In swing trading, traders analyze the overall market trend and various economic data to identify the long-term direction of price movements. Then, using concepts from various analytical styles such as price action, entry and exit points for the trade are determined.

Swing trades usually last from 2 days to 1 month. Therefore, success in this trading strategy requires daily updates to the analysis at the end of each trading day. Given the longer duration of swing trades, risk-to-reward ratio and capital management are of particular importance in this trading style.

What Is Swing Trading?

Swing trading is a style of trading where positions are opened to capture profit from an entire trend. As such, these trades may last from a few days to up to 1 month.

Advantages and Disadvantages of Swing Trading

Swing trading focuses on major market trends, which allows for calmer trade management without the stress of short-term fluctuations. However, swing positions are always exposed to weekend price gaps and overnight holding costs. Below is a table summarizing the pros and cons of swing trading:

Advantages | Disadvantages |

Trade management with reduced stress | Weekend gap risk |

Time-efficient | Requires fundamental knowledge |

Higher risk-to-reward ratio | Overnight holding fees |

Combines technical and fundamental analysis | Vulnerability to sudden news releases that invalidate prior analysis |

Swing Trading Strategies

Swing trading can be implemented using a variety of strategies such as price reversals, retracements, and more. Moreover, for executing trades using any of these strategies, fundamental analysis of the underlying asset is essential.

Reversal Strategy

In this strategy, price momentum is evaluated. When a shift in momentum is detected, the trader looks for additional confirmations to identify a potential trend reversal.

For example, in an uptrend, signs of weakening bullish momentum and the price reaching a key reversal zone may trigger initial signals of a bearish reversal. Then, further confirmations such as classic patterns justify a logical short entry.

Retracement Strategy

A retracement is a short-term movement against the prevailing trend. Therefore, in this strategy, the trader waits for the price to pull back to previously broken levels temporarily. Swing trading also involves entering positions against the primary trend to capitalize on profits from such retracements.

Note: Differentiating between a retracement and a complete trend reversal requires a deep understanding of price behavior and fundamental insight into the asset being traded.

Breakout of Key Levels Strategy

This strategy focuses on identifying key price zones in higher timeframes, such as support and resistance levels or order blocks. Price reactions to these zones trigger trade entries and exits.

For example, in a downtrend, if the price hits a strong support level and breaks below it, followed by continuation patterns, a strong signal for the continuation of the bearish move is confirmed—making a short entry logical.

Key Considerations in Swing Trading

Due to the more extended holding periods in swing trades, commitment to the initial analysis and documenting the reasons behind trade entries is essential for long-term trade management.

Key Notes in Swing Trading:

- Risk-to-Reward Ratio: Given the low frequency of trades in swing trading, entering positions with a poor risk-to-reward ratio can negatively affect the account’s profitability;

- Risk and Capital Management: Since swing trades can last for days or weeks, there's a higher chance that the initial analysis becomes invalid. Thus, applying proper risk and money management is vital for such trades;

- Updating the Analysis: Traders must review and adjust their initial trade analysis after each trading day based on the latest price action and market conditions;

- Weekend Analysis: At the end of the trading week, the trader is required to assess market conditions and decide whether to keep the position open over the weekend or exit the trade.

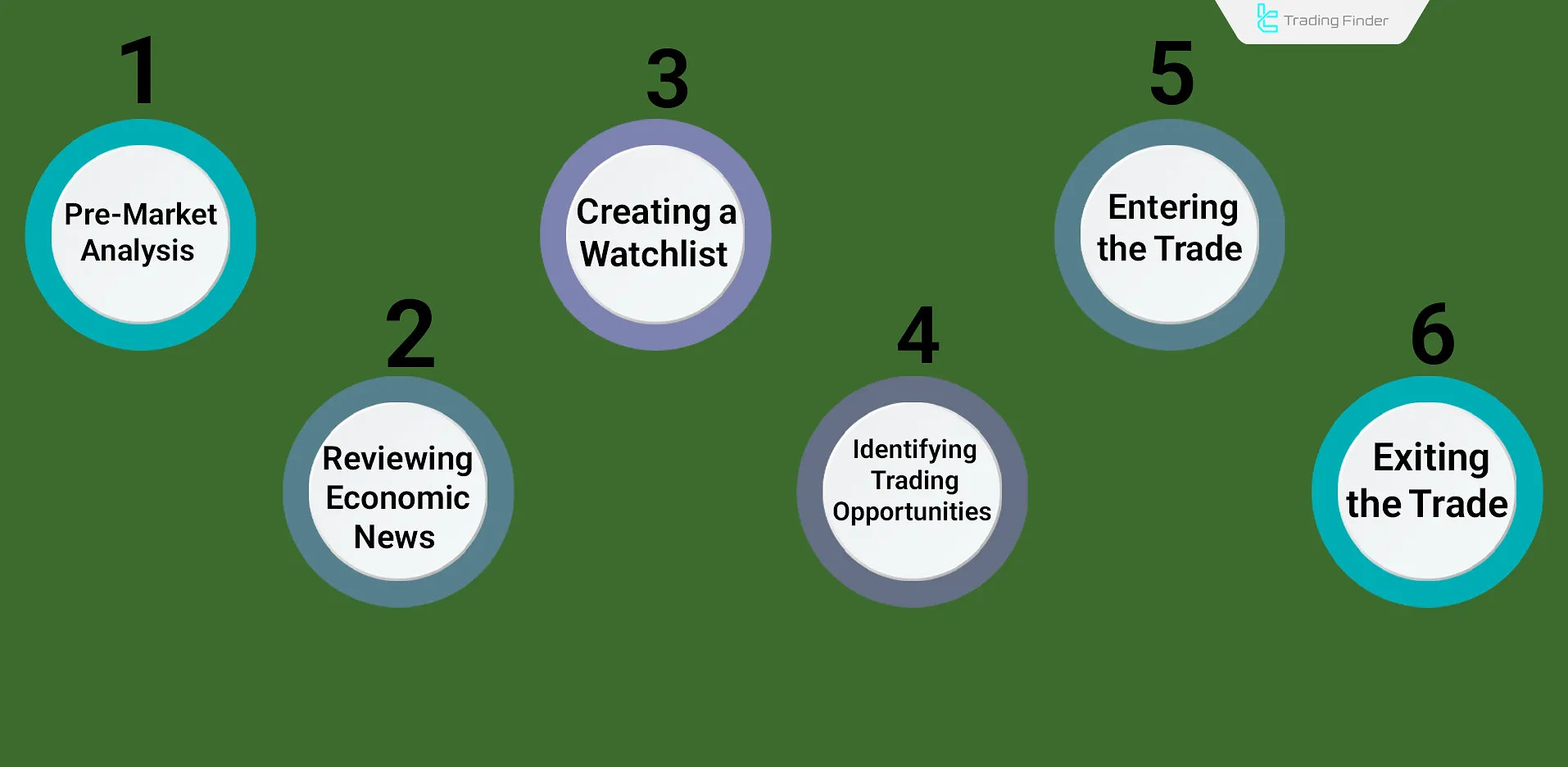

Steps to Execute a Swing Trading Strategy

To trade based on swing trading, a trader must follow a series of steps such as pre-market analysis, reviewing economic news, and more.

#1 Pre-Market Analysis

Daily price fluctuations typically start during the London session and peak during the New York session. Therefore, examining the charts before the London session begins helps traders form an initial market view, which is useful for spotting swing trade setups.

#2 Reviewing Economic News

In this step, the trader must review the latest economic data and impactful news on the selected assets using reliable news sources. As such, market sentiment is assessed before conducting any technical analysis.

#3 Creating a Watchlist

Based on the information gathered in the previous steps, a watchlist of selected assets should be created. Throughout the day, their price action and volatility will be closely monitored.

To build a watchlist and set alerts for assets in the crypto market, you can use the Market Watch tool from TradingFinder.

#4 Identifying Trading Opportunities

After preparing the watchlist, the trader defines entry criteria for trades. Based on their swing trading strategy, the rules for trade entry are outlined.

Once these criteria are clear, the trader waits for them to materialize on the chart.

#5 Entering the Trade

Once sufficient entry signals are present, final factors such as risk-to-reward ratio, take-profit and stop-loss zones, etc., are reviewed. If the risk-to-reward is favorable, the trader proceeds to enter the trade, applying sound money management and placing TP and SL orders accordingly.

#6 Exiting the Trade

There are two ways to exit a swing trade:

- Manual Exit: In this method, the trader evaluates the market and update its analysis. If justified, the trade may be exited manually before the TP or SL orders are triggered;

- Exit via TP or SL Orders: This occurs when the price strongly moves in either direction, aligning with or against the initial analysis. In this case, either the TP or SL order is triggered, and the trade is exited accordingly.

Comparison Between Swing Trading and Day Trading

These two trading styles differ across multiple factors, including duration, target volatility, required expertise, and more. Therefore, when choosing between them, traders should consider their circumstances and trading personality. Below is a detailed comparison:

Criteria | Swing Trading | Day Trading |

Trade Duration | Between 2 days to 1 month | All trades are closed by the end of the trading day |

Analysis Style | Combination of technical and fundamental analysis | Primarily technical analysis |

Best Suited For | Beginners and less experienced traders | Professional traders with high expertise |

Timeframe | 1-hour charts and higher | Timeframes below 1 hour |

Analysis and Monitoring Requirements | No need for constant monitoring or real-time chart analysis | Requires constant trade monitoring and chart updates |

Target Price Movement | Profiting from a full market trend | Profiting from short-term price fluctuations |

Technical Analysis Tools Suitable for Swing Trading

In swing trading, a variety of technical analysis tools—such as indicators and price action concepts—can enhance the success rate of trades. Therefore, understanding the most commonly used tools is essential for those beginning with swing trading.

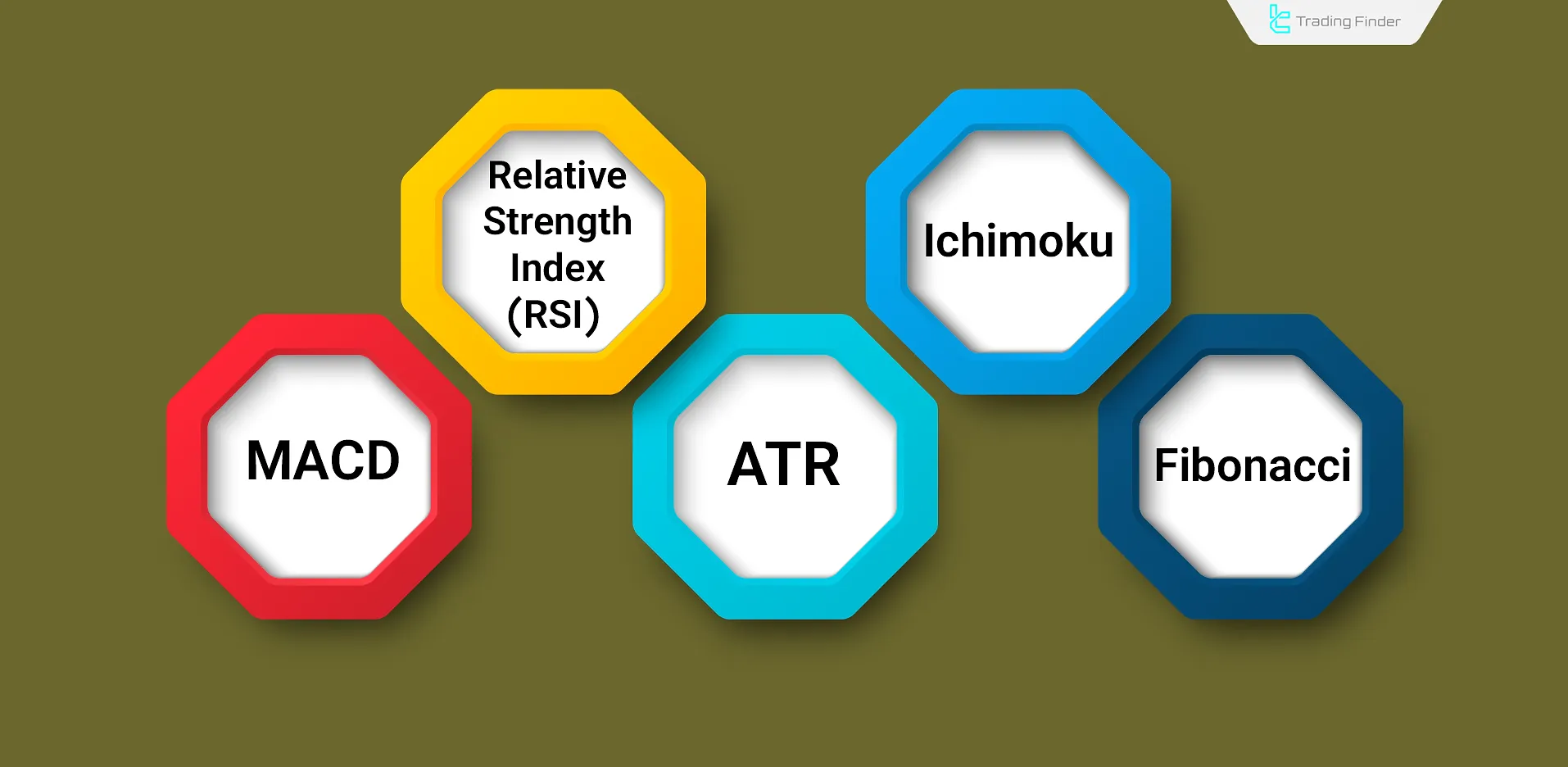

Indicators for Swing Trading

Utilizing technical indicators like MACD, Relative Strength Index (RSI), and others helps traders gain a clearer view of price momentum and facilitates more effective analysis.

Common Indicators for Swing Trading:

- MACD (Moving Average Convergence Divergence)

- RSI (Relative Strength Index)

- ATR (Average True Range)

- Ichimoku

- Fibonacci

Price Action Concepts for Swing Trading

In swing trading, price action methods such as classic patterns,candlestick formations, support and resistance zones, and others are used to confirm price analysis and entry signals.

Key Price Action Concepts:

- Classic Patterns

- Candlestick Patterns

- Support and Resistance

- Old Highs and Lows

- Trends

Conclusion

Swing trading is a trading style where the trader targets an entire price trend to generate profits. As a result, trades in this style typically last more than 2 days and may extend up to a month.

Price behavior in swing trading is analyzed using a combination of technical and fundamental analysis, with higher timeframes (above 1 hour) being commonly employed. Therefore, updating the analysis, reviewing news, and monitoring economic data during the trade are essential.

Swing trading requires less screen time compared to day trading and is more suitable for individuals who do not have time to manage trades in real time.