OANDA Prop Trader provides up to $500K in funding through Classic and Boost Challenges with two evaluation phases, 8–10% profit targets, 5% daily loss limit, and unlimited time to complete the assessments.

Traders gain access to MetaTrader 5 with 1:100 leverage, 62 instruments across forex, metals, indices, commodities, and crypto, spreads from 0.0 pips, and a $7 commission per lot for FX and gold trades.

OANDA Prop Trader; An Introduction to the Prop Firm

OANDA Prop Trader (OPT) is the proprietary trading division of OANDA, a globally regulated broker with over 25 years of market experience. Launched in 2024, OPT allows traders to access up to $500K in virtual funds through transparent two-phase Challenges with fair rules and secure payouts.

Recognized with titles such as Best MetaTrader 5 Prop Firm 2025, Best Prop Firm for Beginners 2025, and Best Prop Firm for High Leverage 2025, OPT combines moderate funding levels, industry-leading technology, and trader-first policies to create a reliable prop trading ecosystem. Key Highlights of OANDA Prop Trader:

- Two Evaluation Models: Choose Classic Challenges with trailing drawdown or Boost Challenges with static drawdown;

- Accessible Pricing: Entry-level Challenge starts at $35 for 5K funding; the highest tier is $2,400 for $500K funding;

- High Trading Power: Trade with leverage up to 1:100 and spreads starting from 0.0 pips on MetaTrader 5;

- Diverse Asset Classes: Access CFDs on forex, indices, commodities, metals, and cryptos with institutional-grade pricing;

- Fee Refund & Payouts: Get your Challenge fee refunded on your first payout, with profit withdrawals up to 90% share.

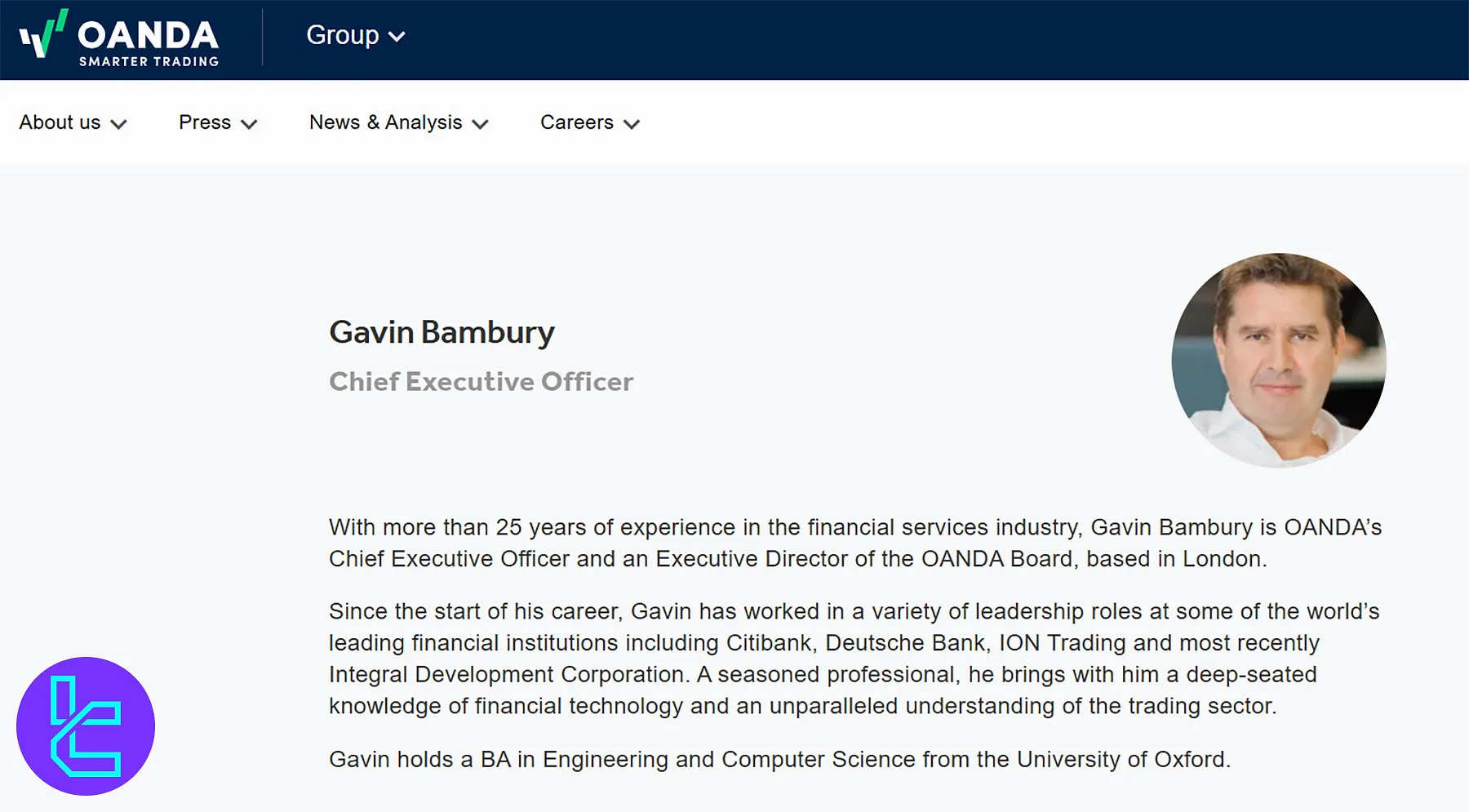

OANDA Prop Trader CEO

Gavin Bambury serves as both the Chief Executive Officer of OANDA Group and the executive head of OANDA Prop Trader. Based in London, he brings over 25 years of leadership experience in global financial services and fintech innovation.

As CEO, Bambury oversees OANDA’s brokerage and prop trading operations, including OANDA Assessments Ltd in Valletta, Malta. His expertise in electronic trading infrastructure and regulatory compliance ensures that the prop division operates with the same standards as the global brokerage.

- CEO of OANDA Group and OANDA Prop Trader (OANDA Assessments Ltd)

- Former senior roles at Citibank, Deutsche Bank, ION Trading, and Integral Development Corporation

- Specialist in financial technology, electronic trading systems, and global market infrastructure

- Holds a BA in Engineering and Computer Science from the University of Oxford

- Leads strategy, innovation, and compliance across OANDA’s prop trading and brokerage businesses

OANDA Prop Trader Table of Specifications

Below is a summarized table of specifications outlining the key structural features of OANDA Prop Trader.

Account Currency | USD |

Minimum Price | $35 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 90% |

Instruments | Forex, Metals, Commodities, Indices, Crypto |

Assets | 62 |

Evaluation Steps | 2-step |

Withdrawal Methods | Rise, Crypto |

Maximum Fund Size | $500,000 |

First Profit Target | 8% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Restricted |

Maximum Total Drawdown | 10% |

Trading Platforms | MetaTrader 5 |

Commission | Forex & Gold $7/lot Commodities & Indices $0 |

Trustpilot Score | 4.3 / 5 |

Payout Frequency | 14 Days |

Established Country | Malta |

OANDA Prop Firm Pros & Cons

Like any proprietary trading program, OANDA Prop Trader has both strengths and limitations. The following table summarizes the main advantages and disadvantages of participating in the program.

Pros | Cons |

Backed by OANDA, a regulated broker | News trading restrictions |

Profit share up to 90% | Boost accounts cannot be merged |

Refund of challenge fees upon first payout | Maximum allocation capped at $500k |

Access to MetaTrader 5 | Inactivity over 30 days leads to a breach |

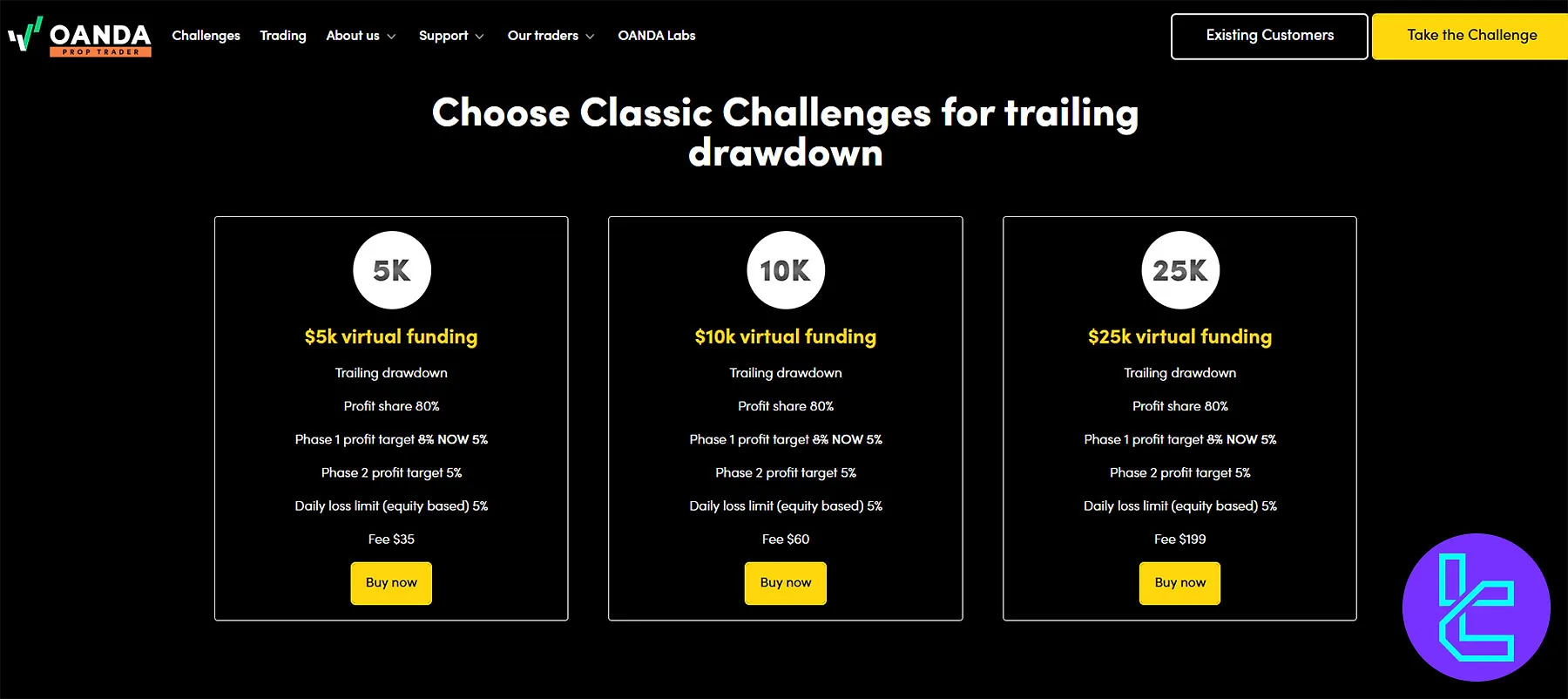

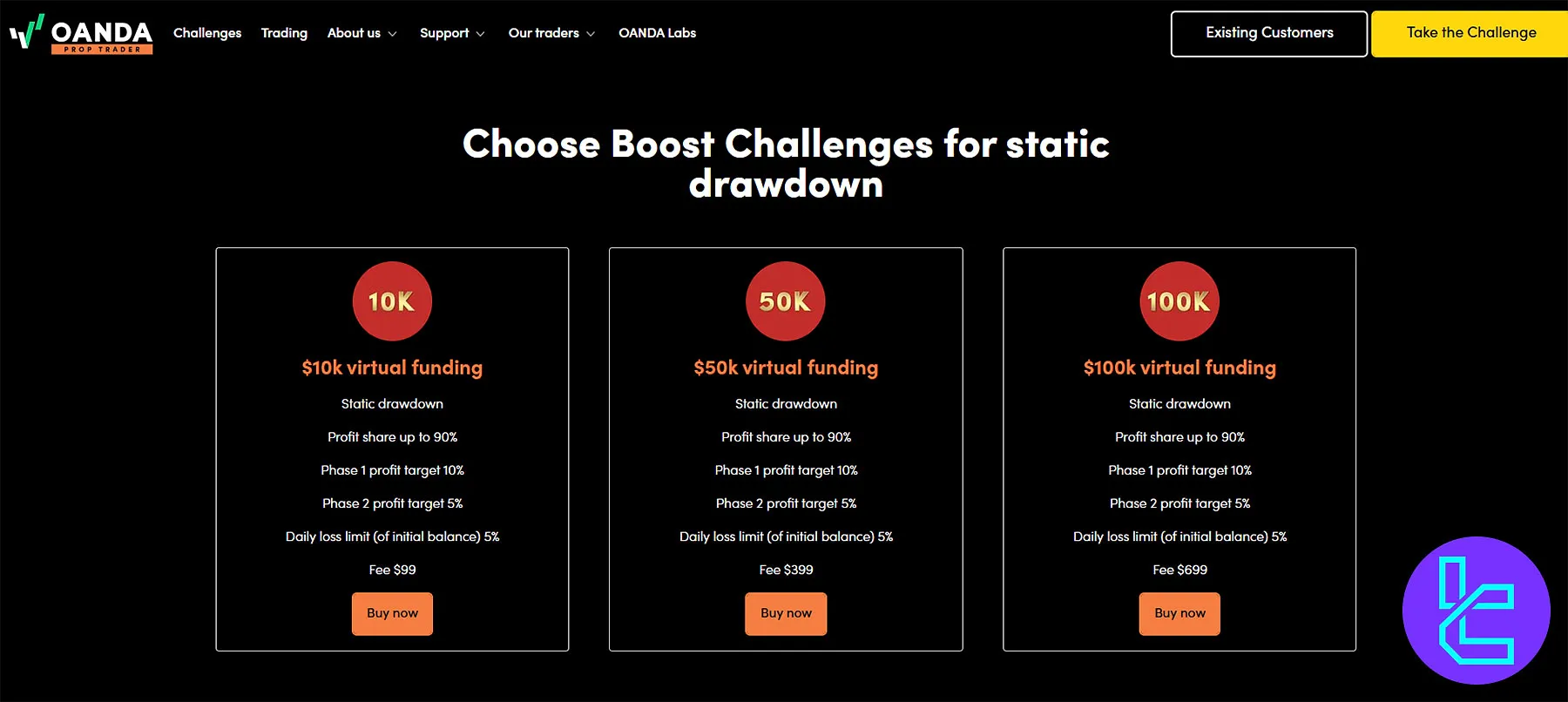

OANDA Prop Trader Pricing

OANDA prop firm features competitive pricing for its Classic and Boost challenges. The fee structure scales with virtual capital, ensuring affordability for smaller accounts while providing access to larger funding options.

Account Balance | Classic | Boost |

$5K | $35 | - |

$10K | $60 | $99 |

$25K | $199 | - |

$50K | $299 | $399 |

$100K | $599 | $699 |

$188K | $888 | - |

$250K | $1,200 | - |

$500K | $2,400 | - |

OANDA Prop Trader Sign Up and Verification

The sign-up process for OANDA Prop Trader is straightforward and designed to onboard traders efficiently. Verification steps are required only after you pass the evaluation phases.

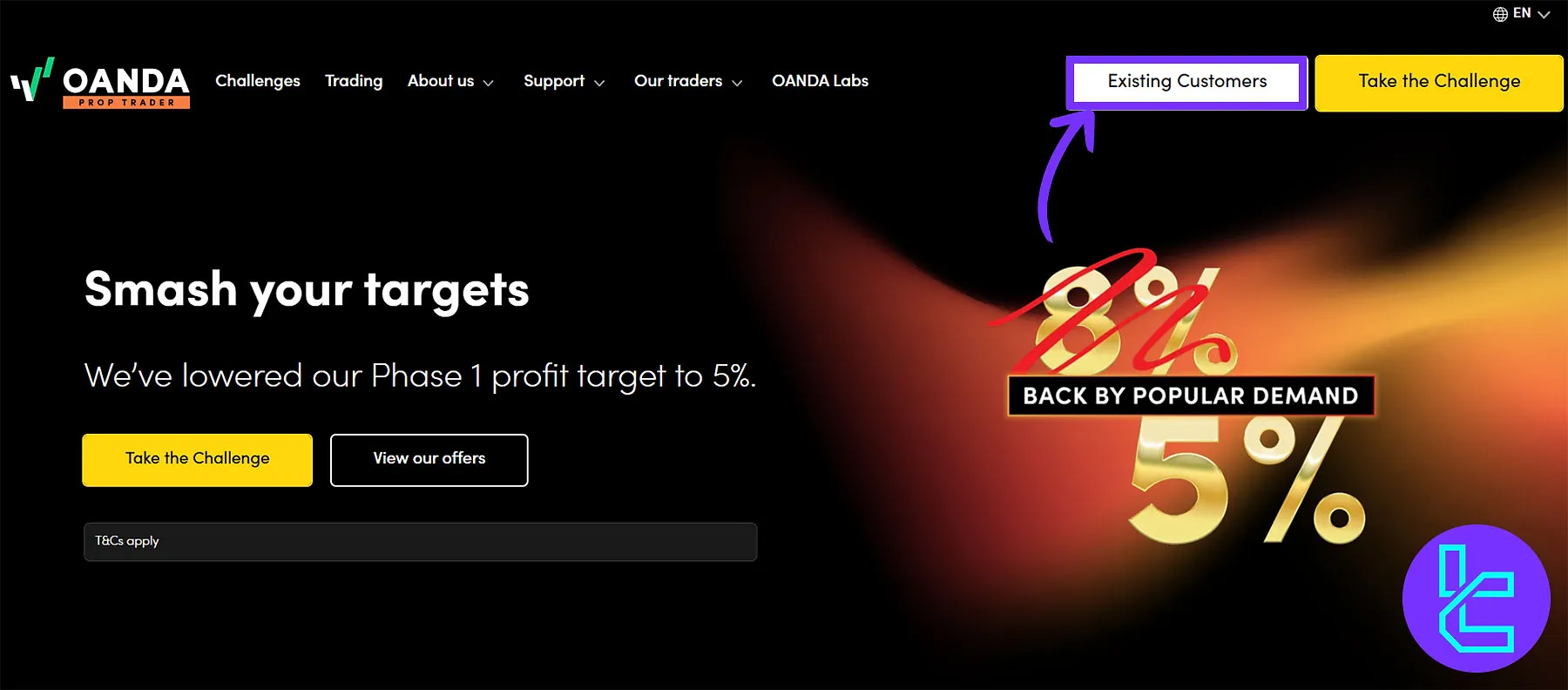

#1 Access the Registration Form

On the OANDA Prop Trader homepage, click “Existing Customers”, to reach the login page.

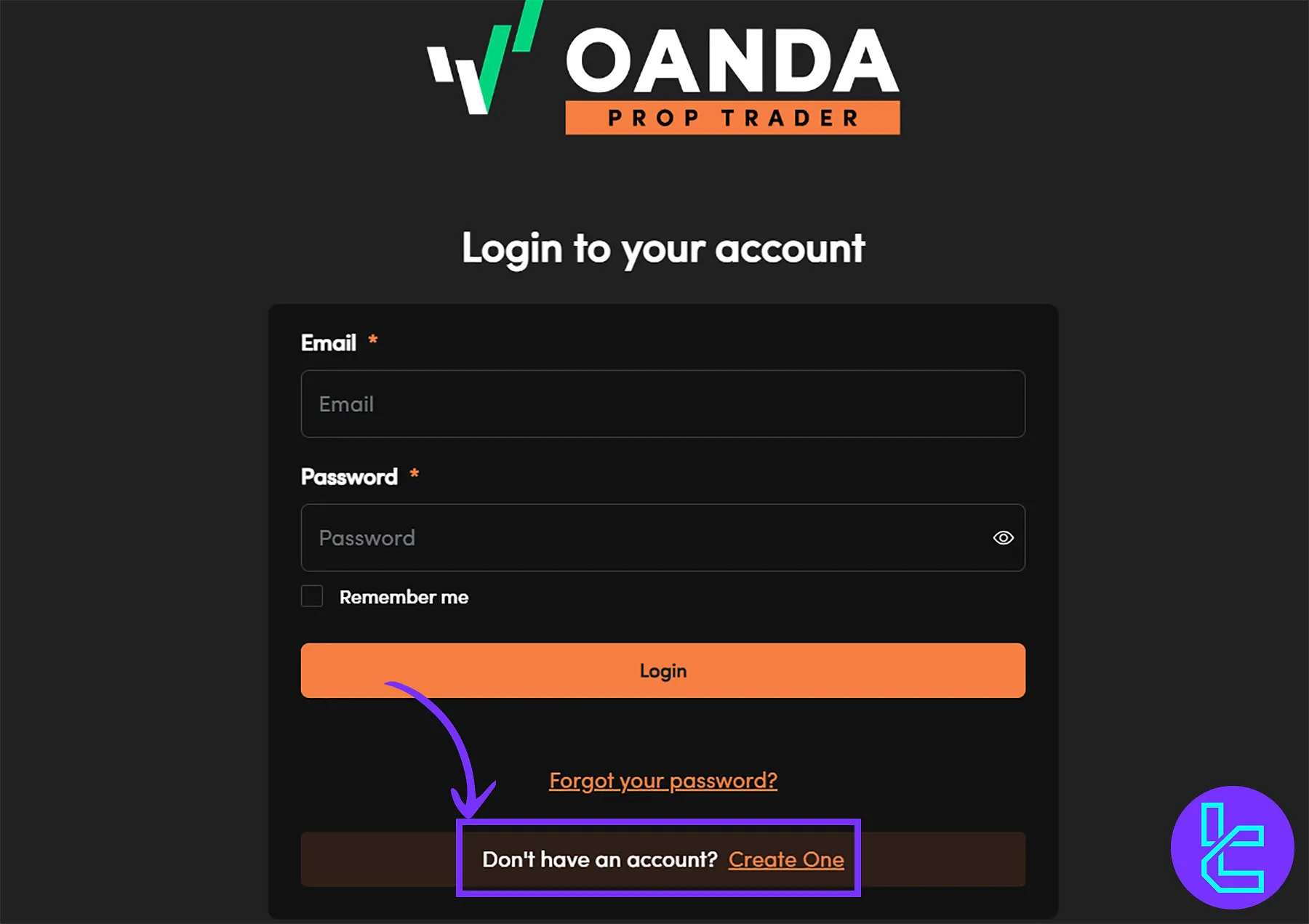

Below the login form, click “Don’t have an account? Create One” to reach the registration form.

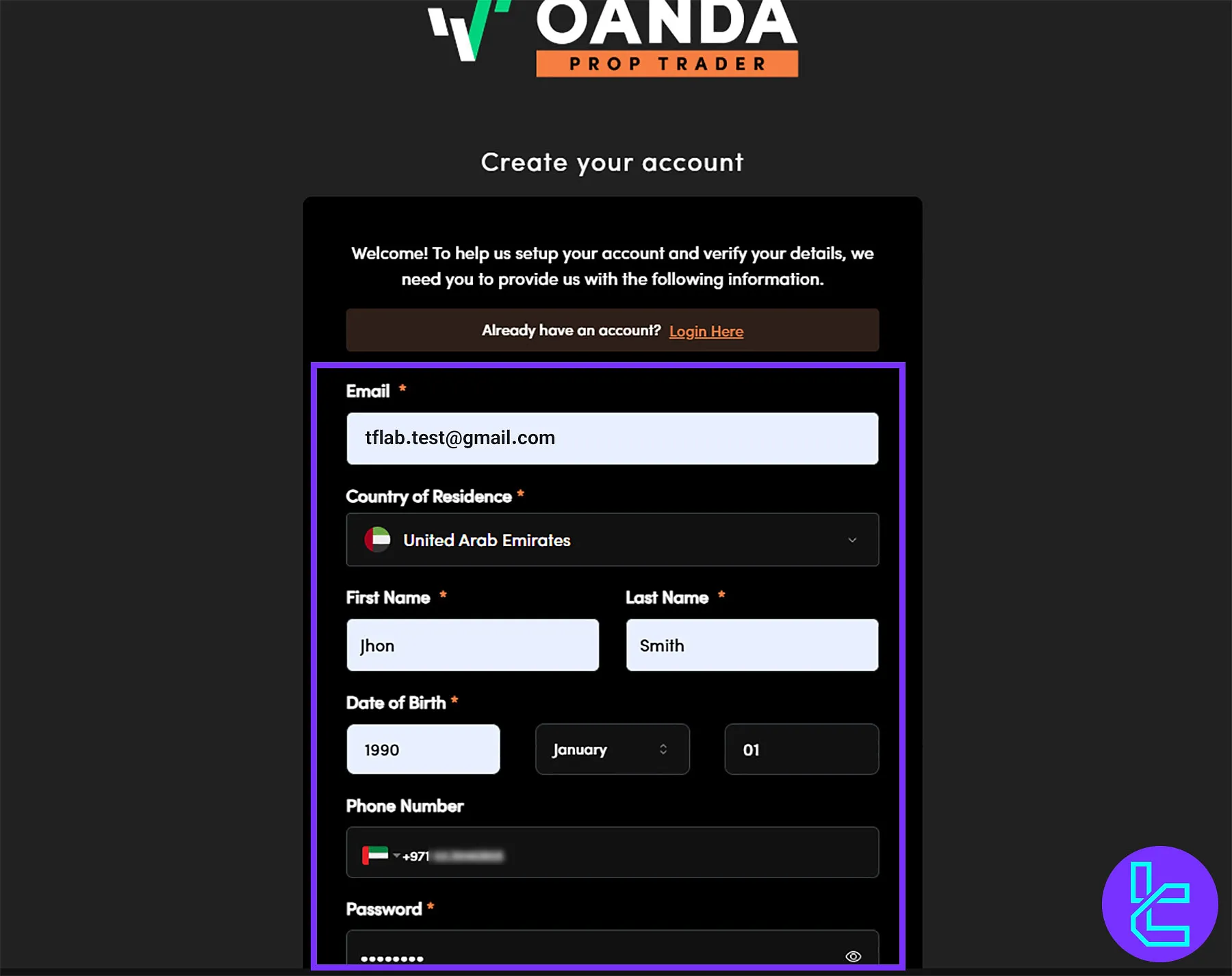

#2 OANDA Prop Trader Sign Up Page

Fill out the registration form with the following details:

- Country of residence

- First name

- Last name

- Date of birth

- Phone number

- Password

#3 Login OANDA Prop Trader

After registration, you’ll be redirected to the login page again. Use your email and password to access the OANDA prop firm dashboard.

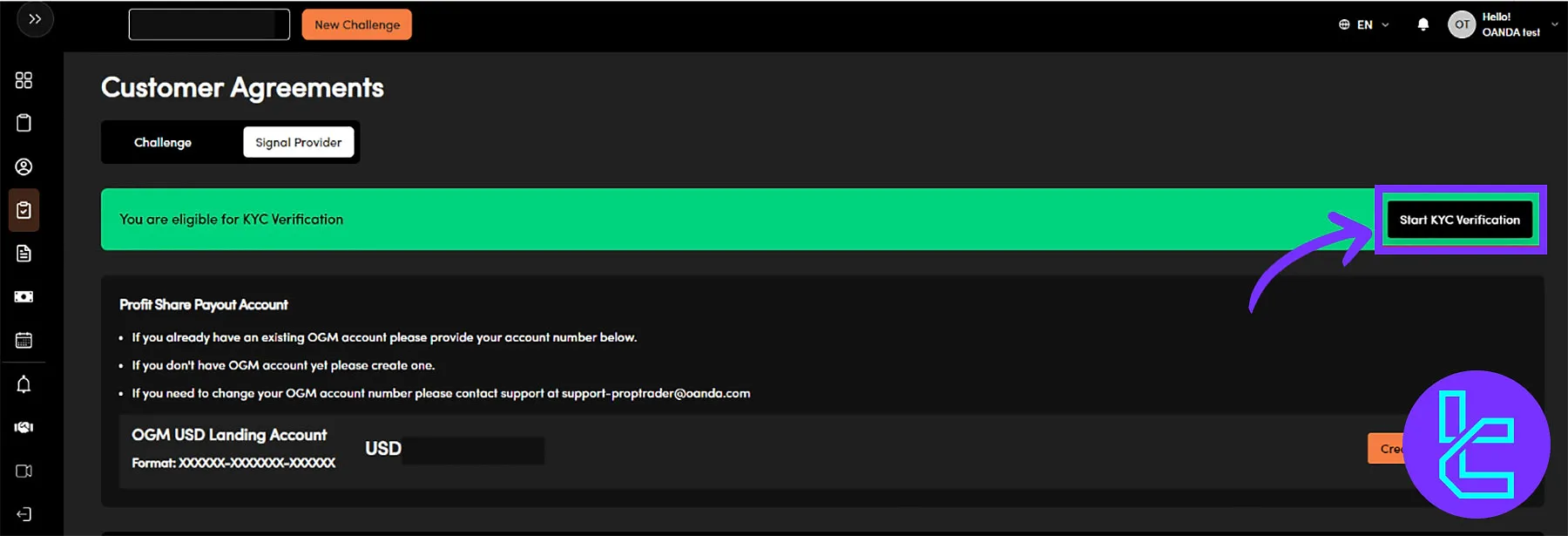

#4 OANDA Prop Trader Verification

Before becoming a funded OANDA Prop Trader, participants must complete a secure verification process through their dashboard. This step ensures compliance with global KYC standards and protects the integrity of OANDA Assessments Ltd’s prop trading program.

Verification requires identity and address confirmation, along with a quick liveness check. Accepted documents vary by country but typically include government-issued ID and proof of residence that meet OANDA’s compliance requirements.

- Accepted IDs: Passport, national ID card, driving license, or residence permit (must be valid for at least one month)

- Proof of Address: Utility bill, bank statement, or official document with matching name and address

- Liveness Check: Real-time verification to confirm the applicant’s identity matches the uploaded documents.

OANDA Prop Trader Challenges

OANDA Prop Trader provides two distinct challenge types: Classic and Boost. Both require traders to meet profit targets over two evaluation phases while adhering to risk management rules. The main differences lie in profit targets, drawdown structures, and profit share conditions.

Challenge Conditions | Classic (Trailing Drawdown) | Boost (Static Drawdown) |

Profit target | Phase 1: 8% / Phase 2: 5% | Phase 1: 10% / Phase 2: 5% |

Daily loss limit | 5% (previous EoD) | 5% (initial balance) |

Maximum drawdown | 10% Trailing | 10% Static |

Profit Share | 80% | up to 90% |

Maximum daily profit (Consistency Rule) | Phase 1: 5% / Phase 2: 2% | Phase 1: 5% / Phase 2: 2% |

Max Leverage | up to 1:100 | up to 1:100 |

Inactivity Period | 30 days | 30 days |

Time limit | Unlimited | Unlimited |

OANDA Prop Trader Classic Challenge

The Classic challenge offers traders a two-phase evaluation with an 8% profit target in Phase 1 and 5% in Phase 2, combined with a 10% trailing drawdown and a competitive 80% profit-sharing model.

Profit target | Phase 1: 8% / Phase 2: 5% |

Daily loss limit | 5% (previous EoD) |

Maximum drawdown | 10% Trailing |

Profit Share | 80% |

Maximum daily profit (Consistency Rule) | Phase 1: 5% / Phase 2: 2% |

Max Leverage | up to 1:100 |

Inactivity Period | 30 days |

Time limit | Unlimited |

This challenge is ideal for traders seeking disciplined growth with unlimited trading time, 1:100 leverage, and full EA support, while maintaining risk controls such as a 5% daily loss limit and news-event restrictions.

OANDA Prop Firm Boost Challenge

The Boost challenge provides a higher 10% profit target in Phase 1 and a 5% target in Phase 2, supported by a static 10% drawdown and an industry-leading profit share of up to 90%.

Profit target | Phase 1: 10% / Phase 2: 5% |

Daily loss limit | 5% (initial balance) |

Maximum drawdown | 10% Static |

Profit Share | up to 90% |

Maximum daily profit (Consistency Rule) | Phase 1: 5% / Phase 2: 2% |

Max Leverage | up to 1:100 |

Inactivity Period | 30 days |

Time limit | Unlimited |

This program suits traders seeking higher returns under fixed-risk conditions, offering 1:100 leverage, EA support, unlimited trading time, and a 5% daily loss cap based on the initial balance for consistent risk management.

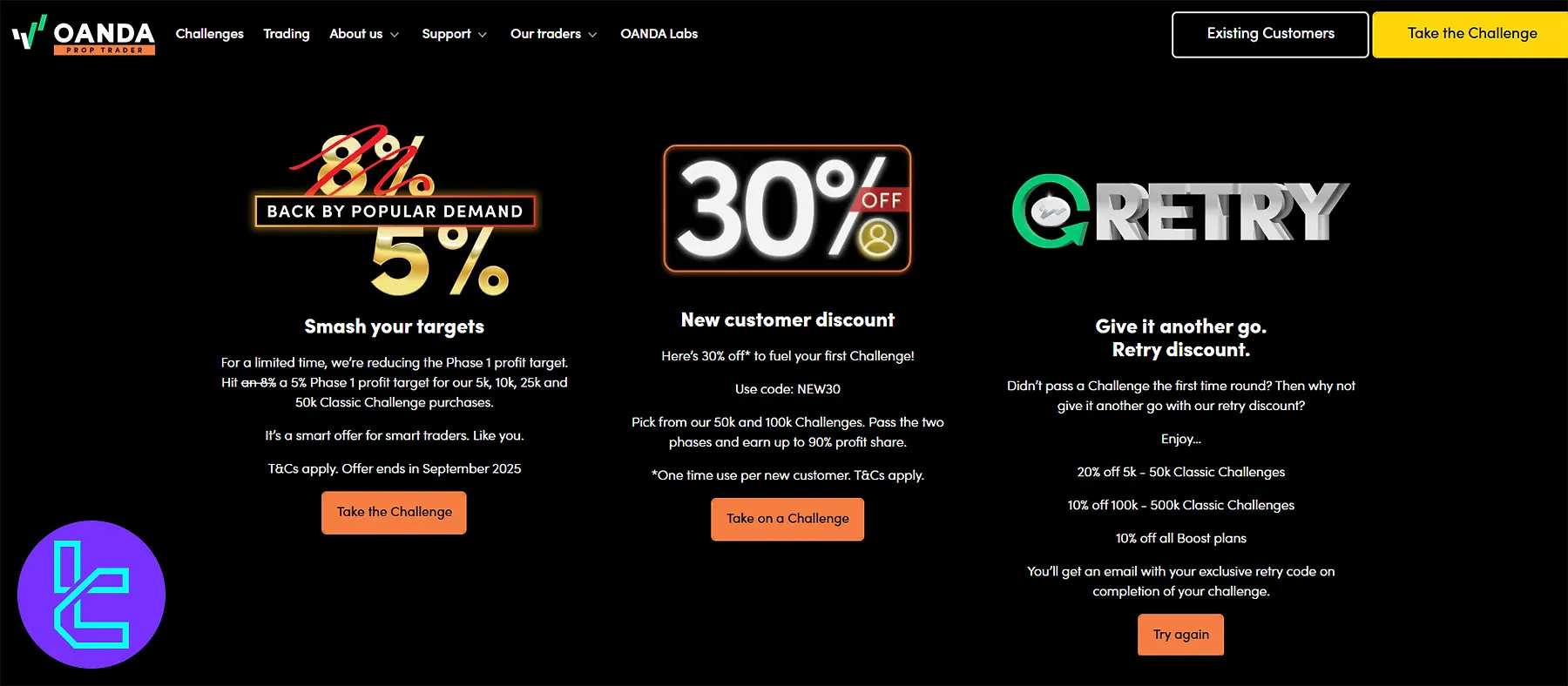

OANDA Prop Firm Discount and Promotion

OANDA provides exclusive prop trading promotions to lower costs and boost participation. Traders can benefit from reduced Phase 1 profit targets, first-time purchase discounts, and retry discounts on Classic and Boost Challenges across multiple funding tiers.

- Lower Phase 1 targets on Classic Challenge accounts up to $50k

- 30% discount for new customers using code NEW30 on $50k & $100k Challenges

- Retry discounts: 20% on $5k–$50k Classic, 10% on $100k–$500k Classic & all Boost plans

OANDA Prop Firm Smash Your Targets Promotion

OANDA reduces Phase 1 profit targets for Classic Challenge accounts, enabling traders to progress faster. This offer applies to $5k, $10k, $25k, and $50k accounts and is available until September 2025.

- Phase 1 profit target: reduced to 5% (from 8%)

- Eligibility: Classic Challenge purchases up to $50k

- Validity: Until end of September 2025

OANDA Prop Trader New Customer Discount

New traders receive 30% off their first OANDA prop challenge, providing an affordable entry to funded trading. This offer applies to $50k and $100k challenges when using the promo code “NEW30”.

- One-time discount per new customer

- 30% off $50k & $100k challenges

- Discount code: NEW30

OANDA Prop Firm Retry Discount

OANDA supports traders who failed their first attempt by offering reduced fees on retry purchases for both Classic and Boost Challenges. The retry code is sent via email after challenge completion.

- 20% off Classic Challenges: $5k–$50k

- 10% off Classic Challenges: $100k–$500k

- 10% off all Boost plans

OANDA Prop Trader Rules

The rules governing OANDA Prop Trader accounts are designed to enforce professional-grade risk management. Violating these rules may result in account termination.

VPN Usage

The prop firm discloses no information regarding its policies on VPN/VPS usage on its help center. So, it’s advisable to consult the support team before attempting to use such services.

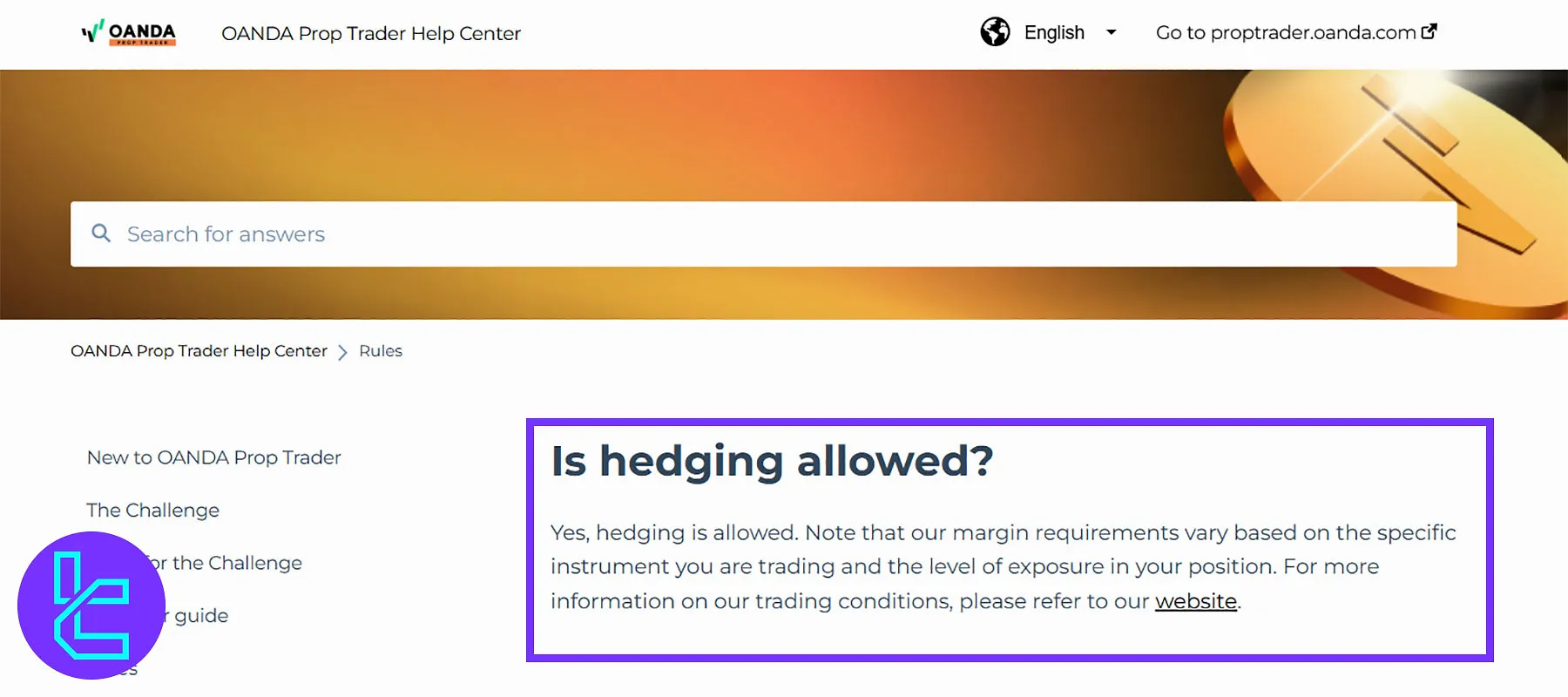

OANDA Prop Firm’s Policy on Hedging

Hedging is fully permitted. Traders can open offsetting positions to manage risk and protect capital. Keep in mind that margin requirements depend on the instrument traded and your overall position exposure.

Use of Expert Advisors (EAs)

OANDA prop firm allows the use of Expert Advisors (EAs), custom scripts, and technical indicators for automated trading strategies.

However, copy trading is prohibited, and any EAs that exploit price or latency arbitrage or engage in other restricted trading behaviors outlined in the broker’s terms and conditions are not permitted.

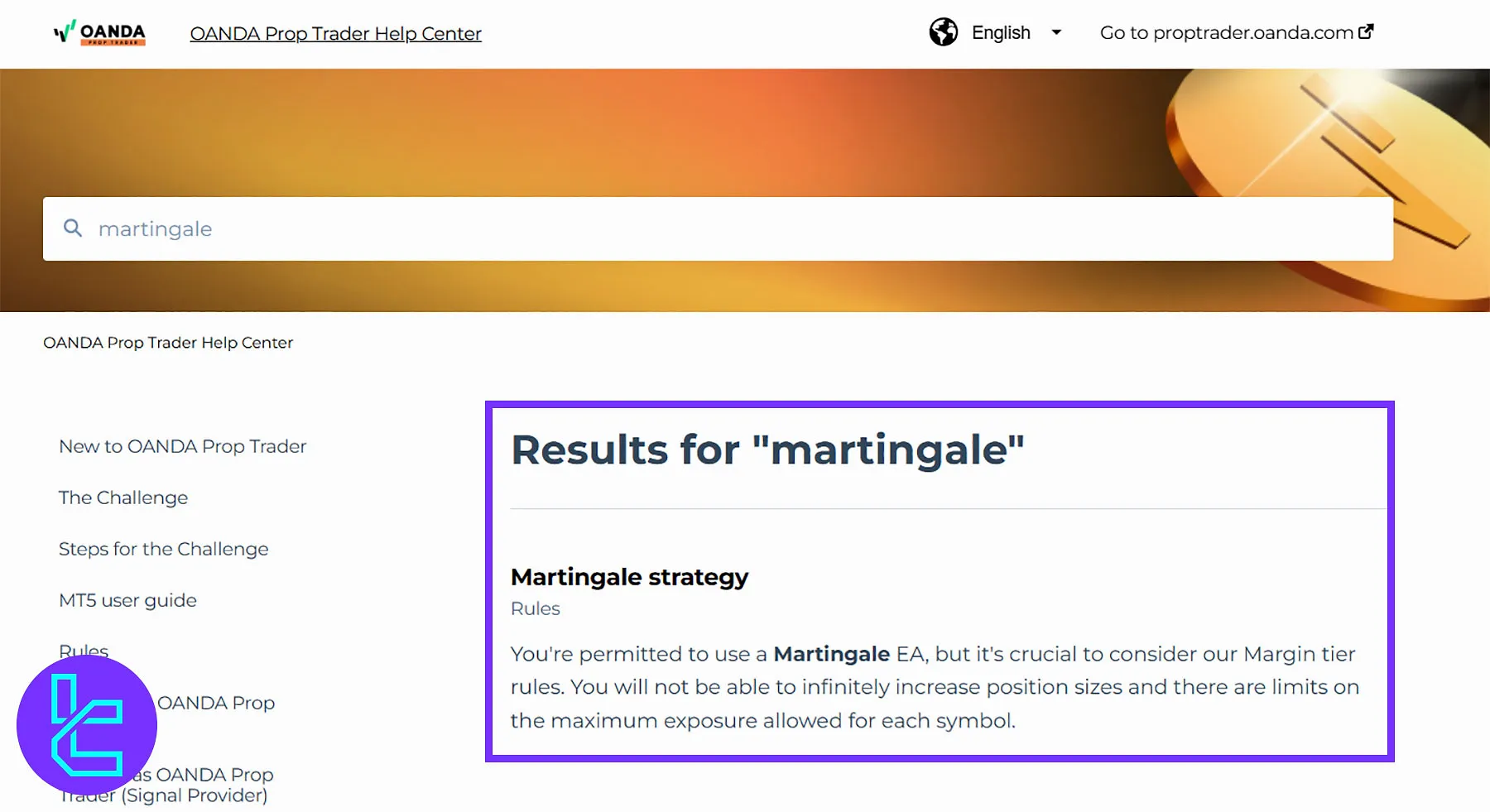

Arbitrage & Martingale

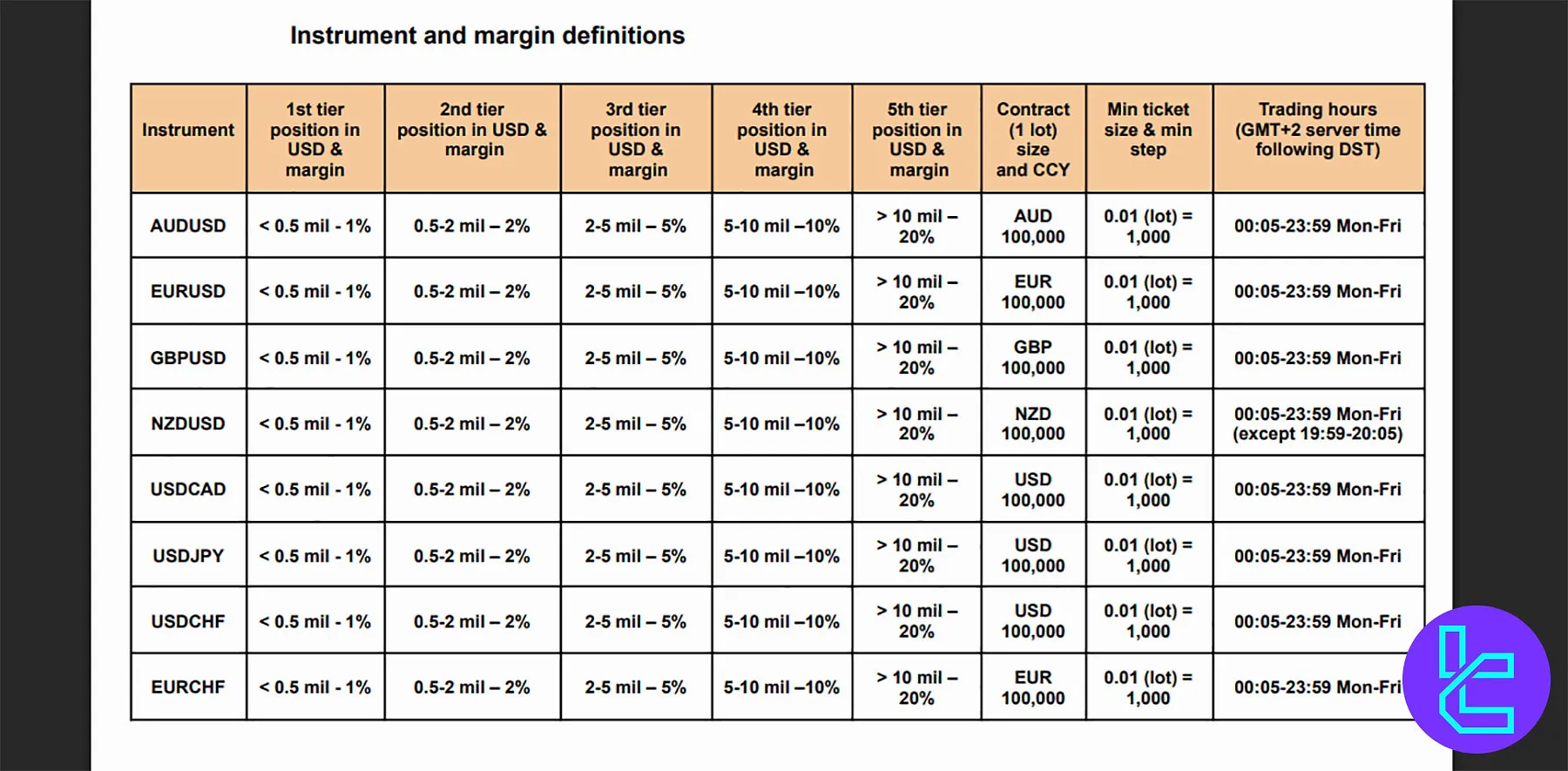

OANDA allows traders to use Martingale strategies and EAs but applies strict tiered margin rules that limit position scaling. Larger position sizes incur higher margin requirements, ensuring controlled exposure across symbols such as USDJPY.

- Martingale EA usage permitted but subject to margin tier limits;

- Tiered margin rates: 1% (<0.5M), 2% (0.5–2M), 5% (2–5M), 10% (5–10M), 20% (>10M);

- Example: 5M USDJPY position requires USD 185,000 margin;

- Latency arbitrage strategies are strictly prohibited.

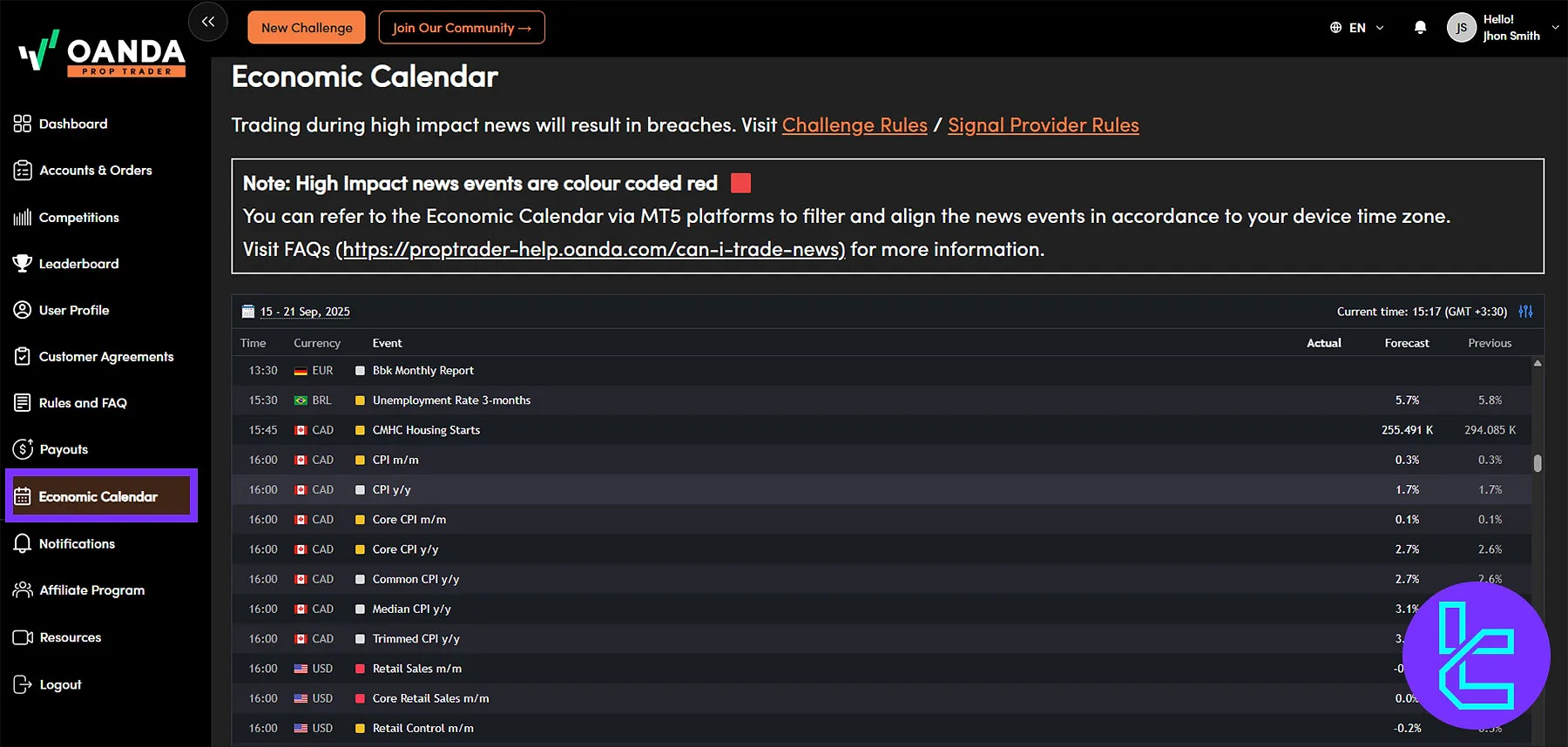

OANDA Prop Firm News Trading Restrictions

OANDA enforces strict news trading restrictions to ensure fair execution. Traders must avoid opening, closing, or triggering trades during a four-minute window around major news events like NFP, CPI, GDP, FOMC, and ECB releases.

- Restricted window: 2 minutes before and after major news events;

- Applies to market, pending, and EA-triggered orders;

- SL/TP adjustments allowed during window (no breach);

- Breaches can result in profit removal or account termination;

- Refer to the MT5 Calendar or Dashboard Economic Calendar for event timing.

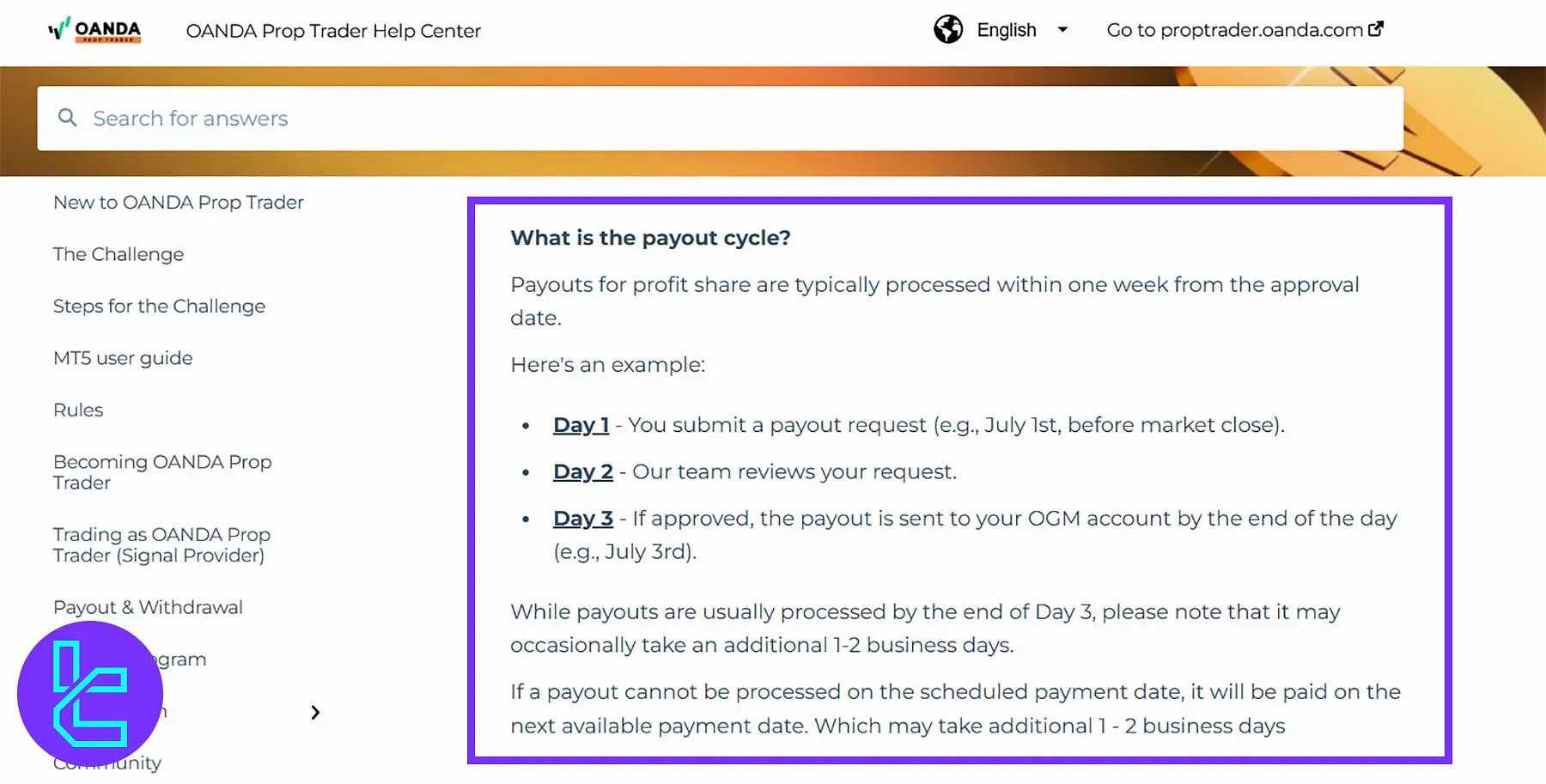

OANDA Prop Trader Payout Policies

OANDA’s Prop Trader payout policy ensures fast, transparent, and flexible withdrawals through bank transfer, Neteller, or Skrill. Minimum payout thresholds vary by account type, with Classic requiring $200 and Boost requiring 2% of the initial balance.

- Minimum Payouts: $200 (Classic); 2% of initial balance (Boost: e.g., $1,000 for $50k plan)

- Payout Frequency: First payout available after 14 days; subsequent requests every 14 days

- Processing Time: Typically, within 3 business days, up to 1 week

- Payment Methods: Bank transfer, Neteller, Skrill (USD only, verified accounts required)

- Regional Rules: South Africa withdrawals limited to bank transfer/wire

Available Trading Platforms on OANDA Prop Trader

OANDA Prop Trader gives participants access to MetaTrader 5 (MT5), a globally recognized multi-asset platform with advanced charting, algorithmic trading support, and 30+ technical indicators, available for desktop, Mac, and web browsers with secure data encryption.

MT5 WebTrader allows instant browser-based access without software installation, providing real-time quotes, interactive charts, and seamless account login for fast, secure prop trading across any operating system or device. OANDA Prop Trader download links:

Download Windows and Mac versions directly from the OANDA Prop Trader Help Center. You can also access a wide range of MT5 indicators via the TradingFinder website.

OANDA Prop Firm Trading Markets

OANDA Prop Trader provides access to a wide range of markets, ensuring diversified trading opportunities. Traders can engage in the Forex market, Spot Metals, Indices, and Commodities with institutional-grade liquidity.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFD | 42 pairs | 50–70 currency pairs | 1:100 |

Spot Metals | CFD | Gold and Silver | 3–7 symbols | Gold 1:100 Silver 1:50 |

Indices | CFD | 15 indices | 15-30 symbols | 1:50 |

Commodities | CFD | WTI, BRENT, and NGAS | 3-8 symbols | 1:50 |

You can check all of the instruments and margin definitions through the OANDA Prop Trader Help Center.

Oanda Prop Firm Leverage

OANDA Prop Trader offers maximum leverage of 1:100 on FX and gold, with reduced leverage on indices and commodities. A tiered margin structure applies based on instrument type and total USD position size.

- FX & Gold: up to 1:100 leverage

- CFD Indices & Commodities: up to 1:50 leverage

- Larger positions subject to higher incremental margin rates under a tiered margin structure

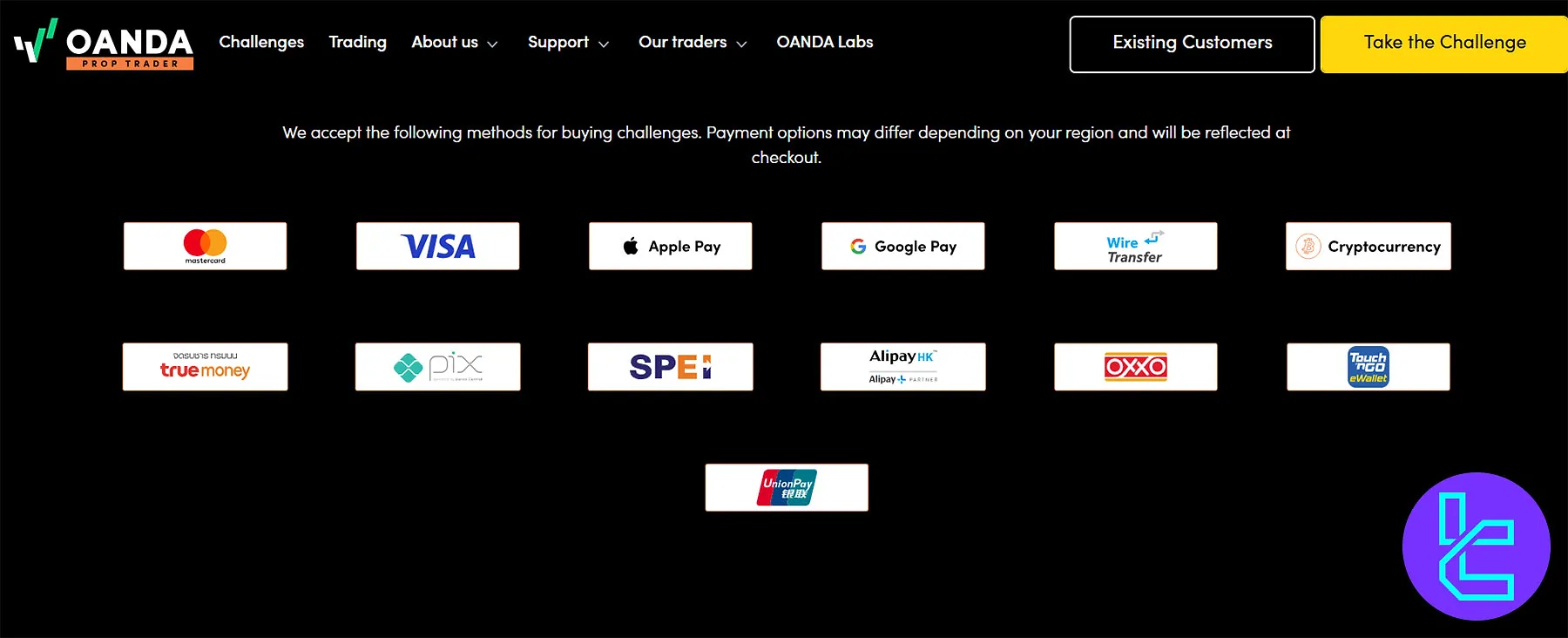

OANDA Prop Trader Payment Methods

OANDA Prop Trader supports global payment options for challenge purchases and payouts, offering flexibility for traders worldwide. All withdrawals are processed in USD, with amounts over $9,000 requiring due diligence clearance before approval.

- Card & Digital Wallets: Mastercard, VISA, Apple Pay, Google Pay, Touch ‘n Go, TrueMoney, AlipayHK, and UnionPay

- Banking & Transfers: Wire transfer, SPEI, PIX, and OXXO

- E-Wallets (payout only): Neteller and Skrill (verification required)

- Cryptocurrency Payments: Supported for challenge purchases

- Compliance: Bank account profile required before withdrawal requests

OANDA Prop Trader Spreads and Commissions

As of 17, 2025, OANDA Prop Trader introduced the Core Pricing + Commission model for FX and Metals, offering ultra-tight spreads from 0.0 pips and a fixed USD 7.0 round-turn commission per lot for maximum cost transparency.

Instrument | Core Spread (From) | Commission (Per Lot, Round Turn) |

FX Pairs | 0.0 pips | $7.0 |

Gold (XAU) | 0.1 pips | $7.0 |

Indices & Commodities | Spread-only model | Included in spreads |

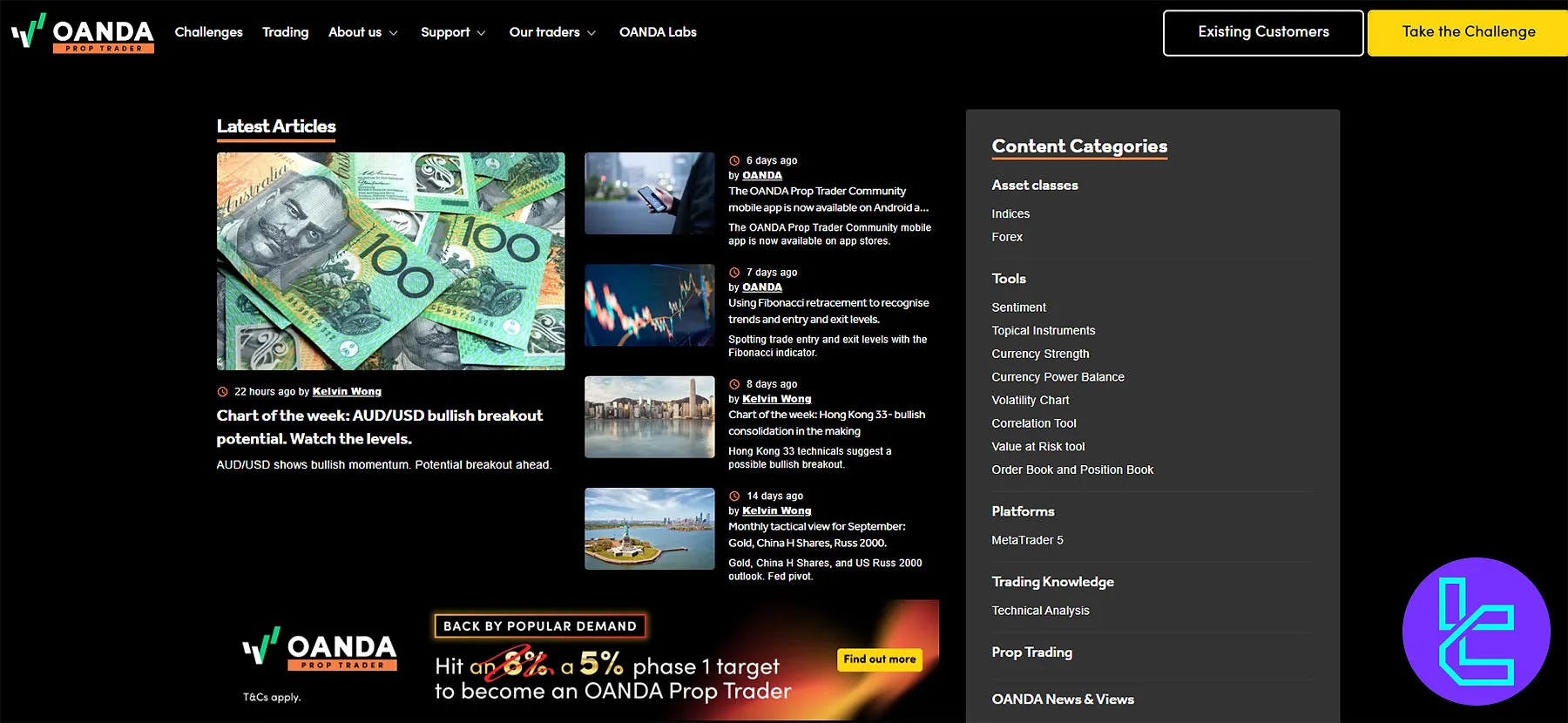

OANDA Prop Trader Educational Materials

OANDA Prop Trader delivers comprehensive trading education through OANDA Labs, covering technical analysis, prop trading strategies, and platform tutorials.

The content is updated regularly and written by in-house experts like Kelvin Wong and Zain Vawda for practical market insights.

- Market Analysis: Weekly “Chart of the Week,” monthly tactical views, and macroeconomic breakdowns (NFP, CPI, FOMC impacts)

- Technical Strategies: Fibonacci retracements, Bollinger Bands®, moving averages, reversal patterns, sentiment, and currency strength tools;

- Prop Trading Guides: Challenge passing strategies, risk management tips, and prop firm comparison articles;

- MT5 Tutorials: One-click trading, economic calendar setup, order modification, closing trades, downloading trade history;

- Trading Tools & Resources: Order Book, Position Book, Value at Risk tool, and volatility charts to refine strategies.

You can also check TradingFinder’s Forex education section for additional resources.

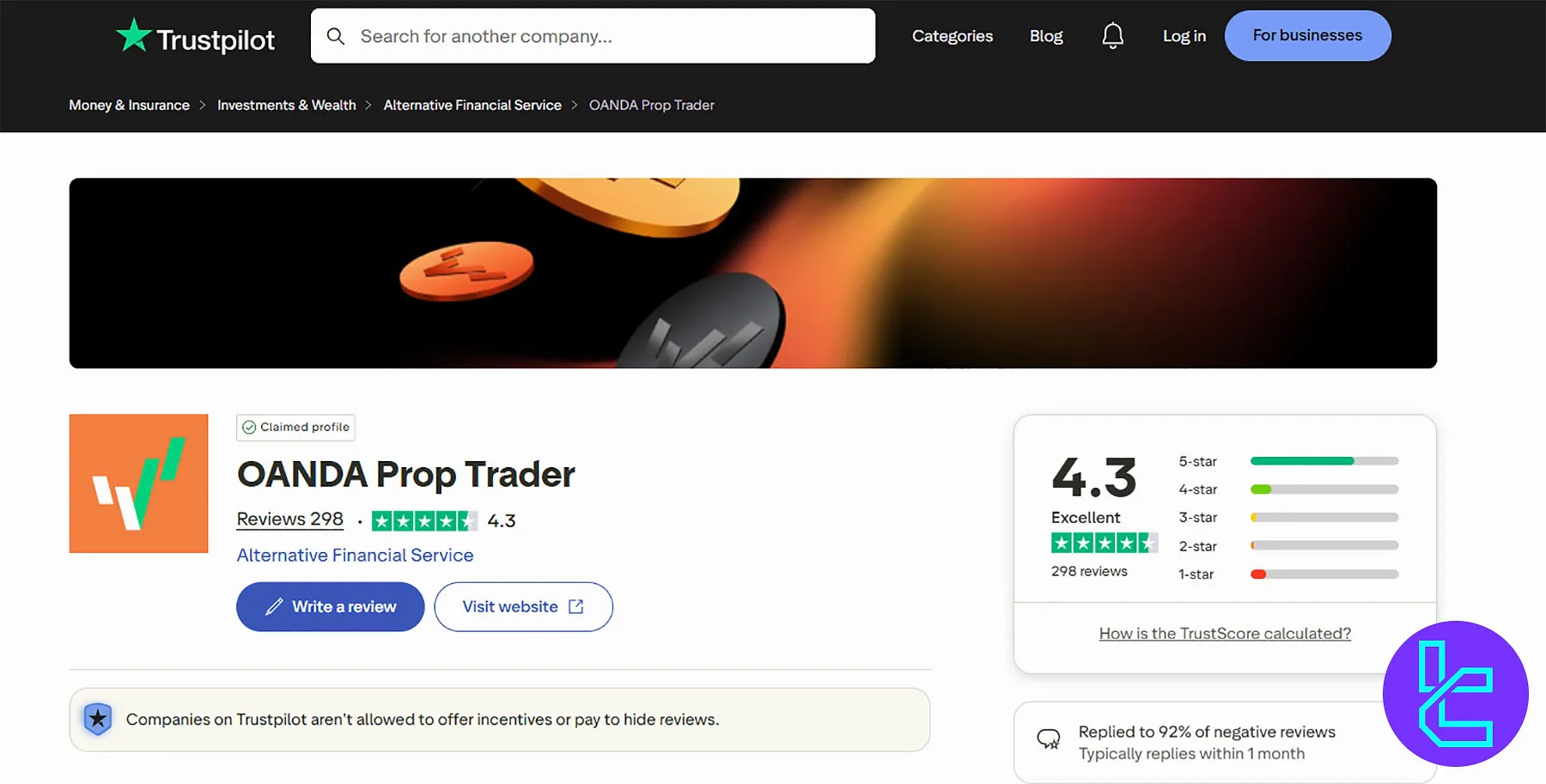

Oanda Prop Firm Trust Scores

The company is rather new and not features on many review platforms. However, the OANDA Prop Trader Trustpilot profile has received an excellent 4.3 out of 5 score based on 298 reviews.

Of all comments, 84% are positive (4-star and 5-star) and 13% are negative (1-star and 2-star).

OANDA Prop Trader Customer Support

OANDA Prop Trader provides dedicated customer support through a detailed FAQ hub and direct email assistance, ensuring traders receive help for account, platform, and challenge-related inquiries.

Support Method | Availability |

Live Chat | No |

Yes (support-proptrader@oanda.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | No |

FAQ | Yes |

Help Center | Yes |

No | |

Messenger | No |

While OANDA Prop Trader provides email-based support, the absence of a live chat option is disappointing. Traders expect real-time assistance, and relying solely on email can delay urgent issue resolution and harm user experience.

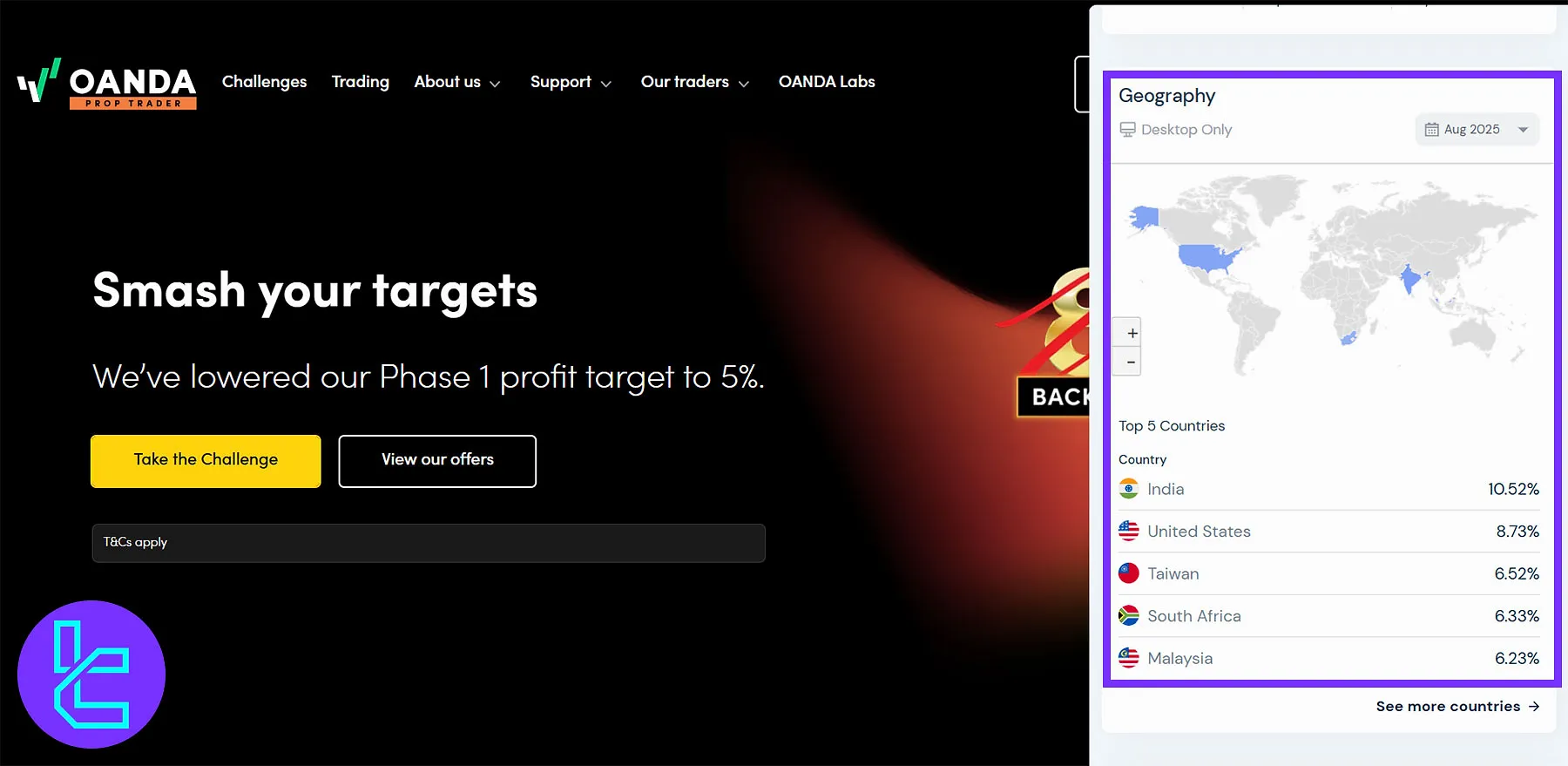

OANDA Prop Trader User Base

OANDA Prop Trader attracts a diverse global audience, with its largest user base concentrated in Asia, North America, and emerging trading regions, reflecting strong international adoption of its prop trading programs and evaluation challenges. Top 5 Countries:

- India: 10.52%

- United States: 8.73%

- Taiwan: 6.52%

- South Africa: 6.33%

- Malaysia: 6.23%

OANDA Prop Trader on Social Media

OANDA Prop Trader maintains a presence across major platforms like Facebook, Instagram, X (Twitter), and YouTube, sharing market updates, educational posts, and challenge promotions to engage traders and build brand visibility.

Social Media | Members/Subscribers |

27K | |

3,437 | |

4.2K | |

364 |

The firm currently lacks channels on Discord, Telegram, and LinkedIn, which limits real-time community interaction and highlights its newcomer status in the prop trading social space.

OANDA Prop Trader Comparison Table

The table below compares OANDA Prop Trader with other leading prop firms, showcasing differences in funding, profit share, and rules.

Parameters | OANDA Prop Firm | |||

Minimum Challenge Price | $35 | $13 | $39 | $97 |

Maximum Fund Size | $500,000 | $100,000 | $250,000 | $200,000 |

Evaluation steps | 2-Step | Instant, 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step |

Profit Share | Up to 90% | 80% | 100% | 80% |

Max Daily Drawdown | 5% | 4% | 5% | 5% |

Max Drawdown | 10% | 8% | 10% | 10% |

First Profit Target | 8% | 8% | 5% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:75 | 1:100 | 1:100 |

Payout Frequency | 14 Days | 10 Days | Bi-weekly | 14 Days |

Number of Trading Assets | 62 | 400+ | 3000+ | 40 |

Trading Platforms | MetaTrader 5 | Match-Trader, cTrader, MetaTrader 5 | Metatrader 5 | MetaTrader 5, cTrader, Dxtrade |

Expert Suggestions

OANDA Prop Trader processes payouts every 14 days via bank transfer, Neteller, or Skrill, refunding the challenge fee after the first payout and offering profit shares as high as 90% for qualified participants.

OANDA prop firm remains competitive with institutional-grade pricing and compliance standards, but news trading restrictions, a $500K allocation cap, and no live chat support leave room for improvement in scalability and real-time assistance.