First Prudential Markets (FP Markets) is a Forex broker regulated by multiple financial authorities, including ASIC, CySEC, SVG FSA, FSCA, and FSC.

This broker offers 2 main account types, Standard and RAW, with floating spreads from 0.0 pips and a minimum deposit of $50.

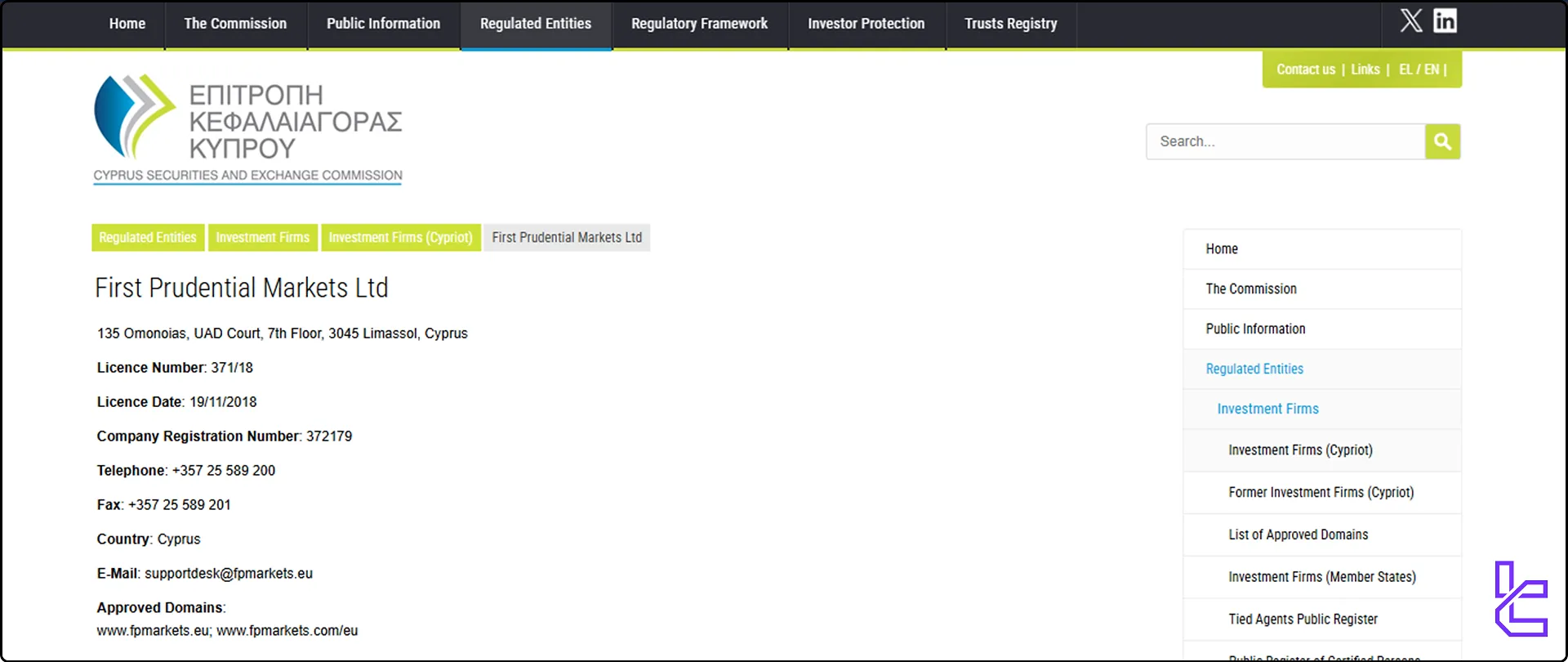

FP Markets Company Info and Regulation

FP Markets, established in 2005, is a multi-regulated Australian brokerage known for its diverse product range and institutional-grade trading conditions. The company's commitment to providing a secure and transparent trading environment is evident through its regulatory compliance. FP Markets regulations:

- ASIC

- CySEC

- FSA (Saint Vincent and Grenadines)

- FSA (Seychelles)

- FSCA

- FSC

FP Markets ensures client safety and regulatory transparency by operating under two top-tier financial regulators, ASIC in Australia and CySEC in Cyprus.

These regulatory oversights ensure that FP Markets adheres to strict financial standards, including segregation of client funds and regular audits.

Entity Parameters/Branches | First Prudential Markets PTY Ltd | First Prudential Markets Ltd | FP Markets (Pty) Ltd | FP Markets Limited | FP Markets Ltd |

| FP Markets LLC |

Regulation | ASIC | CySEC | FSCA | CMA | FSC | FSA | FSA |

Regulation Tier | 1 | 1 | 2 | 2 | 3 | 3 | 3 |

Country | Sydney, Australia | Limassol, Cyprus | South Africa | Kenya | Cook Islands | Seychelles | Saint Vincent and the Grenadines |

Investor Protection Fund/ Compensation Scheme | No | Up to €20,000 under ICF | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:2000 | 1:400 | 1:3000 | 1:2000 | 1:3000 |

Client Eligibility | Only Australia | Only EU/EEA Residents | Only South Africa | Only Kenya | Global | Global | Global |

CEO of FP Markets

Craig Allison is a multi-lingual senior executive, currently Head ofEurope, Middle-East & Africa at FP Markets, with a strong track record in expanding business across international markets.

He specializes in strategic and digital marketing, operational performance, and legal governance.

A qualified solicitor with a PGDL/LPC in Banking, Corporate, Finance, and Securities Law from BPP Law School, he began his career at a leading global law firm before moving into senior leadership roles in financial services and sports marketing.

His expertise includes negotiating complex commercial agreements and building high-value partnerships.

Allison has held key positions at FP Markets, CSM Sport & Entertainment – iLUKA, and Wing Ltd., leading multi-disciplinary teams and driving measurable results.

His skills span financial services, CFD brokerage and forex trading, strategic planning, and regulatory compliance.

You can explore

You can explore Craig Allison LinkedIn Profile to gain insights into the leadership and professional journey of the CEO of FP Markets.

to gain insights into the leadership and professional journey of the CEO of FP Markets.

FP Markets Broker Summary

Let's take a quick look at the key features of FP Markets:

Broker | FP Markets |

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Based Currencies | AUD, EUR, USD, GBP, CHF, JPY, ZAR, MXN, BRL, SGD, CAD, HKD |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | Copy trade, Algo trade, PAMM, MAMM |

Trading Platforms & Apps | MT4, MT5, cTrader |

Markets | Forex, CFDs, ETFs, indices, commodities, metals, cryptocurrencies, stocks |

Spread | From 0.0 pips |

Commission | $3 |

Orders Execution | Instant |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo account, Forex calculator, economic calendar |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, live chat, phone support, call back |

Customer Support Hours | 24/7 |

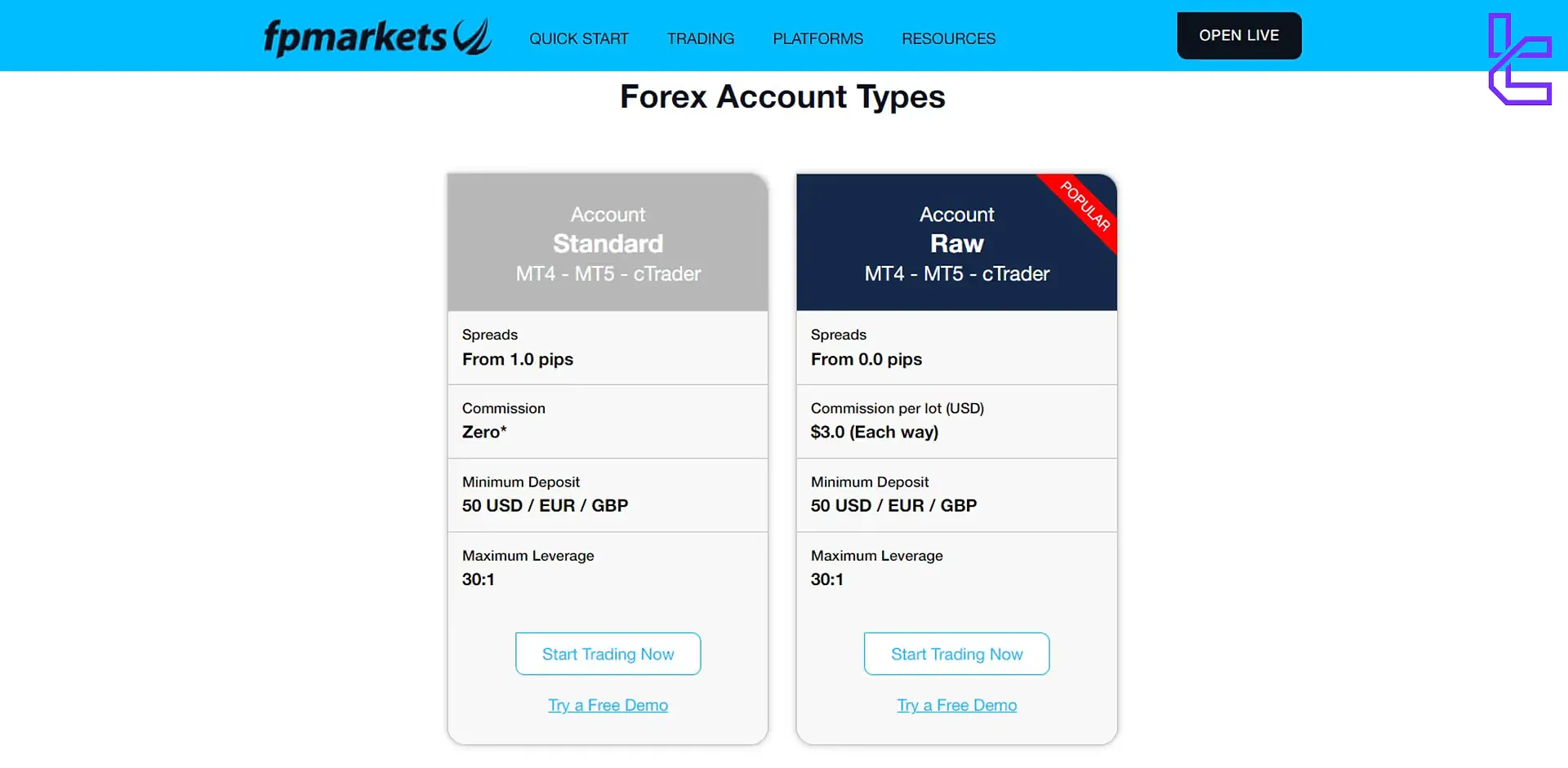

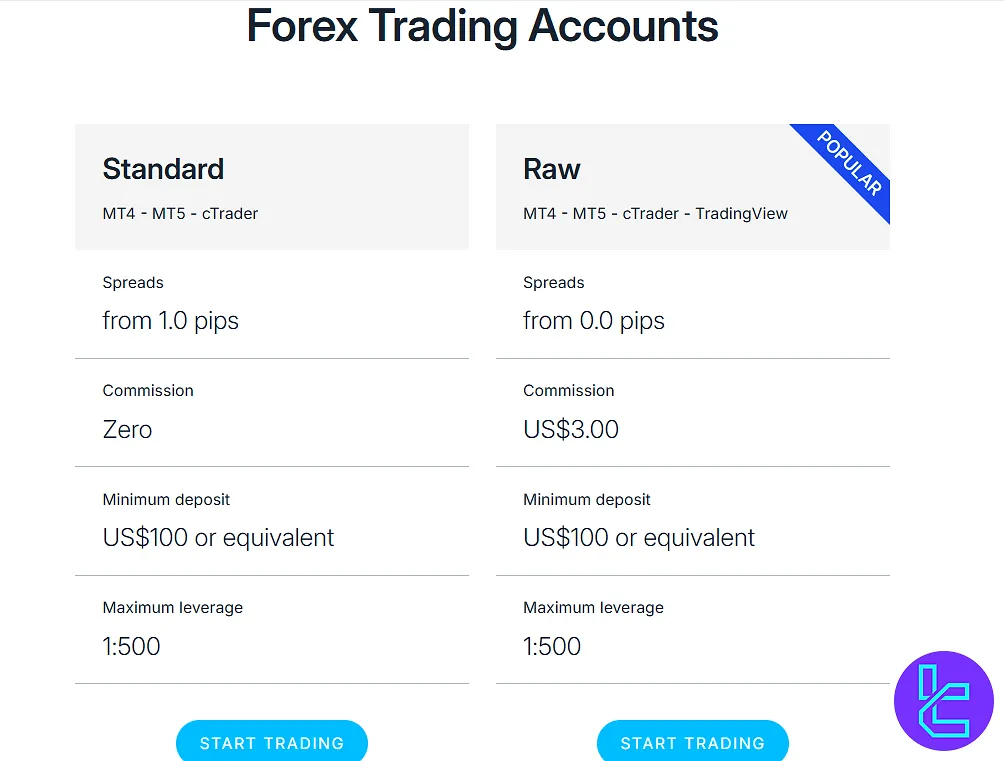

FP Markets Account Types

FP Markets offers2 main account types to suit different trading needs:

Feature | Standard account | RAW Account |

Spread | From 1.0 pips | From 0.0 pips |

Commission | 0 | $3 |

Minimum deposit | $50 | $50 |

Maximum leverage | 1:30 | 1:30 |

Trading Platform | MT4, MT5, cTrader | MT4, MT5, cTrader |

Each account type comes with its unique features, allowing traders to choose based on their trading strategies, risk appetite, and experience level. It’s worth mentioning that FP Markets also offers aprofessional accountwith increased leverage options up to 1:500.

While high leverage increases potential returns, it also amplifies risk. FP Markets promotes responsible trading through negative balance protection and detailed risk disclosures.

Both accounts require a minimum deposit of $50, and Islamic (swap-free)versions are available upon request.

Advantages and Disadvantages of FP Markets Broker

Let's weigh the pros and cons of trading with FP Markets:

Advantages | Disadvantages |

Regulated by top-tier authorities | No proprietary trading platform |

Tight spreads | Not available to US clients |

Wide range of trading instruments | - |

Various trading platforms | - |

A diverse range of educational content | - |

FP Markets Account Opening and Verification Process

The FP Markets registration takes approximately 5 to 10 minutes and involves identity details, financial disclosures, and trading preferences.

During registration, users select their account type, set their preferred leverage option, and choose between the MetaTrader 4 and MetaTrader 5 platforms, all while confirming compliance and trading experience.

#1 Start the Live Account Application

Head to the FP Markets official website and click “Open Live” to begin creating your account.

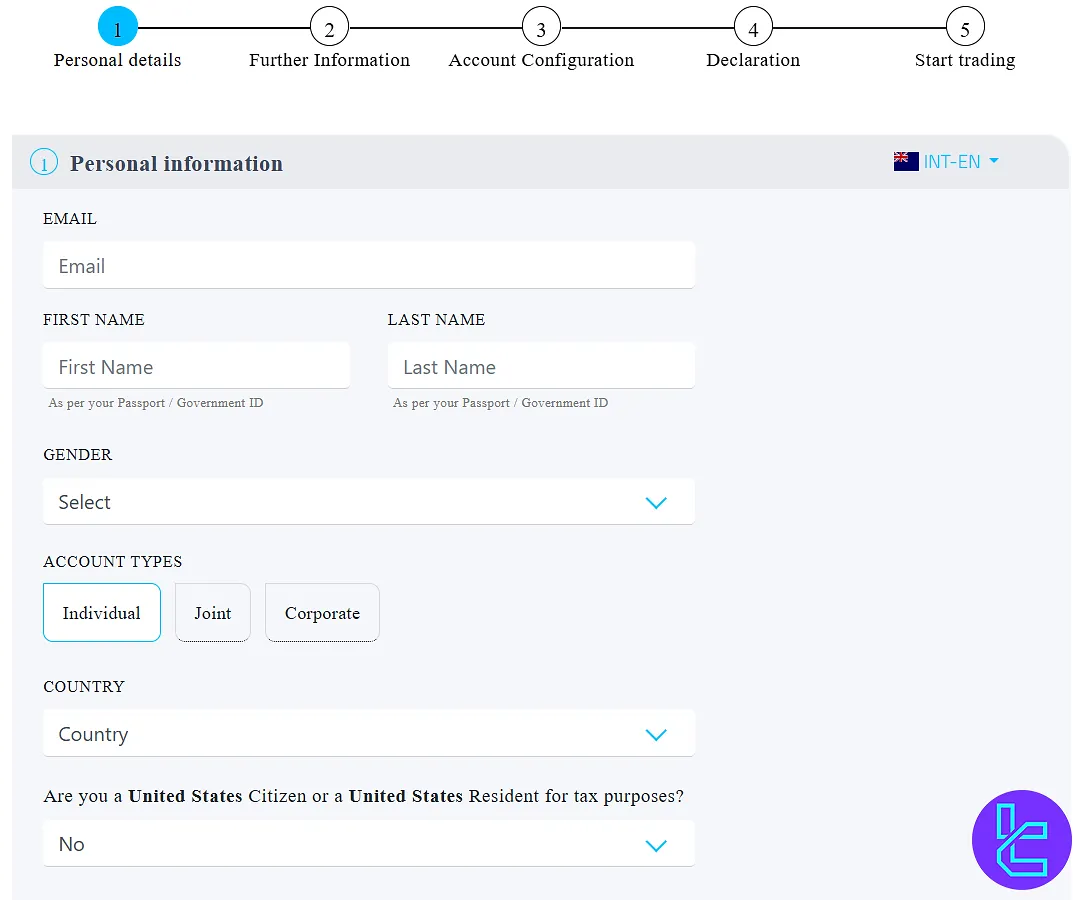

#2 Fill in Personal Information

Fill out the application form with the following details:

- Full name and email

- Country and citizenship

- Phone number and preferred language

- Account type

Click “Save and Next”.

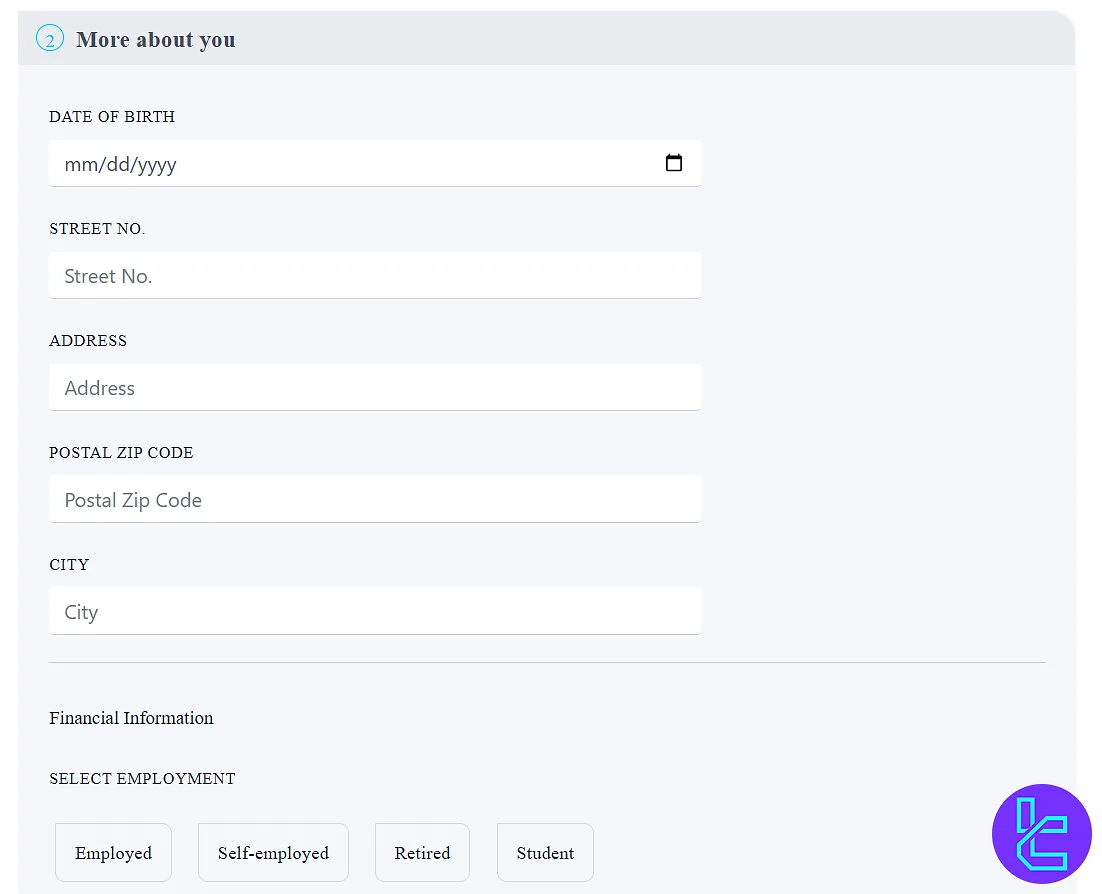

#3 Add Address & Financial Profile

Provide your residential details and financial profile, including:

- Full residential address and ZIP code

- Date of birth

- Employment and financial background

Click “Save and Next”.

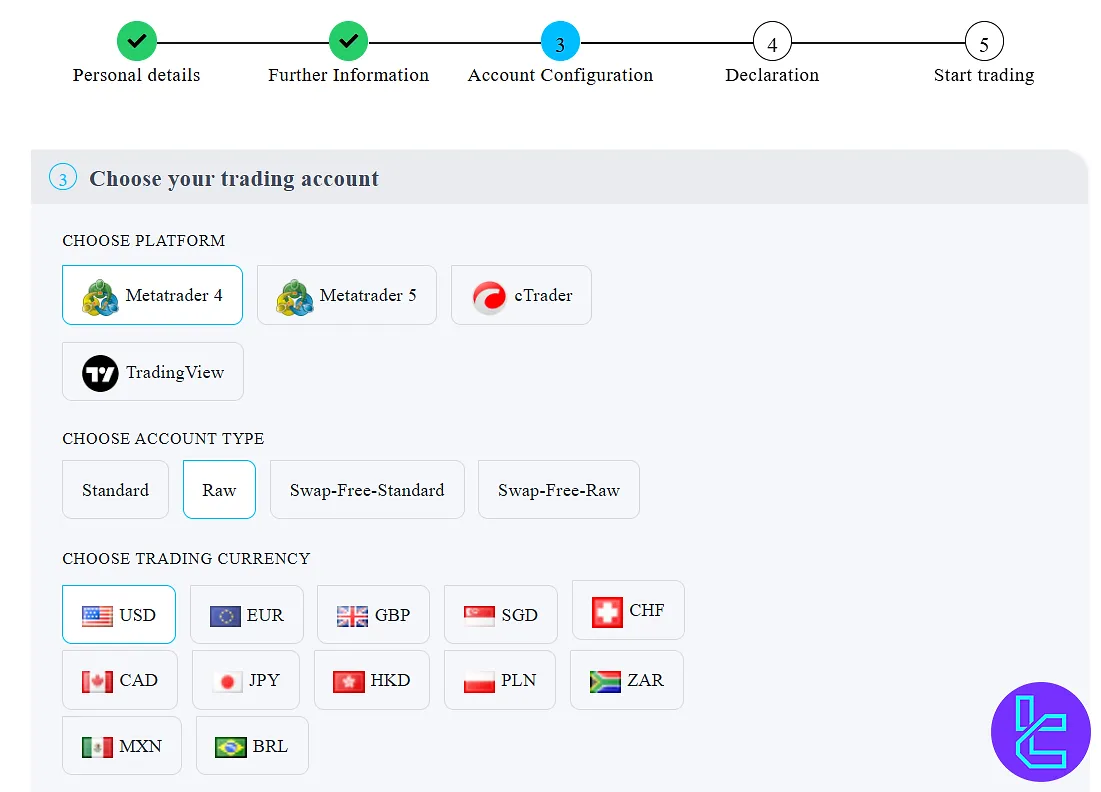

#4 Select Trading Setup

Now it's time to adjust yourtrading account's settings:

- Platform (MetaTrader 4 or 5)

- Account type and base currency

- Leverage

- Password

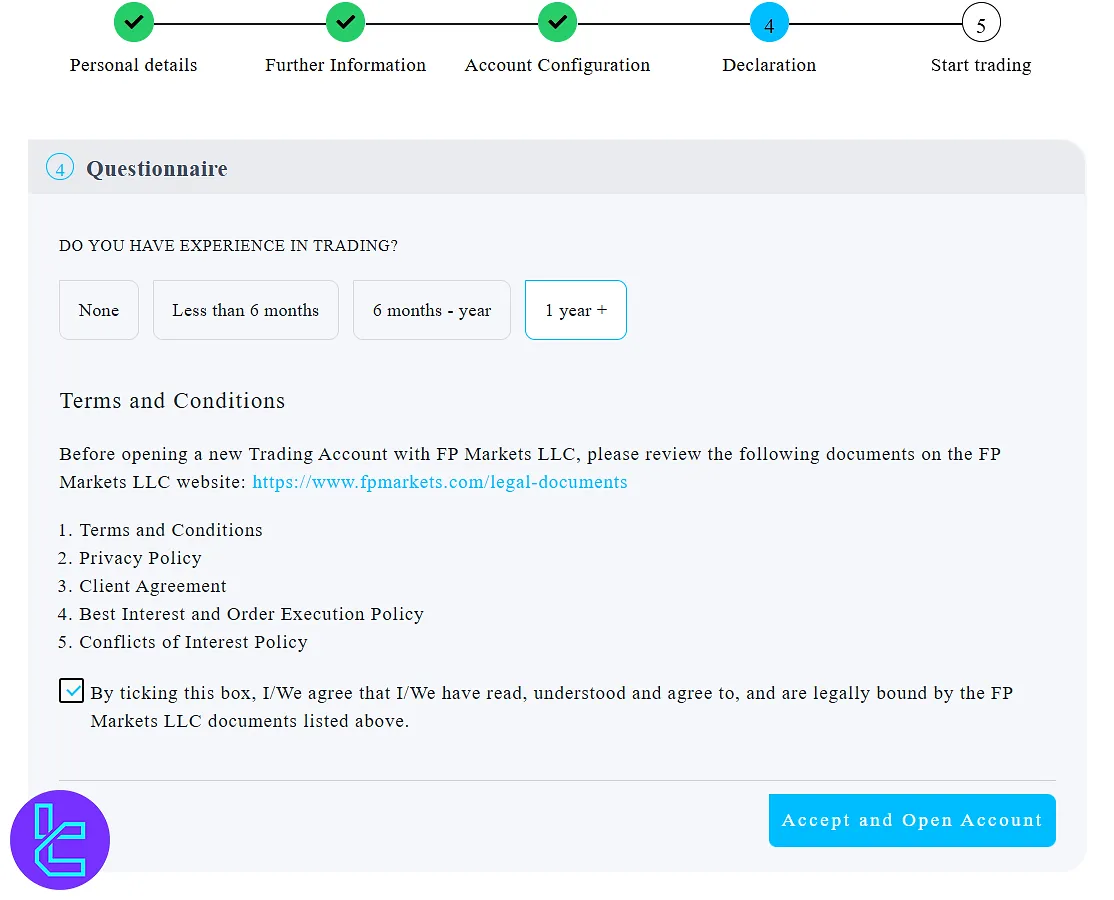

#5 Confirm Experience & Accept Terms

Specify your trading experience, agree to the terms and conditions, and click “Accept and Open Account”.

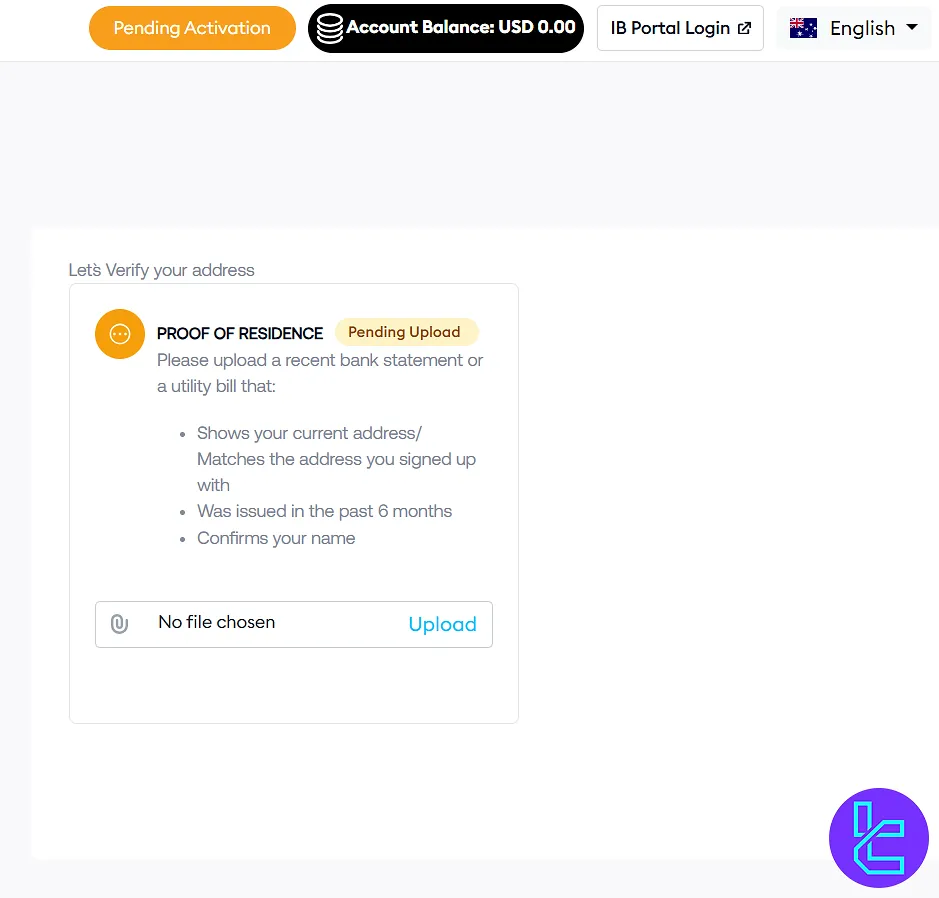

#6 Proceed with the KYC Procedure

To initiate the FP Markets verification process, navigate to the KYC section through the client area and upload supporting documents, including:

- Proof of Identity: Passport or Residence permit

- Proof of Address: Utility bill or Tenancy certificate

The verification process typically takes 24 hours.

Trading Platforms in FP Markets broker

FP Markets offers a variety of popular trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

FP Markets MetaTrader 4 (MT4)

MetaTrader is the most well-known Forex trading platform in the world. Some of its key features include

- Customizable interface

- Over 20 technical analysis tools and indicators

- Available for desktop, web, and mobile

- Custom Indicators

Links:

FP Markets MetaTrader 5 (MT5)

MetaTrader 5 is a more advanced trading platform suitable for modern traders. Key features include:

- 21 timeframes and advanced analytical objects

- Integrated economic calendar

- Over 20 built-in indicators

- Wide range of tradable instruments, including indices, bonds, and cryptocurrencies

Links:

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

FP Markets cTrader

cTrader is an ultra-modern trading platform that has been operating since 2011. Key features of trading in FP Markets with cTrader include:

- Designed for ECN trading

- Advanced charting and order management

- Suitable for both beginners and professionals

Links:

This multi-platform approach empowers users with theflexibilityto choose trading tools that match their strategy, from manual to automated trading.

FP Markets Spreads and Commissions

FP Markets is known for itscompetitive pricingstructure:

- Standard Account: Spreads from 1.0 pips, no commission

- Raw Spread Account: Spreads from 0.0 pips, $3 commission per lot

The actual spreads may vary depending on market conditions and the specific instrument being traded. It's worth noting that FP Markets' low spreads and commissions make it an attractive option for both novice and experienced traders.

Swap Fees

FP Markets applies competitive swap rates (overnight/rollover fees) on all instruments, minimizing costs for positions held past the daily cutoff.

Traders can check exact charges using theForex Swap Rate Calculator in MetaTrader 4 (MT4) or MetaTrader 5 (MT5) by selecting the instrument, trade size, and account currency.

The all-in-one FX calculator also measures pip value, contract size, margin, and potential profit.

Key Points

- Calculated at 00:00 server time and applied only to overnight positions;

- Determined by the interest rate differential of the currency pair;

- Negative swaps may occur on both long and short trades;

- Quoted in points, with MT4/MT5 converting to account currency;

- Triple swap charged midweek (usually Wednesday, sometimes Friday).

FP Markets Non-Trading Fees

FP Markets imposes no inactivity fees, even if an account remains unused. Accounts with no activity for 30 days are archived, but this process carries no financial penalty.

To prevent closure, users should log in at least once within each 30-day period.

Additionally, suppose deposited funds are withdrawn or transferred without being used for trading. In that case, FP Markets may reverse any previously credited bonuses, promotional funds, or benefits associated with those deposits, in accordance with the company’s terms and conditions.

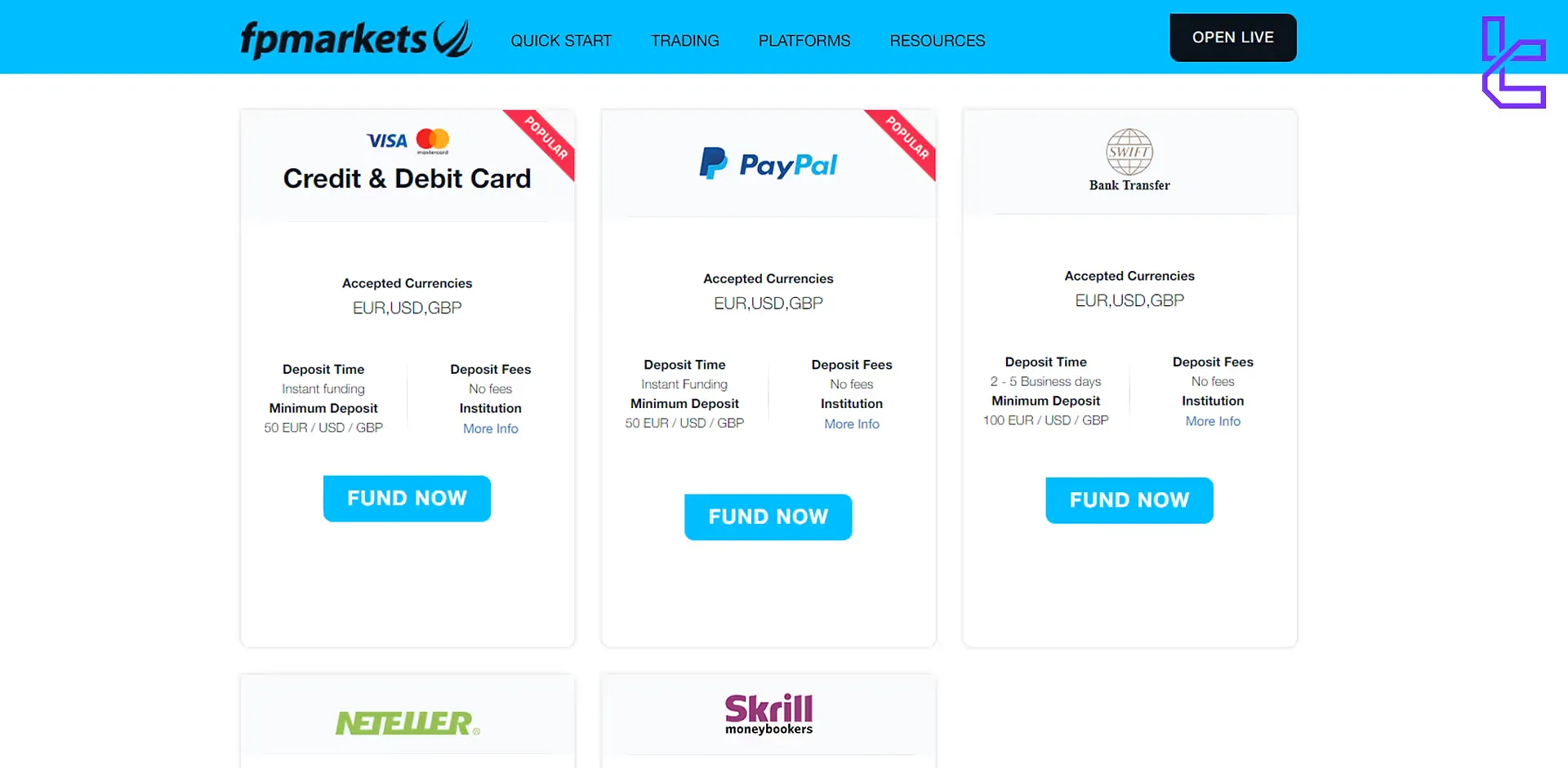

FP Markets Deposit & Withdrawal

The broker offers several payment options, including cryptocurrencies and PayPal. FP Markets deposit and withdrawal methods:

- Credit and Debit

- PayPal

- Bank Transfer

- Skrill

- Neteller

Here's how you can deposit funds to your trading account:

- Log in to your client area;

- Choose the deposit menu;

- Select your preferred funding methods;

- Enter the deposit amount;

- Complete the transaction process.

FP Markets charges no fees for deposits or withdrawals; however, third-party fees, such as blockchain network costs, may apply.

Deposit

FP Markets offers a broad range of funding options designed for fast and cost-free deposits. Traders can choose from the deposit methods listed in the table below:

Deposit Method | Processing Time | Minimum Deposit | Fees |

Credit/Debit Cards | Instant | $50 (EUR/GBP/USD) | No Fees |

Bank Wire Transfers | 2–5 Business Days | $100 (EUR/GBP/USD) | No Fees |

Neteller | Instant | $50 (EUR/GBP/USD) | No Fees |

Skrill | Instant | $50 (EUR/GBP/USD) | No Fees |

PayPal | Instant | $50 (EUR/GBP/USD) | No Fees |

Online Banking | Instant | $50 (EUR/GBP/USD) | No Fees |

The minimum deposit is $50 (EUR/GBP/USD) for cards and e-wallets, while bank wires require $100. FP Markets charges no deposit fees for any method, ensuring that 100% of the transferred amount is credited to the trading account.

Funding must be made from an account in the trader’s own name, and the broker enforces AML compliance, including daily deposit limits. All card deposits are refunded to the same card, and profits over 100 EUR/USD/GBP are sent to a bank account or e-wallet.

Withdrawal

FP Markets provides five cash-out options for clients:

Withdrawal Method | Processing Time | Minimum Withdrawal | Fees |

Credit/Debit Cards | 2–5 Business Days | $5 (EUR/GBP/USD) | No Fees |

Bank Wire Transfers | 3–8 Business Days | $100 (EUR/GBP/USD) | No Fees |

PayPal | Instant | $5 (EUR/GBP/USD) | No Fees |

Neteller | Instant | $5 (EUR/GBP/USD) | No Fees |

Skrill Ltd | Instant | $5 (EUR/GBP/USD) | 1% + Country Fees |

Paysafe Financial Services Ltd | Instant | $5 (EUR/GBP/USD) | 1% (Max $30) |

Processing times depend on the method: PayPal, Skrill, and Paysafe Financial Services Ltd withdrawals are processed instantly, while cards take 2–5 business days and bank wires require 3–8 business days.

Most withdrawal methods are fee-free. However, Paysafe Financial Services Ltd applies a 1% fee capped at $30, and Skrill Ltd charges 1% plus applicable country fees. The minimum withdrawal amount is $5 for most methods, except for bank wire transfers, which require $100.

FP Markets processes withdrawals only to accounts in the trader’s own name and may choose the cash-out method at its discretion. All requests require account verification, and third-party payments are not accepted. The broker may also reverse fee coverage if deposits are not used for trading purposes.

Copy Trading & Investment Options in FP Markets

When it comes to investment options, FP Markets offers a wide range of solutions, from copy trading to PAM and MAM accounts.

- Algo Trading: Algorithmic trading is done through Expert Advisors in FP Markets trading platforms. Traders run the programs to trade 24/7 without human interference;

- Copy Trading: Traders can join FP Markets' proprietary platform “Social Trading” to choose from profitable traders and copy their trades with a low fee;

- MAMM and PAMM Accounts: Traders can let trusted account managers buy and sell assets with tier money and share a portion of the profit with them.

FP Markets Tradable Instruments

FP Markets offers a wide range of over 10,000 tradable instruments across seven asset classes, from the Forex market to ETFs and digital assets.

Category | Types of Instruments | Number of Symbols | Competitor Average |

Forex | Forex CFDs | 60+ Currency Pairs on MT4 | ~70–100 Currency Pairs (e.g. Admirals offers 7,500+ Instruments Overall; Typical Forex Pairs often 70–100) |

Stocks | Share CFDs | 650+ Stocks on Global Exchanges | ~1,000–2,000 Stocks (Admirals Includes Shares/ETFs in Broader Instrument Count) |

Indices | Indices CFDs | 15 Indices (9 Major + 6 Non-Major) | ~20–50 Indices Commonly Available |

Commodities | Commodity CFDs | Coffee, Natural Gas, Corn, etc. (Varied Commodities) | ~20–50 commodity CFDs |

Cryptocurrencies | Metals, CFDs | Gold, Silver, Platinum, etc. | ~20–30 Crypto CFDs |

ETFs | Crypto CFDs | Multiple Including BTC, ETH, XRP, BCH, LTC, etc. | ~300–500 ETFs in Competitive Platforms |

Metals | ETF CFDs | 200+ ETF CFDs | ~5–10 Metal Instruments (Gold, Silver, Platinum, Palladium, etc.) |

Bonuses and Promotions in FP Markets Broker

FP Markets occasionally offers bonuses and promotions to new and existing clients. This broker currently offers an exciting referral program for existing traders. By sharing their links with friends and family, traders can earn up to $800 CPA for affiliates.

It's important to note that bonuses and promotions are subject to change and may have specific terms and conditions. Always check the official website for the most up-to-date offers.

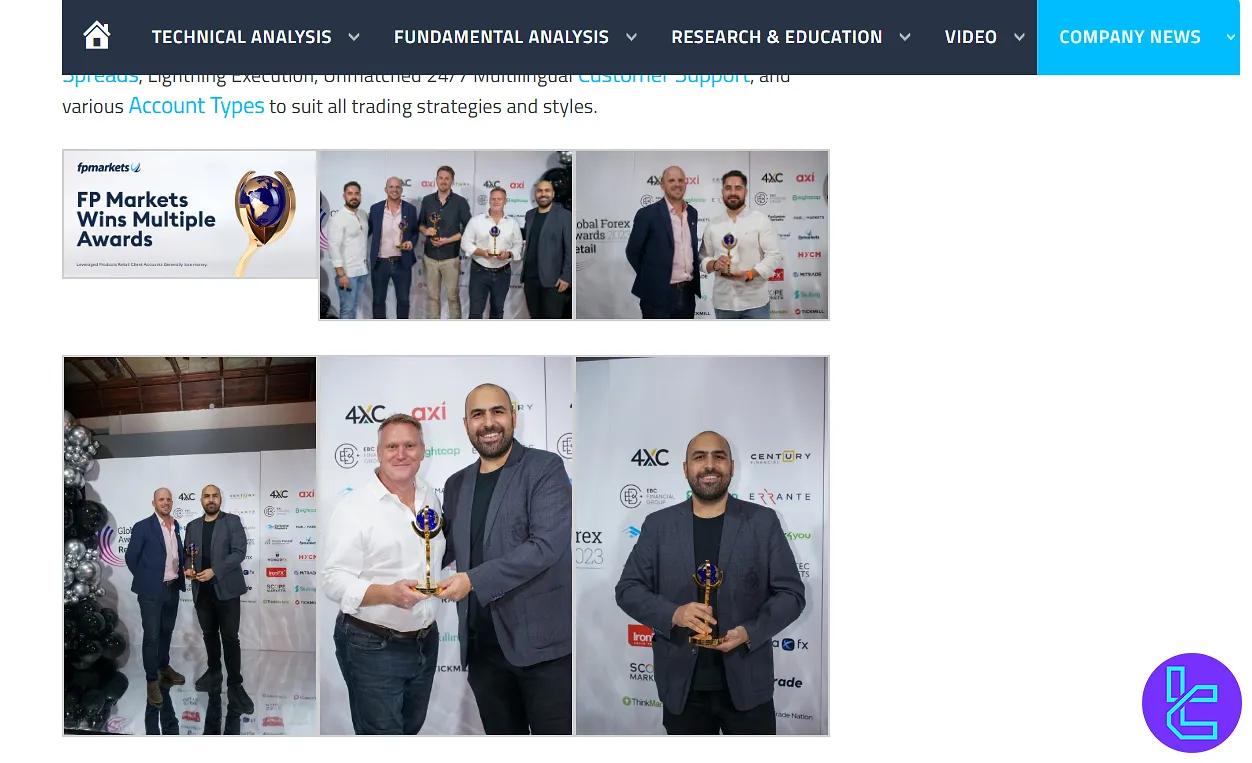

FP Markets Awards

FP Markets was named Best Global Forex Value Broker at the Global Forex Awards 2019 in Limassol, an event recognizing top financial service providers through public voting.

Operating for over 15 years, the broker’s award was attributed to its mix of competitive pricing, fast execution, advanced platforms, broad product range, responsive support, and detailed market analysis.

FP Markets offers access to more than 10,000 instruments — including Forex, Equity CFDs, Indices, Futures CFDs, and Cryptocurrencies — all tradable from a single account for streamlined multi-asset trading.

Additional details about the broker’s awards are available on the FP Markets Awards page on its official website.

FP Markets Support

Now it’s time to cover support channels in our FP Markets review.

Support channel | Details |

Call back | FP Markets call back request |

Live chat | Available 24/7 |

Phone support | +357 25 056 926 |

Email support | supportdesk@fpmarkets.eu |

The broker's commitment to customer satisfaction is evident in its responsive and knowledgeable support team.

FP Markets Banned Countries

FP Markets does not accept clients from certain jurisdictions due to regulatory restrictions. Some notable restricted countries include:

- USA

- Japan

- New Zealand

- Belgium

- Iraq

- Iran

- Syria

- North Korea

Always verify your eligibility to open an account based on your country of residence.

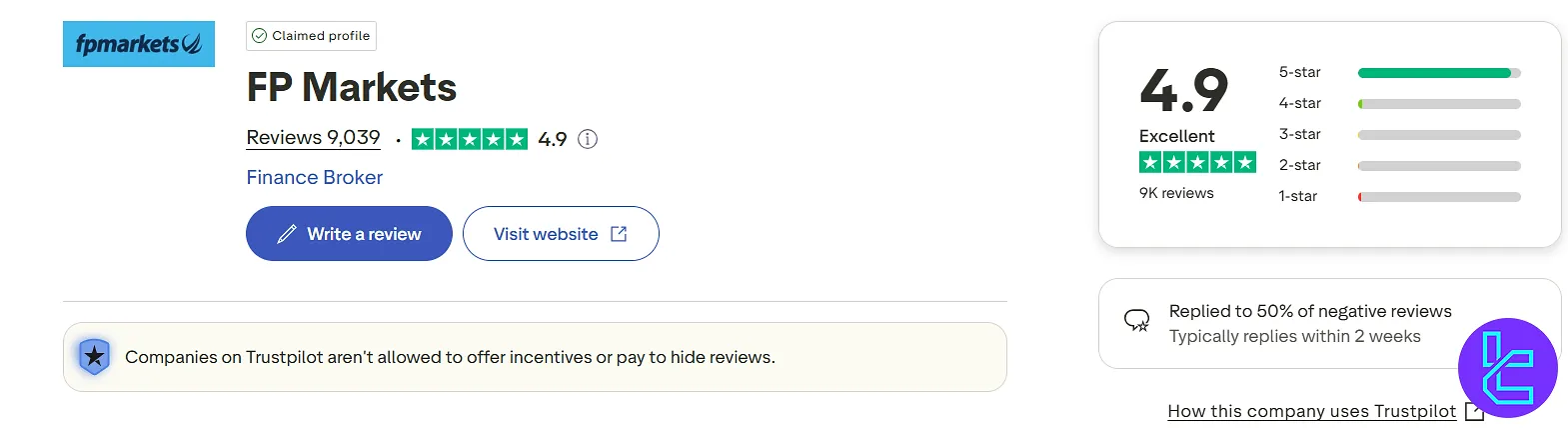

FP Markets Trust Scores

FP Markets has garnered positive reviews from many traders.

Trustpilot | 4.9 |

ForexPeaceArmy | 2.9 |

2.8 |

Traders often praise FP Markets for its:

- Competitive pricing

- Fast execution

- Responsive customer support

- Wide range of trading instruments

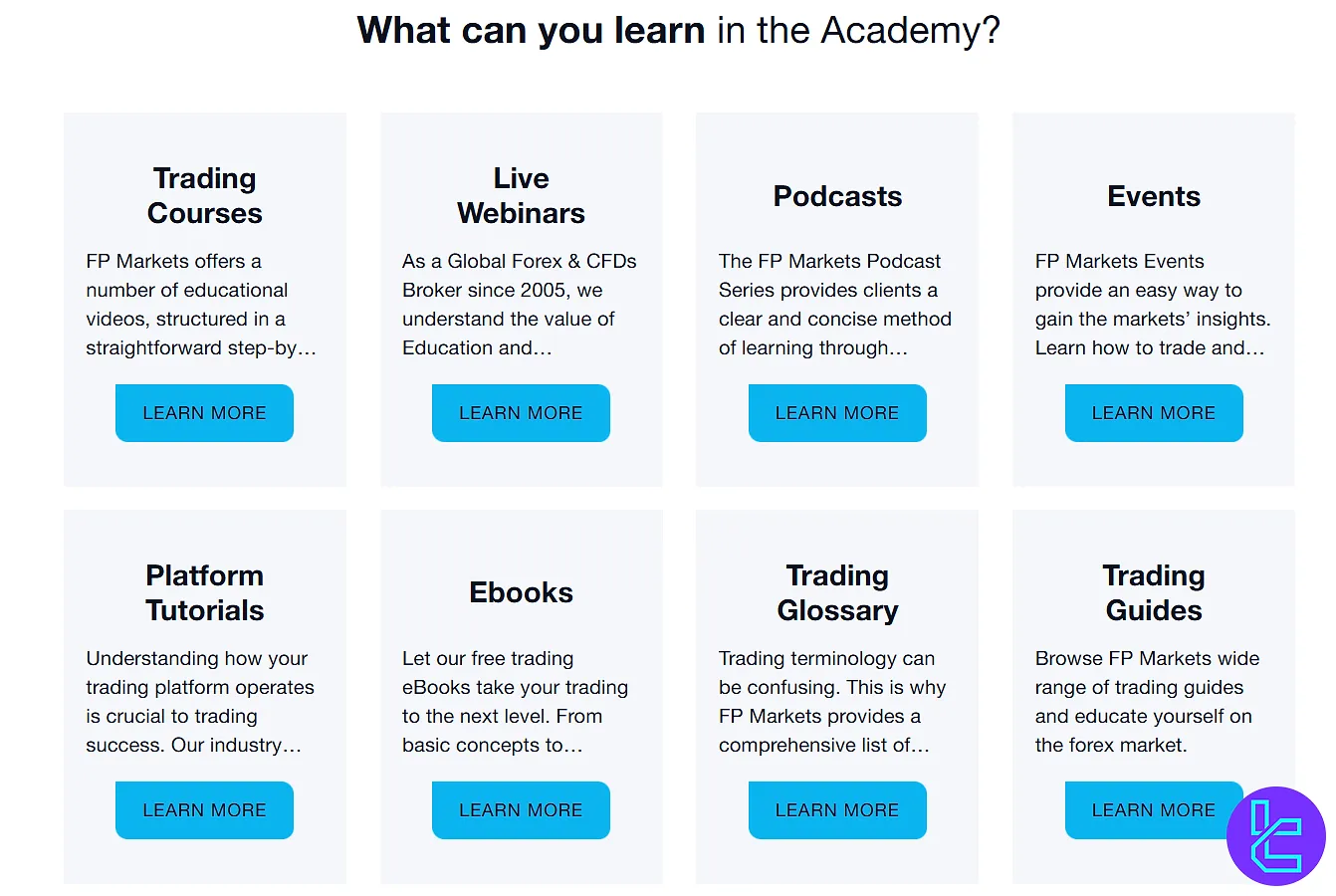

FP Markets Broker Education Materials

FP Markets offers various educational resources. From detailed videos on YouTube to a Trading Glossary, FP Markets covers everything a trader needs to start their journey.

While the educational content is informative, some traders feel it could be more comprehensive compared to other leading brokers.

You can also check TradingFinder's Forex education section for additional resources.

FP Markets Comparison Table

A comprehensive comparison between FP Markets and other top brokers:

Parameter | FP Markets Broker | XM Broker | Exness Broker | FxPro Broker |

Regulation | ASIC, CySEC, FSC, FSCA, FSA | ASIC, FSC, DFSA, CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $3 | $0 (except on Shares account) | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $50 | $5 | $10 | $100 |

Maximum Leverage | 1:500 | 1:1000 | Unlimited | 1:500 |

Trading Platforms | MT4, MT5, cTrader | MT4, MT5, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Standard, RAW | Micro, Standard, Ultra Low, Shares | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 10,000+ | 1400+ | 200+ | 2100+ |

Trade Execution | Instant | Market, Instant | Market, Instant | Market, Pending |

Trading Finder Expert Suggestion

With competitive commissions starting at $3.0, a maximum leverage of 1:500, and a variety of investment options (copy trade, algo trade, PAMM, MAMM), FP Markets provides great trading conditions for traders worldwide.

Meanwhile, the low trust score on ForexPeaceArmy (2.9/5) and Reviews.io (2.8) websites might raise some concerns about the quality of services on the platform.