- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

What is Carry Trade? The Relationship Between Interest Rates and Carry Trade

Carry traders borrow a currency with a low interest rate and invest it in higher-yielding markets (e.g., bonds, gold, stocks,...

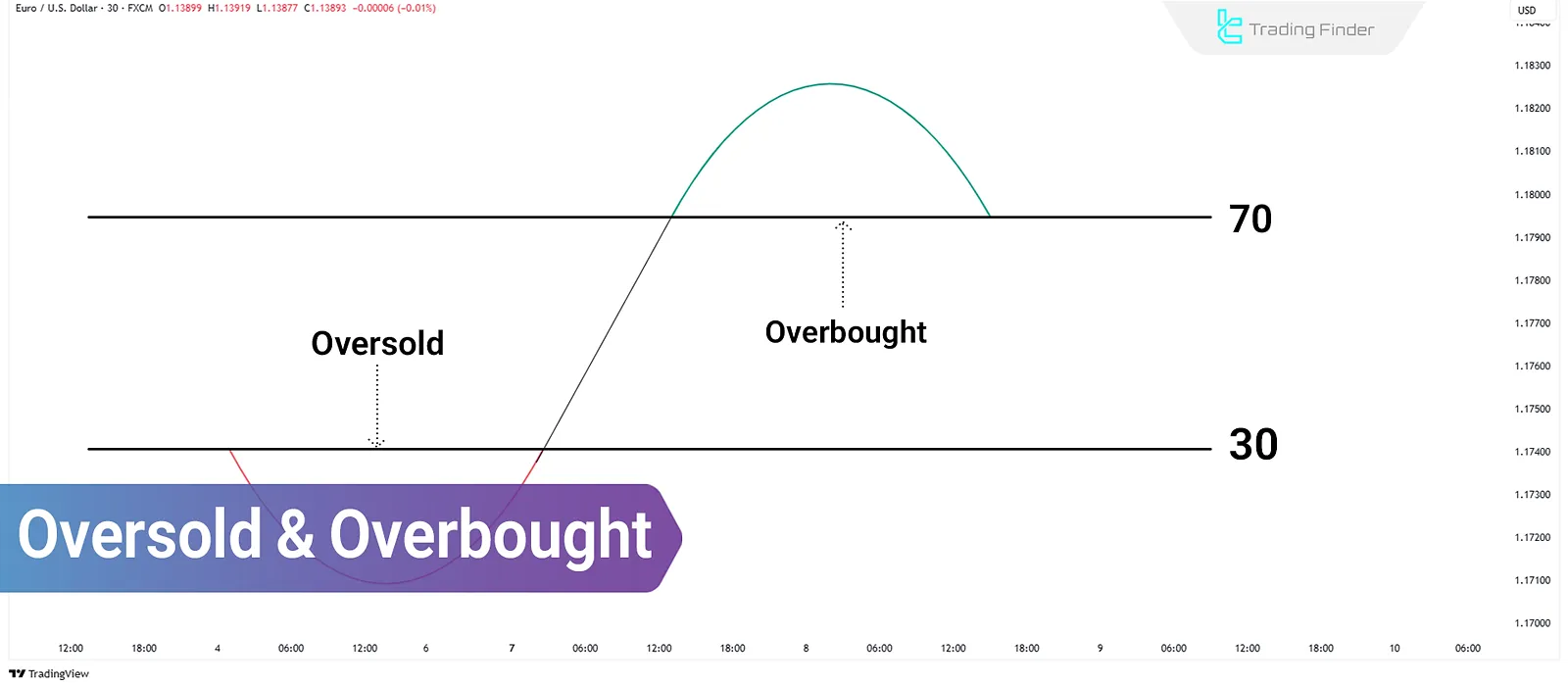

Overbought and Oversold Conditions; Using Tools Like RSI and MACD

Overbought and oversold conditions occur when the price of an asset deviates significantly from its equilibrium or historical...

Fibonacci in Technical Analysis: Tools for Reversal & Continuation

In technical analysis of financial markets, Fibonacci ratios and levels are recognized as one of the oldest tools for...

What Are “Hawkish” and “Dovish”? Central Bank Stance in Interest Rate Decisions

Dovish stance refers to expansionary monetary policy, aimed at stimulating economic growth, which often leads to the depreciation of...

Timeframe Selection Guide – Introduction to Best Timeframe in Technical Analysis

Selecting the best time frame for trading strategies depends on various factors such as analytical style and trading approach,...

What is MACD? [Combining Exponential Moving Averages (EMA)]

The MACD indicator (Moving Average Convergence Divergence) is a trend-following indicator used across all financial markets,...

London Trading Session; Exact Timing in GMT Time Zone

Due to the 24-hour nature of the Forex Market, trading is divided into four major sessions: Tokyo, Sydney, London, and New...

20 Pips a Day Strategy – ICT-Style Scalping

The 20 Pips a Day ICT Strategy is one of the methods based on the ICT style and market structure, aiming to deliver...

Bollinger Bands Indicator; Best Settings Based on Timeframe

The Bollinger Bands indicator is a powerful technical analysis tool that uses a simple moving average to evaluate...

Trading Position Size – Guide to Different Methods of Calculating Position Size

The amount of assets bought or sold in a trade is referred to as the position size. In different markets, position size...

New York Trading Session: Peak Volatility in Overlap with London

During the New York session, liquidity spikes and volatility reaches its peak. This session starts at 8:00 AM local New York...

Best Forex Trading Days of the Week [The Golden Three Days]

Tuesday through Thursday are considered the best days to trade forex, as they experience a significant rise in trading volume and...

![What is MACD? [Combining Exponential Moving Averages (EMA)]](https://cdn.tradingfinder.com/image/362923/03-19-tf-en-macd-01.webp)

![Best Forex Trading Days of the Week [The Golden Three Days]](https://cdn.tradingfinder.com/image/347289/06-01-en-best-days-to-trade-01.webp)