France’s financial markets, regulated by the Autorité des Marchés Financiers (AMF), are among the most secure in Europe, promoting fair trading conditions. With an average daily forex turnover of $242.2 billion in 2025, France offers robust protections against market fraud, ensuring a transparent environment for retail forex traders.

The AMF, founded in 2003, operates under European regulations like EMIR and maintains strict oversight of forex brokers. It provides a daily-updated list of licensed brokers through the REGAFI, helping French traders select trustworthy firms. Below, you'll find a curated list of the best AMF-regulated forex brokers for your trading needs.

| AVATRADE | |||

| FXCM | |||

| XM Group | |||

| 4 |  | IC Markets | ||

| 5 |  | Exness | ||

| 6 |  | easyMarkets | ||

| 7 |  | eightcap | ||

| 8 |  | FxPro | ||

| 9 |  | vt markets | ||

| 10 |  | PUPRIME |

AMF Brokers’ Trustpilot Ratings

When evaluating AMF-regulated brokers, Trustpilot ratings provide valuable insights into customer satisfaction. IC Markets and Exness stand out with top ratings of 4.8/5, based on over 50,000 and 27,000 reviews, respectively, reflecting their strong reputations for service quality and reliability in the forex market.

Broker | Trustpilot Rating | Number of Reviews |

IC Markets | 51,213 | |

27,343 | ||

AvaTrade | 11,821 | |

FXCM | 818 | |

VT Markets | 2,392 | |

1,765 | ||

Eightcap | 3,437 | |

FxPro | 808 | |

2,940 | ||

PU Prime | No PU Prime Trustpilot rating due to breach of guidelines | 1,778 |

Minimum Spread in AMF-Regulated Brokers

AMF-regulated brokers provide highly competitive spreads, with several offering 0.0 pips, meaning no markups and raw spreads directly from liquidity providers. These low spreads ensure traders can access the most efficient trading conditions. Other brokers may offer slightly higher spreads, ranging from 0.2 to 0.7 pips.

Broker | Min. Spread |

Exness | 0.0 Pips |

0.0 Pips | |

Alpari | 0.0 pips |

0.0 Pips | |

NordFX | 0.0 Pips |

FxPro | 0.0 Pips |

Fusion Markets | 0.0 Pips |

0.2 Pips | |

XM Group | 0.6 Pips |

easyMarkets | 0.7 Pips |

AMF Brokers in Non-Trading Fees

AMF-regulated brokers typically offer zero fees for deposits and withdrawals, ensuring cost-effective trading. While many brokers maintain $0 inactivity fees, some charge a monthly or yearly fee for dormant accounts, ranging from $5 to $50, depending on the broker's policy. These fees help maintain account activity.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Global Prime | $0 | $0 | $0 |

Pu Prime | $0 | $0 | $0 |

IC Markets | $0 | $0 | $0 |

easyMarkets | $0 | $0 | $0 |

$0 | $0 | $5/month | |

XM Group | $0 | $0 | $10/month |

$0 | $0 | $10/month | |

MultiBank Group | $0 | $0 | $60/month |

eToro | $0 | $5 | $10/month |

FXCM | $0 | Up to $40 | $50/year |

Number of Trading Instruments in AMF-Regulated Brokers

AMF-regulated brokers provide access to a diverse array of trading instruments, including Forex, stocks, commodities, indices, and cryptocurrencies. While some brokers offer over 26,000 instruments, others provide more specialized markets, ranging from a few hundred to several thousand, allowing traders to choose according to their strategies and preferences.

Broker | Tradable Instruments |

BlackBull Markets | 26,000+ |

FXCM | 13,000+ |

eToro | 7,000+ |

FxPro | 2,100+ |

XM Group | 1,400+ |

1,000+ | |

Eightcap | 800+ |

800+ | |

Alpari | 750+ |

Exness | 200+ |

Top 8 Brokers Regulated by AMF

The Autorité des Marchés Financiers (AMF) is a French regulatory body responsible for overseeing financial markets and ensuring investor protection. We highlight eight brokers regulated by AMF, offering secure, transparent trading environments for French traders and global clients. These brokers offer competitive spreads, robust platforms, and multiple account types to meet the diverse needs of traders.

AvaTrade

AvaTrade is a well-regulated global broker, licensed in multiple jurisdictions such as the Central Bank of Ireland, ASIC, CySEC, and FSCA. With a strong regulatory framework, the broker ensures traders benefit from a secure and transparent trading environment and a safe AvaTrade registration process. Its broad regulatory coverage speaks to its credibility.

The broker offers a wide variety of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary web-based platform. AvaTrade also supports mobile trading apps, providing flexibility for traders who prefer managing their trades on the go, enhancing its accessibility for both new and experienced traders.

AvaTrade dashboard provides a diverse range of tradable instruments, including Forex, stocks, commodities, and cryptocurrencies. With over 1,250 instruments available, traders can access global markets and enjoy the benefits of high leverage, starting from 1:30 up to 1:500 for Forex and commodities. AvaTrade's leverage options cater to different trading strategies.

The broker’s fee structure is competitive, with no commissions on deposits or withdrawals, minimal fees on inactivity, and the AvaTrade rebate program with spread discounts of up to 20%.

AvaTrade’s transparency in its fees and charges ensures traders can focus on their strategies without worrying about hidden costs. However, inactivity fees apply after two months of no trading activity.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

AvaTrade has several advantages, including its broad regulatory coverage, a wide selection of tradable instruments, and the availability of multiple trading platforms. However, some drawbacks include limited account types compared to other brokers and inactivity fees after prolonged periods of no trading.

Pros | Cons |

Well-regulated by multiple authorities | Limited account types |

Wide range of trading instruments | Inactivity fees after 2 months |

Multiple platform options (MT4/MT5) | No PAMM account |

Competitive fees and no commission | No bonuses or promotions for all users |

IC Markets

IC Markets, established in 2007 in Australia, operates under the regulation of top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). This broad regulatory coverage ensures a secure and reliable trading environment for clients worldwide.

With licenses from multiple jurisdictions, IC Markets offers investor protection measures, including segregated client funds and negative balance protection in certain regions. Its European clients are covered by the Investor Compensation Fund (ICF) up to €20,000, enhancing the safety of their investments.

IC Markets provides a range of account types, including Standard, Raw Spread, and Islamic accounts, with a minimum deposit of $200. The broker supports various payment methods such as bank cards, wire transfers, and electronic payments. With spreads starting from 0 pips and leverage of up to 1:500, IC Markets caters to both retail traders and high-frequency traders.

The broker also offers several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, allowing clients to trade across multiple asset classes like Forex, stocks, commodities, and cryptocurrencies. IC Markets' commitment to fast execution and competitive pricing makes it a popular choice for active traders and algorithmic traders.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros and Cons

The broker is known for its competitive pricing, fast execution, the IC Markets rebate program, and a variety of trading platforms. However, some drawbacks include limited leverage for clients in Europe and certain regional restrictions on account eligibility.

Pros | Cons |

Low spreads starting from 0 pips | Limited leverage in Europe (1:30) |

Wide range of tradable instruments | High minimum deposit for some accounts |

Fast order execution, ideal for scalping | Limited account types compared to some competitors |

No inactivity fees | Restricted in several countries |

Eightcap

Eightcap, founded in 2009 and based in Melbourne, Australia, is a globally recognized Forex broker. With its licenses from top-tier regulatory authorities such as ASIC, FCA, and CySEC, Eightcap offers a secure and transparent trading environment. The broker has been consistently recognized for its quality services, winning awards like Global Broker of the Year in 2023.

Eightcap operates under strict regulatory standards, ensuring the protection of client funds. The broker segregates client funds in tier-1 banking institutions and complies with anti-money laundering policies. In Europe, clients are covered by the Investor Compensation Fund up to €20,000, providing additional security for traders.

The broker offers a range of account types to meet various trading needs, including Standard, Raw, and TradingView accounts, all available after completing the Eightcap registration process.

With leverage up to 1:500 and a minimum deposit of $100, Eightcap caters to both retail and active traders. Its trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView, supporting a range of assets like Forex, commodities, metals, and cryptocurrencies.

Eightcap provides traders with access to several trading tools, including Capitalise.ai, FlashTrader, and an AI-powered economic calendar. These tools enhance trading strategies and market analysis, making it an attractive option for both novice and experienced traders looking for cutting-edge features.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

Eightcap stands out with its strong regulatory framework, $3.6 cashback via the Eightcap rebate program, competitive spreads, and advanced trading tools. However, its minimum deposit may be considered high for some, and its educational resources are somewhat limited compared to competitors.

Pros | Cons |

Strong regulation across multiple jurisdictions | Limited educational resources |

Competitive spreads and low commission | Platform restrictions for some regions |

High leverage up to 1:500 | Minimum deposit may be high for some |

Access to advanced trading tools | No PAMM or copy trading services |

VT Markets

VT Markets, founded in Australia, has rapidly grown since its establishment. The broker is regulated in several jurisdictions, including the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the offshore St. Vincent & the Grenadines Financial Services Authority (SVGFSA). The ASIC license is particularly well-regarded for offering strong client protection standards.

The company adheres to regulatory frameworks by maintaining segregated client funds, ensuring they are kept separate from operational funds. Clients under FSCA are protected by an investor compensation fund of up to €20,000. However, VT Markets does not offer excess loss insurance or fund protection beyond these regulatory protections.

VT Markets dashboard provides a variety of account types, including Standard STP, RAW ECN, Cent STP, and Cent ECN accounts. The broker supports a wide range of markets, including Forex, indices, shares, and commodities. Traders have access to platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and VT Markets’ proprietary app, with leverage reaching up to 1:500.

VT Markets also offers copy trading and PAMM accounts, enabling traders to follow experienced investors or invest in professionally managed accounts after completing the VT Markets registration process. The broker supports both manual and algorithmic trading with tools such as Trading Central and VTrade.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros and Cons

VT Markets is praised for its competitive spreads, strong regulatory framework, and advanced trading platforms. However, its relatively high minimum deposit and limited cryptocurrency offerings could be drawbacks for some traders.

Pros | Cons |

Strong regulation in multiple regions | Limited crypto trading options |

Wide range of account types and platforms | Higher minimum deposit compared to some competitors |

High leverage of up to 1:500 | Limited availability in certain countries |

Advanced trading tools and copy trading | No excess loss insurance |

FxPro

FxPro, founded in 2006, is a well-established Forex broker with over 7.8 million client accounts globally. The broker is regulated by respected authorities such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. FxPro operates under multiple licenses to provide a secure trading environment.

The broker ensures client protection through segregated funds and negative balance protection. Clients under FCA regulation are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000, while CySEC clients have coverage up to €20,000 through the Investor Compensation Fund. This broad regulatory network increases client confidence in FxPro’s services.

FxPro dashboard provides access to a wide range of financial instruments, including over 2,100 tradable symbols across Forex, stocks, indices, and cryptocurrencies. The broker offers various account types, including Standard, Raw+, and Elite, with competitive spreads and leverage up to 1:500. Its platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, giving traders flexibility in how they manage their trades.

Despite its broad regulatory reach, traders face some challenges after completing the FxPro registration process, such as high minimum deposit requirements for certain accounts and limited bonuses. However, its reliable execution, comprehensive trading tools, and strong customer support make it a top choice for experienced traders looking for a trusted Forex broker.

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA, FSCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader, Web Trader, Mobile App |

FxPro Pros and Cons

FxPro is renowned for its competitive pricing, diverse account options, award-winning platforms, and the FxPro rebate program. However, the broker's limited bonuses and high minimum deposit requirements could deter some traders.

Pros | Cons |

Well-regulated across multiple regions | High minimum deposit for some accounts |

Wide range of tradable instruments | Limited bonuses and promotions |

Advanced trading platforms (MT4/MT5/cTrader) | No 24/7 customer support |

Negative balance protection | Restrictions in some countries |

PU Prime

PU Prime, established in 2016, is a global Forex and CFD broker headquartered in Seychelles. The broker operates under multiple regulatory licenses from authorities like the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Financial Services Authority of Seychelles. This broad regulatory coverage ensures a secure trading environment for clients across different regions.

Traders benefit from segregation of client funds in top-tier banking institutions and negative balance protection upon completing the PU Prime registration process. However, it does not offer additional investor protection beyond the regulatory frameworks in place. The broker's commitment to secure trading is supported by strict data protection measures.

With a range of account types, including Standard, Prime, ECN, and Cent accounts, PU Prime offers traders flexibility in terms of spreads and commissions. Spreads start from as low as 0.0 pips, and the broker provides leverage up to 1:1000. Trading is available on multiple platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the PU Prime app.

PU Prime dashboard is recognized for its diverse selection of tradable instruments, offering over 800 markets in Forex, indices, commodities, shares, bonds, metals, and cryptocurrencies. The broker also supports social and copy trading through its platform, catering to both novice and experienced traders.

PU Prime deposit and withdrawal methods include credit/debit cards, cryptocurrencies, bank transfers, Alipay, Union Pay, and many more.

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | SVG FSC, Mwali FSC, FSCA, ASIC |

Minimum Deposit | $20 |

Deposit Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Withdrawal Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, PU Prime app |

PU Prime Pros and Cons

PU Prime offers a wide range of trading options, competitive leverage, and a variety of account types. However, it is not available in some regions, and there are concerns about mixed reviews from some traders.

Pros | Cons |

High leverage up to 1:1000 | Not available in certain countries |

Competitive spreads starting from 0.0 pips | Mixed reviews on credible websites |

Wide range of tradable instruments | High minimum deposit for some account types |

Offers copy trading and social trading | No excess loss insurance or fund protection |

Exness

Exness, founded in 2008 by Petr Valov and Igor Lychagov, is a leading global Forex broker known for its fast execution speeds and innovative services.

The broker operates in over 180 countries and has established itself as a reputable brand within the industry. With monthly trading volumes surpassing $4 trillion, Exness has earned recognition for its reliable services and extensive global reach.

Exness is regulated by multiple top-tier authorities, including the UK’s Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulations ensure that Exness adheres to strict compliance standards, offering its clients a secure and trustworthy trading environment.

Exness dashboard provides access to a wide range of account types, including Standard, Pro, Raw Spread, and Zero accounts, catering to both beginner and professional traders.

Exness offers leverage of up to 1:2000 and a minimum deposit of just $10, making it accessible to a broad range of traders. Its trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary app, providing traders with flexible and reliable trading options. Traders also benefit from the three types of Exness bonuses.

Exness also offers a vast range of markets, including Forex, indices, commodities, stocks, cryptocurrencies, and ETFs. With competitive spreads starting from zero and commission fees starting at just $0.2 per lot, completing the Exness registration is a cost-effective choice to start your trading journey.

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros and Cons

Exness is favored for its high leverage options, low minimum deposit, and range of tradable assets. However, its limited educational resources and restrictions in certain regions may pose challenges for some traders.

Pros | Cons |

Wide range of trading instruments | Limited educational resources for beginners |

High leverage options up to 1:2000 | Restricted in certain countries |

Low minimum deposit of $10 | Limited bonuses and promotions |

Fast execution speeds and reliable platforms | Some trading instruments unavailable on certain account types |

easyMarkets

easyMarkets, founded in 2001 and headquartered in Cyprus, is a renowned forex broker offering commission-free trading with a low minimum deposit of $25. The broker caters to both beginners and experienced traders, with a strong focus on providing accessible, transparent, and secure trading services worldwide.

Regulated by top-tier authorities such as CySEC, ASIC, and FSCA, easyMarkets ensures clients' funds are protected with segregated accounts and negative balance protection. The company is also awarded Best Forex/CFD Broker in the TradingView Awards 2023, reflecting its commitment to industry-leading services and secure trading environments.

By completing the easyMarkets registration process, traders get access to a wide range of tradable assets, including forex, indices, metals, commodities, crypto, and stocks. The platform offers leverage up to 1:2000 on select accounts, enabling traders to amplify their market exposure. Available trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and its proprietary app.

The broker features key tools like dealCancellation and Freeze Rate, which allow traders to manage risk and protect their trades. easyMarkets’ Zero Spreads and flexible accounts like Islamic Accounts cater to diverse trading styles and ensure a user-friendly experience.

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Minimum Deposit | $25 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, TradingView, Proprietary platform |

easyMarkets Pros and Cons

easyMarkets stands out with its robust regulatory compliance and cutting-edge tools like dealCancellation and Freeze Rate. While offering high leverage and a variety of platforms, the broker does have certain limitations like geo-restrictions and a restricted range of tradable assets.

Pros | Cons |

Multiple top-tier regulations (ASIC, CySEC) | No cryptocurrency deposits/withdrawals |

High leverage up to 1:2000 | Limited range of tradable assets |

Innovative trading features (dealCancellation) | Lack of 24/7 customer support |

Commission-free trading | Geo-restrictions in some countries |

What Factors Are Important in Selecting the Best AMF Brokers?

When choosing the best AMF-regulated brokers, several key factors must be considered. Regulatory compliance is at the top of the list, ensuring the broker adheres to MiFID II and other European regulations. These regulations ensure client fund protection and transparency. Traders should also assess the broker’s leverage options, trading platforms, and financial instruments available to meet their trading needs.

Additionally, the quality of customer support, available educational resources, and commission structure are vital for a smooth trading experience. AMF-regulated brokers should also offer clear withdrawal processes and security features such as negative balance protection to safeguard traders during volatile market conditions.

- Regulatory compliance with MiFID II

- Leverage limits to protect retail traders

- Segregation of client funds for added security

- Competitive fees and commissions for cost-effective trading

What is AMF?

The AMF (Autorité des Marchés Financiers) is France’s regulatory authority for financial markets. It was established in 2003 to ensure the stability, transparency, and protection of investors in the French financial market. The AMF supervises all financial institutions and enforces regulations designed to prevent fraudulent activities such as money laundering.

AMF's role includes authorizing brokers to operate within France, enforcing market conduct rules, and overseeing the transparency of financial products. It is also responsible for investor education, providing information about market risks and ensuring that brokers follow clear, ethical guidelines to protect consumers.

- Regulates financial markets in France;

- Investor protection against fraud and market manipulation;

- Oversees financial institutions and ensures transparency;

- Educates investors about market risks and protections.

AMF Requirements for Forex Brokers

To be authorized by the AMF, forex brokers must meet strict financial and operational requirements. Brokers are required to provide a detailed business plan, including risk management policies and operational structure. A significant aspect is maintaining sufficient capital reserves, with amounts ranging from €50,000 to €730,000 based on the broker’s services.

In addition to financial stability, brokers must appoint experienced management personnel and ensure regular audits and financial disclosures. These steps ensure that brokers are equipped to handle the financial risks associated with forex trading, providing a secure environment for French traders.

- Minimum capital requirements based on services offered

- Detailed business plan submission for approval

- Appointment of experienced management and staff

- Regular audits to maintain financial transparency

Does AMF Mandate Negative Balance Protection?

AMF requires all AMF-regulated brokers to offer negative balance protection. This safety mechanism ensures that traders cannot lose more money than they have deposited, even during extreme market fluctuations. This protection is particularly important for traders using leverage, as it prevents them from accumulating debts beyond their initial investment.

This protection is standard across AMF-regulated brokers, offering peace of mind to retail traders. It is an essential feature for traders involved in high-risk derivative trading, as it limits their exposure to potential market volatility.

What Safety Protocols Does AMF Implement for Forex Traders?

The AMF enforces robust safety protocols for forex traders to ensure that their funds and personal information remain protected. Brokers must segregate client funds, keeping them separate from the company’s operational funds, ensuring that clients are refunded in case of bankruptcy. Additionally, brokers must have strict anti-money laundering (AML) measures in place.

The AMF also mandates regular reporting from brokers, ensuring transparency and accountability. Through these measures, the AMF ensures that traders are trading in a secure environment where their funds and personal data are safeguarded against potential breaches or misuse.

- Segregation of client funds for fund protection

- Anti-money laundering (AML) compliance

- Regular financial disclosures and audits

- Transparent practices to ensure fair trading conditions

AMF Regulated Brokers' Safety

AMF-regulated brokers are required to follow several strict safety protocols to protect traders. One of the key safety measures is the segregation of client funds, which ensures that client money is kept separate from the broker’s operational funds. This minimizes the risk of traders losing their funds in the event of broker insolvency.

Additionally, negative balance protection is mandatory, preventing traders from losing more than their initial deposit. These regulatory measures ensure that traders’ investments remain protected, even in volatile market conditions.

- Segregated funds for client protection

- Negative balance protection for retail traders

- Regular audits and financial disclosures

- Investor compensation schemes for added security

Forex Trading Tax for Traders in AMF Jurisdiction

In France, forex trading profits are subject to a flat capital gains tax of 30%, which includes both income tax and social charges. Traders who earn income through forex trading must also contribute 17.2% in social security taxes. This tax applies to both retail and professional traders.

The taxation for professional traders can be more complex, with progressive income tax rates of up to 45%. Traders must ensure that their profits and losses are accurately reported for tax purposes, as failure to do so may lead to penalties.

- 30% flat tax on forex profits (12.8% income tax + 17.2% social charges)

- Progressive income tax for professional traders

- Tax treatment can vary depending on trading frequency

- Tax report is mandatory for all forex profits

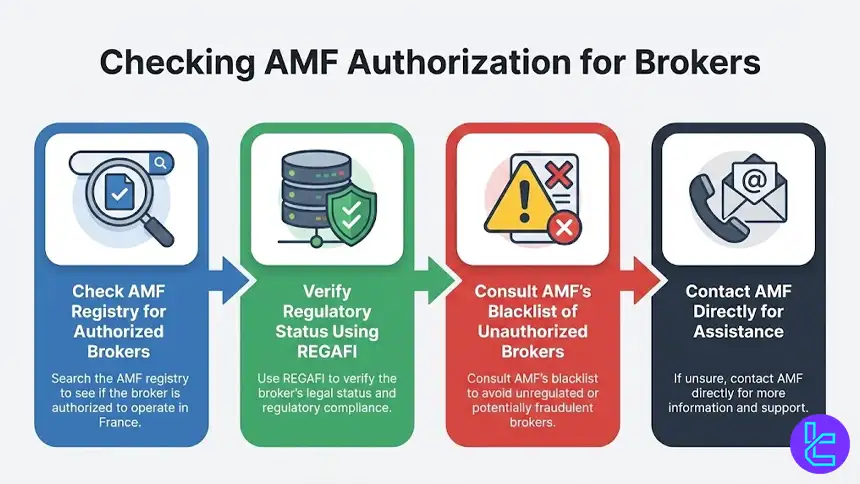

Checking AMF Authorization

When selecting a broker in France, it’s crucial to verify its AMF authorization to ensure it is legally allowed to offer trading services. Traders can use the AMF register or REGAFI to check if a broker is authorized to operate in France. This process ensures that the broker adheres to the strict regulatory requirements set by the AMF.

You can also check the AMF’s blacklist of unregulated brokers to avoid scams or unauthorized entities. This can help traders make informed decisions and trade safely within the legal framework.

- Check AMF registry for authorized brokers;

- Verify regulatory status using REGAFI;

- Consult AMF’s blacklist for unauthorized brokers;

- Contact AMF directly for further assistance.

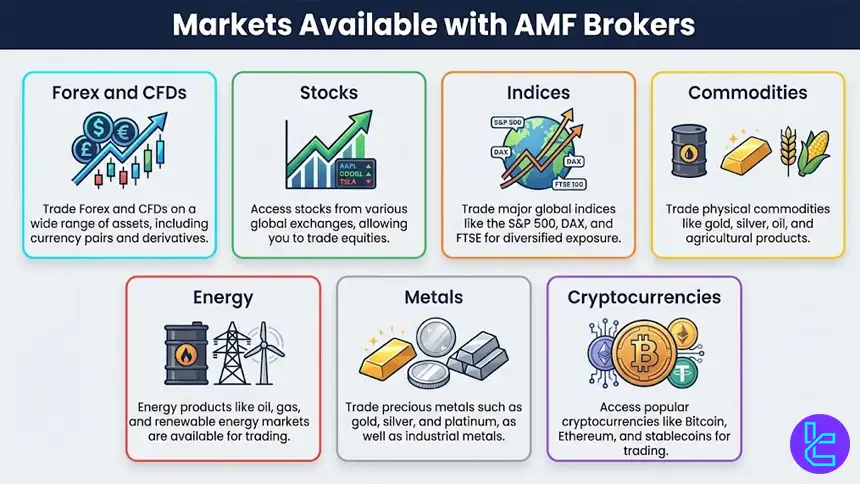

What Markets Can I Trade in AMF Brokers?

AMF-regulated brokers provide a diverse range of markets, including forex, stocks, commodities, and cryptocurrencies. Traders in France can access a wide array of asset classes, allowing them to diversify their portfolios. AMF brokers also offer Contract for Differences (CFDs) on major indices, commodities, and even cryptocurrencies, making it easier for traders to find opportunities across markets.

These brokers must comply with the MiFID II framework, ensuring that only legally authorized products are offered to French traders. This regulation ensures that brokers maintain fair trading conditions and safeguard client investments.

- Forex and CFDs on various assets

- Stocks, commodities, and cryptocurrencies available

- Trading in indices, energy, and metals

- Compliance with MiFID II for market access

Is Crypto Trading Allowed in AMF Forex Brokers?

Crypto trading is regulated under the AMF in France, but brokers cannot offer direct crypto purchases. Instead, traders can access crypto CFDs on AMF-regulated platforms. This provides exposure to cryptocurrencies without the need for traders to own the assets directly, maintaining compliance with France’s stringent regulatory framework.

Despite these opportunities, the AMF mandates that brokers offering crypto CFDs must ensure full transparency and provide adequate risk warnings. French traders must be aware of the risks associated with trading highly volatile assets like cryptocurrencies.

- Crypto CFDs allowed, but no direct crypto purchases

- Transparency and risk warnings for crypto traders

- Regulated to protect retail traders

- Leverage options for crypto CFDs may vary

AMF Compared to Other Regulatory Authorities

When comparing the AMF with other top-tier regulators like the ASIC and CySEC, the AMF stands out due to its stringent marketing restrictions. The AMF prevents brokers from aggressively advertising high-risk leveraged products to retail traders, ensuring that French traders are protected from misleading promotions.

Additionally, the AMF mandates negative balance protection, making it safer for traders compared to some non-EU jurisdictions. It also enforces transparency in trading conditions, requiring brokers to disclose their fee structures and risks clearly to clients.

Parameter | AMF (France) | MAS (Singapore) | CySEC (Cyprus) | ASIC (Australia) |

Minimum Capital Requirement | €730,000 | $1 million SGD | €750,000+ depending on firm type | Between AU$500,000 and AU$1,000,000 |

Client Fund Segregation | Required | Required | Required | Required |

Compensation Scheme | No | No | Investor Compensation Fund (~€20,000) | Investor Compensation Fund (AU$10,000) |

Leverage Limits | 1:30 | 1:30 | Set under MiFID (often 1:30 for retail in EU) | 1:30 |

Negative Balance Protection | Required | Required | Often required | Required |

Reporting & Audits | Ongoing financial reporting | Ongoing financial reporting | Ongoing financial reporting | Ongoing financial reporting |

Expert Suggestions

The AMF-regulated brokers provide a secure and transparent trading environment, backed by the authority's stringent regulations. With a wide range of asset classes available, such as forex, commodities, and cryptocurrencies, French traders are offered the necessary tools to diversify their portfolios.

The AMF’s rigorous standards ensure that traders are protected through measures like negative balance protection and segregated client funds, promoting investor confidence. Traders can rely on brokers that adhere to MiFID II regulations, providing them with a comprehensive and secure trading experience.

By using TradingFinder's Forex Methodology, we have assessed each broker based on regulatory compliance, market accessibility, trading conditions, and customer feedback. This ensures that the brokers we recommend not only meet industry standards but also provide superior service and protection for traders.