FreshForex is a Forex broker that offers 3 primary account types, including Classic, Market Pro, and ECN accounts, with a $25 minimum deposit threshold and high leverage up to 1:2000.

This broker provides 70 currency pairs and various CFD instruments for traders in 158 countries. FreshForex Classic and Market Pro accounts are without commission (except for CFD on corporate shares and cryptocurrencies).

FreshForex complete review for beginner and professional traders

FreshForex complete review for beginner and professional traders

FreshForex Company Info & Regulations

FreshForex, established in 2004, is an online forex and cryptocurrency trading platform based in Kingstown, Saint Vincent and the Grenadines. With nearly two decades of experience, the company has expanded its reach to serve clients in over 158 countries.

FreshForex is committed to trader protection, fast trade execution, and competitive spreads.

It's worth noting that right now, FreshForex doesn’t operate under the oversight of top-tier financial institutions, and traders are advised to consider this fact before creating an account on this platform.

This absence of valid oversight significantly impacts the platform’s transparency and the protection of client funds. Investors should be especially cautious when trading with unregulated brokers, as there’s limited recourse in cases of disputes or malpractice.

While the platform offers advanced trading tools like MT4 and MT5, the lack of regulatory protection makes it unsuitable for risk-averse or beginner traders.

Here you can read important information about FreshForex:

Entity Parameters | Riston Capital Ltd |

Regulation | Unregulated |

Regulation Tier | N/A |

Country | Saint Vincent & the Grenadines |

Investor Protection Fund / Compensation Scheme | None |

Segregated Funds | No |

Negative Balance Protection | No |

Maximum Leverage | 1:2000 |

Client Eligibility | International (except restricted countries) |

FreshForex Broker Summary of Specifications

FreshForex offers a comprehensive suite of trading services catering to novice and experienced traders. Here's a snapshot of what the Forex broker brings to the table:

Broker | FreshForex |

Account Types | Classic, Market Pro, ECN |

Regulating Authorities | No |

Based Currencies | USD, EUR, MBT, ZAR, NGN, MYR, TZS, KZT, RUB |

Minimum Deposit | $25 |

Deposit Methods | Visa, Master Card, Crypto [USDT, BTC, USDC], Perfect Money, Local E-wallets, Local Depositors |

Withdrawal Methods | Visa, Master Card, Crypto [USDT, BTC, USDC], Perfect Money, Webmoney, Local E-wallets, Local Depositors |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:2000 |

Investment Options | No |

Trading Platforms & Apps | MetaTrader 4 and 5 |

Markets | Forex, Precious Metals, Crypto, ETFs, Stocks |

Spread | Form 0 pips |

Commission | From 0.003% per contract |

Orders Execution | Market execution |

Margin Call/Stop Out | 100% / 60%, 100% / 40%, 100% / 20% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | Yes |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Phone call, email, online chat, telegram |

Customer Support Hours | 24/5 |

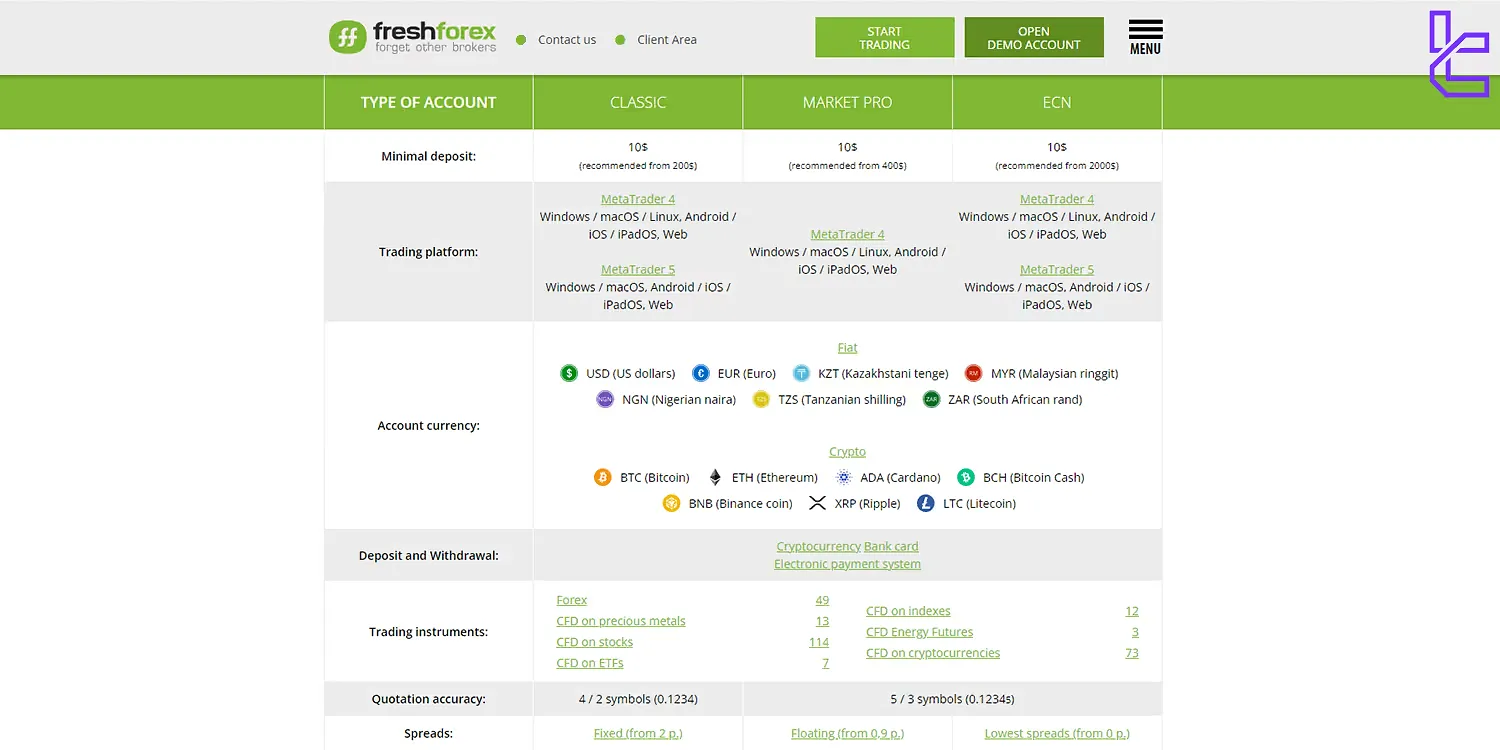

FreshForex broker Accounts

FreshForex offers multiple account types designed to accommodate different trading needs. The minimum deposit requirement is just $10, making it accessible to low-budget traders.

Accounts like Classic and ECN vary in terms of spreads and commission structures. Despite the affordability, traders should consider the fixed spreads starting from 2.0 pips on some accounts, which might not be ideal for scalping or high-frequency strategies.

Classic Account:

- Ideal for beginners

- Over 270 trading instruments

- Floating spreads from 2 pips

- Maximum order size 20 lots

- Order execution time 2-3 seconds

Market Pro Account:

- Tailored for active traders and scalpers

- Floating spreads from 0.9 pips

- Minimum order size 0.01 lot

- Order execution from 0.1 seconds

- Market execution

ECN Account:

- Professional-level trading

- Max leverage 1:1000

- Floating spreads from 0.0 pips

- Maximum order size 10,000 lots

The broker offers afree demo account, allowing potential clients to practice trading strategies and familiarize themselves with the platform before committing to real funds.

Advantages and Disadvantages of FreshForex Broker

When considering FreshForex as your broker, it's crucial to weigh both its strengths and weaknesses. Here's a balanced overview:

Pros | Cons |

$25 minimum deposit | Customer service is unavailable on weekends |

Over 270 instruments | No regulation by top-tier authorities |

Demo and Islamic accounts | Offshore broker |

Various bonuses and promotions |

FreshForex Broker Sign-up and Verification

The FreshForex registration takes less than 5 minutes and grants access to over 270+ instruments via the client area. No document upload is required for registration, only basic personal details and email verification.

This process supports traders across 158 countries, making it one of the most accessible onboarding experiences in the forex market.

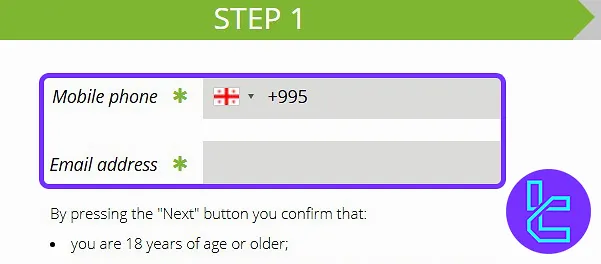

#1 Visit FreshForex Official Site

From the broker's homepage, click “Log in to Client Area”, then select “Register” to open the sign-up section.

#2 Submit Contact Details

Enter your mobile number and a unique email address not previously used on the platform. Click “Next” to proceed.

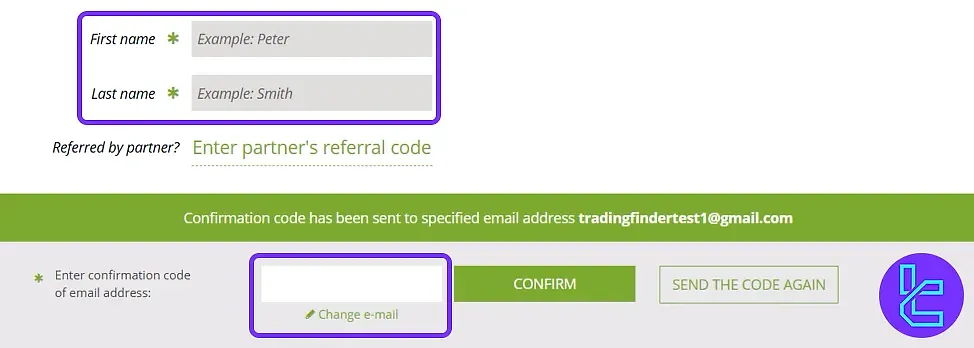

#3 Provide Your Name & Verify Email

Fill in your first and last name, then check your inbox to input the email verification code and activate your account.

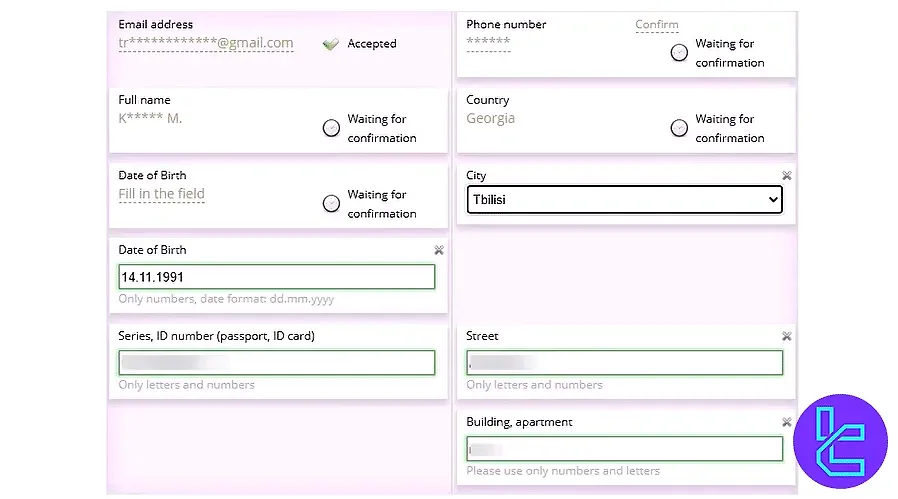

#4 FreshForex Verification

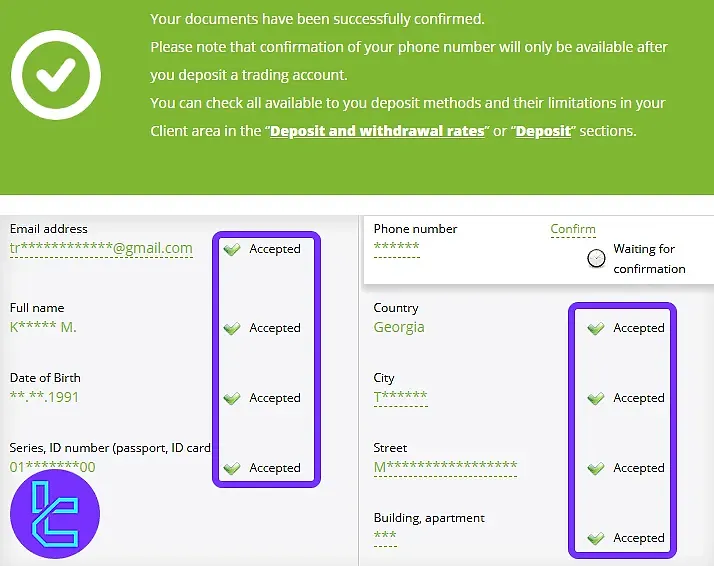

After registering with FreshForex, users can access deposits, withdrawals, and trading functions by completing the FreshForex verification process. This process ensures account security and regulatory compliance.

FreshForex verification procedure:

- Accessing the Verification Section

- Providing Personal Information

- Uploading Required Documents & Awaiting Approval

#1 Accessing the Verification Section

Start by logging into your FreshForex account. Click on your "Avatar" and select "My Personal Data" to enter the verification area.

#2 Providing Personal Information

Within the "Personal Data" section, accurately input your ID number, date of birth, and complete address. Ensure these entries correspond exactly with official documents to avoid verification delays.

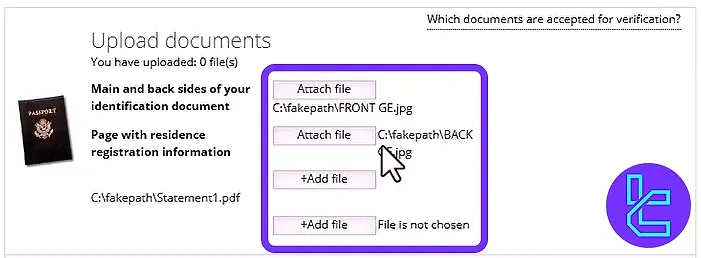

#3 Uploading Required Documents & Awaiting Approval

Upload a clear front and back image of your identification document (POI) along with a recent bank statement or utility bill as proof of address (POA).

Submitted documents are evaluated on business days. Verification status can be monitored at any time by revisiting the "My Personal Data" section.

FreshForex Broker Trading Platforms

FreshForex supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are widely acclaimed for their advanced charting tools, algorithmic trading capabilities, and robust order execution.

MetaTrader 4 (MT4)

MetaTrader 4 is the most well-known platform among forex traders. Here are some of its key features:

- Industry-standard platform

- User-friendly interface

- Advanced charting tools

- Automated trading capabilities

- Large community of traders and developers

- Available for desktop, web, and mobile devices

Links:

MetaTrader 5 (MT5)

FreshForex also offers MetaTrader 5 for its users. Key features of this platform include:

- Next-generation platform

- Enhanced charting capabilities

- More timeframes and analytical objects

- Supports trading in stocks and futures markets

- Economic calendar integrated

- Available for desktop, web, and mobile devices

Links:

Web Terminal

Traders can also use web terminals to access their trading accounts on any device without the need to download another program. Key features of web terminals include:

- Browser-based trading platform

- No download required

- Access from any device with an internet connection

- Real-time quotes and charts

- One-click trading functionality

FreshForex Spreads and Commissions

FreshForex offers variable spreads starting from 0.0 pips on ECN accounts, while fixed spreads from 2.0 pips are applied on Classic accounts.

Commission-free trading is available on select account types. However, ECN accounts incur commissions starting at 0.003% per contract.

Account Type | Spread | Commission |

Classic account | Floating from 2.0 pips | No |

Market Pro account | Floating from 0.9 pips | No |

ECN account | Floating from 0.0 pips | From 0.003% per contract |

It's worth noting that spreads can vary depending on market conditions, especially during times of high volatility or major news events. FreshForex claims to source liquidity from multiple providers to ensure competitive pricing.

Swap Fee at FreshForex

The broker clearly states that swap fees apply when positions are carried past the daily cutoff.

They also offer a dedicated “Swap-Free” or Islamic account option with fixed commissions instead of interest‐based rollover.

In light of this, here are some key details:

- On its Swap-Free account option, FreshForex charges a fixed commission per 1 lot instead of applying the usual swap interest adjustment;

- For example, on major currency pairs (e.g., AUDCAD, EURUSD) the Swap-Free account commission is 10 USD per 1 lot;

- On more exotic pairs (e.g., EURINR, USDTRY) the fixed commission in the Swap-Free account is up to 200 USD per 1 lot for overnight holding;

- The standard (non-Swap-Free) account will have swaps calculated by interest rate differentials, and multiple days’ swap (“triple swap”) applies at the weekly rollover (Wednesday → Thursday).

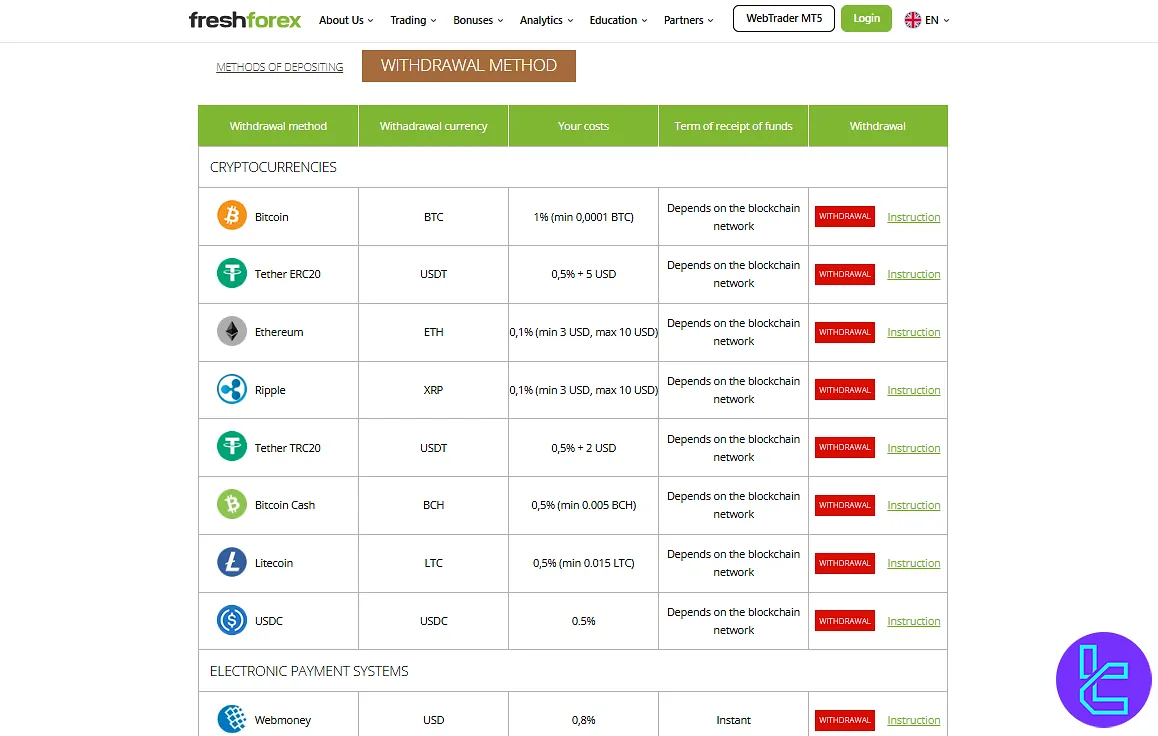

Non-Trading Fees at FreshForex

The broker states that non-trading operations such as deposits and withdrawals incur specific costs or exemptions depending on the method used.

In the other hand, FreshForex does not charge an inactivity fee or monthly maintenance fee for dormant accounts.

Below are the key details you should know:

- Deposits: the broker charges 0% commission for many payment methods when depositing;

- Withdrawals: for cryptocurrency withdrawals, fees can be e.g. 0.1% + min 0.0001 BTC for Bitcoin. Also, for USDT (ERC20) the fee is indicated as 0.5% + 5 USD;

- FreshForex does not charge an “inactivity fee” or monthly maintenance fee for dormant accounts;

- when funds are transferred between accounts of different currencies, the conversion is made at the broker.

Deposit & Withdrawal Methods in Freshforex Broker

FreshForex offers a variety of deposit and withdrawal methods to cater to traders from different regions. Here's an overview of the available options:

- Credit/Debit Cards (Visa, Mastercard)

- Bank Wire Transfer

- E-wallets (Volet, Perfect Money, WebMoney)

- Cryptocurrencies (Bitcoin, Ethereum, Thether)

- Local payment systems (varies by country)

Here's the steps you need to take to fund your trading account:

- Enter FreshForex client area;

- Choose your preferred payment option;

- Enter the deposit amount and other necessary details;

- Complete the transaction process.

The broker claims zero deposit and withdrawal fees, though users should verify if third-party charges apply. Processing times vary: deposits are typically instant, while withdrawals may take up to 10 minutes to 24 hours, depending on the method.

The minimum withdrawal amount is $1, which makes the platform accessible even for small-scale traders.

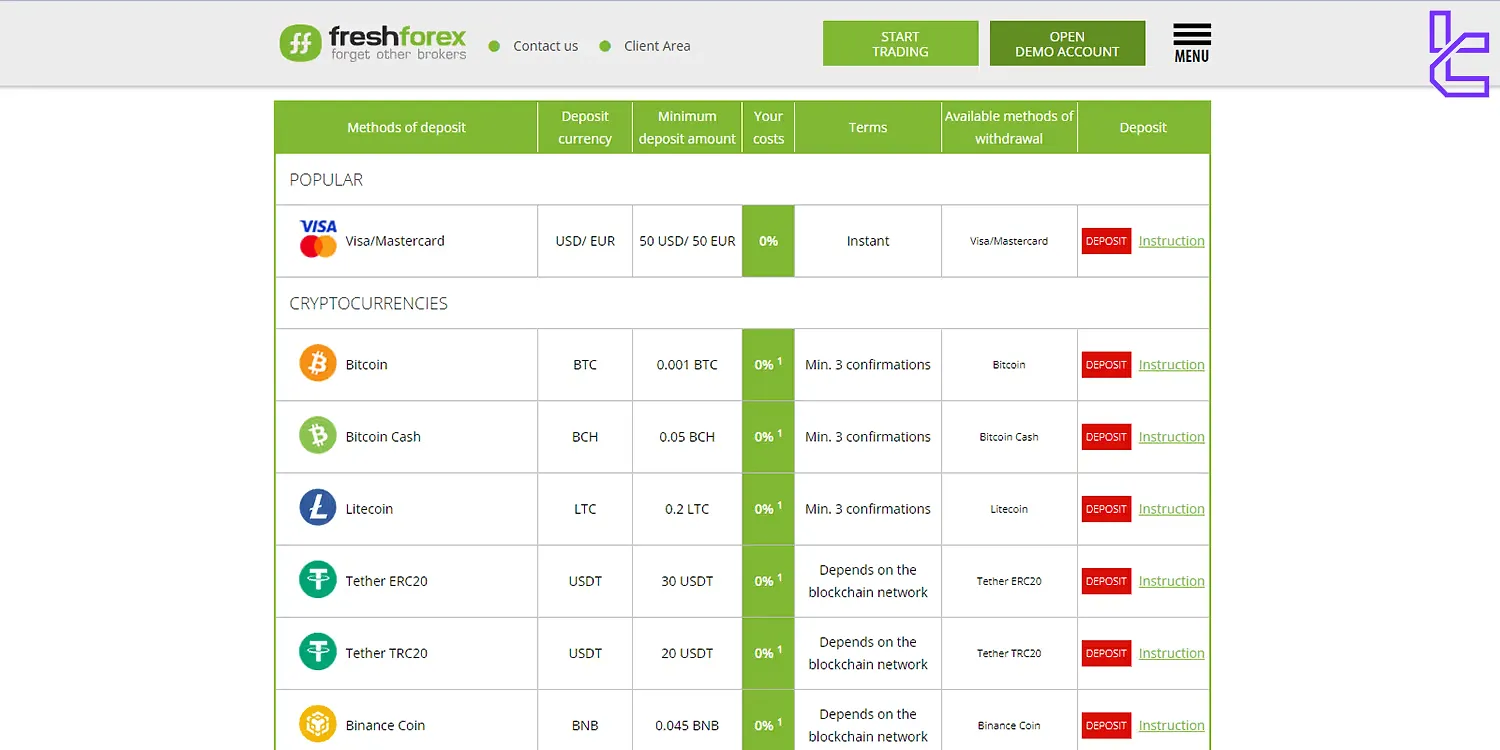

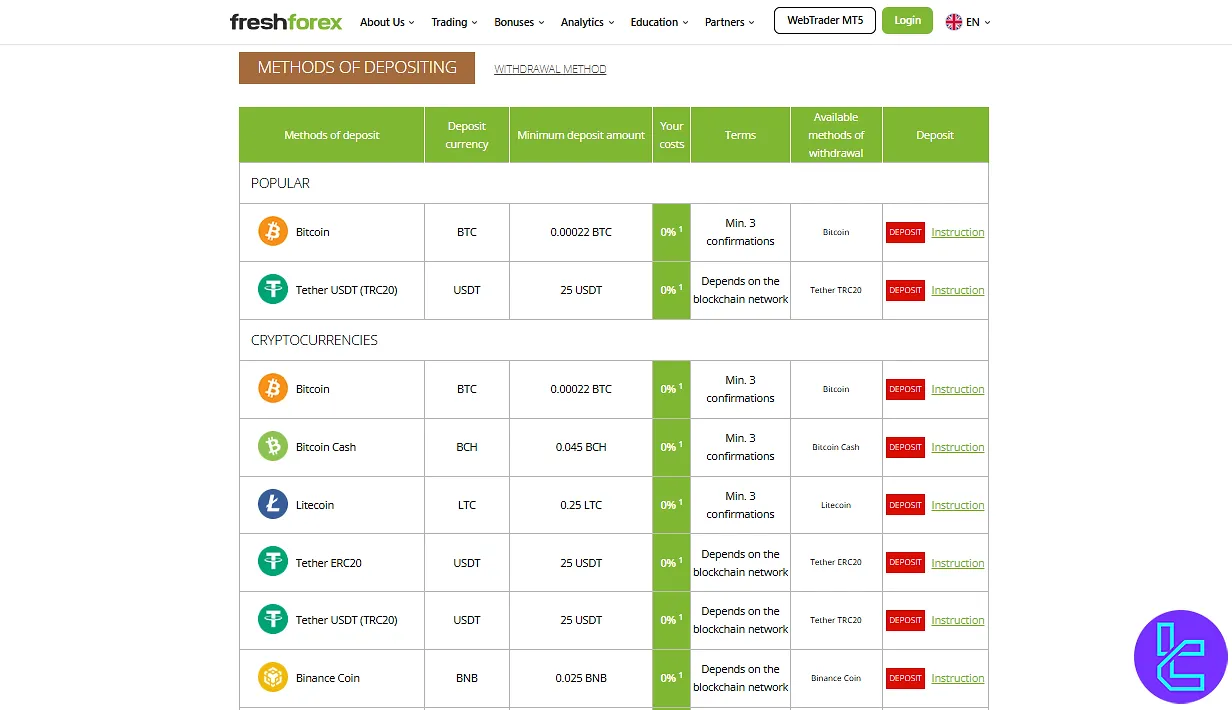

Deposit Methods at FreshForex

FreshForex provides a diverse range of over 20 secure deposit methods designed to suit traders worldwide. The broker supports cryptocurrencies, e-wallets, bank cards, mobile payments, and local banking systems, ensuring convenient access regardless of location.

Deposits are generally processed instantly and without any commission, except for potential network or third-party payment fees.

Below is an overview of the main deposit families and some popular examples from each:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Cryptocurrencies (e.g., Bitcoin, Ethereum, Tether TRC20) | BTC / ETH / USDT etc. | From 0.00022 BTC or 25 USDT | 0% | Instant |

Electronic Payment Systems (e.g., Sticpay, WebMoney, Volet) | USD / EUR / local currencies | From 25 USD | 0% – 30% (system-based) | Instant |

Bank Cards (Visa, Mastercard) | USD / EUR / NGN | From 25 USD or 38 500 NGN | 0% | Instant |

Mobile Payments (M-Pesa) | KES | 3 300 KES | 0% | Up to 1 day |

Internet Banking (e.g., Malaysia, Indonesia, Vietnam) | MYR / IDR / VND | From 110 MYR or equivalent | 0% | Instant – 3–7 days (region-based) |

Local Depositors (Africa, Asia, Latin America) | Local currencies / USD | N/A | 0% | Variable |

Withdrawal Methods at FreshForex

FreshForex offers more than 20 reliable withdrawal options, allowing traders to access their profits swiftly and securely. Each method is optimized for convenience, supporting both international and regional systems across multiple currencies.

Most transactions are processed during business hours, with fees depending on the chosen payment system rather than the broker itself.

Below is a breakdown of the major withdrawal method families and their key details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Cryptocurrencies (e.g., Bitcoin, Ethereum, Tether TRC20) | BTC / ETH / USDT / XRP | Varies by crypto (e.g., 0.0001 BTC) | 0.1% – 1% (network-based) | Depends on blockchain |

Electronic Payment Systems (e.g., WebMoney, Sticpay, Volet, Ozow) | USD / EUR / ZAR / NGN | From 25 USD or local equivalent | 0% – 2.5% + fixed fee | Instant – up to 5 business days |

Bank Cards (Visa, Mastercard) | USD / EUR | From 25 USD | 2.5% + 5 USD/EUR | Up to 5 business days |

Mobile Payments (M-Pesa) | KES | 3 300 KES | 5% + 80 KES | Up to 5 business days |

Internet Banking (e.g., Malaysia, Indonesia, Vietnam, Nigeria) | MYR / IDR / VND / NGN | Equivalent to 1 USD | 1% – 3% + fixed local fee | Up to 5 business days |

Copy Trading & Investment Options Offered on FreshForex

Unfortunately, FreshForex doesn’t offer a PAMM account or copy trading feature at the moment. This broker used to have a copy trading system called “Flagman invest” which account managers could use to receive funds from beginner traders and manage them.

FreshForex Markets and Symbols

FreshForex provides traders with a wide selection of trading instruments across global markets, catering to both beginners and professionals.

From traditional forex pairs and precious metals to stocks, indices, and cryptocurrencies, every trader can diversify their portfolio efficiently.

Below is a summary of the main trading categories available on FreshForex:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor & exotic currency pairs | 49 | ~40–50 pairs | 1:2000 |

CFDs on Precious Metals | Gold, silver, platinum, etc. | 13 | ~10–15 instruments | 1:2000 |

CF Ds on Stocks | Shares of global companies | 115+ | ~70–120 instruments | N/A |

CFDs on ETFs | Exchange-traded funds | 7 | ~5–10 instruments | N/A |

CFDs on Indices | Global stock indices | 12 | ~8–12 instruments | 1:2000 |

CFDs on Energy Futures | Oil, gas & other energy contracts | 3 | ~2–5 instruments | 1:2000 |

CFDs on Cryptocurrencies | Major crypto coins as CFD instruments | 70+ | ~40–80 instruments | N/A |

FreshForex continuously expands its list of tradable assets to meet the evolving needs of global traders. With flexible leverage and access to multiple markets from a single account, it provides an ideal environment for both short-term and long-term strategies.

FreshForex Broker Bonuses and Promotions

FreshForex offers several bonuses and promotions to attract and retain traders. Here are some of their key offerings:

- No Deposit Bonus: FreshForex offers this bonus to traders who create a classic, market pro, or ECN account using a promotion code. Traders can withdraw their profits using this bonus or extend the time limit byseven more days by depositing funds into their accounts;

- 101% Deposit Bonus: To receive this bonus, traders need to fund $101 dollars or more to receive 101% of the deposit amount as a bonus;

- while bonuses can provide additional trading capital, they should not be the primary factor in choosing a broker. Always consider the overall trading conditions, regulation, and reputation of the broker.

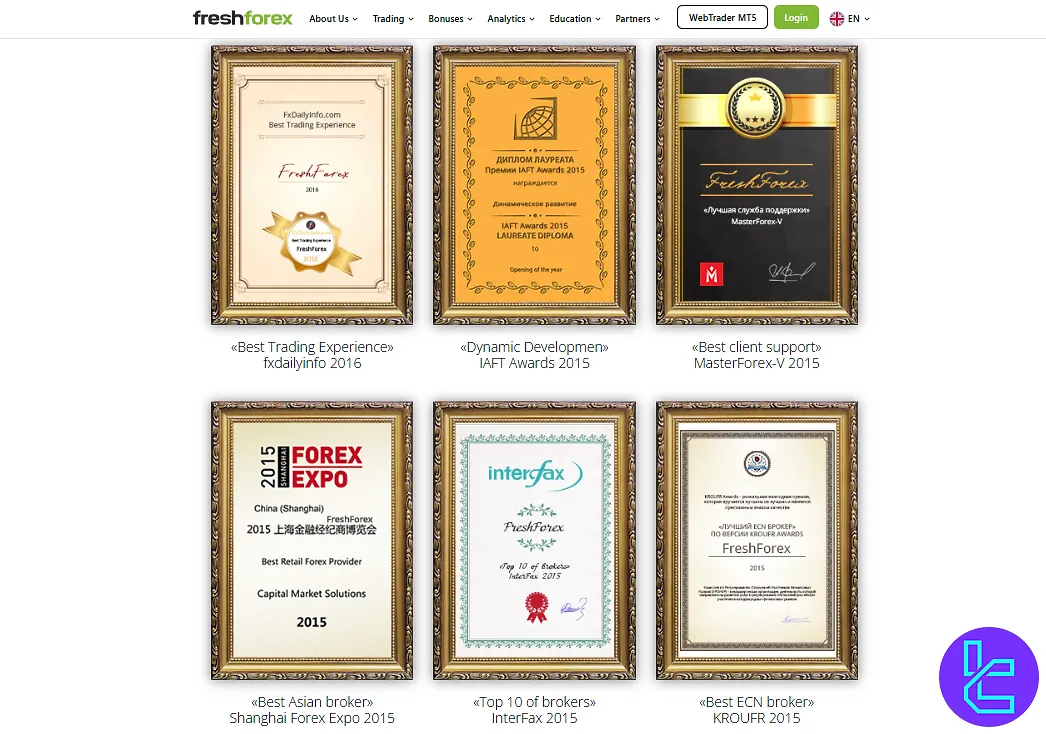

FreshForex Awards

FreshForex has been consistently recognized for its excellence in service quality, transparency, and innovation. Over the years, the broker has received multiple international awards that highlight its reliability and strong position in the forex market.

Each FreshForex award reflects the company’s ongoing commitment to providing top-tier trading experiences for its clients.

Here are some of the most notable awards:

- Fastest Growing Forex Broker 2022

- Best Trading Experience 2016

- Dynamic Development 2015

- Best Client Support 2015

- Best Asian Broker 2015

- Top 10 of Brokers 2015

- Best ECN Broker 2015

FreshForex Broker Support

It’s time to assess customer support in our FreshForex broker review. This broker provides customer support through various channels to assist traders with their queries and concerns.

Support channel | Details |

Live chat | Available 24/5 |

Email Support | info@freshforex.com |

Phone Support | +442070992124 |

Telegram support | Telegram |

The hotline operates between 07:00 to 16:00 GMT. While FreshForex aims to provide comprehensive support, it's worth noting that the service is not available 24/7.

Some user reviews have reported mixed experiences with customer support, so it's advisable to test the responsiveness and helpfulness of the support team before committing to a live account.

Restricted Countries in FreshForex broker

Due to regulatory restrictions and international sanctions, FreshForex operates globally but does not provide services to certain countries.

Here's a list of some key restricted countries:

- United States

- United Kingdom

- Hong Kong

- France

- Australia

- Belgium

- Israel

- Iran

- North Korea

- Syria

Additionally, FreshForex does not accept clients from:

- Countries under international sanctions

- High-risk countries identified by FATF

- Regions with serious AML/CFT deficiencies

It's important to note that this list is incomplete and may change over time due to evolving regulatory landscapes and geopolitical situations. Traders should always check the most up-to-date information on the FreshForex website or contact customer support to confirm their eligibility to open an account.

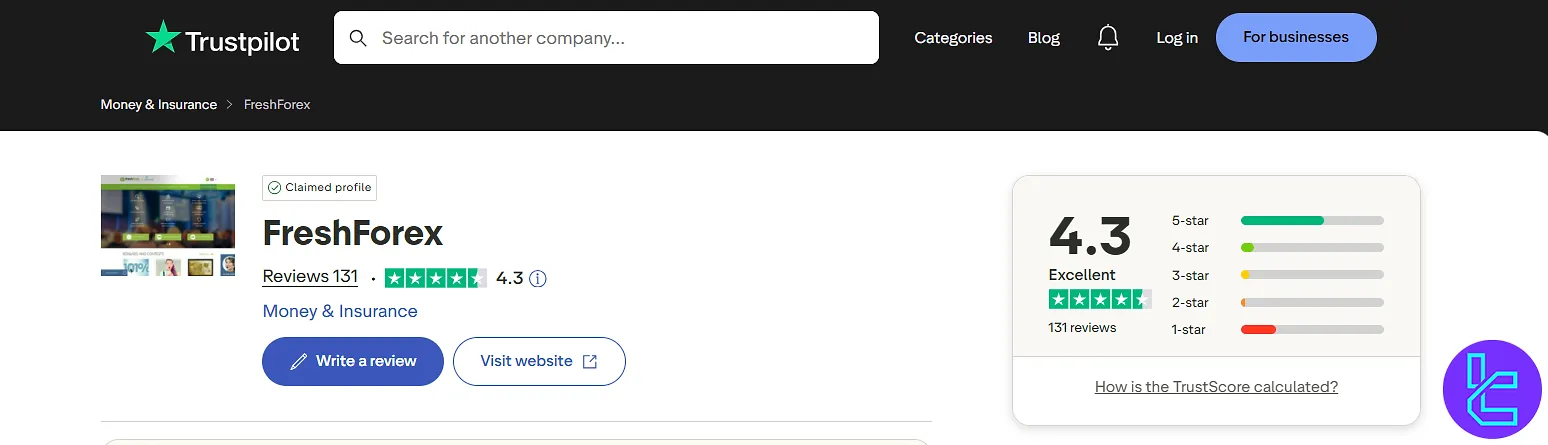

FreshForex Broker Trust Scores & Reviews

FreshForex has received mixed reviews from traders and industry experts. Here's a summary of trust scores and user feedback:

4.3 | |

Forex Peace Army | 2.087 |

2.7 |

It's important to note that online reviews can be subjective and may not represent the experiences of all traders.

FreshForex Broker Education

FreshForex provides a comprehensive suite of educational resources to help traders enhance their trading skills.

From forex trading basics to technicaland fundamental analysis, Freshforex offers a variety of articles for market participants to learn the ins and outs of trading.

This broker also provides forex webinars for traders to get updated with news and technical analysis on various currency pairs.

You can also use TradingFinder's Forex education and Crypto tutorial sections for additional resources.

Comparison of FreshForex with Other Brokers

Let's take a quick look at FreshForex's offerings in comparison with other popular brokerage companies:

Parameter | FreshForex Broker | IC Markets Broker | LiteForex Broker | HFM Broker |

Regulation | None | FSA, CySEC, ASIC | CySEC | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From 0.003% | From $3 | From $0.0 | From $0 |

Minimum Deposit | $10 | $200 | $50 | From $0 |

Maximum Leverage | 1:2000 | 1:500 | 1:30 | 1:2000 |

Trading Platforms | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MT4, MT5, Mobile App |

Account Types | Classic, Market Pro, ECN | Standard, Raw Spread, Islamic | Classic, ECN, Demo | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | 270+ | 2,250+ | N/A | 1,000+ |

Trade Execution | Market | Market | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit |

TF Expert Suggestion

FreshForex's low trading costs (spreads from 0.0 pips and 0.003% commissions) combined with a no-deposit and $101 deposit bonus have made this platform a prominent player in the brokerage space.

However, the lack of proper regulation by highly regarded financial authorities such as FCA, SEC, CySEC, and ASIC is a major drawback that traders need to consider.