Apex Trader Funding is an American prop firm that was founded by "Darrell Martin" and has received numerous awards, including “Nasdaq Interview 2023” and "Benzinga FintechDealDay".

Apex Trader Funding Prop Form provides up to 100% of profit to the trader [in some accounts], and its maximum funding is $300,000.

Apex Trader Funding Company Information

Apex Trader Funding, founded in 2021 by “Darrell Martin”, has quickly risen to prominence as one of the most innovative and trader-friendly prop firms with Forex and cryptocurrency trading options in the market.

Apex Trader Funding has a clear mission: to provide traders with the best opportunity to obtain funding and pursue success in the futures markets. Key features of Apex Trader:

- 100% profit share on the first $25,000 per account, and 90% beyond that

- Two payouts per month for consistent cash flow

- Ability to trade full-sized contracts in both evaluations and funded accounts

- No scaling or failing due to exceeding contract size limits

- Absence of daily drawdown restrictions

- Freedom to trade on holidays and during news events

- No total cap on maximum payout

- Simple one-step evaluation process

- Real-time data included with all accounts

- Straightforward risk management rules

- Option to manage up to 20 accounts simultaneously

An Introduction to the CEO

Darrell Martin is the visionary behind Apex Trader Funding and the founder of Apex Investing. With nearly 20 years of trading experience, he has built tools and resources that empower traders worldwide.

- Background: Holds Bachelor’s and Master’s degrees; started as a retail trader;

- Experience: Speaker at international trade expos and educator for major exchanges;

- Achievements: Creator of innovative trading tools used in 150+ countries;

- Mission: Making trading education and tools accessible to traders of all levels.

Specifications Summary

To give you a clear picture of what Apex Trader Funding prop firm offers, here's a summary of their key specifications:

Account currency | USD |

Minimum price | $137 |

Maximum Leverage | 1:1 |

Maximum Profit Split | 100% |

Instruments | Equity, Interest Rate, Currency, Commodity, Cryptocurrency |

Assets | +80 |

Evaluation Steps | 1-step |

Withdrawal Methods | Wire Transfer, ACH |

Maximum Fund Size | $300K |

First Profit Target | 6% |

Max. Daily Loss | None |

Challenge Time Limit | - |

News Trading | Yes |

Maximum Total Drawdown | Up to 3% |

Trading Platforms | Tradovate, NinjaTrader, Wealthcarts, TradingView, ATAS, Bookmap, Edgeclear, Finamark, Jigsaw Trading, Motivewave, Quantower, Rithmic, Sierra Chart, Volfix |

Commission Per Round Lot | Not Specified |

Trustpilot Score | 4.5/5 |

Payout Frequency | 2 times in a month |

Established Country | United States |

Established Year | 2021 |

Advantages & Disadvantages

Like any trading solution, Apex Trader Funding has its pros and cons. Let's break them down:

Pros | Cons |

Extremely high profit split (100% of first $25,000, 90% thereafter) | All trading must be completed within a single day (no overnight positions allowed) |

No daily drawdown limits, allowing for more trading flexibility | News trading strategies are prohibited |

Simple one-step evaluation process with a low 6% profit target | Does not support MT4/MT5 platforms, focusing solely on futures-specific platforms |

Ability to trade during news events and holidays | Relatively new company (established in 2021) compared to some competitors |

A wide range of futures instruments available | - |

Support for lesser-known trading platforms like NinjaTrader and Tradovate | - |

Up to 20 funded accounts can be managed, simultaneously | - |

Regular payouts (twice per month) | - |

Despite these few drawbacks, the advantages of trading with Apex Trader Funding far outweigh the disadvantages for most futures traders.

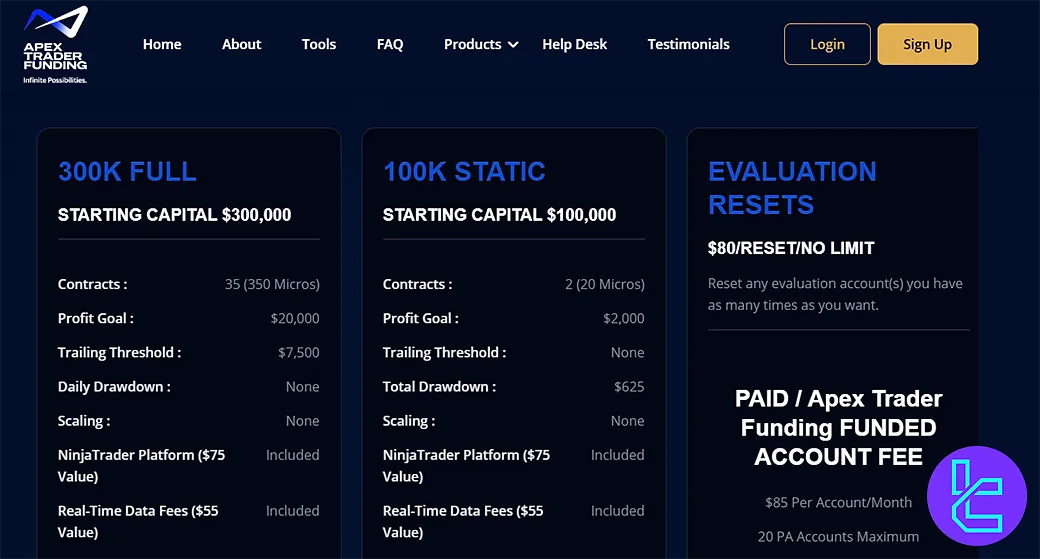

What are the Funding and Prices in Apex Trader Funding?

Apex Trader Funding has considered two types of complete and static challenges for traders. As you can see below, each account has a different price. Funding and costs of Apex Funding Prop Firm:

| Platform | Tradovate | Rithmic | WealthCharts |

| $25,000 FULL Account Price | $167/Month | $157/Month | $147/Month |

| $50,000 FULL Account Price | $187/Month | $177/Month | $167/Month |

| $100,000 FULL Account Price | $297/Month | $297/Month | $297/Month |

| $150,000 FULL Account Price | $397/Month | $397/Month | $397/Month |

| $250,000 FULL Account Price | $397/Month | $397/Month | $397/Month |

| $300,000 FULL Account Price | $397/Month | $397/Month | $397/Month |

| $100,000 STATIC Account | $157/Month | $147/Month | $137/Month |

The account prices at this prop firm are fairly high.

The pricing for these accounts varies, with occasional promotions and discounts available. Traders should check the Apex Trader Funding website for the most up-to-date pricing information.

How to register in Apex Trader Funding Prop firm?

Registering with Apex Trader Funding is easier than it may seem. ATF Sign Up:

#1 Visiting the Website

Go to the Apex Trader Funding website at its genuine URL, then click on the "Sign Up" button located in the top-right corner of the page.

#2 Completing the Forms

In the next page, choose your preferred account size and funding plan. Afterwards, fill out the registration form with your personal information, such as your name and email.

Fill the Address Information Form with these:

- Street

- City

- Country

- State

- ZIP Code

- Phone Number

#3 Finalizing the Account Opening Process

Verify your email address by clicking on the link sent to your inbox. Agree to Terms & Conditions.

Next, follow the steps below:

- Fund your account using one of the available payment methods;

- Download and set up your chosen trading platform;

- Begin your evaluation phase.

#4 Verification

The verification process is typically quick and efficient, allowing you to start trading promptly. For a complete identity verification, provide the required documents as proof of identity and proof of residence.

Apex Trader Funding's customer support team is available to assist with any questions or issues during the registration and verification process.

What are the Evaluation Stages of ATF?

One of the standout features of Apex Trader Funding is its simplified evaluation process. Unlike many prop firms that require multiple stages of evaluation, Apex Trader Funding has a single-step process.

At Apex Trader Funding reviews, we found that one of its distinguishing features is the 100% profit split on the first $25,000 in profits! After that, the profit sharing will be 90% for the trader and 10% for ATF.

Although no scaling is provided, traders may operate up to 20 funded accounts simultaneously, increasing potential earnings through multi-account strategies.

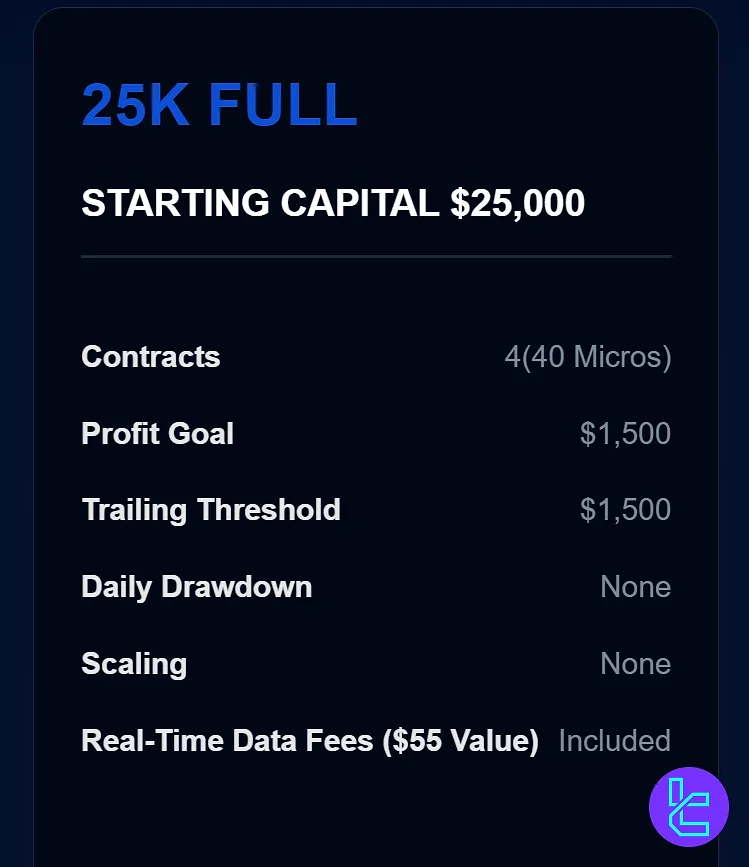

Apex Trader Funding $25K FULL Program

Traders can trade up to 4 standard contracts (or 40 micros) under this plan.

Once funded, traders enjoy a 100% profit split, allowing them to retain all generated profits.

Plan Details:

Plan | $25,000 FULL |

Profit Goal | 6% |

Daily Drawdown | None |

Scaling | None |

Trailing Threshold | $1500 |

Contracts | 4 (40 Micros) |

Profit Split | 100% |

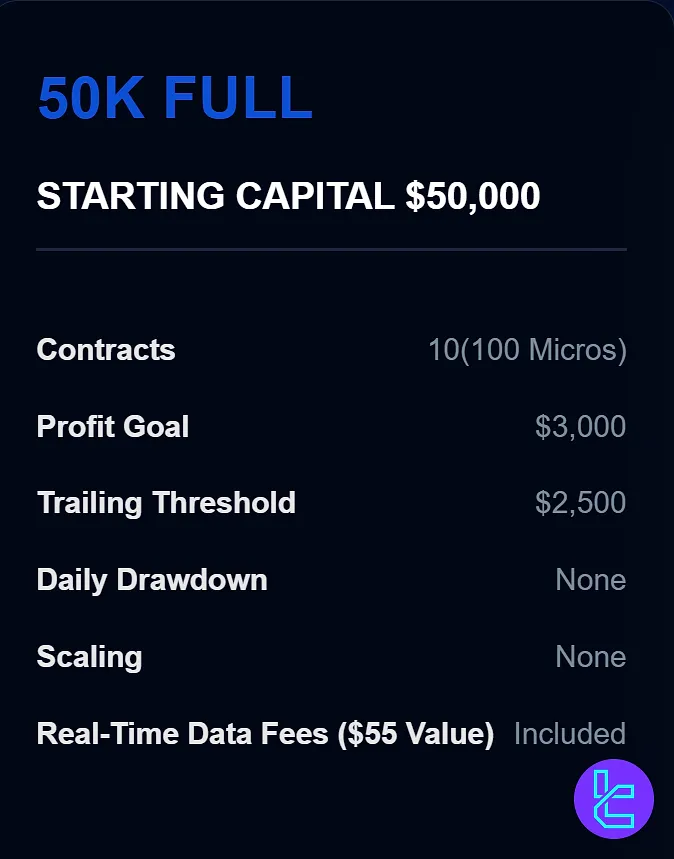

Apex Trader Funding $50K FULL Program

his plan comes with a 6% profit goal and a $2,500 trailing threshold.

Participants can trade up to 10 standard contracts (or 100 micros), providing more flexibility for strategy execution.

Plan Parameters:

Plan | $50,000 FULL |

Profit Goal | 6% |

Daily Drawdown | None |

Scaling | None |

Trailing Threshold | $2500 |

Contracts | 10 (100 Micros) |

Profit Split | 90% |

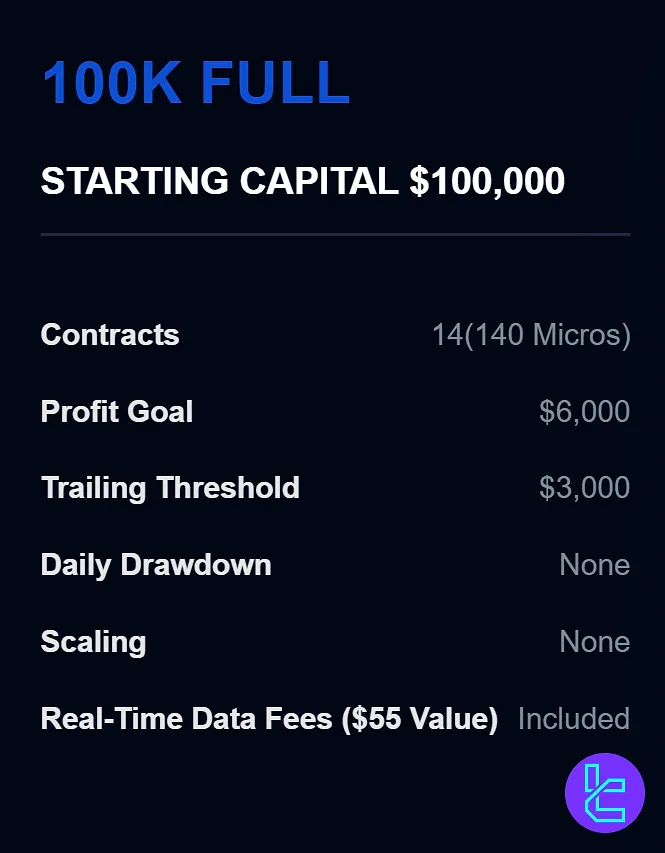

Apex Trader Funding $100K FULL Program

This account allows trading up to 14 standard contracts (or 140 micros), enabling higher-volume trades and diversified entries.

Traders keep 90% of all profits, striking a balance between generous payouts and robust funding conditions.

ATF $100K account parameters:

Plan | $100,000 FULL |

Profit Goal | 6% |

Daily Drawdown | None |

Scaling | None |

Trailing Threshold | $3000 |

Contracts | 14 (140 Micros) |

Profit Split | 90% |

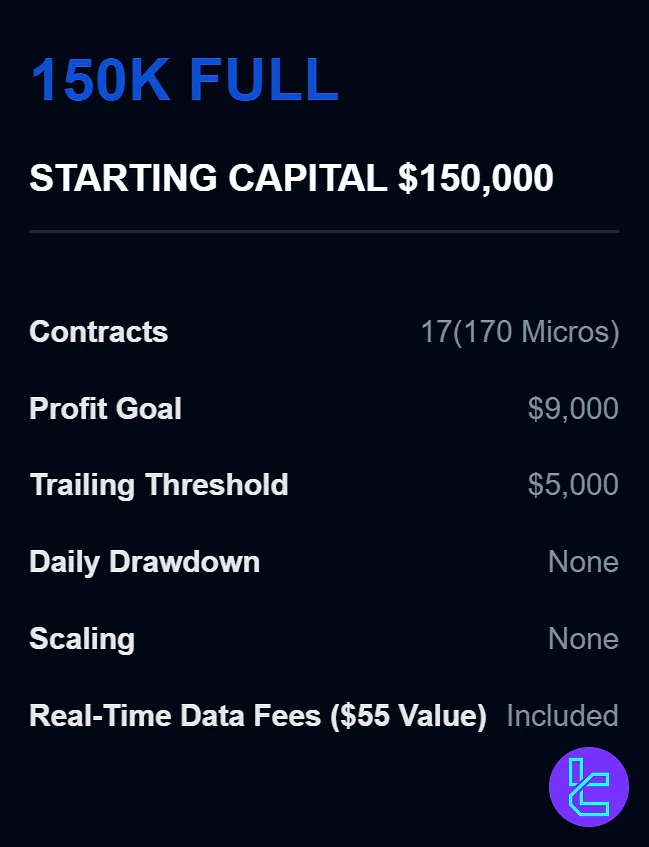

Apex Trader Funding $150K FULL Challenge

This account carries no daily drawdown requirements like other plans, giving traders freedom to execute their strategies without restrictions.

The $150K account supports up to 17 standard contracts (or 170 micros).

Plan details:

Plan | $150,000 FULL |

Profit Goal | 6% |

Daily Drawdown | None |

Scaling | None |

Trailing Threshold | $5000 |

Contracts | 17 (170 Micros) |

Profit Split | 90% |

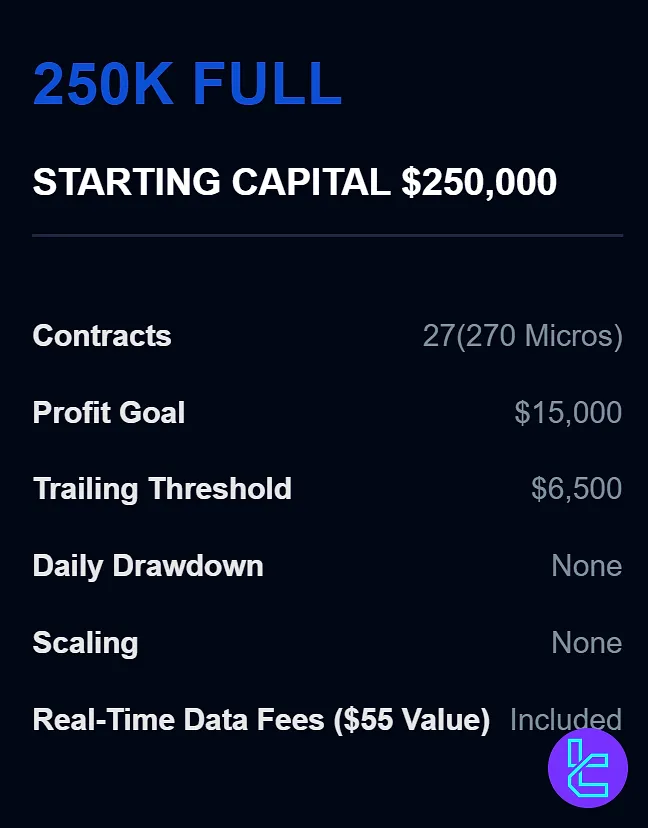

Apex Trader Funding $250K FULL Program

This other plan is similar to the previous ones, but is different in the contract number and the trailing threshold.

You can trade 27 contracts or 270 micros in this account.

Account parameters:

Plan | $250,000 FULL |

Profit Goal | 6% |

Daily Drawdown | None |

Scaling | None |

Trailing Threshold | $6500 |

Contracts | 27 (270 Micros) |

Profit Split | 90% |

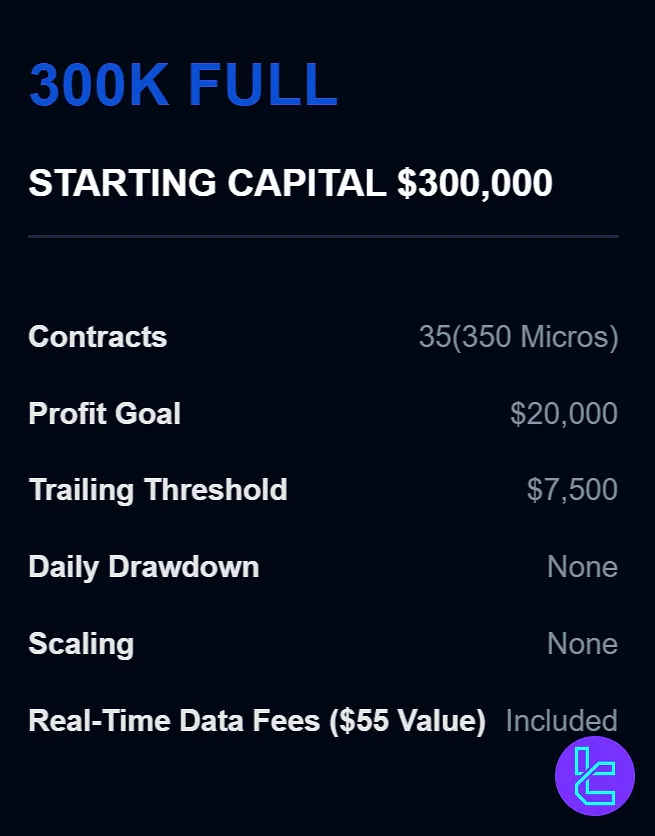

Apex Trader Funding $300K FULL Challenge

Traders can operate with up to 35 contracts (or 350 micros), while enjoying included real-time data fees valued at $55 per month, making this plan both powerful and cost-effective.

Other factors in the $300K account are the same as those in previously mentioned plans.

Evaluation details:

Plan | $300,000 FULL |

Profit Goal | 6% |

Daily Drawdown | None |

Scaling | None |

Trailing Threshold | $7500 |

Contracts | 35 (350 Micros) |

Profit Split | 90% |

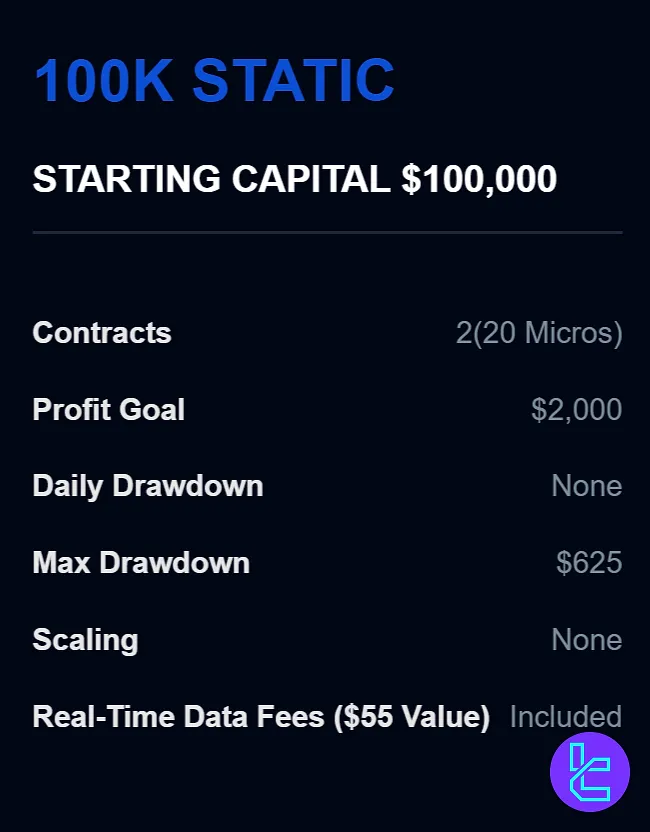

Apex Trader Funding $100K STATIC Account

The Apex Trader Funding $100K STATIC Account is designed for traders who prefer fixed risk parameters rather than a trailing drawdown.

With a $100,000 starting balance and a $2,000 profit goal, this account offers a simple and transparent structure for achieving funding.

STATIC plan specifics:

Plan | $100,000 STATIC |

Profit Goal | 2% |

Daily Drawdown | None |

Scaling | None |

Trailing Threshold | None |

Contracts | 2 (20 Micros) |

Profit Split | 90% |

Apex Trader Funding Bonuses and Discounts

Apex Trader Funding frequently offers promotions and discounts to attract new traders and reward existing ones. ATF bonuses and discounts:

- Seasonal discounts on evaluation accounts (e.g., holiday specials)

- Referral bonuses for bringing new traders to the platform

- Loyalty rewards for long-term, consistently profitable traders

- Occasional promo codes for significant discounts (e.g., the "MATCH" code for 80% off evaluations)

- Free account promotion of the same size upon reaching payout

These offers can change over time, so it's best to check the Apex Trader Funding website.

Apex Trader Funding Rules

You must adhere to the trading rules set by ATF to prevent any account closures. ATF Rules:

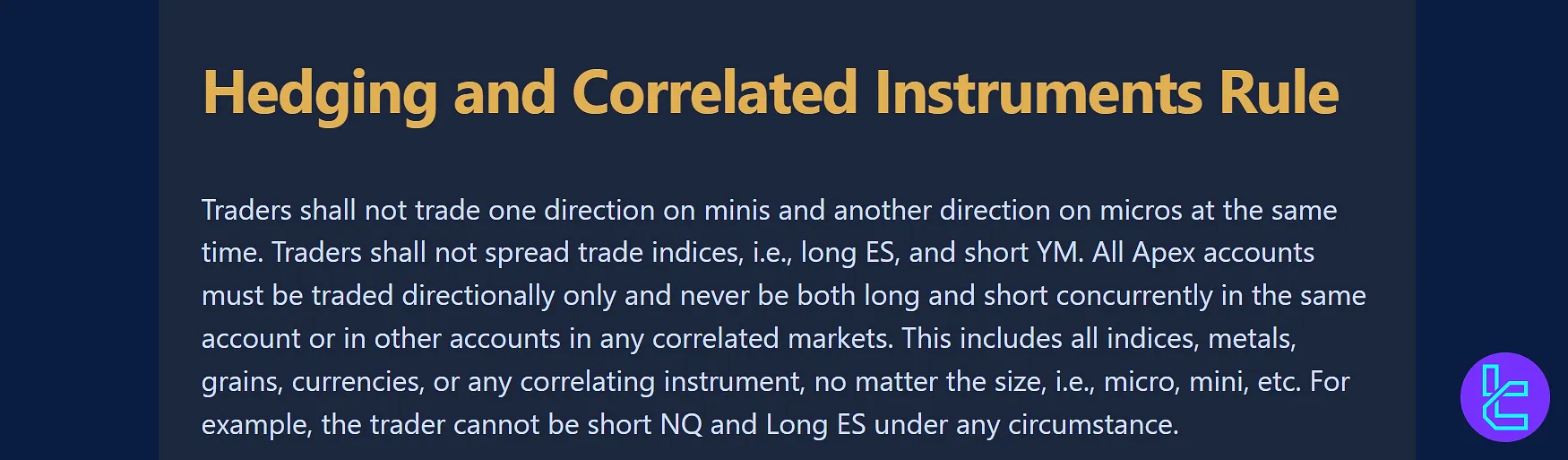

- Hedging Restrictions: Traders cannot engage in opposite directional trades, such as long positions on mini accounts and short positions on micro accounts, at the same time;

- News Trading: Trading based on news events is allowed, but with specific restrictions; Traders cannot open opposing positions (e.g., long and short) during the same news event.

VPN Usage

There is no data provided by the company.

Hedging

In accordance with Apex's trading guidelines, traders are prohibited from taking conflicting directional positions across different account sizes or correlated instruments. For example, a tradercannot simultaneously hold a long position on a mini account and a short position on a micro account.

Additionally, traders are not permitted to spread trades in correlated markets, such as holding a long position in the ES index while shorting YM. These restrictions apply universally to all accounts and asset classes, including indices, metals, and grains, across all account sizes (mini, micro, etc.).

For example, it is not permissible for a trader to be short on NQ and long on ES simultaneously under any circumstances.

Expert Advisors (EA)

The firm has released no information regarding EA usage rules.

Martingale and Arbitrage Strategy

ATF's website does not have any data regarding the prohibition of strategies.

News Trading

News trading isallowed with specific restrictions. While traders are permitted to base their trades on news events, they must avoid taking opposing positions (such as long and short) during the same news release.

News trading is acceptable as long as it adheres to Apex's consistency rules, such as ensuring that traders do not exceed a 30% profit or 30% loss in a day. Additionally, traders are expected to use news trading strategies responsibly and consistently to comply with the platform's regulations.

Violating these rules during news trading may result in disqualification from the challenge.

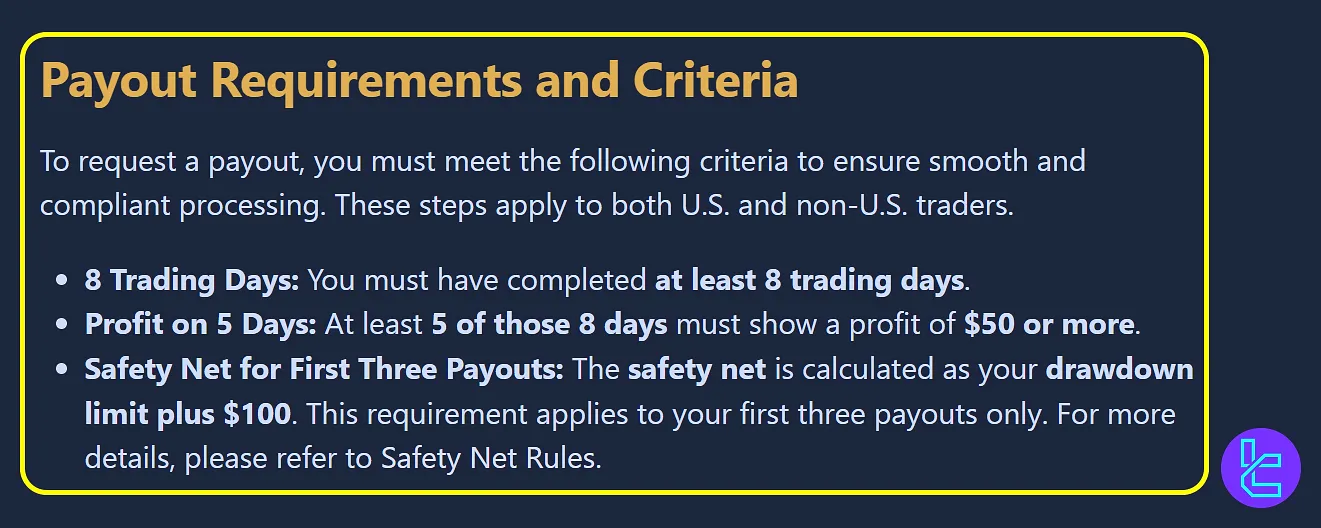

Payout Rules

Apex Trader Funding has designed its payout process to be both transparent and efficient, giving traders quick access to their profits. Following the steps carefully ensures smooth approval and avoids unnecessary delays.

Payout Methods: U.S. vs. Non-U.S.

Payouts are handled differently based on where the trader is located. After the first successful request, future payouts are automated through the selected method.

- U.S. Traders: Paid via Direct Deposit (ACH). Using the correct ACH routing number is essential since wire routing numbers are not accepted;

- Non-U.S. Traders: Paid through Plane, a secure global payment gateway. After approval of the first payout, an email invitation is sent to connect a local bank account for future transfers.

Eligibility and Requirements

To qualify for a payout, traders must meet several conditions. These rules encourage consistency and help protect accounts from excessive risk:

- Minimum eight trading days completed

- At least five profitable days with fifty dollars or more per day

- Safety net requirement during the first three payouts (account balance must remain above trailing drawdown plus one hundred dollars)

- Thirty percent consistency rule in effect until the sixth payout (no single day can make up more than thirty percent of total profits)

Minimum Balance and Payout Thresholds

Each account must meet the required minimum balance before a payout can be processed. After the sixth payout, there is no maximum withdrawal limit as long as the account stays above the safety level.

Account Size | Minimum Balance | Maximum Payout (First 5) |

$25K | $26,600 | $1,500 |

$50K | $52,600 | $2,000 |

$100K | $103,100 | $2,500 |

$150K | $155,100 | $2,750 |

$250K | $256,600 | $3,000 |

$300K | $307,600 | $3,500 |

$100K Static | $102,600 | $1,000 |

Minimum payout for any account is $500 and the account must meet all eligibility rules before the request can be approved.

Payout Timeline

Once a request is submitted through the Apex dashboard, it goes through several steps before funds arrive:

- Review and approval usually within two business days

- Transfer initiated via ACH (U.S.) or Plane (international) within three to four business days

- Funds typically reach the trader’s bank account within three to seven business days depending on the bank’s processing times

Multiple Accounts Advantage

Traders with more than one account can withdraw from each account independently. This setup allows scaling of income while diversifying trading strategies across several accounts.

100 Percent Payouts

After five successful withdrawals, traders become eligible for one hundred percent payouts from the sixth request onward.

With an eight-day payout cycle, this level can be reached in roughly forty-eight trading days, giving full access to profits in around two months.

Tax and Compliance

Apex requires accurate information for all payout requests. The country of the bank account must match the trader’s primary country of residence.

- U.S. Traders: Receive Form 1099-NEC by January 31 each year and must report Apex income on their annual tax return;

- Non-U.S. Traders: No tax form is provided; traders are responsible for reporting income according to local regulations.

What Platforms are Available on Apex Trader Funding?

ATF supports 14different trading platforms. Unfortunately, MetaTrader 4 and 5 are not one of them! Apex Trader Funding Trading platforms:

- Tradovate

- NinjaTrader

- Wealthcarts

- TradingView

- Trader

- ATAS

- Bookmap

- Edgeclear

- Finamark

- Jigsaw Trading

- Motivewave

- Quantower

- Rithmic

- Sierra Chart

Each platform comes with its own set of features and benefits, allowing traders to choose the one that best suits their trading style and preferences.

Apex Trader Funding provides the necessary licenses and real-time data for these platforms as part of their funding packages, saving traders additional costs.

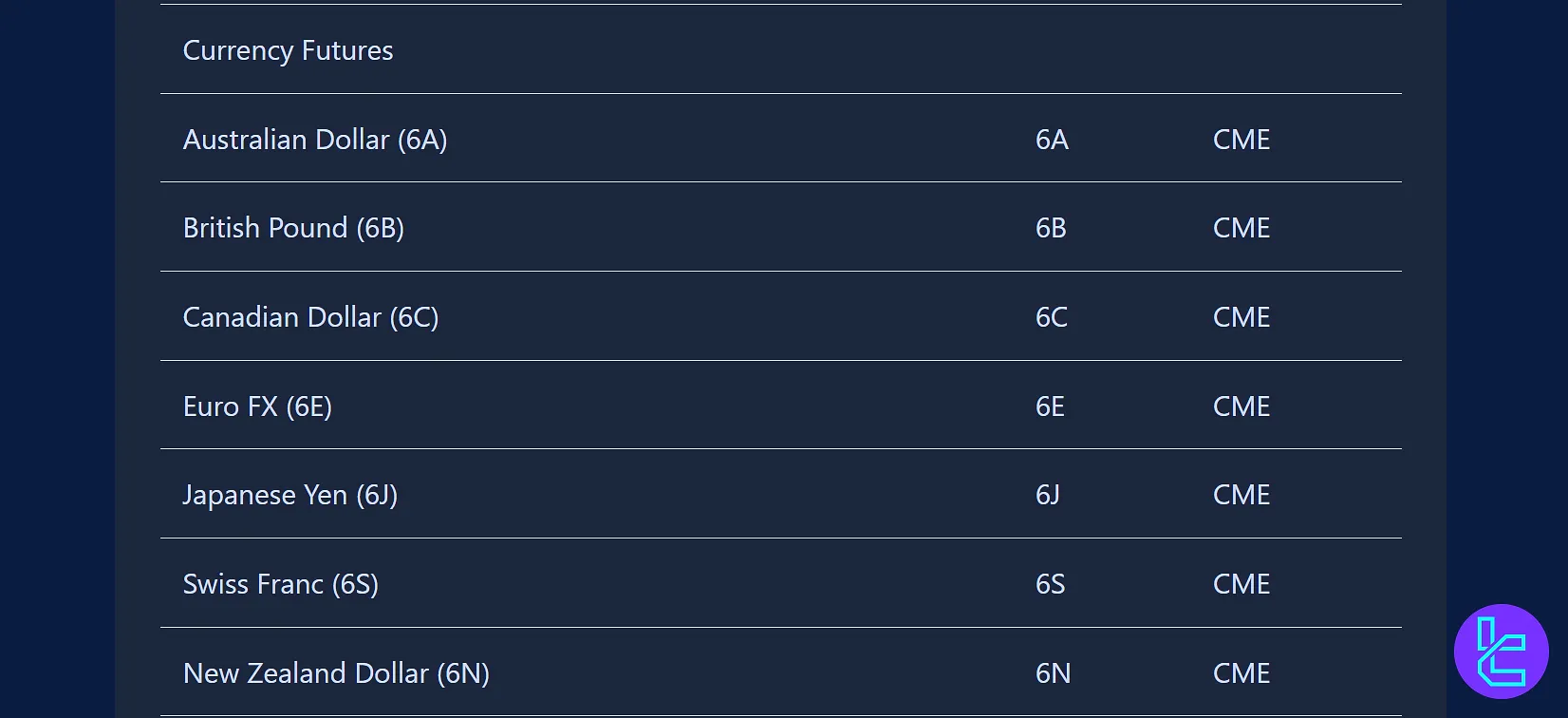

Tradable Instruments and Symbols

Apex Trader Funding offers a wide range of instruments across various markets:

Equity

- E-mini S&P 500

- E-mini NASDAQ 100

- E-mini Dow Jones

- Russell 2000

- Nikkei 225

Interest rate

- 10-Year Treasury Note

- 30-Year Treasury Bond

- Eurodollar

Currency

- Euro FX

- Japanese Yen

- British Pound

- Australian Dollar

- Canadian Dollar

Commodity

- Crude Oil

- Natural Gas

- Gold

- Silver

- Corn

- Soybeans

- Wheat

Cryptocurrency

- Bitcoin

- Ethereum

Apex Trader Funding Payment Methods

Apex Trader Funding Prop Form does not support many payment and payout methods; ATF payment methods:

For account funding:

- Credit cards (Visa, Mastercard, Discover, American Express)

- Bank transfer/ACH

For payouts:

- Wire transfer

- ACH (for US-based traders)

The minimum payout amount is $500, and Payouts are processed twice a month.

Fees & Costs on Apex Trader Funding Prop Firm

Apex Trader Funding aims to keep its fee structure simple and transparent. Here's what you need to know about fees and costs:

- One-time evaluation fee (varies based on account size)

- No monthly fees for funded accounts

- No data fees (real-time data included)

- No payout fees (bank charges may apply for wire transfers)

The absence of recurring fees for funded accounts means that traders can focus on generating profits without worrying about ongoing costs eating into their earnings.

Apex Trader Funding Educational Resources

While Apex Trader Funding excels in many areas, one potential drawback is the limited educational resources provided directly by the company.

Although there needs to be more prop trading educational resources, ATF has a complete and comprehensive FAQ page for traders that answers all their questions. Unlike ATF, other prop firms such as the list below provide suitable educational resources:

- Earn2Trade

- City Traders Imperium (CTI)

- The 5%ers

- SurgeTrader

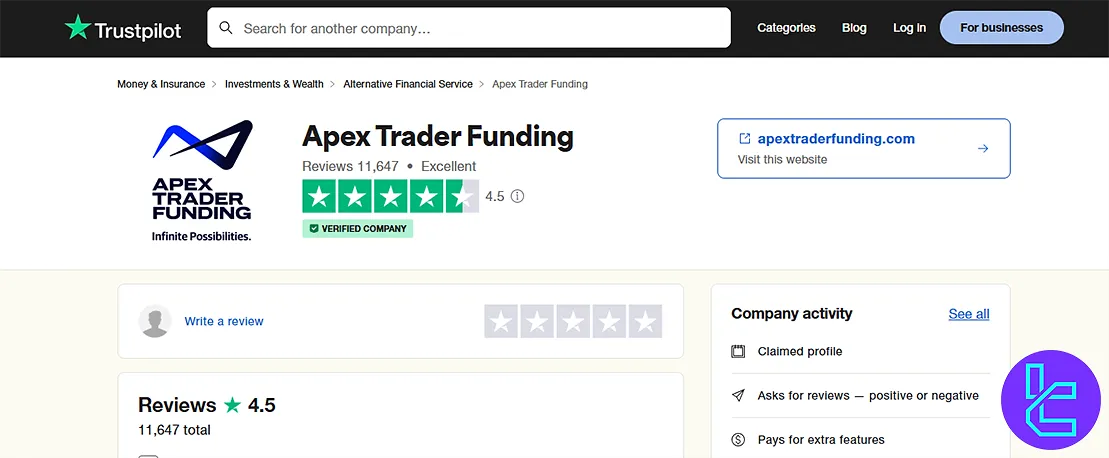

Apex Trader Funding Prop Firm Trust Scores

Apex Trader Funding has garnered impressive trust scores from reputable review platforms:

- ATF Trustpilot: 4.5/5 stars based on over 9,000 reviews

Apex Trader Funding's score on Trustpilot is 4.5 out of 5 - PropFirmMatch: 3.7 out of 5

The high Trustpilot score, in particular, is a strong indicator of customer satisfaction. Many reviewers praise Apex Trader Funding for its:

- Transparent and fair policies

- Responsive customer support

- Quick and reliable payouts

- Flexible trading conditions

Apex Trader Funding Support: Channels & Opening Hours

Apex Trader Funding support is available 24/7 and it provides customer support through various channels:

Support Method | Availability |

Live Chat | No |

No | |

Phone Call | Yes (via 1-855-273-9873) |

Discord | No |

Telegram | No |

Ticket | Yes (through the Help Desk) |

FAQ | Yes (on the Website) |

Help Center | No |

No | |

Messenger | No |

The local office is located at Apex Trader Funding Inc. 2028 E. Ben White Blvd Ste 240 -9873 Austin, TX 78741.

Support is available 24/7, ensuring that traders can get assistance whenever they need it, regardless of their time zone

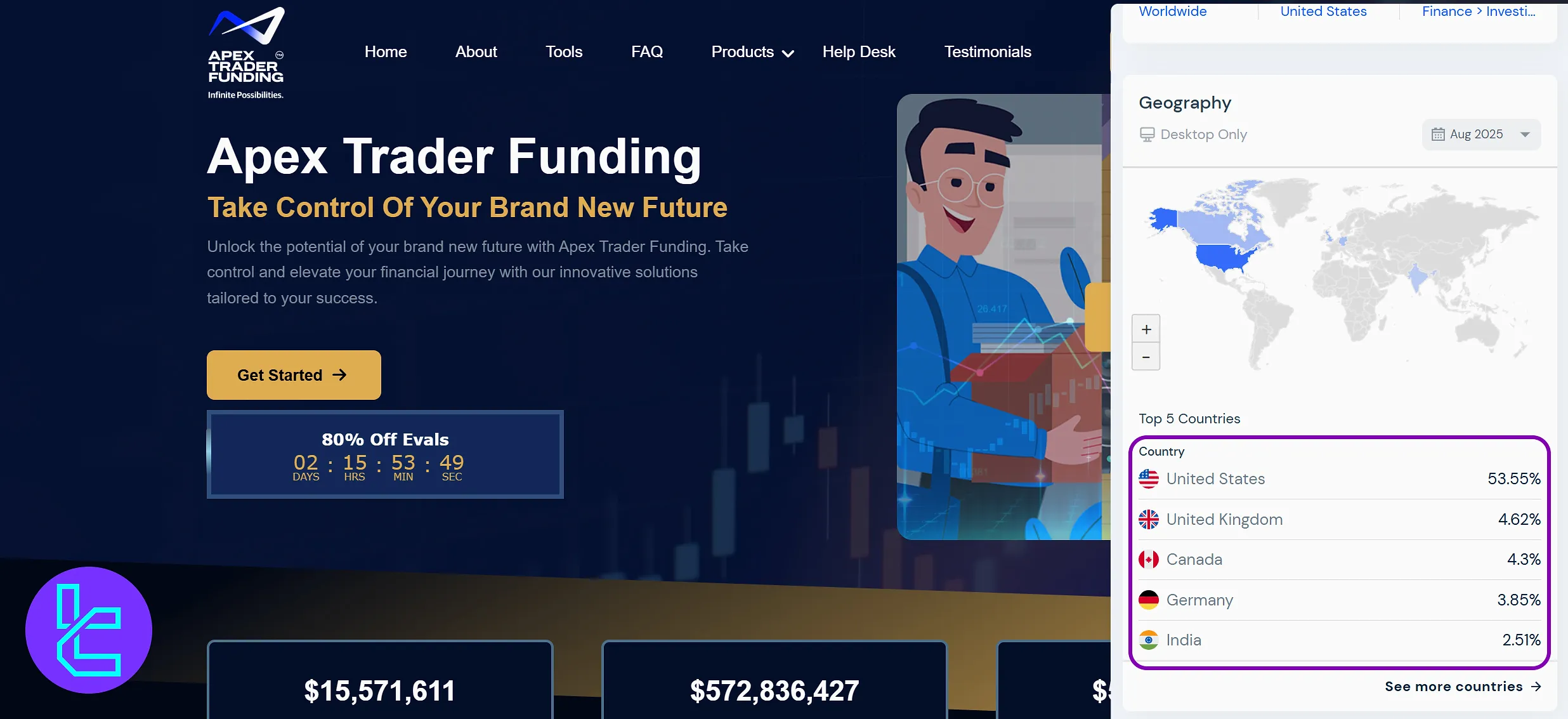

Apex Trader Funding User Regions

Apex Trader Funding attracts a globally diverse user base, with the United States leading by a wide margin at 53.55% of total desktop traffic.

The United Kingdom follows with 4.62%, while Canada and Germany contribute 4.3% and 3.85% respectively. India rounds out the top five with 2.51%, showcasing the firm’s growing footprint in Asia.

This global distribution highlights the platform’s strong presence in North America and Europe, while steadily gaining traction among traders in emerging markets.

Apex Trader Funding Prop Firm on Social Media

ATF maintains an active presence on several social media platforms. Apex Trader Funding social media:

Social Media Channels | Members/Subscribers |

45,000+ | |

12,000+ | |

30,000+ | |

8,500+ | |

5,000+ |

Following Apex Trader Funding on these platforms can help traders stay updated on the latest news, promotions, and educational content from the company.

Apex Trader Funding Compared to Other Prop Firms

Here's a helpful comparison between ATF and other companies competing with it:

Parameters | Apex Trader Funding Prop Firm | |||

Minimum Challenge Price | $137 | $32 | €55 | $97 |

Maximum Fund Size | $300,000 | $4,000,000 | Infinite | $200,000 |

Evaluation steps | 1-phase, 2-phase | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step |

Profit Share | 100% | 95% | 100% | 80% |

Max Daily Drawdown | None | 5% | 5% | 5% |

Max Drawdown | 3% | 10% | 8% | 10% |

First Profit Target | 6% | 8% | 10% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:1 | 1:100 | 1:100 | 1:100 |

Payout Frequency | 2 Times a Month | Varies | 14 Days | Bi-weekly |

Number of Trading Assets | 80+ | 78 | 150+ | 40 |

Trading Platforms | Tradovate, NinjaTrader, Wealthcarts, TradingView, ATAS, Bookmap, Edgeclear, Finamark, Jigsaw Trading, Motivewave, Quantower, Rithmic, Sierra Chart, Volfix | MT4, MT5, cTrader, MatchTarder | Proprietary platform | MetaTrader 5, cTrader, Dxtrade |

TradingFinder Expert Suggestions

$137 minimum price, 8 different challenges and over 80 assets to trade are some of the features of the Apex Trader Funding.

The maximum drawdown in this prop is 3%, and the first profit target is 6%. On the contrary, news trading strategies are not allowed.