Fintokei provides up to $400,000 in trading capital to traders who can pass their 1, 2, or 3-phase challenges.

The minimum challenge price in this Czech Republic-based prop trading firm is $99, and traders have up to 180 days to complete their challenges.

Fintokei Company Overview

Fintokei isn't your typical prop trading firm. It's an education and evaluation company that provides traders with a safe environment to hone their skills, develop healthy trading habits, and build a rock-solid track record. Founded by the same minds behind the Purple Trading retail broker, Fintokei brings over 15 years of industry experience to the table.

Key information about Fintokei prop firm:

- CEO: David Varga

- Founding location: Czech Republic

- Founding year: 2022

- Funding plans: from $10,000 to $400,000

- Scale-up plan: up to €4,000,000

Get to Know the CEO of Fintokei

David Varga is the Co-Founder and CEO of Fintokei as well as Co-Founder & Board Member at Purple Trading. With a strong background in FX & CFD trading and investments across stocks, ETFs, and crypto, he has built a reputation for combining innovation with long-term market expertise.

Based in Limassol, Cyprus, David focuses on creating opportunities for investors and traders by delivering innovative trading tools and reliable portfolio management services.

Under his leadership, Purple Trading has expanded into regulated EU investment services, offering products such as ETFs, Forex/CFDs, and soon stocks.

He is also actively looking for talented traders and business partners to strengthen collaborations across Europe and the Middle East, particularly in roles like Tied Agents, Master IBs, Fund Managers, and Strategy Providers.

Fintokei Specifications Summary

Let's review what Fintokei offers:

Account currency | USD, JPY, EUR, CZK |

Minimum price | $99 |

Maximum leverage | 1:100 |

Maximum profit split | 100% |

Instruments | Forex, indices, commodities, metals |

Assets | USD/JPY, S&P 500, Gold |

Evaluation steps | 1-Step, 2-Step, and 3-Step |

Trading platform | MT4, MT5, cTrader |

Withdrawal methods | Bank Transfer, Credit/Debit card, crypto |

Maximum fund size | $4,000,000 |

First profit target | 2% |

Maximum daily loss | 5% |

Challenge time limit | Min 3 Days, Max 180 days |

News trading | Allowed |

Maximum total drawdown | 10% |

Commission per round lot | $6 |

Trustpilot score | 4.8/5 |

Payout frequency | Instant |

Established country | Czech |

Established year | 2022 |

Fintokei Advantages & Disadvantages

Like any trading platform, Fintokei has its strengths and weaknesses. Let's break them down:

Advantages | Disadvantages |

Massive scaling potential (up to $4 million) | Restricted access for some countries |

High performance rewards (up to 100% profit split) | Higher than average challenge prices |

Instant payouts | - |

Various evaluation plans | - |

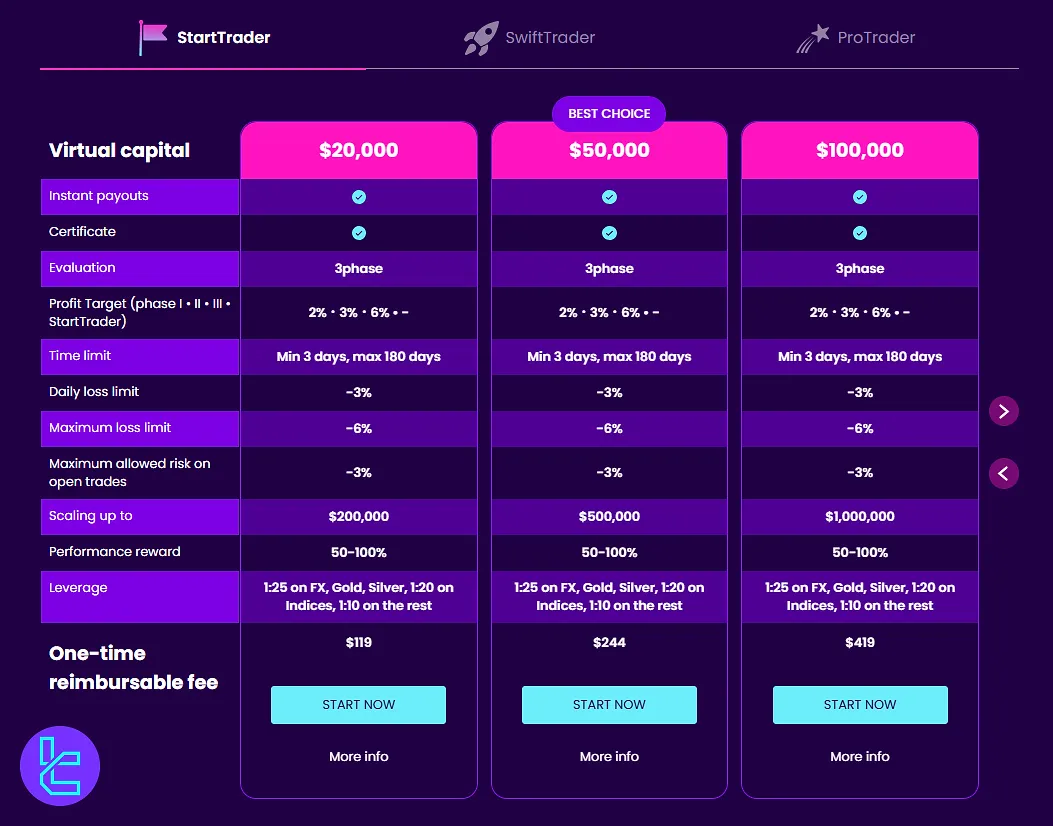

Fintokei Prop Funding & Challenge Prices

Here's a quick breakdown of Fintokei funding options:

Account size | StartTrader | ProTrader | SwiftTrader |

$10,000 | - | $99 | $119 |

$20,000 | $119 | $159 | $179 |

$50,000 | $244 | $319 | $369 |

$100,000 | $419 | $529 | $599 |

$200,000 | - | $1,149 | $1,299 |

$400,000 | - | $2,399 | - |

Fintokei’s higher-than-average prices might discourage some traders from buying a challenge from this prop firm.

Fintokei Prop Account Opening & Verification

The Fintokei registration is simple and takes under 3 minutes. Whether you're opting for a free or premium account, the process requires only basic personal and trading-related information.

#1 Access the Signup Page

Go to the official Fintokei homepage, click “Start Now”, and choose between a free or premium account to begin.

#2 Complete the Registration Form

Enter the details as mentioned below:

- First and Last Name

- Username

- Email Address

- Mobile Number

- Password + Confirmation

- Country of Residence

- Preferred Trading Platform

- Interface Language

Accept the terms, complete the CAPTCHA verification, and click “Confirm” to finalize.

Fintokei Prop Firm Evaluation Challenges

Fintokei has 3 unique evaluation programs in one-step, two-step, and three-step models. Follow along to learn about each account.

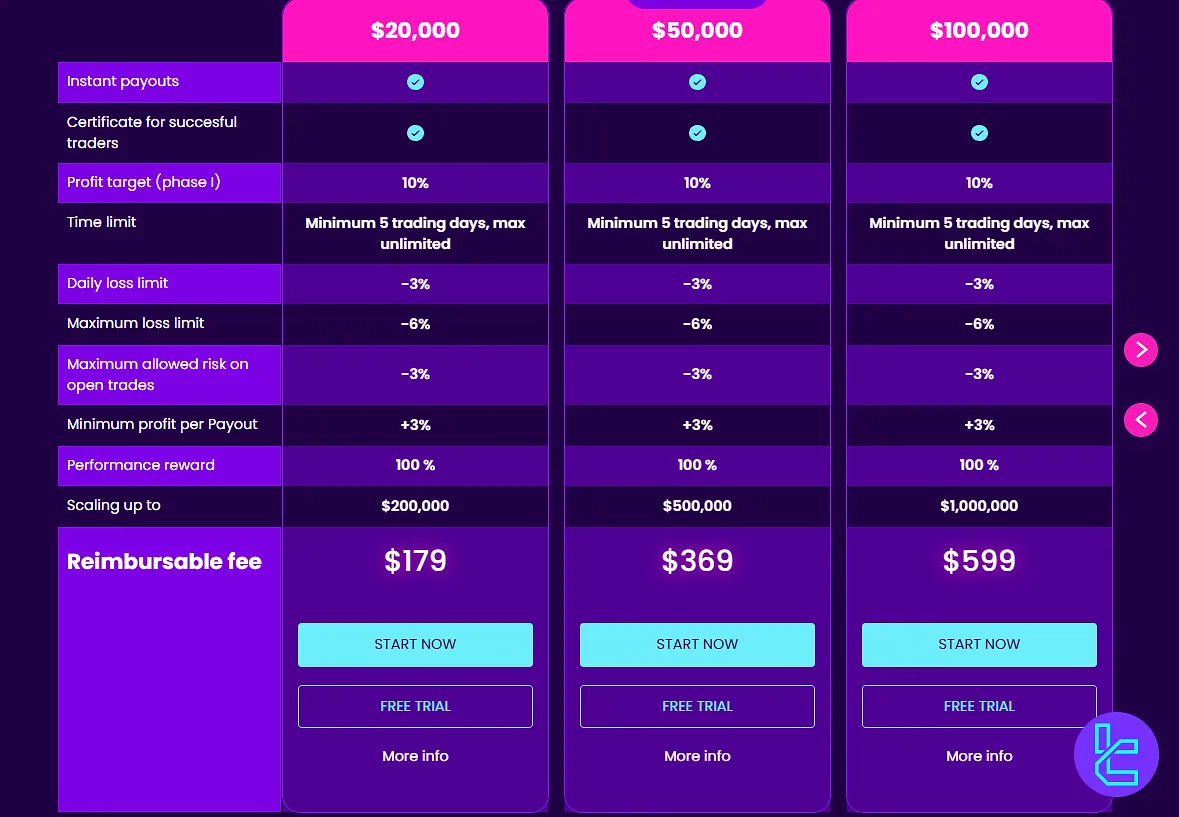

Fintokei StartTrader

The Fintokei StartTrader Program is designed for traders aiming to prove consistency with a structured, step-based evaluation.

Here are the account details:

Account Type | 3-Step | ||

Maximum daily drawdown | 3% | ||

Maximum overall drawdown | 6% | ||

Profit target | 2% (Step 1), 3% (Step 2), 6% (Step 3) | ||

Profit split | 50-100% | ||

Payouts | Instant | ||

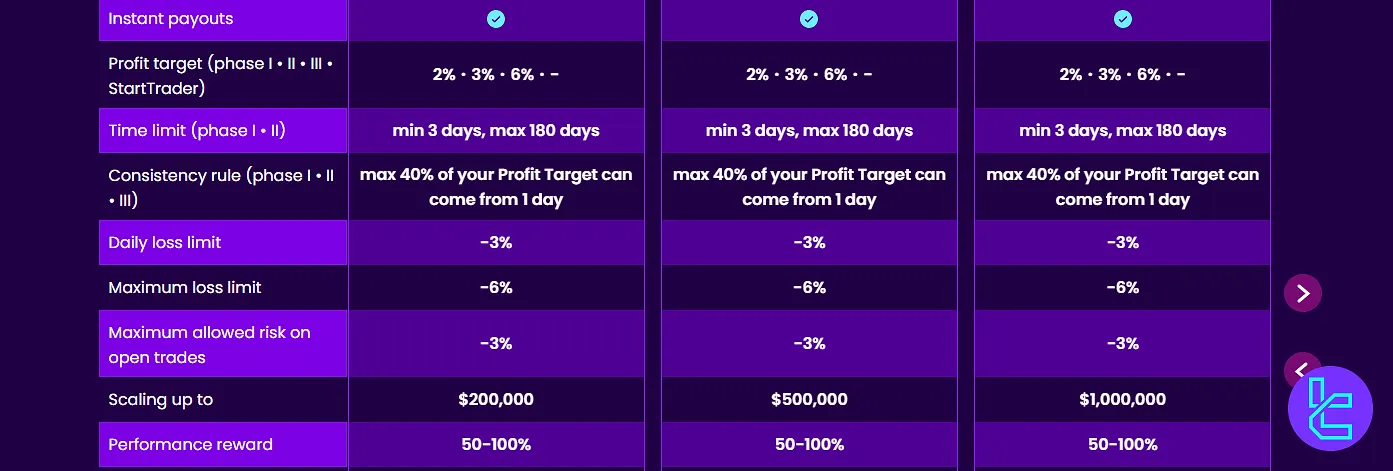

Fintokei SwiftTrader Evaluation

The Fintokei SwiftTrader Evaluation is built for traders who want a faster track to funding with a 1-step challenge.

The parameters are as follows:

Account Type | 1-Step |

Maximum daily drawdown | 3% |

Maximum overall drawdown | 6% |

Time limit | Min. 5 Trading Days |

Profit Target | 10% |

Payouts | Instant |

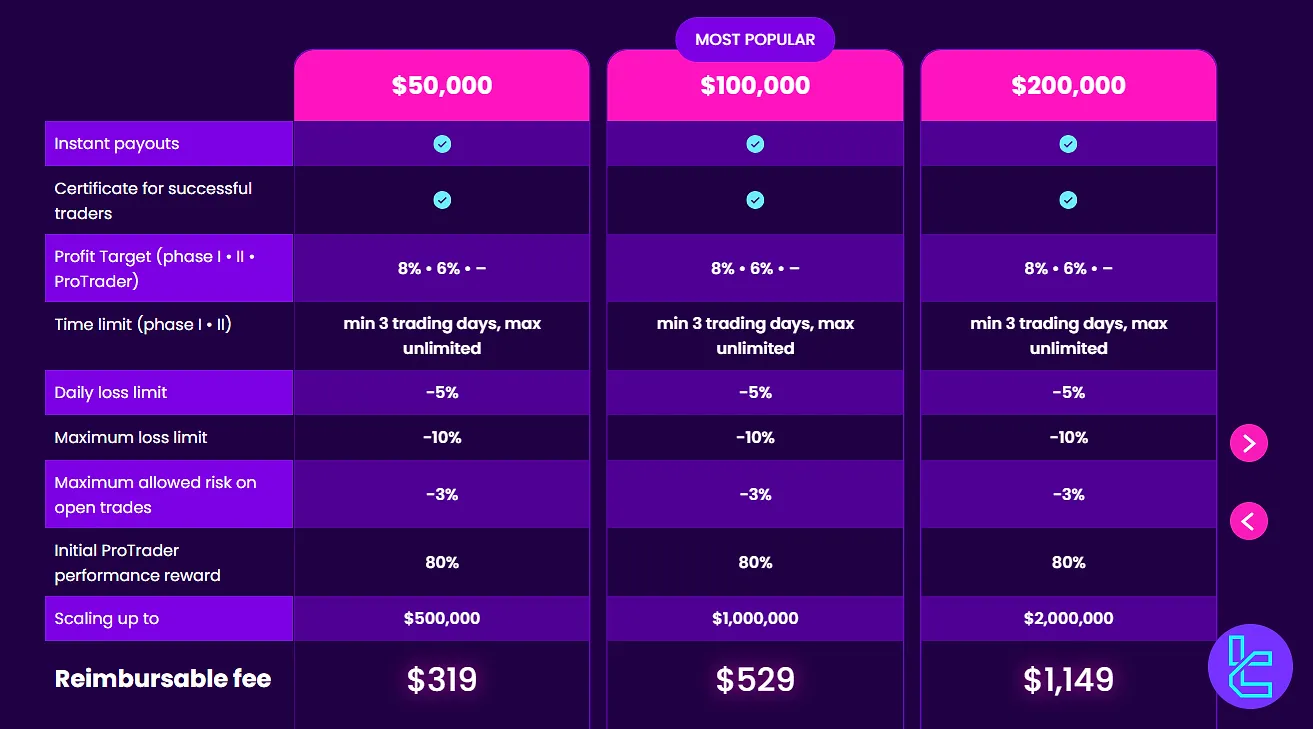

Fintokei ProTrader Plan

The Fintokei ProTrader Plan is tailored for skilled traders who can handle stricter risk rules and higher targets.

The details are outlined here:

Account Type | 2-Step |

Maximum daily drawdown | 5% |

Maximum overall drawdown | 10% |

Profit target | 8% (Step 1), 6% (Step 2) |

Profit split | 80% (and more with scaling) |

Payouts | Instant |

The prop firm also provides another plan under the name "ProTrader Swing", but, during our investigations, we did not find any difference between that and the regular ProTrader plan.

Fintokei Prop Bonuses and Discounts

While Fintokei doesn't offer traditional bonuses or discounts, they do provide an affiliate program. With this program, traders can earn up to 10% commission on their referee’s purchases.

Remember, the one-time fee for joining a Fintokei program is also fully refundable if you complete the challenge successfully. This risk-free approach allows you to focus on developing your skills without worrying about losing your investment.

Fintokei Rules

As with many Prop Firms, Fintokei allows and disallows certain practices related to trading; Key Points of Fintokei Rules:

- VPN & VPS Usage: IP tracking is enforced to prevent abuse. Unusual IP activity, such as logging in from multiple countries or using VPNs can result in account restrictions;

- Hedging: Hedging across multiple accounts or clients is strictly prohibited;

- Expert Advisors (EAs): Using commercial or free EAs without individual customization or intervention is not allowed;

- Martingale & Arbitrage Strategies: Martingale strategies and latency arbitrage are prohibited. However, normal averaging (DCA-style) is allowed;

- News Trading: News trading is allowed during periods of high volatility from major news events;

- Payouts: Since Aug 4, 2025, traders get Instant Payouts with one-click requests, approvals in under 20 seconds, active accounts, and funds delivered within 1 business day.

VPN & VPS Usage

Fintokei tracks IP addresses to ensure fair usage of trading accounts and to prevent any form of abuse or manipulation.

Unusual IP activity, such as logging in from multiple countries in a short time or using VPNS, proxies, or anonymizers, can trigger red flags and may lead to account restrictions or violations.

Hedging Policy

Hedging across multiple accounts or clients is strictly prohibited. Using multiple trading accounts to hedge positions or offset risk is not allowed at Fintokei and may result in penalties or account suspension.

Expert Advisor (EA) Usage

Using commercial or free Expert Advisors (EAs) without individual customization or modification is not allowed. Even if these EAs are profitable, they must be personally adjusted or customized by the trader to comply with Fintokei’s guidelines.

Martingale & Arbitrage Strategies

Martingale strategies and aggressive averaging methods (increasing position sizes after losses) are not supported as they are high-risk and speculative.

However, normal averaging (Dollar-Cost Averaging or DCA) is allowed, where positions of equal size are opened at regular intervals to reduce the entry price in a structured and risk-managed way.

Latency arbitrage is strictly prohibited, as it takes advantage of price discrepancies between platforms or feeds, which undermines the fair market.

News Trading Policy

Fintokei allows news trading during periods of extreme volatility caused by significant news events. Traders can open or close trades before, during, or after such events without restrictions, giving them the flexibility to capitalize on market movements.

Payouts

Starting August 4, 2025, Fintokei became the first FX/CFD prop firm to introduce Instant Payouts, giving traders the ability to access their performance rewards without delays.

With one click, payouts are processed instantly, keeping accounts active while funds are sent within 1 business day.

Fintokei Payouts Main Features:

- Average processing under 20 seconds

- Account stays active even after payout request

- Funds delivered quickly, often within the same day

Understanding Scaling at Fintokei

Scaling at Fintokei is designed for traders who consistently meet performance goals. It provides the opportunity to expand a virtually funded account to larger allocations once profitability requirements are achieved.

Depending on the program, balances can grow in stages, for example, from €10,000 to €100,000.

For ProTrader, StartTrader, and SwiftTrader (new accounts activated after August 18, 2025), the two-month countdown for scaling begins either at the moment the virtually funded account is created or from the last scaling event.

To qualify, traders must:

- Generate at least 10% profit in two consecutive months;

- Ensure all trades are closed before the request.

For SwiftTrader accounts opened before August 18, 2025, the time frame is measured from the date of the first payout or the most recent scaling event.

The same requirements apply: a minimum of 10% profit across two consecutive months and no open positions at the time of request.

Only one scaled account can be active per trader, and accounts running at a loss are ineligible. Performance rewards must be withdrawn before scaling is processed.

Requests are submitted directly to support@fintokei.com with account details for review.

Scaling progresses through predefined levels. After the initial stage (Level 0), each successful evaluation advances the account to the next level, with progressively larger capital allocations.

Note that if Fintokei’s Consistency Rules apply to an account, scaling privileges are suspended until those conditions are resolved.

ProTrader & ProTrader Swing Scaling

Accounts under these plans can grow through multiple levels, beginning at $12,500 and potentially reaching allocations in the millions.

Each stage requires at least a 10% profit target achieved over two consecutive months with all trades closed.

Reward ratios vary across levels, with higher stages offering increasing allocations tied to specific performance metrics.

SwiftTrader Scaling Model

SwiftTrader participants begin with allocations from $12,500 and can expand step by step up to $2,000,000.

Each level demands the same 10% profit target achieved consecutively over two months. Depending on the level, performance reward ratios may reach 100%.

StartTrader Scaling Framework

The StartTrader track begins with allocations of $25,000 and follows a similar two-month, 10% profit rule. Scaling continues through multiple tiers, potentially extending to $1,000,000 at higher stages. Selected levels also involve collaboration with Fintokei’s portfolio management division.

Fintokei Trading Platforms

Fintokei supports three of the most popular trading platforms in the industry:

- MetaTrader 4 (MT4): The classic platform known for its simplicity and reliability

- MetaTrader 5 (MT5): The next-gen platform with advanced charting and analysis tools

- cTrader: A modern platform favored by many for its user-friendly interface

Traders can choose the platform they are most comfortable with or take this opportunity to familiarize themselves with a new one. Furthermore, you can download and access various indicators for MetaTrader platforms via these links:

Instruments & Symbols Available For Trading in Fintokei

Fintokei offers a focused selection of financial instruments:

- Forex Market: Major, minor, and exotic currency pairs

- Metals: Gold, Silver

- Energies: Crude Oil, Natural Gas

- Indices: Major global stock indices

While this selection might seem limited compared to some brokers, it covers the most liquid and popular markets. This focus allows traders to specialize and develop expertise in specific areas, potentially leading to more consistent results.

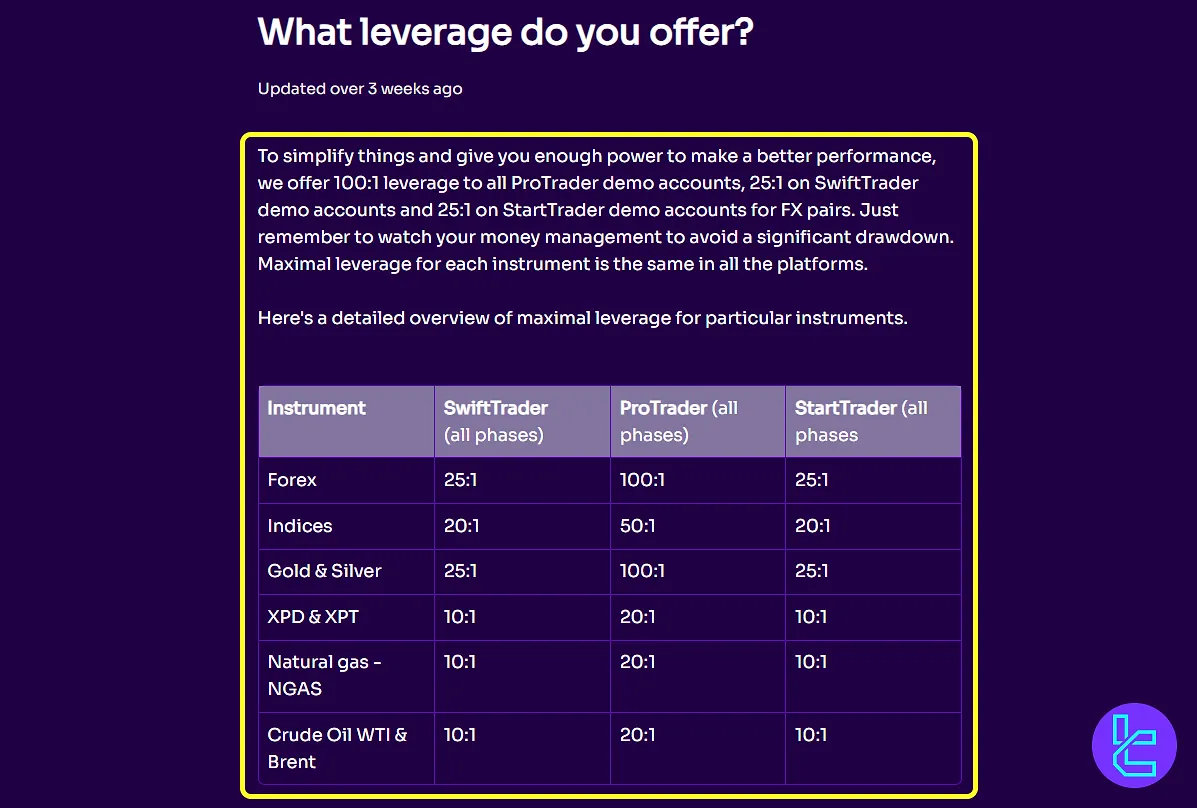

Fintokei Trading Leverage

Fintokei provides flexible leverage options across its trading programs to help traders optimize performance while managing risk.

ProTrader accounts benefit from trading leverage up to 100:1, while Swift Trader and Start Trader offer leverage up to 25:1 on major FX pairs.

Maximum Leverage by Instrument:

- Forex: 25:1 (SwiftTrader/StartTrader), 100:1 (ProTrader)

- Indices: 20:1 (SwiftTrader/StartTrader), 50:1 (ProTrader)

- Gold & Silver: 25:1 (SwiftTrader/StartTrader), 100:1 (ProTrader)

- XPD & XPT (Palladium & Platinum): 10:1 (SwiftTrader/StartTrader), 20:1 (ProTrader)

- Natural Gas (NGAS): 10:1 (SwiftTrader/StartTrader), 20:1 (ProTrader)

- Crude Oil WTI & Brent: 10:1 (SwiftTrader/StartTrader), 20:1 (ProTrader)

Fintokei applies the same leverage rules across all phases of its programs.

Fintokei Prop Firm Payment Methods

Fintokei understands the importance of flexible payment options. They accept:

- Credit/Debit Cards: Visa/MasterCard

- Cryptocurrencies: Bitcoin, Ethereum, and other altcoins

- Bank Transfers

- GooglePay and ApplePay

This approach ensures that most traders can easily fund their accounts and receive their payouts. The addition of crypto options is particularly appealing for traders in regions where traditional banking might be restrictive.

Fintokei has 2 distinct withdrawal policies based on account type:

For SwiftTrader users, profits may be withdrawn only after achieving a minimum 10% profit and a 14-day waiting period. After the first successful withdrawal, only a minimal withdrawable balance is required for future payouts.

For ProTrader users, withdrawals can be requested after 14 days from account creation or the last withdrawal. All open trades must be closed at the time of request - otherwise, Fintokei will automatically liquidate those positions.

Fintokei Trading Costs

Fintokei's fee structure is straightforward. Traders can buy and sell their favorite instruments with $6 Commission per round lot across all programs.

It is also worth noting that Fintokei trading spreads start from 1.5 pips and can go up, especially on low liquidity or high volatility times. Fintokei has no hidden fees or ongoing costs. Once traders pay the initial fee and start trading, they are only charged the standard commission on their trades.

Fintokei Prop Firm Educational Resources

Fintokei provides a substantial library of educational tools designed to support traders at all levels. Upon purchasing a funded program, traders gain access to over 100 educational videos, daily news broadcasts, and a suite of trading calculators.

These resources are hosted under the “Edu & Tools” tab in the user dashboard and aim to enhance both strategy development and market awareness.

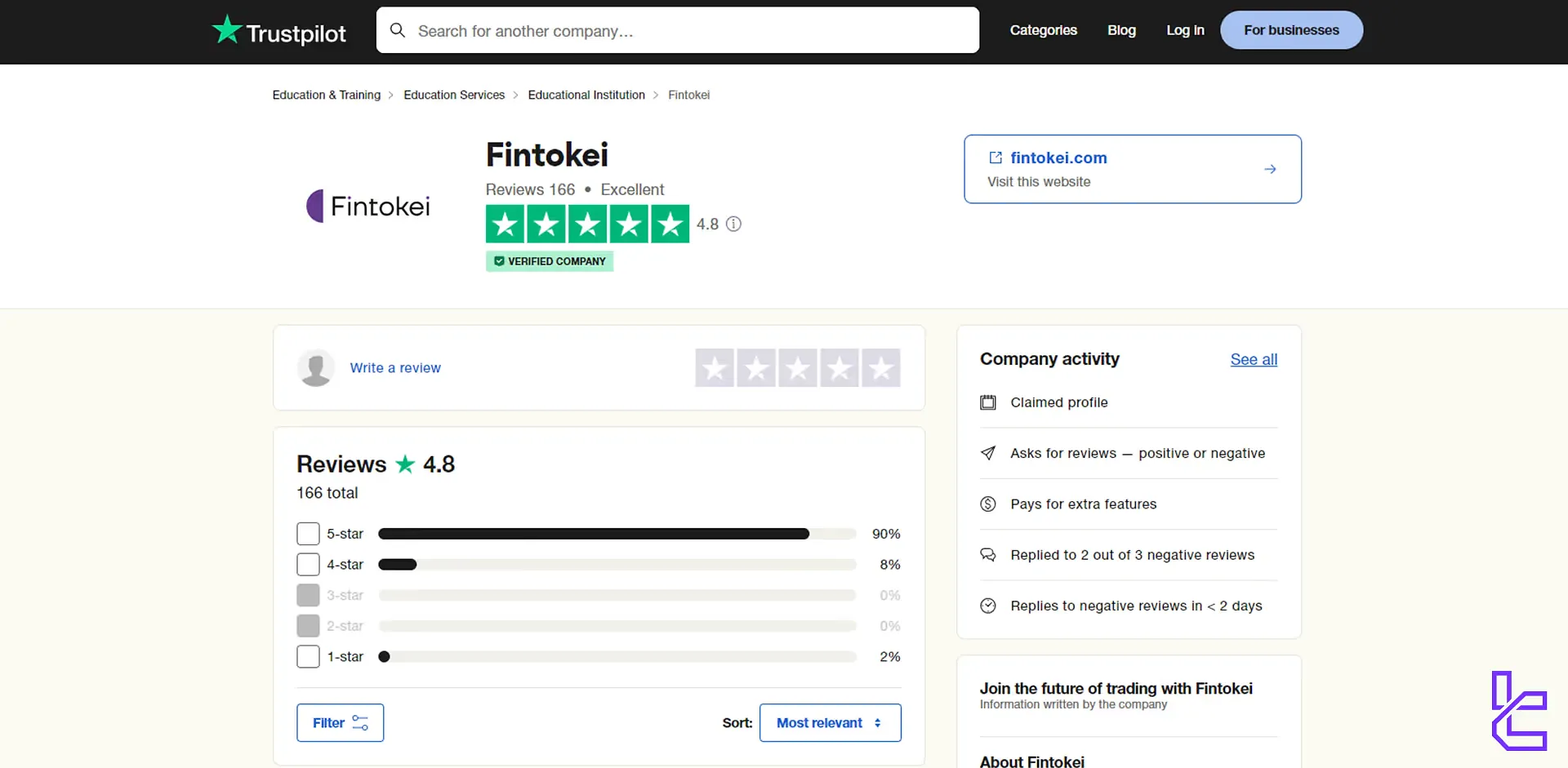

Fintokei Trust Scores

The firm has made a strong impression on the trading community. Fintokei Trustpilot score is 4.8/5 from over 100 reviews, with 90% being 5-star.

This high trust score is a testament to Fintokei's commitment to trader success and satisfaction. It's always reassuring to see a prop firm with such positive feedback from its community.

Fintokei Customer Support Channels

Fintokei takes pride in its customer-centric approach. Here are their customer service channels:

Support Method | Availability |

Live Chat | No |

Yes (Through support@fintokei.com) | |

Phone Call | Yes (via +420 321 338 152) |

Discord | No |

Telegram | No |

Ticket | No |

FAQ | No |

Help Center | No |

No | |

Messenger | No |

Traders consistently report positive experiences with Fintokei's support team, citing their patience in explaining complex concepts and their efficiency in resolving issues.

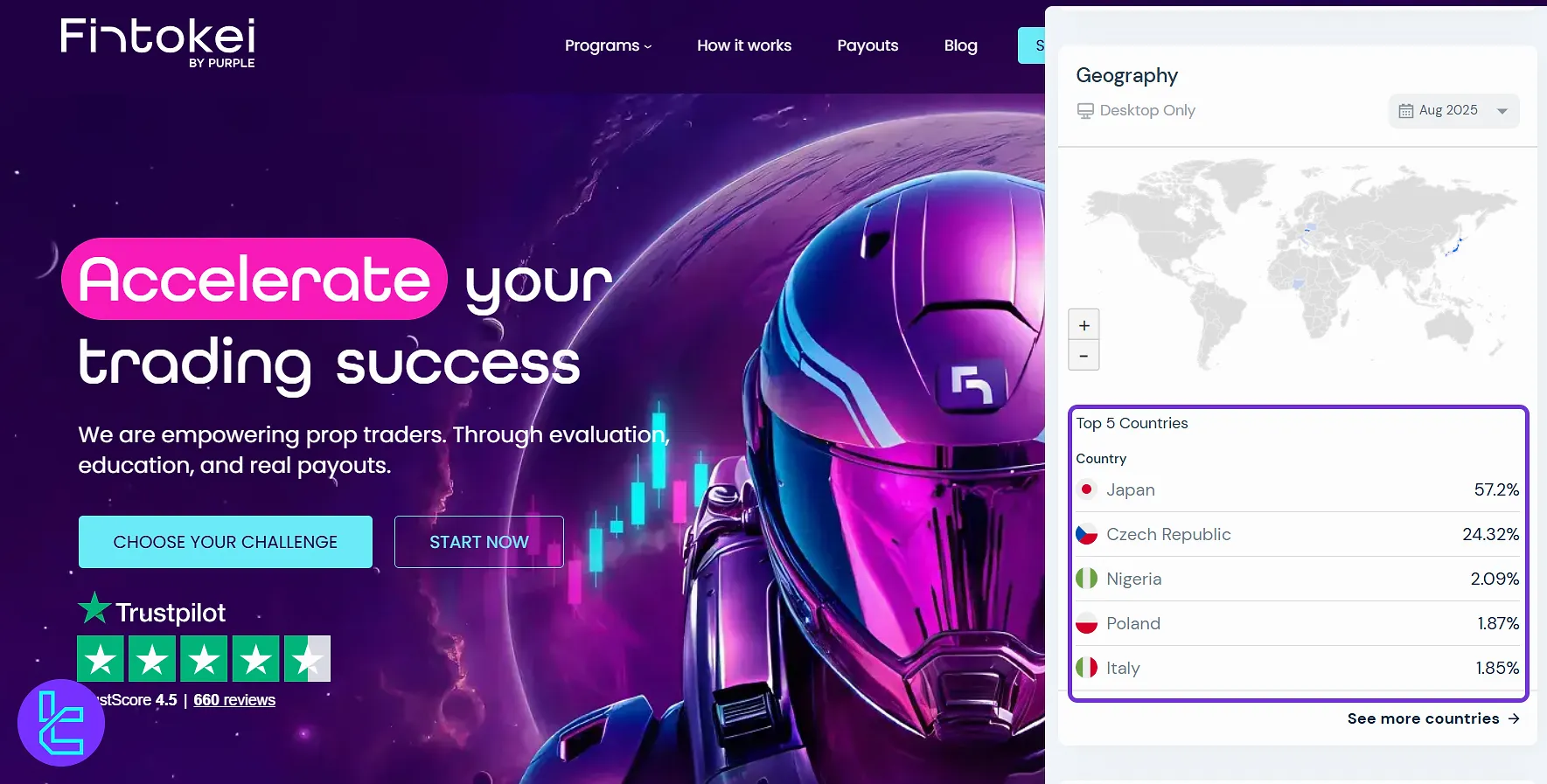

Demography of User Regions in Fintokei

Fintokei’s global presence is reflected in its user demographics, with a strong concentration of traders in Asia and Europe. As of August 2025, the platform’s desktop traffic highlights Japan as the clear leader, followed by key regions across Europe and Africa.

Top 5 Countries by User Share:

- Japan: 57.2%

- Czech Republic: 24.32%

- Nigeria: 2.09%

- Poland: 1.87%

- Italy: 1.85%

This distribution demonstrates Fintokei’s dominant popularity in Japan, while also expanding steadily across European markets and emerging regions like Nigeria.

Fintokei Prop Firm Socials

Fintokei maintains an active presence on major social media platforms:

Social Media | Members/Subscribers |

Over 34.2K | |

Over 22.6K | |

Over 1.2K |

Following Fintokei on these platforms can provide valuable insights into their operations and offer additional learning resources.

Fintokei Comparison Table

Let's examine what makes Fintokei stand apart from other prop firms; Fintokei Comparison:

Parameters | Fintokei Prop Firm | |||

Minimum Challenge Price | $99 | $39 | $33 | $97 |

Maximum Fund Size | $4,000,000 | $250,000 | $400,000 | $200,000 |

Evaluation steps | 1-Phase, 2-Phase, 3-Phase | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 50% to 100% | 100% | 100% | 80% |

Max Daily Drawdown | 5% | 5% | 7% | 5% |

Max Drawdown | 10% | 10% | 14% | 10% |

First Profit Target | 2% | 5% | 6% | 5% |

Challenge Time Limit | Min 3 Days | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Instant | Bi-weekly | Weekly | Bi-weekly |

Number of Trading Assets | N/A | 3000+ | 40+ | 40 |

Trading Platforms | MT4, MT5, cTrader | Metatrader 5 | MetaTrader 5, Match Trader | MetaTrader 5, cTrader, Dxtrade |

TF Expert Suggestion

Fintokei stands out with an impressive profit split of up to 100% and a substantial scaling potential reaching $4 million.

However, traders should weigh these benefits against the relatively high trading costs, including $6 commissions, and challenge fees that exceed industry averages.

With a commendable 4.8/5 Trustpilot rating, Fintokei has garnered positive user feedback, but its unavailability in major markets like the USA, India, Russia, and China remains a significant limitation for many aspiring traders.