New Zealand is regulated by the Financial Markets Authority (FMA) under the Financial Markets Conduct Act (FMCA), with additional oversight aligned to global standards set by institutions such as the Bank for International Settlements (BIS) and IOSCO principles.

The presence of the New Zealand dollar (NZD) as an actively traded currency pair further increases market relevance. FMA regulation, fund segregation, execution quality, and platform reliability are the most important factors when selecting a New Zealander broker.

| Tickmill | |||

| Vantage Markets | |||

| BlackBull Markets | |||

| 4 |  | Fxview | ||

| 5 |  | Blueberry Markets | ||

| 6 |  | MultiBank | ||

| 7 |  | Fusion Markets | ||

| 8 |  | Global Prime |

New Zealand Forex Brokers Based on Their Trustpilot Rating

These are the best brokers regulated by FMA and the table below, compares the with their Trustpilot scores.

Broker | Trustpilot Rating | Number of Reviews |

3.6/5 ⭐️ | 1050 | |

Vantage Markets | 4.5/5 ⭐️ | 11359 |

4.8/5 ⭐️ | 2909 | |

Blueberry Markets | 4.7/5 ⭐️ | 3069 |

Fxview | 4.4/5 ⭐️ | 253 |

MultiBank | 4.6/5 ⭐️ | 1565 |

Fusion Markets | 4.8/5 ⭐️ | 5465 |

Global Prime | 4.7/5 ⭐️ | 380 |

Comparison of Forex Brokers in New Zealand Based on Spread

Brokers serving New Zealand residents typically offer variable or raw spreads influenced by liquidity providers, execution models, and account structure.

In the table below, we compare thebest forex brokers in New Zealand based on spreads, highlighting average pricing on major currency pairs, commission models, and execution conditions.

Broker | Min. Spread |

Tickmill | 0 Pip |

Vantage Markets | 0 Pip |

BlackBull Markets | 0 Pip |

Blueberry Markets | 0 Pips |

Variable based on the account type | |

MultiBank | 0.0 Pips |

0 Pips | |

Global Prime | 0 Pips |

How Much Are the Non-Trading Fees of New Zealander Forex Brokers?

Non-trading fees can significantly impact overall trading costs for New Zealand forex traders, especially for long-term or low-frequency accounts. These charges may include inactivity fees, deposit and withdrawal costs, currency conversion fees, and account maintenance expenses.

In the section below, we examine how much the top forex brokers serving New Zealand traders charge for non-trading activities.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Tickmill | $0 | $0 | Yes |

$0 | $0 | No | |

BlackBull Markets | $0 | $0 | No |

$0 | $0 | No | |

Fxview | $0 | $0 | No |

Pepperstone | $0 | $0 | No |

FP Markets | $0 | $0 | No |

OctaFX | $0 | $0 | No |

Tradable Instruments of New Zealander Forex Brokers

The range of tradable instruments is a key factor when selecting a forex broker, as it determines portfolio flexibility and access to global markets. Leading brokers typically provide exposure to forex pairs, CFDs on indices, commodities, metals, cryptocurrencies, and global equities.

Broker | Number of Instruments |

Tickmill | 700+ |

Vantage Markets | 500+ |

BlackBull Markets | 26K+ |

Blueberry Markets | 300+ |

Fxview | 500+ |

20K+ | |

Fusion Markets | 250+ |

150+ |

Top 8 Forex Brokers in New Zealand

The New Zealand forex market operates within a well-structured regulatory framework, overseen by the Financial Markets Authority (FMA) under the Financial Markets Conduct Act (FMCA). This environment emphasizes transparency, fair dealing, and strong client protection, making New Zealand a reliable jurisdiction for retail and professional traders.

The best forex brokers in New Zealand combine FMA aligned compliance, competitive trading costs, advanced platforms, and access to global liquidity.

Tickmill

Tickmill is a global multi asset forex and CFD broker founded in 2014, serving more than 785,000 registered traders across 180+ countries. The broker operates under a No Dealing Desk (NDD) model, routing orders directly to liquidity providers to ensure fast execution and minimal conflict of interest.

Tickmill is regulated by several authorities, including the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority (FSA Seychelles), FSCA South Africa, and LFSA Labuan, offering strong regulatory coverage and client fund protection.

Traders can access Forex, indices, commodities, stocks, bonds, and cryptocurrencies through MetaTrader 4, MetaTrader 5, WebTrader, and mobile apps after Tickmill registration.

Tickmill supports scalping, hedging, algorithmic trading, and Islamic accounts, making it suitable for both retail and advanced traders focused on low cost execution and regulatory reliability. There is also Tickmill rebate, suitable for traders who wnat to cover their trading costs.

Account Types | Classic, Raw |

Regulating Authorities | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Deposit | $100 |

Deposit Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Withdrawal Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Tickmill Pros and Cons

Table below, is a glance of Tickmill broker pros and cons.

Pros | Cons |

Regulated by multiple top tier authorities (FCA, CySEC, FSCA) | Limited variety of account types |

Tight spreads from 0.0 pips on Raw accounts | Relatively fewer Forex pairs than some competitors |

Fast market execution with NDD model | Trustpilot user score is moderate |

Supports MT4, MT5, WebTrader, and mobile apps | No PAMM account support |

Islamic accounts and copy trading available | Educational content not industry leading |

Vantage Markets

Vantage Markets is a global multi-asset forex and CFD broker founded in 2009 and headquartered in Sydney, Australia.

The broker operates through several regulated entities under authorities such as the Australian Securities and Investments Commission (ASIC), Financial Conduct Authority (FCA), Financial Sector Conduct Authority (FSCA), Vanuatu Financial Services Commission (VFSC), and CIMA in the Cayman Islands.

Vantage Markets offers access to Forex, indices, commodities, shares, ETFs, and cryptocurrencies, supporting platforms such as MetaTrader 4, MetaTrader 5, TradingView, ProTrader, and a proprietary mobile app.

The broker also provides copy trading via ZuluTrade, DupliTrade, and Myfxbook AutoTrade, which are available after Vantage Markets registration. Strong execution, diverse platforms, and broad regulation make Vantage Markets suitable for both retail and advanced traders.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FSCA, VFSC, FCA, CIMA |

Minimum Deposit | $20 |

Deposit Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Withdrawal Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application |

Vantage Markets Pros and Cons

The table below provides an overview of the pros and cons of Vantage Markets as a broker.

Pros | Cons |

Regulated by multiple top-tier authorities (ASIC, FCA) | High minimum deposit for Pro ECN account |

Wide platform support including MT4, MT5, TradingView | No proprietary desktop trading platform |

Tight spreads from 0.0 pips on ECN accounts | Some countries are restricted |

Copy trading and PAMM options available | Trustpilot score is relatively mixed |

No inactivity fee and fast execution | Offshore leverage varies by entity |

BlackBull Markets

BlackBull Markets is a New Zealand based forex and CFD broker founded in 2014 and officially registered as Black Bull Group Limited. The broker is regulated by the Financial Markets Authority (FMA) of New Zealand and also operates an offshore entity under the Seychelles FSA, allowing it to serve a broad international client base.

BlackBull Markets specializes in ECN trading, offering three main account types: ECN Standard, ECN Prime, and ECN Institutional, with spreads starting from 0.0 pips and leverage up to 1:500.

The broker provides access to more than 26,000 tradable instruments, covering forex, stocks, indices, commodities, metals, and cryptocurrencies.

With segregated client funds (available after BlackBull Markets registration), negative balance protection, 24/7 support, and a strong local presence in New Zealand, BlackBull Markets is particularly well suited for active traders seeking deep liquidity and institutional grade execution.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

The table shown below summarizes the positive and negative aspects of trading with BlackBull Markets.

Advantages | Disadvantages |

Regulated by FMA New Zealand with FSCL membership | ECN Prime account requires a $2,000 minimum deposit |

Access to 26,000+ tradable instruments | Wide product range may be complex for beginners |

Spreads from 0.0 pips on ECN accounts | Not available in some regions including the US |

Supports MT4, MT5, cTrader, TradingView | Offshore entity regulated under Tier 3 authority |

Copy trading and stock investing platforms available | $5 flat fee on withdrawals |

24/7 customer support and fast execution | Educational content may overwhelm new traders |

Regulated by FMA New Zealand with FSCL membership | ECN Prime account requires a $2,000 minimum deposit |

Blueberry Markets

Blueberry Markets is a Forex and CFD broker founded in 2016, offering access to more than 300 tradable instruments across Forex, indices, commodities, shares, metals, and cryptocurrencies.

The broker operates under the regulation of the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC), ensuring client fund segregation and negative balance protection.

Blueberry Markets provides two main account types, Standard and Direct, both with a minimum deposit of $100 and leverage up to 1:500.

After signing up and going through Blueberry Markets registration, traders can access popular platforms such as MetaTrader 4, MetaTrader 5, and WebTrader, supporting automated trading and advanced charting tools.

Overall, Blueberry Markets is suitable for traders seeking a regulated broker with flexible trading conditions and modern trading infrastructure.

Account Types | Standard, Direct |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $100 |

Deposit Methods | Visa/MasterCard, Bank wired |

Withdrawal Methods | Visa/MasterCard, Bank wired |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, Webtrader |

Blueberry Markets Pros and Cons

A quick comparison of Blueberry Markets broker pros and cons is displayed in the table below.

Advantages | Disadvantages |

Regulated by ASIC and VFSC | Not available to US clients |

Competitive spreads from 0.0 pips | Limited educational depth compared to top-tier brokers |

Supports MT4 and MT5 platforms | No Islamic account option |

Copy trading via DupliTrade | No deposit or trading bonuses |

Negative balance protection | Higher commission on Direct account |

Fxview

Fxview is a Forex and CFD broker established in 2017 as part of the Finvasia Group, serving traders across 180+ countries.

The broker operates through multiple regulated entities, including Cyprus Securities and Exchange Commission (CySEC) for EU clients and the Financial Sector Conduct Authority (FSCA) for global traders.

Traders gain access to 500+ instruments across Forex, indices, commodities, stocks, and cryptocurrencies using MetaTrader 5, ActTrader, and ZuluTrade in Fxview dashboard.

Spreads start from 0.0 pips, commissions from $0, and leverage reaches up to 1:1000 under the FSCA entity. With features like free VPS, API trading, and KYC-free deposits up to $2,000 available after Fxview registration, Fxview is positioned for cost-conscious and technically advanced traders.

Account Types | Zero Commission, Raw ECN, Premium ECN, Islamic, Demo |

Regulating Authorities | FSCA |

Minimum Deposit | $50 |

Deposit Methods | Visa, MasterCard, Bank Wire Transfer, Skrill, Neteller, Crypto, Vertu Pay, Local Bank Transfer |

Withdrawal Methods | Visa, MasterCard, Skrill, Neteller, Crypto, Vertu Pay, Local Bank Transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT5, ActTrader, ZuluTrade |

Fxview Pros and Cons

The following table offers a clear snapshot of Tickmill’s strengths and weaknesses.

Pros | Cons |

Regulated by CySEC and FSCA | No TradingView platform support |

ECN execution with tight spreads from 0.0 pips | Geo-restrictions for some regions |

Negative balance protection on all accounts | Premium ECN account requires high capital |

Free VPS, API trading, and ZuluTrade access | Limited proprietary education content |

KYC-free deposits up to $2,000 | Stock CFD range smaller than top-tier brokers |

MultiBank

MultiBank Group is a global multi-asset Forex and CFD broker founded in 2005, with headquarters in Dubai and regulated across multiple top-tier jurisdictions.

The broker operates under authorities such as ASIC, CySEC, MAS, FMA, BaFin, SCA (UAE), and CIMA, providing strong international compliance and client protection.

MultiBank dashboard offers trading through MetaTrader 4, MetaTrader 5, and its proprietary MultiBank-Plus platform, supporting Forex, indices, commodities, shares, metals, and cryptocurrencies.

Client funds are held in segregated Tier-1 bank accounts, supported by negative balance protection and up to $1 million excess loss insurance per client.

After doing MultiBank registration and MultiBank verification, copy trading, Islamic accounts, and extensive global coverage are available for all traders.

Account Types | Standard, Pro, ECN |

Regulating Authorities | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BAFIN, AUSTRAC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Credit Or Debit Card, Bank Transfer, Crypto, SEPA |

Withdrawal Methods | Bank Wire, Credit Cards, Neteller |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MultiBank-Plus, MT4 Platform, MT5 Platform, Web Trader MT4 |

MultiBank Pros and Cons

The table below highlights the major advantages and limitations of the MultiBank trading environment.

Advantages | Disadvantages |

Regulated by multiple tier-1 authorities (ASIC, CySEC, MAS, FMA) | Educational resources are limited |

Zero commission across all account types | No advanced research or trading signals |

Spreads from 0.0 pips on ECN accounts | High minimum deposit for ECN account |

Supports MT4, MT5, and MultiBank-Plus | Guaranteed stop-loss not available |

Up to $1M client fund insurance | Inactivity fee after prolonged dormancy |

Regulated by multiple tier-1 authorities (ASIC, CySEC, MAS, FMA) | Educational resources are limited |

Zero commission across all account types | No advanced research or trading signals |

Fusion Markets

Fusion Markets is a multi-asset forex and CFD broker founded in 2019 by Phil Horner, operating under the trading name Gleneagle Securities Pty Limited.

The broker is regulated by Australian Securities and Investments Commission (ASIC) and Vanuatu Financial Services Commission (VFSC), offering different leverage limits based on jurisdiction.

This broker is best known for its ultra-low trading costs, with raw spreads from 0.0 pips and no minimum deposit requirement in Fusion Markets dashboard. Client funds are held in segregated accounts with top-tier banks such as HSBC and National Australia Bank.

The broker supports multiple professional platforms including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, making it suitable for both discretionary and algorithmic traders. Copy trading and MAM accounts are also available after to processes of Fusion Markets registration and Fusion Markets verification.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

Below is a table that outlines the main pros and cons associated with the Fusion Markets broker.

Pros | Cons |

Ultra-low spreads from 0.0 pips | No investor compensation scheme |

No minimum deposit requirement | Limited educational resources |

Regulated by ASIC and VFSC | No proprietary trading platform |

Supports MT4, MT5, cTrader, TradingView | Relatively young broker |

Fast execution and VPS support | Asset range smaller than top-tier brokers |

Global Prime

Global Prime is an Australia based forex and CFD broker founded in 2010, offering access to more than 150 tradable instruments across forex, indices, commodities, cryptocurrencies, bonds, and US share CFDs.

The broker operates under a strong regulatory framework, primarily supervised by the Australian Securities and Investments Commission, with an additional offshore entity regulated by the Vanuatu Financial Services Commission.

Global Prime focuses on transparent execution, routing orders directly to tier one liquidity providers with average execution speeds around 10 milliseconds.

Traders can choose between Standard and Raw accounts, with raw spreads starting from 0.0 pips and competitive commissions. Client funds are held in segregated accounts with major banks such as HSBC and NAB, enhancing capital security.

The broker supports MetaTrader 4 and integrates third party tools like Autochartist and ZuluTrade alongside with Global Prime rebate. With no minimum deposit requirement, commission free funding, and 24/7 customer support, Global Prime registration appeals to both retail and professional traders seeking low cost and regulation focused trading conditions.

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | Unlimited |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

In the table below, the key benefits and drawbacks of Global Prime are presented.

Advantages | Disadvantages |

Regulated by ASIC with strong compliance standards | Only MetaTrader 4 platform available |

Raw spreads from 0.0 pips with fast execution | No Islamic or swap free accounts |

Segregated client funds with top tier banks | Limited proprietary trading tools |

No minimum deposit requirement | No traditional deposit bonuses |

24/7 customer support and multiple payment methods | Restricted availability in some countries |

Forex Trading in New Zealand

Forex trading in New Zealand operates within a well-regulated and transparent financial environment overseen by the Financial Markets Authority (FMA). New Zealand traders can legally access global currency markets through locally registered or internationally regulated brokers that comply with the Financial Markets Conduct Act (FMCA).

The country follows an open market approach, allowing retail and professional traders to participate in forex and CFD trading without unnecessary restrictions, provided investor protection rules are respected.

New Zealand benefits from strong alignment with international regulatory standards such as IOSCO principles and BIS guidelines, which enhances market integrity.

Traders typically access forex markets via offshore liquidity providers using platforms like MetaTrader 4, MetaTrader 5, cTrader, and proprietary trading systems. With stable infrastructure, reliable payment systems, and strict regulatory oversight, New Zealand remains one of the safer jurisdictions for forex trading in the Asia Pacific region.

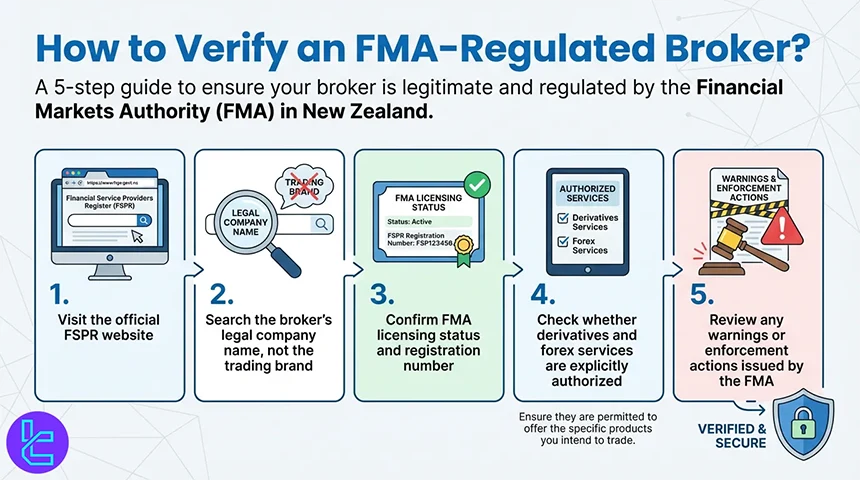

How to Verify an FMA-Regulated Broker?

Verifying whether a forex broker is regulated by the Financial Markets Authority (FMA) is a critical step for New Zealand traders before opening an account.

The FMA maintains an official Financial Service Providers Register (FSPR) that lists all licensed and authorized financial entities operating in the country.

To verify a broker:

- Visit the official FSPR website

- Search the broker’s legal company name, not the trading brand

- Confirm FMA licensing status and registration number

- Check whether derivatives and forex services are explicitly authorized

- Review any warnings or enforcement actions issued by the FMA

Additionally, traders should ensure that the broker segregates client funds, follows AML KYC requirements, and provides transparent risk disclosures. Avoid brokers that falsely claim FMA regulation without appearing on the official register.

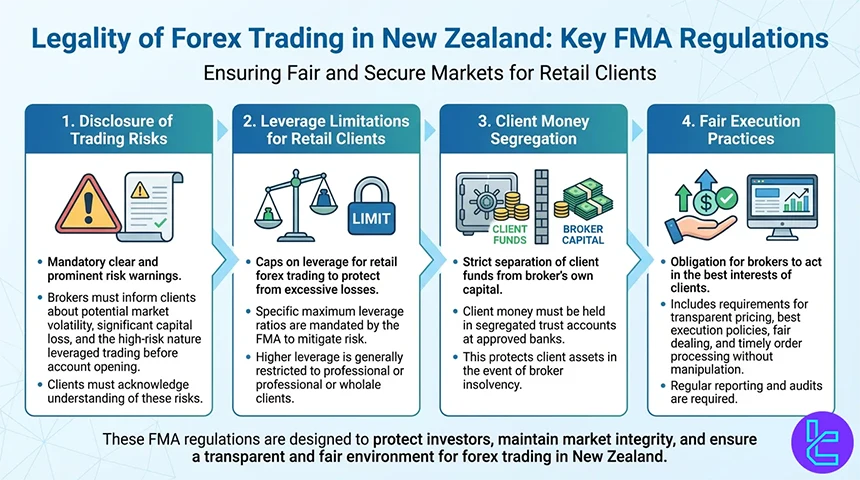

Legality of Forex Trading in New Zealand

Forex trading is fully legal in New Zealand and recognized as a legitimate financial activity under national law. The Financial Markets Authority (FMA) regulates forex and CFD trading activities to ensure fair dealing, transparency, and investor protection.

There are no restrictions on who can trade forex based on residency, age above legal adulthood, or capital size. However, brokers must comply with strict rules regarding:

- Disclosure of trading risks

- Leverage limitations for retail clients

- Client money segregation

- Fair execution practices

Unregulated offshore brokers are not illegal to use, but they are not protected under New Zealand law.

For legal safety and dispute resolution, trading with FMA regulated or well known Tier 1 regulated brokers is strongly preferred.

What Are the Most Important Factors to Choose a New Zealander Forex Broker?

TradingFinder forex methodology evaluates FMA regulated forex brokers in New Zealand using data driven criteria that focus on trader safety, execution quality, and transparency.

- Regulation and Client Protection: including FMA registration, fund segregation, and compliance with the Financial Markets Conduct Act (FMCA)

- Trading Costs: such as spreads, commissions, swap rates, and non-trading fees

- Account Types and Market Coverage: availability across forex and CFD instruments

- Platforms and Execution: including MT4, MT5, TradingView, and direct liquidity access

- Deposits, Withdrawals, and Onboarding: efficiency, processing speed, and fee transparency

- Customer Support and Trust Signals: based on responsiveness, dispute handling, and verified user reviews

This methodology ensures New Zealand forex brokers are ranked based on measurable factors that directly impact real trading conditions rather than marketing claims.

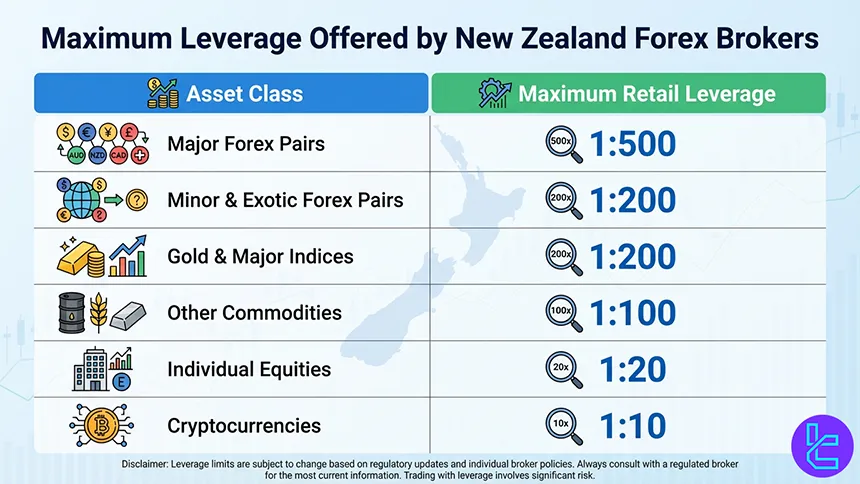

How Much is the Maximum Leverage Offered by New Zelander Forex Brokers?

Forex brokers operating under the supervision of the Financial Markets Authority (FMA) in New Zealand are not subject to ESMA leverage caps.

As a result, FMA regulated and FMA compliant brokers typically offer significantly higher leverage compared to EU regulated entities, while still enforcing internal risk controls and margin requirements.

In practice, most forex brokers serving New Zealand traders provide leverage up to 1:500 for retail accounts, with leverage levels varying by asset class and market volatility.

Asset Class | Maximum Retail Leverage |

Major Forex Pairs | 1:500 |

Minor & Exotic Forex Pairs | 1:200 |

Gold & Major Indices | 1:200 |

Other Commodities | 1:100 |

Individual Equities | 1:20 |

Cryptocurrencies | 1:10 |

Does FMA-Regulated Brokers Offer Negative Balance Protection?

Most FMA regulated forex brokers provide negative balance protection as part of their retail client risk management framework

This protection ensures that traders cannot lose more than their deposited funds, even during extreme market volatility or price gaps.

Negative balance protection typically applies to:

- Retail trading accounts

- Margin based forex and CFD products

- Accounts affected by sudden market events

Negative balance protection is a key safeguard that aligns New Zealand with other well regulated markets such as the UK and Australia, reducing systemic risk for retail traders.

How is the Taxation of FMA-Regulated Forex Brokers?

In New Zealand, profits from forex trading are generally considered taxable income under Inland Revenue Department (IRD) rules.

There is no specific capital gains tax, but trading profits may still be taxed depending on trading intent and frequency.

Key tax considerations include:

- Active traders are usually taxed on net profits

- Losses may be deductible against other income

- CFDs and leveraged forex trades are treated as income generating activity

- Brokers do not withhold taxes on behalf of traders

Traders are responsible for accurate reporting and record keeping, including transaction history and profit calculations. Because tax treatment can vary based on individual circumstances, consulting a qualified New Zealand tax advisor is strongly recommended.

When Can I Trade Forex in New Zealand? Trading Hours

Forex trading in New Zealand follows the global 24-hour market cycle, with trading activity aligned to New Zealand Standard Time (NZST) and New Zealand Daylight Time (NZDT) depending on the season.

The forex market officially opens with the Sydney and Wellington sessions, giving New Zealand traders early access to global liquidity. Forex Market Sessions in New Zealand Time:

Market Session | NZST Time |

Sydney / Wellington | 08:00 – 17:00 |

Tokyo | 10:00 – 19:00 |

London | 20:00 – 05:00 |

New York | 01:00 – 10:00 |

The most active trading periods occur when major market sessions overlap, particularly during the London–New York overlap, which delivers the highest liquidity and volatility.

The London–New York overlap (01:00–05:00 NZST) is considered the most liquid window for trading major forex pairs such as EUR/USD and GBP/USD.

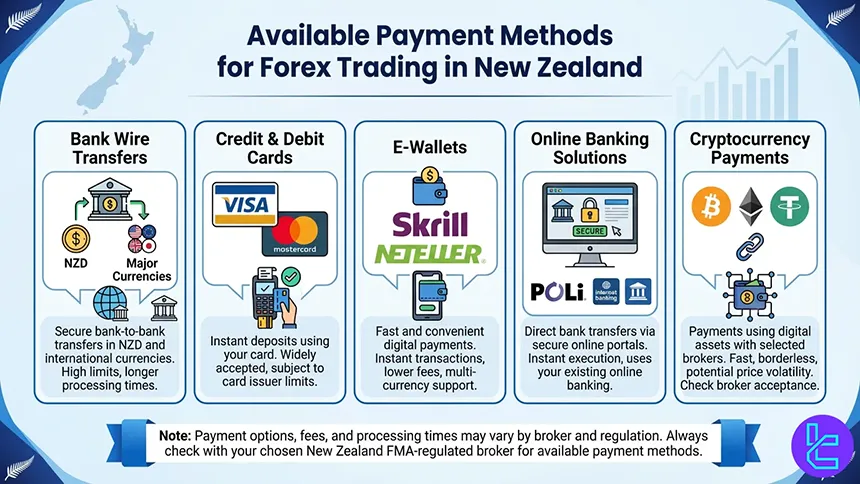

What are the Available Payment Methods for Forex Trading in New Zealand?

Forex brokers serving New Zealand traders typically support a wide range of secure and fast payment methods. These options allow efficient account funding and withdrawals while complying with AML regulations.

Common payment methods include:

- Bank wire transfers in NZD and major currencies

- Credit and debit cards Visa and Mastercard

- E-wallets such as Skrill and Neteller

- Online banking solutions

- Cryptocurrency payments with selected brokers

Forex Trading in New Zealand Compared to Other Countries

Forex trading in New Zealand operates under a principles-based regulatory model supervised by the Financial Markets Authority (FMA).

Unlike the EU’s MiFID II or the UK’s post-Brexit FCA framework, New Zealand focuses on broker registration, fair dealing, and disclosure rather than strict leverage caps. This approach gives traders wider access to international brokers and higher leverage options, while still enforcing client money segregation and conduct standards.

As a result, New Zealand sits between highly restrictive European regimes and more flexible offshore markets, offering a balance of accessibility, transparency, and global broker availability.

Comparison Factor | New Zealand | |||

Primary Regulator | Financial Markets Authority (FMA) | Capital Markets Authority (CMA) | Cyprus Securities and Exchange Commission (CySEC) | Financial Conduct Authority (FCA) |

Regulatory Framework | National FMA regime with FSPR registration | National CMA regulation | EU-wide MiFID II and ESMA | National FCA framework (post-Brexit) |

Retail Leverage Cap Forex Majors | No fixed cap under FMA | Up to 1:400 | 1:30 | 1:30 |

Investor Protection Level | Medium to High | Medium | High | Very High |

Negative Balance Protection | Not mandatory | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Mandatory under FMA rules | Mandatory | Mandatory | Mandatory |

Broker Transparency Requirements | Disclosure-based supervision | CMA conduct rules | Strict EU disclosure rules | Very strict conduct and disclosure standards |

Broker Availability | Local and international brokers | Local and international brokers | Broad EU access via passporting | FCA-licensed local and international brokers |

Access to International Brokers | High global access | High regional access | High EU access | High global broker access |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5 | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Depends on broker policy | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Income tax if trading is a business | Capital gains tax may apply | Capital gains tax applies | Capital gains or income tax depending on activity |

Conclusion

New Zealand’s forex market operates under FMA oversight within the Financial Markets Conduct Act (FMCA) framework, aligning with IOSCO and BIS standards.

Leading brokers such as Global Prime, BlackBull Markets, Tickmill, Vantage Markets, and MultiBank provide access to Forex, CFDs, indices, commodities, and cryptocurrencies through platforms like MT4, MT5, cTrader, and TradingView.

Key selection factors include fund segregation, execution quality, leverage flexibility, and transparent non-trading fees.

Brokers are evaluated through a weighted scoring system that considers core elements like costs, regulatory standing, and account diversity under TradingFinder forex methodology.