HTX (formerly Huobi) delivers a comprehensive suite of crypto trading services, featuring TradingView integration, automated bots, API access, P2P and OTC trading, launchpad access, NFT marketplace, and referral rewards, tailored to support both retail and institutional cryptocurrency investors worldwide.

HTX, formerly known as Huobi, the 10th largest crypto exchange in the world based on CoinMarketCap's data. Its total assets reach over $4B, with +47M registered users.

The maximum spot trading commission (maker) is 0.2%, which can be decreased to 0.0126% by leveling up in the related system.

Company Specifics & Regulation

HTX, established in 2013, has a rich history in the cryptocurrency industry. Originally founded in Beijing, China, by Jun Du and Leon Li, the company has since expanded its operations globally and is currently headquartered in Seychelles.

Here's a quick overview of HTX's company in numbers and its regulatory status:

- Total Assets: More than $4B

- Daily Trading Volume: Over $4 billion

- Registered Users: +47M

The crypto exchange was previously branded Huobi, but it was rebranded to HTX in September 2022 (to mark its 10th anniversary).

It is actively working to align with the EU’s Markets in Crypto-Assets (MiCA) regulation.

HTX CEO

Leon Li, a Tsinghua University graduate and former Oracle engineer, founded Huobi Group in 2013, transforming it into one of the world’s leading digital asset financial service providers.

- Founder & CEO of Huobi Group (2013)

- Graduated from Tsinghua University, Department of Automation

- Background as a computer engineer at Oracle

- Early pioneer and serial fintech entrepreneur

- Global leader in digital asset financial services

Key Specifics and Features

Here's a summary of the key features that make HTX what it is:

Exchange | HTX |

Launch Date | 2013 |

Levels | L1 Basic Permissions, L2 Basic Verification, L3 Advanced Verification |

Trading Fees | From 0.2% |

Restricted Countries | Mainland China, Hong Kong, China, United States of America, Singapore, Cuba, Iran, North Korea, Sudan, Syria, Venezuela |

Supported Coins | Over 700 |

Futures Trading | Yes |

Minimum Deposit | 1 USDT |

Deposit Methods | Cryptocurrency Transactions |

Withdrawal Methods | Cryptocurrency Transactions |

Maximum Leverage | 200x |

Minimum Trade Amount | Not Specified |

Security Factors | Multi-factor Authentication, Proof of Reserves, Multi-tier Storage System |

Services | Copy Trading, Staking Options, Shark Fin, Dual Investment |

Customer Support Ways | Live Chat, Email |

Customer Support Hours | 24/7 |

Fiat Deposit | No |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | HTX |

Advantages and Disadvantages of HTX's Services

Learning about the benefits of a crypto exchange is helpful, but we should also know about the drawbacks to get a balanced image. Pros and Cons of Trading With HTX:

Advantages | Disadvantages |

More Than 700 Cryptocurrencies | Restricted in Some Countries |

Diverse Trading Options with Advanced Services | No Fiat Deposits |

Passive Income Opportunities | - |

User Levels & Verification Model

Based on our investigations of the website and official sources related to the exchange, there are three levels for verification on the platform, which differ in terms of withdrawal limit. User Levels on HTX:

User Level | Withdrawal Amount Limit in 24 Hours (BTC) |

L1 Basic Permissions | 5 |

L2 Basic Verification | 200 |

L3 Advanced Verification | 3,000 |

Exchange Commissions and Trading Costs

Knowing about the fees and commissions is crucial for any trader. HTX offers a decent fee structure, particularly for high-volume traders and HTX & TRX token holders. To be precise, the fee varies based on the amount of trading volume. Here's the table for spot fees:

Level | 30-Day Spot Trading Volume (USDT) | or | Previous Day Total Assets (UDST) | Spot Fee (Maker) | Spot Fee (Taker) |

Prime0 | Less Than 10,000 | / | Less Than 2,000 | 0.2% | 0.2% |

Prime1 | More Than or Equal to 10,000 | / | More Than or Equal to 2,000 | 0.16% | 0.17% |

Prime2 | More Than or Equal to 80,000 | / | More Than or Equal to 10,000 | 0.14% | 0.15% |

Prime3 | More Than or Equal to 500,000 | / | More Than or Equal to 30,000 | 0.10% | 0.1% |

Prime4 | More Than or Equal to 3,000,000 | / | More Than or Equal to 50,000 | 0.08% | 0.1% |

Prime5 | More Than or Equal to 9,000,000 | / | More Than or Equal to 80,000 | 0.065% | 0.09% |

Prime6 | More Than or Equal to 15,000,000 | / | More Than or Equal to 100,000 | 0.055% | 0.07% |

Prime7 | More Than or Equal to 30,000,000 | / | More Than or Equal to 300,000 | 0.045% | 0.055% |

Prime8 | More Than or Equal to 120,000,000 | / | More Than or Equal to 500,000 | 0.032% | 0.0388% |

Prime9 | More Than or Equal to 300,000,000 | / | More Than or Equal to 2,000,000 | 0.0224% | 0.0318% |

Prime10 | More Than or Equal to 900,000,000 | / | - | 0.0168% | 0.0268% |

Prime11 | More Than or Equal to 1,800,000,000 | / | - | 0.0126% | 0.0218% |

You can see the fees for futures trading in the table below:

Level | USDT-M (maker) | USDT-M (taker) | Coin-M (Maker) | Coin-M (taker) |

Prime0 | 0.02% | 0.06% | 0.02% | 0.05% |

Prime1 | 0.018% | 0.055% | 0.015% | 0.045% |

Prime2 | 0.016% | 0.05% | 0.012% | 0.045% |

Prime3 | 0.014% | 0.045% | 0.009% | 0.042% |

Prime4 | 0.01% | 0.04% | 0.006% | 0.04% |

Prime5 | 0.005% | 0.03% | 0.003% | 0.036% |

Prime6 | 0.004% | 0.0295% | 0.0% | 0.035% |

Prime7 | 0.003% | 0.0285% | -0.002% | 0.033% |

Prime8 | 0.002% | 0.28% | -0.003% | 0.032% |

Prime9 | 0.0% | 0.0275% | -0.004% | 0.03% |

Prime10 | -0.005% | 0.265% | -0.005% | 0.0285% |

Prime11 | -0.01% | 0.025% | -0.008% | 0.027% |

The trader earns a discount on trading fees with HTX and TRX deductions. The exchange does not charge any commissions on deposits and withdrawals. Also, there are no hidden fees.

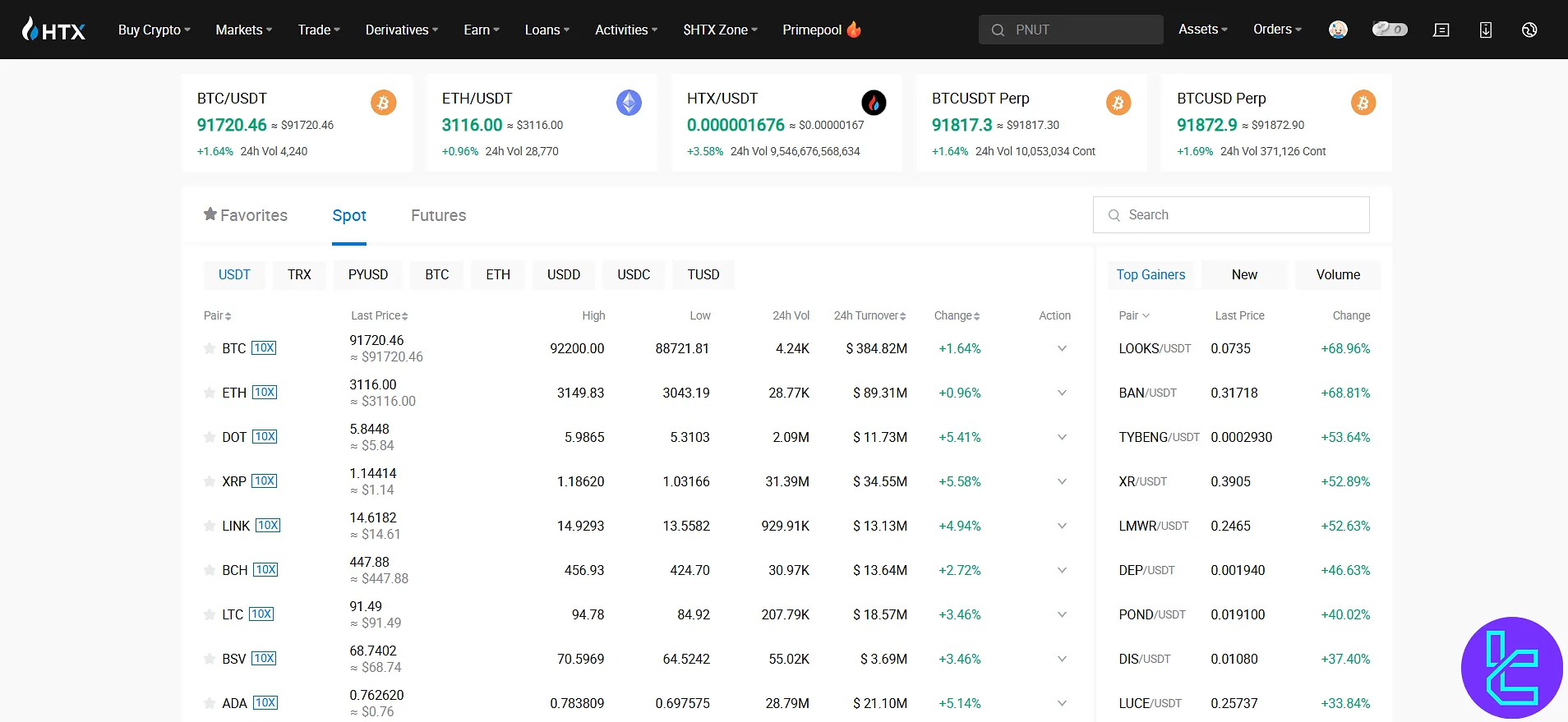

Tradable Digital Assets

HTX boasts an impressive array of over 700virtual cryptocurrencies and tokens available for trading, catering to diverse investor preferences. The asset categories include:

- DeFi

- GameFi

- Metaverse

- Memecoins

- AI

- Payments

- And so on

In addition to individual asset variety, the exchange supports more than 1,000 trading pairs, allowing for flexible trading strategies, cross-asset swaps, and high liquidity conditions.

HTX also facilitates fiat on-ramping in major global currencies, including USD, EUR, and GBP, enhancing accessibility for a broad user base.

Futures And Margin Trading Options

The broker provides attractive futures and margin trading options for users looking to leverage their positions. The platform offers several types of cryptocurrency derivative products:

- USDT-margined Contracts:

- Perpetual and quarterly delivery futures contracts settled in USDT

- Leverage up to 200x available

- Coin-margined Contracts:

- Perpetual futures contracts settled in the underlying cryptocurrency (e.g., BTC, ETH)

- Also offers leveraged trading

- Options:

- Both European and American-style options available

- Allows users to multiply their crypto asset holdings

These derivative products provide traders with the opportunity to potentially earn outsized returns from cryptocurrency price movements.

However, it's crucial to note that leveraged trading carries significant risks and is suitable only for experienced traders who understand and can manage these risks effectively.

Sign Up and Verification Tutorial

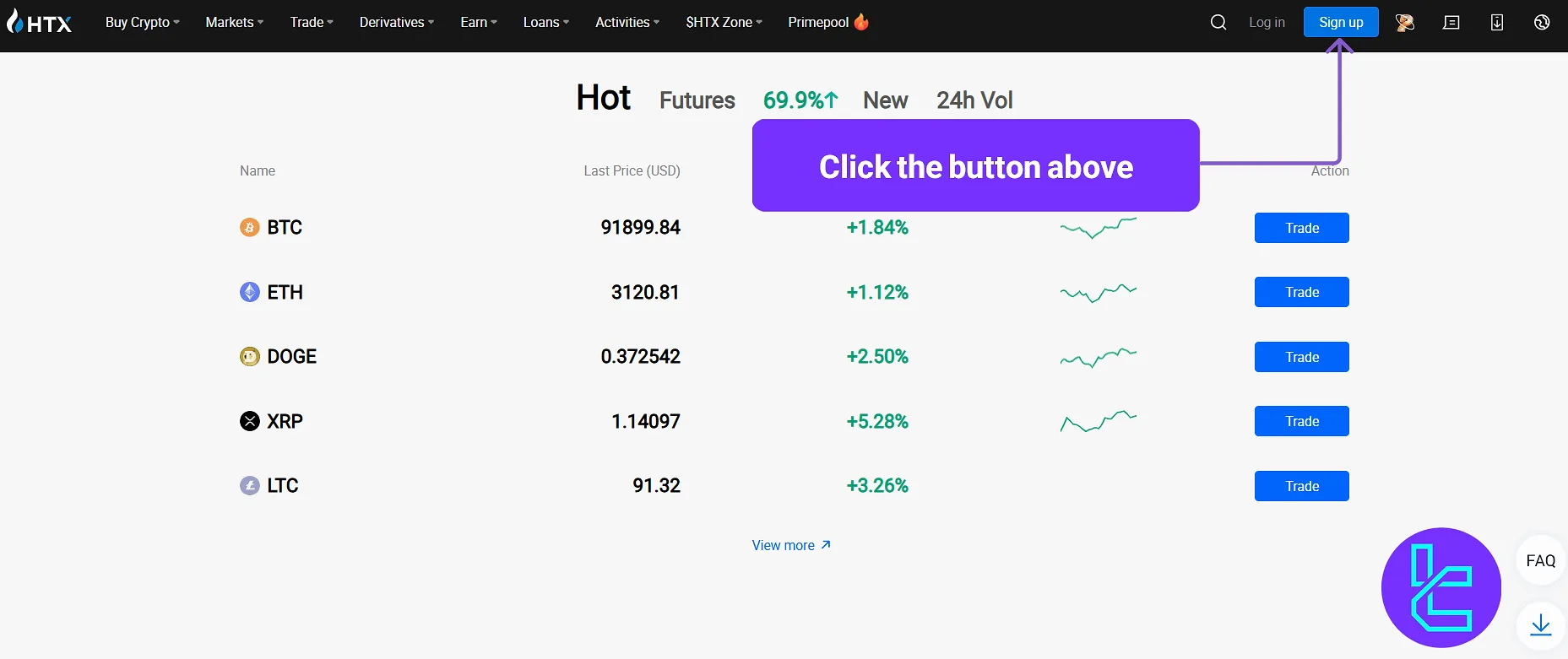

To start trading on HTX Exchange, users need to complete a registration process that takes a few minutes. For withdrawals, you need to provide your identity documents. Here are the steps to HTX registration:

#1 Visit the HTX Official Website

To get started, visit the official website of the exchange you're interested in. Look for the "Sign Up" button on the homepage and click on it to begin the registration process.

Click the designated button on the screenshot to sign up

Click the designated button on the screenshot to sign up

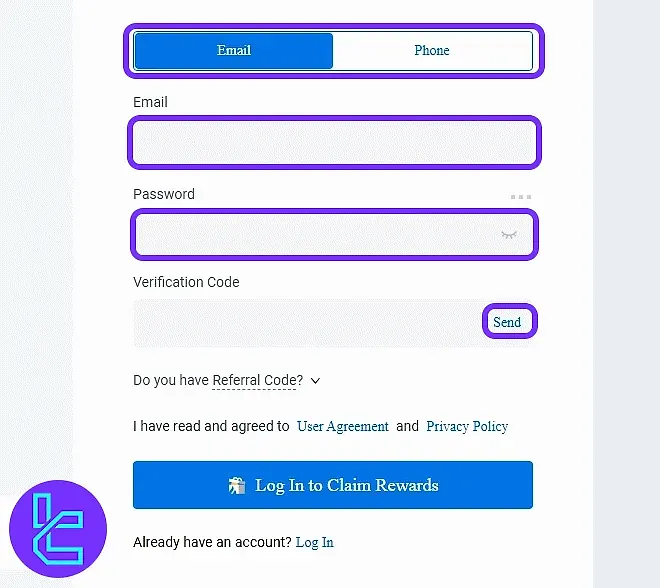

#2 Provide Your Email Address or Phone Number for HTX

Next, you will be prompted to provide youremail address or phone number. Some exchanges also offer the option to use your Google, Apple, or Telegram account for faster registration. Choose the method that is most convenient for you.

Finally, you'll be asked to create a strong password. Make sure to choose a password that meets the exchange’s required conditions, such as a mix of uppercase and lowercase letters, numbers, and special characters.

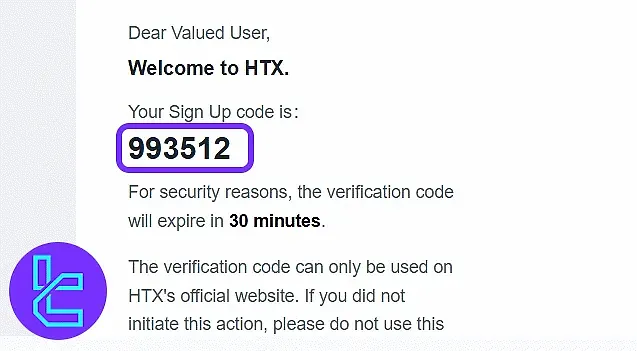

#3 Verify Your Email or Phone Number on HTX

Once you've provided your contact information, the exchange will send averification code to your email address or phone number. Enter the code you received to verify your contact details and proceed with the registration.

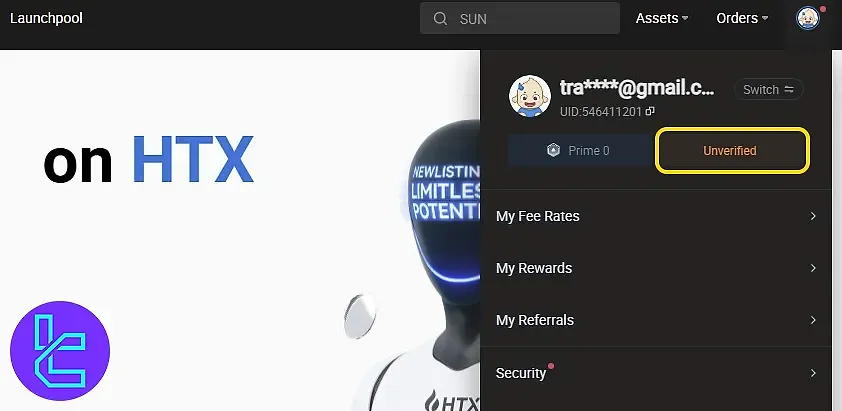

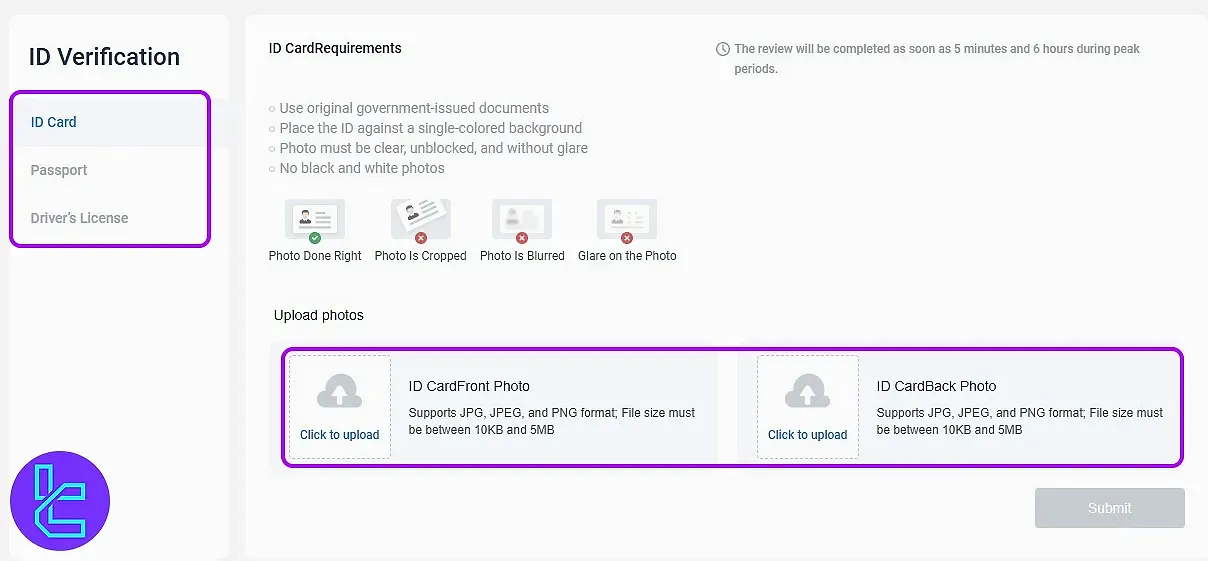

#4 Access the KYC Section

Log in, click the avatar, and select "Unverified". Choose "Personal" or "Institutional" verification. Four levels exist, from 5 BTC/day (Level 1) up to 3,000 BTC/day + fiat trading (Level 4).

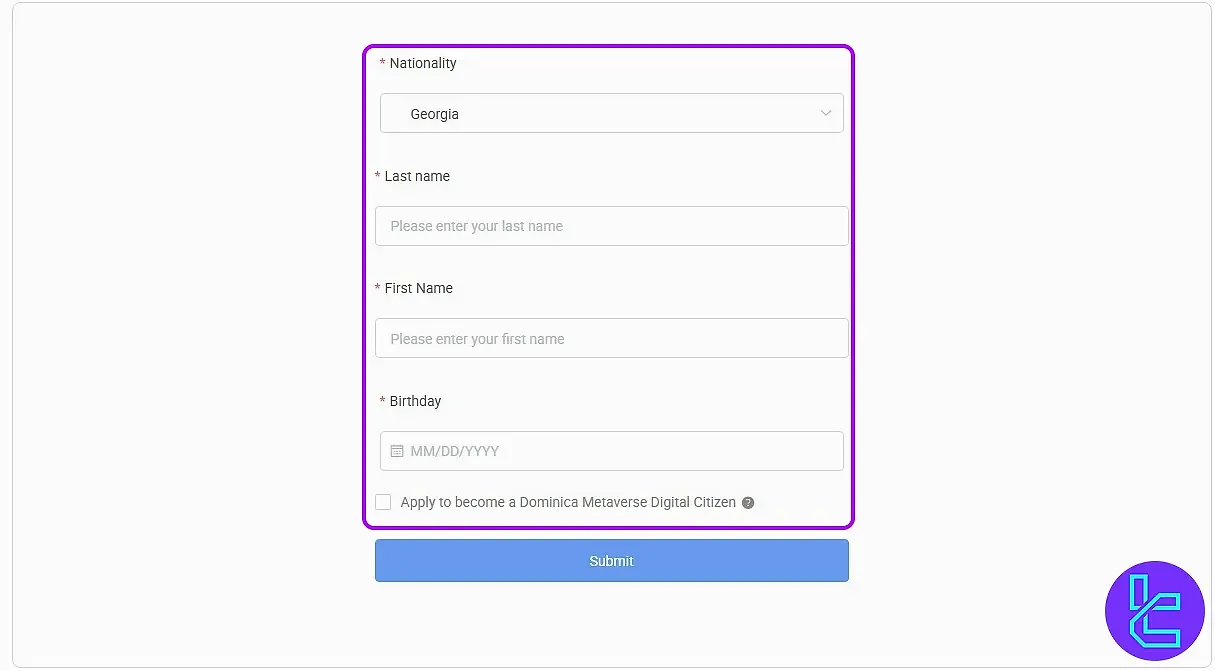

#5 Submit Basic Information

Provide the following information:

- Nationality

- Full name

- Date of birth

You may also opt for the Dominica Metaverse Digital ID, launched with Tron and DMC Labs.

#6 Upload ID Documents

Upload a valid identity document, such as:

- Passport

- Driver’s license

- National ID card

Ensure images are clear and complete.

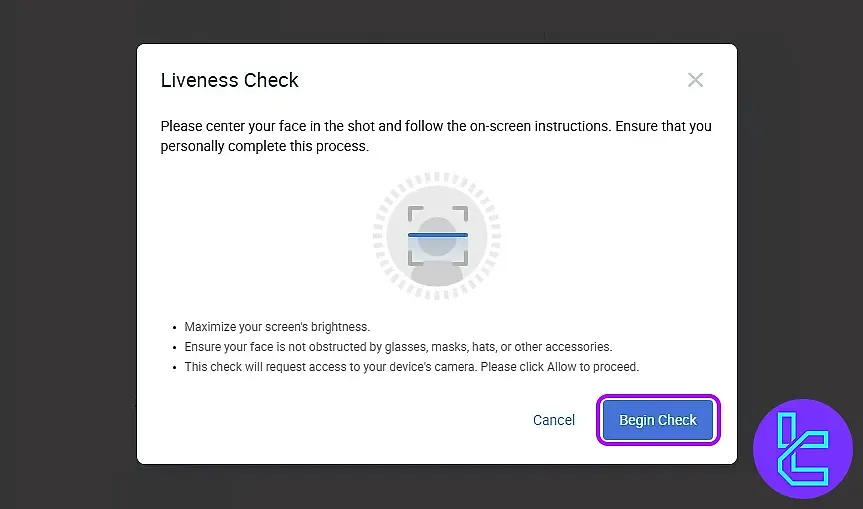

#7 Complete Facial Recognition

Enable your camera, align your face, and finish biometric verification to upgrade to Level 3.

#8 Provide Financial & Address Details

Enter employment, income, source of funds, and trading experience. Then upload a proof of residence, including:

- Utility bill

- Bank statement

How to Trade Spot on HTX

Trading spot on the HTX Exchange enables direct buying and selling of cryptocurrencies at competitive market prices. Follow these steps to start trading efficiently.

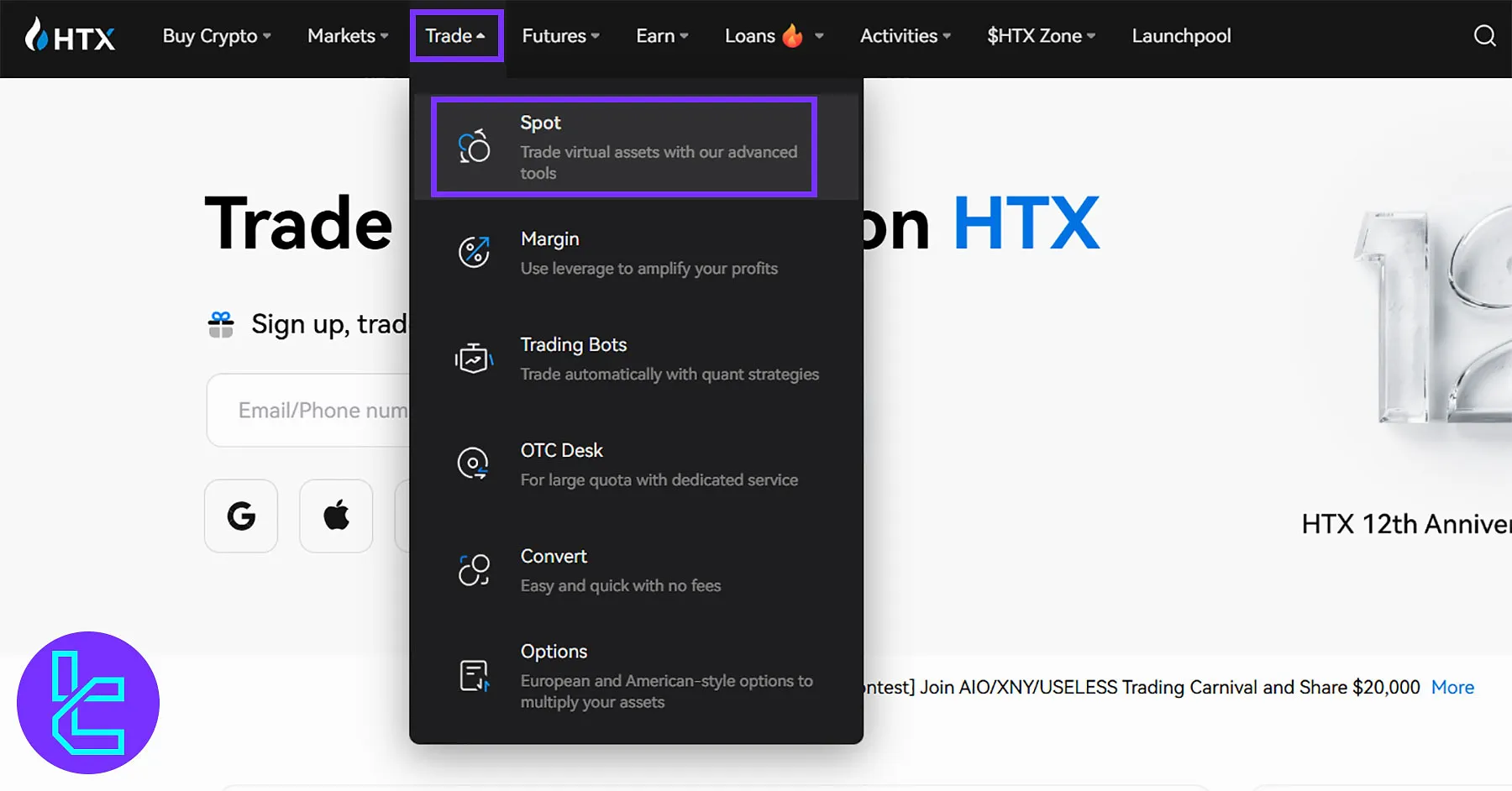

#1 Log in and Access the Spot Market

Sign in to your HTX account, from the "Trade" menu, select "Spot" market to reach the trading interface.

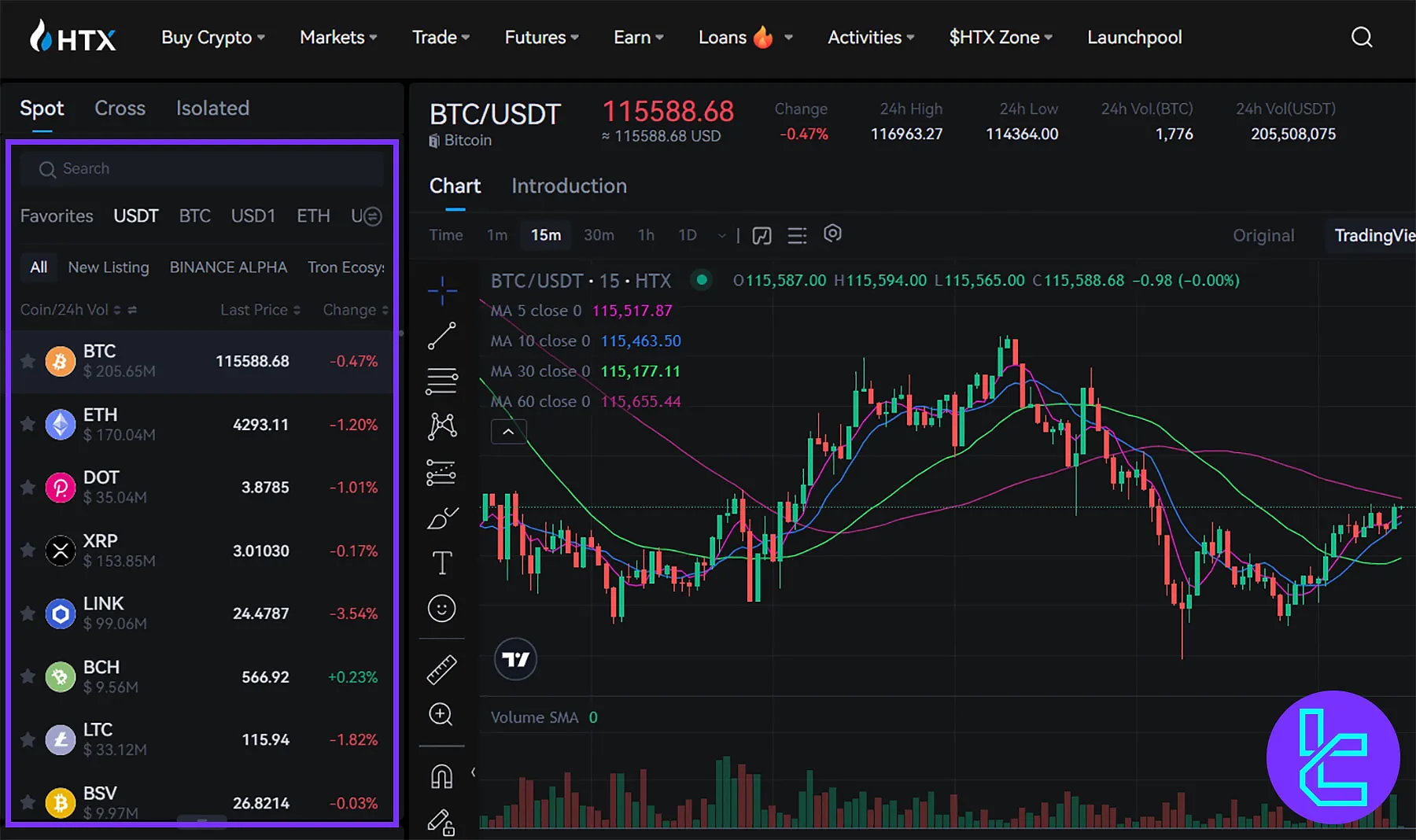

#2 Select Asset and Review Market Data

Use the search bar to find your preferred asset, like Bitcoin, and choose the market (e.g., USDT, USD1, ETH, etc.). You can utilize HTX’s charts and analytics tools to study price trends, volumes, and liquidity before placing a trade.

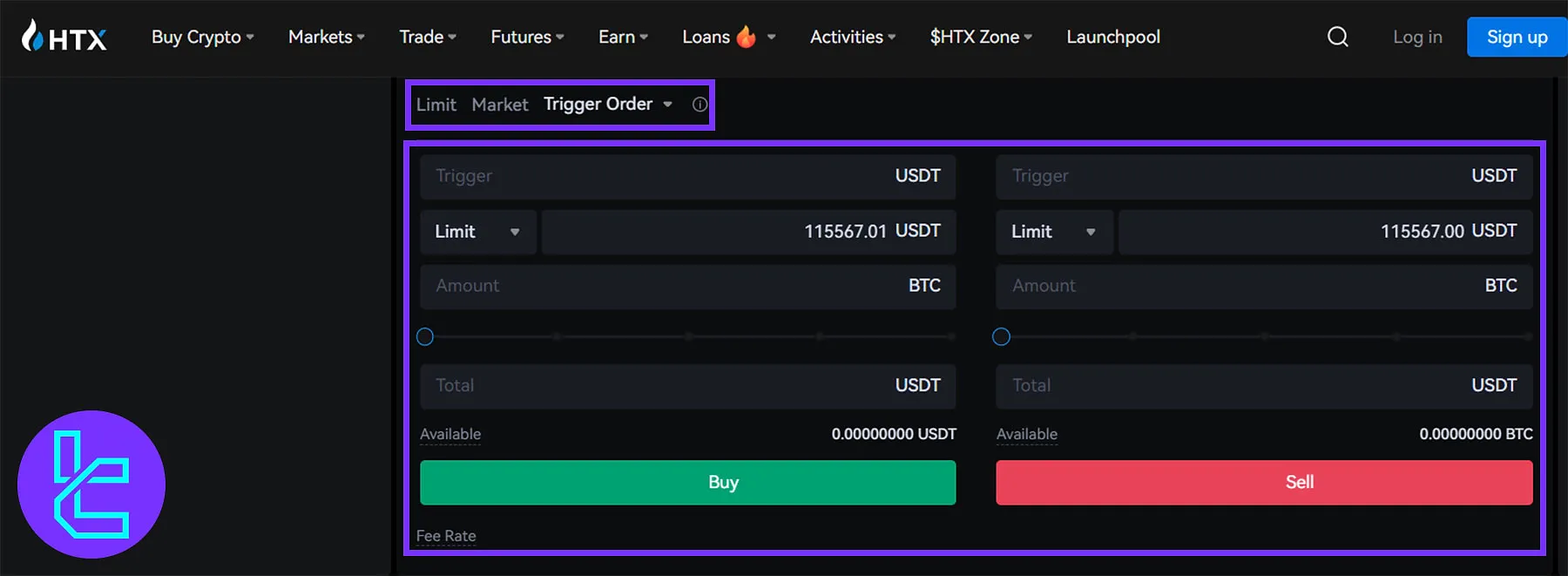

#3 Select Order Type

HTX offers flexible order types tailored to different strategies:

- Market Order: Executes instantly at the current market price;

- Limit Order: Executes at your chosen price or better;

- Post Only: Ensures your trade adds liquidity; canceled if it would match immediately;

- TP/SL Order: Executes once the trigger price is hit, ensuring controlled profit-taking or loss-limiting;

- Trigger Order: Executes at market or set price when trigger is reached; doesn’t freeze funds.

#4 Enter Trade Details

Set the quantity to trade and use quick options (25%, 50%, 75%, 100%) for faster order placement.

#5 Confirm and Execute the Trade

Check order details carefully. Click "Buy" or "Sell". Orders execute instantly (market) or rest in the order book (limit/others).

#6 Manage Portfolio and Withdraw Funds

Monitor balances, review trade history, and withdraw crypto or stablecoins securely from HTX to your external wallet.

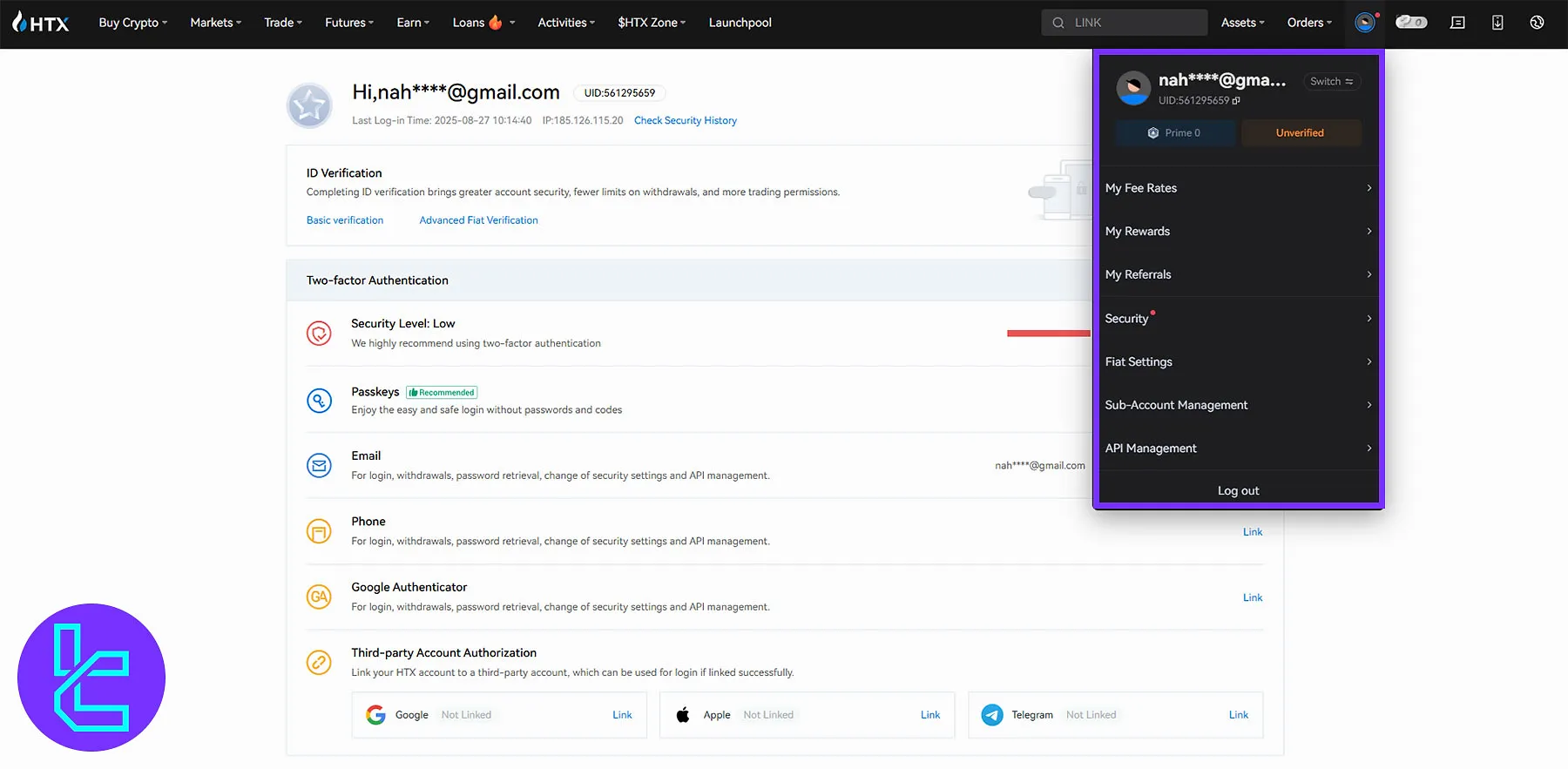

HTX Client Dashboard

The HTX Client Dashboard provides traders with a comprehensive interface to manage accounts, track rewards, optimize fees, and strengthen security.

With intuitive navigation across multiple sections, it ensures a seamless trading experience supported by advanced tools and customizable features.

HTX Account Settings

The Account Settings tab centralizes all profile management functions, including ID verification, password settings, and two-factor authentication. Traders can enhance their account security while personalizing their experience.

- Complete basic or advanced ID verification for higher limits;

- Enable two-factor authentication via email, phone, or Google Authenticator;

- Manage linked accounts with third-party authorizations (Google, Apple, Telegram).

HTX Fee Rates

The "My Fee Rates" section provides insights into fee structures and discounts. HTX offers competitive maker/taker fees with additional reductions through token deductions and VIP level upgrades.

- Maker/Taker fees starting from 0.02% for spot and futures

- Discounts available with HTX and TRX tokens

- Tiered benefits through Prime loyalty levels

HTX My Rewards

The tab is a hub for bonuses, coupons, and promotional credits. Traders can claim and track their earned benefits from trading activities, campaigns, and referrals.

- Earn rewards from trading competitions and deposit tasks;

- Track active, expired, or used bonuses in one place;

- Boost earnings with APR boosters and airdrops.

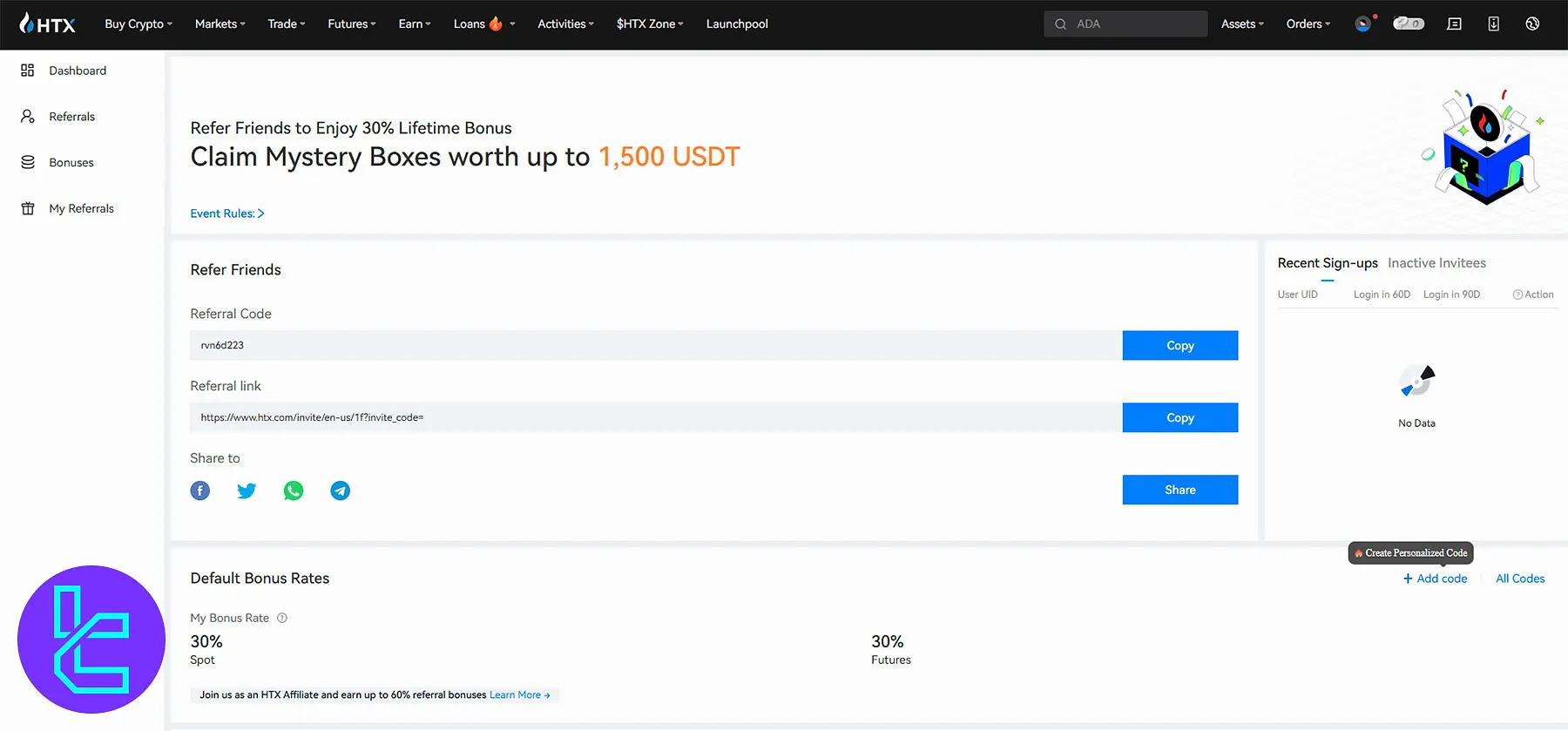

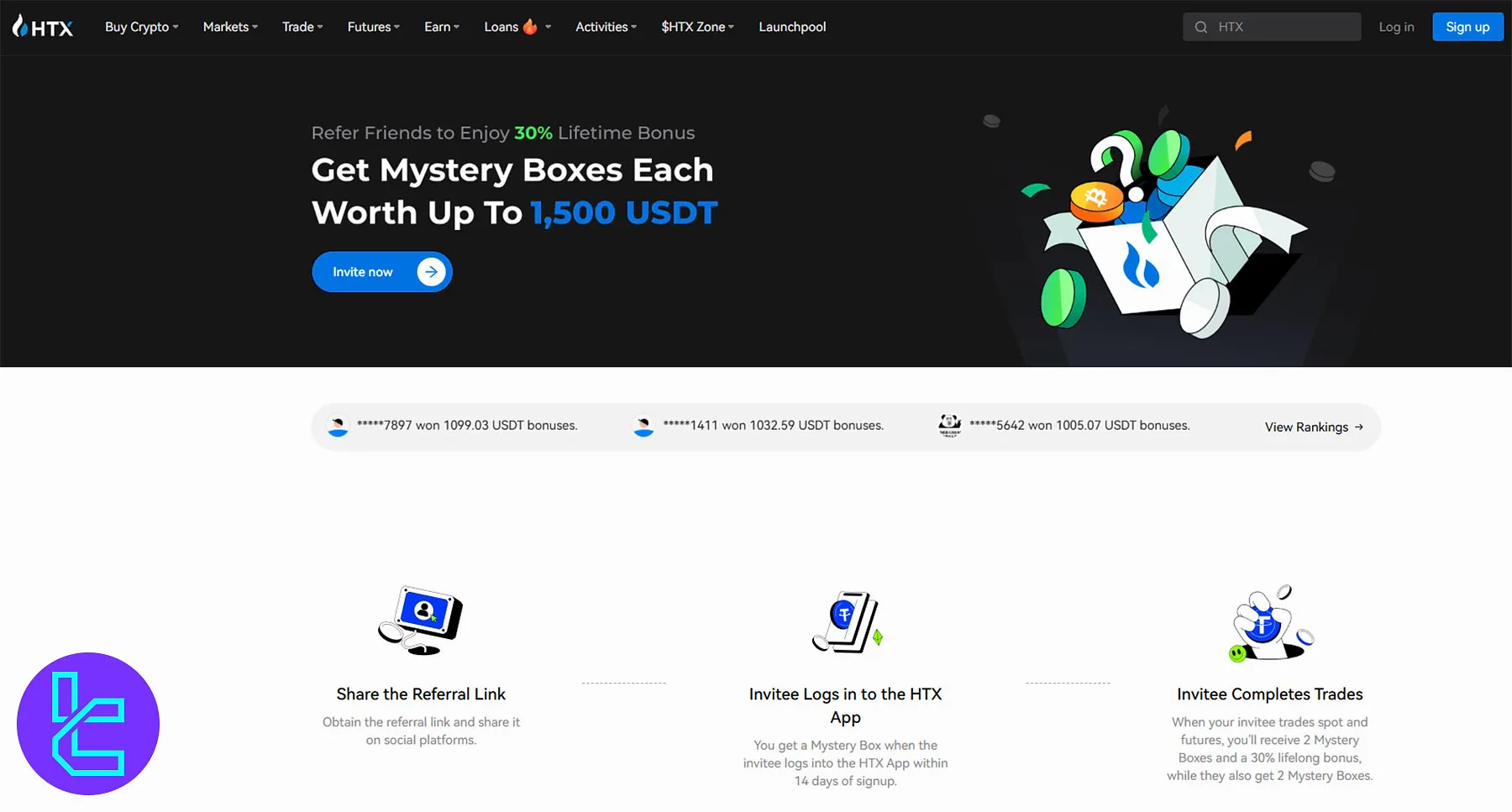

HTX My Referrals

The section allows users to earn by inviting friends. With generous commissions and mystery box rewards, it’s a strong incentive program for community growth.

- Up to 30% commission from referees’ trades

- Mystery box rewards worth up to 1,500 USDT

- Easy sharing with referral links and codes

Access the HTX dashboard to manage your referrals

Access the HTX dashboard to manage your referrals

HTX Security

The "Security" tab focuses on protecting user accounts through advanced verification and authentication settings. Traders can safeguard their funds with multiple protective layers.

- Set up login and trading passwords;

- Enable anti-phishing codes for email protection;

- Add emergency contact and beneficiary settings.

HTX Fiat Settings

The "Fiat Settings" tab provides users with options to manage currency preferences and streamline fiat deposits/withdrawals.

- Select the default fiat currency for portfolio display;

- Configure deposit and withdrawal preferences;

- Manage linked payment channels securely.

HTX Sub-Account Management

The Sub-account Management section is designed for institutions and professional traders managing multiple portfolios. It provides flexible control over subordinate accounts.

- Create and manage multiple sub-accounts;

- Assign roles and permissions for each;

- Track equity, performance, and API usage individually.

HTX API Management

The API Management tab enables automated trading through secure API keys. HTX ensures flexibility with robust integration options.

- Create up to 20 API keys per account;

- Restrict keys with IP binding for security;

- Enable market data queries, trading, and withdrawals.

Platforms and Software

HTX offers a proprietary trading platform application that provides users with a comprehensive suite of tools for managing their digital asset portfolios.

The platform supports multiple languages and currencies, making it accessible to a global user base. You can access the app in these ways:

Advanced traders benefit from robust API access for algorithmic strategies, while casual users can operate comfortably via intuitive web, desktop, or mobile interfaces (iOS/Android).

HTX’s multilingual interface and extensive feature set position it as a versatile platform for global crypto participants, regardless of experience level.

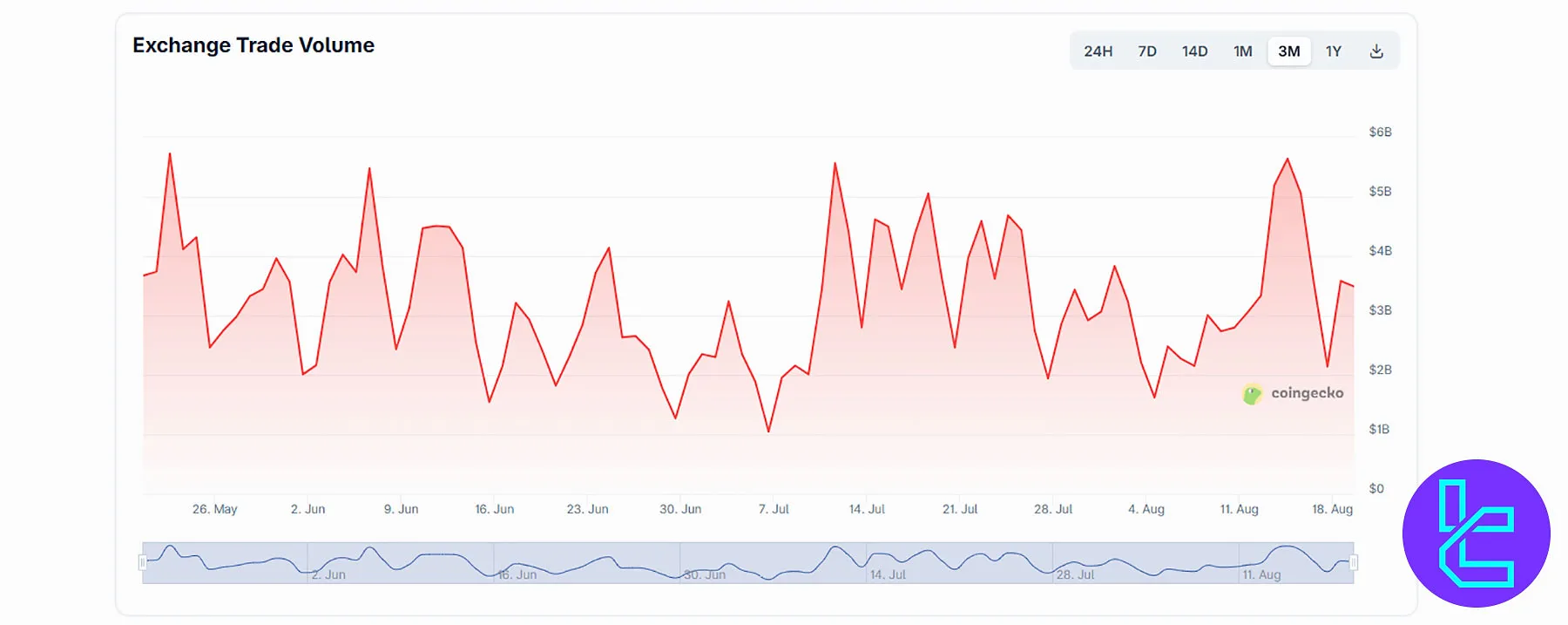

HTX Trade Volume

HTX (formerly Huobi) recorded three-month trading volumes fluctuating between $1B and $6B daily, showing strong market presence.

Peaks in July and mid-August 2025 highlight intensified investor activity, reflecting the exchange’s global liquidity and consistent dominance in cryptocurrency trading.

- Daily Range: $1B–$6B in trade volume

- July Surge: Spikes near $5B during mid-July

- August High: Volume exceeded $5B mid-August

- Consistent Liquidity: Rarely dropped below $1B

- Strong Engagement: Volatility reflects high investor participation

HTX Services

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

| No | |

Launchpad | Yes |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX | No |

Auto-Invest (Recurring Buy) | No |

Is HTX Exchange Safe and Secure Enough?

The exchange has taken measures to keep up the safety and security of user funds and data on its platform. Here's an overview:

- Proof of reserves at a minimum ratio of 1:1 with transparency and regular reports;

- Multi-tier storage system made of hot, warm, and multi-party offline wallets, with +90% of funds stored in cold storage;

- Account security features, such as multi-factor authentication, alerts for unusual activities, and more.

While these security measures are robust, it's important to remember that no exchange is completely immune to risks.

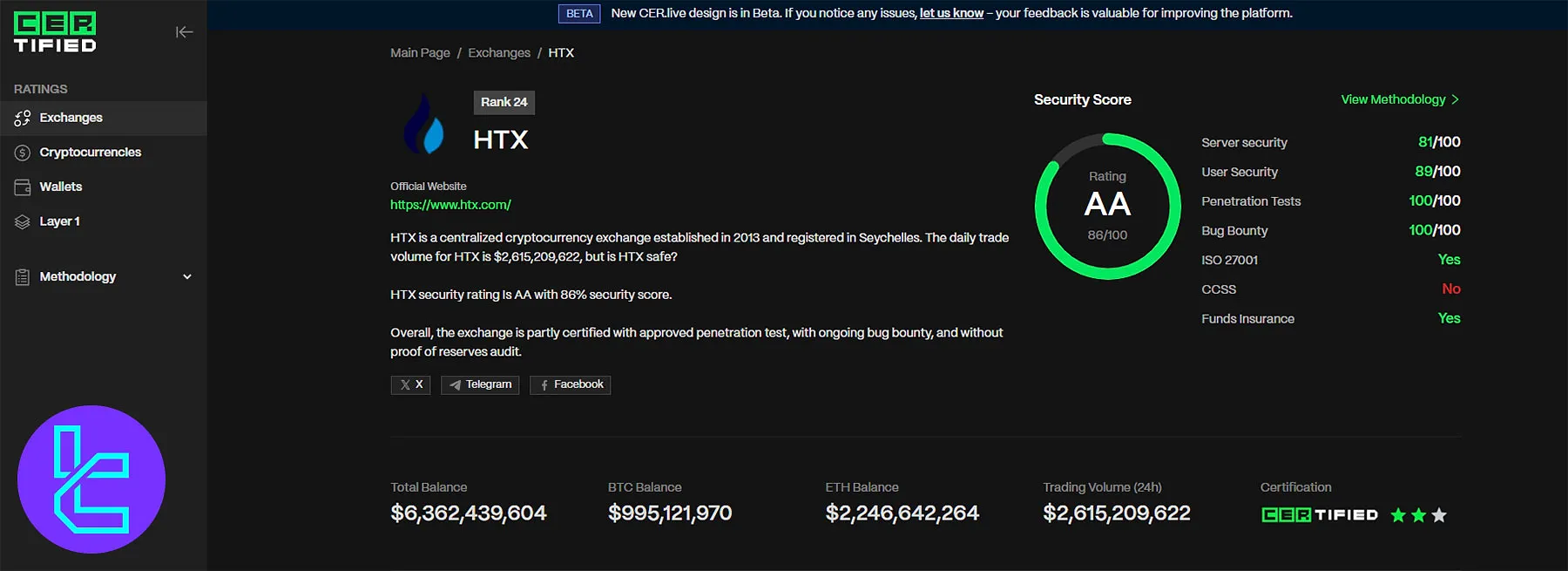

HTX Security Rankings

The exchange maintains strong security standings with an 86/100 AA rating on CER.live. The HTX CertiK Skynet profile also scores an 84.40 rating, supported by penetration tests, bug bounty programs, and ISO 27001 compliance.

HTX security rankings on the CER.live website

HTX security rankings on the CER.live website

However, missing proof-of-reserves and CCSS certification highlight areas for further improvement.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 84.40% (A) |

Operational | 92.40% | |

Market | 92.31% | |

Cybersecurity | 83.21% | |

Fundamental | 70.87% | |

Listing Security | 87.39% | |

Community | 80.13% | |

CER.live Security Score | Overall Score | 86% (AA) |

Server Security | 81% | |

User Security | 89% | |

Penetration Tests | 100% | |

Bug Bounty | 100% | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

Deposit and Withdrawal Options

Some crypto platforms provide methods for fiat deposits and withdrawals; However, HTX does not follow the rule. To be precise, HTX deposits and withdrawals are only made via digital assets through crypto wallet transactions.

There's an option for buying crypto directly with fiat currencies on the platform, though.

How to Deposit Tokens on HTX

HTX supports multiple networks and tokens, allowing users to fund their accounts securely with the correct chain and address. To deposit tokens, generate your deposit address directly from the HTX dashboard.

- Go to the "Balances" menu and select "Deposit";

- Select the token you wish to deposit and choose its supported chain;

- Copy or scan the QR code address;

- Provide the address to the sender for transfer;

- Once processed, confirm the transaction with the transfer ID and check your balance.

How to Select the Right Chain for HTX Deposits

Choosing the correct network ensures your assets arrive safely. Here's what you need to know:

- Tokens may support multiple chains (HECO, ERC20, TRC20, OMNI);

- Always match the chain supported by both inbound and outbound platforms;

- Different chains may display different deposit addresses and fees;

- Not all tokens support all chain types; verify availability on the deposit interface.

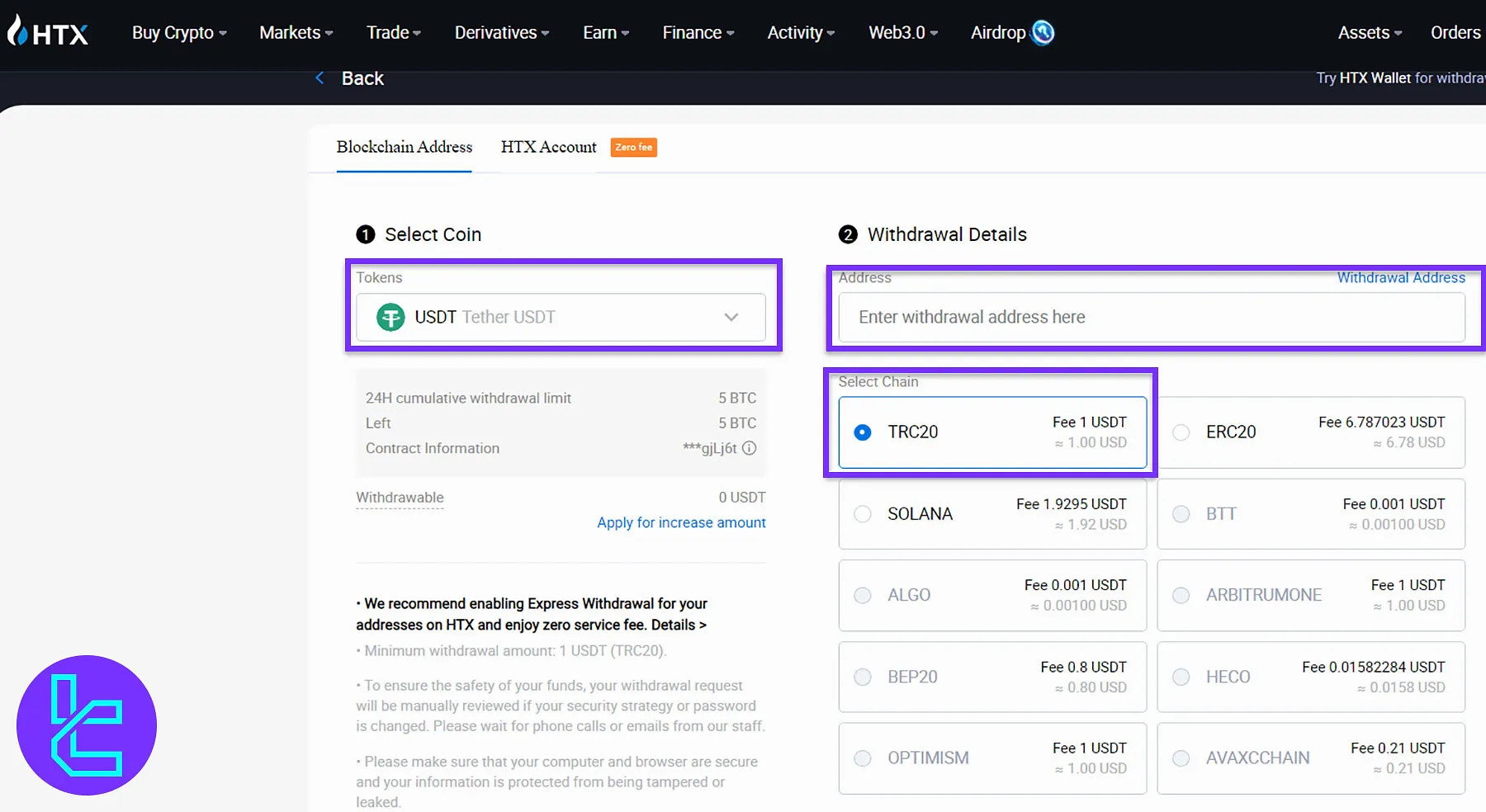

How to Withdraw from HTX

HTX allows users to securely withdraw cryptocurrencies by selecting the correct chain and completing two-factor authentication.

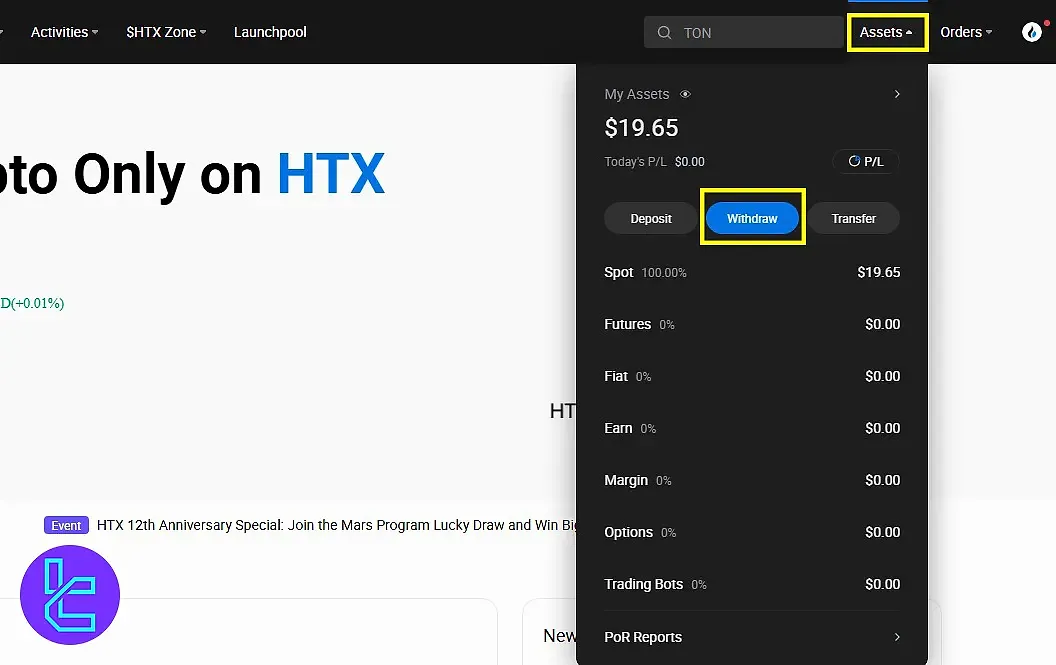

#1 Access the Withdrawal Page

Start by logging in to your HTX account.

- Click "Balances", choose the token (e.g., USDT), then click "Withdraw";

- Ensure you select theright chain (OMNI, ERC20, TRC20, etc.).

#2 Enter Withdrawal Details

Provide accurate withdrawal information before proceeding.

- Enter the withdrawal address from your destination wallet/exchange;

- Input the amount to withdraw;

- Double-check the address and chain to prevent asset loss.

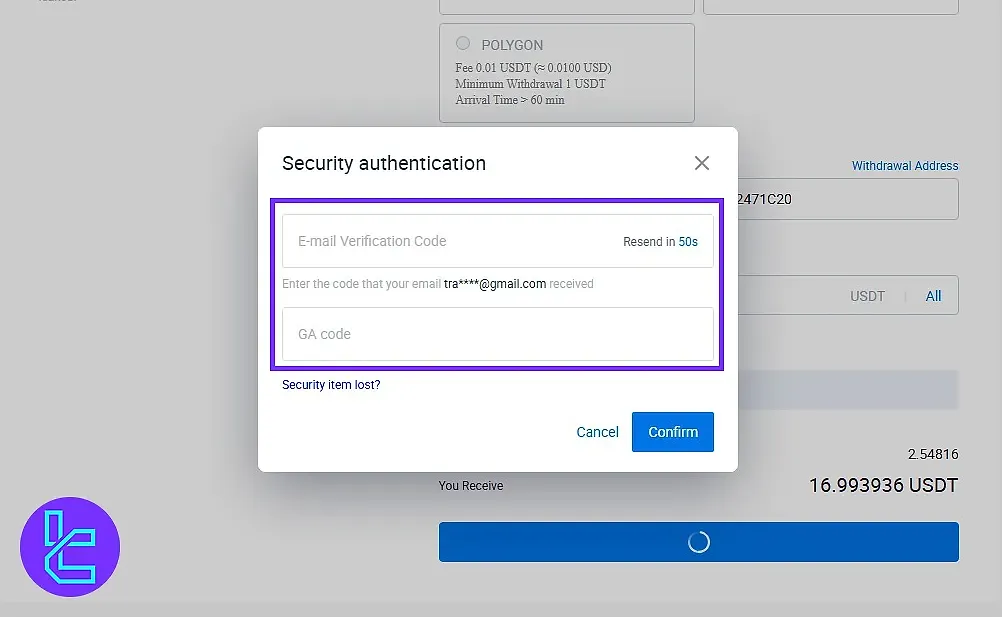

#3 Complete Security Verification

HTX requires multi-layer authentication for withdrawals.

- Enter the Email Verification Code sent to your registered email;

- Enter your Google Authenticator code (or other 2FA methods linked);

- Click Confirm to finalize your request.

#4 Track Withdrawal Status

Monitor your withdrawal until completion.

- Click "Track Withdrawal Status" to view real-time progress;

- Status will display as "Completed" once processed on the blockchain.

Important Notes on HTX Withdrawals

- USDT-ERC20 addresses only accept Ethereum-based USDT;

- USDT-Omni addresses only accept Omni-layer USDT;

- Sending funds to the wrong chain address may result in permanent loss.

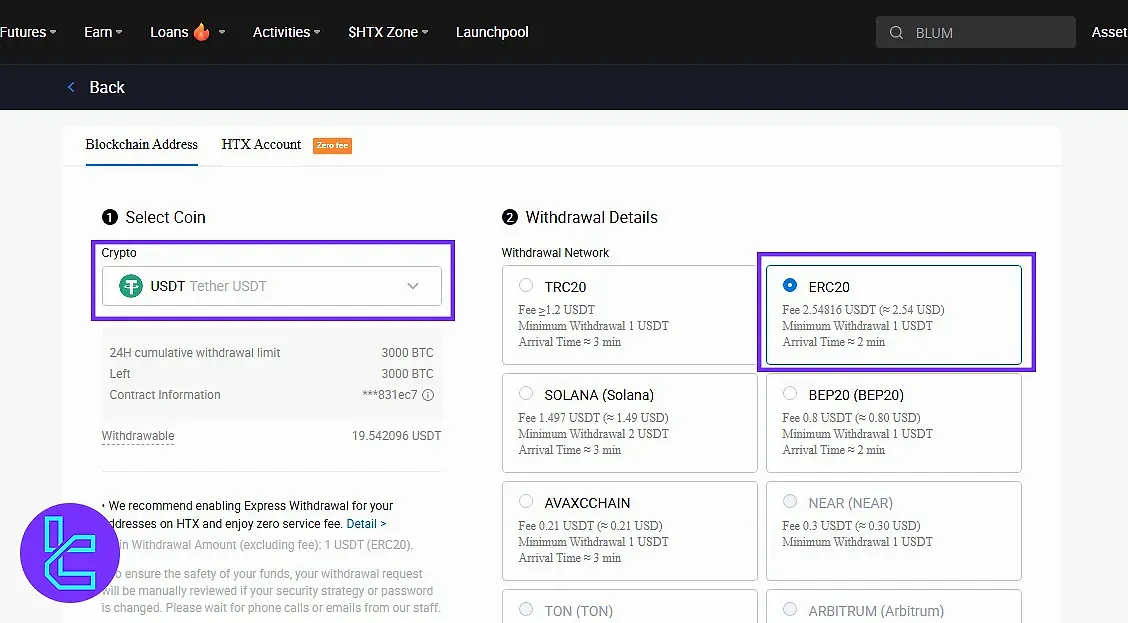

HTX Tether ERC20 Withdrawal

HTX ERC20 withdrawal is fast, secure, and typically processed in under two minutes.

The process requires your wallet address, withdrawal amount, and two-factor verification via email and Google Authenticator. A 2.5 USDT network fee and 1 USDT minimum withdrawal apply.

#1 Access Withdrawal Page

From your HTX dashboard, go to Assets > Withdraw to start the process.

#2 Select USDT and ERC20 Network

Choose USDT as the coin and set the network to ERC20.

#3 Enter Wallet Address and Amount

Provide your destination wallet address and withdrawal amount. Fees and limits will be displayed before confirmation.

#4 Confirm Withdrawal Request

Review details and click "Confirm" to proceed.

#5 Complete Security Verification

Enter the email code and Google Authenticator OTP to authorize the payout.

#6 Track Transaction Status

Monitor your withdrawal status in the transaction history. Confirmation updates are also sent via SMS or email.

Trust Ratings and User Reviews

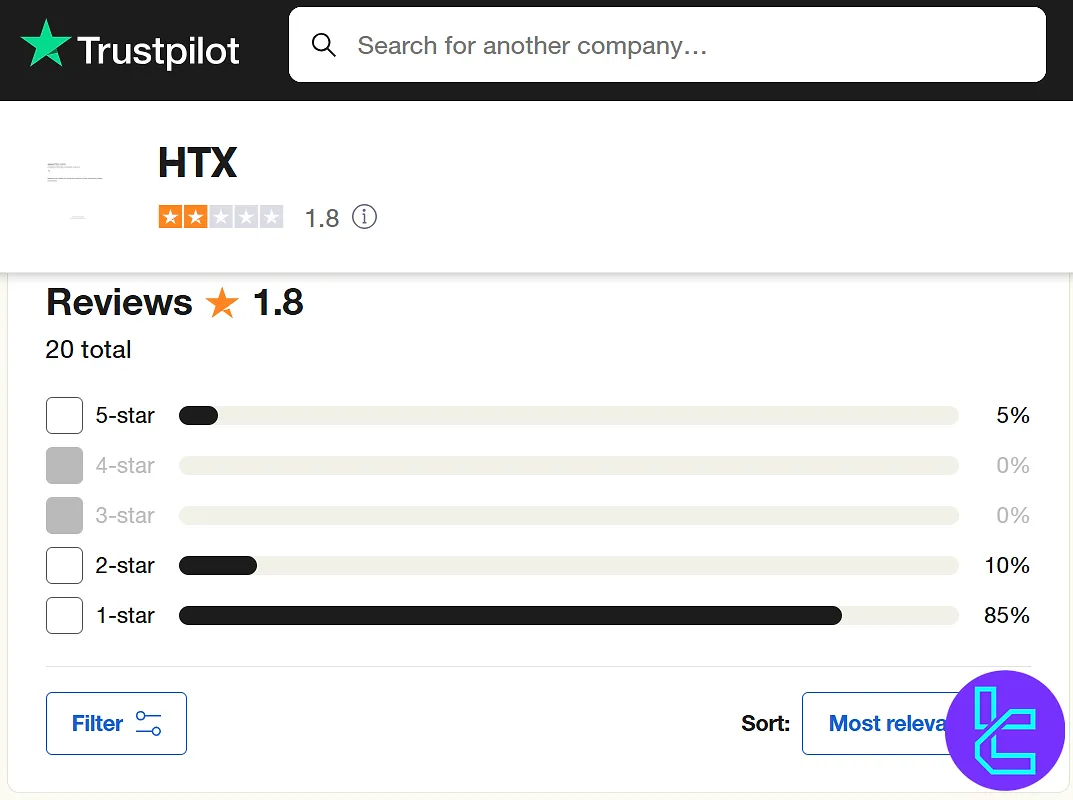

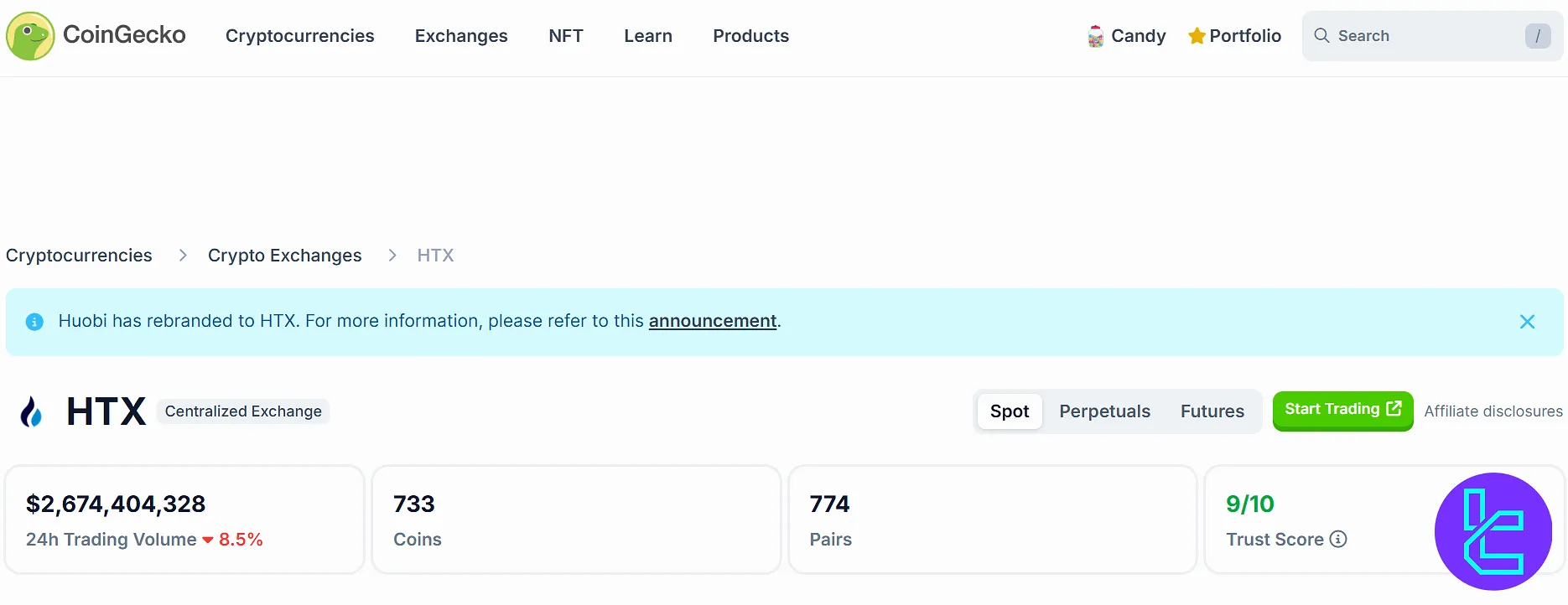

When evaluating an exchange, it's crucial to consider user feedback and trust scores on relevant websites, such as CoinGecko. HTX has received mixed reviews across different platforms:

- HTX Trustpilot: 1.8/5 (Poor), based on only 20 reviews

- CoinGecko: 9/10 (Excellent), evaluated based on the website's algorithms

Because of the low number of reviews on Trustpilot, its score is not reliable enough. However, thorough personal research is always recommended.

In recognition of its improved trustworthiness, HTX was named one of the “Top 25 World’s Most Trustworthy Crypto Exchanges of 2025” by Forbes.

HTX Features

Let's examine the various advanced options on the platform; HTX Features:

Yes | |

Yield Farming | No |

Social Trading | No |

Launchpool | Yes |

Crypto Cards | No |

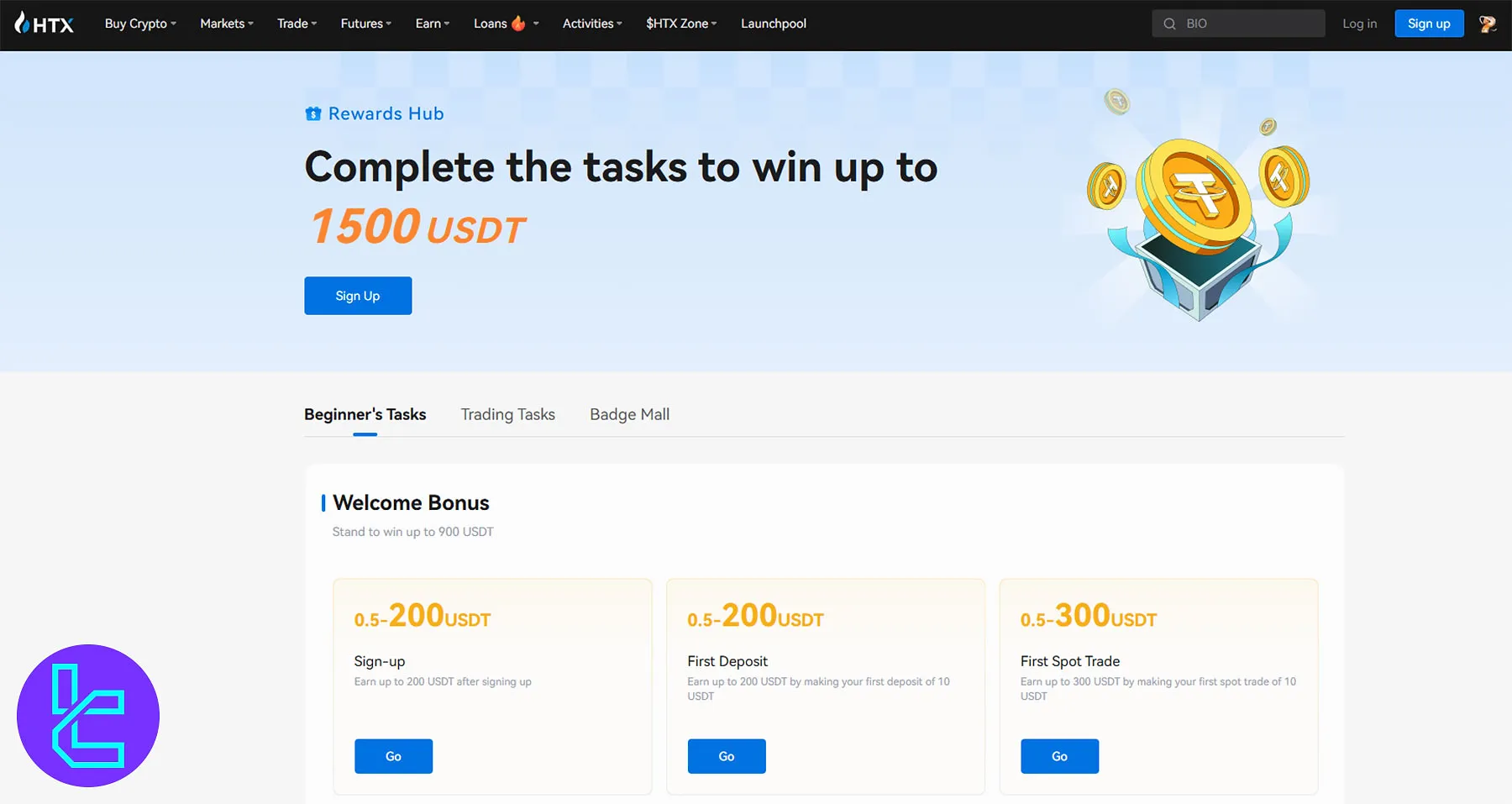

HTX Promotions

HTX runs attractive promotions, including a Reward Center, referral bonuses, and competitive futures trading contests.

These programs give both beginners and active traders the chance to unlock USDT, crypto rewards, and exclusive bonuses by completing tasks or inviting friends.

Promotion | Reward Amount | Requirement |

HTX Reward Center | Up to 1,500 USDT | Complete tasks such as signup, first deposit, spot/futures trades, and volume milestones |

HTX Futures Contest | Up to 20,000 USDT (per event) | Register for ongoing contests and trade designated futures pairs |

HTX Referral Program | Mystery Boxes worth up to 1,500 USDT + 30% lifelong bonus | Invite friends, ensure they log in, and trade spot/futures within 14 days |

HTX Reward Center

The HTX Reward Center allows users to earn incremental rewards by completing onboarding and trading tasks. Bonuses are credited after each milestone is achieved, including:

- Signup Bonus: Earn up to 200 USDT for registering and depositing at least 10 USDT;

- First Spot Trade: Receive up to 300 USDT after a 10 USDT spot transaction;

- First Futures Trade: Unlock up to 200 USDT for a 100 USDT futures order;

- Volume Milestones: Cashback and coupons for reaching 100,000 USDT spot or 1,000,000 USDT futures volume.

HTX Futures Trading Contest

HTX hosts futures trading contests across trending tokens with prize pools up to 20,000 USDT. Rewards depend on trading volume and performance during the event.

- Events: Popular contests like HIFI, AI tokens, ETH, fan tokens, and Web3 pairs

- Prize Pools: 10,000 – 20,000 USDT available per contest

- Requirements: Register before trading; only USDT-margined perpetual futures count

- Rules: Sub-accounts and market makers excluded; fraudulent activity disqualified

HTX Referral Program

The Referral Program lets users earn unlimited Mystery Boxes and lifelong commission bonuses by inviting friends to the platform.

- Mystery Boxes: Each worth up to 1,500 USDT; contain BTC, ETH, DOGE, SHIB, TRX, USDT, and more

- Conditions: Invitee must log in within 14 days and trade ≥200 USDT spot or ≥300 USDT futures

- Bonus: Earn a 30% lifelong commission on invitees’ trades

- Unlimited Referrals: More invites generate more Mystery Boxes and continuous rewards

Support Contact Information and Schedule

HTX does not provide a dedicated page for its contact information on the website, and the email address is not easy to find. The exchange provides customer support through 2 channels:

- Live Chat: Available on the bottom right corner of the website;

- Email: Contact htxsupport@htx-inc.com.

There is no information regarding the support's working hours on the website, which is a drawback. However, based on our investigation, the department is available 24/7.

Copy Trading and Investment Services

HTX puts on a great performance in terms of investment features, offering various options for users to earn passive income and optimize their trading strategies. Let's have a quick introduction to them:

- Copy Trading: Follow and automatically replicate moves and strategies of successful users;

- Staking Options: For various assets with APY up to 100%;

- Shark Fin: Earn interest based on price movements of specific cryptocurrencies;

- Dual Investment: Structured product combining "Buy Low" and "Sell High" for two different currencies.

These passive income options cater to different risk appetites and investment preferences, allowing users to potentially earn returns on their idle crypto assets.

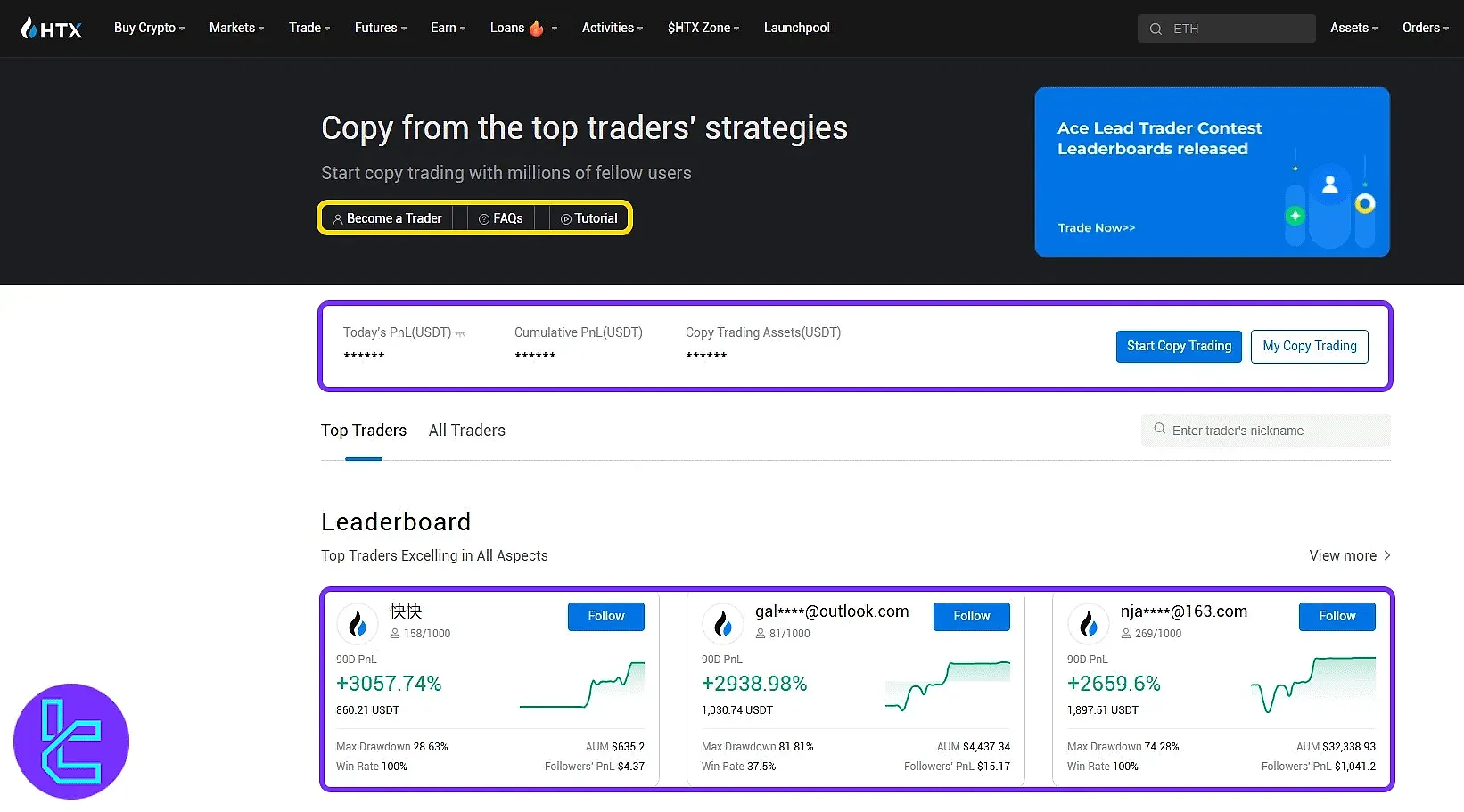

How to Activate HTX Copy Trading?

With HTX copy trading, investors can automatically mirror the strategies of professional traders. This feature allows beginners to trade without advanced knowledge while providing experts with an opportunity to earn commissions.

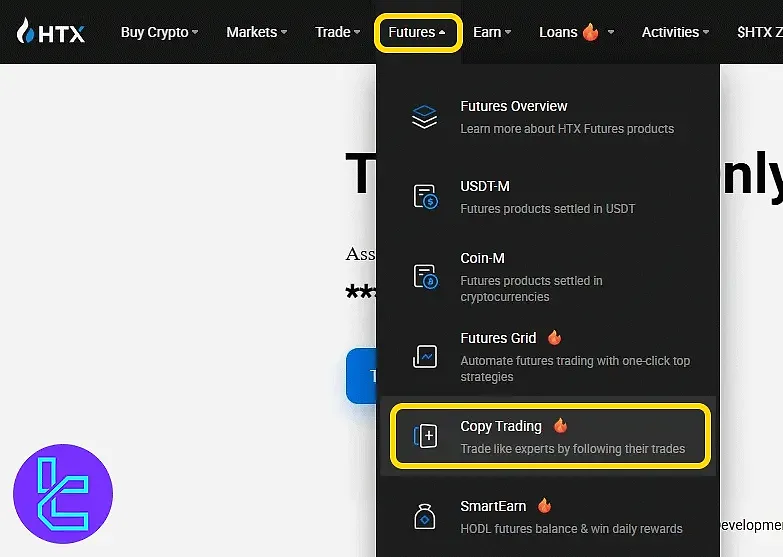

#1 Access the Copy Trading Section

From the HTX dashboard, open the "Futures" tab and select "Copy Trading" to enter the social trading panel.

#2 Explore the Dashboard

Review daily PnL, balances, and trader lists. Use filters for ROI, drawdown, and follower stats.

You may also apply to become a trader by submitting personal details and proof of past performance.

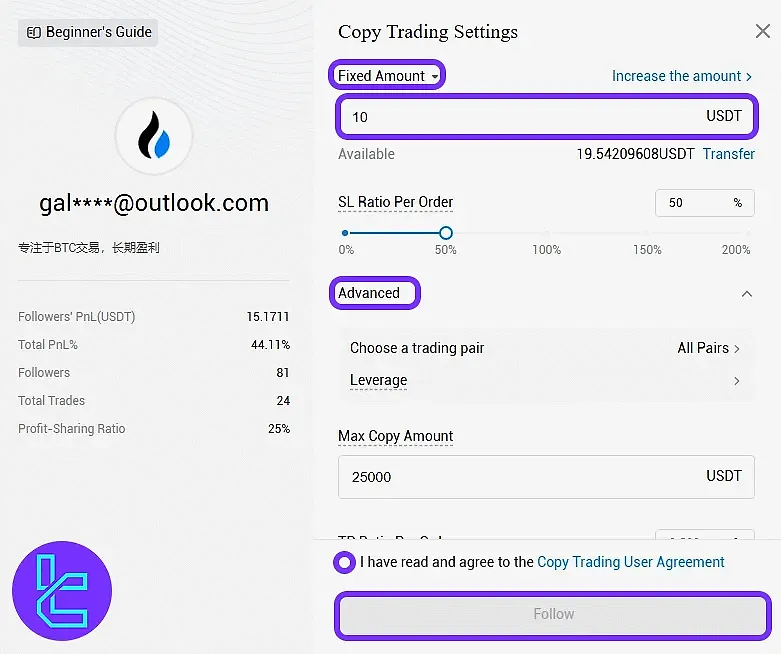

#3 Select a Trader & Configure Settings

Browse trader cards, open profiles, and check performance analytics. Choose between Fixed Amount mode (set exact value per trade) or Fixed Ratio mode (mirror trades proportionally). Advanced settings allow custom adjustments, including:

- Stop-loss

- Take-profit

- Leverage

- ROI caps

#4 Manage Active Copy Trades

In "My Copy Trades", monitor performance, adjust copy rules, transfer funds, or stop copying at any time.

Which Countries Are Restricted from HTX Services?

The company has implemented restrictions on its services for certain countries and regions due to legal and security considerations. Here's a full list of banned countries:

- Mainland China

- Hong Kong, China

- United States of America

- Singapore

- Cuba

- Iran

- North Korea

- Sudan

- Syria

- Venezuela

HTX Comparison Table

Let's see the differences between HTX features and top exchanges; HTX Comparison:

Features | HTX Exchange | |||

Number of Assets | 700+ | 400+ | 1300+ | 32 |

Maximum Leverage | 1:200 | 1:125 | 1:100 | 5x |

Minimum Deposit | 1 USDT | $1 | N/A | $1 |

Spot Maker Fee | 0.0126% - 0.2% | 0.02% - 0.1% | 0.005% - 0.1% | 0.5% Down to 0.02% |

Spot Taker Fee | 0.0218% - 0.2% | 0.04% - 0.1% | 0.015% - 0.1% | 0.5% Down to 0.02% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | None |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | No | Yes | Yes | Yes |

Staking | Yes | Yes | No | Yes |

Copy Trading | Yes | Yes | Yes | N/A |

Writer's Opinion And Conclusion

HTX provides access to a maximum leverage of 200x in futures trading with USDT-margined and Coin-margined contracts.

The company has received a 1.8/5 rating on the Trustpilot website based on approximately 20 reviews. On the other side, CoinGecko has submitted a 9/10 trust score.