TMGM "TradeMax Global Markets" is an Australian forex broker that started its work in 2013. More than 12000 assets are available to trade in TMGM. This broker offers copy trading and social trading with rewards program [redeem points.]

TMGM Forex Broker Company Information & Regulation

TMGM, short for TradeMax Global Markets, was founded by a team of experienced traders with a vision to address the pain points commonly faced by traders in the industry. Since its inception, This forex broker company has grown exponentially, expanding its global footprint to serve an international clientele.

One of TMGM's strongest suits is its robust regulatory framework. The broker is overseen by several reputable financial authorities, including:

- The primary entity, Trademax Australia Limited, is licensed by the Australian Securities and Investments Commission (ASIC), a Tier-1 regulator. It ensures full segregation of client funds and negative balance protection;

- Additional regulatory coverage comes from the VFSC in Vanuatu, the FSC in Mauritius, and the CMA in Kenya — all classified as Tier-3 regulators. These offshore entities offer higher leverage but less stringent investor safeguards;

- Across all jurisdictions, TMGM provides up to AUD 10 million in Professional Indemnity insurance coverage;

- The Vanuatu-based arm is also a member of The Financial Commission, adding an extra layer of dispute resolution and compensation (up to EUR 20,000).

Over the past ten years, TMGM has demonstrated a commitment to innovation and client-centric services.

| Entity Parameters/Branches | Trademax Australia Limited | Trademax Global Limited | Trademax Global (International) Pty Ltd | Trademax Global Markets (KE) Pty Ltd |

Regulation | ASIC | VFSC | FSC | CMA |

Regulation Tier | 1 | 3 | 3 | 3 |

Country | Australia | Vanuatu | Mauritius | Kenya |

Investor Protection Fund/Compensation Scheme | Up to 10 million AUD under Professional Indemnity insurance | Up to 10 million AUD under Professional Indemnity insurance + up to EUR 20,000 under The Financial Commission | Up to 10 million AUD under Professional Indemnity insurance | Up to 10 million AUD under Professional Indemnity insurance |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | No | No |

Maximum Leverage | 1:30 | 1:1000 | 1:1000 | 1:1000 |

Client Eligibility | Only Australian Residents | Global | Global | Global |

Summary of Specifications

TMGM stands out in the crowded forex market and CFD brokerage space with its impressive array of features and specifications. Let's break down the key aspects that make TMGM a compelling choice for traders:

Broker | TMGM |

Account Types | EDGE/ECN, CLASSIC |

Regulating Authorities | ASIC – Australia, VFSC – Vanuatu, CMA -Kenya, FSC-Mauritius, FSA - |

Based Currencies | USD, AUD, EUR, GBP, NZD, CAD |

Minimum Deposit | $100 |

Deposit Methods | VISA, MasterCard, Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Union Pay, Fasapay, Crypto (USDT, USDC) |

Withdrawal Methods | Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Crypto (USDT, USDC) |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading, Social Trading |

Trading Platforms & Apps | MT4, MT5, IRESS, TMGM Mobile App |

Markets | Forex, Stocks, Indices, Commodities, Energies, Cryptocurrency |

Spread | From 0.0 Pips in EDGE Account, From 1.0 Pips in CLASSIC |

Commission | $3.5 in EDGE, $0.0 in CLASSIC |

Orders Execution | Market Execution, Limit Order, ECN |

Trading Features | Demo Account, Islamic Account, 1:1000 Maximum Leverage, $50 Minimum Deposit, IRESS Account and Platform, +12000 Assets |

Affiliate Program | Yes |

Bonus & Promotions | Rewards Program |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Email, Visit in Person |

Customer Support Hours | 24/7 |

Restricted Countries | USA, Japan, North Korea, Iran, Syria, Cuba, Sudan, Belarus, Crimea |

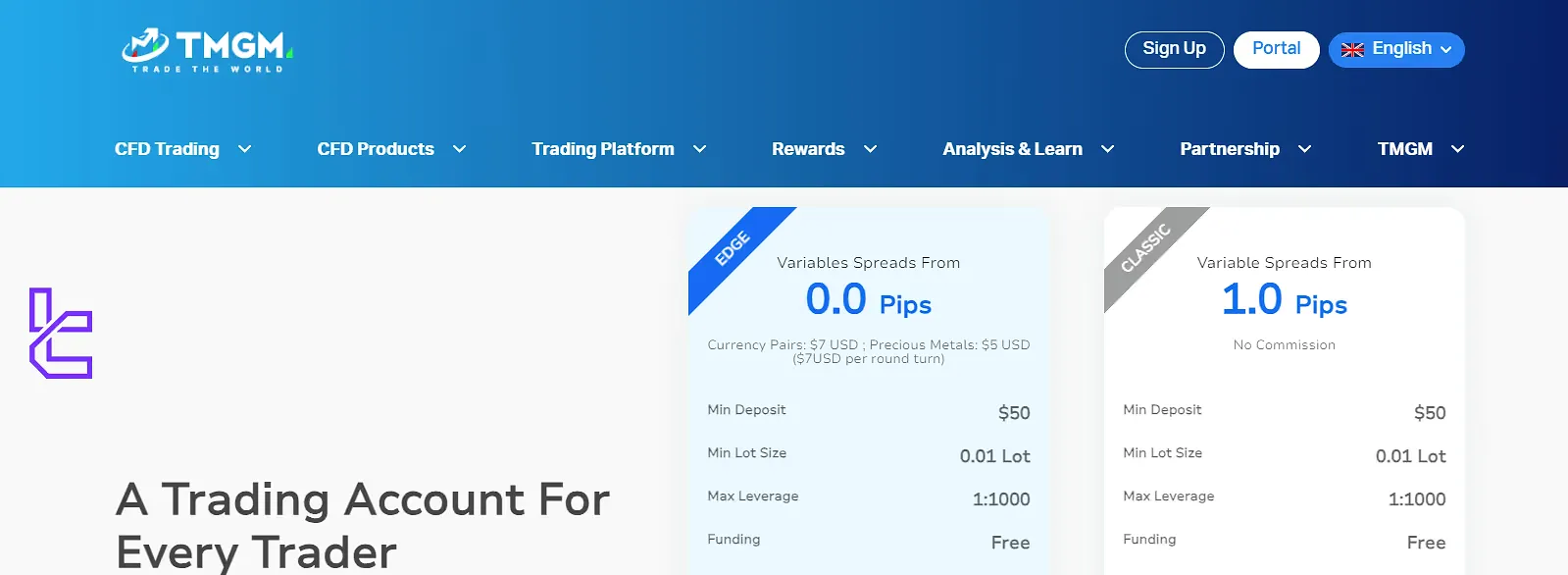

What are Account Types of TMGM Trading? Full Comparison!

TMGM offers 2 account types and each of them suits for different trading styles and preferences. TMGM Account Types:

| Features | Edge/ECN | Classic |

Trading Platforms | MT4, MT5 | MT4, MT5 |

Spreads | From 0.0 Pips | From 1.0 Pips |

Commissions per Lot | $3.5 | $0.0 |

Minimum Deposit | $100 | $100 |

Minimum Lot Size | 0.01 | 0.01 |

Maximum Leverage | 1:1000 | 1:1000 |

Base Currencies | USD, EUR, GBP, AUD, NZD, CAD | USD, EUR, GBP, AUD, NZD, CAD |

Funding Fee | Waived | Waived |

Withdrawal Fee | Free | Free |

Stop Out Level | 40% | 40% |

EAs | Allowed | Allowed |

Scalping | Allowed | Allowed |

News Trading | Allowed | Allowed |

Islamic Account | Yes | Yes |

Besides retail accounts, TMGM offers IRESS account for institutional traders and has 3 tires called: STANDARD, PREMIUM and GOLD.

Each IRESS tier comes with different commission structures and minimum deposit requirements, catering to the needs of institutional traders.

Across all account types, TMGM maintains its commitment to fast execution, deep liquidity, and a wide range of tradable instruments. This flexibility in account offerings allows traders to select the option that best aligns with their trading approach and risk profile.

Pros and Cons

While TMGM benefits from MetaTrader’s widespread adoption, some traders may find its platform experience dated and lacking in customization.

Additionally, a notable drawback is the inactivity fee, which applies after six months of non-use or if balances fall below a set threshold. TMGM Pros and Cons:

Advantages | Disadvantages |

Extensive Range of Tradable Symbols (12,000+ Including) | Inactivity Fee |

Multiple Tier-1 Regulatory Licenses | Low Diversity in Account Types |

Copy Trading and Trading Signals Available | - |

Support For Metatrader 4 And 5 Platforms | - |

Competitive Spreads and Commissions | - |

Fast Execution Speeds (Average Under 30ms) | - |

Dedicated Account Manager | - |

24/7 Support | - |

TMGM's strengths lies in its robust regulatory standing, diverse product offering, and advanced trading capabilities. The availability of copy trading and trading signals can be particularly beneficial for less experienced traders or those looking to diversify their trading strategies.

However, the broker's limited educational resources may be a drawback for beginners or those looking to expand their trading knowledge. Traders seeking comprehensive educational support might need to supplement TMGM's offerings with external resources.

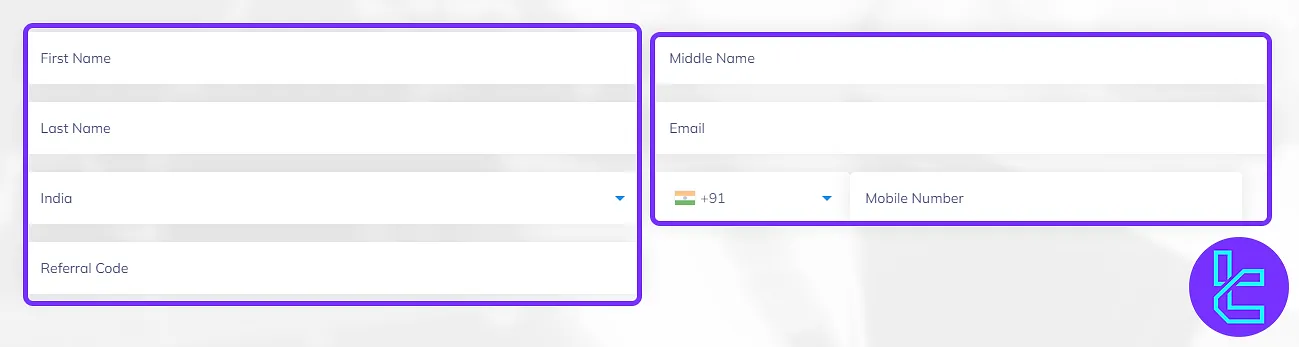

TMGM Account Registration: Detailed Guide!

Opening a TMGM trading account is a short 4-stepprocess designed to onboard traders onto platforms like MetaTrader 4, MetaTrader 5, or IRESS with preferred leverage up to 1:1000 and multiplebase currencies (USD, AUD, EUR, GBP, NZD, CAD).

The sign-up process includes identity verification and financial profiling, which ensures regulatory compliance and tailored trading options. TMGM registration:

#1 Submit Personal Information

Initiate registration by entering your full name, email address, mobile number, and country of residence.

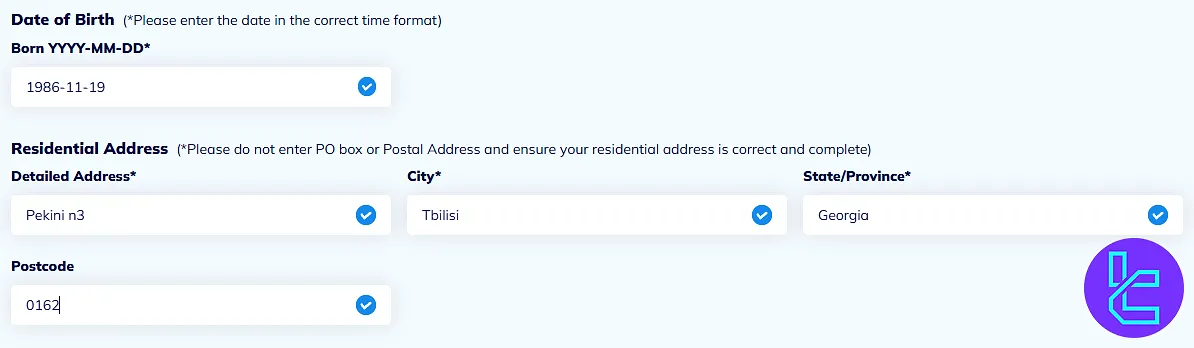

#2 Provide Date of Birth and Residential Address

Complete the form with your birthdate, city, postal code, and region to proceed.

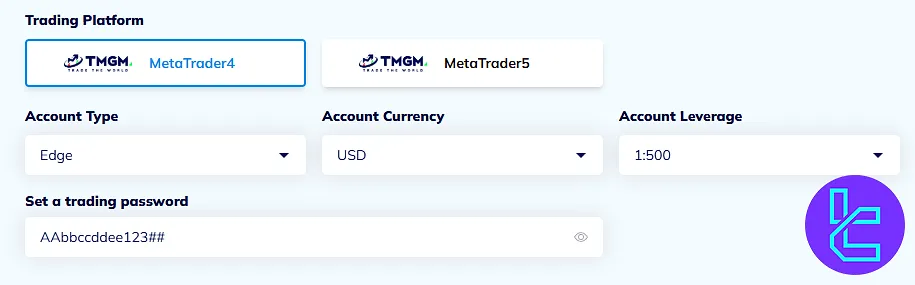

#3 Configure Account Preferences

Choose your account type (Edge or Classic), trading platform, preferred base currency, and set your leverage. Create a secure password and agree to terms.

#4 Fill Out Financial Information

Answer a few questions about your employment status and income range to finalize account setup and prepare for verification.

#5 Verify your account

Complete TMGM KYC, by go through the3steps below:

- Entering the Identity Verification Section

- Submitting ID and Address Documents

- Reviewing Document Confirmation Status

What Platforms TMGM Supports?

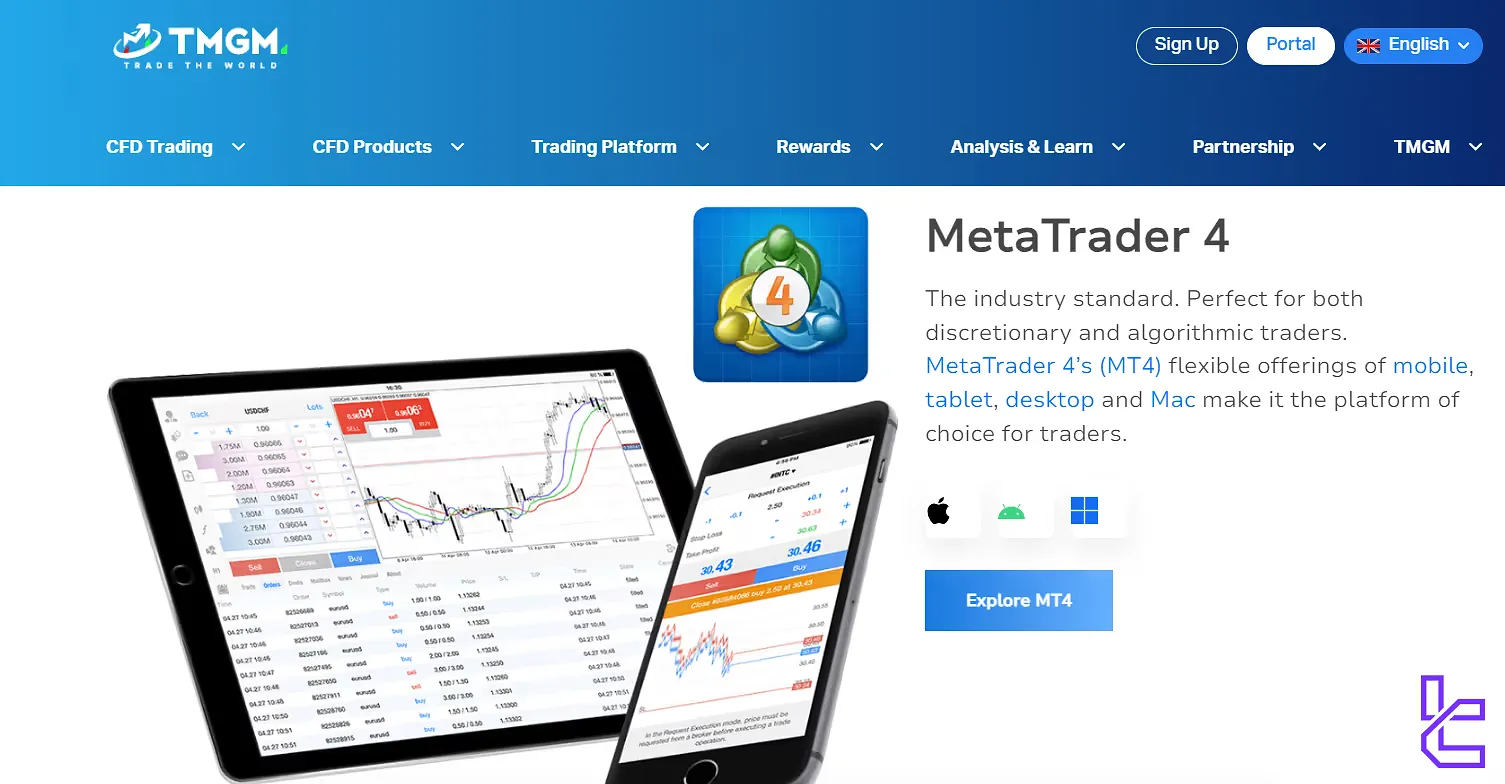

TMGM provides traders with access to some of the most popular and advanced trading platforms such as MetaTrader 4 and MetaTrader 5. TMGM Trading Platforms:

MetaTrader 4 (MT4)

- Industry-standard platform known for its user-friendly interface

- Advanced charting capabilities with multiple timeframes

- Supports Expert Advisors (EAs) for automated trading

- Available for desktop, web and mobile devices

You can utilize TradingFinder's MT4 indicators for advanced technical analysis.

MetaTrader 5 (MT5)

- Next-generation platform with enhanced features

- More technical indicators and analytical tools

- Supports trading on multiple asset classes

- Improved backtesting capabilities for EAs

- Available for desktop, web, and mobile devices

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

IRESS Platform

- Advanced platform for professional traders

- Comprehensive market data and analysis tools

- Ideal for trading stocks and other securities

- Available to IRESS account holders

TMGM Mobile App

- Proprietary app for quick account access

- Perform deposits and withdrawals on the go

- Monitor account status and open positions

- Available for iOS and Android devices

TMGM Forex Broker Spreads and Commissions

This broker offers competitive pricing structures across its account types. TMGM Spreads and Commission:

Specifics | EDGE | CLASSIC |

Spreads | From 0.0 Pips | From 1.0 Pips |

Commission | $3.5 ($7 at Round Turn) | $0.0 |

Live tests conducted during peak trading hours (Feb 2025) revealed the following spreads:

- EUR/USD: 0.9–1.0 pips

- GBP/JPY: 1.8–1.9 pips

- Gold: 18–21 pips

- Crude Oil: 0.03 pips

- Dow Jones: 4.0 basis points

- DAX (Germany 40): 3.0–4.0 basis points

- Bitcoin: $16–$24 per trade

TMGM Swap Fees

Swap fees represent the cost or gain of maintaining a leveraged position overnight, influenced by interbank interest rate differentials. A swap long applies when holding a long (buy) position overnight, while a swap short pertains to short (sell) positions.

Below are indicative swap rates for standard lots (100,000 units of the base currency):

- EUR/USD: Long positions incur a$6.21 charge, while short positions receive a $2.28 credit;

- GBP/JPY: Long positions earn a $14.32 credit, whereas short positions face a $33.60 charge.

Live trading data indicates that TMGM’s swap rates range from average to relatively high, depending on the instrument and market conditions. It's important to note that swap values are variable and subject to periodic adjustments.

Note: It's worth noting that TMGM also offers Islamic (swap-free) versions of both account types, catering to traders who require Shariah-compliant trading conditions.

TMGM Non-Trading Fees

While there are no deposit or withdrawal fees, the broker charges a $10 inactivity fee per month after 12 months of account dormancy.

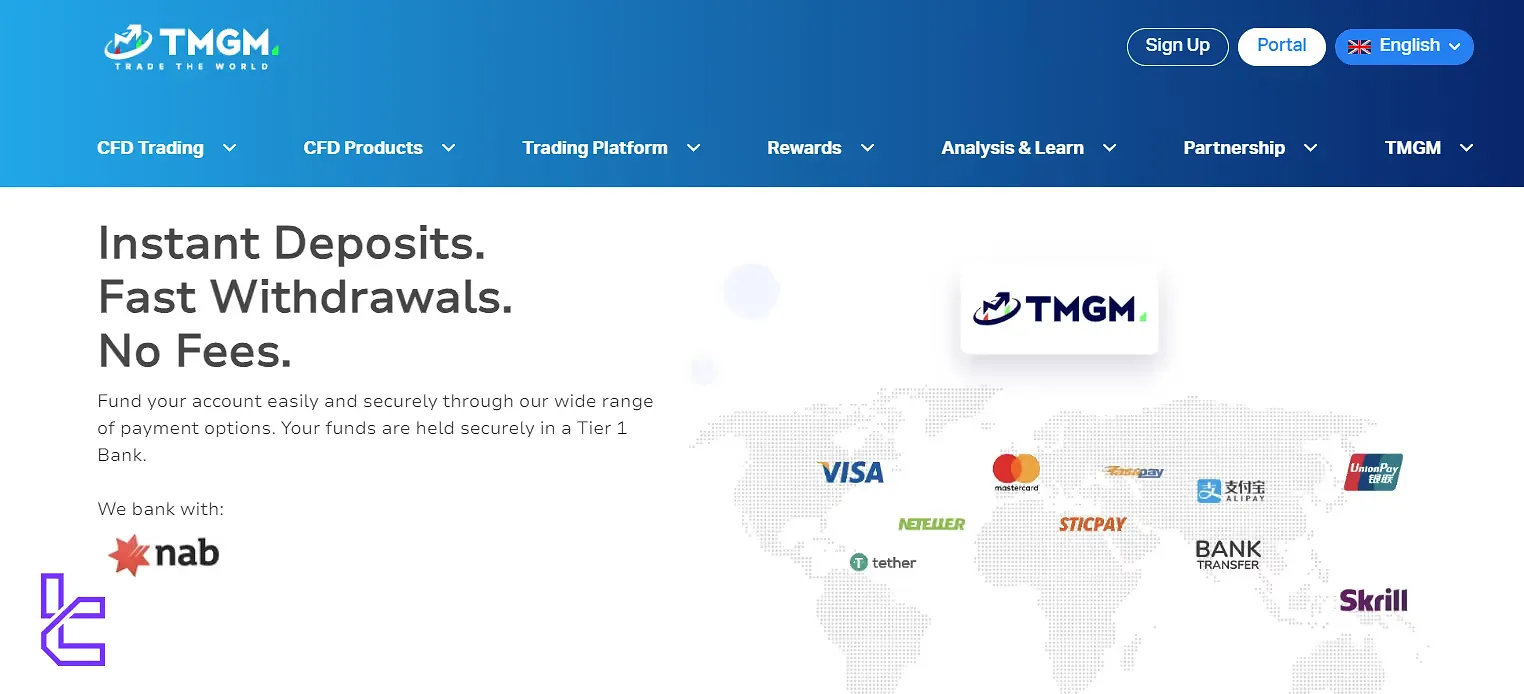

TMGM Trading Deposit & Withdrawal Methods

TradeMax Global Markets offers a variety of secure and convenient methods for depositing and withdrawing funds and each of them has its own specifics such as processing time. TMGM deposit & withdrawal Methods:

- VISA / MasterCard

- Bank Transfer

- RMB Instant

- Revolut

- WISE

- Neteller

- Skrill

- Union Pay

- Fasapay

- Crypto (USDT, USDC)

For both deposit and withdrawal, multiple currencies (USD, AUD, EUR, GBP, NZD, CAD, etc.) are supported.

TMGM Deposits

TMGM supports over 10 deposit options, including Cryptocurrencies (USDT and USDC), bank wire, and e-wallets like Skrill and Neteller.

Most deposits are instant and fee-free, with support for major currencies and multiple card providers including Visa, MasterCard, Wise, and Revolut.

Deposit Method | Min Deposit | Processing Time |

VISA | $100 | Instant |

Master Card | $100 | Instant |

Bank Transfer | $100 | 1 to 3 Working Days |

RMB Instant | $100 | Instant |

Revolut | $100 | 1 Working Day |

WISE | $100 | 1 Working Day |

Neteller | $100 | Instant |

Skrill | $100 | Instant |

Union Pay | $100 | Instant |

Fasapay | $100 | Instant |

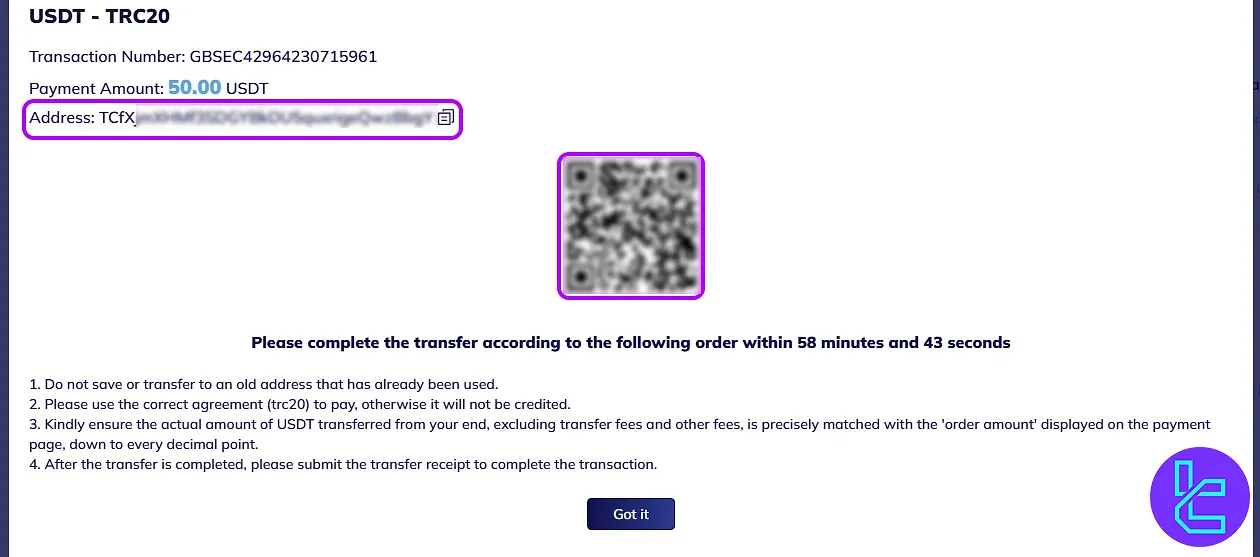

TMGM TRC20 Deposit

TMGM TRC20 deposit is a fast 6-step process. After logging in, head to the “Funding” section and select USDT (TRC20) as your method. Choose your trading account, enter the amount, and receive a unique wallet address.

Transfer the exact amount from your crypto wallet, take a screenshot showing the transaction details, and upload it for verification. Once submitted, the deposit is typically confirmed within 20 minutes.

This method offers quick execution and low fees, making it ideal for funding TMGM Standard or ECN accounts efficiently.

TMGM Withdrawals

Traders can withdraw via stablecoins, e-wallets, or bank transfer, with payouts processed in 1–4 days. While most methods are fee-free, intermediary charges may apply. Withdrawals via TRC20 are recommended for speed and cost efficiency.

Withdrawal Method | Min Withdrawal | Processing Time |

Bank Transfer | $100 | 1 to 3 Working Days |

RMB Instant | $100 | Instant |

Revolut | $100 | 1 Working Day |

WISE | $100 | 1 Working Day |

Neteller | $100 | Instant |

Skrill | $100 | Instant |

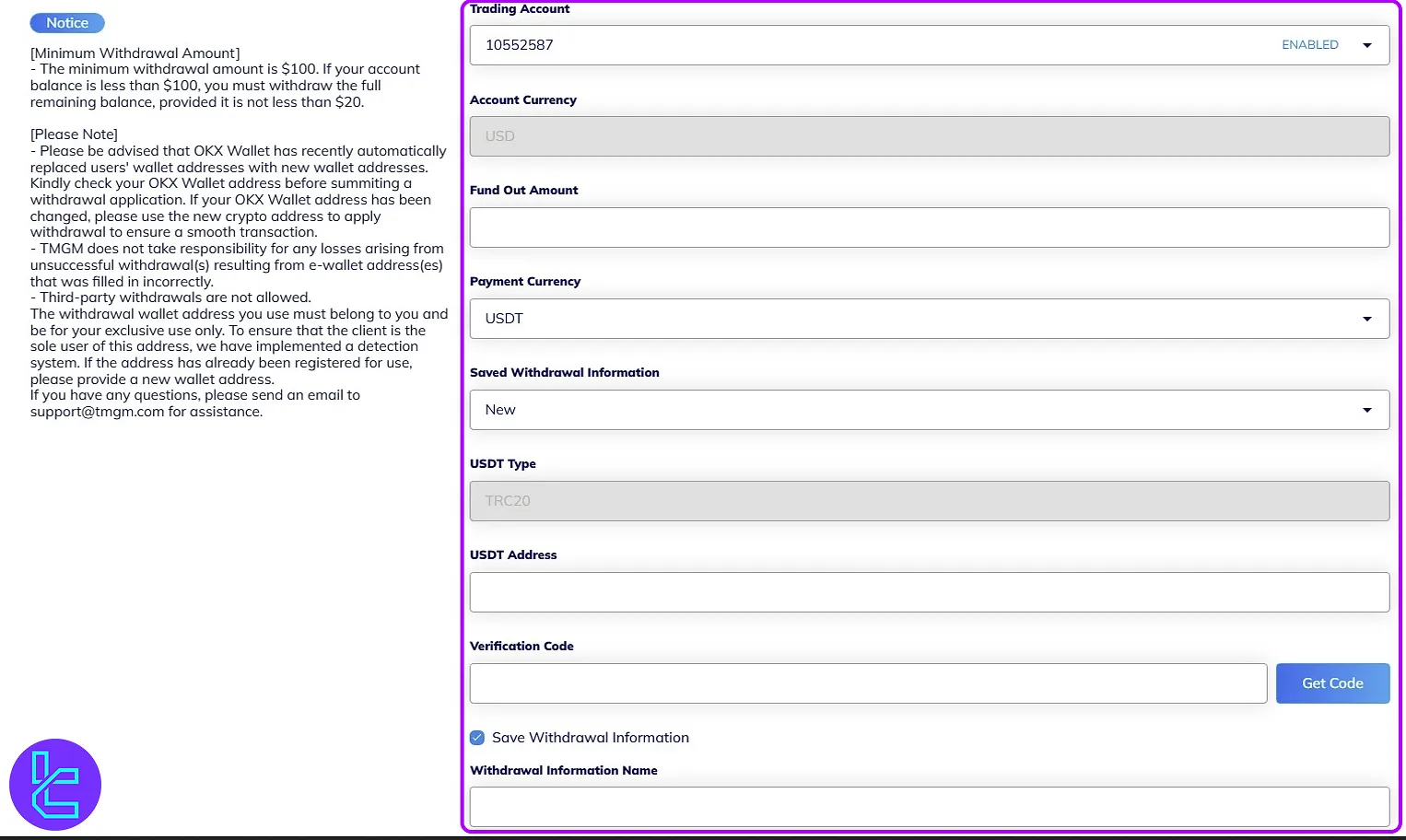

TMGM TRC20 Withdrawal

TMGM TRC20 withdrawal is a fast 4-step process. First, access the “Withdrawal” section from the dashboard. Then, select USDT (TRC20) as your payout method.

Enter your withdrawal amount (minimum \$100), choose or add a TRC20 wallet, and verify via email. After submitting, you can track or cancel the request from the “Report” section.

This method is quick to initiate and is typically processed within 1–2 business days. All you need is a valid TRC20 wallet to receive your funds efficiently.

Does TMGM Offers Copy Trading? Investment Options Review!

TMGM offers copy trading functionality through its partnership with ZuluTrade and call it “HUBx”. This copy trade and social trading platform allows traders to:

- Follow and copy successful traders (signal providers)

- Diversify their trading strategy without extensive market knowledge

- Learn from experienced traders' strategies

TMGM's copy trading feature, combined with its diverse range of tradable assets and advanced platforms, offers traders a comprehensive suite of tools to potentially enhance their trading performance and diversify their investment strategies.

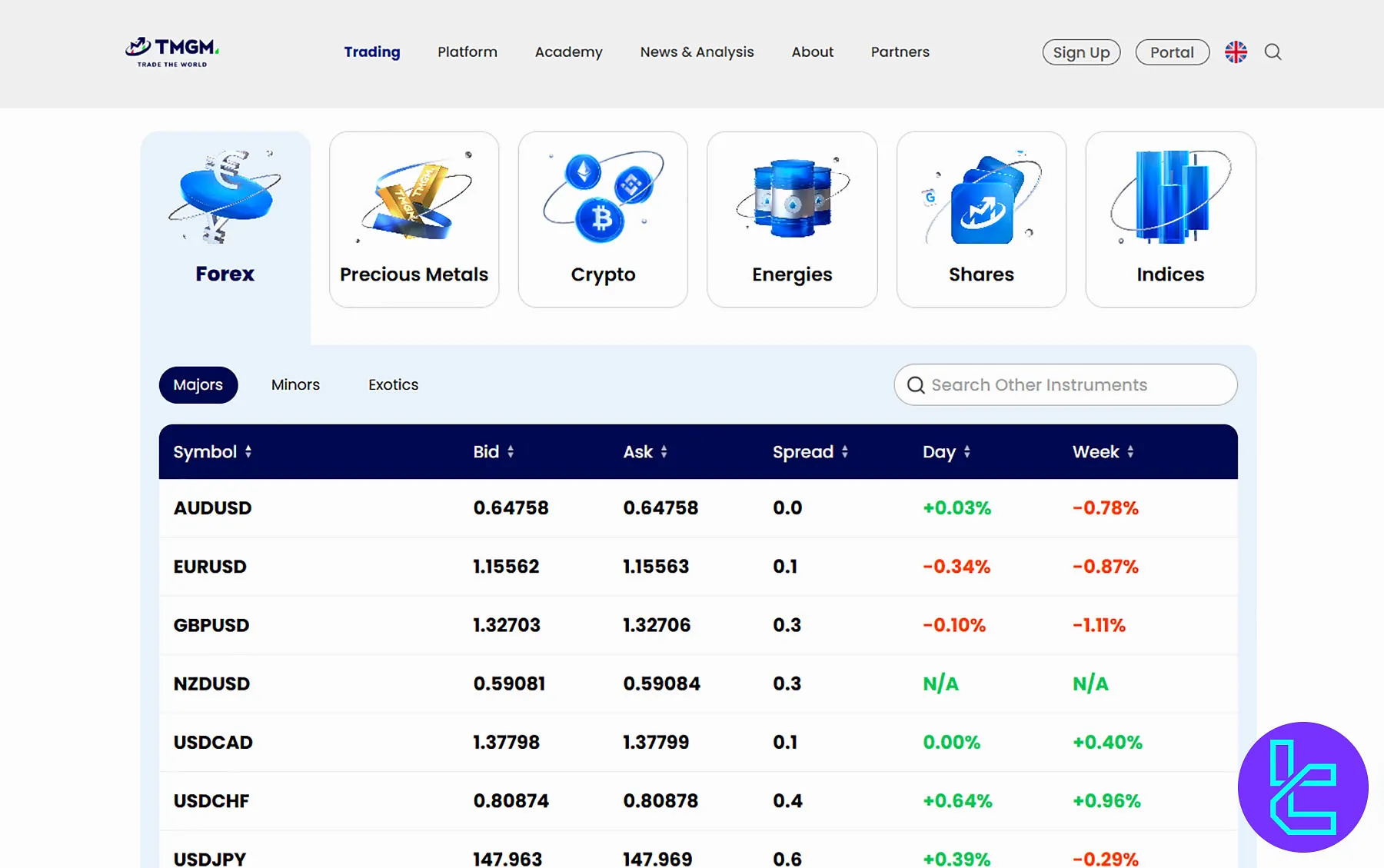

TMGM Instruments & Assets

TMGM offers access to a diverse range of over 12,000 tradable instruments across several asset classes, although product availability may vary by trading platform and regulatory entity.

Most instruments are accessible via the MetaTrader 4 and MetaTrader 5 platforms, with additional stock trading options available through the IRESS platform (for eligible clients). TMGM Instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 50 currency pairs | 50 - 70 currency pairs | 1:1000 |

Metals | CFDs | Over seven pairs | 10 - 20 instruments | Gold 1:1000 Other instruments 1:200 |

Indices | CFDs | 17 major global indices | 10 - 20 instruments | 1:500 |

Stocks | CFDs | Over 12,000 | 800 - 1200 | 1:20 |

Cryptocurrencies | CFDs | 20 crypto pairs | 20 - 30 instruments | 1:200 |

Energies | CFDs | 3 (BRENT, WTI, and NGAS) | 3 - 5 instruments | 1:200 |

Are There Any Available Bonuses on TMGM Trading?

Yes, TradeMax does offer various bonuses and promotional incentives to attract and retain traders. TMGM Bonuses:

TMGM Rewards Program

- Earn points for every lot traded

- Redeem points for a variety of rewards such as Electronics (e.g., iPad, MacBook), Cashback up to $2500 and other trending products

Promotional Offers

TMGM runs periodic campaigns with special bonuses such as Welcome bonuses for new clients, Trading competitions with prizes.

TMGM Awards

TMGM has received multiple global awards for its trading platform, sports sponsorship, and trustworthiness. Here's a list of the most important TMGM awards:

- Most Trusted Forex Broker 2024 (Wiki Finance Expo, Bangkok)

- Best Forex Trading Platform 2024 (IFINEXPO, Hong Kong)

- Most Innovative Sports Sponsorship (Forex Sports Awards)

Support: is it Available 24/7?

Customer support is a crucial aspect of any forex broker, and TMGM doesn't disappoint in this department. The broker offers round-the-clock support to its clients, ensuring that help is always at hand, regardless of time zones or trading hours. TMGM support:

TMGM Support is Available 24/7 Even in Holidays

TMGM Support is Available 24/7 Even in Holidays

- 24/7 Availability: Support team is accessible at all times, catering to the global nature of forex trading

- Multiple Channels: Traders can reach out via phone, email, live chat and visit in person for assistance

- Multilingual Support: Services are offered in over 10 languages, accommodating a diverse client base

- Quick Response Times: Known for fast and efficient resolution of queries and issues

While 24/7 support is a significant advantage, it's worth noting that the quality of support can vary depending on the complexity of the issue and the time of day. However, this broker commitment to customer service is evident in its efforts to provide comprehensive assistance to its traders.

Full List of TMGM Restricted Countries

As a globally operating broker, TMGM has to navigate various international regulations, which results in certain geographic restrictions. While the broker aims to serve a wide client base, there are limitations on who can access their services. TMGM Trading Restricted Countries:

- USA

- Japan

- North Korea

- Iran

- Syria

- Cuba

- Sudan

- Belarus

- Crimea

Trust Scores & Reviews

Trust and reputation are paramount in the forex industry, and TMGM has worked hard to establish itself as a reliable broker. Let's take a look at how TMGM fares in terms of trust scores [sites like Trustpilot, ForexPeaceArmy and Reviews.io] and user reviews:

- Trustpilot: 4.4 out of 5

- ForexPeaceArmy: 1.7 out of 5

- Reviews.io: 3.6/5

While TMGM's Trustpilot score isn't that high, it's commendable that the broker openly displays this information on their website, demonstrating a commitment to transparency. In TMGM REVIEWS.io, Many users praise TMGM for its:

- Fast execution speeds

- Competitive spreads

- Reliable customer support

- Wide range of trading instruments

However, some users have reported issues with:

- Withdrawal processes

- Platform stability during high volatility periods

TMGM Educational Resources

TMGM recognizes the importance of trader education and offers a range of resources to help clients enhance their trading knowledge and skills. TMGM's educational resources:

- Online Tutorials: Step-by-step guides on various forex education topics and platform usage

- Webinars: Live and recorded sessions covering market analysis and trading strategies

- Analysis and Blog Posts: Regular updates on market trends, economic events, and trading tips

Check TradingFinder's Forex education section for additional learning materials.

TMGM Comparison with Other Brokers

Table below compares the features of TMGM with some of the top forex brokers:

| Parameter | TMGM Broker | XM Broker | IC Markets Broker | FBS Broker |

| Regulation | ASIC, VFSC, FSC, FMA | ASIC, FSC, DFSA, CySEC | FSA, CySEC, ASIC | FSC, CySEC |

Minimum Spread | From 0.0 Pips in EDGE Account, From 1.0 Pips in CLASSIC | From 0.6 Pips | 0.0 Pips | 0.0 Pips |

Commission | $3.5 in EDGE, $0.0 in CLASSIC | None Except On Shares Account No Withdrawal & Deposit Commissions | Average $1.5 | From $0 |

Minimum Deposit | $100 | $5 | $200 | $5 |

Maximum Leverage | 1:1000 | 1:1000 | 1:500 | 1:3000 |

Trading Platforms | MT4, MT5, IRESS, TMGM Mobile App | MT4, MT5, Mobile App | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App |

Account Types | EDGE, CLASSIC | Micro, Standard, Ultra Low, Shares | Standard, Raw Spread, Islamic | Standard |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | +12000 | 1400+ | 2,250+ | 550+ |

| Trade Execution | Market Execution, Limit Order, ECN | Market, Instant | Market | Market |

TradingFinder Conclusion and final words

Partnered with Chelsea football club, TMGM forex broker offers 2 account types [Edge, Classic] with $100 minimum deposit and 1:1000 maximum leverage. This broker allows EAs, scalping, news trading and has a room for Islamic account.