Stablecoins link their value to assets such as the dollar or gold and create price stability; this structure makes their use in investment and value transfer secure.

The main models include fiat-backed with bank reserves, crypto-backed with digital collateral, and algorithmic with supply-and-demand management, where each model has distinct risks and functions.

Today, stablecoins form the core of the decentralized finance or DeFi ecosystem and play a central role in exchanges, lending, and international payments.

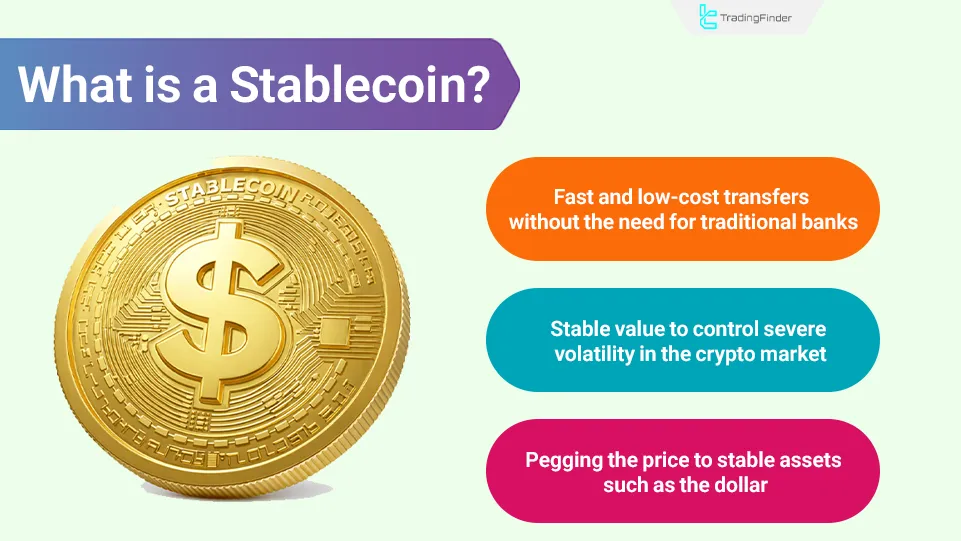

Definition of Stablecoin

A stablecoin is defined as a digital currency that is designed to control the severe volatility of the crypto market.

Unlike Bitcoin and Ethereum, whose prices experience significant fluctuations, the value of stablecoins is pegged to stable assets such as the US dollar, the euro, and gold.

For this reason, stablecoins act as an intermediary between the highly volatile world of digital currencies and the stable values of the real world, enabling trading, saving, and value transfer with lower price risk.

This feature has led stablecoins to be used as the base unit of many financial activities in the crypto market and to have an application beyond being merely an asset for investment.

How Stablecoins Work

Stablecoins are designed with the aim of creating value stability in the market.

This category of cryptocurrencies allows users, while benefiting from the speed and transparency of the blockchain network, to remain protected from the intensity of the common fluctuations in other cryptocurrencies.

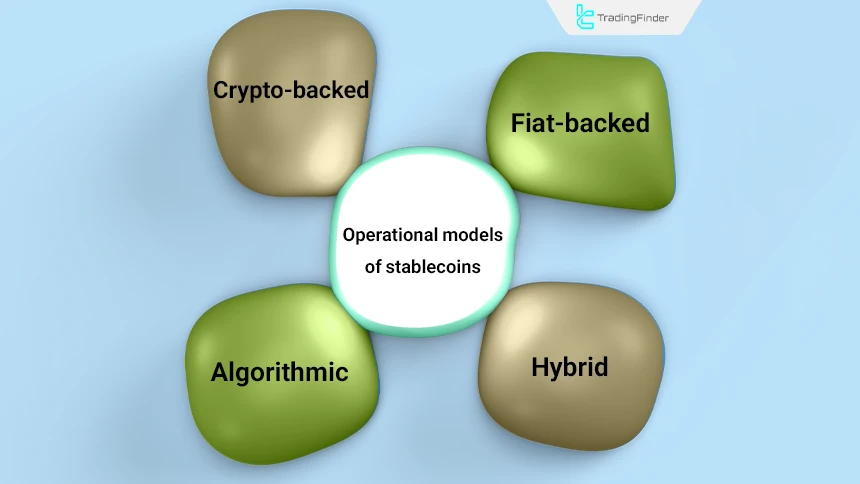

Operational models of stablecoins:

- Fiat-based: Supported by traditional currencies held in bank accounts, such as the US dollar or the euro;

- Crypto-based: Collateralization of digital assets with a ratio above 100% to guarantee value;

- Algorithmic: Use of smart contracts to regulate supply and demand without reliance on real backing;

- Hybrid: Combination of fiat reserves, cryptocurrencies, and automated algorithms to create sustainable balance.

Although stablecoins are designed to maintain a fixed price, in practice they may experience slight fluctuations. These fluctuations usually occur at the following times:

- Severe collapse of the crypto market

- Release of negative news about the issuer

- Decrease in liquidity on exchanges

- Cyberattacks or hacking of platforms

Advantages and Disadvantages of Using Stablecoins

Stablecoins are not only used in everyday transactions, but are also applied in areas such as lending, international payments, staking, and the execution of smart contracts.

Despite their widerange of applications, like other financial instruments, their use is accompanied by specific advantages and disadvantages.

Advantages and disadvantages of using stablecoins:

Advantages | Disadvantages |

Reduction of the risk of severe volatility in the crypto market | Dependence of fiat-based models on banks and issuing companies |

Use in lending, yield farming, and liquidity pools | In algorithmic models, there is a possibility of losing value (such as the collapse of UST) |

Fast and low-cost transfers without the need for traditional banks | Some countries impose restrictions or bans on usage |

Conversion of highly volatile assets into stable currency during times of crisis | In critical conditions, some stablecoins may fail to maintain their value or their liquidity may decrease |

Easy conversion into cryptocurrencies or fiat currencies | If reserves are not transparent, user trust is undermined |

Hidden Risks of Stablecoins

Although stablecoins are designed to reduce volatility, they have specific risks that are often overlooked. The most important of these risks include:

- Reserve risk: Lack of clarity or transparency regarding the assets backing a stablecoin can lead to a loss of user trust;

- Depeg risk: In critical market conditions, some stablecoins may lose their parity with the dollar or the reference asset;

- Legal risk: National regulations regarding stablecoins are constantly changing and the use of some of them may become restricted or prohibited;

- Liquidity risk: During periods of heavy selling pressure, the ability to quickly convert a stablecoin into its underlying asset may decrease.

Centralized and Decentralized Stablecoins

Stablecoins are generally divided into two main categories: centralized and decentralized. Their differences lie in the method of management, the type of backing, and the level of transparency.

Centralized stablecoins are managed by a single central entity or company, while decentralized stablecoins are controlled by smart contracts and decentralized algorithms, and are usually backed by other cryptocurrencies or algorithmic mechanisms to maintain value.

In the table below, we compare centralized and decentralized stablecoins:

Criterion | Centralized | Decentralized |

Control | By a central entity (USDT, USDC) | By smart contracts and DAO (DAI, LUSD) |

Backing | Real assets such as the dollar and gold | Cryptocurrencies such as ETH or BTC |

Transparency | Periodic reports by the issuing entity | Full transparency on the blockchain |

Risk | Government intervention and account freezing | Contract bugs or collateral collapse |

Price stability | Dependent on fiat reserves, more stable | Dependent on algorithms and collateral, riskier |

Use case | Widely used on exchanges | Widely used in DeFi and lending |

Centralized Stablecoins

This category of stablecoins is issued by financial companies and is usually backed by fiat currency or government treasury bonds. The process of minting and burning tokens is managed by a centralized entity, and it has the ability to block transactions.

The main feature of this model is high liquidity and reliance on the banking system, although centralization risk and dependence on financial regulations are considered its weaknesses.

Centralized stablecoins:

- USDT Tether

- USDC USD Coin

- BUSD Binance USD

- GUSD Gemini Dollar

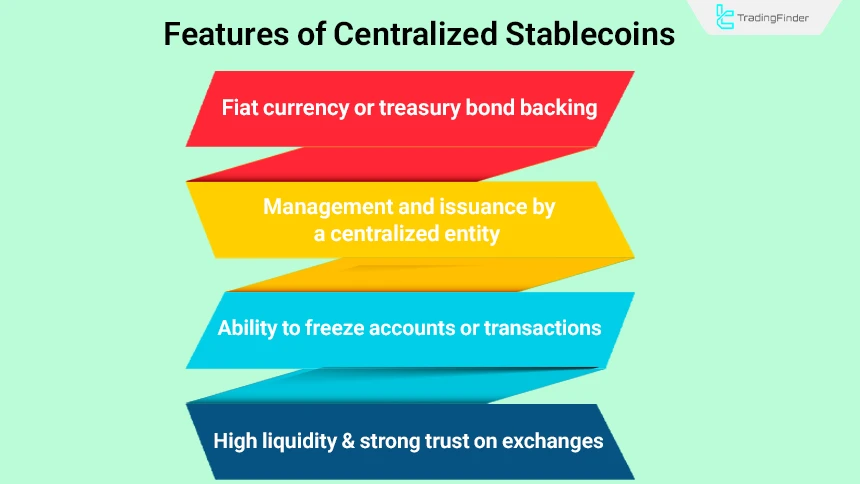

Features of Centralized Stablecoins

The transparency of centralized stablecoins is usually ensured through bank audit reports, but full control remains in the hands of the issuing entity.

This structure has led to high liquidity and strong market acceptance, while at the same time carrying the risks of centralization and regulatory intervention.

Features of centralized stablecoins:

- Backing based on fiat currencies or treasury bonds held in banks;

- Management and control by centralized companies or financial institutions such as Tether or Circle;

- Ability to freeze transactions in order to comply with legal frameworks;

- High trust in daily use, accompanied by direct dependence on the traditional financial structure.

Decentralized Stablecoins

Decentralized stablecoins are managed using smart contracts and digital-asset collateralization mechanisms, and their backing includes cryptocurrencies such as Ethereum and Bitcoin.

A prominent example of this structure is the DAI stablecoin associated with the MakerDAO protocol, which is monitored through automated contracts.

The main advantage of this model is transparency and resistance to censorship; however, in bearish market conditions, there is a risk of depeg or price deviation, as well as risks arising from smart contract vulnerabilities. Below, we refer to several decentralized stablecoins.

Decentralized stablecoins:

- Dai DAI (MakerDAO)

- LUSD Liquity USD

- Frax FRAX (Frax Protocol)

- MIM Magic Internet Money

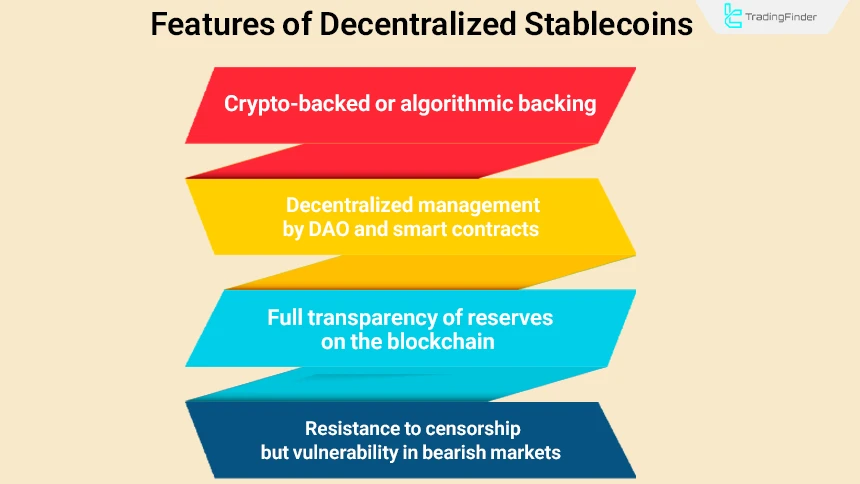

Features of Decentralized Stablecoins

This group is managed by smart contracts and DeFi protocols, and no centralized entity controls their processes. This structure is fully transparent, because all transactions and data are recorded on the blockchain.

These stablecoins have been developed in line with the decentralized philosophy of blockchain and are mostly aligned with DeFi objectives.

An educational video from the CoinGecko channel on YouTube provides supplementary information for better understanding decentralized stablecoins, and interested users can watch it for further information.

Features of decentralized stablecoins:

- Crypto-based or algorithmic backing;

- Decentralized management by DAO and smart contracts;

- Full transparency of reserves on the blockchain;

- Resistance to censorship but vulnerability in bearish markets.

Difference Between Centralized and Decentralized Stablecoins From a Governance Perspective

In centralized stablecoins, key decisions are made by a specific company or entity, whereas in decentralized stablecoins, users decide on major changes through voting within the protocol. This difference results in different levels of trust and transparency in the two models.

As a result, the governance model also affects the degree of flexibility and the system’s resistance to external pressures; centralized stablecoins can adapt more quickly to legal requirements, but they are exposed to the risk of unilateral decisions.

While decentralized examples, by relying on collective consensus, prevent the concentration of power, their decision-making process is usually slower and more complex.

Types of Stablecoins

Stablecoins are divided into the following three categories based on the type of backing and the value stabilization mechanism:

- Fiat-backed stablecoins

- Crypto-backed stablecoins

- Algorithmic stablecoins

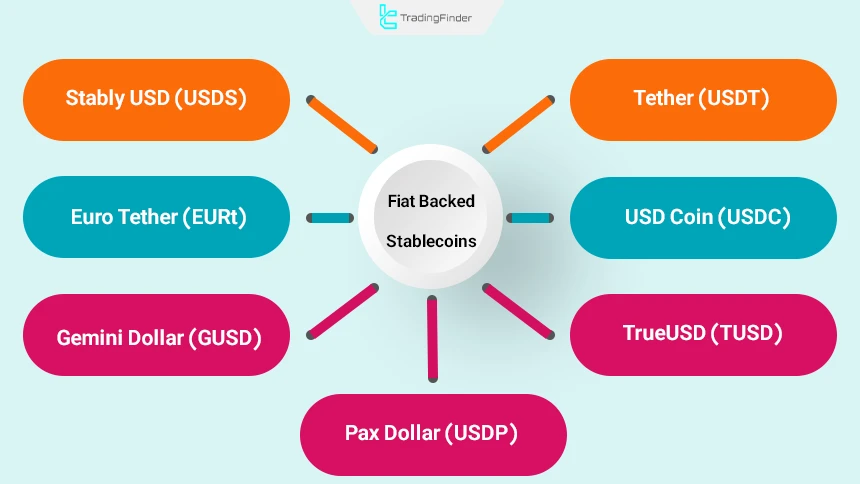

Fiat-Backed Stablecoins

Fiat-backed stablecoins hold the largest share of the stablecoin market due to their transparency, high liquidity, and closeness to the traditional financial system.

Among them, USDT is the main market leader because of its trading volume and wide exchange coverage, and USDC is a leading option due to its transparency and strong legal backing.

Fiat-backed stablecoins:

- Tether (USDT)

- USD Coin (USDC)

- TrueUSD (TUSD)

- Pax Dollar (USDP)

- Gemini Dollar (GUSD)

- Euro Tether (EURt)

- Stably USD (USDS)

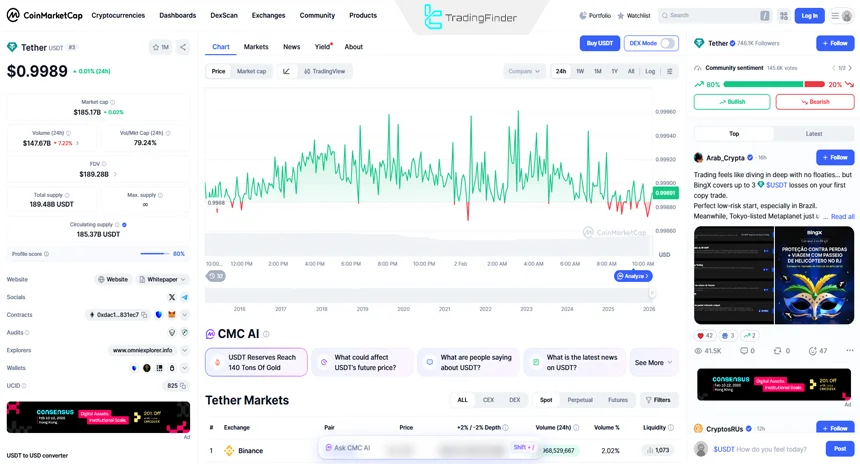

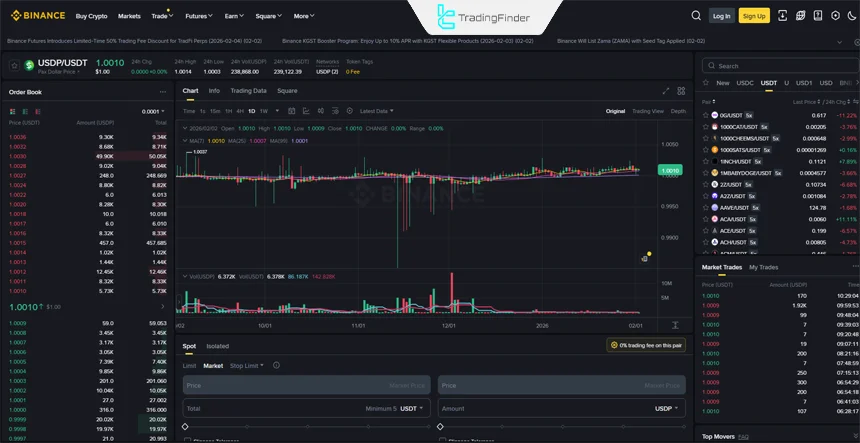

Tether (USDT)

Tether is issued by Tether Limited, affiliated with iFinex, and is currently the largest stablecoin in the world in terms of market capitalization and daily trading volume.

Over recent years, Tether has faced criticism regarding the level of transparency of its reserves, but it now publishes periodic audit reports in order to increase investor confidence.

In addition to the USD version, Tether has also issued other variants, including the euro, the Chinese yuan, and gold.

The main role of USDT in the market is to provide fast liquidity on exchanges and to serve as a dollar substitute for traders. Currently, more than 70 percent of the total stablecoin market is held by Tether, which has consolidated its position as the leading stablecoin.

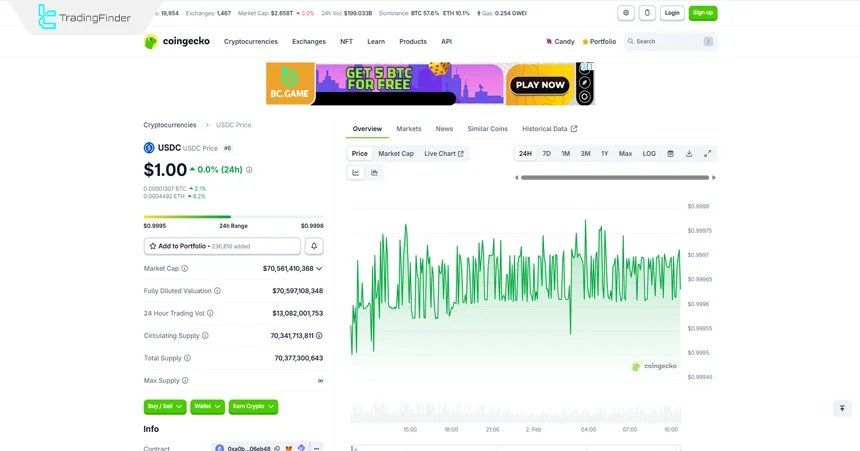

USD Coin (USDC)

USD Coin holds about 20% of the stablecoin market share and is issued by the Centre consortium, jointly managed by Circle and Coinbase. This stablecoin has gained significant credibility among traditional financial institutions due to its high transparency and fully audited reserves.

Its operations are conducted under strict oversight by United States regulators, and since 2023 part of its reserves has been held in US Treasury bonds. USDC is recognized as a suitable option, especially among fintech companies and DeFi projects, due to its structural stability and transparency.

TrueUSD (TUSD)

The TUSD stablecoin is issued by Archblock, previously known as TrustToken. This cryptocurrency was the first stablecoin introduced to the market with a special focus on transparency and the publication of daily audit reports.

All of its reserves are held in third-party bank accounts, and data related to these reserves is made publicly available in real time. Due to its transparent structure and instant reporting mechanism, TUSD is widely used on DeFi platforms and international exchanges.

Note: By third-party bank accounts, this refers to the accounts of banks or independent financial institutions that have no direct relationship with the issuing company.

Pax Dollar (USDP)

Pax Dollar is issued by Paxos Trust Company and operates under the direct supervision of the New York State Department of Financial Services (NYDFS).

This stablecoin, with high liquidity backing and a transparent legal framework, is designed especially for digital payments and use by financial institutions.

Its reliable nature and full compliance with United States regulations have made it a suitable option for corporate payments and an efficient tool for fast financial settlements.

Gemini Dollar (GUSD)

Gemini Dollar is issued by the Gemini exchange, founded by the Winklevoss twins. This stablecoin has official approval from the New York State Department of Financial Services (NYDFS) and entered the market from the outset with a focus on regulatory compliance.

The GUSD stablecoin enables fast deposits and withdrawals and, on some platforms, offers yield-earning capability as well. In addition to its use within the Gemini ecosystem, this token is also utilized in DeFi projects as a transparent and regulated instrument.

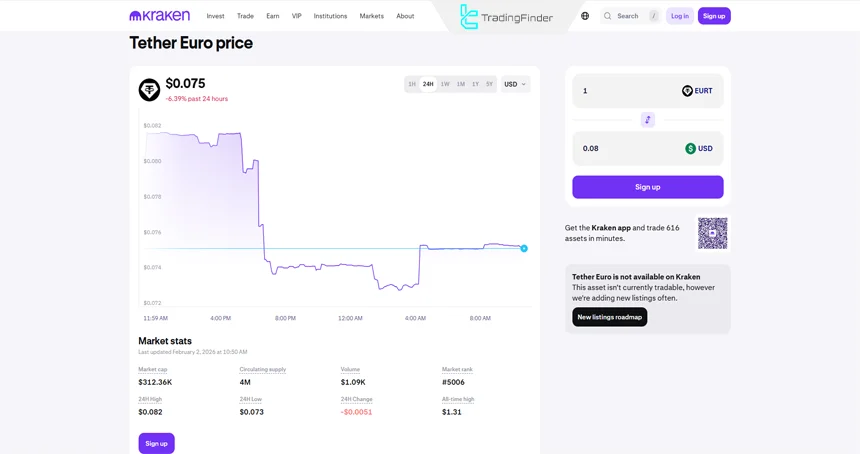

Euro Tether (EURt)

Euro Tether is one of the few euro-based fiat-backed stablecoins issued by Tether Limited. Although its trading volume and liquidity are lower than those of USDT, it is considered a key tool for European users and traders.

This stablecoin was launched to build a bridge between the crypto market and the euro financial system and has gained significant importance in international transactions and euro-based payments.

Stably USD (USDS)

Stably USD is issued by Stably with backing in US dollars and is designed with a focus on direct cooperation with United States banks.

Due to the publication of transparent reserve reports, this stablecoin has gained user trust and holds a special position in terms of compliance with financial standards.

Its usability across multiple blockchains, including Ethereum and Binance Smart Chain, has provided greater flexibility for traders and DeFi projects.

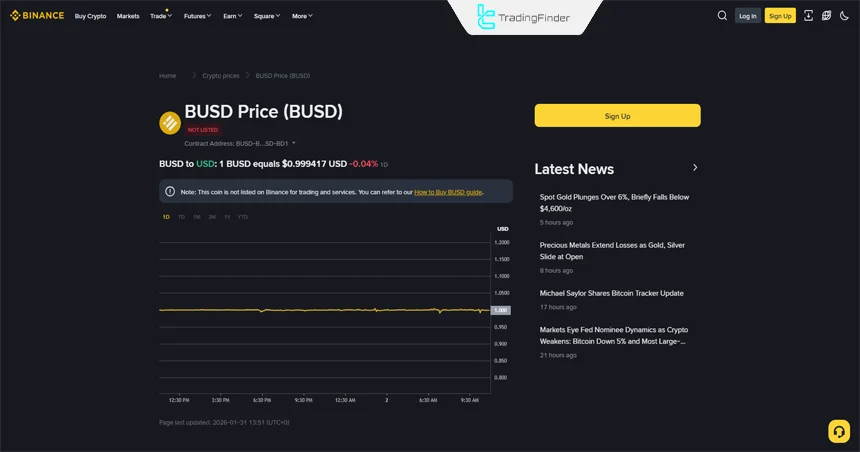

Binance USD (BUSD) [Production and Services Stopped and Under Winding Down]

Binance USD was the result of cooperation between the Binance exchange and Paxos Trust Company and was recognized as a regulated stablecoin with approval from the New York State Department of Financial Services (NYDFS).

In February 2023, by order of the same regulatory authority, the issuance of new tokens was halted. Nevertheless, the tokens in circulation are still supported and can be traded, but their liquidity has gradually declined.

The main role of BUSD in the Binance ecosystem was defined as a trading pair and a payment tool, and before the halt in production, it held a key position on this platform.

Crypto-Backed Stablecoins

This group, instead of fiat currencies, derives its backing from digital assets such as Ethereum (ETH) or Bitcoin (BTC). Their key structural feature is overcollateralization.

The reason for this is the high volatility of crypto assets, which requires collateral exceeding the issued amount in order to ensure value stability.

For example, if there is an intention to issue 100 dollars’ worth of stablecoins, the user must lock at least 150 dollars or more of a digital asset, such as Ethereum (ETH), in a contract to maintain the stability of the token.

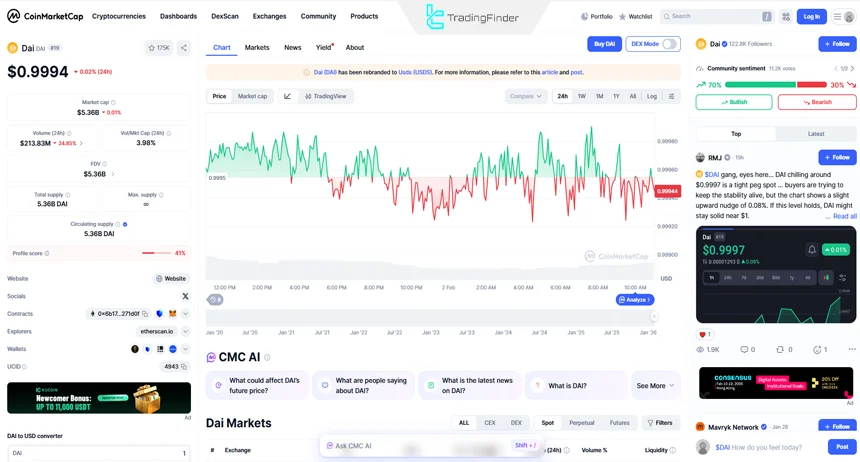

Dai DAI (MakerDAO)

The Dai stablecoin is one of the most prominent decentralized stablecoins based on the MakerDAO protocol.

Initially, it was issued only with Ethereum (ETH) as collateral, but today a combination of different assets such as Ethereum, Wrapped Bitcoin (WBTC), USD Coin (USDC), and other cryptocurrencies are used as collateral in this network.

The value stabilization mechanism of Dai operates based on a system of vaults; in this way, users lock their digital assets in smart contracts and, in return, receive DAI tokens.

Due to its decentralized structure, this stablecoin is recognized as the most credible crypto-backed example, and its value is consistently maintained close to 1 dollar.

The role of Dai in the DeFi ecosystem is fundamental, and many projects consider it the core of decentralized financial activities.

Synthetix sUSD (Synthetix USD)

Synthetix USD (sUSD) is the native stablecoin of the Synthetix protocol, and its backing is the SNX token. By locking SNX tokens in smart contracts, users are able to mint sUSD.

This stablecoin plays a foundational role in the Synthetix ecosystem, as it serves as the basis for creating synthetic assets within this protocol.

The sUSD stablecoin allows traders to trade assets such as stocks, commodities, and various indices in the form of synthetic tokens on the blockchain, thereby providing access to diverse financial markets in a decentralized environment.

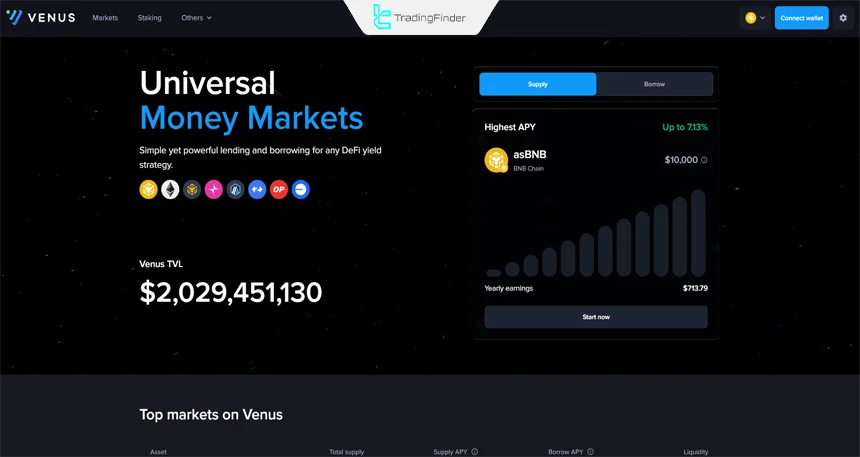

Venus Protocol (VAI)

The VAI token is the native stablecoin of the Venus Protocol platform on the BNB Chain network. Its backing consists of a set of digital assets such as Binance Coin, Ethereum, Tether, and other cryptocurrencies.

Users can mint the VAI token within the protocol by collateralizing these assets. This stablecoin plays a key role in the Venus ecosystem, and its main use cases include lending, borrowing, and conducting transactions within the BNB Chain environment.

This group, instead of fiat currencies, derives its backing from digital assets such as Ethereum (ETH) or Bitcoin (BTC). Their key structural feature is overcollateralization. The reason for this is the high volatility of crypto assets, which requires collateral exceeding the issued amount in order to ensure value stability.

For example, if there is an intention to issue 100 dollars’ worth of stablecoins, the user must lock at least 150 dollars or more of a digital asset, such as Ethereum (ETH), in a contract to maintain the stability of the token.

Magic Internet Money (MIM)

Magic Internet Money (MIM) is the native stablecoin of the Abracadabra.money protocol, and its backing consists of a set of crypto assets such as Ethereum, Convex (CVX), and yield-bearing tokens (yvTokens).

Its issuance mechanism works in such a way that users lock interest-bearing tokens, such as yvUSDT and yvDAI, in the protocol’s contracts, and in return MIM is minted.

The main innovation of this stablecoin lies in the use of yield-bearing assets as collateral. Due to its flexibility and composability, the MIM token is widely used in DeFi protocols for trading and yield farming.

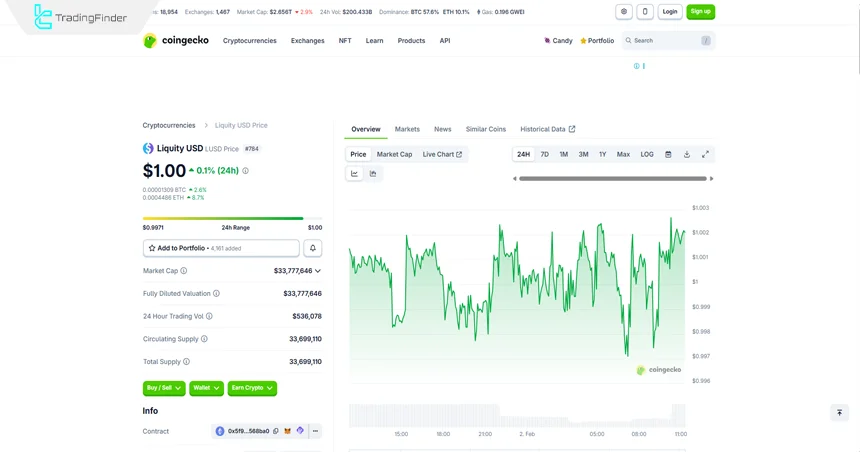

Liquity USD (LUSD)

LUSD is the native stablecoin of the Liquity protocol, and its backing is composed entirely of Ethereum. By locking Ethereum in the contracts of this protocol, users are able to obtain LUSD tokens.

Its mechanism is designed with zero repayment fees and has a fully decentralized structure.

This feature has made LUSD recognized as one of the few stablecoins backed solely by Ethereum. The main use of this token is value storage in a decentralized environment and utilization in DeFi protocols.

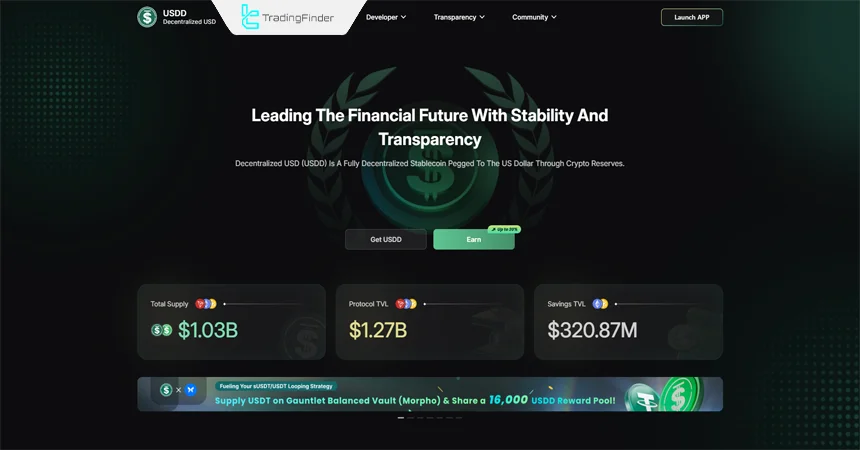

USDD (Tron’s Decentralized Dollar)

USDD is the decentralized stablecoin of the Tron network, and its backing is provided by crypto assets of this network such as Tron (TRX) and other tokens.

Its stabilization mechanism is a combination of algorithmic control and collateralization and has similarities to the UST stablecoin model (former Terra project), with the difference that the level of collateralization in USDD is considered higher.

This stablecoin operates under the support of the TRON Foundation, and its main use is defined within the Tron ecosystem and the decentralized exchanges associated with this network.

Algorithmic Stablecoins

Algorithmic stablecoins, unlike fiat-backed or crypto-backed models, instead of holding collateral such as dollars or Ethereum, use algorithms and smart contracts to control supply and demand.

These systems automatically increase or decrease the number of tokens in circulation so that their value remains close to one dollar or a specified base currency.

Key features of algorithmic stablecoins:

- No direct fiat or crypto backing: Supply and demand are managed solely through algorithms;

- Supply control mechanism: When the price rises above 1 dollar, new tokens are issued, and when the price falls, part of the tokens are burned or locked;

- High risk: Due to the absence of physical or digital collateral, this type of stablecoin faces the greatest risk of value collapse or depeg in severe market crises.

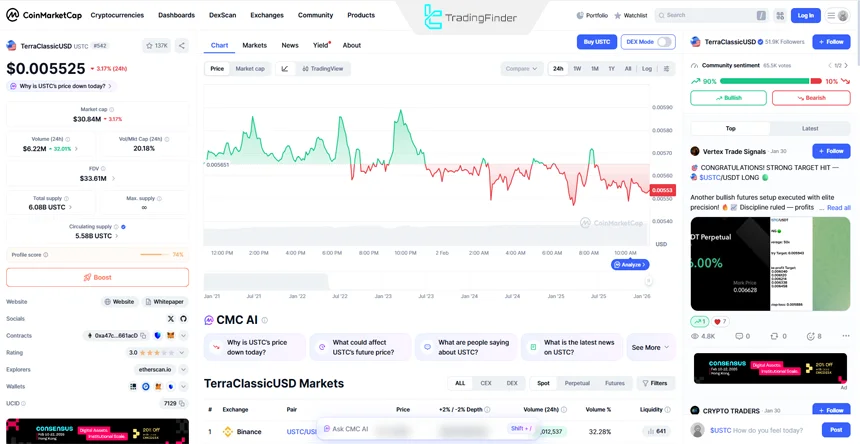

TerraUSD UST (failed)

TerraUSD, as the algorithmic stablecoin of the Terra network, operated based on a link with the LUNA token; when the price increased, LUNA was minted, and when it decreased, part of LUNA was burned.

This mechanism, in 2022, due to heavy selling pressure and excessive issuance of LUNA, entered the so-called “Death Spiral” cycle and ultimately led to the simultaneous collapse of the value of UST and LUNA and the loss of billions of dollars in capital.

Frax

Frax is one of the innovative stablecoins built on the Ethereum blockchain that uses a hybrid model. In this mechanism, part of the value is backed by fiat (usually USD Coin), and the other part is maintained through an algorithmic mechanism.

The ratio between collateral and algorithm changes according to market conditions in order to preserve value stability. Frax is still active and is recognized as one of the most successful semi-algorithmic examples in the stablecoin sector.

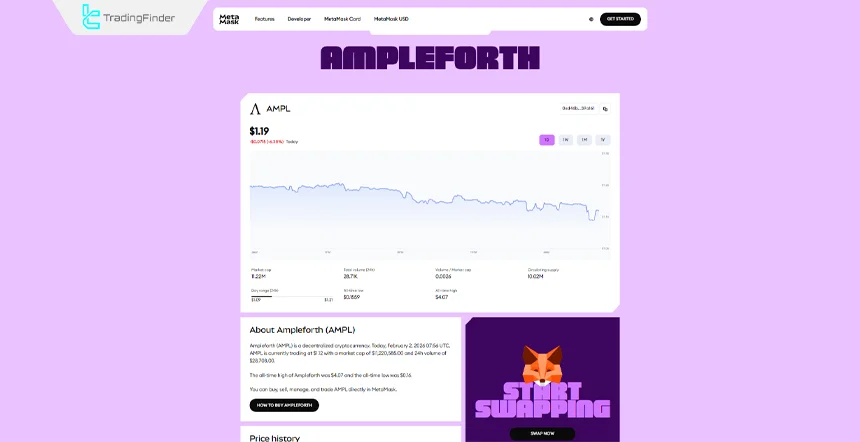

Ampleforth AMPL

Ampleforth is a non-traditional stablecoin on the Ethereum blockchain that uses a rebase mechanism to adjust supply. In this model, the number of tokens in circulation changes daily based on the average market price.

Unlike stablecoins that are directly pegged to the dollar, the AMPL stablecoin targets the balance of its total market value through supply changes rather than direct pegging.

The main use of this token is mostly in the DeFi field and it is known as an experimental and exploratory asset.

Neutrino USD (USDN)

Neutrino USD is the algorithmic stablecoin of the Waves ecosystem, whose value is maintained by relying on the WAVES token. Its mechanism is designed based on on-chain algorithms to ensure price stability near one dollar.

However, USDN has repeatedly experienced depeg events and, as a result, has lost the trust of a large part of the market. This issue has severely weakened its position as a stable stablecoin and led to its limited use in the DeFi ecosystem.

How Does an Algorithmic Stablecoin Maintain its Price?

In algorithmic stablecoins, the price is controlled not by real backing but by adjusting supply and demand. When the price rises above 1 dollar, the system issues more tokens, and when the price falls, part of the tokens are burned.

This model is theoretically stable, but in severe market crises it may lose its effectiveness.

In this structure, algorithms usually try to guide traders’ behavior toward returning the price to the target level by using a secondary token or economic incentives, so that arbitrage profit becomes the main balancing factor.

However, if market confidence in this mechanism weakens or sudden selling volume increases, the supply-adjustment cycle can, instead of stabilizing, lead to an intensification of price decline and challenge the stability of the system.

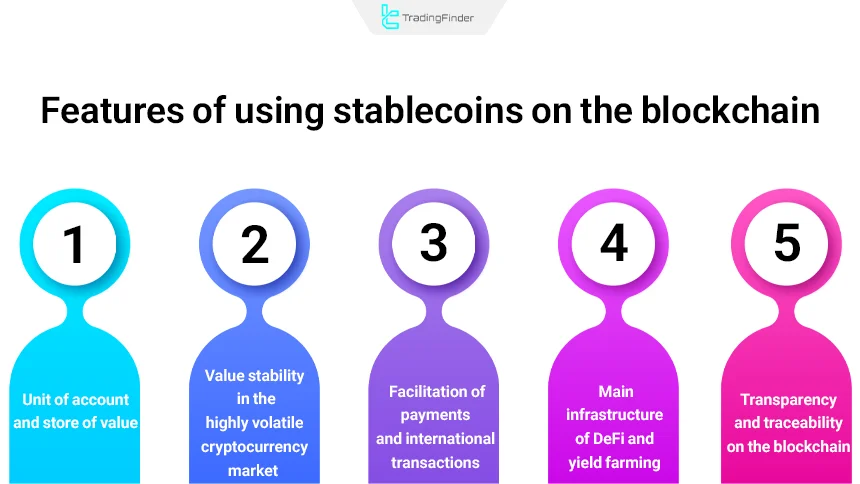

Features of Using Stablecoins on the Blockchain

Stablecoins are the backbone of DeFi trading and payments on the blockchain, and without them the crypto ecosystem would not have such stability and efficiency.

Below are the main features of using stablecoins on the blockchain:

- Value stability in the highly volatile digital currency market;

- Unit of account and store of value;

- Facilitation of international payments and transactions;

- Main infrastructure of DeFi and yield farming;

- Transparency and traceability on the blockchain.

Role of Stablecoins in DeFi

Stablecoins are the main pillar of the DeFi ecosystem, and many decentralized financial services are practically impossible without them:

- Use as collateral for obtaining loans on platforms such as Aave and Compound

- Participation in liquidity pools

- Tool for calculating real profit without dealing with price volatility

- Substitute for the dollar on decentralized exchanges

Stablecoins make it possible to design more complex financial products such as decentralized futures contracts, blockchain-based insurance, and on-chain payment systems, which without a stable unit of value would face the risk of severe volatility.

For this reason, their role is not limited to being a supplementary tool, but they are recognized as the base layer for the stable and predictable operation of DeFi protocols.

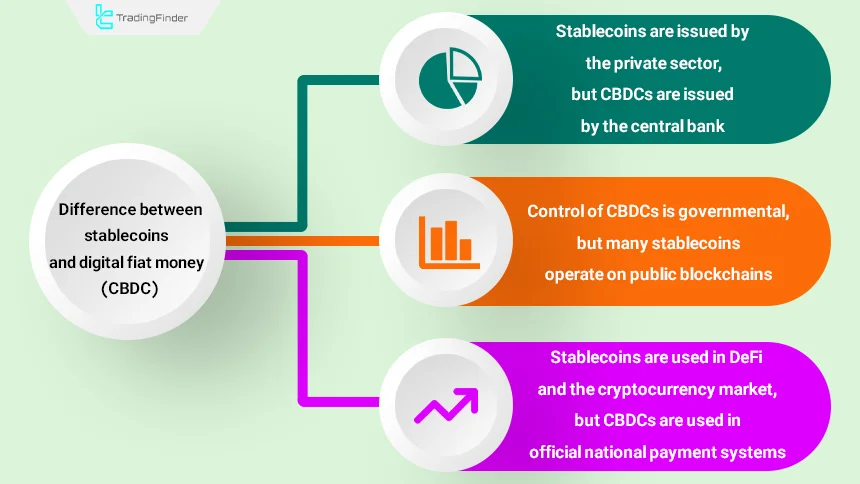

Difference Between Stablecoins and Digital Fiat Money (CBDC)

Stablecoins are often confused with central bank digital currencies, but they have fundamental differences:

- Stablecoins are usually issued by private companies or blockchain protocols, while CBDCs are issued by central banks;

- Control and monitoring of CBDC transactions are entirely in the hands of the government, but many stablecoins operate on public blockchains;

- Stablecoins are mostly used in the DeFi ecosystem and crypto trading, while CBDCs are designed for official national payment systems.

Difference Between Stablecoins and Other Cryptocurrencies

The main difference between stablecoins and other cryptocurrencies lies in the nature of their price and their design objective.

Unlike most cryptocurrencies, stablecoins aim for value stability rather than volatility, which has turned them into a bridge between the crypto world and the traditional financial system.

While cryptocurrencies such as Bitcoin or Ethereum are tools for investment, smart contracts, or long-term value storage. Below, we examine the differences between stablecoins and other cryptocurrencies:

Feature | Stablecoins | Other cryptocurrencies |

Price stability | Pegged to fiat currency or stable assets (for example, USDT to the dollar) | Experience severe price volatility |

Use case | Payment tool, fast transfer, and risk hedging | Mostly for investment, smart contracts, or speculation |

Backing | Fiat, commodity, or algorithmic backing | Valuation based solely on supply and demand |

Risk | Lower price risk | High risk and high profit potential |

Difference Between Stablecoins and Electronic Money

Unlike bank electronic money, which can only be used within the banking framework, stablecoins operate on the blockchain and have peer-to-peer transfer capability. In addition, banking restrictions, sanctions, and bank working hours do not affect stablecoins.

From this perspective, stablecoins, in addition to acting as a payment tool, also function as a settlement unit in decentralized ecosystems such as DeFi and non-custodial exchanges.

In contrast, bank electronic money remains dependent on centralized infrastructure and the domestic regulations of each country.

This difference causes stablecoins to have a role beyond simple value transfer and to be recognized as a communication bridge between the traditional financial system and the blockchain-based economy.

Real-World Use Cases of Stablecoins

Stablecoins are not only trading tools in the crypto market and also have applications in the real economy:

- International money transfer: Reduced cost and time compared to traditional banking systems;

- Paying freelancers: Bypassing banking restrictions in sanctioned countries;

- Preserving asset value during high inflation: A temporary substitute for national currency in countries with severe inflation;

- Payments in foreign online stores: Without the need for an international credit card.

Why did Some Stablecoins Fail? (Review of Real Cases)

Throughout the history of the cryptocurrency market, some stablecoins have failed due to poor design or mismanagement. The most famous example is the TerraUSD project, which lost its parity with the dollar in a short period due to an unstable algorithmic model.

This event showed that not all stablecoins are equal in terms of security and stability and that choosing them requires careful evaluation.

In addition to TerraUSD, examples such as Iron Finance and Basis also demonstrated that excessive reliance on automated arbitrage and the absence of transparent backing can lead to rapid collapse under selling pressure.

These experiences proved that the stability of a stablecoin depends not only on its technical mechanism but also on the level of market trust, the liquidity of reserves, and crisis management capability, and without these factors, even seemingly smart designs will be fragile.

How to Assess the Credibility of a Stablecoin

To evaluate a stablecoin, the following items can be reviewed:

- Audit reports

- Transparency of financial reserves

- History of depeg events

- Daily trading volume

- Development team or issuing company

An educational article on identifying real and fake stablecoins on the coinbase.com website provides more comprehensive explanations for recognizing legitimate stablecoins and can be consulted for further study.

Practical Example of Evaluating the Credibility of USDC

For example, the USDC stablecoin is evaluated based on the following indicators:

- Audit reports: Circle publishes monthly audit reports by independent institutions that confirm the parity of reserves with circulating tokens;

- Transparency of financial reserves: USDC reserves consist of cash and short-term US Treasury bonds, and their details are published publicly;

- History of depeg: In March 2023, the price of USDC temporarily fell to around 0.88 dollars but returned to 1 dollar after intervention by the Federal Reserve;

- Daily trading volume: The daily trading volume of USDC is usually several billion dollars, indicating high liquidity;

- Development team or issuing company: USDC is issued by the registered company Circle in cooperation with Coinbase, which reduces the risk associated with anonymous projects.

Considering independent audits, reserve transparency, recovery history after depeg, high trading volume, and a reputable issuing company, USDC has higher credibility compared to many other stablecoins.

Legal Status of Stablecoins in Different Countries

Regulations related to stablecoins are not the same in all countries, and this affects the level of risk in using them:

- In the United States, stablecoins are subject to oversight by financial authorities, and issuing companies must report their reserves;

- In the European Union, the MiCA framework has been developed to control the issuance of stablecoins;

- In some countries, the use of stablecoins is considered restricted or prohibited;

These legal differences show that the risk of stablecoins is not only technical and also depends on government policies.

Stablecoins and Taxation

In many countries, trading and holding stablecoins are considered similar to other cryptocurrencies for tax purposes.

If a user profits from price differences or uses stablecoins in transactions, they may be subject to capital gains tax. Tax laws vary by country and local regulations must be considered.

In addition, some governments are drafting separate regulations for stablecoins to clarify their distinction from highly volatile currencies in the tax system, especially when these assets are used as payment instruments or stores of value.

Therefore, professional crypto market users must, in addition to monitoring prices, also incorporate changes in tax regulations related to stablecoins into their financial strategies.

Secure Storage of Stablecoins (Wallet & Security)

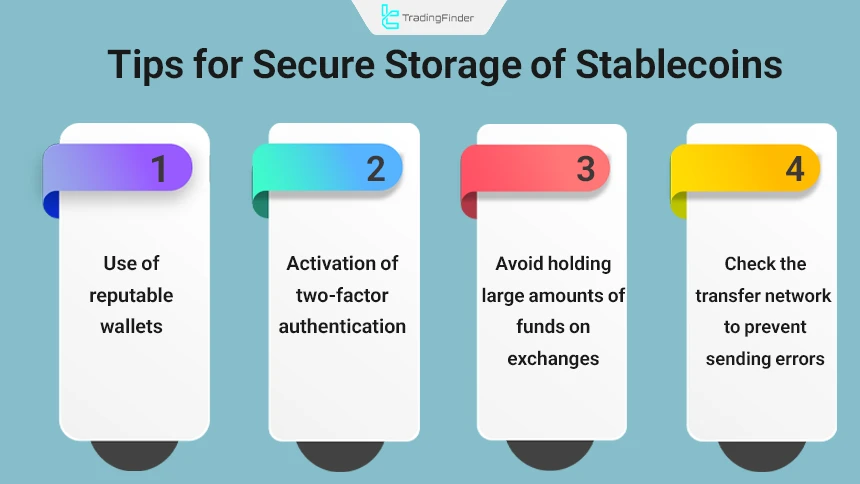

For secure storage of stablecoins, the following points should be observed:

- Use of reputable wallets such as Trust Wallet or Ledger

- Activation of two-factor authentication

- Avoid holding large amounts of funds on exchanges

- Check the transfer network (ERC20, TRC20, BEP20) to prevent mistakes in sending

Comparison of Stablecoin Transfer Networks

Stablecoins are transferred on different blockchain networks, each of which has different characteristics. Comparison table of stablecoin transfer networks:

Features | ERC20 (Ethereum) | TRC20 (Tron) | BEP20 (BNB Smart Chain) |

Host blockchain | Ethereum | Tron | Binance Smart Chain (BSC) |

Token standard | ERC-20 | TRC-20 | BEP-20 |

Average transfer fee | High (usually 3 to 20 dollars, depending on network congestion) | Very low (near zero or less than 1 dollar) | Low (about 0.2 to 1 dollar) |

Transaction confirmation speed | Medium (about 1 to 5 minutes) | Fast (a few seconds to 1 minute) | Fast (about 5 to 30 seconds) |

Network security level | Very high (the most decentralized network) | Medium | High |

Degree of decentralization | Very high | Low | Medium |

Exchange support | Very wide | Wide | Wide |

Risk of wrong network transfer | Very high (if the destination does not support it) | High | High |

Common use case | Official transfers, DeFi, reputable projects | Fast and cheap transfers between exchanges | Daily transactions and light DeFi |

Note: Sending a stablecoin on a network different from the destination network (for example, sending USDT-TRC20 to an ERC20 address) in most cases leads to loss of assets, unless through complex and costly recovery processes that are usually not worth pursuing.

Future of Stablecoins in Financial Markets

With the entry of banks, governments, and major financial companies into the blockchain field, the role of stablecoins will become more prominent

It is expected that stablecoins will remain a bridge between the traditional financial system and the cryptocurrency market, but will be subject to stricter oversight.

Along this path, we will likely witness greater standardization in backing, reserve transparency, and legal frameworks for stablecoins, in order to reduce systemic risks and increase public adoption.

At the same time, the development of stablecoins backed by diverse assets or national currencies can expand their application beyond mere trading tools and turn them into part of the international payment infrastructure.

Can Stablecoins Replace the Dollar?

Stablecoins are dependent on reference assets such as the dollar and are not themselves considered a replacement for national money.

However, they can play the role of a digital and intermediary-free version of the dollar on a globalscale, especially in countries with limited access to banking systems.

However, the widespread use of dollar-backed stablecoins can strengthen the influence of the dollar in the digital space rather than eliminate it, because their value remains tied to US monetary policy.

For this reason, stablecoins function more as tools for the global distribution of the dollar than as its competitor, and their main impact will be facilitating cross-border payments and preserving value in unstable economies.

The use of stablecoins can reduce the gap between the formal financial system and users outside the banking network and enable their participation in digital commerce and online financial services.

Nevertheless, this expansion of use may increase governments’ sensitivity to capital flow control and exchange-rate policies and make the future of stablecoins increasingly dependent on the interaction between blockchain technology and international regulations.

Common Mistakes in Using Stablecoins

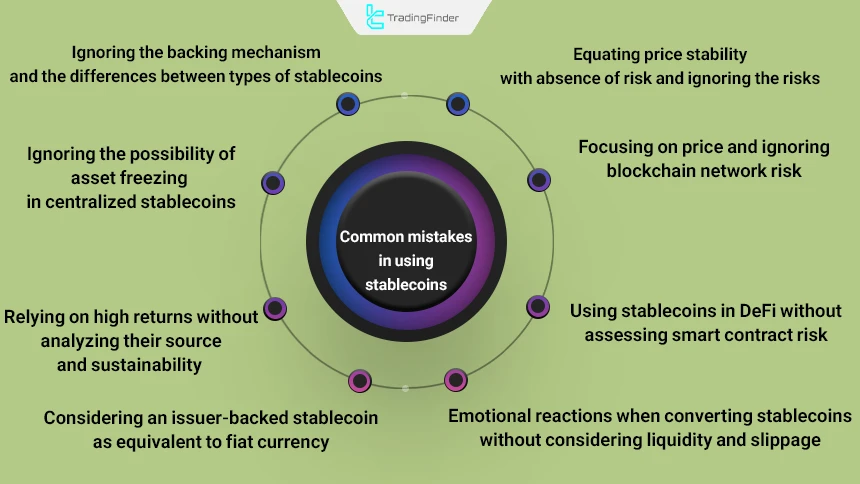

Incorrect use of stablecoins leads to misjudgment of risk levels and harmful investment decisions. Below are the common mistakes in using stablecoins:

- Equating price stability with absence of risk and ignoring issuer risk, legal risk, and the possibility of depeg or price deviation;

- Ignoring the type of backing mechanism and the differences between fiat-backed, crypto-backed, and algorithmic stablecoins;

- Focus on price and neglect of the risk of the blockchain network used for transferring and storing assets;

- Using stablecoins in decentralized finance or DeFi protocols without assessing smart contract risk and their economic structure;

- Relying on high interest rates without analyzing the source and sustainability of returns;

- Ignoring the possibility of asset freezing by the issuer in centralized stablecoins;

- Emotional reactions when converting between stablecoins in crisis conditions without considering liquidity and slippage;

- Treating stablecoins, whose nature is a digital obligation of the issuer, as equivalent to fiat currency.

Support and Resistance Indicator (Major/Minor)

The support and resistance indicator is one of the practical analytical tools in the cryptocurrency market that is designed to accurately identify important Support & Resistance Levels on the price chart.

These levels are usually areas where the market reacts, pauses, or changes direction, and therefore play a decisive role in technical analysis.

In the visual structure of this indicator, Major Support areas are shown with green lines and Major Resistance with red lines.

Minor Support and Minor Resistance levels also appear with darker lines on the chart so that the difference between major and minor zones can be clearly distinguished. This visual separation allows the trader to identify sensitive market areas without cluttering the chart.

- Support & resistance indicator in TradingView

- Support & resistance indicator in MT5

- Support & resistance indicator in MT4

This tool is classified within the group of TradingView support and resistance indicators as well as supply and demand indicators and is suitable for multi-timeframe analysis and the intraday trading style.

In terms of target market, it is not limited to a specific asset and can be used in forex, cryptocurrencies, stocks, and forward markets.

The calculation logic of the indicator is based on the automatic detection of price reversal points in short-term and long-term periods. These zones are divided into four categories:

- Long-term major support, which shows the main market bottoms,

- Long-term major resistance, which identifies important trend highs,

- Long-term minor support, which displays temporary pauses in a downward path,

- Long-term minor resistance, which reveals limited price reactions in an upward trend.

In a bullish scenario such as the daily chart of a cryptocurrency, when the price reaches major support, it may be accompanied by a positive reaction, and traders may enter a buy position after observing a confirmation candle.

In a bearish trend, when the price fails to break through the main resistance, the probability of a sharp decline increases; a situation that this indicator illustrates well.

In the settings section, options such as Long Term S&R Pivot Period and Short Term S&R Pivot Period are available to define the calculation period of the levels.

It is also possible to change line styles, their thickness, and to enable or disable major and minor lines on different timeframes.

Overall, the Support Resistance Major/Minor indicator is considered an efficient tool for determining entry and exit points and identifying reversal or trend-continuation zones in the market.

Conclusion

Stablecoins are an integral part of the cryptocurrency and DeFi ecosystem and are designed to reduce volatility and create price stability.

By linking their value to assets such as the dollar, euro, gold, or even other cryptocurrencies, they enable use in international payments, staking, lending, and trading.

Depending on their design type (fiat-backed, crypto-backed, or algorithmic), they have different advantages and risks, including high liquidity and broad adoption alongside the danger of depeg, centralization, or algorithmic problems.

Overall, stablecoins are considered an important bridge between the traditional financial system and the blockchain world.