Nordic Funder was founded in 2021 and funds traders with $1M. To scale up to $1M, traders must hit the 10% profit target.

The first profit target, max drawdown, and max daily loss are 5%, 8%, and 5%, respectively.

Nordic Funder Prop Firm Company Overview

Nordic Funder is the largest proprietary trading firm in Scandinavia. This Swedish powerhouse has rapidly carved out a niche for itself, blending traditional Nordic values of efficiency and quality with cutting-edge trading technology.

What sets Nordic Funder prop firm apart is its unwavering commitment to trader success. They've crafted a program that's not just about funding, but about nurturing talent and fostering a community of skilled traders. Here's what makes them tick:

- Efficiency: Nordic Funder operates with precision and clarity, ensuring a smooth experience for traders;

- Innovative Strategies: They're not content with the status quo, constantly pushing the boundaries of prop trading;

- Quality Service: Top-tier support and resources to grow in your trading journey;

- Regulated Partner: They've partnered with Scandinavian Capital Markets, a broker with 8 years of solid regulation under its belt;

- Diverse Trading Options: From Forex to Crypto, Metals to Indices, they've got all bases covered;

- Scalability: Start at $25K and scale your way up to $1 million in funding.

Nordic Funder CEO

Nordic Funder, Scandinavia’s largest proprietary trading firm, is led by David Nudelman. He founded the firm in November 2021, and under his leadership, it has quickly grown into a dominant player in the Nordic trading landscape.

As CEO, Nudelman has been pivotal in shaping Nordic Funder’s vision, building strong funding programs for traders, and positioning the company as a competitive force in the European prop trading market.

Nordic Funder Specifications

Let's break down Bordic Funder specifications in a table that'll give you the full picture at a glance:

Account currency | USD |

Minimum price | $42 |

Maximum leverage | 1:20 |

Maximum profit split | 90% |

Instruments | Forex, crypto, metals, commodities, indices |

Assets | N/A |

Evaluation steps | 1-Step, 2-Step, 3-Step |

Trading platform | MT4 |

Withdrawal methods | Rise |

Maximum fund size | $1,000,000 |

First profit target | 5% |

Maximum daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Yes (conditioned) |

Maximum total drawdown | 8% |

Commission per round lot | $7 FX and Metals |

Trust pilot score | 4.5/5 |

Payout frequency | 14 days |

Established country | Sweden |

Established year | 2021 |

Nordic Funder Benefits and Drawbacks

Let's dissect the pros and cons of Nordic Funder:

Pros | Cons |

Transparent funding structure | Geo-restrictions |

Up to $500,000 funding | Restrictions on copy trading and news trading |

Scaling opportunity up to $1 million | No support for MT5 or TradingView |

Maximum 90% profit sharing | - |

Nordic Funder Funding and Prices

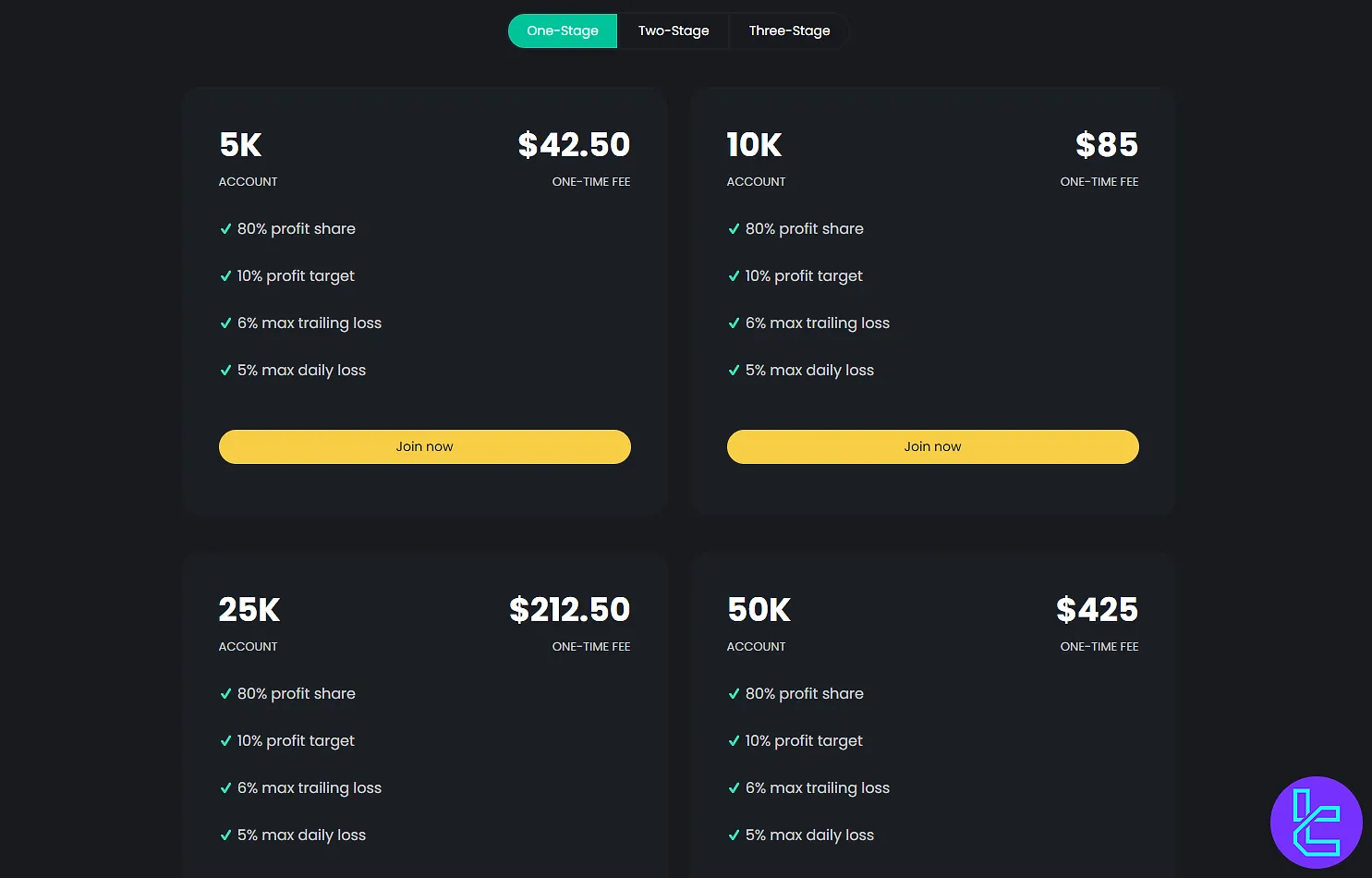

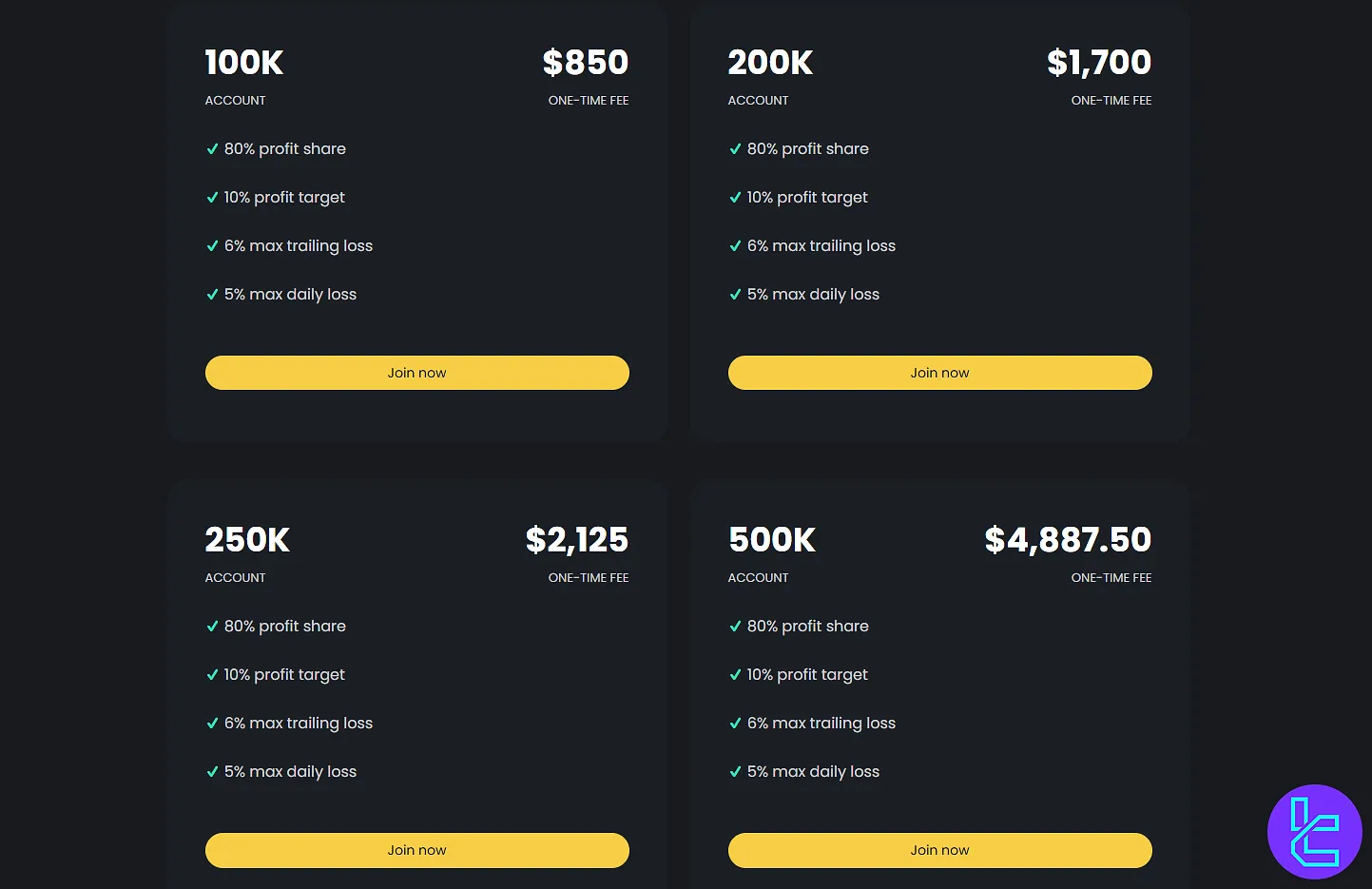

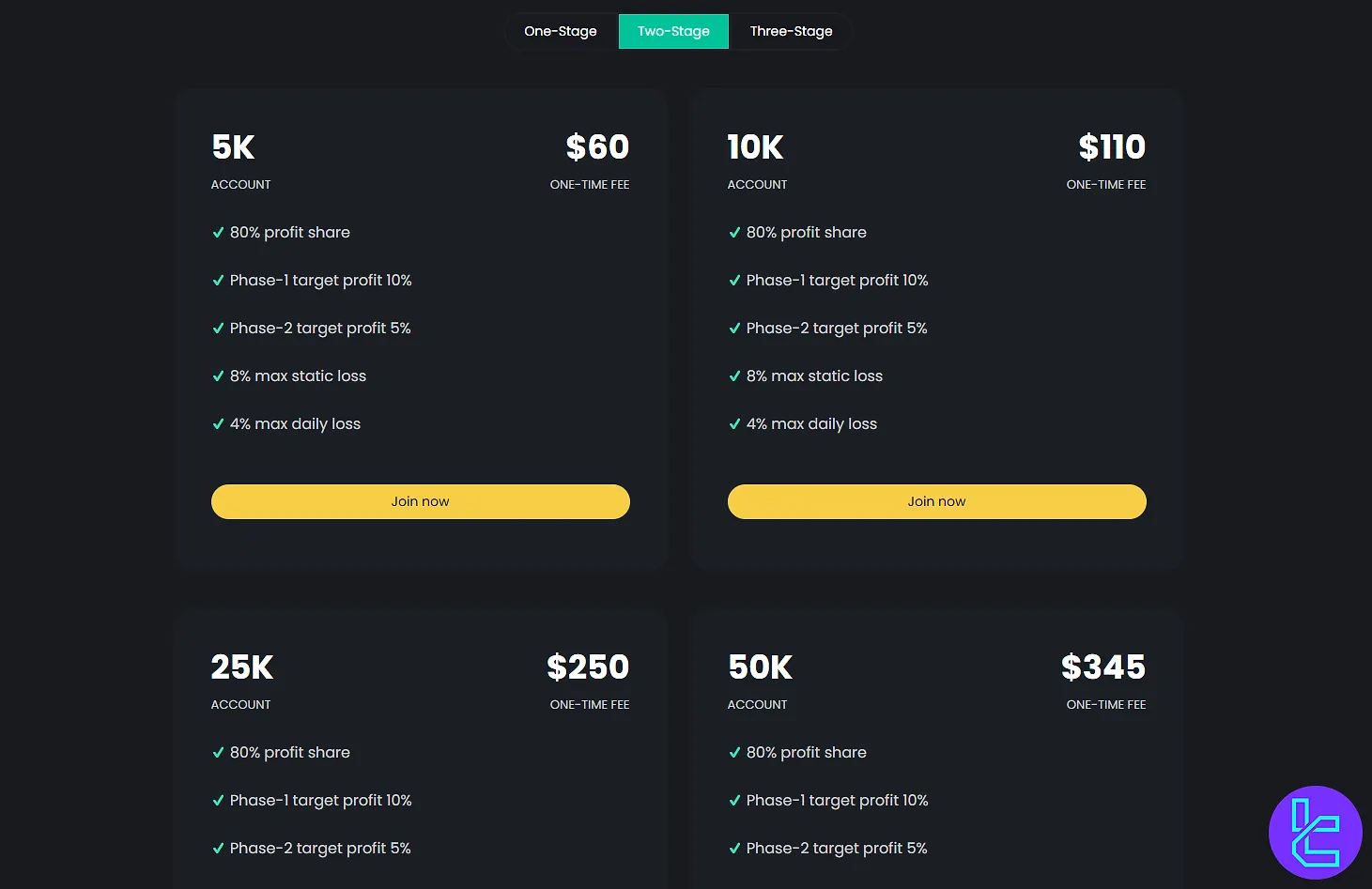

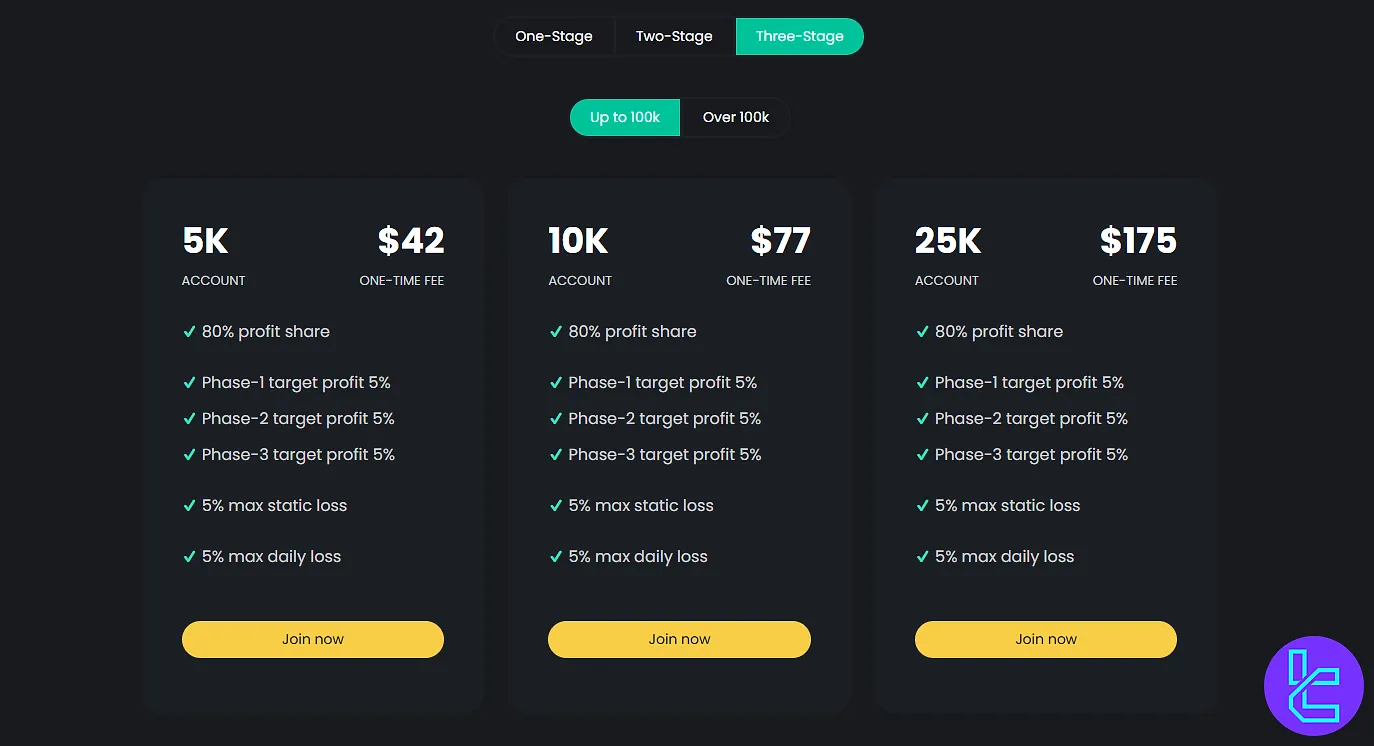

Nordic Funder provides traders with three challenge models: One-Stage, Two-Stage, and Three-Stage, each with distinct pricing and risk structures.

For the One-Stage Challenge, fees start at $42.50 for a $5K account and rise to $4,887.50 for a $500K one. While the Two-Stage Challenge starts slightly more expensive, it gets cheaper as the account balance increases.

The Three-Stage Challenge is the Nordic Funder's cheapest program, offering funded accounts from $42 to $1,932.

Account Balance | One-Stage | Two-Stage | Three-Stage |

$5K | $42.50 | $60 | $42 |

$10K | $85 | $110 | $77 |

$25K | $212.50 | $250 | $175 |

$50K | $425 | $345 | $241.50 |

$100K | $850 | $525 | $367.50 |

$200K | $1,700 | $1,000 | $700 |

$250K | $2,125 | $1,225 | $857.50 |

$500K | $4,887.50 | $2,760 | $1,932 |

Nordic Funder's pricing and funding structure is designed to reward skill and consistency. Challenges can also scale up to 1 million dollars. For traders looking to grow their capital, Nordic Funder offers a compelling proposition that's hard to ignore.

Nordic Funder Account Sign-up and Verification Guide

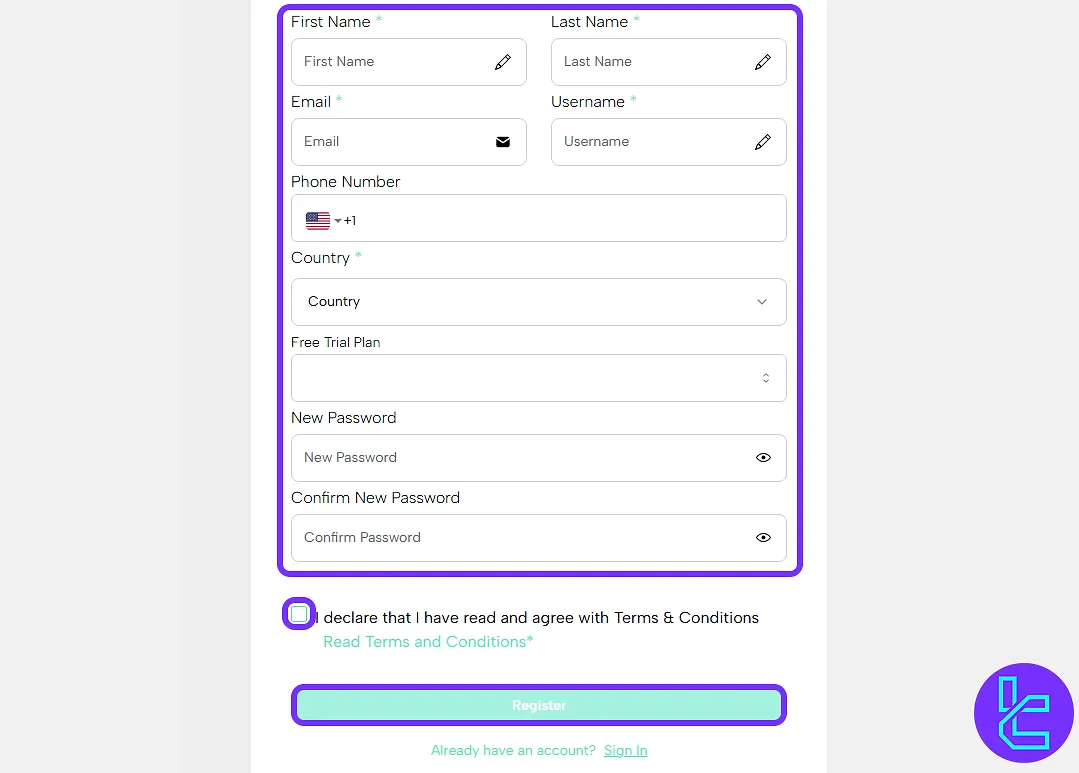

Setting up an account with Nordic Funder is a streamlined process tailored for fast access to the dashboard. Without needing ID documents or verification codes, traders can register and reach their portal in under five minutes.

The Nordic Funder registration journey covers access through the homepage, a personal information form, and direct login to the trading environment.

#1 Navigate to the Registration Portal

Head over to the Nordic Funder website and choose “Create an Account” from the login menu. This will take you to the secure account registration panel.

#2 Enter Personal Details

Fill in required fields, including:

- Full name

- Username

- Phone number

- Password

- Country of residence

After you complete the form, accept the terms to proceed (no document uploads or verification steps needed).

#3 Dashboard Access

Return to the login page, input your credentials, and instantly explore your prop trading dashboard.

You can navigate through the client portal to the "Challenges" menu and purchase your preferred funding account.

#4 Nordic Funder Verification

After successfully passing the assessment for the first time, you’ll be required to verify your identity. This involves submitting supporting documents, including:

- Proof of Identity: ID card or Passport

- Proof of Address: Bank statement or Utility bill

Nordic Funder Evaluation

Nordic Funder’s evaluation programs are offered in three formats:

- One-Stage: 10% profit target, 6% total drawdown, and 5% daily limit (Trailing model)

- Two-Stage: 10% / 5% profit target, 8% max drawdown, and 4% daily limit (Static drawdown)

- Three-Stage: 5% profit target in each stage, 5% max drawdown, and 5% max daily loss (Static drawdown)

Note: While static drawdown is a fixed loss limit from the starting balance, trailing drawdown adjusts upward with profits.

Nordic Funder follows the EOD balance model to calculate daily loss, meaning the drawdown limit is calculated based on your account balance at the end of each trading day, not intraday.

Remember, while the process is straightforward, successful trading requires skill, strategy, and risk management.

Trading Conditions | One-Stage | Two-Stage | Three-Stage |

Profit Target | 10% | 10% / 5% | 5% / 5% / 5% |

Max Drawdown | 6% | 8% | 5% |

Drawdown Type | Trailing | Static | Static |

Max Daily Loss | 5% | 4% | 5% |

Daily Loss Type | EOD Balance | EOD Balance | EOD Balance |

Inactivity | 30 Days | 30 Days | 30 Days |

Refunds | No | No | No |

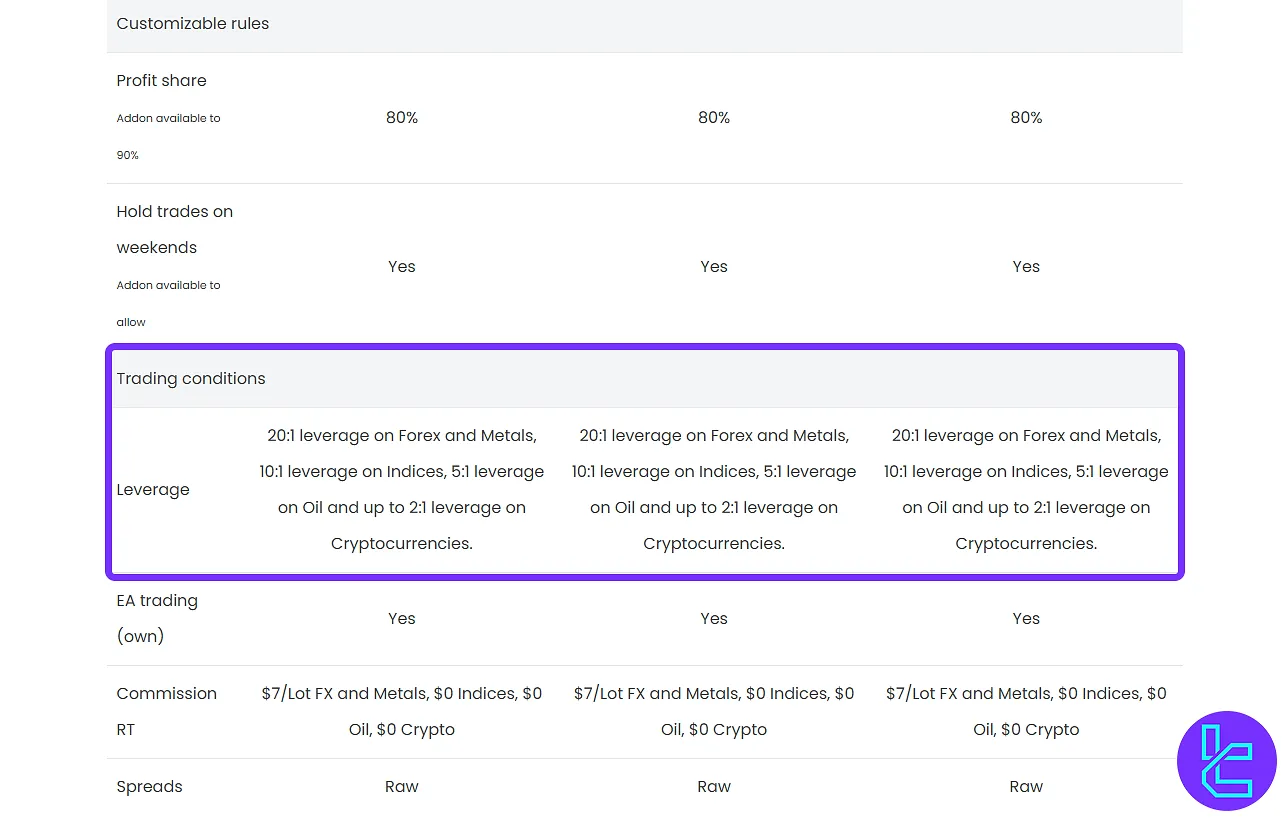

Profit Share | 80% | 80% | 80% |

Max Leverage | 1:20 | 1:20 | 1:20 |

Spreads | Raw | Raw | Raw |

Commission | $7/lot FX and Metals, $0 Indices, $0 Oil, $0 Crypto | ||

Nordic Funder 1-phase Challenge

The 1-Phase Challenge at Nordic Funder is built around a transparent framework that evaluates traders on core performance metrics. Participants are expected to reach a 10% profit target while adhering to strict risk controls, including a 6% maximum trailing loss and a 5% maximum daily loss.

Once the objectives are achieved, traders unlock access to funded accounts with an 80% profit share, ensuring both sustainability and profitability.

This single-step structure is designed to highlight discipline, consistency, and risk-adjusted performance.

Trading Condition | One-Stage Program |

Profit Target Phase 1 | 10% |

Maximum Drawdown Limit | 6% |

Maximum Daily Drawdown | 5% |

Maximum Leverage | 1:20 |

Nordiv Funder 2-Phase Challenge

The 2-Phase Challenge at Nordic Funder is tailored for traders who value a gradual evaluation process with balanced objectives. In Phase 1, traders aim for a 10% profit target, followed by a more conservative 5% profit target in Phase 2.

To ensure disciplined trading, participants must respect an 8% maximum static loss and a 4% maximum daily loss, while enjoying an 80% profit share once funded.

This dual-stage structure is designed to highlight consistency and adaptability, rewarding traders who can perform under structured risk limits across multiple phases.

Trading Condition | Two-Stage Program |

Profit Target Phase 1 | 10% |

Profit Target Phase 2 | 5% |

Maximum Drawdown Limit | 8% |

Maximum Daily Drawdown | 4% |

Maximum Leverage | 1:20 |

Nordiv Funder 3-Phase Challenge

The 3-Phase Challenge at Nordic Funder is designed for traders who prefer a structured and progressive evaluation model. Each stage requires a 5% profit target, allowing participants to demonstrate steady growth over three steps.

To maintain discipline, traders must respect a 5% maximum static loss and a 5% maximum daily loss throughout the program.

Once funded, successful candidates benefit from an 80% profit share, ensuring that consistent performance and risk management are rewarded across multiple phases.

Trading Condition | Three-Stage Program |

Profit Target Phase 1 | 5% |

Profit Target Phase 2 | 5% |

Profit Target Phase 3 | 5% |

Maximum Drawdown Limit | 5% |

Maximum Daily Drawdown | 5% |

Maximum Leverage | 1:20 |

Nordic Funder Bonuses and Discounts

Nordic Funder doesn’t offer bonuses directly on the website, but traders can search on third-party platforms or join the Nordic Funder newsletter to receive discount codes for buying challenges.

Nordic Funder offers a great affiliate program that allows traders to earn commissions by referring new traders to the platform.

Nordic Funder Trading Rules

This section outlines the key trading guidelines, including the use of VPNs, hedging practices, the role of Expert Advisors (EAs), acceptable trading strategies, and the restrictions on news trading.

- VPN Usage: No official rules on VPN use are provided by the company;

- Hedging Restrictions: Hedging within a single account is permitted, but executing buy and sell trades across multiple accounts is strictly prohibited;

- Expert Advisors (EA): Personal, trader-owned EAs are allowed, but third-party automated systems or copy trading strategies are not;

- Aggressive Trading Strategies: Nordic Funder restricts high-frequency trading, latency arbitrage, and triangular arbitrage, while there are no restrictions on martingale;

- News Trading: Opening positions within three minutes before or after a news event is prohibited;

- Payout Rules: Traders at Nordic Funder can request payouts once every 30 days via the dashboard, with approved profits distributed through available payment solutions under the firm’s 80% profit share model.

VPN Usage

Nordic Funder does not provide explicit guidelines regarding the use of VPNs. Users should be aware that no specific restrictions on VPN use are mentioned on the website.

However, using a VPN may trigger security checks or lead to account restrictions, especially if frequent IP address changes are detected.

Additionally, it's crucial to avoid VPNs that use IP addresses from prohibited countries.

Hedging

While hedging or executing opposite trades within the same account is allowed, certain activities involving multiple accounts are prohibited.

Specifically, placing a buy trade on one account and a sell trade on another, or similar opposing positions across multiple accounts or prop firms, is not permitted.

Group hedging strategies are also strictly forbidden.

Expert Advisors (EAs)

EAs are allowed on the platform as long as they are personal and owned by the trader. However, using third-party automated trading systems or engaging in copy trading is prohibited.

Martingale and Arbitrage

Nordic Funder does not impose restrictions on aggressive trading strategies such as the Martingale strategy or dedicating all available capital to a single position. However, the following methods are restricted:

- High-frequency trading

- Latency arbitrage

- Triangular arbitrage

Attempts to arbitrage a trading account either internally with another account at the company or with any third-party company are prohibited.

News Trading

Traders may hold positions during news events, but are prohibited from opening new positions within three minutes before or after a news event. This includes newly opened trades and pending orders.

If violations occur, the company may close the position, remove the associated profit and loss, reduce the account's leverage, or even breach the account.

The company retains the authority to define what constitutes a news event, ensuring the integrity of its program.

Nordic Funder Payout Rules

At Nordic Funder, traders can request a payout of their gains directly through the trader dashboard. Withdrawals are permitted no more than once every 30 days, ensuring a balanced and sustainable system. To initiate, traders simply click the Withdraw Profits button and enter the desired amount.

All approved payouts are processed via the firm’s outbound payment solutions, with flexibility to update methods as needed. Once the request is confirmed, the funds owed are distributed promptly, aligning with Nordic Funder’s commitment to rewarding profitable performance under its 80% profit share model.

Nordic Funder Prop Firm Trading Platforms

All trading at Nordic Funder is conducted on the popular MetaTrader 4 (MT4) platform. Traders benefit from Scandinavian Capital Markets' broker infrastructure, enabling fast execution and tight spreads.

MT4 is fully customizable withthird-party plugins, giving traders enhanced control over their interface and tools. Key features of MT4:

- Real-time quotes in the Market Watch window

- One-click trading for swift execution

- 128-bit encryption for secure data transmission

- Multiple chart types (bars, candlesticks, lines)

- Wide range of technical analysis indicators and drawing tools

- Expert Advisors (EAs) support for automated trading

- Available on multiple devices (iOS, Android, Windows, and Mac)

Links:

TradingFinder has developed various MT4 indicators that you can use for free.

Available Markets and Instruments in Nordic Funder Prop Firm

Nordic Funder offers a diverse range of tradable instruments, including:

- Forex Pairs: Major pairs, minor, and exotic pairs

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and more

- Metals: Gold, silver

- Commodities: Crude Oil (WTI and Brent), Natural Gas

- Indices: US30 (Dow Jones), SPX500 (S&P 500), and more

You can trade these instruments with up to 1:20 leverage and competitive spreads.

Nordic Funder Leverage

Nordic Funder provides traders with competitive leverage conditions tailored to different asset classes. On Forex and Metals, leverage goes up to 20:1, while Indices are offered with 10:1 leverage. For Oil trading, the maximum leverage is 5:1, and for cryptocurrencies, it is capped at 2:1.

This structure is designed to balance trading opportunities with robust risk management, ensuring traders can scale positions responsibly across diverse markets.

Nordic Funder Prop Payment Methods

Nordic Funder offers a range of payment methods for both buying challenges and withdrawing profits.

- Payment methods: Credit/debit cards, cryptocurrencies, and PayPal are all accepted for initial deposits.

- Payout Method: Nordic Funder uses Rise, a third-party payment provider, for processing withdrawals.

After the initial 24-hour waiting period, subsequent payouts can be requested every 14 days. Nordic Funder also offers a 75/25 profit split in favor of the trader, which can also increase up to 90%.

It’s also worth mentioning that the minimum withdrawal is 2% of the account balance.

Nordic Funder Commissions

When it comes to trading costs, Nordic Funder offers excellent rates through its partnership with Scandinavian Capital Markets. There is no commission for trading Forex, metals, commodities, and index instruments.

This platform doesn’t charge any fees for deposits and withdrawals.

Does Nordic Funder Offer Educational Resources?

While Nordic Funder excels in many areas, comprehensive educational resources don't appear to be one of its strengths.

Besides a general explanation of the rules and conditions, the Nordic Funder prop firm doesn't offer any other resources, including forex trading techniques and strategies.

If you need vast educational content, you can check out TradingFinder's forex education.

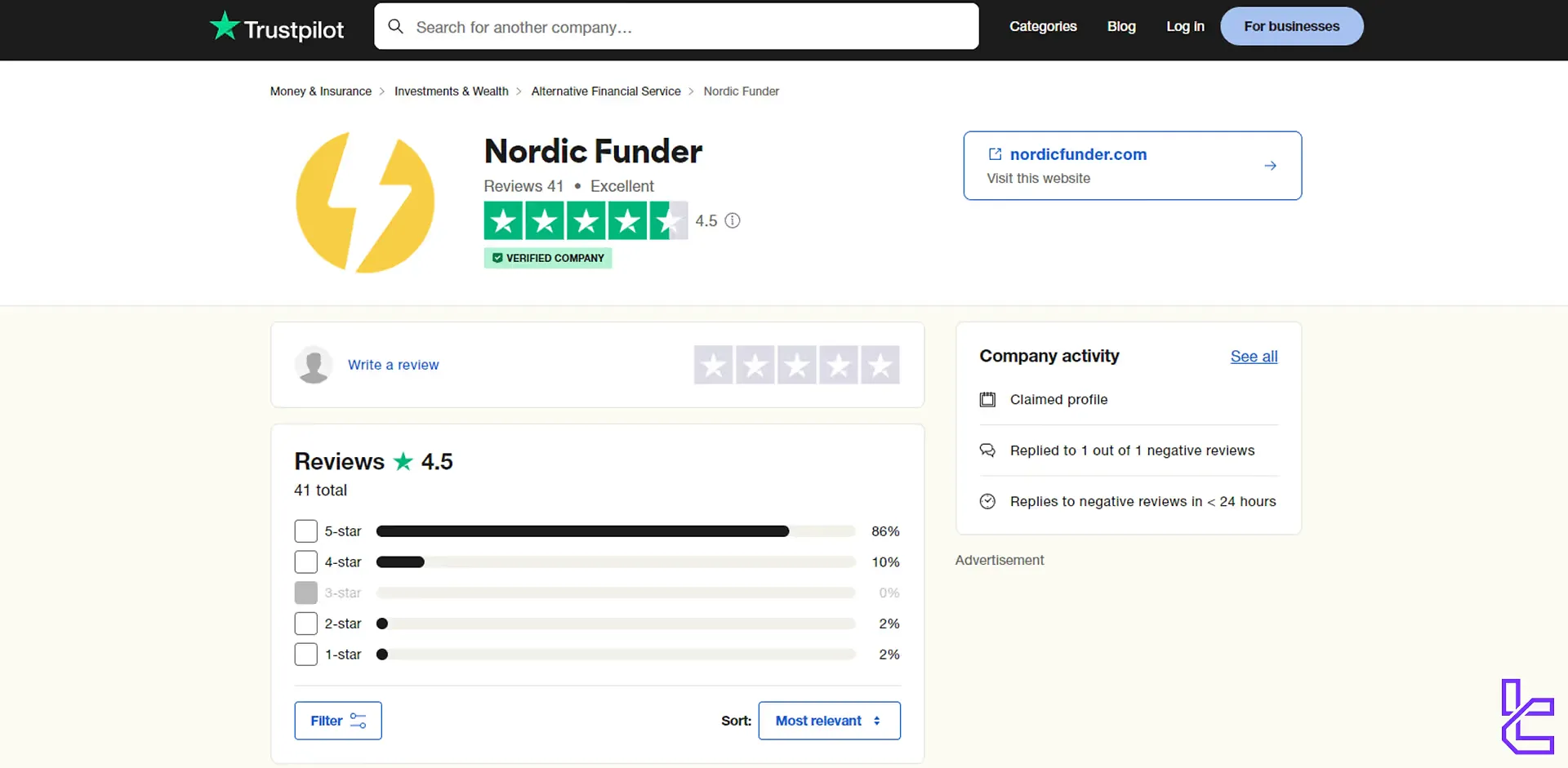

Nordic Funder Trust Scores

The prop firm has garnered an impressive reputation among traders, as evidenced by the excellent rating on the Nordic Funder Trustpilot profile:

- Overall rating: 4.5 out of 5 stars

- 5-star reviews: An impressive 86% of all reviews

- Total review count: 41

The high trust score suggests that Nordic Funder is delivering on its promises to traders and maintaining a positive reputation in the prop trading community.

Nordic Funder Customer Support

Nordic Funder takes pride in their "Swedish efficiency" when it comes to customer support:

Support Method | Availability |

Live Chat | Yes (Available on the Website) |

| Yes (hey@nordicfunder.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | No |

FAQ | No |

Help Center | No |

| No | |

Messenger | No |

Traders can expect timely assistance with any issues or questions they may have, contributing to a smooth overall trading experience with Nordic Funder.

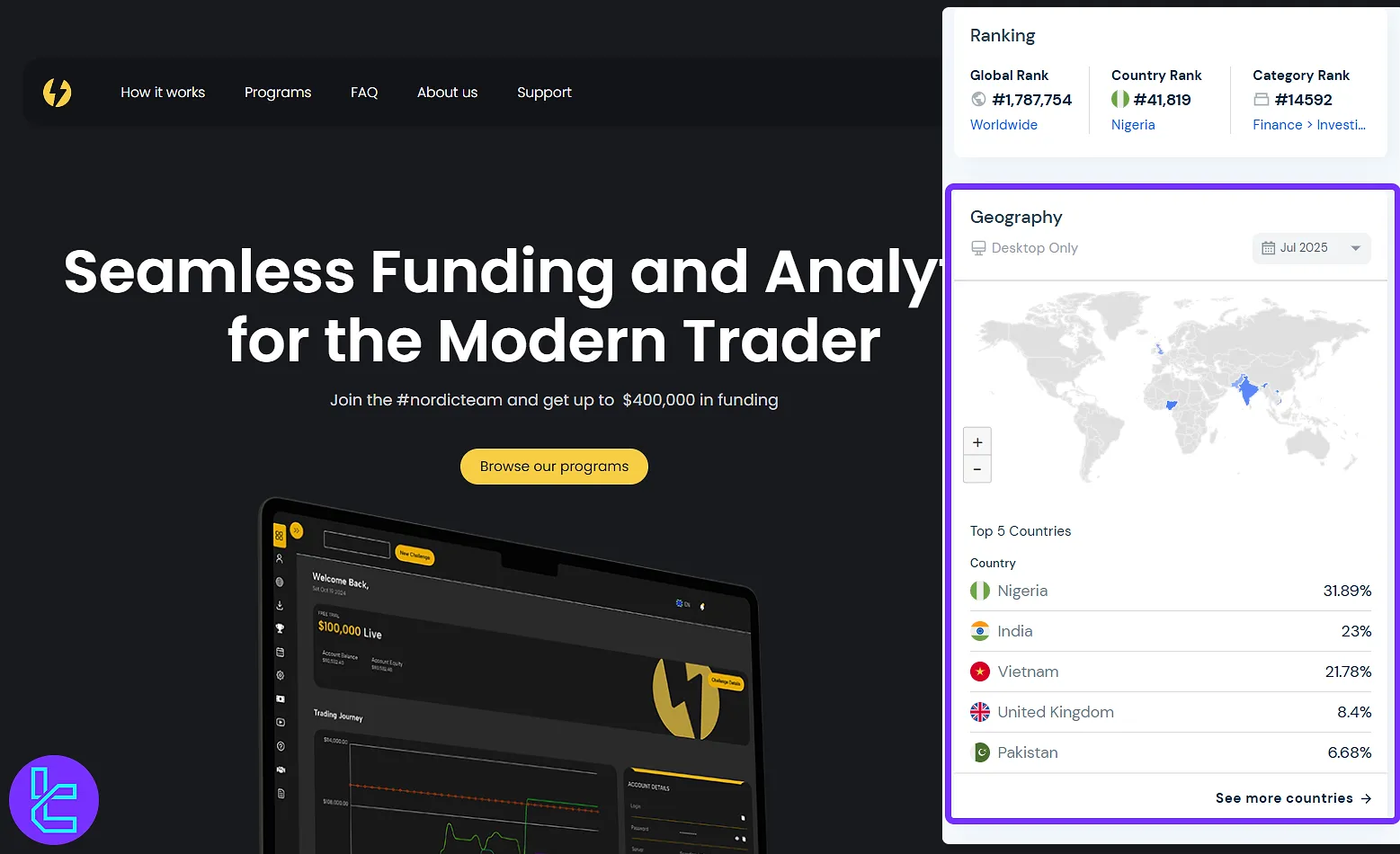

Nordic Funder Userbase

Nordic Funder has built a truly global trader community, with its strongest presence in Nigeria (31.8%), India (23%), and Vietnam (21.7%). The firm is also growing rapidly in developed markets such as the United Kingdom (8.4%) and emerging hubs like Pakistan (6.6%).

By attracting traders across different regions, Nordic Funder demonstrates its scalability and appeal as a modern prop trading platform designed for diverse trading styles worldwide.

Nordic Funder Prop Firm Socials

Nordic has a strong presence on social media:

Social Media | Members/Subscribers |

Over 3,000 | |

Over 1,500 | |

Over 1,000 |

These channels often serve as additional touchpoints for traders to stay updated on company news, trading insights, and community engagement.

Nordic Funder has a strong presence on various social media platforms, including Instagram

Nordic Funder has a strong presence on various social media platforms, including Instagram

Nordic Funder vs Top Prop Firms

Let's compare Nordic Funder's services with other prominent players in the industry.

Parameters | Nordic Funder Prop Firm | |||

Minimum Challenge Price | $42 | $39 | $15 | $33 |

Maximum Fund Size | $1,000,000 | $250,000 | $100,000 | $400,000 |

Evaluation steps | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding |

Profit Share | 90% | 100% | 85% | 100% |

Max Daily Drawdown | 5% | 5% | 4% | 7% |

Max Drawdown | 8% | 10% | 8% | 14% |

First Profit Target | 5% | 5% | 8% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:20 | 1:100 | 1:75 | 1:100 |

Payout Frequency | 14 Days | Bi-weekly | 10 Days | Weekly |

Number of Trading Assets | N/A | 3000+ | 400+ | 40+ |

Trading Platforms | MetaTrader 4 | Metatrader 5 | Match-Trader, cTrader | MetaTrader 5, Match Trader |

TF Expert Suggestion

With account balances ranging from $5K to $500K and prices starting at $42 and going up to $4887.50, Nordic Funder provides diverse options for traders.

The prop firm’s partnership with the Scandinavian Capital Markets broker, no commission trading conditions, and 90% profit split suggest that traders will have a decent experience using the platform services.