Grand Capital has won 18 global awards, including the “Most profitable affiliate program” in Expo Dubai 2024. It has partnered with UpTrader and MetaQuotes to provide leverage options of up to 1:1000 for a minimum deposit of $10.

Grand Capital; Company Introduction and Regulation

With over 1,500,000 clients, Grand Capital has established itself as a prominent player in the online trading industry since its inception in 2006. The company became a member of The Financial Commission (FinaCom) in 2016 and has implemented a €20,000 insurance scheme for each client.

The broker has received 18 global awards over its 16-year operation, including honors for Best ECN Broker and Best Trading Technologies. It’s partnered with UpTrader and MetaQuotes and is registered in Seychelles with the IBC number “036046”. Key features of Grand Capital:

- Worldwide presence across 144 countries

- 500+ trading assets

- 24/7 multilingual support

- Copy trading and investment options

- Listed on FinaCom as a “Category A” broker

Here is a summary of the available information regarding the broker's entity:

Entity Parameters/Branches | Grand Capital Limited |

Regulation | None |

Regulation Tier | N/A |

Country | Seychelles |

Investor Protection Fund / Compensation Scheme | Up to €20,000 under Financial Commission |

Segregated Funds | N/A |

Negative Balance Protection | None |

Maximum Leverage | 1:1000 |

Client Eligibility | Global |

The Broker's CEO

The current CEO of Grand Capital for the MENA region is Shadi Mashkok. Showing his commitment,Mashkok was recognized among the Top 50 Chief Executive Officers in the industry, highlighting his significant influence and contribution to the global trading ecosystem.

Check out his LinkedIn account through this link:

Grand Capital Table of Specifications

Grand Capital offers a comprehensive suite of trading services catering to novice and experienced traders. With competitive trading conditions and extensive educational resources, the Forex broker aims to provide a well-rounded trading experience for its diverse client base.

Broker | Grand Capital |

Account Types | Standard, MT5, Micro, ECN Prime, Swap Free |

Regulating Authorities | None |

Based Currencies | Variable based on the account type |

Minimum Deposit | $10 |

Deposit Methods | Bank Cards, Bank Transfer, E-payments, Crypto, Local Exchange |

Withdrawal Methods | Bank Cards, Bank Transfer, E-payments, Crypto, Local Exchange |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading, Investment Portfolio |

Trading Platforms & Apps | MT4, MT5, WebTrader |

Markets | Forex, Stocks, ETFs, Crypto, Indices, Energy, Metals, Commodities, Bonds |

Spread | Variable based on the account type |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | MT5, ECN Prime 100% / 80% Standard, Micro, Swap Free 100% / 40% |

Trading Features | Mobile Trading, Copy Trading, Investment options, Economic Calendar |

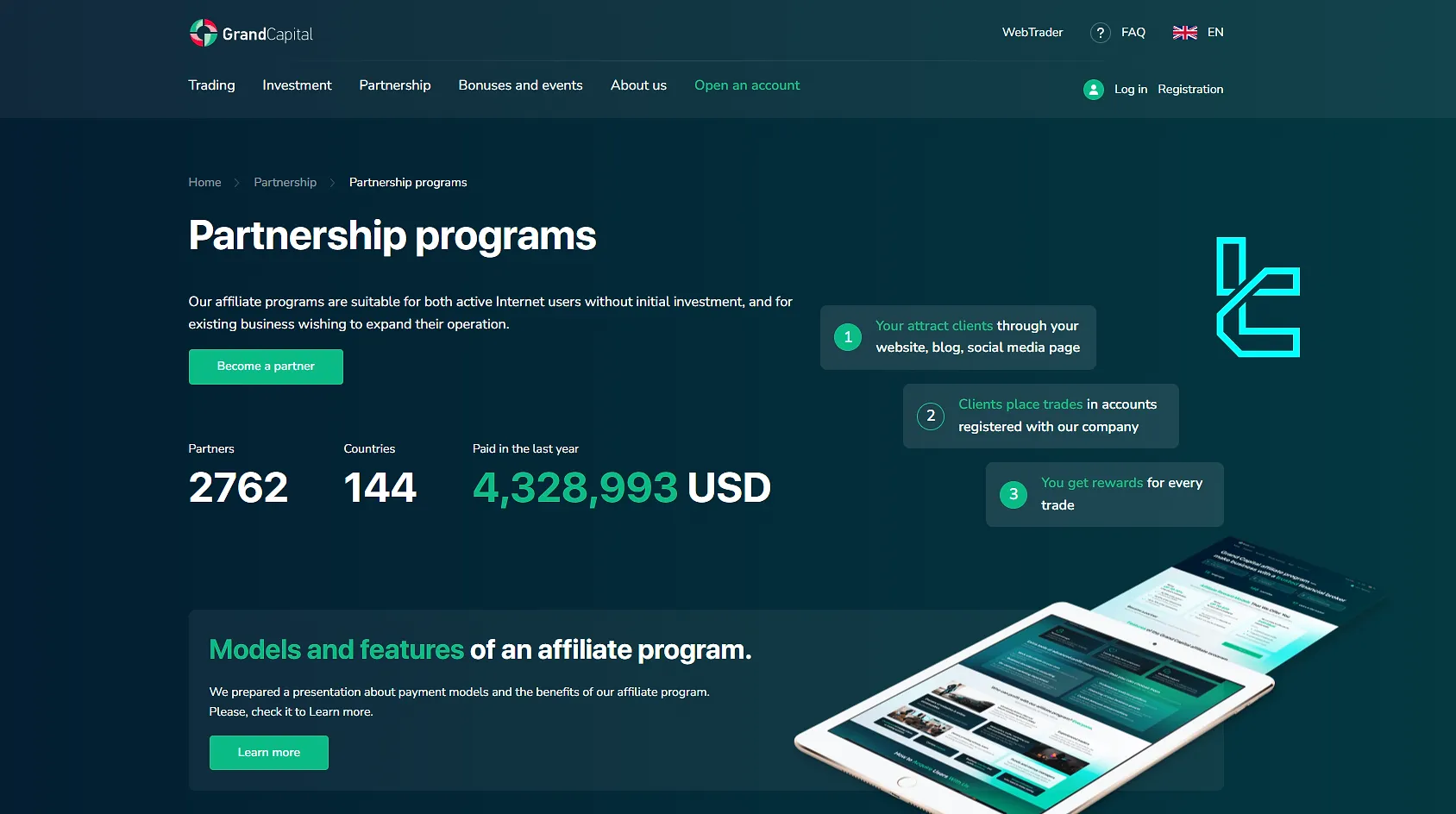

Affiliate Program | Yes |

Bonus & Promotions | 40% deposit, Cashback, Trading Tournaments |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Phone |

Customer Support Hours | 24/7 |

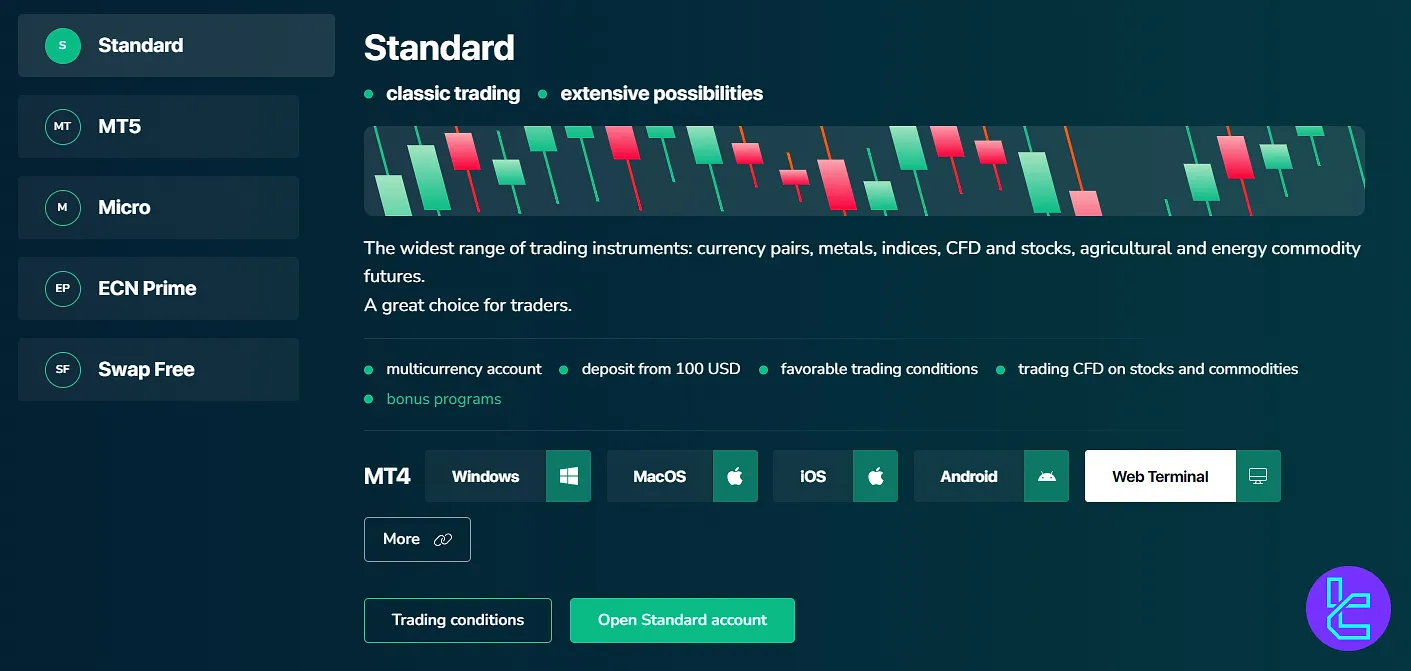

Grand Capital Account Types

The broker offers a variety of account types to cater to different trading styles and experience levels. Grand Capital Accounts Review:

Features | Standard | MT5 | Micro | ECN Prime | Swap Free |

Min Deposit | $100 | $100 | $10 | $500 | $100 |

Base Currency | USD, EUR, RUB, JPY, GBP, MMK | USD | USD, EUR, RUR, GBP | USD | USD |

Margin Call / Stop Out | 100% / 40% | 100% / 80% | 100% / 40% | 100% / 80% | 100% / 40% |

Instruments | 500+ | 400 | 66 | 38 | 150 |

1:1000 | 1:100 | 1:500 | 1:100 | 1:1000 | |

Min Order Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

Grand Capital Broker Upsides and Downsides

A comprehensive partnership program, 500+ instruments across 9 asset classes, and multiple investment options are some of the broker’s advantages.

However, we must also consider the weaknesses to have a balanced look.

Pros | Cons |

Wide range of trading instruments | No regulation |

Multiple account types | High minimum deposit for the ECN Prime account ($500) |

Low minimum deposit for Micro account ($10) | Geo-restrictions |

Competitive spreads and leverage | Limited trading platform offerings (MT4/5 and WebTrader) |

Grand Capital Account Opening and KYC Verification

Opening an account with Grand Capital is a straightforward process that involves several steps to ensure compliance with regulatory requirements and to provide a secure trading environment.

#1 Visit the Official Website

Navigate to Grand Capital’s homepage and click on “Open an Account” to initiate the registration.

#2 Complete the Registration Form

In the form that appears after hitting “Register", provide these details:

- Full name

- Email address

- Phone number

#3 Choose Your Account Type

Select the account that best fits your trading style from Grand Capital’s range of retail account types.

#4 Identity & Security Verification

Upload valid documents, such as a passport or driver’s license, for identity confirmation. Then, in the client area, activate OTP authentication under the “Security” section to finalize setup.

Trading Platforms on Grand Capital Broker

We must discuss the trading platforms in this Grand Capital review. While the broker offers a selection of popular trading platforms to cater to various trading styles, the lack of more advanced solutions like TradingView can be disappointing for potential clients.

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

TradingFinder has developed various advanced MetaTrader 4 and MT5 indicators that you can use for free

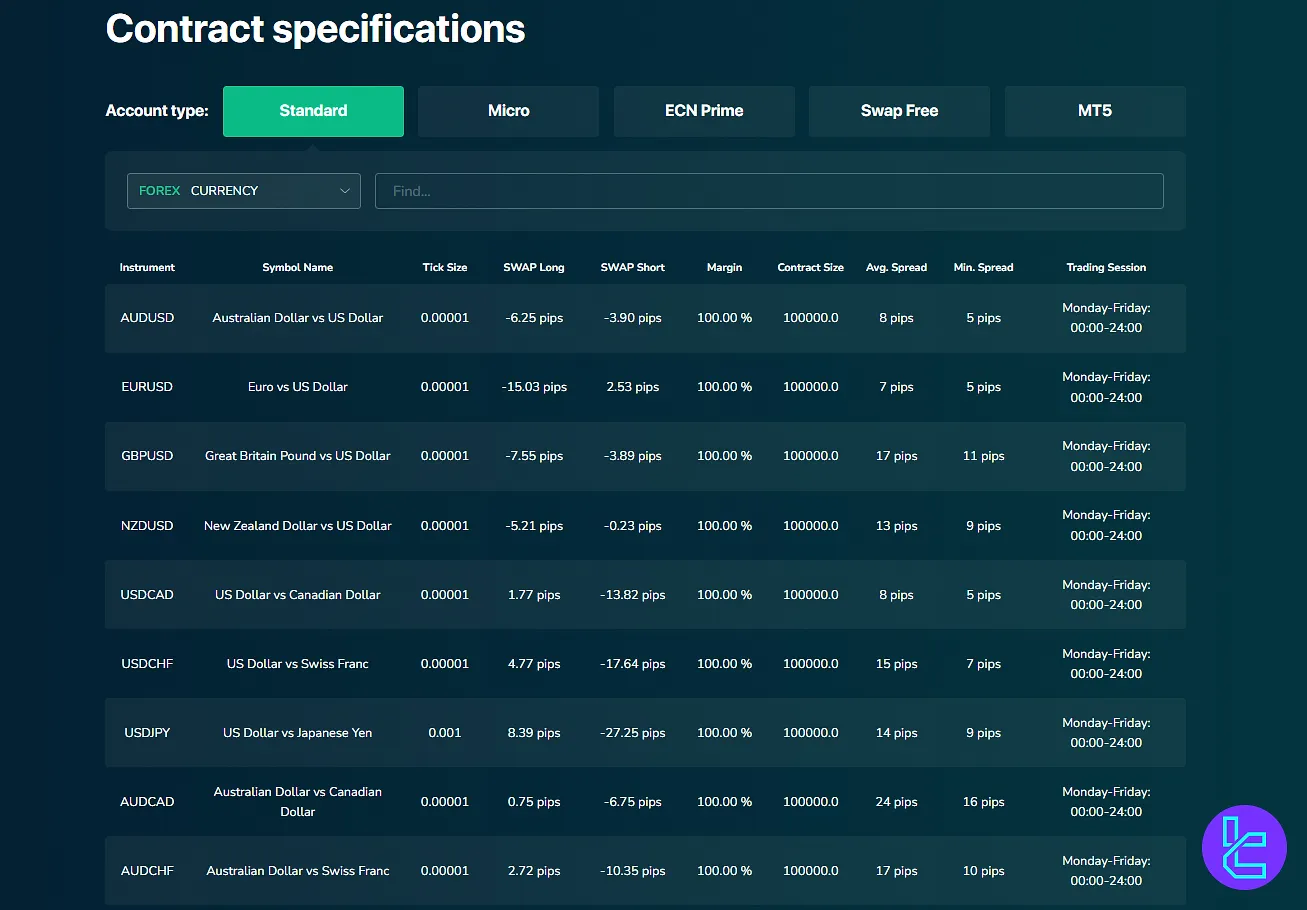

Grand Capital Fee Structure

The broker’s fee structure is mainly based on commissions and spreads, which vary depending on the account type and trading instrument.

Account Type | Commission (per lot) | Spreads |

Standard | FOREX: $0 CFD: $14 - $15 CFD STOCK USA: 0.1% CFD ETF: 0.1% | From 1.0 pip |

MT5 | FOREX, Metals, Indices, Energies: $5 - $10 CFD USA, EURO, Russia, Asia: 0.1% Crypto: 0.5% CFD ETF: 0.1% | From 0.4 pips |

Micro | $0.0 | From 1.0 pip |

ECN Prime | FOREX, Metals, Energies: $5 Indices: $7 CFD ETF: 0.1% CFD STOCK USA: 0.1% CFD STOCK EU: 0.1% | From 0.4 pips |

Swap Free | FOREX: $5 FOREX METALS: $10 CFD INDICES: $30 CFD ENERGIES: $45 CFD METALS: $50 CFD CURRENCIES: $35 CFD BONDS: $55 CFD SOFTS, GRAINS, MEATS: $10 CFD STOCK: USA, Russian: 0.10% | From 1.0 pip |

Non-Trading Costs

Note that a monthly inactivity fee of $15 applies after 90 consecutive days without trading activity. Deposit and withdrawal fees vary based on the chosen payment method, and crypto-based payments follow blockchain network fees.

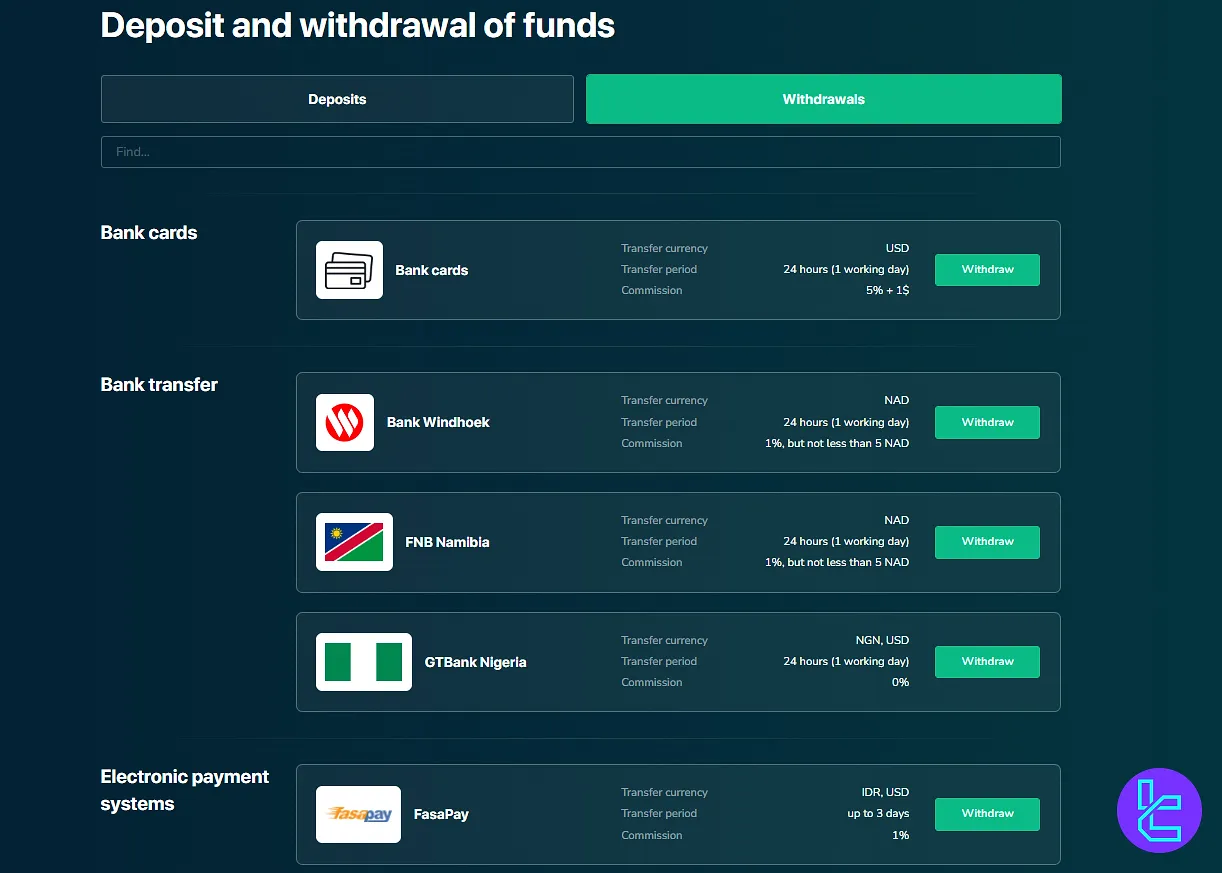

Grand Capital Broker Payment Methods

The company offers a wide array of deposit and withdrawal options to accommodate traders from different regions.

Deposit Options

There are various payment options available for traders working with Grand Capital:

Method | Currency | Deposit Fee |

Bank Cards | EUR, USD | 0% |

Local Bank Transfer | NAD, NGN, USD | Variable based on the bank |

FasaPay | USD, IDR | 0% |

Help2Pay | THB, IDR, MYR, INR, VND | Compensated by the Broker |

Tunder X | KHR, MMK, THB, LAK | Compensated by the Broker |

Crypto | BTC, ETH, USDT | Determined by Blockchain |

Indian Exchanger | INR, USD | 0% |

Withdrawal Methods

There is no difference between the payment solutions available for deposits and those for withdrawals with this brokerage, but there might be various parameters:

Option | withdrawal Cost | Processing Time |

Bank Cards | 5% + $1 | 24 Hours |

Local Bank Transfer | 0-1% | 24 Hours |

FasaPay | 1% | Up to 3 Days |

Help2Pay | Varies | Up to 3 Days |

Thunder X | 1.5% | Up to 3 Days |

Crypto | Determined by Blockchain | Up to 3 Days |

Indian Exchanger | Varies | 1-3 Days |

Grand Capital Copy Trading or any Growth Plans

The broker offers two main investment servicesdesigned to cater to traders and investors of varying experience levels: Copy Trading and Investment Portfolio.

Copy Trading

- A minimum investment of $100

- Automatic copy of successful traders' strategies

- Wide selection of trading strategies across various instruments

- Full control over risk through customizable settings

- Adjustable copy ratios and drawdown limits

- multiple strategies

Investment Portfolio

- A minimum deposit of $1,000

- Professionally managed portfolios focusing on Stocks, Indices, and Metals

- Designed and managed by expert analysts

- Monthly rebalancing to optimize performance

- 15-25% average monthly returns

- Conservative and aggressive portfolio options

What Markets Are Available on Grand Capital Broker?

The company provides access to more than 500 financial instruments across 9 asset classes. The wide range of financial markets allows traders to diversify their portfolios and capitalize on various trading opportunities. Note thatthe availability of instruments varies based on the account type. The following table demonstrates the brokerage's instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | Standard, Micro, Swap-Free, ECN accounts | 55+ Currency Pairs | 50–70 pairs |

Stocks | CFDs on global company shares (via MT5 platform) | 500+ Global Stocks | 800–1200 stocks |

ETFs | CFDs on Exchange-Traded Funds | 50+ ETFs | 40–100 ETFs |

Crypto | CFDs on cryptocurrencies (BTC, ETH, LTC, XRP, etc.) | 20+ Cryptocurrencies | 15–30 cryptocurrencies |

Indices | CFDs on global indices (US, Europe, Asia) | Around 14 Indices | 10–20 indices |

Energy | CFDs on energy commodities (Oil, Gas) | 5–6 Instruments | 5–10 instruments |

Metals | CFDs on precious metals (Gold, Silver, Platinum, Palladium) | 4 Major Metals | 4–6 metals |

Commodities | CFDs on soft commodities (Agriculture, Coffee, Sugar, etc.) | Around 10 Instruments | 10–20 instruments |

Bonds | CFDs on government bonds | 5–6 Bonds | 5–10 bonds |

Grand Capital Bonus and Promotional Plans

Bonus is one of the most attractive topics in this Grand Capital review. The broker offers several attractive promotional plans to incentivize traders and enhance their trading experience.

- Affiliate Program: Earning commissions by referring new clients in a tiered structure

- Deposit Bonus: 40% extra funds on any deposits

- Cashback: Cash rebate for active trading on the Standard account

- Trading Tournament: Monthly contest with a $500 prize (profits are withdrawable)

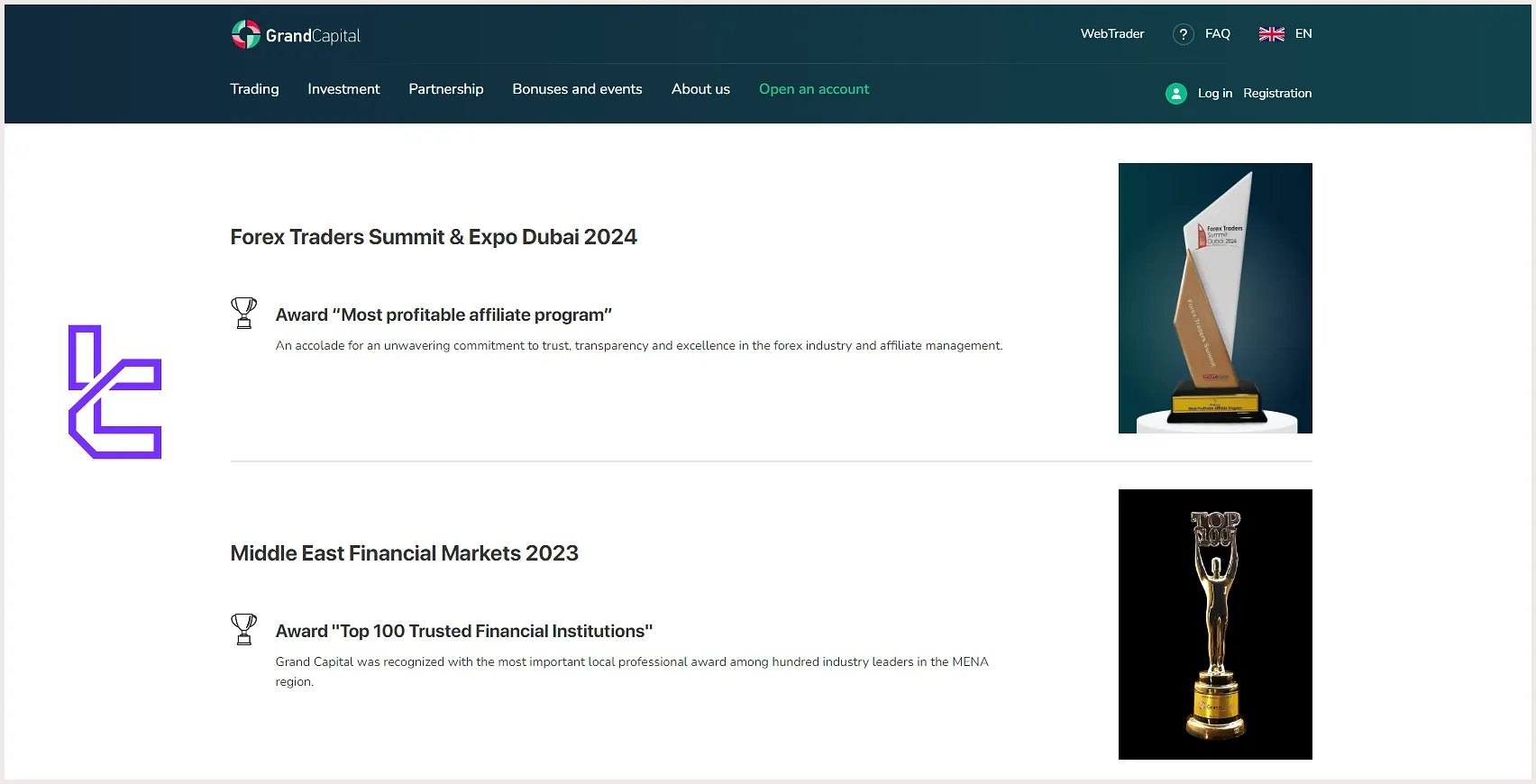

Grand Capital Accolades

Grand Capital has gained industry recognition through multiple expo awards. Its distinctions include Best Trading Technology, recognition for Forex market stability, acknowledgment as Best Broker in Europe, and as a Top Investment Service Provider.

Grand Capital won the “Most Profitable Affiliate Program” award in Expo Dubai 2024

Grand Capital won the “Most Profitable Affiliate Program” award in Expo Dubai 2024

Grand Capital awards include, but are not limited to:

- Top Crypto Broker, Smart Vision Investment Summit Egypt 2024

- Top 50 Chief Executive Officers, Middle East Financial Markets Awards Dubai 2024

- Top 100 Trusted Financial Institutions, Middle East Financial Markets 2023

- Most Supported Forex Broker for Introducing Brokers, Forex Traders Summit Dubai 2022

- Best Broker in Europe, ForexStars 2015

How to Reach Grand Capital Broker Customer Support

The company offers 24/7 support in 15 languages. However, it doesn’t give you many options to make contact. Grand Capital support is accessible through only two main channels, including:

support@grandcapital.net | |

Phone | +2484422900 |

Grand Capital Geo-Restrictions

Grand Capital Limited is registered in Seychelles and is a member of FinaCom. Due to regulatory compliance, it can’t provide services in certain regions, including:

- United States

- Seychelles

- Saint Vincent and the Grenadines

- Japan

- Spain

- Italy

- France

- Portugal

- Denmark

- Estonia

- Slovenia

- Greece

- Malaysia

- Russian Federation

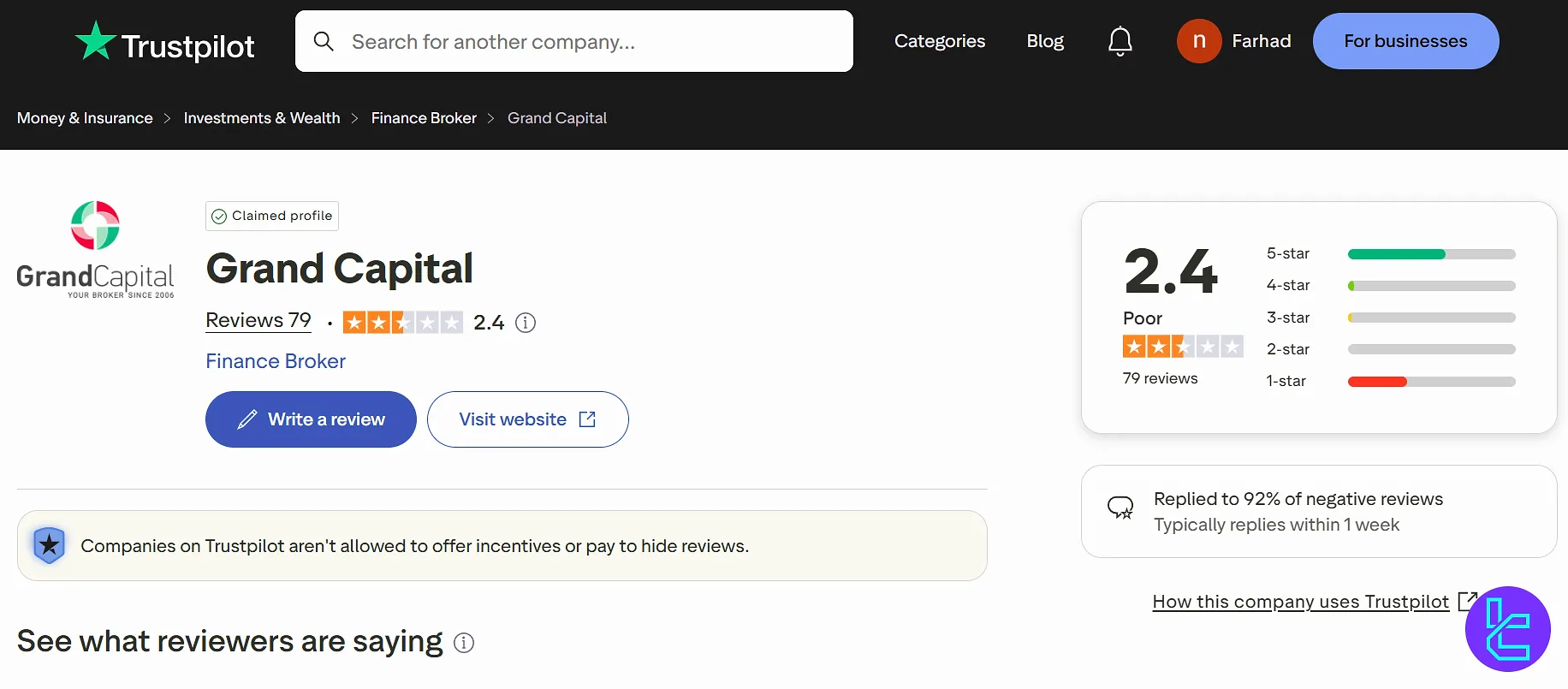

Grand Capital Broker User Satisfaction

Trust Score may be the most important topic in this Grand Capital review. The company is registered in Seychelles as an online brokerage service provider and doesn’t have a good standing among its clients.

2.4 out of 5.0 based on 79 ratings | |

Forex Peace Army | 1.7 out of 5.0 based on 28 reviews |

Reviews.io | 2.4 out of 5.0 based on 79 comments |

Does Grand Capital Provide Educational Materials

The company doesn’t take traders’ education very seriously and offers limited materials compared to its competitors. It focuses more on analysis and market events.

- Trading Textbook: A free beginner guide for the broker’s clients

- Daily Reviews: Fundamental/Technical reviews, market news, and pre-market

- Economic Calendar: The market’s most important events

You can also use TradingFinder's comprehensive Forex tutorials for additional educational resources.

Grand Capital Compared to Other Forex Brokerages

Before finishing this article, let's have a comparison between the reviewed broker and some of its peers:

Parameter | Grand Capital Broker | AMarkets Broker | FXTM Broker | Fusion Markets Broker |

Regulation | None | FSA, FSC, MISA | FSC | ASIC, VFSC |

Minimum Spread | Variable Based on the Account Type | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | Variable Based on the Account Type | From $0.0 | Variable | From $0.0 |

Minimum Deposit | $10 | $100 | $200 | $0 |

Maximum Leverage | 1:1000 | 1:3000 | 1:3000 | 1:500 |

Trading Platforms | MT4, MT5, WebTrader | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Account Types | Standard, MT5, Micro, ECN Prime, Swap Free | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | Zero, Classic, Swap-Free |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 550+ | 1000+ | 250+ |

Trade Execution | Market | Instant, Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Grand Capital provides access to the most popular Stocks from the US, Europe, Asia, and Russia alongside Forex and Metals. It offers 40% deposit bonus and an investment portfolio with 15%-25% monthly returns. The broker also offers a copy trading service with a minimum deposit requirement of $100.