Bulgaria’s forex market operates under the Financial Supervision Commission (FSC), established in 2003, alongside EU MiFID compliance. According to the BIS Triennial Survey 2025, the country recorded $4 billion in average daily OTC forex turnover, a 50% increase since 2022, reflecting growing market activity.

Top FSC regulated brokers combine competitive spreads starting from 0.0 pips on EUR/USD, sub-second execution speeds, and 24/5 multilingual support. Evaluation criteria include FSC registration, trading costs, platform reliability, and overall user ratings.

| DEGIRO | |||

| FUSION MARKETS | |||

| fpmarkets | |||

| 4 |  | eightcap | ||

| 5 |  | BlackBull Markets | ||

| 6 |  | GLOBAL PRIME | ||

| 7 |  | Libertex | ||

| 8 |  | eToro |

BFSC Brokers Ranked by Trustpilot

Trustpilot scores highlight overall client satisfaction among BFSC regulated brokers. Several top rated firms hold 4.8 out of 5 stars, supported by between 3,000 and 10,000 verified reviews, indicating strong execution quality, transparent pricing structures, and responsive multilingual customer service.

Mid tier providers maintain ratings between 4.0 and 4.6 stars, with review volumes ranging from a few hundred to over 30,000. These figures reflect differences in global client base size, platform stability, withdrawal processing speed, and overall trading experience consistency.

Broker | Trustpilot Rating | Number of Reviews |

FP Markets | 9,995 | |

Fusion Markets | 6,267 | |

3,126 | ||

Global Prime | 414 | |

eToro | 30,622 | |

Eightcap | 3,479 | |

DEGIRO | 5,360 | |

9,495 |

Bulgarian Brokers’ Minimum Spreads

Many FSC supervised Bulgarian brokers advertise minimum spreads from 0.0 pips under raw pricing models. A 0.0 spread typically means no markups are added by the broker, and traders access real market spreads sourced directly from liquidity providers, with costs often reflected through transparent commissions instead.

Broker | Min. Spread |

Eightcap | 0.0 Pips |

0.0 pips | |

BlackBull Markets | 0.0 Pips |

Varchev | 0.0 Pips |

0.0 Pips | |

Fusion Markets | 0.0 Pips |

Libertex | 0.1 Pips |

Plus500 | 0.5 Pips |

Non-Trading Fees in BFSC Regulated Brokers

Non-trading fees among BFSC regulated brokers vary by funding method and account policy. Many providers offer zero deposit and withdrawal charges, while some apply small percentage-based transfer costs or fixed withdrawal fees. Inactivity fees may apply monthly after dormant periods, depending on platform terms and account classification.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

$0 | $0 | $0 | |

DEGIRO | $0 | $0 | $0 |

Trading 212 | $0 | $0 | $0 |

Varchev | Up to 0.4% | Up to 0.4% | $0 |

$0 | $0 | $10/month | |

XTB | $0 | $0 | €10/month |

eToro | $0 | $5 | $10/month |

Libertex | $0 | Up to €10 | €10/month |

Number of Trading Instruments in BFSC Brokers

BFSC regulated brokers provide access to a broad range of trading instruments across the forex market, equities, indices, commodities, ETFs, bonds, and crypto CFDs. Product coverage ranges from several hundred assets to tens of thousands, with some multi asset platforms offering exposure to millions of securities through global exchange connectivity.

Broker | Tradable Instruments |

2M+ | |

Saxo | 71,000+ |

Varchev | 50,000+ |

BlackBull Markets | 26,000+ |

Trading 212 | 13,000+ |

FP Markets | 10,000+ |

eToro | 7,000+ |

250+ |

Top 7 Bulgaria FSC Regulated Forex Brokers

This list highlights seven broker brands commonly used by Bulgaria-based traders, filtered around regulation, pricing structure, platform availability, and account accessibility. Coverage spans EU-style protections and offshore leverage models, with options ranging from social investing and multi-exchange access to raw spread CFD trading, segmented funds, and fast execution infrastructure.

Fusion Markets

Fusion Markets is a multi regulated forex and CFD broker founded by Phil Horner. It operates under ASIC in Australia and VFSC in Vanuatu, offering access to forex, indices, commodities, metals, cryptocurrencies, and share CFDs with a cost focused trading model.

The broker is backed by Gleneagle Securities Pty Limited, an Australian financial services group managing over $400 million in client assets. Client funds are held in segregated accounts with HSBC and National Australia Bank, reinforcing operational transparency and capital protection standards.

Fusion Markets dashboard provides Zero, Classic, and Swap Free accounts with no minimum deposit requirement. Raw spreads start from 0.0 pips with a fixed commission, while the Classic model integrates trading costs into spreads. Maximum leverage reaches 1:500 depending on jurisdiction and client classification.

Traders can use MetaTrader 4, MetaTrader 5, cTrader, and TradingView across desktop, web, and mobile, after completing the Fusion Markets registration process. The broker supports copy trading via Fusion+, MAM and PAMM solutions, VPS hosting, and over 30 funding methods, with no deposit or withdrawal fees.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

Fusion Markets combines ultra low spreads, platform diversity, and flexible account access, but it also has structural limitations that traders should consider before opening a live account. Below is a balanced overview of its main advantages and drawbacks.

Pros | Cons |

Raw spreads from 0.0 pips | No investor compensation scheme |

No minimum deposit requirement | Limited proprietary research tools |

Multiple platform support including MT4, MT5, cTrader, TradingView | Restricted availability in several countries |

Segregated client funds with tier one banks | Educational resources are relatively basic |

DEGIRO

DEGIRO is a European online brokerage founded in Amsterdam in 2008, opening retail services in 2013. It now serves over 3 million investors across 15 countries, providing access to stocks, ETFs, bonds, futures market, options, and structured products through a proprietary web and mobile platform.

The broker operates under strict European supervision, regulated by the Netherlands Authority for the Financial Markets and prudentially overseen by De Nederlandsche Bank, with primary regulation by BaFin in Germany. This multi layer framework strengthens compliance, transparency, and investor protection standards.

DEGIRO is widely recognized for its competitive pricing model. For example, US stock trades carry a €1 commission plus a €1 handling fee. Selected ETFs start from zero commission, while options begin at €0.75, supported by a transparent fee calculator and no inactivity charges.

The company claims more than 100 international awards, including Best International Stock Broker 2025 and Best Neo Broker 2024/25. Investors gain access to over 45 exchanges in 30 countries, with integrated ESG ratings, analyst insights, economic calendars, and secure two factor authentication, after completing the DEGIRO registration process.

Account Types | Standard |

Regulating Authorities | BaFIN, AFM, DNB |

Minimum Deposit | $0 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Maximum Leverage | 1:50 |

Trading Platforms & Apps | Proprietary Platform |

DEGIRO Pros and Cons

DEGIRO stands out for its low-cost structure and broad European market access, yet it may not suit traders seeking leveraged forex, copy trading, or advanced asset diversification tools. Below is a balanced overview of its main strengths and limitations.

Pros | Cons |

Access to 45 global exchanges | No demo account |

Transparent and low commission model | Currency conversion fees apply |

Strong EU regulatory oversight | Limited asset classes compared to multi-asset CFD brokers |

No inactivity or custody fees | Services restricted outside the EU |

Libertex

Libertex is a CySEC regulated broker operated by Indication Investments Ltd in Limassol, working under MiFID II standards. The brand has been active since 1997 and serves a global client base across more than 120 countries, positioning it as a long running provider in online trading.

Client protection is supported through segregated accounts and negative balance protection, plus participation in the Investor Compensation Fund covering eligible clients up to €20,000. This structure targets stronger fund safety for EEA and Switzerland clients using regulated services.

Libertex dashboard offers access to forex, cryptocurrencies, commodities, stocks, and indices through multiple platform choices, including MT4, MT5, and its proprietary interface. Traders can select from several live account formats plus a demo, with execution available via Market or Instant models depending on account setup.

Pricing is designed around tight spreads and trade based commissions that vary by instrument and market conditions. Retail leverage follows EU limits, while professional status can unlock higher leverage up to 1:600, alongside features such as copy trading, auto trading tools, and built in risk controls, all available after completing the Libertex registration process.

Libertex deposit and withdrawal methods include banking solutions like SEPA and SOFORT, VISA, MasterCard, and E-Wallets like Skrill and Neteller. The broker charges no deposit fees with instant processing for most methods.

Account Types | Demo, Real, Invest, MT4, MT5 |

Regulating Authorities | CySEC |

Minimum Deposit | €100 |

Deposit Methods | E-payments, Credit/Debit Card, Bank Wire Transfer |

Withdrawal Methods | E-payments, Credit/Debit Card |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MT4, MT5, Proprietary Platform |

Libertex Pros and Cons

Libertex blends regulated investor protections with broad CFD coverage and multiple platform options, but it also has limitations such as country restrictions and lighter education depth. The pros and cons below summarize what will be expanded in the next section.

Pros | Cons |

Tier one regulation under CySEC and MiFID II alignment | Not available in several major jurisdictions |

Segregated client funds and negative balance protection | Educational content is relatively limited |

Investor Compensation Fund coverage for eligible clients | Fees depend on instrument and conditions, not fully standardized |

Multiple platform choices plus demo and copy trading | Customer support hours are not clearly stated on the website |

eToro

eToro is an Israel based multi asset broker founded in 2007, operating as eToro Ltd and headquartered in Tel Aviv. It focuses on social investing with CopyTrader, Smart Portfolios, and crypto staking, alongside access to stocks, ETFs, commodities, indices, currencies, and digital assets through a proprietary trading platform.

The broker runs a multi-jurisdictional structure regulated by authorities such as the FCA in the UK, CySEC in the EU, ASIC in Australia, MFSA in Malta, FSRA in Abu Dhabi, and other regional bodies. Client safeguards vary by entity, including segregated funds and negative balance protection in several regulated branches.

eToro registration provides access to a wide range of account types, including Personal, Professional, Corporate, and Islamic accounts, with a low entry minimum deposit and broad payment coverage including cards, bank transfers, and popular e-wallets. A demo account is included for testing the platform, while minimum order sizing enables small ticket copy trading and stock investing.

Costs depend on region and asset class, combining spreads with commissions on specific markets and fixed non-trading charges such as withdrawal fees from USD accounts. Execution details are not clearly specified in public terms, and the platform design prioritizes simplicity, portfolio tools, and in-app risk controls.

Account Types | Standard, Demo |

Regulating Authorities | FINRA, SIPC |

Minimum Deposit | $100 |

Deposit Methods | Online Bank Transfers, Wire Transfer, Credit/Debit Card, PayPal |

Withdrawal Methods | Online Bank Transfers, Wire Transfer, Credit/Debit Card, PayPal |

Maximum Leverage | 1:1 |

Trading Platforms & Apps | Proprietary Platform |

eToro Pros and Cons

eToro delivers strong regulatory breadth and standout social trading features, but its platform limitations and support structure may not fit every trading style. The pros and cons below summarize what will be detailed in the next section.

Pros | Cons |

Social investing suite with CopyTrader and Smart Portfolios | No MT4 or MT5 platform support |

Multiple regulators across key regions | No phone based customer support |

Wide multi asset market coverage | Fees vary by region and product type |

Flexible funding methods including major e-wallets | Some services restricted by country and entity |

Global Prime

Global Prime is an Australia founded brokerage established in 2010 by Jeremy Kinstlinger, offering access to 150+ tradable instruments across forex, indices, commodities, crypto CFDs, and bonds. The broker promotes raw pricing with spreads from 0.0 pips and fast execution, targeting cost sensitive active traders.

Regulation is split across ASIC in Australia and VFSC in Vanuatu, enabling both domestic and international coverage under different entity rules. Client funds are held in segregated accounts with HSBC and National Australia Bank, and the ASIC entity includes negative balance protection and an investor protection framework.

Global Prime offers Standard and Raw account models, plus a Pro Trading mode for eligible clients, selectable after the Global Prime registration process. The Standard account combines wider spreads with zero commission, while Raw accounts are designed for tighter spreads with a per lot commission model. Order sizing starts small, and leverage availability depends on the regulated branch.

Beyond trading conditions, Global Prime adds value through partner-style incentives and tools such as Autochartist signals and social trading integration via ZuluTrade. Promotions may include TradingView Premium access, an FT subscription, and Global Prime rebate program, paired with 24/7 support and a broad set of funding methods.

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | $0 |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

The broker combines strong regulation, a thorough Global Prime verification process, transparent pricing, and reliable infrastructure, but it still has limitations around platform choice and regional availability. The pros and cons below summarize what will be expanded in the next section.

Pros | Cons |

Tier one regulation under ASIC plus offshore coverage via VFSC | Platform lineup is limited compared to multi terminal brokers |

Segregated client funds held with top tier banks | Some countries are restricted due to compliance rules |

Raw spread pricing and strong execution focus | No swap free option for interest sensitive accounts |

24/7 support and broad deposit and withdrawal methods | Promotions are not always available across all regions |

FP Markets

FP Markets is an Australia-based broker established in 2005 under the First Prudential Markets brand, offering multi asset CFD contracts with institutional style conditions. It supports Standard and Raw pricing models, a low entry deposit requirement, and a broad selection of base currencies for global clients.

Regulation is structured across multiple entities, with top tier oversight from ASIC and CySEC plus additional registrations in other jurisdictions, resulting in a thorough FP Markets verification process. This framework supports segregation of client funds, regular compliance checks, and negative balance protection across regulated branches, with investor compensation available under the CySEC entity.

Trading access spans forex, indices, commodities, metals, stocks, ETFs, and cryptocurrencies, delivered through MT4, MT5, and cTrader. FP Markets also offers a demo environment and supports copy trading plus managed account formats such as PAMM and MAMM, serving both manual and systematic strategies.

Costs differ by account type. Standard accounts bundle fees into spreads with zero commission, while Raw accounts target tighter spreads with a per lot commission structure. Islamic swap free versions are available on request, and the broker maintains a 24/7 support setup through live chat, email, and phone, all available after completing the FP Markets registration process.

Neteller, Skrill, VISA, MasterCard, bank transfers, PayPal and other online banking solutions are among FP Markets deposit and withdrawal methods. Note that Skrill withdrawals incur a 1% transaction fee.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros and Cons

FP Markets balances strong regulation, platform variety, and deep product coverage, but it may not suit traders who want a proprietary terminal or full access from every jurisdiction. The pros and cons below summarize what will be expanded in the next section.

Pros | Cons |

Tier one regulation through ASIC and CySEC | No proprietary trading platform |

Wide multi asset product range, including ETFs and crypto CFDs | Not available to clients in some countries |

Multiple platforms including MT4, MT5, and cTrader | Conditions vary by entity and region |

Islamic swap-free option, plus copy trading and PAMM support | Some features require additional onboarding steps |

Eightcap

Eightcap is an Australia founded broker established in 2009 in Melbourne, offering CFD trading across forex, commodities, metals, indices, shares, and cryptocurrency. It provides three live account formats plus a demo, pairing multi-market access with market execution and a trading environment designed for active, short term strategies.

The broker operates under a multi-jurisdiction regulatory structure that includes ASIC, FCA, CySEC, and SCB. This coverage supports core safety measures such as segregated client funds and negative balance protection across entities, while investor protection rules vary by region based on the licensed branch.

Eightcap registration provides access to Standard, Raw, and TradingView accounts. The Standard model starts from wider spreads, while the Raw account targets tighter pricing with a commission based structure. Leverage availability depends on client classification and jurisdiction, with higher limits offered under offshore entities.

A key differentiator is Eightcap’s trader-focused tool stack, including Capitalise.ai for code-free automation, FlashTrader for faster order workflow, and an AI-powered economic calendar that highlights historical market impact. Platform access includes MT4, MT5, and TradingView, supporting web, desktop, and mobile workflows.

Incentives and promotional programs include sign up bonus, referrals, trading challenges, and the Eightcap rebate program offering cashbacks of up to $3.6 per lot for forex trading.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

Eightcap combines strong regulatory coverage, platform flexibility, and useful third party tools, but it also has drawbacks around education depth and account cost structure. The pros and cons below summarize what will be expanded in the next section.

Pros | Cons |

Regulation across multiple top tier jurisdictions | Educational materials are relatively basic |

Platform choice includes MT4, MT5, and TradingView | Higher minimum deposit than some low entry brokers |

Tool suite includes automation and AI calendar features | Some features depend on region and entity |

Broad CFD market coverage, including shares and crypto | Availability and crypto access vary by jurisdiction |

What Factors Were Considered for Selecting the Best BFSC Brokers?

Selecting brokers for Bulgarian traders starts with regulatory alignment. Priority goes to firms authorized by the Bulgarian Financial Supervision Commission or passported under EU rules via MiFID II. Licensing transparency, published risk disclosures, and a clear client money policy form the first layer of screening.

The next layer focuses on execution quality and trading costs. Evaluation typically checks spread structure, commission clarity, slippage handling, and order protection features like guaranteed stop policies when offered. Platform stability, mobile functionality, and the availability of professional tools also matter for real world consistency.

Finally, selection considers operational reliability. This includes client support responsiveness, deposit and withdrawal predictability, complaint handling routes, and whether the broker clearly separates retail and professional protections. Brokers with straightforward onboarding and robust KYC tend to score higher in usability without compromising compliance.

- Regulation: Status in Bulgaria or EU passporting, verified in public registers, plus clear license disclosures and entity information;

- Investor protections: Segregation rules, compensation scheme participation, and negative balance protection for retail accounts;

- Risk controls: Leverage limits for retail traders, margin closeout policies, and standardized CFD risk warnings;

- Trading costs: Spread type, commission model, overnight financing clarity, and non-trading fees transparency;

- Platform and tools: MT4, MT5, cTrader, TradingView, and charting or automation capabilities;

- Operations: Funding speed, support availability, restricted country clarity, and dispute resolution channels.

What is the Financial Supervision Commission (FSC)?

The Financial Supervision Commission in Bulgaria was established in 2003 under the Financial Supervision Commission Act. It is independent from the executive branch and reports to the National Assembly. Its mandate covers nonbank financial sectors, including investment intermediaries, insurers, pension funds, and payment-related entities.

For forex and CFDs, the FSC oversees investment intermediaries that service Bulgarian clients. It drafts rules, issues guidance, and performs on-site and off-site inspections to enforce compliance. When firms breach obligations, the FSC can impose fines, suspend licenses, or revoke authorization in severe cases.

Bulgaria is an EU member, so the FSC operates within the MiFID II framework. That connection aligns local oversight with EU-wide conduct standards and cross-border passporting rules. As a result, EU-regulated firms like those supervised by CySEC can serve Bulgarians legally, depending on passporting status.

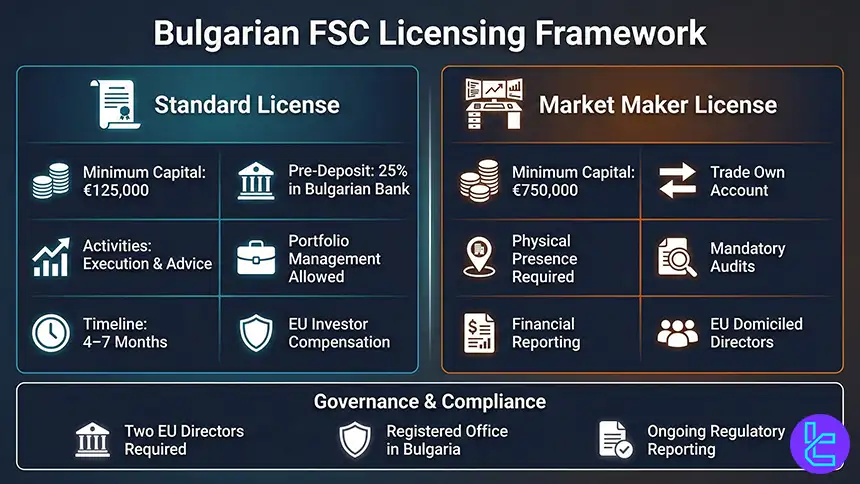

FSC Requirements for Forex Brokers

In Bulgaria, forex brokers are treated as investment intermediaries and must hold an appropriate license. There are two licensing paths, a standard broker license and a market maker license. Each path comes with different capital thresholds and permitted activities, shaping how the broker can operate.

Standard licenses have a minimum capital requirement of €125,000 and allow order execution, investment advice, and portfolio management. Applicants must deposit 25% of the required capital in a Bulgarian bank before applying, with the remaining amount payable shortly after approval. Fees for issuing licenses are described as comparatively low.

Market maker licenses require €750,000 in minimum capital and allow firms to trade on their own account. Brokers must maintain a physical presence in Bulgaria, undergo audits, and file financial reports. The process can take four to seven months and requires qualified EU domiciled directors with relevant credentials.

- Licensing includes standard intermediary permissions or market maker permissions, each with different capital and activity rules;

- Capital thresholds include €125,000 for standard licensing and €750,000 for market maker licensing;

- Applicants must pre-deposit part of the capital in a Bulgarian bank, then complete the remaining funding after approval;

- Governance rules include at least two directors domiciled in the EU with proven financial competence;

- Operational rules include a registered office, physical presence, audits, and regular financial reporting to the regulator;

- Investor protection includes participation in compensation arrangements, consistent with EU regulation expectations.

Negative Balance Protection in BFSC Brokers

Negative balance protection is a retail client safeguard tied to EU conduct rules. It limits losses to the amount deposited in the account, preventing debt creation from leveraged CFD moves. If account equity drops below zero, the broker must restore it to zero without requiring additional deposits.

This safeguard is supported by margin calls and automated closeouts. MiFID compliant brokers begin closing positions when retail account equity falls to a defined threshold. Closeouts reduce the likelihood of runaway losses during volatility, especially for traders using leverage in fast moving markets.

A key nuance is the difference between retail and professional status. Professional classification can allow higher leverage but may reduce protections, including the loss of negative balance protection. Bulgarian traders should understand the tradeoff before switching account classifications.

FSC Bulgaria Safety Protocols for Forex Traders

BFSC aligned brokers apply safeguards aimed at retail risk control. Retail clients must undergo appropriateness testing for complex derivatives like CFDs, futures, and options. If the trader fails the test, access to leverage can be restricted, reducing the chance of losses driven by inexperience.

Leverage caps are part of EU conduct rules. Retail leverage is limited, and brokers must apply automatic closeouts when equity drops to a set percentage. These mechanisms aim to prevent large losses during volatility and enforce consistent margin management across EU-regulated environments.

Disclosure is also central. Brokers must show standardized risk warnings and publish the percentage of retail clients who lose money on CFD trading. Regular updates to these loss percentages create an accountability loop and help consumers understand that leveraged derivatives carry significant downside risk.

- Appropriateness tests assess knowledge and experience before granting access to leveraged derivatives;

- Leverage caps reduce exposure, especially for retail traders using CFDs and other margin products;

- Automatic closeouts can be triggered when equity falls to a regulatory threshold, limiting further losses;

- Standardized risk warnings must be visible, emphasizing the probability of retail losses in CFD trading;

- Brokers must publish and update retail loss percentages, improving transparency for prospective clients;

- Client funds should remain segregated, with controlled access rules for execution purposes only.

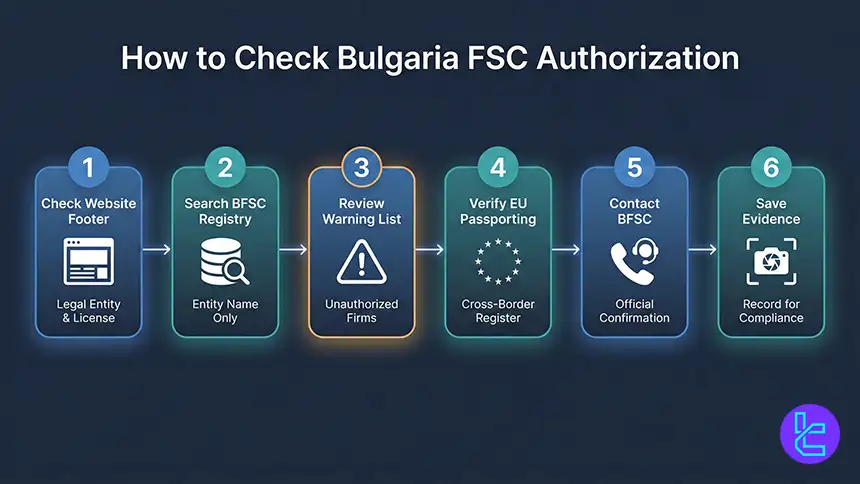

How to Check Bulgaria FSC Authorization

Verification begins with the broker’s own disclosures. Locally approved companies typically display license information and numbers in the website footer. Traders should confirm the exact legal entity name, not only the brand, because authorization is entity specific within corporate groups.

The BFSC registry and warning list are key tools. The regulator maintains an updated list of unauthorized firms targeting Bulgarian clients without approval. This helps traders avoid cloned brands, offshore lookalikes, and firms that claim EU status without valid registration.

Traders can call the BFSC information center and can visit the headquarters in Sofia. Direct verification is useful when a broker’s disclosures are unclear, or when the firm operates through complex multi entity structures across EU jurisdictions.

- Check the broker footer for the legal entity name, license number, and regulator reference details;

- Search the BFSC official registry using the entity name, not only the trading brand;

- Review the BFSC warning list for unauthorized firms targeting Bulgarian residents without approval;

- Confirm EU passporting where relevant through EU and EEA registers;

- Contact BFSC support channels for clarification when information conflicts across sources;

- Save screenshots of disclosures and registry results for compliance records and future dispute resolution.

Does BFSC Mandate a Leverage Cap for Forex Brokers?

Leverage is capped at 1:30 for major forex pairs, and 1:20 for cross and exotic pairs. For more volatile instruments, the cap tightens, with crypto derivatives described as capped at 1:2.

These limits aim to reduce the probability of rapid account depletion. Leverage magnifies both gains and losses, so caps are a consumer protection tool. These caps are tied to MiFID compliance and risk mitigation for inexperienced traders, supported by margin closeouts and negative balance protection.

Professional status can change access. Traders can qualify for professional accounts and access higher leverage, but doing so can reduce protections. This is a deliberate tradeoff in EU regulation, meant for experienced clients who can absorb greater risk.

Is Crypto Trading Legal in Bulgaria?

Crypto access is generally available through regulated brokers, but often in derivative form. Bulgarians can legally trade spot forex, currency derivatives, and crypto derivatives with authorized brokers.

EU aligned restrictions typically apply to retail risk. Crypto derivatives leverage is limited for retail clients, reflecting higher volatility. Brokers must also use standardized risk warnings and closeout rules, so crypto CFDs sit inside the same consumer protection framework as other CFDs.

Practical availability depends on the broker’s entity and region. Some EU entities restrict certain crypto derivatives for retail clients, and access may differ for professional clients. Bulgarian traders should confirm whether they are trading spot crypto, crypto CFDs, or other structured products before funding.

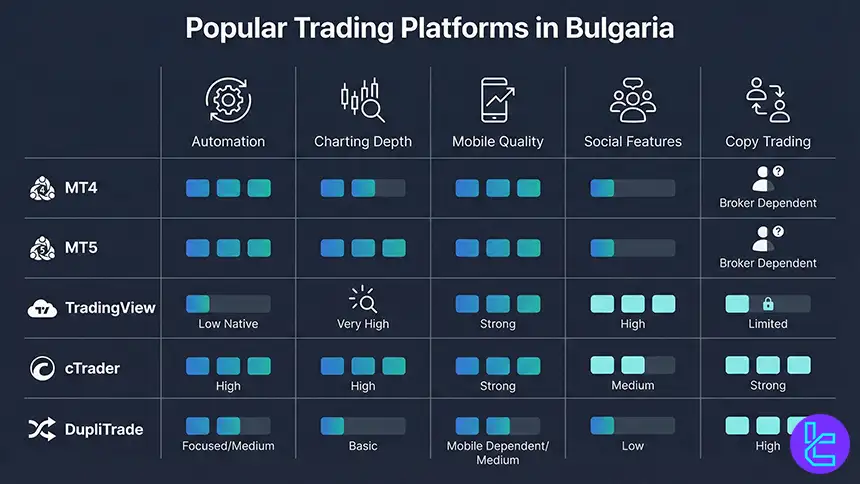

Popular Platforms Among Bulgaria Brokers

Platform choice shapes execution, analysis depth, and automation capability. MetaTrader 4 is beginner-friendly and widely used, with support for expert advisors and mobile access. It also offers a web trader option, which can lower setup friction while keeping core charting and trading functions available.

MetaTrader 5 targets advanced analysis, with more indicators, timeframes, and integrated tools. MT5 is a successor platform that supports one click trading and deeper analytics. For traders who rely on multi asset workflows, MT5 can streamline switching between instruments and timeframes.

Other options include TradingView, cTrader, and DupliTrade. TradingView is suitable for charting with Pine Script backtesting and community idea sharing. cTrader supports C# based automation and copy trading features, while DupliTrade supports strategy simulation and copying under a structured environment.

Is Forex Income Taxable in Bulgaria?

Bulgarian residents pay personal income taxes at a flat 10% rate, and earnings from trading currencies on the forex market incur 10% taxes. Corporate taxation is also relevant for broker operations.

Bulgaria levies a 10% corporate tax, presented as one of the lowest in Europe, and compares it with Cyprus at 12.5%. Lower corporate tax and lower business costs can attract brokerage firms to establish local operations.

Tax handling depends on individual circumstances, residency, and instrument type. It’s advisable to consult a professional tax expert and reference the National Revenue Agency as an official source for guidance.

What Markets Can I Trade in BFSC Brokers?

BFSC and EU regulated brokers generally provide access to multiple asset classes through CFDs and other products. Forex trading and derivative instruments like futures, options, and CFDs have grown in Bulgaria, which indicates multi-market participation.

Market availability then depends on broker licensing, platform integration, and client classification.

Common markets include forex pairs, indices, commodities, and shares, with crypto derivatives often available under stricter leverage caps for retail. Instrument breadth matters because it supports diversification and hedging.

- Forex: Majors and crosses, with EU aligned leverage caps for retail clients

- CFDs: Indices and commodities, often with different margin rates by volatility

- Shares and ETFs: As CFDs or as cash instruments, depending on broker model and entity

- Crypto derivatives: CFDs and futures on crypto assets

- Futures and options: Derivatives across various markets

Bulgaria Euro Adoption and Its Impact on Trading Costs

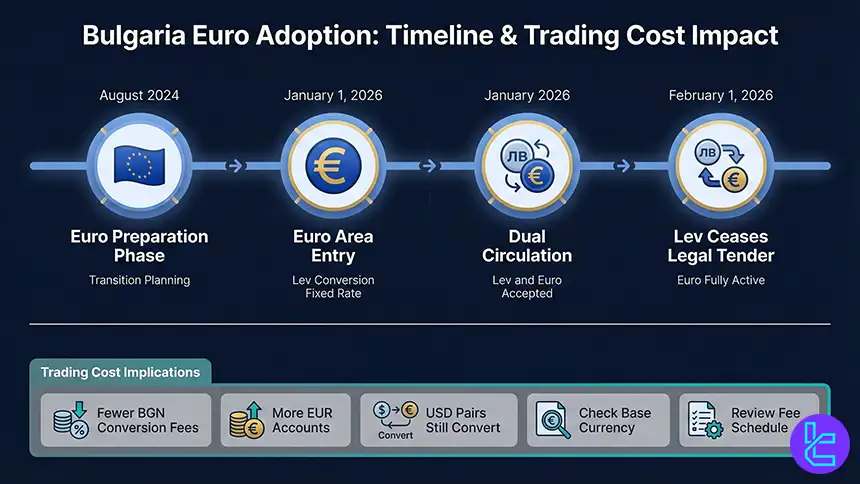

Bulgaria officially joined the euro area on January 1, 2026. Lev accounts were converted at a fixed rate, and dual circulation was mandated until the end of January 2026, with the lev ceasing to be legal tender from February 1, 2026.

This change affects forex trading in practical ways. BGN pairs become less relevant and currency exchange fees tied to BGN/EUR can disappear for many users. Brokers may increasingly offer euro-denominated accounts, which can reduce conversion friction for deposits, withdrawals, and reporting.

Traders should still check the account base currency, funding rails, and conversion schedules. Even with euro adoption, conversion fees can still appear when using non-euro payment methods or when trading instruments denominated in other currencies. Reviewing broker fee schedules and statements remains critical for total cost control.

Bulgaria FSC Compared to Other Regulatory Authorities

The BFSC operates inside the EU regulatory ecosystem, aligned with MiFID II. This creates harmonized conduct standards and enables passporting for firms licensed in other EU states. The text highlights that firms regulated by CySEC can serve Bulgarian traders without necessarily holding a separate BFSC license, depending on passporting status.

Compared with offshore regulators, EU oversight typically imposes stricter leverage caps, stronger disclosures, and retail protections like negative balance protection. The text contrasts EU leverage limits with offshore leverage that can reach much higher ratios, and recommends EU regulated firms due to stronger investor protection policies.

Parameter | FSC (Bulgaria) | AMF (France) | CySEC (Cyprus) | ASIC (Australia) |

Minimum Capital Requirement | €750,000 | €730,000 | €750,000+ depending on firm type | Between AU$500,000 and AU$1,000,000 |

Client Fund Segregation | Required | Required | Required | Required |

Compensation Scheme | Investor Compensation Fund (~€20,000) | No | Investor Compensation Fund (~€20,000) | Investor Compensation Fund (AU$10,000) |

Leverage Limits | 1:30 | 1:30 | Set under MiFID (often 1:30 for retail in EU) | 1:30 |

Negative Balance Protection | Required | Required | Often required | Required |

Reporting & Audits | Ongoing financial reporting | Ongoing financial reporting | Ongoing financial reporting | Ongoing financial reporting |

Conclusion and Expert Suggestions

For Bulgaria based traders, the strongest edge of BFSC aligned and EU passported brokers is the protection stack: MiFID-style leverage limits for retail accounts, mandatory margin closeout rules, and negative balance protection that prevents account debt in fast markets.

Practical choice should focus on what affects day to day trading: platform stability on web and mobile, clarity of the legal entity serving Bulgarian residents, and predictable funding policies that avoid surprise inactivity or withdrawal charges. Since Bulgaria uses the euro, checking base currency options and conversion handling also matters for ongoing account costs.

TradingFinder applies its Forex Methodology to score brokers using verifiable regulation checks, safety policies, total cost transparency, execution consistency, platform and tool quality, and more.