- TradingFinder

- Education

- Forex Education

- Smart Money Education

Smart Money Education

The Smart Money Concept (SMC) trading style is one of the most advanced methods of price action analysis in financial markets, focusing on identifying smart money behavior and its impact on price manipulation. This style leverages precise market structure analysis, Change of Character (CHoCH), Break of Structure (BOS), identification of Order Blocks, and concepts such as price swings, key zones, and supply and demand levels to help traders detect key changes in market trends and enter trades with greater confidence. Additionally, multi-timeframe analysis enables traders to gain a broader perspective of different market flows and more accurately determine entry and exit points. In the Smart Money Concept (SMC) strategy, traders learn how to exploit liquidity flows driven by large financial institutions and avoid price traps designed for retail traders. This approach focuses on analyzing Liquidity Zones, Imbalances, and Institutional Order Flow, allowing traders to better understand price behavior at various market levels and make more informed decisions. TradingFinder offers the best educational content on the Smart Money Concept (SMC) for traders, from beginner to advanced levels. These courses include comprehensive training on Change of Character, Break of Structure, multi-timeframe analysis, liquidity, and other advanced SMC concepts and techniques. The goal of these trainings is to empower traders to operate professionally in financial markets and achieve favorable outcomes.

What Is a Breaker Block? A Guide to Identifying, Support & Resistance in ICT

The Breaker Block is one of the concepts in the ICT trading style. This method focuses on the break of Order Blocks(OB) and...

What Is the Killzone? London, New York, and Asian Killzones in Forex

ICT Kill Zones in Smart Money are key time intervals in financial markets when the highest volatility and trading volume occur....

Premium and Discount Arrays (PD Arrays); How to Identify PD Arrays in the ICT Trading

The ICT PD Array inSmart Moneyor "Premium and Discount Zones" is a structured approach used to identify optimal entry points in...

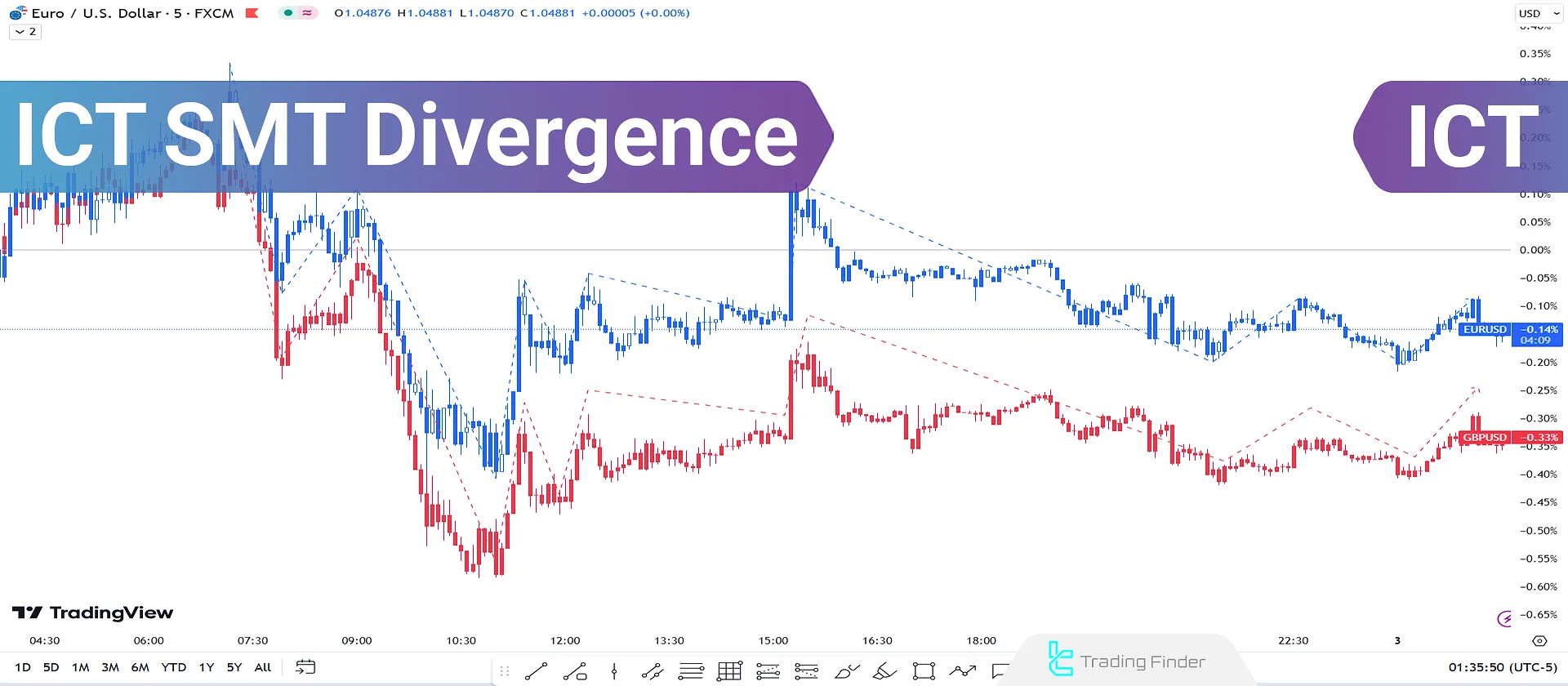

SMT Divergence in ICT: Guide to Identifying SMT Signals & Trading Strategies

ICT SMT Divergence occurs whentwo related and correlated assets show opposite trends [one bullish and the other bearish] on their...

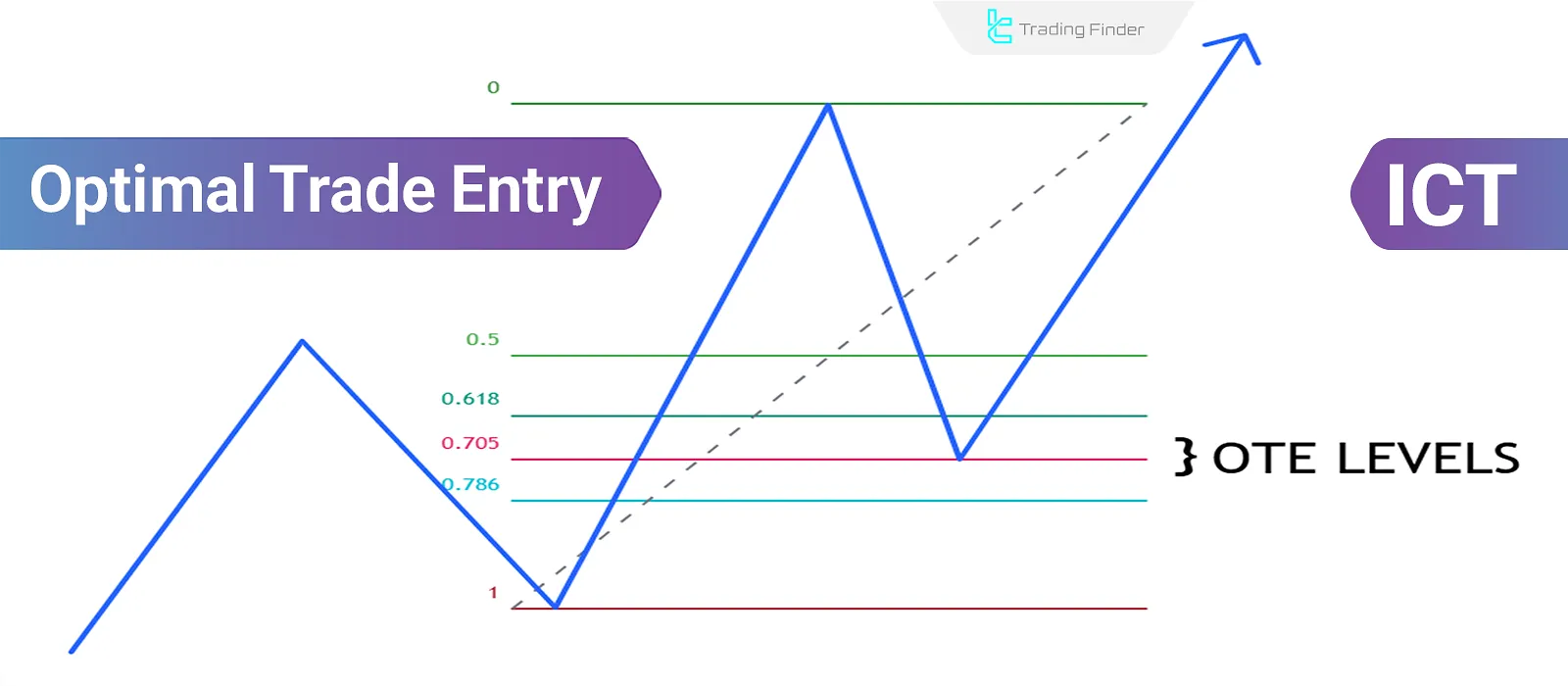

What Is the OTE Strategy? Optimal Trade Entry Using Key Fibonacci Levels in ICT Style

OTE (Optimal Trade Entry) strategy uses multiple Fibonacci levels to identify the optimal time and place to enter a position. In...

Break of Market Structure (BOS); Liquidity Flow and Trend Continuation in ICT

Break of Structure (BOS) refers to continuing the market trend by breaking the previous structure. By leveraging the Break of...