- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

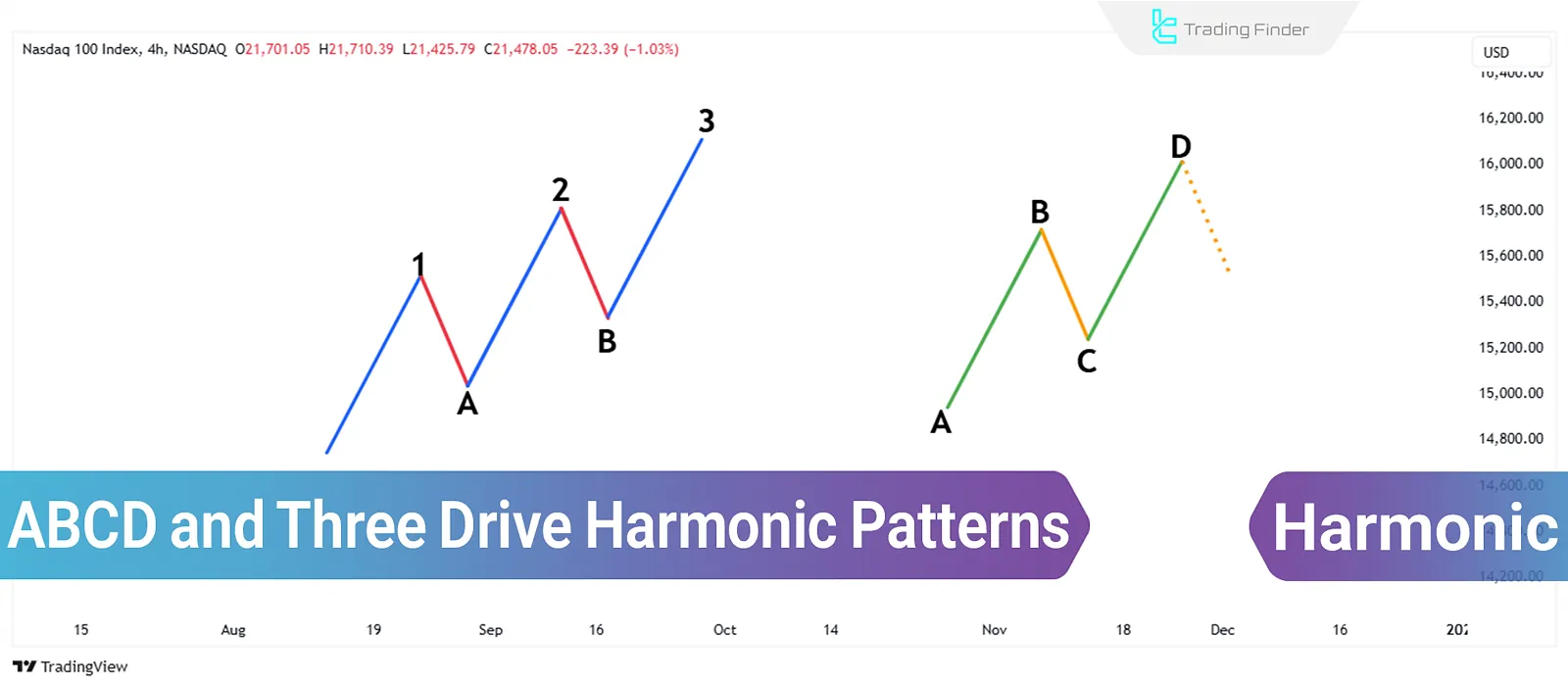

ABCD and Three-Drive; Harmonic Patterns in technical analysis & Fibonacci ratios

Harmonic patterns, based on Fibonacci ratios, are among the tools used in technical analysis. The ABCD pattern and the Three-Drive...

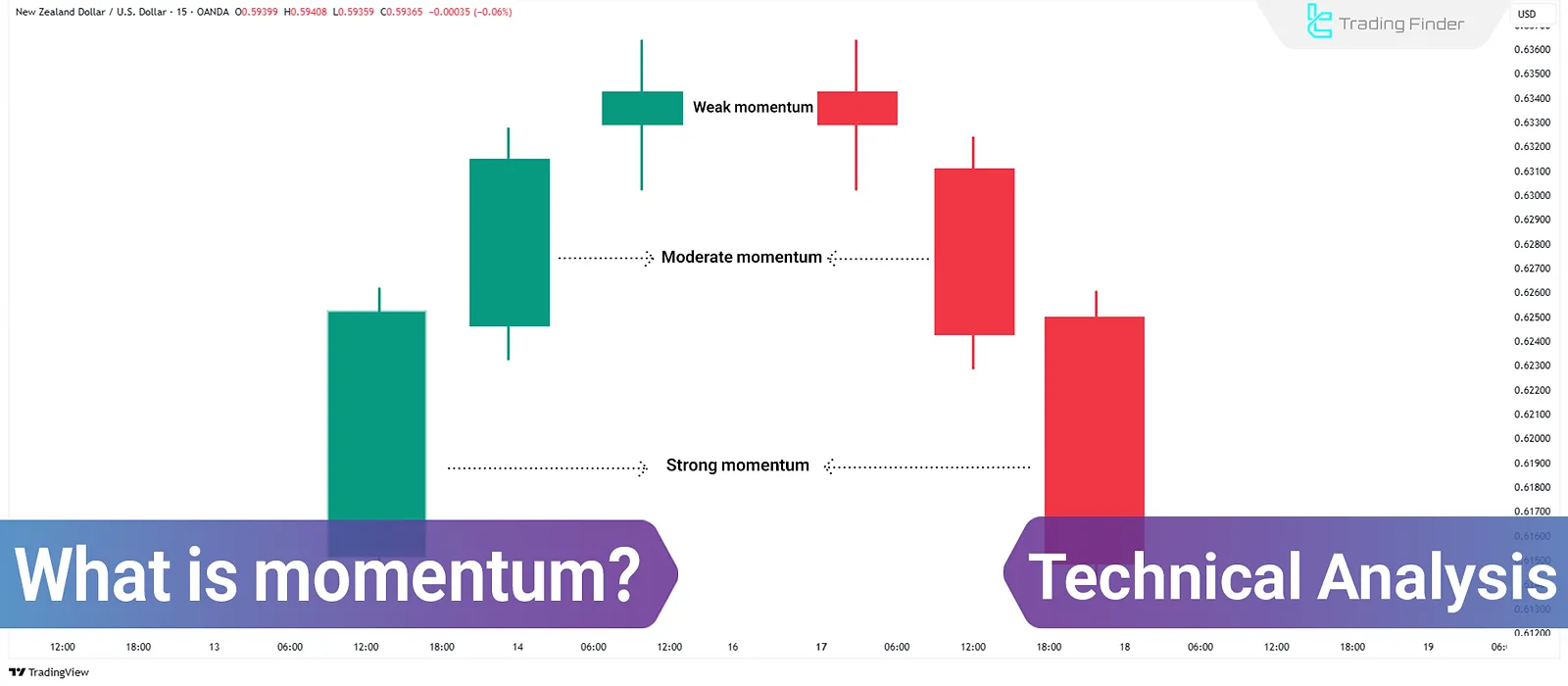

Momentum in Technical Analysis: The Speed and Strength of Price Movement

Among various technical analysis tools, momentum is one of the concepts that examines the speed and strength of pricemovements....

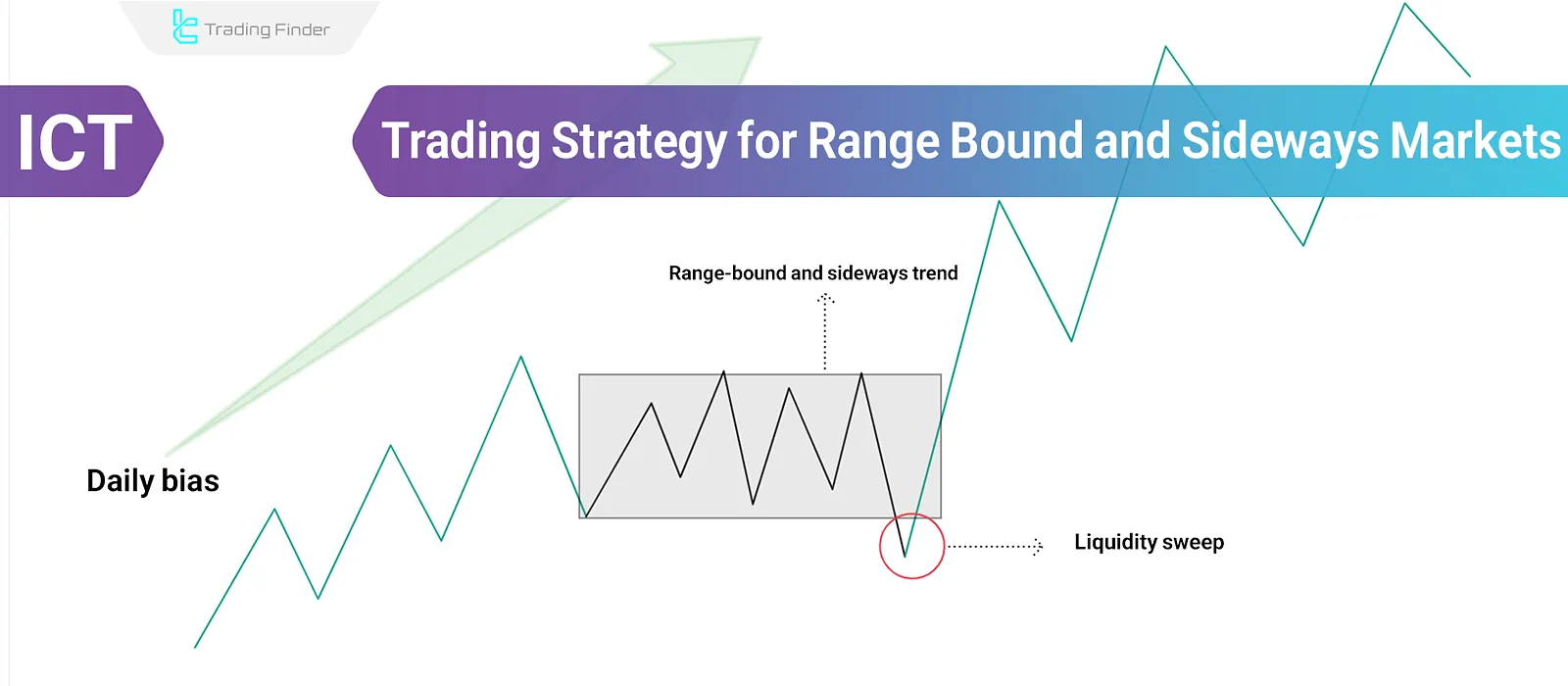

ICT Range and Consolidation Trading Strategy: Identifying Sideways Markets

Range markets (also called consolidation zones) are the primary areas where smart money accumulates liquidity. In these zones, price...

What is Scalping? Best Scalping Trading Strategies

Scalping is a highly fast-paced trading strategy in financial markets where the period between opening and closing trades is only...

The Impact of Monetary Policy on Inflation [Contractionary and Expansionary]

Monetary policy, with its direct impact on liquidity, reduces or increases inflation. The way monetary policy affects economic...

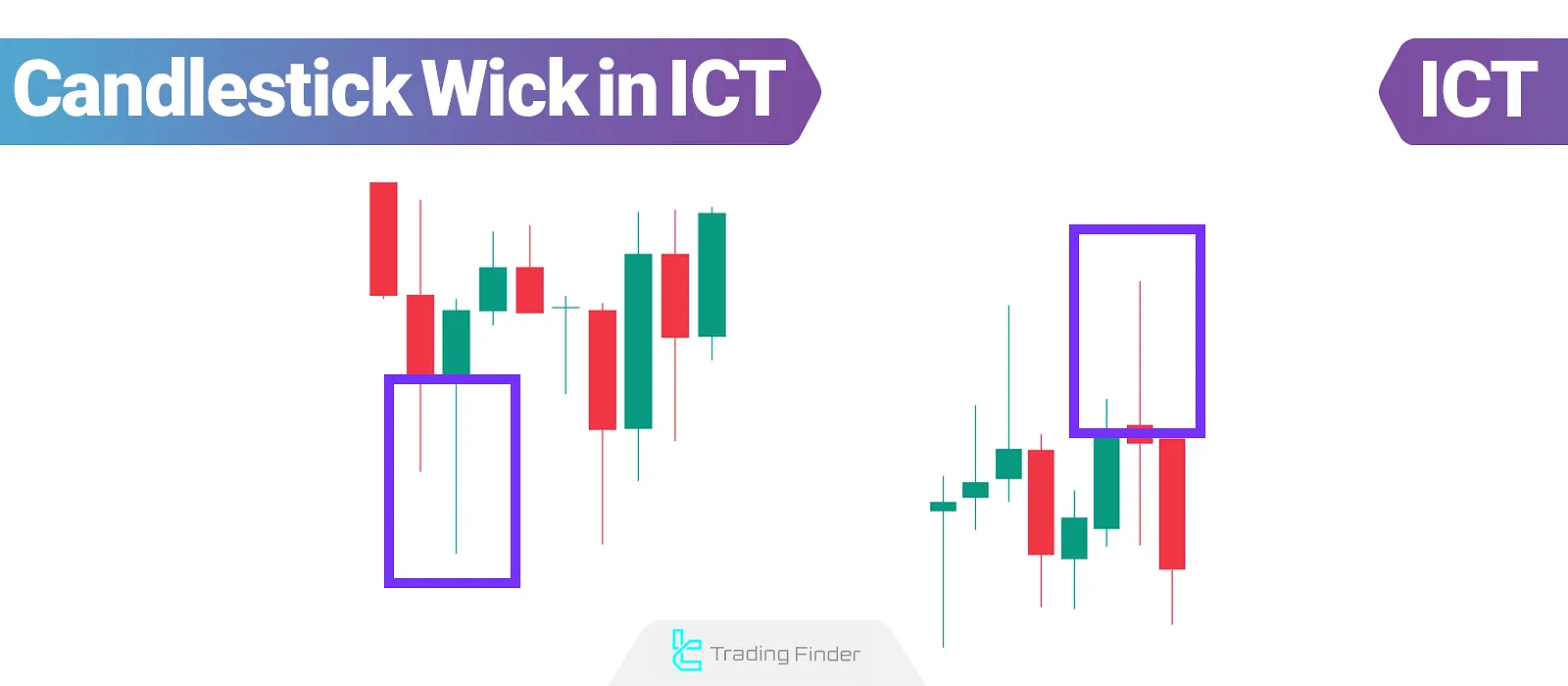

Candlestick wicks in ICT; a Guide to Identifying Market Reversals

The candlestick shadow in ICT reveals is a precise depiction of the market's reaction to key levels and its behavior relative to...

Candlestick Patterns in Support and Resistance; Candle Pattern Trading at S/R

Candlestick patterns, as the foundation of Price Action analysis, reflect order behavior at key supply and demand zones. Combining...

What is Monetary Policy? [Impact of monetary policies on economic growth]

Monetary policy shapes the cycles of economic expansion and recession. Therefore, understanding monetary policy, its tools such...

Stagflation [Causes of Stagflation + Ways to Overcome It]

Stagflation is the worst phase of an economy; Despite rising unemployment rates, economic growth declines instead of...

Xmaster (XHMaster) Formula Indicator: Identifying Start/End of Trends

The Xmaster Formula Forex Indicator issuesentry signals based on overbought and oversold zones. A key advantage of this indicator...

Choosing a Forex Broker - Step-by-Step to Choose the Best Forex Broker

In financial markets such as Forex market, a broker acts as the intermediary between the trader and the market. To make the...

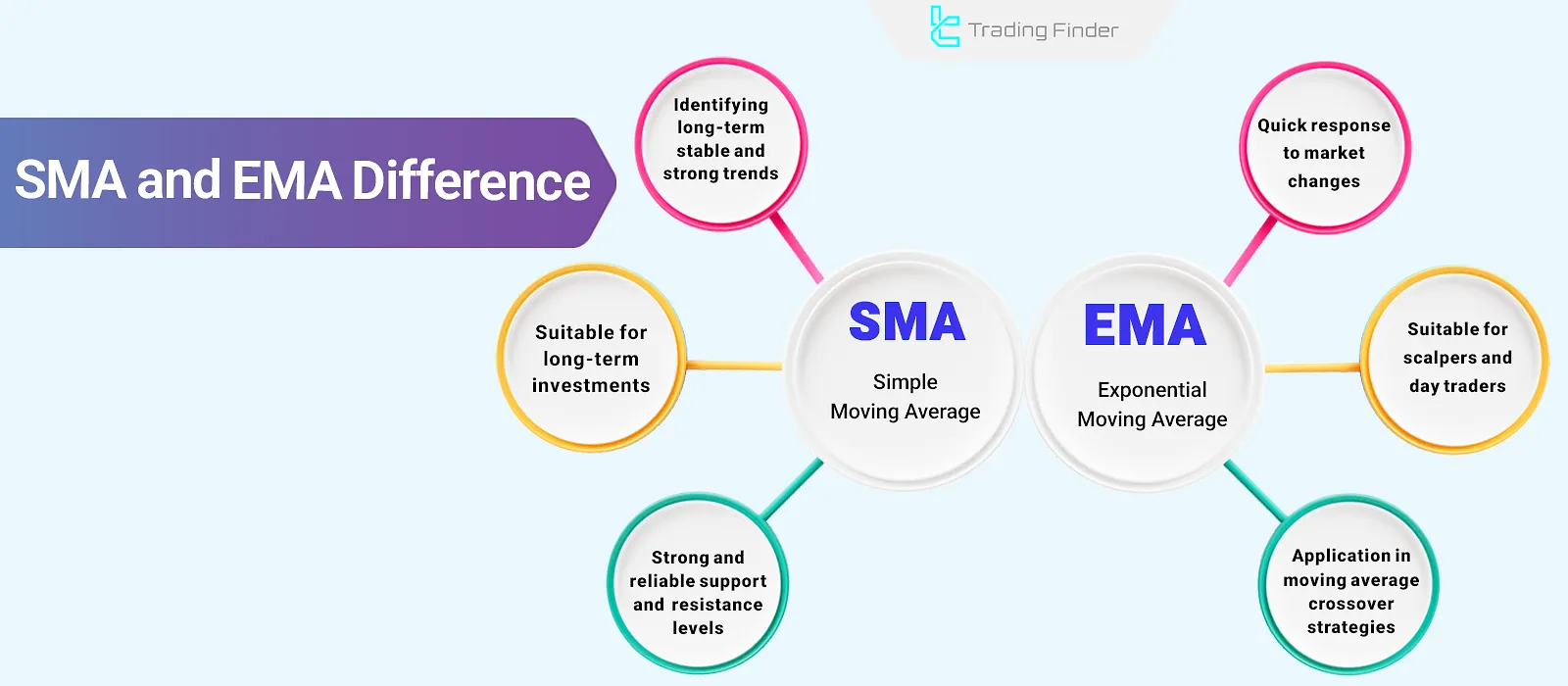

Simple vs Exponential Moving Average + Golden Cross and Death Cross

Price trend analysis indicators like Moving Averages smooth out market fluctuations and reveal the overall price movement structure....

![The Impact of Monetary Policy on Inflation [Contractionary and Expansionary]](https://cdn.tradingfinder.com/image/371783/16-029-tf-en-the-impact-of-monetary-policy-on-inflation-01.webp)

![What is Monetary Policy? [Impact of monetary policies on economic growth]](https://cdn.tradingfinder.com/image/366877/16-028-tf-en-what-is-monetary-policy-01.webp)

![Stagflation [Causes of Stagflation + Ways to Overcome It]](https://cdn.tradingfinder.com/image/366251/16-018-tf-en-what-is-stagflation-01.webp)