- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

Previous Session High and Low (PSH & PSL); How to Trade Using PSH and PSL

The Previous Session High (PSH) and Previous Session Low (PSL) are critical levels used in ICT style (Inner Circle Trader)...

Gunning Stops and Running Stops; ICT Style

Gunning Stops and Running Stops are price movements in ICT trading that trigger Stop Loss Orders. Understanding Gunning Stops and...

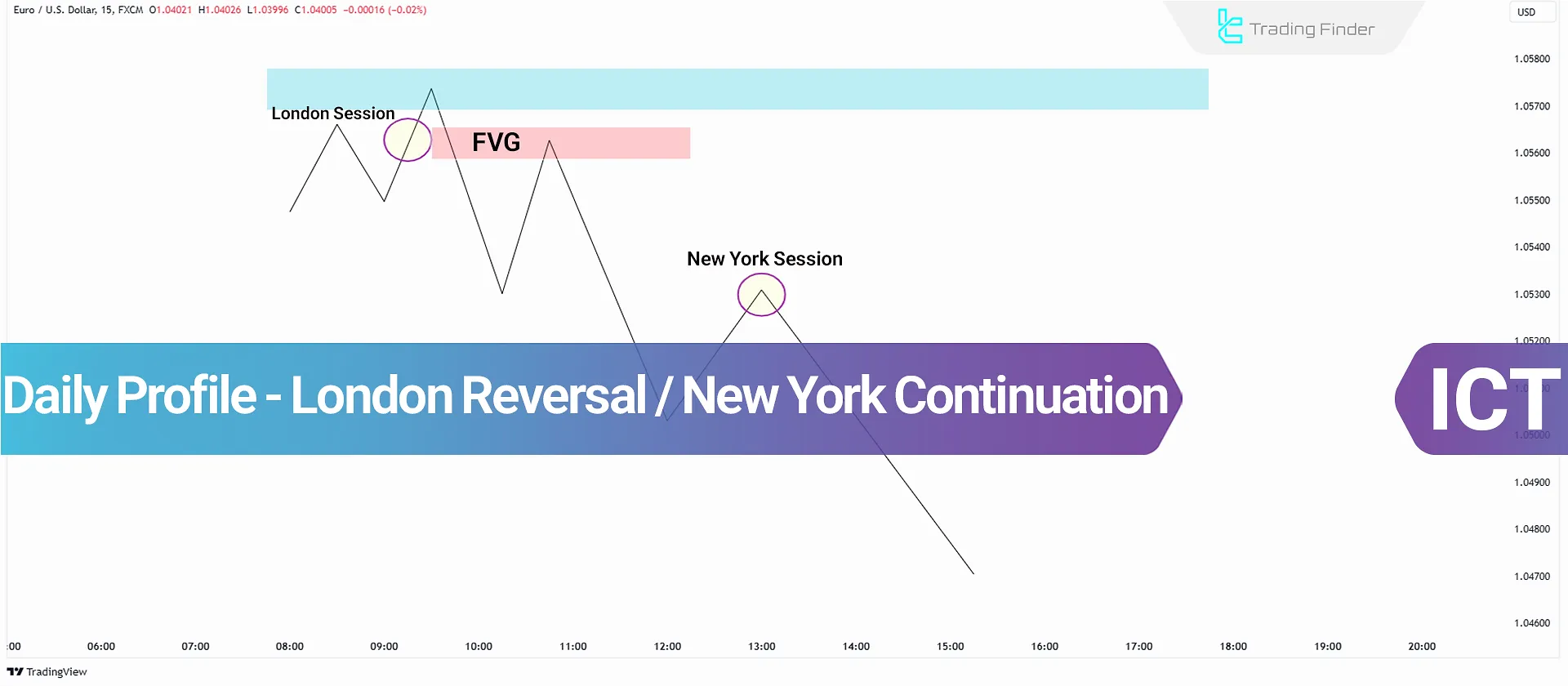

Daily Profile London Reversal and New York Continuation – ICT style

Understanding daily profile trading in the London and New York sessions is a key concept in ICT trading methodology. This concept...

What is FVG (Fair Value Gap)? How to Trade Using Fair Value Gap in ICT Style

Fair Value Gap orICT FVG is a three-candle pattern that creates an empty or unreturned zone between the first candle's high and...

What is the ICT Style? Analysis of ICT Terminology

The ICT trading style is a price action-based methodology developed by Michael J. Huddleston. This strategy focuses on analyzing...

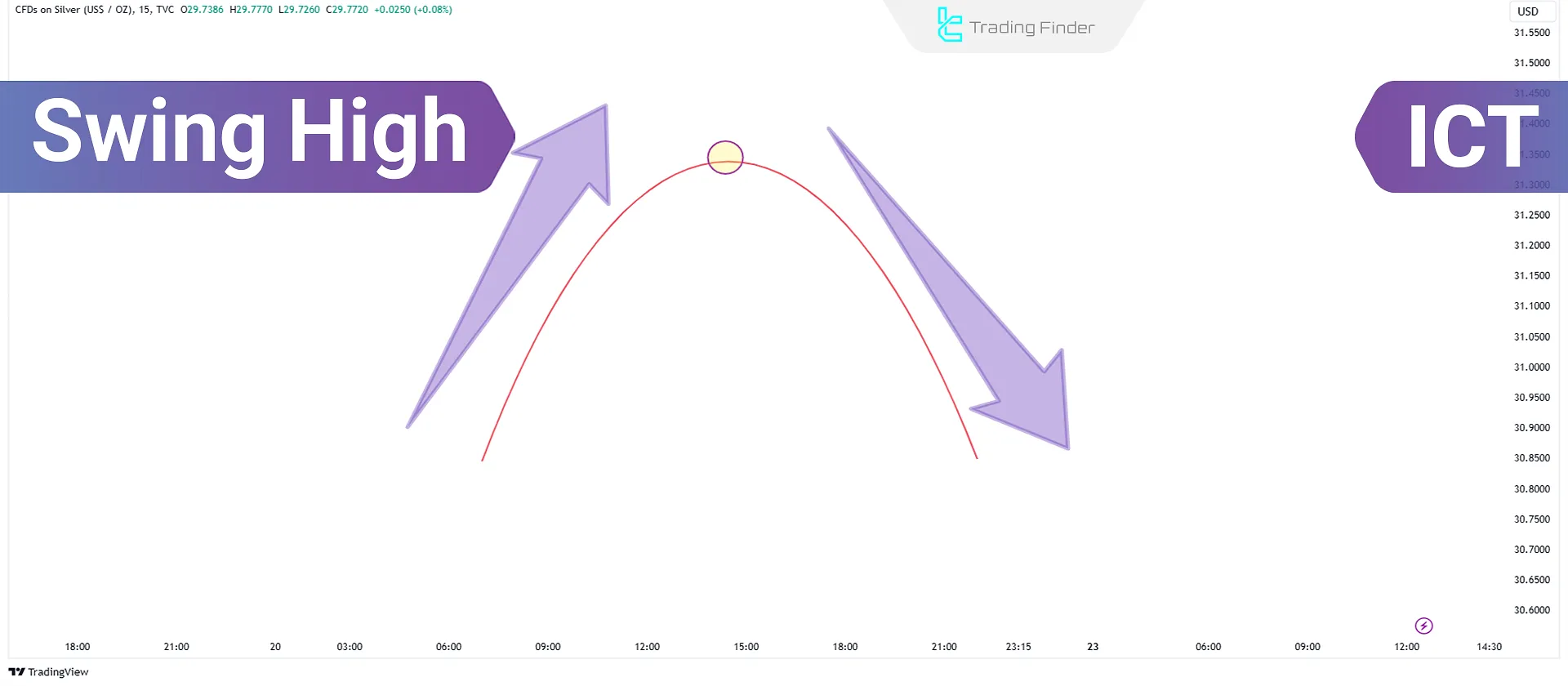

What are Swing Highs? A guide to Identifying Swing Highs or Peaks in ICT

A swing high refers to the highest price level that forms after an upward move and is followed by a downward market movement....

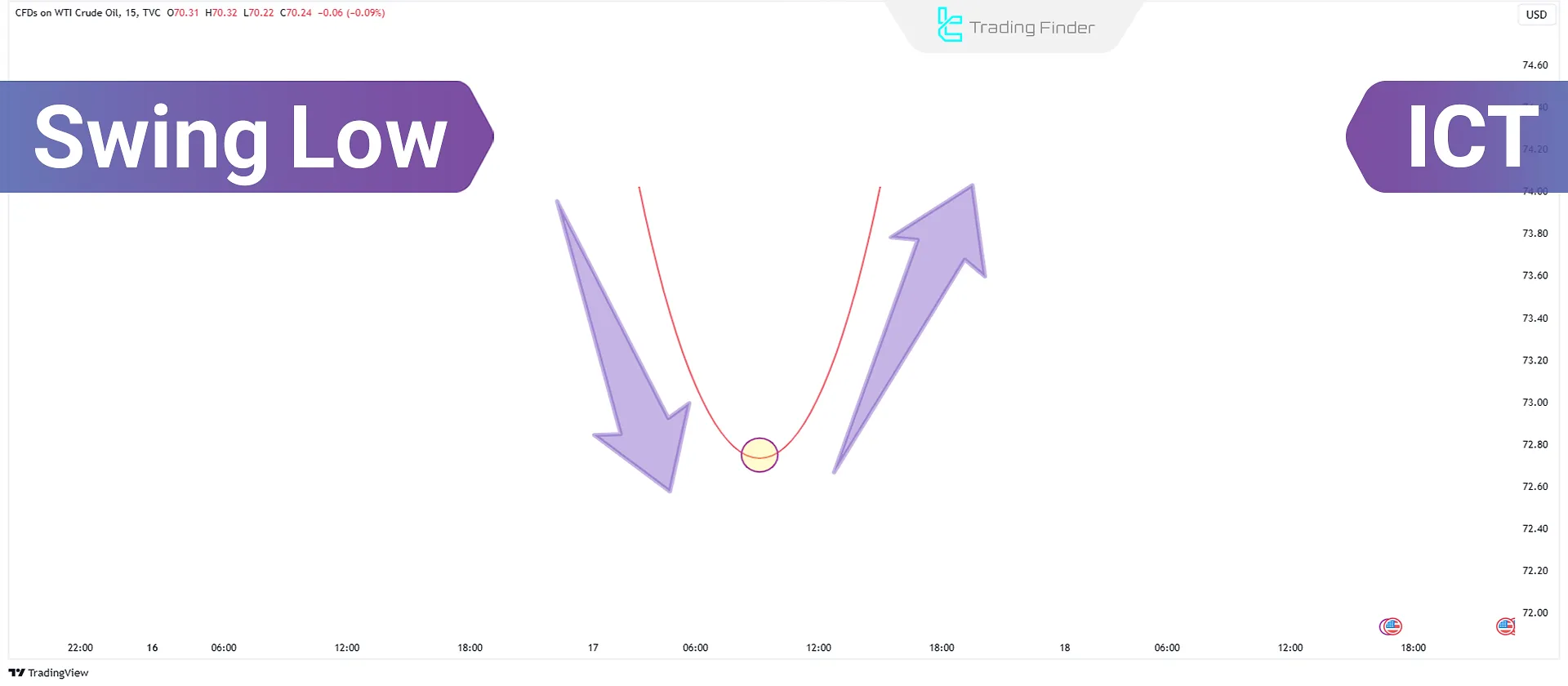

What Is a Swing Low? How to Identify It and Its Application for Identifying

Swing Low is a key point on a price chart where the market reaches its lowest value within a specific timeframe and then moves...

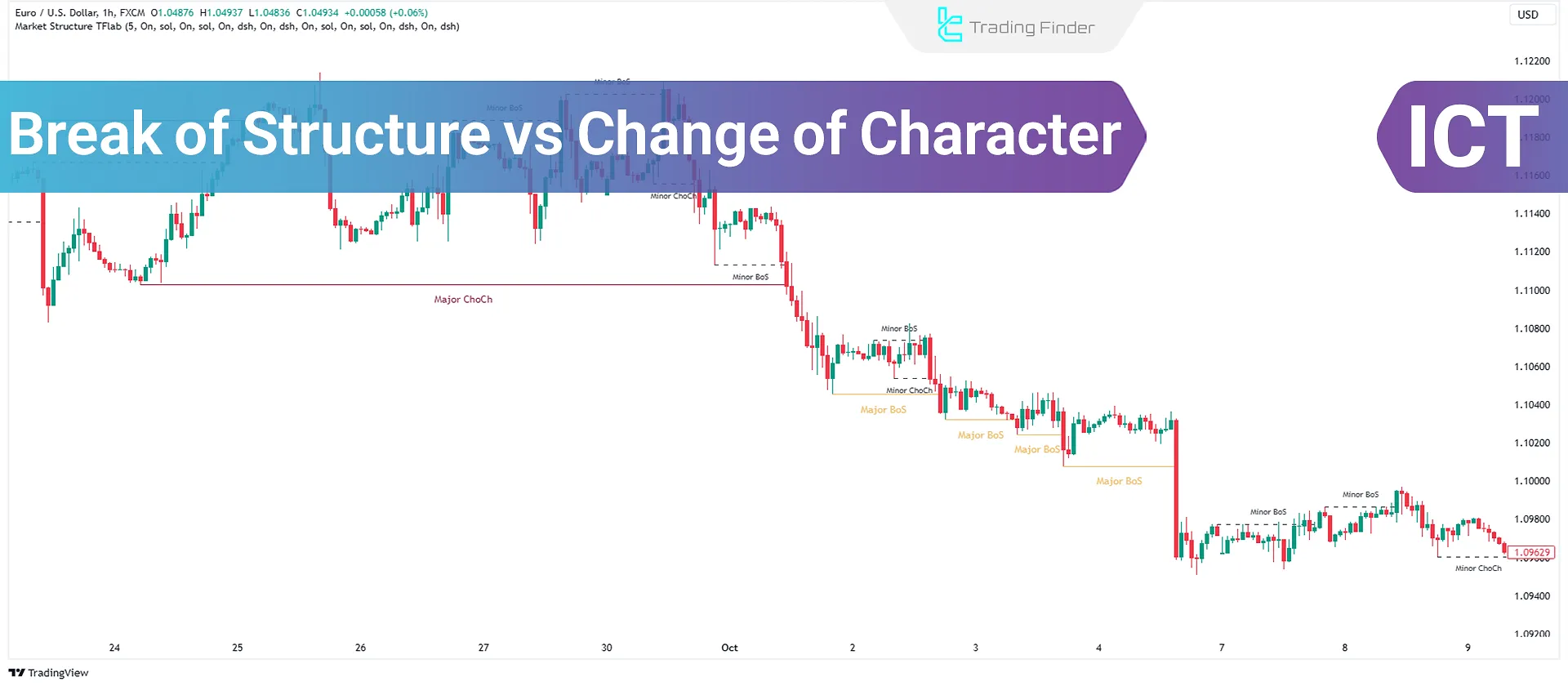

Market Structure Break and Change of Character; how to trade with BOS and CHoCH

Break of Structure (BOS) refers to breaking the previous high or low to confirm the current trend, while Change of Character...

Complete TradingView Tutorial [Registration, Symbols, and Screener]

TradingView Tutorial helps traders in various financial markets such as crypto, Forex, stocks, symbols, etc. to get familiar with...

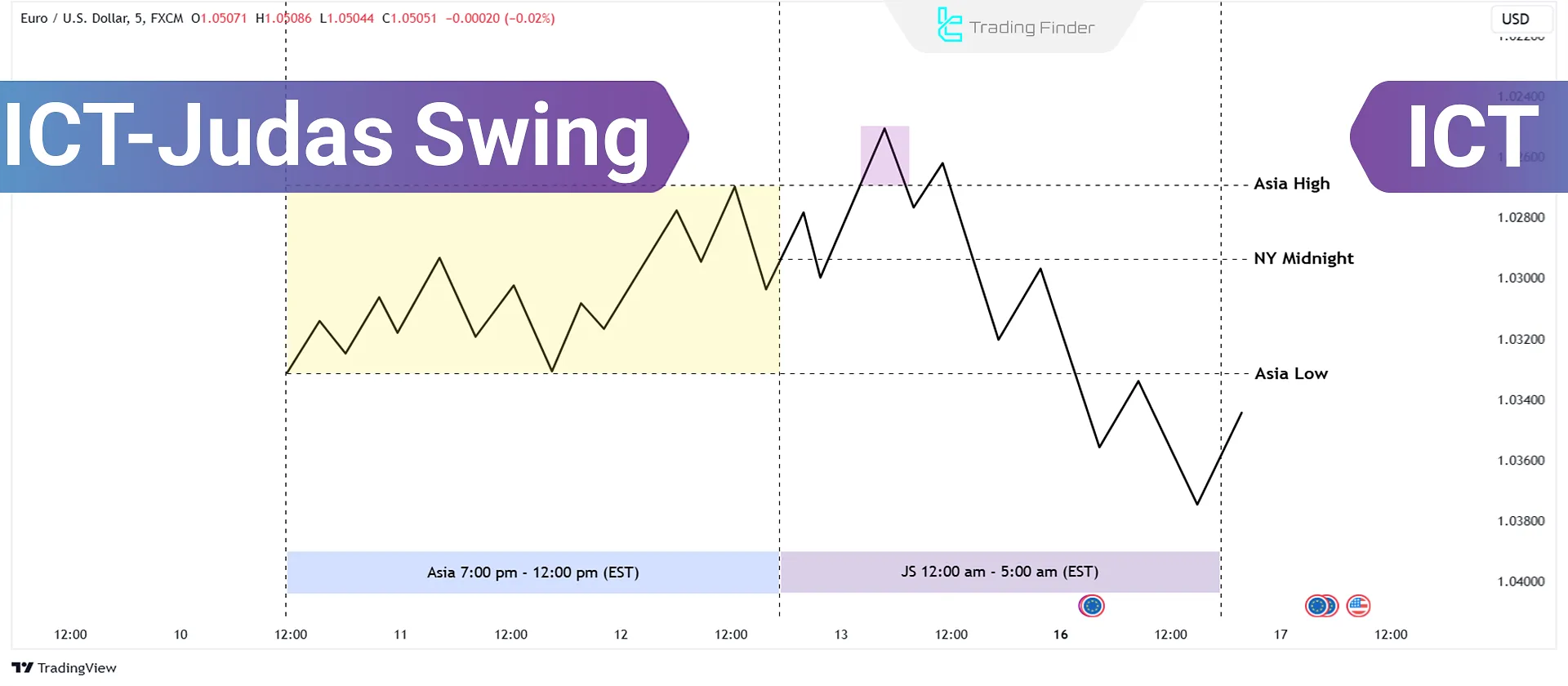

ICT Judas Swing Strategy: Complete Guide to the New York Midnight Trading Setup

The ICT Judas Swing Strategy represents a false move against the main trend initiated by Smart Money. This tactic misled retail...

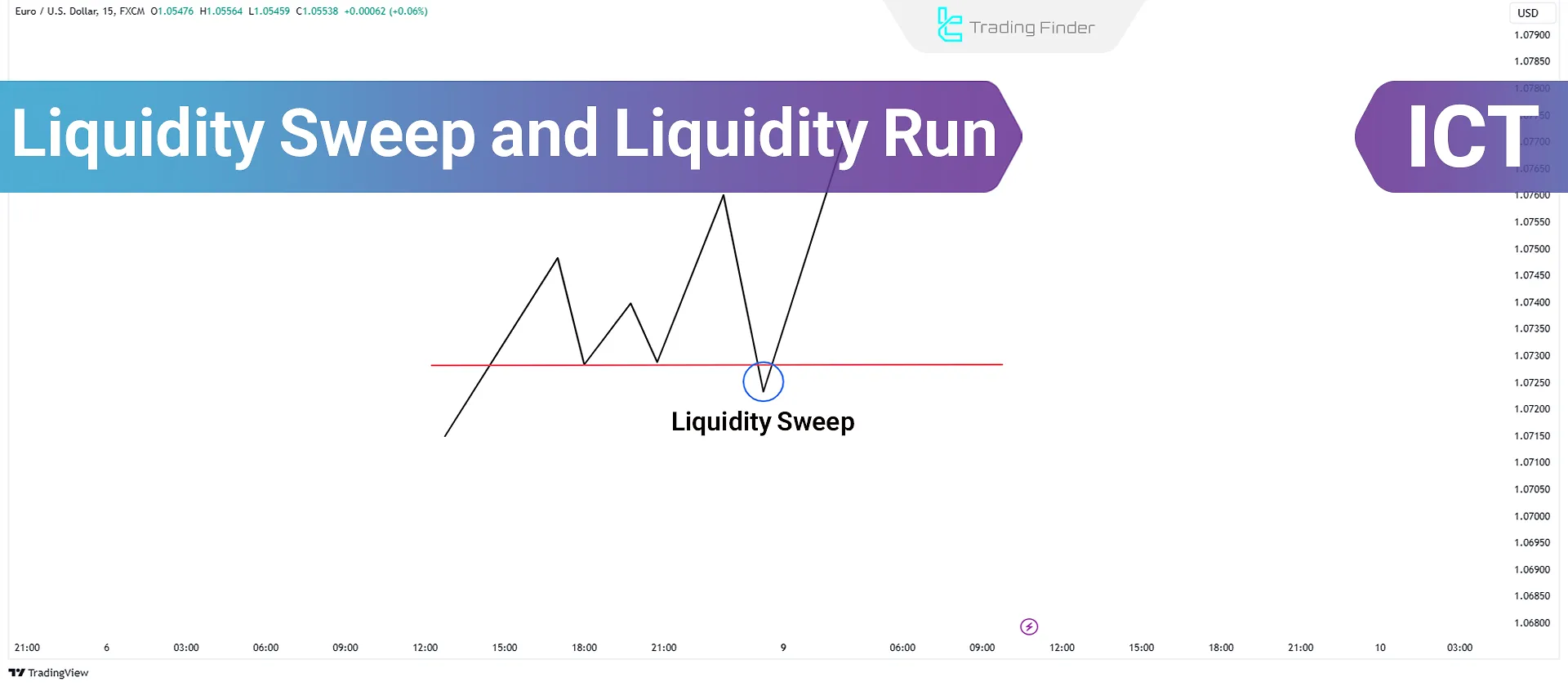

Liquidity Sweep & Liquidity Run; Liquidity Hunting in ICT Style

The liquidity sweep and run strategy in ICT style provides suitableentry and exit points by targeting liquidity at key levels and...

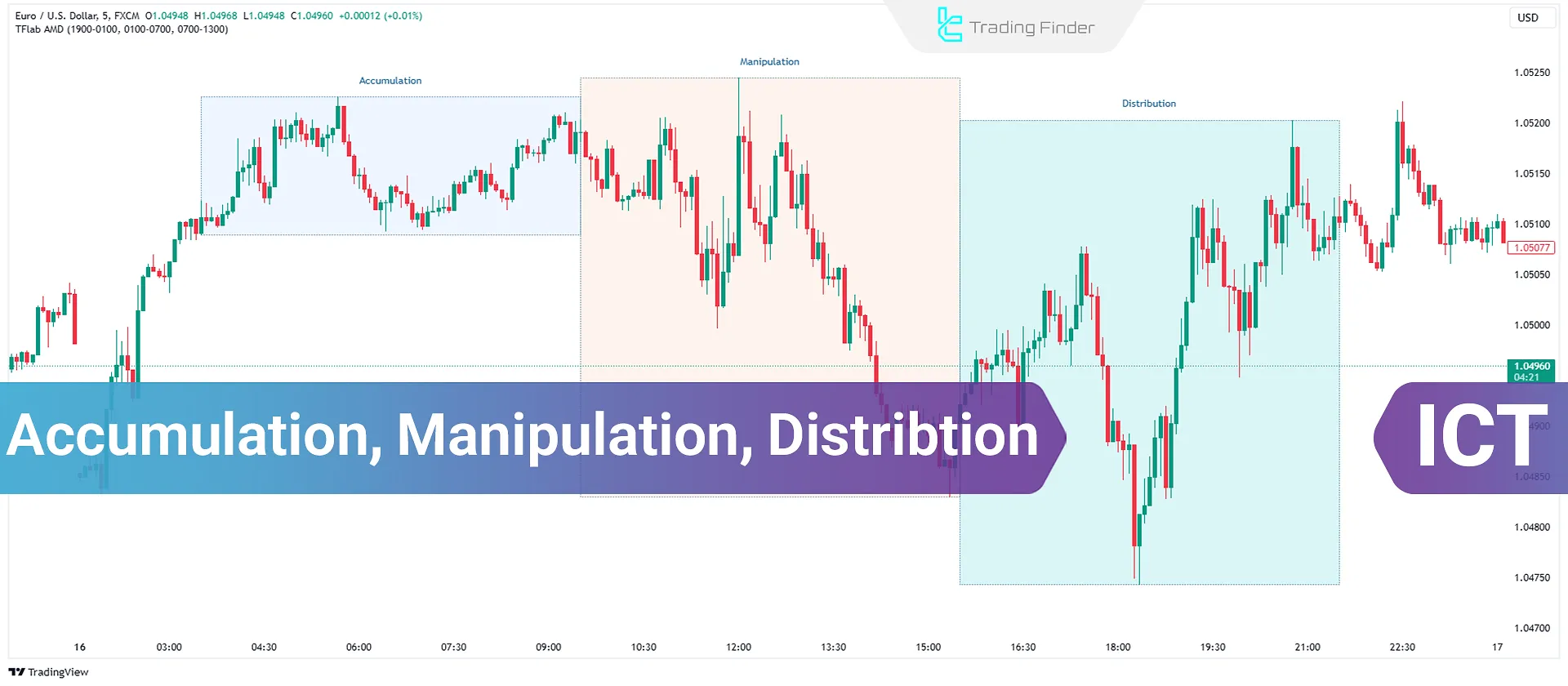

Power of Three Strategy (PO3): Accumulation, Manipulation & Distribution in ICT

Accumulation, Manipulation, and Distribution (ICT Power of 3 strategy) is a trading strategy designed to help retail traders...

![Complete TradingView Tutorial [Registration, Symbols, and Screener]](https://cdn.tradingfinder.com/image/230331/tradingview-tutorial-full-eng-01.webp)