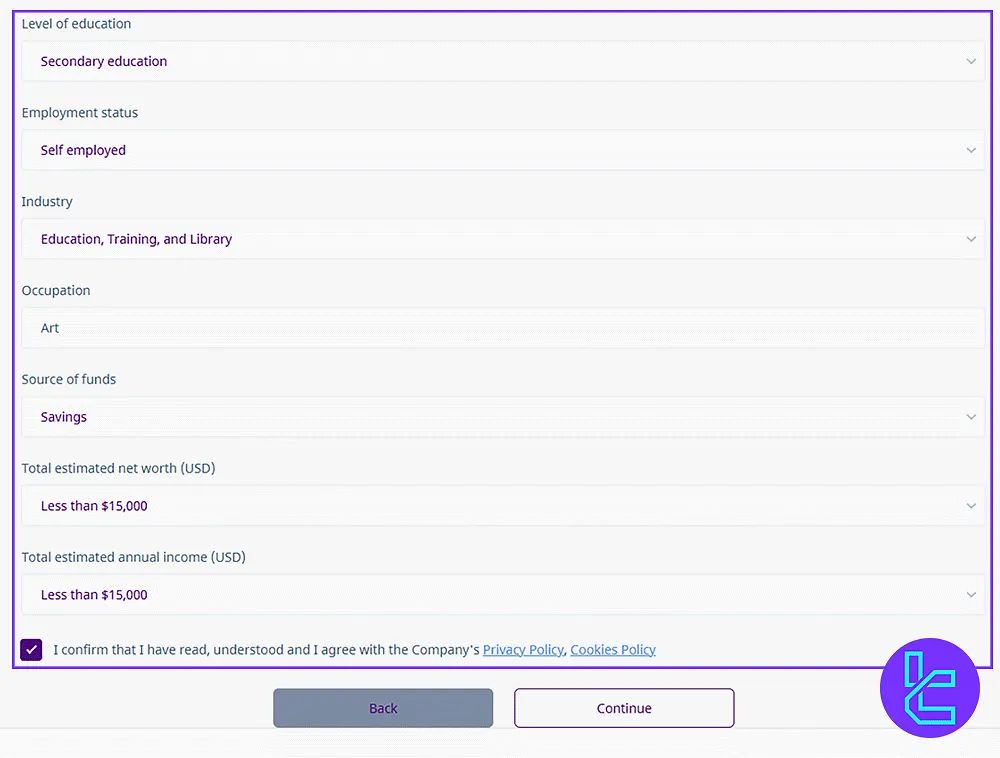

Baxia Markets Sign-Up & Verification Process

To begin trading with the Baxia Markets broker, traders must follow an easy account opening process. Baxia Markets registration:

#1 Access the Signup Page & Submit Personal Details

Head to the official Baxia Markets website and click on “Create Account.” Fill in your name, email, mobile number, country of residence, and create a strong password. Agree to the terms and proceed.

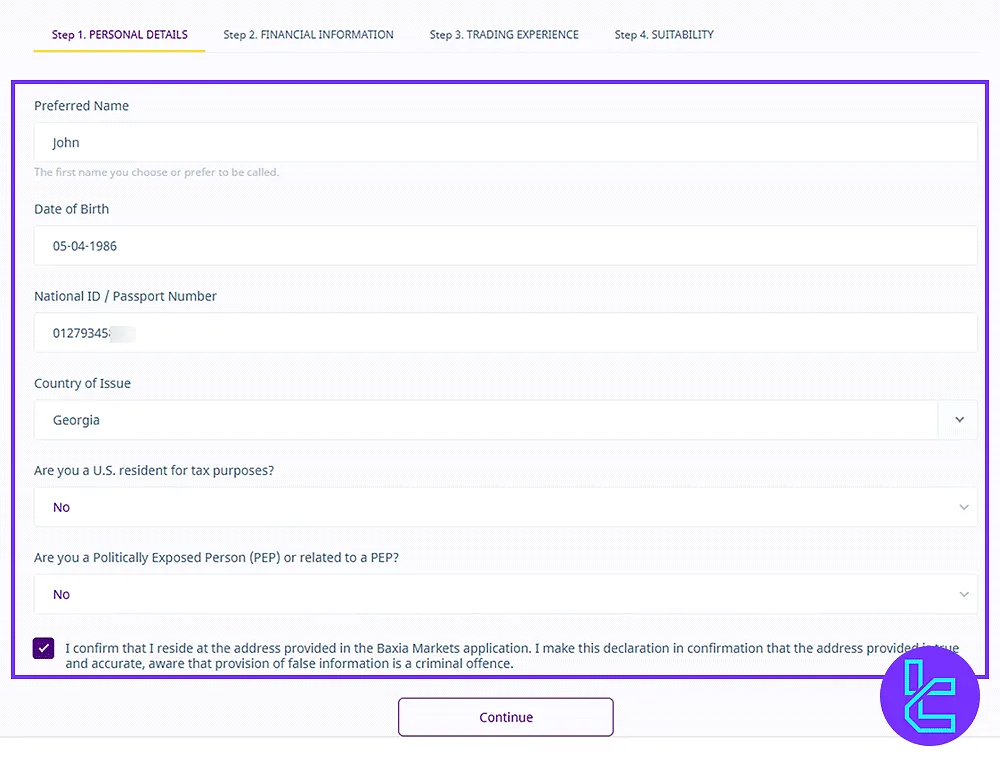

#2 Email Verification & Identity Confirmation

Check your inbox for the activation link and click to verify your email. Then, enter your date of birth, ID number, country of issue, and declare your U.S. citizenship and political exposure status.

#3 Financial Profile & Trading Background

Provide details about your education level, income, and financial status. Continue by answering questions on your trading experience, including past exposure to CFDs, trading volume, and investment objectives.

#4 Complete Suitability Assessment

Respond to a few final questions regarding previous interactions with brokers and confirm your understanding of trading risks. Submit the form to finalize your account setup.

#5 Provide the Necessary Documents for User KYC

To comply with the anti-money laundering (AML) laws, Baxia Markets requires all users to verify their identity by providing a valid ID card, passport, or driver's license. Traders must also authenticate their residential address by uploading images of their utility bill or bank statement.

Baxia Markets Trading Platforms

Baxia Markets supports trading through both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), providing traders with access to two of the industry’s most widely used platforms. MT4 is well-suited for beginners and includes essential features such as nine timeframes, four pending order types, one-click execution, and over 30 built-in indicators.

It also supports Expert Advisors (EAs) for automated strategies and includes a MultiTerminal for managing multiple accounts simultaneously. For more advanced traders, MT5 offers greater flexibility with 21 timeframes, six pending order types, a market depth (DOM) feature, and a wider range of over 38 built-in technical indicators.

It also includes a multi-threaded strategy tester and an integrated economic calendar forfundamental analysis. Both platforms are available as downloadable desktop clients for Windows and Mac, web-based terminals that require no installation, and mobile apps compatible with Android, iOS, and Huawei devices.

Although Baxia Markets does not offer a proprietary trading platform, its reliance on MetaTrader ensures robust charting, trading strategy automation, and fast execution across all devices.

Baxia Markets Spreads and Commissions

Baxia Markets offers competitive pricing across its account types:

Account types | Spread | Commission |

Standard | From 1.0 Pips | No commission |

Cent | From 1.0 Pips | No commission |

Zero | From 0.0 Pips | $2.5 per side per 100,000 traded |

Baxia Markets uses a multi-bank liquidity system to ensure tight spreads and fast execution. The broker is transparent about its pricing, with no hidden fees on deposits or withdrawals.

Other fees in Baxia Markets:

- Over-night swap fees

- No deposit and withdrawal fee

- No inactivity fee

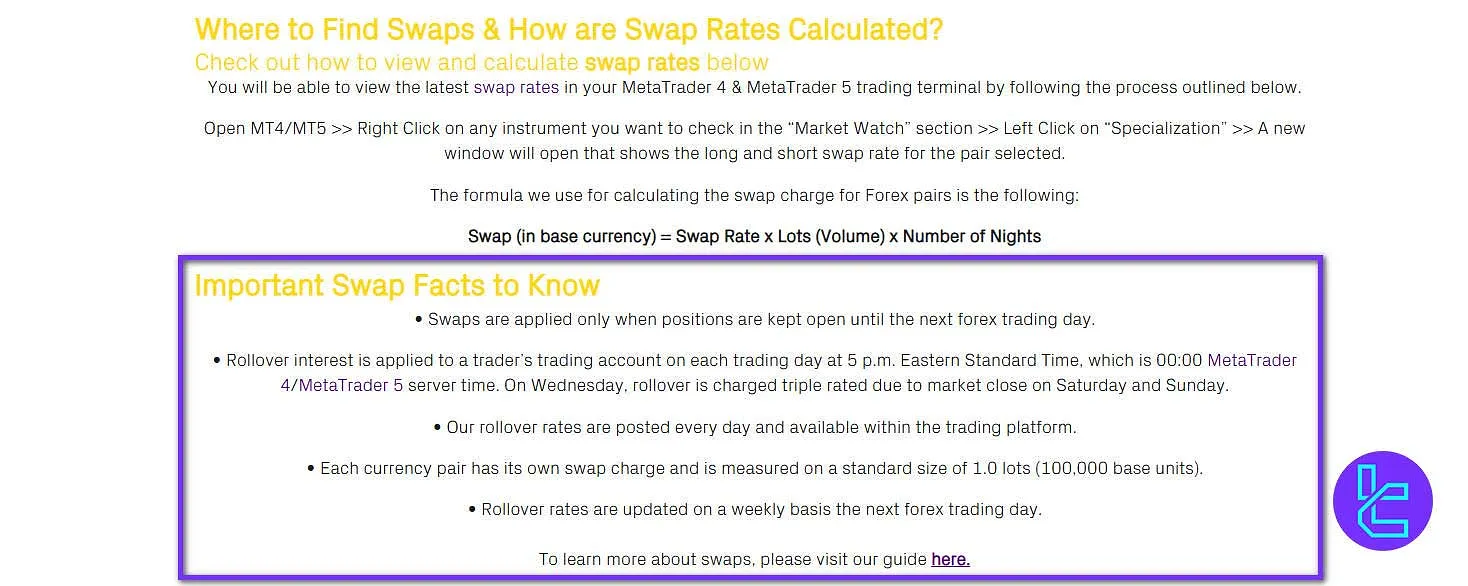

Baxia Markets Swap Fees

Baxia Markets applies overnight swap charges for trading positions held beyond the close of the trading day. Traders can view the latest swap rates directly in the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) terminal.

To check rates, open the terminal, right-click any instrument in the “Market Watch” section, select “Specification,” and a window will display both long and short swap values for the chosen instrument.

Swap fees for Forex pairs are calculated using the formula:

Key points to consider:

- Swaps are only applied to positions maintained until the next trading day;

- Rollover interest is posted daily at 5 p.m. EST (00:00 server time). Wednesdays incur triple swaps to account for weekend market closure;

- Each currency pair has an individual swap rate, typically based on a standard lot of 1.0 (100,000 base units);

- Swap rates are updated weekly and remain accessible through the MT4/MT5 trading platform.

Baxia Markets Non-Trading Fees

Regarding deposits and withdrawals, the broker applies a standard processing fee of $5 for most payment methods, with minimum transaction amounts starting at $30, and processing times ranging from 1–5 business days, depending on the method.

Specific fees include:

- Visa & Mastercard: $5 fee, minimum $30, up to 5 business days

- AstroPay: $5 fee, minimum $30, up to 2 business days

- Fasapay: $5 fee, minimum $30, up to 2 business days

- PayRedeem: $5 fee, minimum $30, up to 2 business days

- Sticpay: $5 fee, minimum $30, up to 2 business days

- Neteller: $5 fee, minimum $30, up to 2 business days

- Skrill: $5 fee, minimum $30, up to 2 business days

- Perfect Money: $5 fee, minimum $30, up to 2 business days

- Bank Transfer (SWIFT): $5 fee + intermediary bank charges, minimum $100, up to 5 business days

- Local Transfers (JPY, THB, VND, MYR, IDR, INR, ZAR): $5 fee, minimum $30, up to 2 business days

- Cryptocurrency: $5 fee, minimum $30, up to 2 business days

Deposits follow the same fee structure, though third-party processing or currency conversion charges may apply depending on the method. This clear, standardized approach ensures traders know the costs upfront for both funding and accessing their accounts.

Baxia Markets does not charge inactivity fees, allowing traders to keep accounts open without penalties even during extended non-trading periods.

Baxia Markets Deposit & Withdrawal Options

Baxia Markets offers a wide range of deposit and withdrawal options to cater to traders worldwide:

- Cryptocurrencies: Bitcoin, Ethereum, and other major cryptocurrencies accepted

- Credit/Debit Cards: Visa and MasterCard

- E-wallets: Perfect Money, Neteller, Skrill, Stickpay

- Local Payment Methods: FasaPay, local bank transfers in selected countries

- Bank Wire Transfer

Key points about Baxia Market deposits and withdrawals:

- Average processing time: 2 days

- Minimum deposit: $10

Baxia Markets does not charge fees for deposits or withdrawals, though third-party fees may apply.

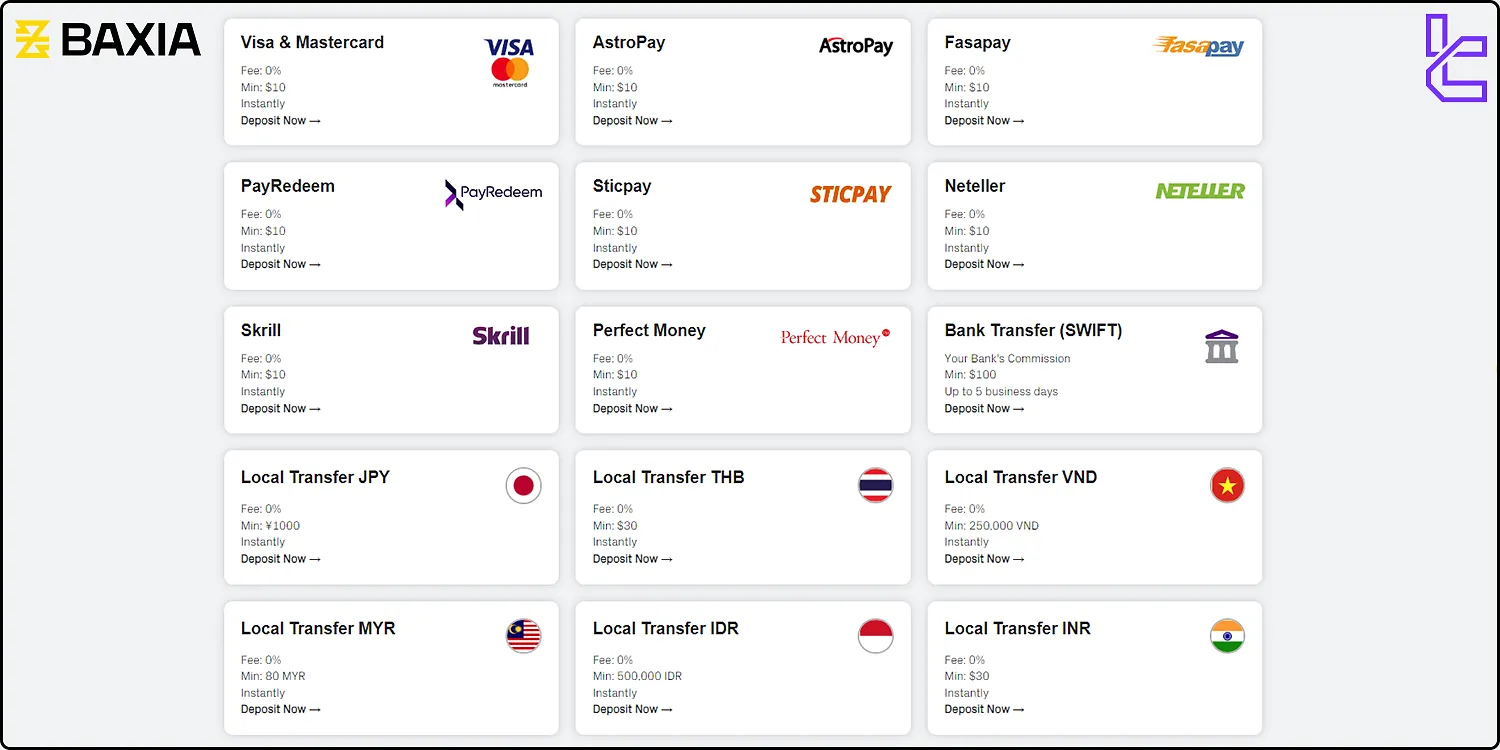

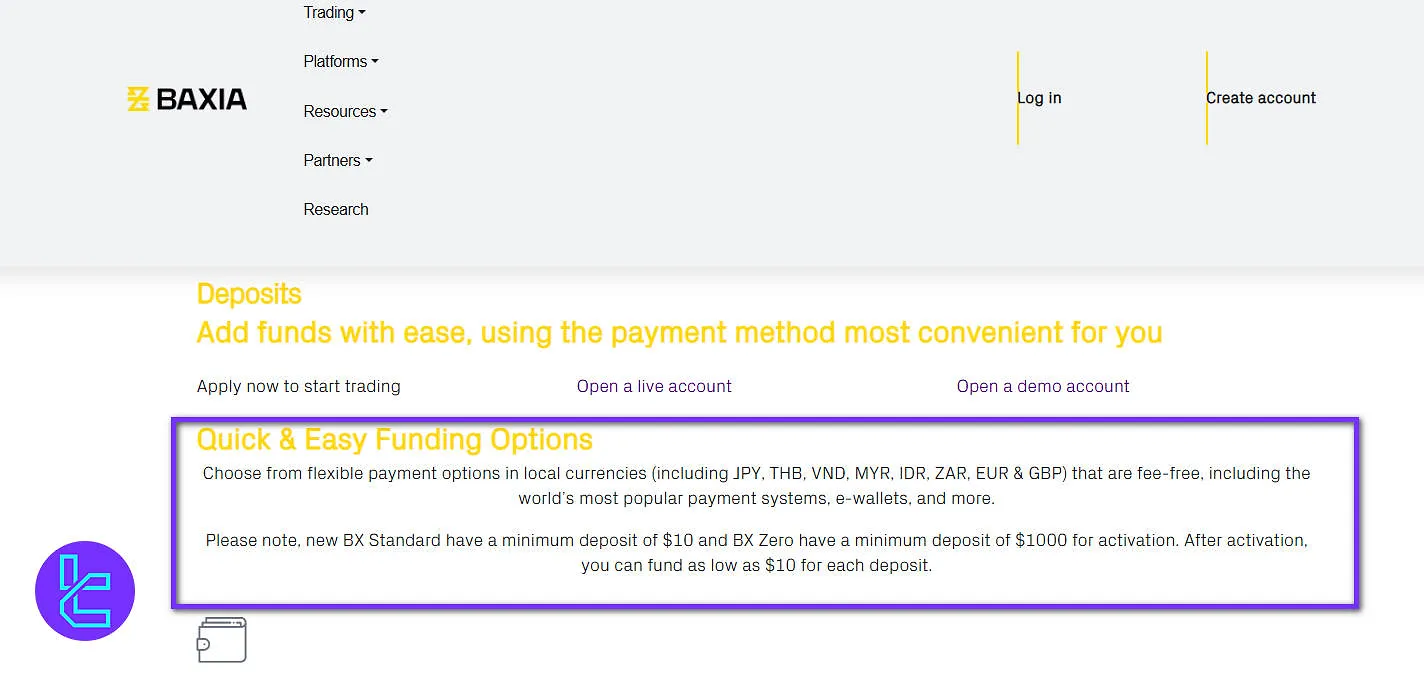

Baxia Markets Deposit

Baxia Markets provides a variety of deposit methods designed for speed and flexibility, supporting multiple local currencies including JPY, THB, VND, MYR, IDR, ZAR, EUR, and GBP.

For new accounts, the BX Standard account requires a minimum deposit of $10, while the BX Zero account starts at $1,000. Once activated, deposits as low as $10 can be made for each transaction.

Most methods are processed instantly and are fee-free, with the exception of bank transfers, where your bank’s commission may apply. Cryptocurrencies are also accepted with low minimums and immediate processing.

The following table summarizes the available deposit channels, processing times, and minimum amounts:

Deposit Method | Fee | Minimum Deposit | Processing Time |

Visa & Mastercard | 0% | $10 | Instant |

Astro Pay | 0% | $10 | Instant |

Fasapay | 0% | $10 | Instant |

Pay Redeem | 0% | $10 | Instant |

Sticpay | 0% | $10 | Instant |

Neteller | 0% | $10 | Instant |

Skrill | 0% | $10 | Instant |

Perfect Money | 0% | $10 | Instant |

Bank Transfer (SWIFT) | Bank’s commission | $100 | Up to 5 business days |

Local Transfer JPY | 0% | ¥1,000 | Instant |

Local Transfer THB | 0% | $30 | Instant |

Local Transfer VND | 0% | 250,000 VND | Instant |

Local Transfer MYR | 0% | 80 MYR | Instant |

Local Transfer IDR | 0% | 500,000 IDR | Instant |

Local Transfer INR | 0% | $30 | Instant |

Local Transfer ZAR | 0% | 200 ZAR | Instant |

Crypto | 0% | $25 | Instant |

Baxia Markets Withdrawal

Baxia Markets provides a secure and structured process for withdrawing funds through a dedicated client portal. Clients can access multiple payment channels, including credit/debit cards, e-wallets, bank transfers, local transfers in multiple currencies, and cryptocurrencies.

Withdrawal requests are processed efficiently, with most methods completed within 2 business days, while some bank transfers may take up to 5 business days.

A standard processing fee of $5 applies to most methods, except for certain bank transfers where intermediary charges may also occur. Minimum withdrawal amounts start from $30 for most options, with bank transfers requiring at least $100.

The following table summarizes the available withdrawal methods, fees, minimum amounts, and estimated processing times:

Withdrawal Method | Fee | Minimum Withdrawal | Processing Time |

Visa & Mastercard | $5 | $30 | Up to 5 business days |

Astro Pay | $5 | $30 | Up to 2 business days |

Fasapay | $5 | $30 | Up to 2 business days |

Pay Redeem | $5 | $30 | Up to 2 business days |

Sticpay | $5 | $30 | Up to 2 business days |

Neteller | $5 | $30 | Up to 2 business days |

Skrill | $5 | $30 | Up to 2 business days |

Perfect Money | $5 | $30 | Up to 2 business days |

Bank Transfer (SWIFT) | $5 / Intermediary fees may apply | $100 | Up to 5 business days |

Local Transfer JPY | $5 | $30 | Up to 2 business days |

Local Transfer THB | $5 | $30 | Up to 2 business days |

Local Transfer VND | $5 | $30 | Up to 2 business days |

Local Transfer MYR | $5 | $30 | Up to 2 business days |

Local Transfer IDR | $5 | $30 | Up to 2 business days |

Local Transfer INR | $5 | $30 | Up to 2 business days |

Local Transfer ZAR | $5 | $30 | Up to 2 business days |

Crypto | $5 | $30 | Up to 2 business days |

Copy Trading & Investment Options in Baxia Markets Broker

PAMM (Percentage Allocation Management Module) and MAM (Multi-Account Manager) accounts at Baxia Markets offer flexible investment solutions. PAMM accounts allow investors to allocate funds to professional traders, distributing profits proportionally.

MAM provides advanced management tools for handling multiple trading accounts with personalized risk settings, ideal for money managers and investors.

Baxia Markets Bonuses

Baxia Markets offers several promotional incentives aimed at attracting new clients and encouraging engagement:

- $30 Welcome Bonus: New users can receive a $30 trading credit without the need to deposit funds. This allows traders to test live market conditions with minimal risk;

- Refer-a-Friend Program: Existing clients can earn a $50 reward for each referred trader who successfully registers, deposits, and meets specific trading requirements;

- Demo Contest: Periodically, Baxia Markets organizes demo account competitions where participants can win prizes based on simulated trading performance.

These promotions are subject to terms and conditions and may not be available in all regions. Traders are advised to review the broker’s bonus policy for full eligibility criteria.

Baxia Markets Awards

Baxia Markets does not publicly disclose any formal industry awards on its website, and there is no verifiable record of the broker receiving recognized accolades.

While the platform references itself as “award-winning” in marketing materials, no details regarding awarding bodies, categories, or years are provided.

Baxia Markets Broker Tradable Instruments

Baxia Markets provides access to a moderately broad selection of nearly 100 tradable CFD instruments across five asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | Over 50 currency pairs (majors and minors, e.g., EUR/USD, GBP/USD, USD/JPY) | 50–70 currency pairs | Up to 1:1000 |

Indices | CFDs on leading global stock market indices | Around 10–15 indices (S&P 500, FTSE 100, DAX 30, etc.) | 10–20 indices | N/A |

Metals & Energies | CFDs on Gold, Silver, Crude Oil, Brent | Around 8 instruments | 5–15 instruments | N/A |

Cryptocurrencies | CFDs on Bitcoin, Ethereum, Litecoin (quoted in USD) | 3 major crypto assets | 3–10 assets | N/A |

Shares | CFDs on global equities from US, UK, Europe, Asia, and Australia | Over 1000 stocks | 800–1200 | N/A |

All instruments are available through leveraged CFD trading on the MT4 and MT5 platforms. While the asset range is not as expansive as some multi-asset brokers, it’s well-suited for traders focused on forex and major markets.

Baxia Markets Broker Support Channels

Baxia Markets prides itself on providing comprehensive customer support:

- Live Chat: available on the website

- Email Support: upport@baxiamarkets.com

- Phone Support: +44 1392580012

The support team is known for its professionalism and dedication to resolving client issues promptly.

Baxia Markets Restricted Countries

While Baxia Markets serves clients globally, there are certain restrictions:

- United States

- North Korea

- Iran

- Syria

- Cuba

- Sudan

- Iraq

- Venezuela

- Afghanistan

- Russia

- Myanmar

- Crimea

- Donetsk

- Palestine

- Yemen

- Belarus

- Libya

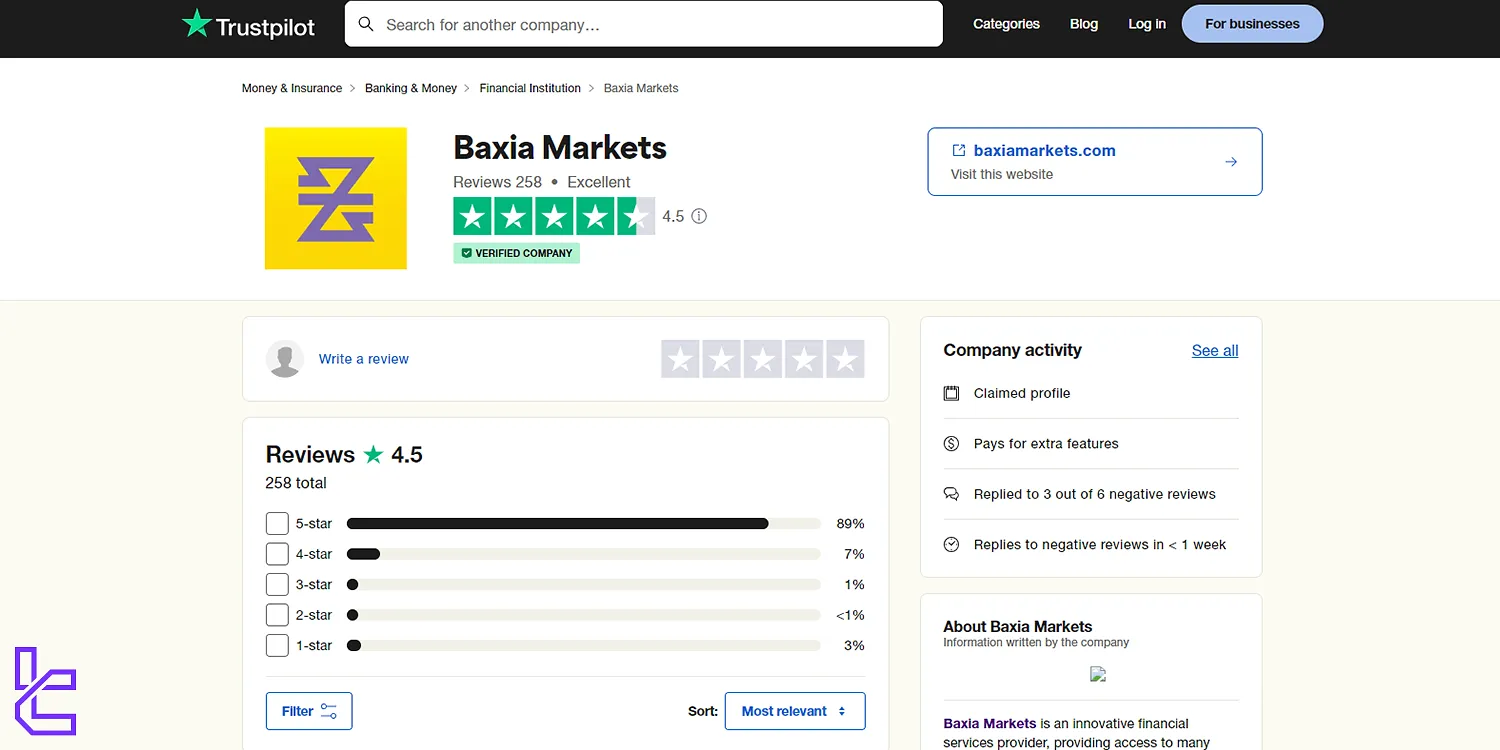

Baxia Markets Broker Trust Scores & User Reviews

Baxia Markets has garnered positive feedback from many traders:

- Trustpilot Score: 4.5/5

- Number of reviews: over 250

- Number of 5-star reviews: Over 88%

While the overall sentiment is positive, it's important to conduct your own due diligence and consider multiple sources when evaluating a broker.

Baxia Markets Broker Educational Resources

Baxia Markets provides a modest set of educational and research tools aimed at beginner to intermediate traders:

- Educational Center: Covers trading fundamentals, financial markets, and risk management strategies

- Research Materials: Includes news articles, curated watchlists, and PDF market reports

- Economic Calendar: Integrated with real-time data and event filters

- Trading Tools: Includes a forex calculator and position size calculator

- Multimedia: Maintains a basic YouTube channel (limited content)

While the educational suite is not as comprehensive as top-tier brokers, it offers enough foundational content for new traders to get started and stay informed.

Baxia Markets in Comparison with Other Forex Brokers

While Baxia Markets is well-known for offering excellent services, traders should still compare them with other Forex brokers to determine whether there is a better option for their specific needs.

Parameters | Baxia Markets Broker | |||

Regulation | SCB, FSA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC | ASIC, VFSC | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Spread | Floating from 0.0 pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | From $2.5 | From $0.0 | From $0.0 | $3 |

Minimum Deposit | $10 | $1 | $0 | $50 |

Maximum Leverage | 1:1000 | 1:500 | 1:500 | 1:500 |

Trading Platforms | MT4, MT5 | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MT4, MT5, cTrader |

Account Types | Zero, Standard | Standard, Razor | Zero, Classic, Swap-Free | Standard, RAW |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1000+ | 1200+ | 250+ | 1000+ |

Trade Execution | Market | Instant | Market, Instant | Instant |

TF Expert Suggestion

As a Forex broker with over 70,000 users worldwide, Baxia Markets aims to provide high-quality trading services and low trading fees (variable spreads from 0.0 pips and $2.5 commissions).

However, the lack of proper regulation by top-tier authorities, including FCA, ASIC, and CySEC, could be a major drawback for traders who prioritize safety.