Tuesday through Thursday are considered the best days to trade forex, as they experience a significant rise in trading volume and price volatility.

This period forms the core of the trading week, offering numerous opportunities for intraday traders. On the other hand, Mondays and Fridays typically suffer from lower liquidity.

Usually, on Mondays after the Forex market opens, price gaps caused by the U.S. weekend holidays are formed .Fridays, however, see decreased volatility as institutional players close their positions before the weekend.

Which Days Are Best for Forex Trading?

Tuesday, Wednesday, and Thursday not only witness high trading volume but also coincide with the release of critical economic data and news. This invites active participation from retail traders, central banks, and institutional players.

Such concentrated activity creates ideal conditions for volatility trading and timely entries and exits. Analysts rely on data and market sentiment in these periods to rapidly interpret fluctuations and pinpoint optimal trading zones.

Most Active Forex Trading Days

Tuesday and Thursday are known for the highest trading volume, highest liquidity, and tightest spreads. After the market opens, institutional participation increases the predictability of price movements.

Impact of Economic News on the best Forex trading days of the week

A large portion of market volatility between Tuesday and Thursday is driven by the release of macroeconomic data.

Reports such as U.S. Non-Farm Payrolls (NFP), Federal Reserve interest rates, or inflation indicators can cause significant price jumps. Traders seeking fast movements often choose these days as the best days to trade forex.

Comparison of the Impact of Major Economic News on the best days to trade

The effect of major economic news on the best Forex trading days of the week is directly related to the type of news and its release time. In the table below, we compare the impact of each key economic report on the best days to trade forex:

Type of Economic News | Typical Release Time | Highest Impact Day | Volatility Level | Trading Notes |

U.S. Non-Farm Payrolls (NFP) | First Friday of every month | Friday | Very High | Opportunity for scalping and news-based trades; high risk due to gaps and slippage |

Interest Rates & Monetary Policy (Fed, ECB, BoE, BoJ) | Tuesday to Thursday | Tuesday – Thursday | High | Sets mid-term trend direction; suitable for swing traders |

Consumer Price Index (CPI) & Inflation Data | Midweek (Tuesday or Wednesday) | Tuesday – Wednesday | High | Main driver of rate expectations; good for news-based and trend trading |

GDP Growth | End of month – midweek | Tuesday – Thursday | Medium to High | Changes market outlook for the national currency; safer to trade after data stabilizes |

Economic Activity Indicators (PMI / ISM) | Start of the month (Monday or Tuesday) | Monday – Tuesday | Medium | Acts as a leading indicator, giving early price direction for the week |

Retail Sales & Trade Balance | Mostly Tuesday to Thursday | Tuesday – Thursday | Medium | Lower impact than CPI and NFP, but important during calm markets |

Trading on the Day After Major News

In Forex, the day after the release of major economic news (such as NFP, interest rates, CPI, or central bank decisions) is considered a golden opportunity for many traders. This is because the market’s behavior after the news shock tends to form more sustainable trends.

Reasons why market conditions become better for trading on the day after news releases:

- Emotional overreaction and irrational volatility get absorbed

- Spread and slippage decrease

- The main market direction becomes clear

- Technical analysis gains higher reliability

High-Risk Trading Days of the Week

Identifying high-risk days can prevent poor entries in the forex market. These are periods when liquidity drops and market behavior becomes erratic.

Next, we review the high-risk days of the week for Forex trading:

- Monday: Traders return from the weekend, creating unstable market conditions;

- Friday: Liquidity declines in the New York session’s close, prompting institutional exits;

- Major economic release days: Liquidity providers may exit to avoid exposure;

- Bank holidays: The absence of major players leads to low volume and erratic volatility.

Note: Although Fridays usually see lower volume, the release of the U.S. NFP report on the first Friday of every month can create intense volatility and short-term trading opportunities.

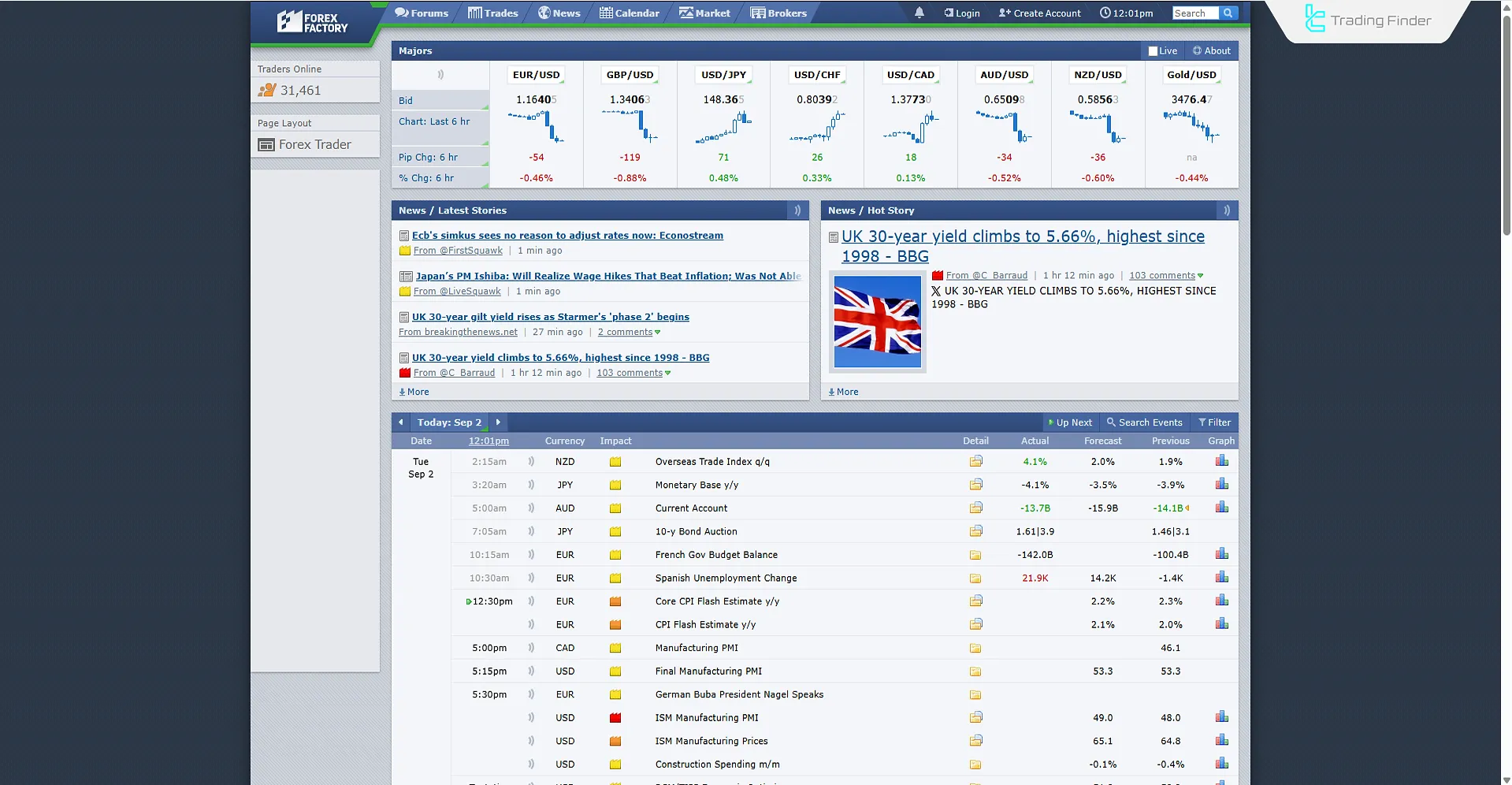

To stay updated with economic news, bank holidays, and major global events, you can use the Forex Factory website:

Example of High-Risk Days of the Week (Sunday Night Gap)

For example, the Sunday Night Gap occurs mostly in highly traded currency pairs like EUR/USD and GBP/USD because these pairs react more strongly to weekend political and economic events.

Professional traders often interpret such gaps as potential signals for entry or exit, but gap-filling is not guaranteed. Sometimes, continuation of the gap can mark the beginning of a powerful trend.

Effect of Triple Swap on Tuesdays

One of the lesser-known characteristics of Tuesdays is the application of Triple Swap. This happens because brokers calculate the weekend rollover interest, which can significantly affect profit or loss on open positions.

Traders using mid-term strategies must factor this in when managing trades.

Busiest Hours in the Forex Market

The London New York overlap has the highest daily trading volume, thanks to active participation from banks, institutions, and retail traders.

Key price movements and optimal trading opportunities occur especially in the Kill Zone of these sessions.

Major Kill Zones Throughout the Day

Kill Zones in Forex Trading Sessions Based on UTC Time are as follows:

- Asian Kill Zone: From 01:00 to 03:00 UTC

- London Kill Zone: From 07:00 to 10:00 UTC

- First Half of New York Kill Zone: From 13:00 to 16:00 UTC, Overlapping with the London session

- Second Half of New York Kill Zone: From 18:00 to 20:00 UTC, Coinciding with major economic news releases

Example of key Kill Zones displayed on the gold chart

Example of key Kill Zones displayed on the gold chart

Killzones Toolkit Indicator

The Killzones Toolkit indicator highlights high-volatility time zones on the chart with colored boxes, enabling precise analysis of the New York, London, and Tokyo sessions.

These zones, called Killzones, are often accompanied by higher trading volume and faster price movements and are considered key points for trade entries or exits.

This tool is not limited to Forex; traders can also use it in Cryptocurrency and Stock markets. Its ability to run on short timeframes like M1, M5, and M15, as well as higher ones like H1 and H4, makes it suitable for multiple trading styles.

Key Features of Killzones Toolkit:

- Platform: MetaTrader 5 & 4

- Skill Level: Intermediate

- Trading Styles: Scalping & Fast Scalper

- Indicator Type: Reversal & Breakout

- Target Markets: Forex, Crypto, Stocks, and Equities

This indicator displays key market time zones with distinct colors and allows precise identification of important levels. For example, the green box during the New York session often acts as support, triggering bullish moves.

Conversely, the blue box during the London session typically acts as resistance, creating conditions for bearish trends. For a better understanding of how it works, watch the video below:

The settings section allows changing session colors, setting start times, selecting reference candles, and defining the maximum number of candles to analyze. This flexibility makes the indicator useful for different strategies.

Overall, the Killzones Toolkit is a complementary tool for Technical Analysis, offering a deeper view of price behavior during volatile hours when used alongside Fundamental Analysis.

This indicator is available for both MetaTrader 4 and MetaTrader 5 platforms for free:

Daily Volatility of Currency Pairs to Determine the Best Days to Trade Forex

The table below shows the average daily range (difference between high and low) for some currency pairs during the week, helping to identify the best forex trading days.

For example, in the table below, the average daily volatility of some currency pairs over a week illustrates the most volatile days of the week:

Day of the Week | EUR/USD Avg. Range | GBP/USD Avg. Range | USD/JPY Avg. Range |

Monday | 80 pips | 95 pips | 65 pips |

Tuesday | 120 pips | 140 pips | 90 pips |

Wednesday | 135 pips | 150 pips | 100 pips |

Thursday | 145 pips | 160 pips | 110 pips |

Friday | 100 pips | 120 pips | 85 pips |

Keep in mind that bank holidays in the U.S., Europe, or Japan can directly impact market liquidity. During such days, trading volume decreases, and price moves become less predictable.

Thus, even on the busiest weekdays, if they coincide with official holidays, the market may remain quiet and shallow.

For a more detailed review of weekly price charts, you can also watch the Twfforex YouTube channel video:

Which Months Are Best for Trading?

Markets usually perform better at the beginning of the year. The January Effect marks mass sell-offs that open up space for new investors.

Due to heightened volatility, the period between January and May is considered ideal. Post-summer, September to November also brings back strong market activity.

After summer, during September to November, markets typically return to a more volatile phase, providing more opportunities for traders. For For more information, check the learn best months to trade forex education article on myfxbook.com.

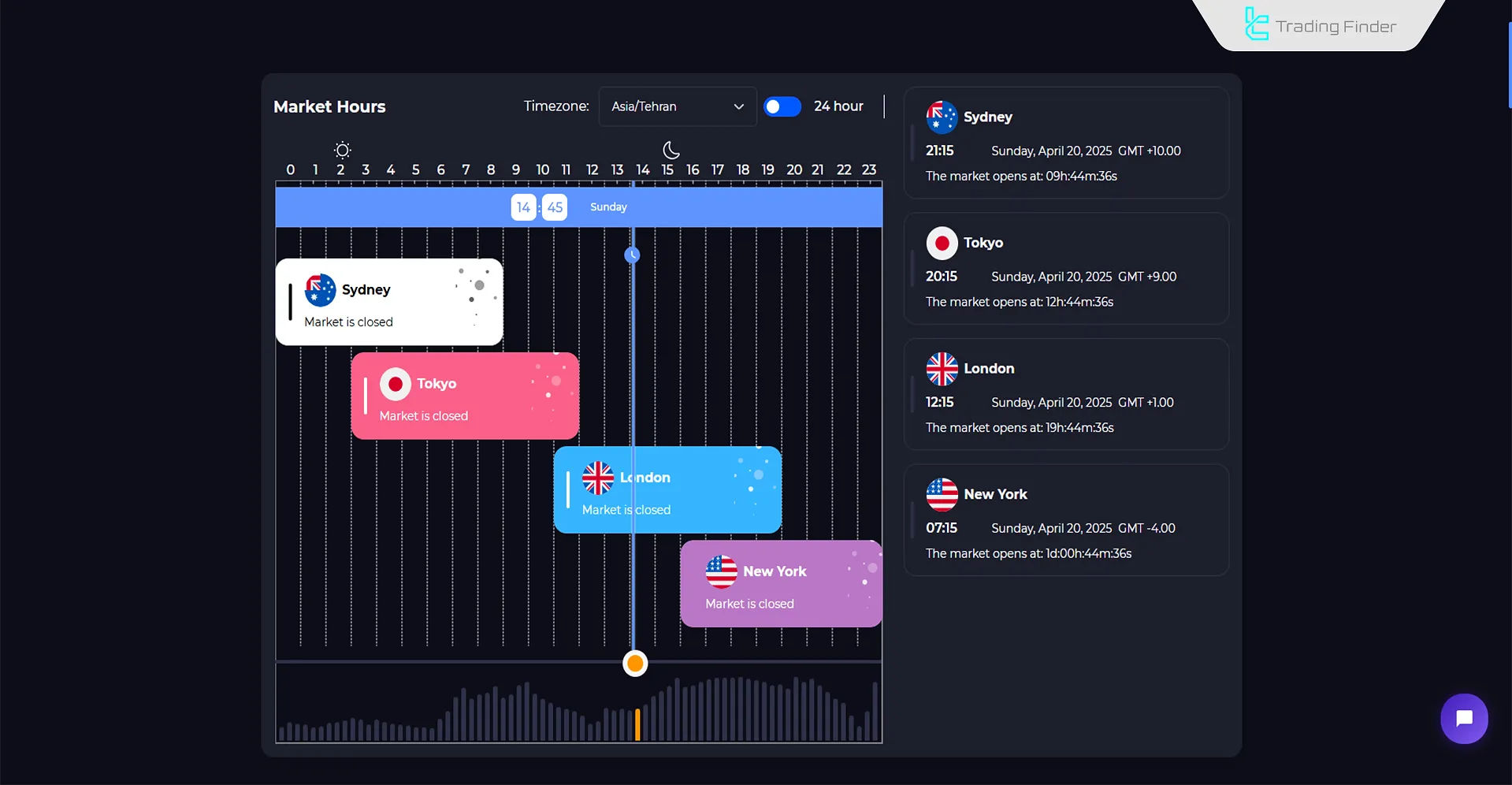

For precise trading session times and global Forex market hours, you can use TradingFinder’s trading session tool, which provides accurate schedules and overlapping session data.

Best Days Based on Trading Strategy

Choosing the best Forex trading days of the week can vary depending on your trading style:

- Scalpers: Most opportunities for quick in-and-out trades occur on Tuesday and Thursday due to higher volatility;

- Swing Traders: Use early week to determine overall market direction and enter trades on Wednesday;

- Position Traders: Avoid holding positions over Friday to reduce Monday gap risk.

Daily Volatility of Currency Pairs to Determine the Best Days to Trade Forex

The table below shows the average daily range (difference between high and low) for some currency pairs during the week, helping identify the best forex trading days of the week.

Day of the Week | EUR/USD Avg. Range | GBP/USD Avg. Range | USD/JPY Avg. Range |

Monday | 80 pips | 95 pips | 65 pips |

Tuesday | 120 pips | 140 pips | 90 pips |

Wednesday | 135 pips | 150 pips | 100 pips |

Thursday | 145 pips | 160 pips | 110 pips |

Friday | 100 pips | 120 pips | 85 pips |

Which Months Are Best for Trading?

Markets usually perform better at the beginning of the year. The January Effect marks mass sell-offs that open up space for new investors.

Due to heightened volatility, the period between January and May is considered ideal. Post-summer, September to November also brings back strong market activity.

Conclusion

Tuesday, Wednesday, and Thursday are the best forex trading days of the week for intraday traders. These days offer maximum volume and volatility, allowing traders to pick ideal entry times after the Forex market opens and during Kill Zones.

Conversely, Mondays and Fridays show lower volume and volatility and are not ideal for active trading, making them less favorable days to trade forex.