Ademo account enables users to test and evaluate trading strategies without risking real capital, providing a safe way to enhance performance across various markets, such as Forex market.

Connected to real trading platforms, a demo account reflects live market data and price movements, enabling users to trade under real-time conditions. All tools and features of the trading platform are fully accessible through the demo trading environment.

What Is Demo Account?

A demo account, also known as a practice or trial account, is offered by brokers to let users test their trading strategies. All market conditions are simulated within a demo trading account, but no real funds are required; Trades are executed using virtual capital.

The demo account connects to a live trading platform, replicating all features of a real account to create a realistic simulation.

Pros and Cons of Demo Accounts

Using a demo account to test trading strategies helps traders develop their skills. However, since real capital is not involved, extended use may lead to a lack of experience in managing trading emotions.

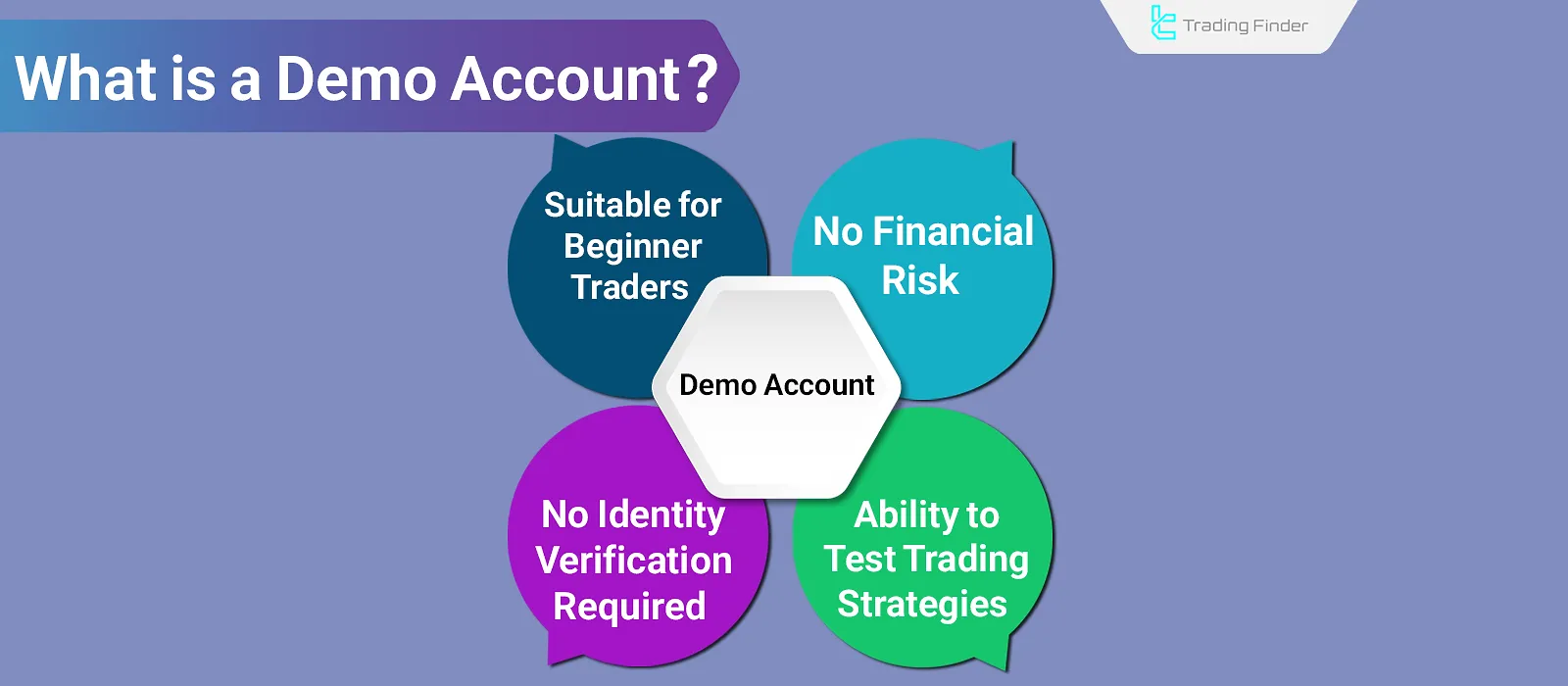

Advantages of Using a Demo Account

Besides enabling traders to practice their strategies, a demo account helps them become familiar with the trading platform and its functions. Key benefits include:

Advantages of a Demo Account for Testing Robots and Algorithmic Strategies

A demo account is the best environment for testing robots and algorithmic strategies. The trader can evaluate the robot’s performance using live data without concern for potential errors and can test different settings with no financial cost.

This process allows weaknesses in the strategy to be identified and the final version to be implemented on a real account with greater precision.

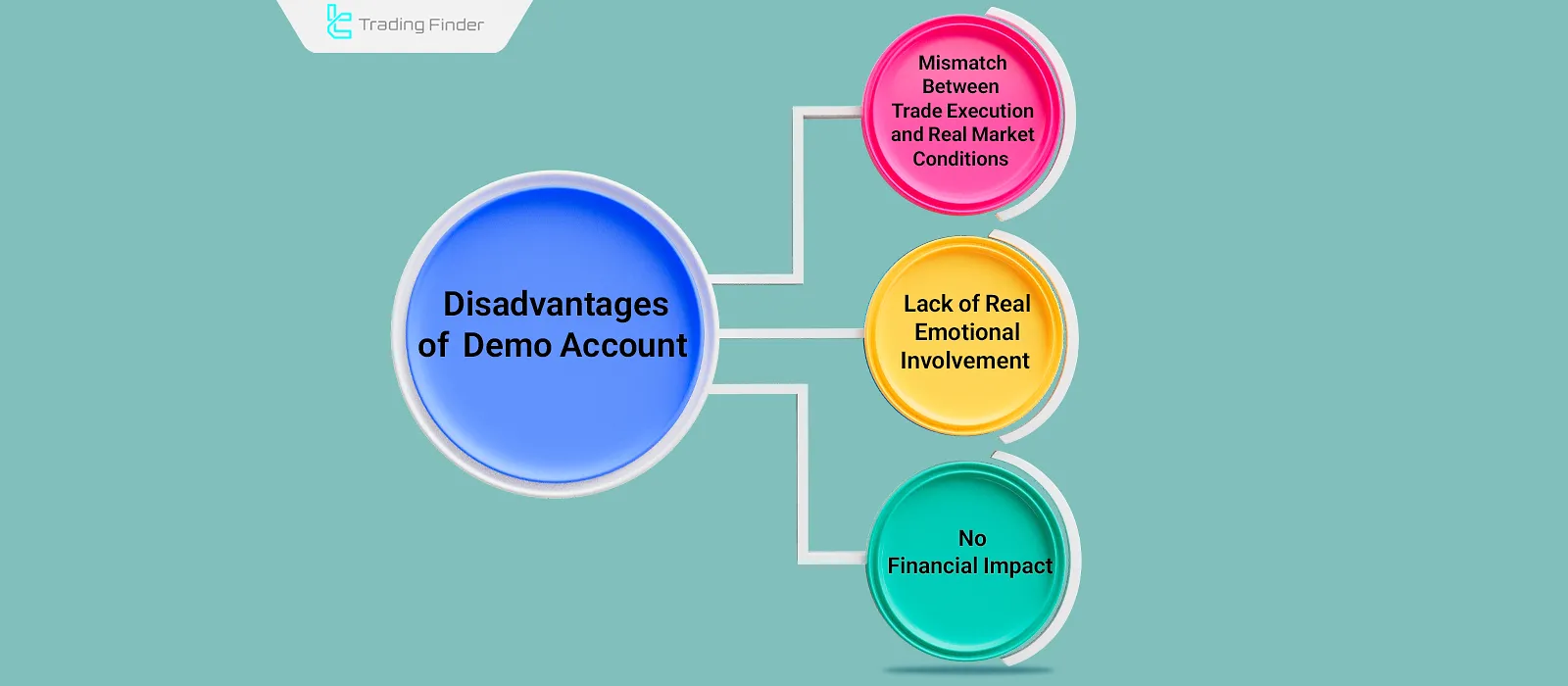

Disadvantages of Using a Demo Account

Prolonged use of a demo account may lead to hesitation in switching to a real account and lower self-confidence. The absence of real money also results in emotional detachment, making emotional management in real trades significantly different.

Disadvantages include:

- Lack of real market execution: In demo accounts, orders are filled instantly and without transaction costs, unlike in real trading;

- No emotional pressure: Without the fear of losing real funds, traders do not practice emotional discipline;

- No financial impact: The absence of real losses, limits the trader’s development in financial risk assessment and money management.

The Importance of Trading in a Demo Account

Backtesting alone is often unreliable due to a lack of real-time volatility. Hence, demo trading offers a more realistic environment for testing strategies under conditions similar to those of real-world markets.

It also helps traders become familiar with various tools and features, reducing confusion when switching to a live account.

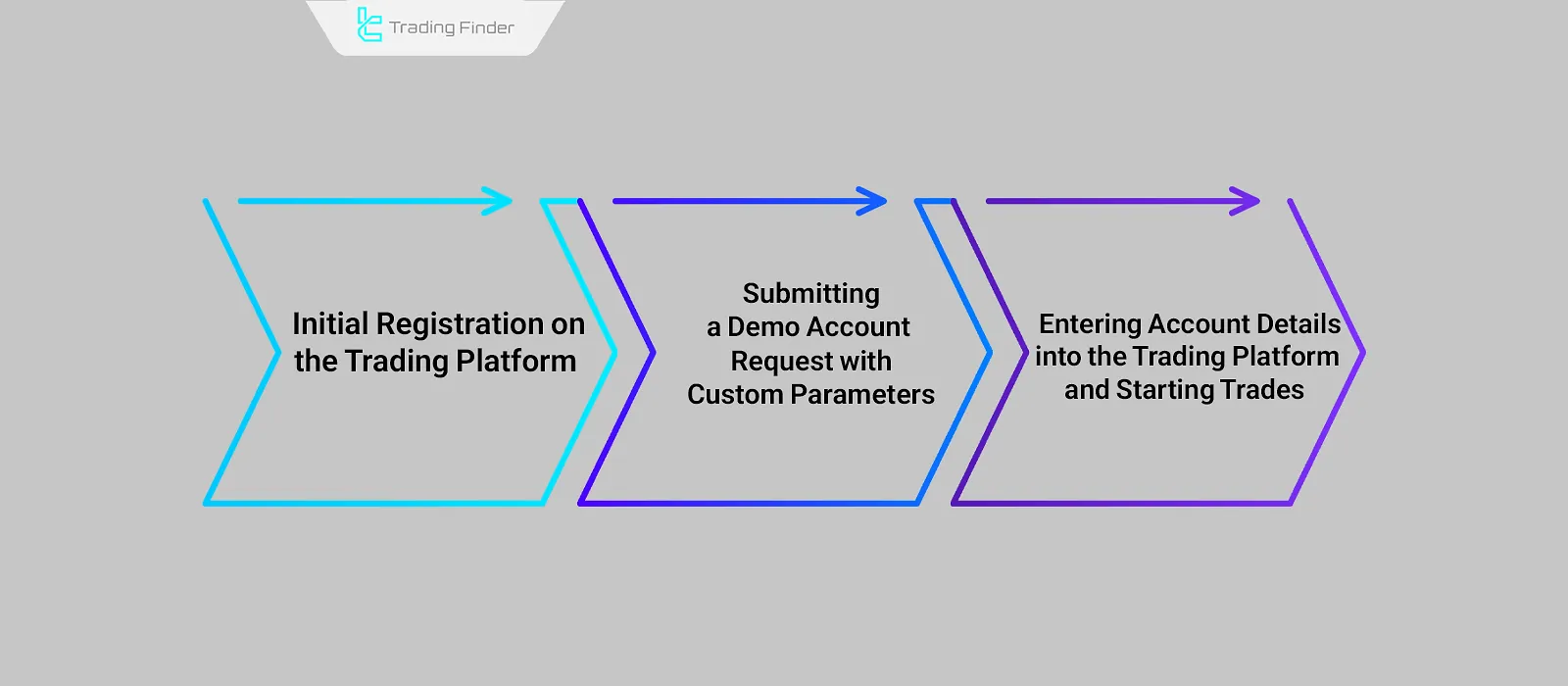

How to Create a Demo Account؟

Since demo accounts do not involve real money, most platforms do not require complete identity verification. To open a demo account, first choose a trading platform and sign up. Then, select the demo trading option and enter the necessary details (such as balance, leverage, etc.).

Once you receive the account credentials, you can connect it to platforms like MetaTrader 4 or MetaTrader 5 and start trading.

When Should You Move from a Demo Account to a Real Account?

The transition from demo account trading to a real account should take place when the trader reaches several criteria; once these conditions are met, entering the real account with a small position size is the best decision.

Criteria for Transferring Trades From demo trading accounts to a Real Account:

- Consistent profitability across different periods

- Full compliance with capital management

- Complete mastery of the platform

- No emotional involvement in demo trades

- Full understanding of the strategy’s behavior

Key Tips for Demo Trading

Because there is no financial risk, money management is often overlooked in demo trading. Traders tend to focus primarily on entry and exit strategies, often overlooking key risk management factors such as position sizing and stop loss orders.

Guide to Proper Use of a Demo Account

To use a demo account forex, also known as a simulation account, effectively and fully understand the demo trading meaning, a clear practice plan must be established. The most important guidelines for proper use are as follows:

- Trading with position sizes similar to a real account;

- Recording all trades in a journal and reviewing the reasons for entry and exit;

- Observing stop loss, take profit, and capital management rules;

- Testing the strategy across different time frames and market conditions;

- Periodic performance analysis and correction of mistakes.

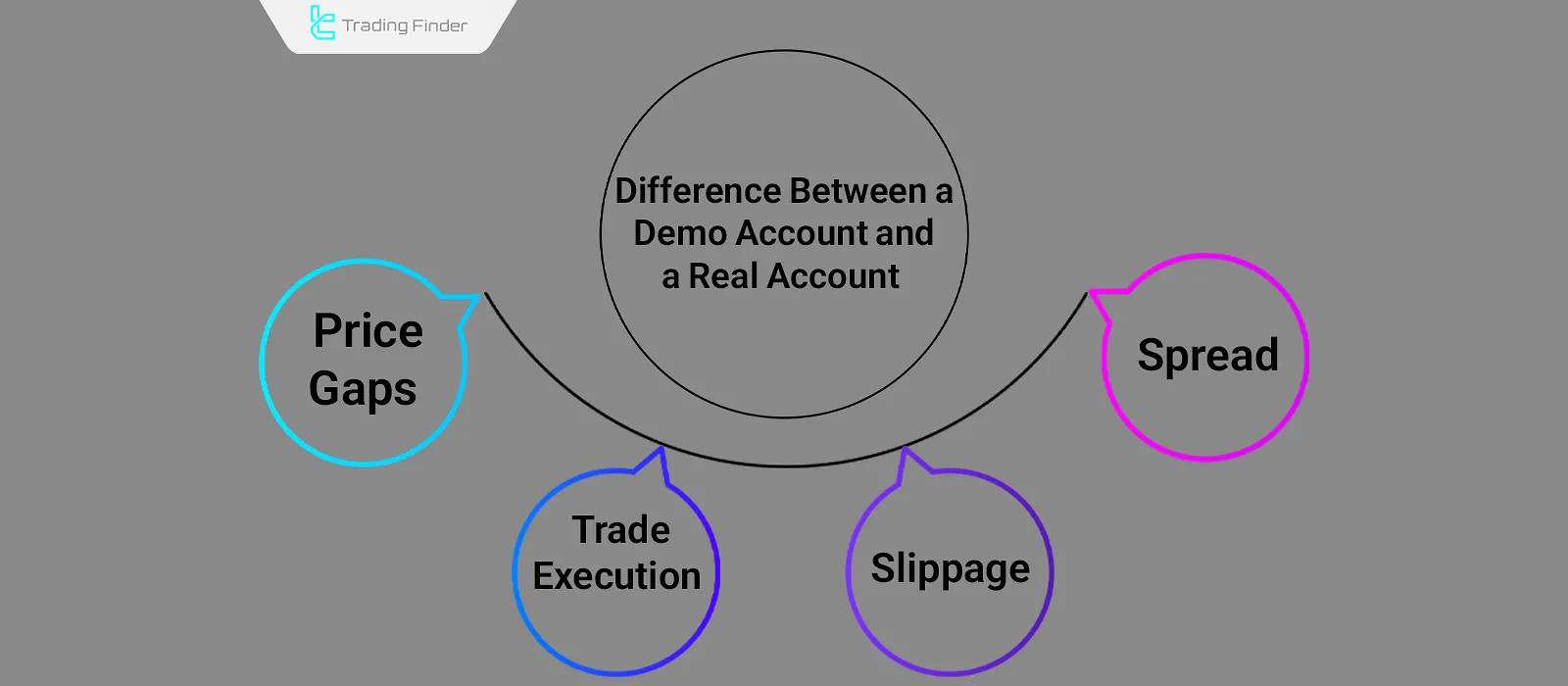

Differences Between Demo and Real Accounts

Although demo accounts are connected to live market servers and display real price fluctuations, the absence of real liquidity introduces differences in areas such as spread, slippage, and execution.

Key differences:

- Spread: Often not calculated or remains fixed in demo environments;

- Slippage: Since there's no liquidity concern, orders execute exactly at the chosen price;

- Execution Speed: Trades in demo accounts are instant, unlike real accounts where execution may involve delays;

- Price Gaps: Price gaps that may prevent order execution in real accounts do not impact trades in demo.

On the IQ Option YouTube channel, the difference between these two accounts is explained in video format:

Comparison Table of Demo Account and Real Account:

Feature | Demo Account | Real Account |

Type of Capital | Virtual | Real |

Price Slippage | Usually without slippage | Dependent on liquidity |

Order Execution | Fast and without delay | Possibility of delay |

Spread | Fixed or lower | Variable and real |

Trader Emotions | Stress free | Under psychological pressure |

Financial Risk | Zero | Real |

News Impact | Less noticeable | Fully real |

Psychological Conditions | Simpler | More difficult |

Appropriate Duration for Using a Demo Account

Using a demo account should be limited and goal oriented. Staying too long in a risk-free environment leads to the formation of incorrect trading habits and unrealistic confidence.

Usually, several weeks of focused practice along with trade recording is sufficient for entering a real account. The main objective of the demo is learning and preparation, not permanent trading.

Common Mistakes When Trading in a Demo Account

The absence of financial risk in a demo account causes traders to make mistakes that will later affect their real performance.

In such conditions, many individuals trade without a plan, do not define a clear stop loss, and do not take their emotional behavior seriously, because they know no real loss affects their capital.

Common mistakes when trading in a demo account:

Trade Journal Recording Expert Advisor in Notion for MetaTrader

The trade journal recording expert advisor in Notion is a specialized product from TradingFinder that fully automates the process of transferring trade information from the trading platform to the Notion environment.

This tool is designed for traders who intend to maintain a professional, integrated, and accurate journal and want to store details of each trade such as take profit, stop loss, entry price, trading symbol, and other important data in Notion without manual input.

This expert advisor is considered a practical tool and is categorized under “trading utility indicators”. Its structure is compatible with various trading styles such as scalping, swing trading, day trading, and multi time frame analysis, and it is usable for Forex, crypto, company stocks, and other supported markets.

To run this expert advisor, several key components must be configured in the trading platform and the Notion user account. The first step is enabling WebRequest in the trading platform to allow requests to the api.notion.com address.

After that, the user must extract the Parent Page ID of the Notion parent page from the end of the URL and enter it in the settings.

The next step is obtaining the Notion Token from the Integrations section, which plays a key role in authentication and connection between the trading platform and the user’s Workspace.

The licensing process for this tool is also handled through TradingFinder support, and requests can be made via Telegram and WhatsApp.

After receiving the license, the user can complete the connection steps and build a fully automated trading journal and systematically record the history of all trades.

This expert advisor is considered an efficient tool for traders who want to analyze their trading performance without manual data entry.

Data transfer speed, recording accuracy, integration with the Notion information management system, and the possibility of free use are among the main advantages of this system, which make it a practical solution for building a professional journal.

- Download Trade Journal Recording Expert Advisor in Notion for MetaTrader5

- Download Trade Journal Recording Expert Advisor in Notion for MetaTrader4

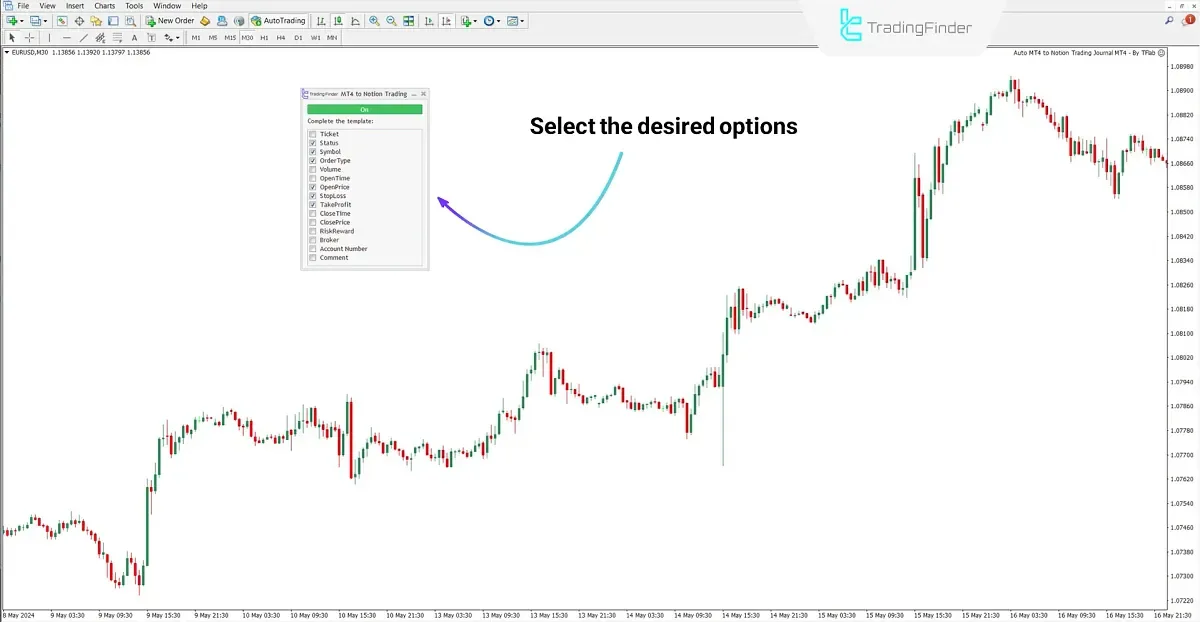

Example of Using the Expert Advisor When Selecting Required Data in the Trading Platform

When running the expert advisor, the user can specify which trade information should be recorded in the journal.

As shown in the image, after activating the expert advisor in the trading platform, a settings window is displayed where various details such as trade type, position open time, volume, entry price, profit and loss amount, trade ID, and other desired fields can be selected.

By enabling each option, the expert advisor becomes responsible for extracting the corresponding data and automatically storing it in the user’s trading journal.

This field selection method ensures that the final output is fully customized to the user’s needs and only the required information is recorded in the journal.

Are Demo Accounts Available in Crypto Markets?

While demo accounts are more common in Forex brokers, some crypto exchanges also offer virtual trading in cryptocurrencyMarket environments.

These demo setups do not require identity verification and only need an email for access. Top exchanges offering demo trading include:

Limitations of a Demo Account Compared to Real Market Conditions

A demo account is only a practice environment and cannot simulate all real market conditions. Severe volatility, order execution delays, price slippage, and psychological pressure are factors that are experienced only in a real account.

Demo results do not guarantee success in a real account, and the trader must consider the differences between these two environments in their trading plan.

For Which Traders Is a Demo Account Not Suitable?

A demo account is not suitable for individuals who enter the market solely for the purpose of making easy trades or without observing capital management rules. Those who use unrealistic position sizes in demo trading or trade without considering the structure of their strategy will not achieve similar performance in a real account.

Also, traders who seek to understand market emotions should be aware that a demo account cannot replicate the psychological pressure of the real environment.

Why Is a Demo Account More Important for Iranian Traders?

Financial and currency conditions in Iran make direct entry into a real account highly risky for many traders. Due to currency restrictions, conversion costs, and lack of sufficient experience in international markets, a demo account is a necessary stage for Iranian users.

This account helps the trader become familiar with the platform structure, order execution process, and global market behavior before entering the real environment and prevents early mistakes.

Conclusion

A demo account is a simulated trading environment that allows traders to practice their strategies without risking real money. However, success in a demo trading setup does not guarantee profit in a live account.

While demo accounts are excellent for testing strategies and learning platform functionalities, the lack of real capital hinders the development of emotional discipline and risk management skills.