- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

Rally Base Rally (RBR) Pattern: Bullish Continuation Strategy Explained

The Rally Base Rally (RBR) trading strategy is a popular technical analysis method for predicting future asset movements in various...

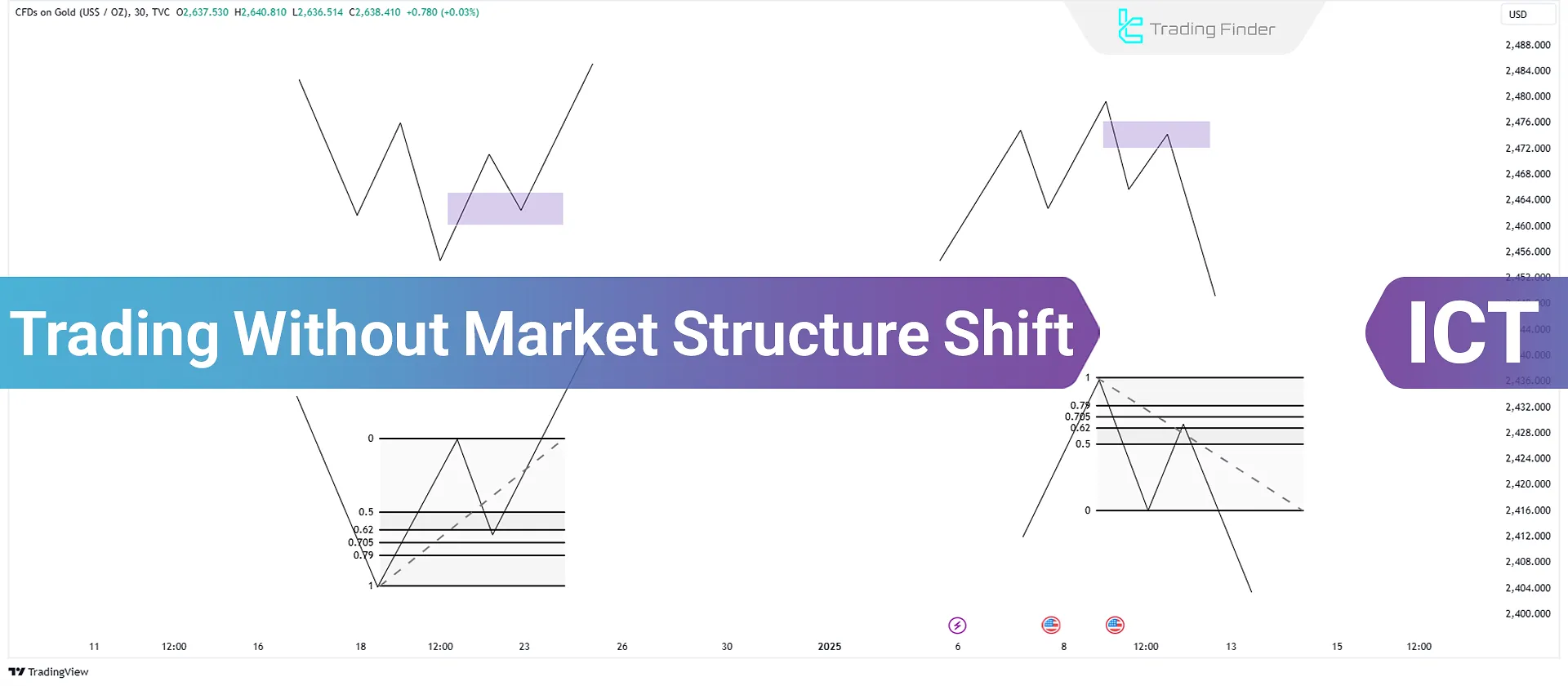

Trading Without Market Structure Shift; Importance of Trading Without MSS & MSB

With "Trading Without Market Structure Shift" strategy in the ICT style, traders can execute trades without waiting for a Market...

No Displacement Model in ICT Trading [Uptrend & Downtrend]

No Displacement in the ICT trading model and Smart Mony refers to a scenario where the price breaks a key level (such as a...

Smart Money Concept (SMC): Complete Guide to Liquidity-Based Trading Strategy

The Smart Money Concept (SMC) is an advanced method of market analysis that focuses on market structure, order flow and liquidity...

Stop Hunting Training - Triggering Stop Losses of Retail Traders - ICT

Stop hunting is a process in which the market is designed to trigger the stop losses of retail traders, with these movements...

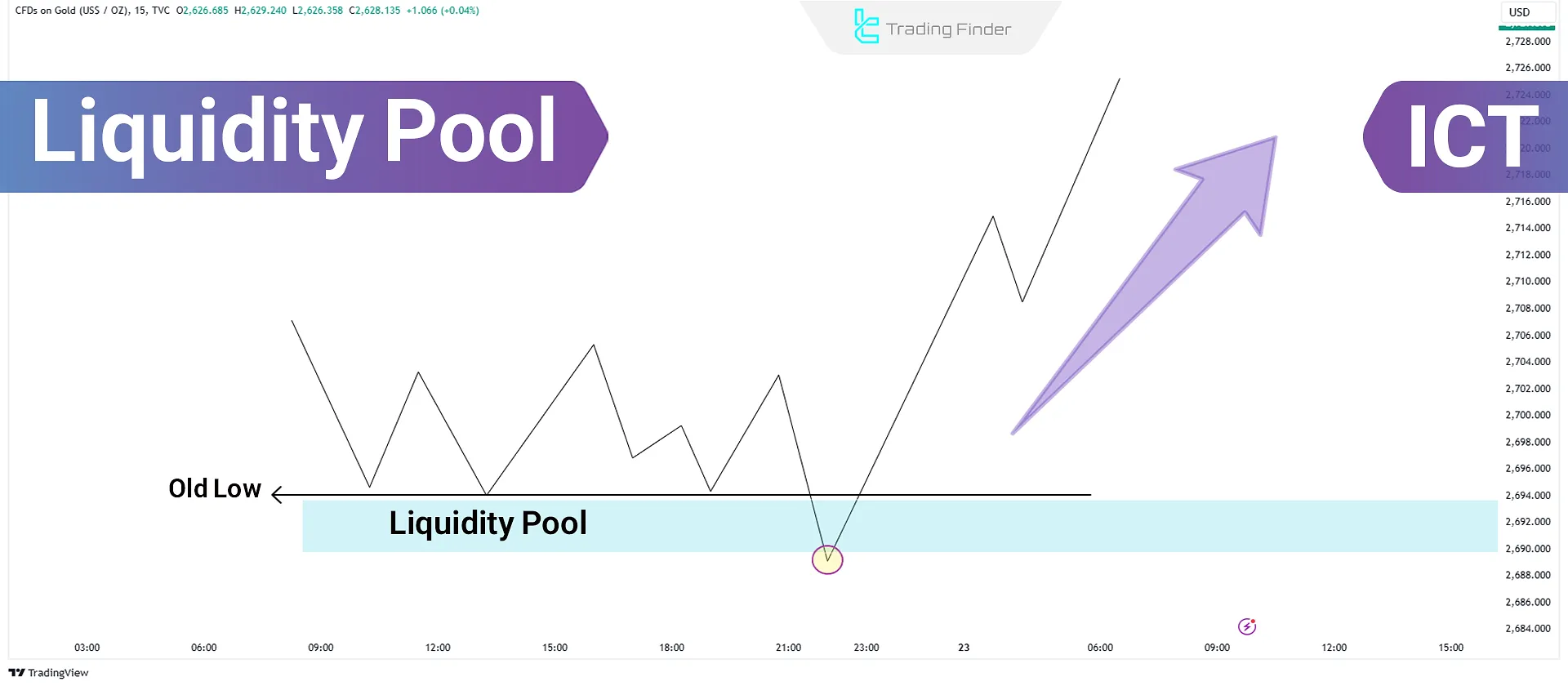

Liquidity Pool Trading Model in ICT Style

A Liquidity Pool refers to key zones where pending buy orders (Buy Stops) or sell orders (Sell Stops) accumulate. These orders...

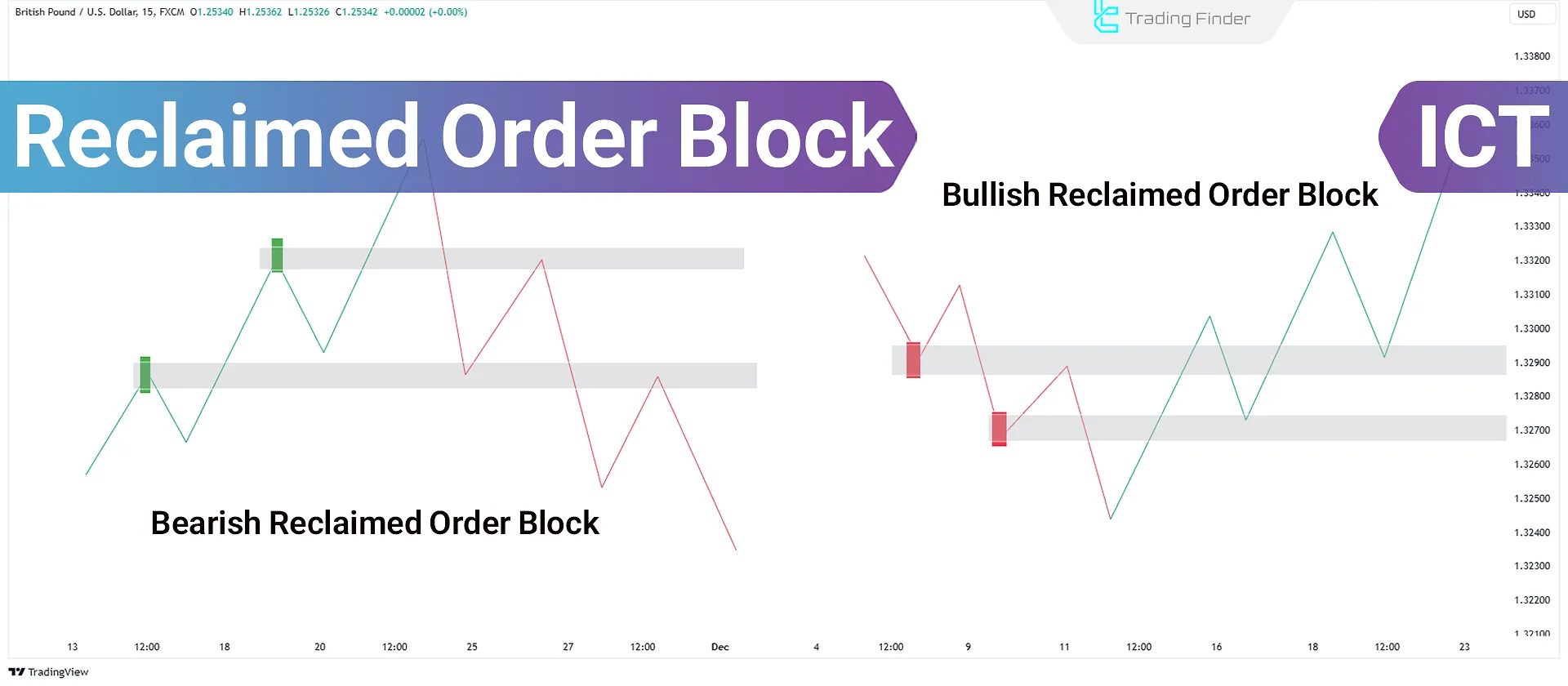

Reclaimed Order Block; Reclaimed Order Block vs Regular Order Block

A Reclaimed Order Block in the ICT trading style initially functions as an Order Block but guides the subsequent price movement...

Learn Seek & Destroy (S&D) Profile in ICT Trading

The Seek & Destroy (S&D) profile is a common daily market behavior in the ICT trading strategy, often observed on days...

Market Structure Trading in Bullish, Bearish, and Ranging Trends - ICT & SMC

Market Structure is a tool for analyzing price behavior and identifying movement trends in Forex Market and cryptocurrency markets....

Forex Liquidity Explained: Definition, Importance & Key Concepts

Liquidity in forex refers to stop loss activation zones triggered by market algorithms and Smart Money. These areas often...

All Time High (ATH) and All Time Low (ATL); Importance of Using Highs and Lows

In forex markets, identifying key price movement levels is one of the most important tools for analyzing asset behavior. Two...

New York Reversal Strategy in ICT Daily Profiles [London & New York AM Sessions]

The New York Reversal Strategy in daily profiles is a core concept in ICT trading style, used by professional traders to identify...

![No Displacement Model in ICT Trading [Uptrend & Downtrend]](https://cdn.tradingfinder.com/image/257229/7-33-en-no-displacement-01.webp)

![New York Reversal Strategy in ICT Daily Profiles [London & New York AM Sessions]](https://cdn.tradingfinder.com/image/241316/7-36-en-ict-daily-profile-new-york-reversal-01.webp)