In day trading, traders use technical analysis through various methods, such as ICT style and RTM style (Read The Market), to analyze price movements, open and close their positions within the same day.

Day trading opportunities appear quickly on the chart and vanish just as rapidly. For this reason, the trader's reaction speed is extremely important in this method.

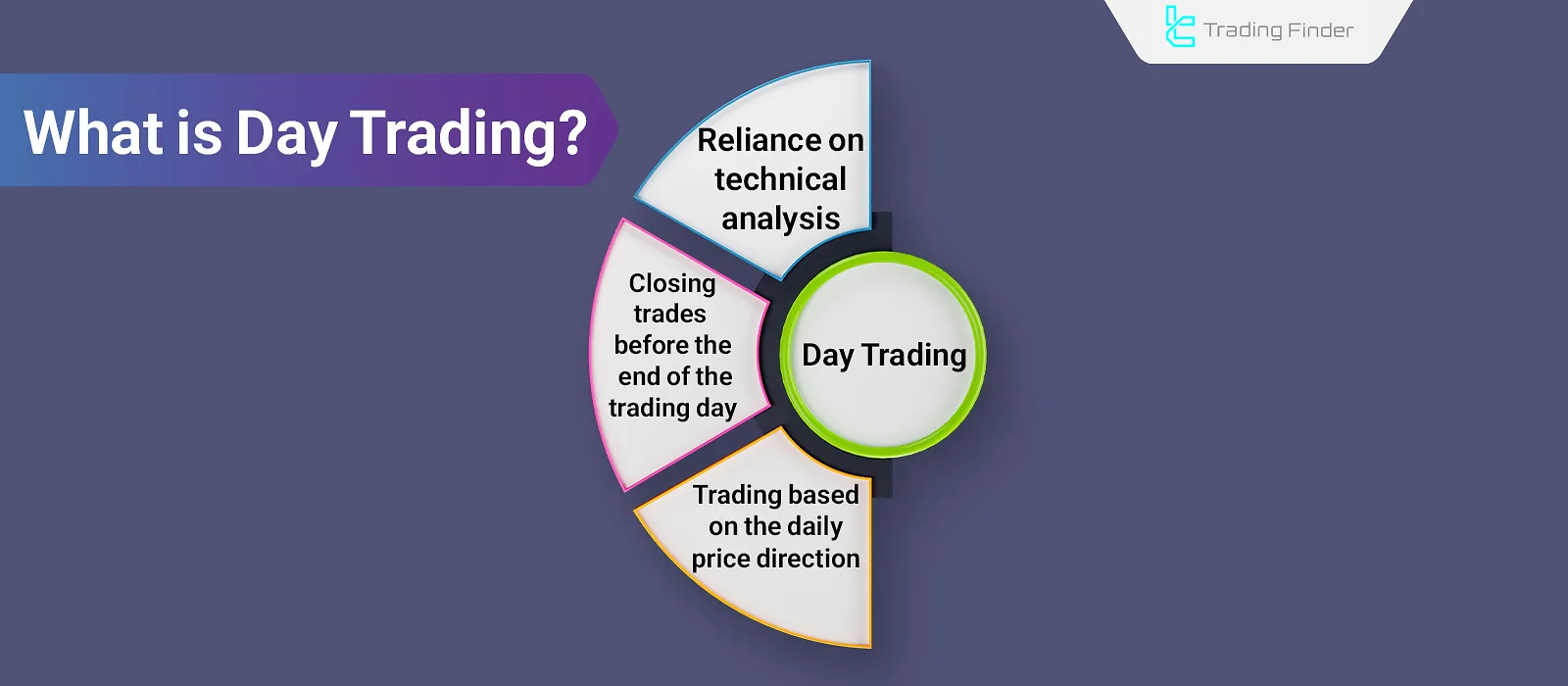

What Is Day Trading?

Day trading refers to trades in which both entry and exit occur within a single trading day. Therefore, the goal of day trading is to make a profit from the daily price fluctuations of a trading instrument.

Day trading is primarily executed using technical analysis, and the influence of fundamental analysis is lesssignificant in this style. Additionally, day trading is more suitable for individuals who have enough time to analyze and manage trades throughout the day.

Essential Characteristics of a Successful Day Trader

A day trader must have the ability to analyze price movements quickly and make accurate decisions within short timeframes, which is one of the core trading methods in active markets.

High concentration, disciplined execution of the trading plan, and proper reaction to market volatility are the core characteristics of this trading style and professional trading methods.

- Fast processing of price behavior;

- Ability to manage risk in highly volatile conditions;

- Discipline in strategy execution;

- Quick acceptance of losses and emotion free exits;

- Strong command of technical tools and liquidity behavior.

Advantages and Disadvantages of Day Trading

Due to the use of leverage in day trading, the level of price volatility and the number of trading opportunities are greater than in other trading styles. However, this also leads to an increase in risk.

The table below, outlines the advantages and disadvantages of day trading:

Advantages | Disadvantages |

Ability to evaluate daily performance | Requires more capital |

More frequent trading opportunities | Higher risk compared to long-term trading |

Possibility to withdraw profits daily | Requires a high level of experience |

Greater experience due to a high number of trades | Time-consuming |

Minimal impact from news events | Requires emotional discipline |

No concerns about holding trades overnight | Increased costs and commissions due to trade volume |

Best Times for Day Trading

According to the day trading definition, for daily trading and analysis, choosing the right timing has a significant impact on trading results; volatility and liquidity vary across different hours.

- Overlap of the London and New York sessions for Forex;

- Active US market hours for indices and gold;

- Round the clock volatility for cryptocurrencies;

- The first 90 minutes and the final 60 minutes of the US stock market.

Types of Day Trading Methods

In day trading, the main price trend is typically determined at the beginning of the day. Then, trades are executed based on the dominant direction throughout the rest of the day. Therefore, trades can be conducted with or against the trend.

Trading in the Direction of the Trend

In this method, the main direction of the day is first identified on the higher timeframe, and entry points in the same direction are identified on the lower timeframe. Since the trade aligns with the trend, the risk of loss is reduced in this method.

Trading Against the Trend

In this method, after identifying the main price trend, the trader waits for a counter-trend opportunity. The goal is to detect the end of an existing trend and enter at the start of a new trend.

Although the risk is higher in this method, if successful, the trader can gain substantial profits. Moreover, this method requires a high level of trading experience and a deep understanding of price behavior.

Range-Bound Trading

In this method, based on recent price reactions and the study of price patterns, the chart highs and lows are identified, and trades are executed accordingly. For instance, when the price reaches a high, a sell trade is executed; when it reaches a low, a buy trade is made.

This method heavily utilizes limit orders and stop-loss orders.

Breakout Trading

In this method, key price levels such as support and resistance zones are identified by analyzing past market behavior. The trader then waits for the price to reach these zones.

Upon reaching one of these areas, and using various price patterns such as classic Patterns, a trade is executed in the direction of the breakout.

In the educational day trading article on the Investopedia website, this trading method is explained in full:

Specialized Day Trading Strategies

In day trading, strategies are designed based on price behavior and liquidity within a structured daily trading plan.

- Breakout Strategy: Entering after price breaks key levels

- Pullback Strategy: Entering during corrective price movements

- VWAP Reversion: Entering when price returns to the VWAP line

- Momentum Scalping: Entering during fast trending price movements

- Liquidity Sweep: Entering after traders’ stop losses are triggered and liquidity is absorbed

News-Based Trading

In this method, there is less focus on chart behavior and more emphasis on news and economic data. Therefore, success in this method requires a deep understanding of the market being traded and access to strong news sources.

Important news events rarely occur during normal market conditions. Also, such news is often priced in before its release.

Practical Example of a Day Trading Scenario

According to the day trading meaning, in a typical scenario, the daily direction is first identified on a higher timeframe, and key liquidity zones are marked on the chart.

When price reaches these areas, it is evaluated, and based on the market’s reaction, a trade is executed either in the direction of the trend or against the trend.

The stop loss is placed at the invalidation level of the analysis, and the take profit is defined according to the day’s structure.

How to Use News in Day Trading

Major news increases the speed of price movement. Entering directly at the moment of a news release carries high risk; the best approach is to enter after the main direction of the move becomes clear.

In such conditions, a small stop loss and fast exits are extremely important.

The day trading style is explained in video format on the TradingLab YouTube channel:

Day Trading vs. Swing Trading

The key difference between these two trading strategies is the duration of the trades. In day trading, positions are opened and closed within the same day, whereas in swing trading, trades may remain open for several days.

Feature | Swing Trading | Day Trading |

Trade Duration | From 2 days to several weeks | Maximum of one trading day |

Time Commitment | Up to a few hours per day | Requires constant monitoring throughout the day |

Number of Trades | Relatively low | One to several trades per day |

Importance of Speed | Less important compared to other factors | Extremely important |

Capital Requirement | Moderate capital to start | High capital needed due to frequent trading |

Important Points for Day Trading

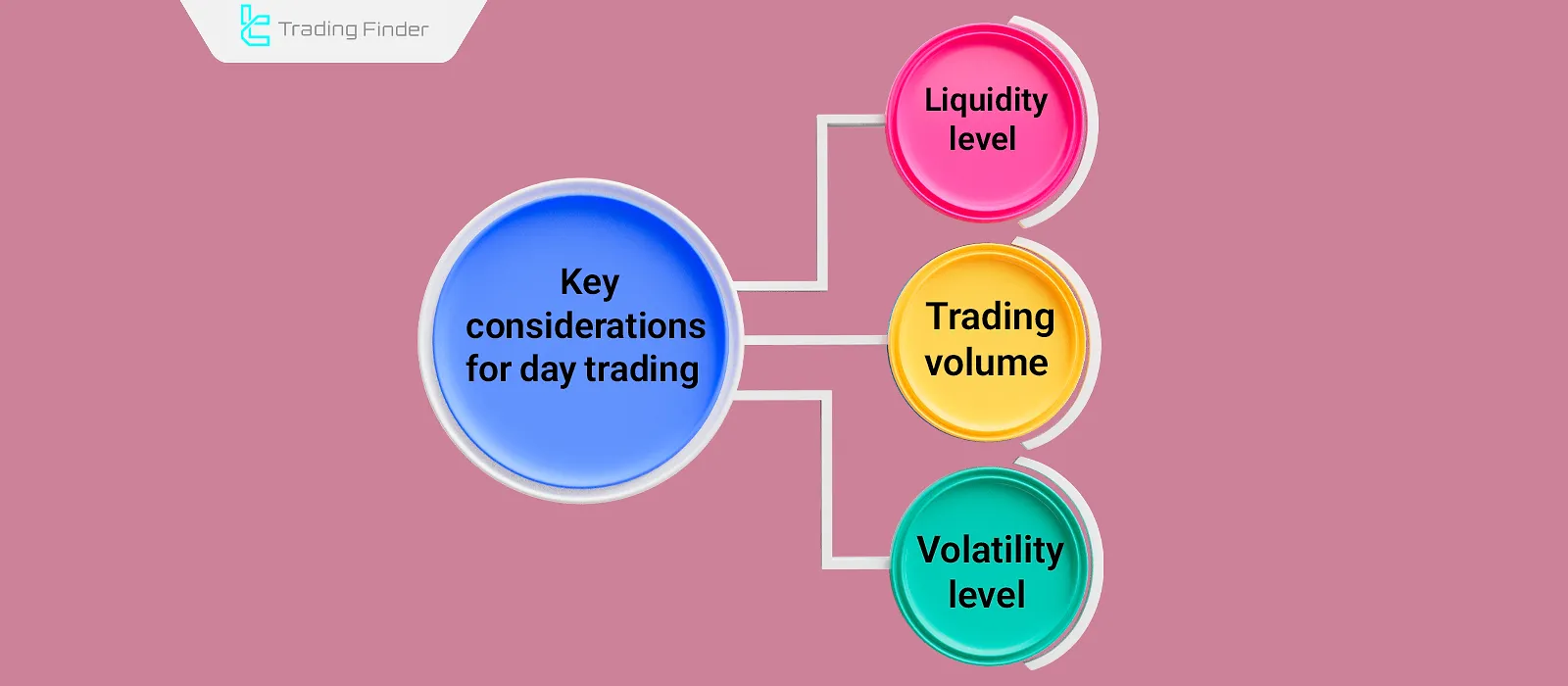

Given that the aim of day trading is to benefit from short-term price volatility, several key factors such as liquidity, volatility, and trading volume of the asset must be analyzed.

Liquidity

Due to the importance of speed in day trading, the asset's liquidity level must be evaluated. One helpful indicator is the spread (the difference between bid and ask prices). The lower the spread, the higher the liquidity of the asset.

Trading Volume

Trading volume affects various features of the asset such as execution speed and technical analysis reliability. The higher the volume, the more suitable the asset is for day trading.

Price Volatility

In day trading, the number of trades is high, and assets with low volatility do not provide enough entry points. Therefore, the daily volatility of an asset should be reviewed before trading.

Volatility directly influences the number and size of trades and also impacts how analyzable the chart is.

How to Choose the Right Instrument for Day Trading

To select a suitable instrument, liquidity behavior and daily volatility must be evaluated using technical analysis for day trading. Checklist for choosing the right instrument for day trading:

- High trading volume

- Low spread

- Clearly identifiable technical behavior

- Sufficient volatility to create entry opportunities

Comparison Table of Suitable Instruments for Day Trading

In day trading, choosing the trading instrument plays a decisive role in execution quality, risk management, and result consistency.

Each instrument, based on factors such as liquidity level, daily volatility range, behavior during economic news releases, and spread structure, creates different conditions for scalping, intraday trading, and short term strategies when applying technical analysis for day trading.

Comparison Table of Instruments with Different Volatility Levels:

Feature | High Volume Instruments | Medium Volatility Instruments | Low Volatility Instruments |

Order Execution Speed | Very suitable | Suitable | Weak |

Spread | Low | Medium | High |

Number of Trading Opportunities | High | Medium | Low |

Suitable for Day Trading | Yes | Partially | No |

Ways to Reduce Day Trading Risks

Day trading is more suitable for experienced and skilled individuals who can analyze price trends effectively. However, even then, day trading comes with its own risks.

To reduce the risks of day trading, it is essential to observe several practices such as keeping a trading journal, setting daily profit and loss limits, and more.

- Design a Detailed Trading Plan: Outline all possible reactions to in-trade events before entering the market and starting your activity;

- Keep a Daily Trading Journal: Record all actions along with the reasons behind them to analyze and optimize your trading strategy;

- Set Daily Profit and Loss Limits: Define a maximum profit and loss for each day to prevent overtrading.

Recording a daily trading Journal

Reviewing daily performance is only possible through maintaining a journal; reviewing the journal at the end of the week identifies weaknesses in the strategy and leads to performance improvement.

Different Components of a daily trading Strategy Journal:

- Reason for entry and exit

- Risk amount per trade

- Trade outcome

- Trader’s emotional response

Best Time to Optimize the Trading Plan

Based on daily trading performance, adjustments to the trading plan should be made at the end of each week. At this stage, both successful and unsuccessful trades are reviewed, and the entry structure, stop loss, and risk management are optimized.

Weekly optimization of the plan prevents the repetition of mistakes. In addition, the level of deviation from the plan during the week is recorded and recurring behavioral patterns are identified.

This process ensures that decisions for the following week are made based on real and measurable data rather than subjective judgment.

Common Mistakes of Day Traders

A large portion of daily trading losses results from repeating incorrect behaviors such as having no defined stop loss, trading during low liquidity hours, and similar errors.

Required Tools for Daily Trading

To execute daily trading, accurate analytical and trade management tools are essential.

- Trading platform with fast order execution

- Advanced charting tools

- Economic calendar for high volatility events

- Position sizing tools

- Real time news feed to track market reactions

Current Volume Profile Indicator and Its Application in Price Behavior Analysis

The Current Volume Profile indicator is a specialized tool for displaying how trading volume is accumulated and distributed across different price levels within a daily trading strategy and helps the trader understand where the highest market activity has occurred.

Unlike tools that process data based on time, this indicator focuses on the actual volume of transactions. The volume structure is displayed using horizontal bars or color coded histograms, showing how much trading activity has taken place at each price level.

The most important feature of this tool is identifying the area with the highest volume, known as the POC or Point of Control. This level usually represents where large investors entered the market and is often regarded as a key support or resistance level.

In bullish trend analysis, when price is forming higher lows, volume is usually higher on bullish candles. This is visible in the volume profile through purple histograms concentrated at higher levels.

Such distribution indicates that liquidity inflow is reinforcing the price movement and increases the probability of trend continuation. In contrast, in bearish trends, histograms often accumulate in areas where selling pressure increases.

If volume rises on bearish candles and the POC is formed at lower levels, it signals seller dominance and continuation of bearish pressure.

In the settings section of this indicator, parameters such as the number of volume bars, calculation timeframe, position of the volume profile, histogram length ratio, and color of volume bars can be adjusted.

An important point is that the selected timeframe for volume calculation should be larger than the analysis timeframe so that data is processed accurately.

Using the Current Volume Profile allows traders to identify volume concentration points and potential trend reversal zones before clear reactions appear on the chart.

Therefore, this tool is considered one of the effective methods for analyzing liquidity flow and understanding market behavior at different price levels.

Appropriate Capital for Daily Trading

The size of initial capital has a direct impact on daily trading performance. For beginners, capital between $300 and $500 is suitable because smaller capital has lower tolerance for daily volatility and requires precise leverage management.

Larger capital provides greater ability to withstand fluctuations and to execute multiple strategies simultaneously. In the US stock market, the PDT rule also requires a minimum capital of $25,000 for daily trading activities.

Conclusion

Day trading is a strategy in which trades are opened and closed within the same day, and the outcome is finalized by the end of the trading session. The main price direction is identified early in the day, and trades are executed accordingly.

Day trading strategies are mostly based on technical analysis, and fundamental analysis plays a minimal role in this style.