Forex trading in Saudi Arabia continues to expand as investors diversify beyond oil and real estate.

With 2025 average trading volume reaching $7.39 billion, up 23% from $5.82 billion, traders prioritize brokers offering Sharia-compliant Islamic swap-free accounts, Arabic support, SAR payments, and licenses accepted under SAMA guidance.

Leading brokers for Saudi clients deliver strong regulatory standing, competitive spreads, transparent pricing, advanced trading platforms, and localized services.

| FxPro | |||

| Eightcap | |||

| Fusion Markets | |||

| 4 |  | BlackBull Markets | ||

| 5 |  | Global Prime | ||

| 6 |  | FXTM | ||

| 7 |  | Vantage Markets | ||

| 8 |  | Moneta Markets |

Brokers in Saudi Arabia Trustpilot Ratings

Saudi forex traders increasingly rely on Trustpilot scores when selecting brokers, with leading providers achieving ratings between 4.8/5 and 2.6/5 across more than 25,000 verified reviews.

The ranking highlights broker reliability, client satisfaction, execution quality, support performance, and long-term trust within the Saudi trading community.

Broker | Trustpilot Score | Number of Reviews |

Fusion Markets | 4.8/5 ⭐️ | 5,506 |

BlackBull Markets | 4.8/5 ⭐️ | 2,914 |

Global Prime | 4.7/5 ⭐️ | 380 |

Vantage Markets | 4.5/5 ⭐️ | 11,383 |

4.3/5 ⭐️ | 453 | |

4.1/5 ⭐️ | 3,348 | |

FxPro | 3.8/5 ⭐️ | 862 |

FXTM | 2.6/5 ⭐️ | 1,074 |

Forex Brokers in Saudi Arabia Ranked by Minimum Spreads

Saudi forex traders seeking low-cost execution benefit from brokers offering minimum spreads starting at 0.0 pips.

This ranking highlights platforms that deliver ultra-tight pricing, deep liquidity, fast order execution, and competitive trading conditions, making them highly attractive for scalping, day trading, and high-volume strategies.

Broker | Minimum Spread |

Fusion Markets | 0.0 pips |

BlackBull Markets | 0.0 pips |

0.0 pips | |

Admirals | 0.0 pips |

Tastytrade | 0.0 pips |

CMC Markets | 0.0 pips |

Vantage Markets | 0.0 pips |

0.0 pips |

Saudi Arabia Forex Brokers with Lowest Non-Trading Fees

Cost-conscious Saudi traders prioritize brokers with zero deposit fees, minimal withdrawal charges, and no inactivity penalties.

Several leading platforms offer free funding, low-cost withdrawals from $0 to $5, and inactivity policies as low as $0 to $10 per month, significantly reducing overall trading expenses.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

No | No | No | |

Global Prime | No | No | No |

Fusion Markets | No | No | No |

No | $5 | No | |

Tastytrade | No | Up to $5 | No |

CMC Markets | No | No | £10/month |

Admirals | No | Up to 1% | €10/month |

FXTM | No | Up to $30 | $10/month |

Forex Brokers in Saudi Arabia Ranked by Trading Instruments

Saudi traders gain broader market exposure through brokers offering from 250+ up to 26,000+ trading instruments.

This ranking highlights platforms providing extensive access to the Forex market, stocks, indices, commodities, ETFs, and crypto CFDs, supporting diversified strategies, multi asset portfolios, and advanced global market participation.

Broker | Number of Trading Instruments |

BlackBull Markets | 26,000+ |

IG | 17,000+ |

2,100+ | |

FXTM | 1,000+ |

Vantage Markets | 1,000+ |

Eightcap | 800+ |

Tickmill | 600+ |

250+ |

Top 6 Forex Brokers in Saudi Arabia

Saudi traders benefit from access to world-class Forex and CFD brokers offering ultra-low spreads from 0.0 pips, leverage reaching 1:1000, and diversified market coverage ranging from 250+ to 26,000+ instruments.

The leading providers combine strong international regulation, Islamic swap-free trading, advanced platforms such as MT4, MT5, cTrader, and TradingView, plus flexible funding methods and competitive execution models for retail and professional traders.

Moneta Markets

Moneta Markets is a global Forex and CFD broker founded in 2020 and headquartered in Johannesburg, South Africa.

The broker operates under FSCA regulation and delivers access to over 1,000 tradable instruments across Forex, indices, stocks, commodities, cryptocurrencies, bonds, and ETFs through MT4, MT5, Pro Trader, and App Trader platforms.

By completing the Moneta Markets registration process, traders can choose between three account types, including Direct, Prime, and Ultra, with a low minimum deposit of $50 and leverage up to 1:1000.

Moneta Markets trading conditions include floating spreads from 0.0 pips, commissions starting from $0, STP and ECN execution, negative balance protection, and segregated client funds for enhanced trading security. The broker supports international traders with multiple base currencies, including USD, EUR, GBP, SGD, CAD, and JPY.

Moneta Markets deposit and withdrawal methods cover Visa, MasterCard, international bank transfer, FasaPay, SticPay, JCB, and cryptocurrency payments such as USDT, BTC, ETH, and USDC, offering fast processing and zero deposit fees.

Moneta Markets dashboard provides access to Islamic swap-free accounts for Sharia-compliant trading, copy trading via Moneta CopyTrader, PAMM investment solutions, demo accounts, trading education, 20 percent deposit bonus, 50 percent cashback offers, and responsive 24/5 multilingual customer support.

Account Types | Direct, Prime, Ultra |

Regulating Authorities | FSCA, FSRA |

Minimum Deposit | $50 |

Deposit Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Withdrawal Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Pro Trader, App Trader |

Moneta Markets Pros and Cons

The following advantages and disadvantages summarize Moneta Markets’ suitability for traders in Saudi Arabia based on trading costs, platform depth, Islamic compliance, and regional accessibility.

Pros | Cons |

Islamic swap-free accounts fully compliant with Sharia principles | No local regulatory license in Saudi Arabia |

Low $50 minimum deposit accessible for retail traders | No physical office presence inside the Kingdom |

Ultra-low spreads from 0.0 pips and competitive commissions | Some withdrawal methods require up to 7 business days |

Multiple funding methods, including crypto with zero deposit fees | PAMM performance depends on individual money managers |

Global Prime

Global Prime is an Australian Forex and CFD broker founded in 2010, offering access to 150+ financial instruments across Forex, indices, commodities, cryptocurrencies, bonds, and US share CFDs.

The broker delivers raw spreads from 0.0 pips with ultra-fast execution speeds starting from 10 milliseconds.

The company operates under strong regulatory oversight with licensing from ASIC and additional international registration, which leads to a stringent Global Prime verification process and client funds segregation.

Trading conditions include leverage up to 1:500, minimum order size of 0.01 lots, and commission-free deposits and withdrawals.

Global Prime registration provides access to two core account types, Standard and Raw, with spreads from 0.9 pips and 0.0 pips, respectively.

The platform offering centers on MetaTrader 4 across desktop, web, Android, and iOS, supported by Autochartist signals, VPS access, and advanced Pro Trading tools.

Global prime funding options exceed 20 global and regional methods, including cards, crypto, PayPal, Skrill, Neteller, and local gateways.

Withdrawals incur no broker fees, and customer support operates 24/7 through live chat, phone, email, and ticket systems. Traders can receive up to 44.44% spread discounts via the Global Prime rebate program.

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | $1 |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

The following advantages and disadvantages summarize Global Prime’s suitability for Saudi Arabia traders based on trading costs, platform reliability, regulatory strength, and regional accessibility.

Pros | Cons |

Strong ASIC regulation with segregated client funds | No Islamic swap-free accounts available |

Raw spreads from 0.0 pips with very fast execution | MT4 is the only trading platform currently |

Zero deposit, withdrawal, and inactivity fees | Limited maximum leverage compared with some competitors |

20+ funding methods, including crypto and local gateways | No physical office presence in Saudi Arabia |

Fusion Markets

Fusion Markets is a multi-regulated Forex and CFD broker founded by Phil Horner, delivering ultra-low trading costs with average spreads from 0.0 pips and execution speeds near 0.02 ms.

The broker provides access to over 250 global instruments across Forex, indices, metals, energy, cryptocurrencies, and US share CFDs.

Fusion Markets operates under regulatory oversight from ASIC and VFSC, while client funds are stored in segregated accounts with leading international banks.

By completing the Fusion Markets registration process, traders benefit from zero minimum deposit, leverage up to 1:500, and various trading platforms, including MetaTrader 4, MetaTrader 5, TradingView, and cTrader. The broker supports three core account types: Zero, Classic, and Swap-Free.

Fusion Markets dashboard provides access to raw spreads, $0 commission options, VPS hosting, copy trading via Fusion+, DupliTrade integration, and MAM/PAMM accounts. Islamic swap-free accounts are available for Sharia-compliant trading.

Funding remains highly flexible with more than 30 deposit and withdrawal methods including bank transfer, cards, PayPal, crypto, Skrill, Neteller, and regional gateways.

Deposits and withdrawals carry zero broker fees, while customer support operates 24/7 via live chat, phone, email, and ticket system.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

The following advantages and disadvantages summarize Fusion Markets’ suitability for Saudi Arabia traders based on cost efficiency, platform depth, Islamic compliance, and regional accessibility.

Pros | Cons |

Islamic swap-free accounts for Sharia compliance | No physical office presence in Saudi Arabia |

Zero minimum deposit with ultra-low spreads | Limited proprietary research tools |

Access to MT4, MT5, TradingView, and cTrader | Investor protection scheme not available |

30+ funding methods with zero deposit and withdrawal fees | Educational resources remain basic |

BlackBull Markets

BlackBull Markets is a New Zealand-based multi award winning Forex and CFD broker founded in 2014, offering access to over 26,000 trading instruments across six asset classes.

The broker delivers ECN pricing with spreads from 0.0 pips and execution speeds optimized for professional trading environments.

The broker operates under regulatory oversight from the New Zealand FMA and Seychelles FSA, maintaining segregated client funds, negative balance protection, and tier one banking relationships. Completing the BlackBull Markets verification procedure is mandatory for all traders.

BlackBull Markets provides leverage up to 1:500 with advanced infrastructure hosted on Equinix NY4 and LD5 servers.

BlackBull Markets registration provides access to ECN Standard, ECN Prime, and ECN Institutional accounts with zero minimum deposit on Standard accounts and commission-based pricing for Prime and Institutional traders. Platforms include MetaTrader 4, MetaTrader 5, TradingView, cTrader, BlackBull CopyTrader, and BlackBull Invest.

Funding options cover bank transfer, cards, crypto, and regional e-wallets with instant processing on most methods. The broker offers 24/7 multilingual support via live chat, phone, email, and WhatsApp, supported by 3,000+ educational videos and extensive market research tools.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

The following advantages and disadvantages summarize BlackBull Markets' suitability for Saudi Arabian traders based on market access, trading costs, Islamic compliance, and regional service coverage.

Pros | Cons |

Islamic swap-free accounts available for Sharia compliance | No local office presence in Saudi Arabia |

Access to 26,000+ instruments across global markets | A Prime account requires higher minimum capital |

ECN pricing with spreads from 0.0 pips | A large platform feature set may overwhelm beginners |

MT4, MT5, TradingView, and cTrader availability | Flat withdrawal processing fee applies |

FxPro

FxPro is a global Forex and CFD broker founded in 2006, serving over 7.8 million client accounts worldwide. The broker delivers ultra-fast trade execution below 12 milliseconds and provides access to more than 2,100 trading instruments across Forex, shares, indices, futures, metals, energy, and cryptocurrencies.

The company operates under strong regulatory oversight from FCA, CySEC, FSCA, and SCB, ensuring high compliance standards and client protection.

FxPro maintains segregated client funds, negative balance protection, and compensation schemes for eligible entities, reinforcing long-term operational stability and trust.

FxPro dashboard offers access to four main account types, including Standard, Pro, Raw+, and Elite, with minimum deposits starting from $100.

Traders benefit from leverage up to 1:500, tight spreads from 0.0 pips, advanced order execution models, and full access to MetaTrader 4, MetaTrader 5, cTrader, WebTrader, and mobile platforms by completing the FxPro registration process.

The broker supports multiple base currencies, flexible funding via cards, bank wire, Skrill, Neteller, and PayPal, plus professional trading features such as Expert Advisors, copy trading through FxPro CopyTrade, Islamic swap-free accounts, and PAMM solutions. Customer support operates 24/5 in multiple languages.

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA, FSCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader, Web Trader, Mobile App |

FxPro Pros and Cons

The following advantages and disadvantages summarize FxPro’s suitability for Saudi Arabia traders based on platform reliability, Islamic compliance, regulatory strength, and regional accessibility.

Pros | Cons |

Islamic swap-free accounts available for Sharia compliance | Customer support not available 24/7 |

Up to 30% discount on spreads via FxPro rebate program | Some account types require higher minimum deposits |

Access to 2,100+ instruments across major markets | Limited promotional incentives |

MT4, MT5, cTrader, WebTrader, and mobile platforms | Certain regional restrictions apply |

Vantage Markets

Vantage Markets is a global Forex and CFD broker founded in 2009 and headquartered in Sydney, Australia, operating through over 30 international offices.

The broker offers access to Forex, indices, commodities, shares, ETFs, bonds, and cryptocurrencies with spreads starting from 0.0 pips and leverage up to 1:1000.

Vantage Markets maintains strong regulatory coverage across multiple jurisdictions, including FCA, ASIC, FSCA, VFSC, and CIMA, providing segregated client funds, negative balance protection, and insurance protection of up to $1,000,000 for eligible accounts. These layers enhance operational security for international traders.

Vantage Markets provides five trading platforms, including MetaTrader 4, MetaTrader 5, ProTrader, TradingView, and its proprietary mobile application.

Investment options include copy trading, social trading, ZuluTrade, DupliTrade, and Myfxbook AutoTrade, supporting both active and passive trading strategies.

Vantage Markets registration provides access to Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap Free accounts with minimum deposits from $20.

Traders benefit from 24/7 customer support, extensive educational resources, VPS hosting, trading championships, loyalty rewards, and fast global execution infrastructure.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FSCA, VFSC, FCA, CIMA |

Minimum Deposit | $20 |

Deposit Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Withdrawal Methods | E-Wallets, bank transfer, credit/debit cards, Perfect Money, local payment options |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, ProTrader, TradingView, proprietary application |

Vantage Markets Pros and Cons

The following advantages and disadvantages summarize Vantage Markets’ suitability for Saudi Arabia traders based on Islamic compliance, regulatory strength, trading costs, and regional service accessibility.

Pros | Cons |

Islamic accounts available for Sharia compliance | Some account types require higher minimum deposits |

High leverage up to 1:1000 for flexible trading strategies | No proprietary desktop trading terminal |

Multiple copy trading and social trading options | Certain regional restrictions apply |

Trust scores vary across review platforms |

Is Forex Trading Legal in Saudi Arabia?

Forex trading is legal in Saudi Arabia and widely practiced by both retail and professional investors. The local financial framework allows individuals to participate in global currency markets using internationally regulated brokers. This legal environment has supported the rapid growth of online Forex participation across the Kingdom.

Although Saudi authorities do not impose a domestic ban on Forex trading, traders are expected to operate through brokers that meet recognized regulatory standards. This ensures legal protection, transparency, and long-term security for Saudi investors entering international financial markets.

Which Authorities Regulate Forex Trading in Saudi Arabia?

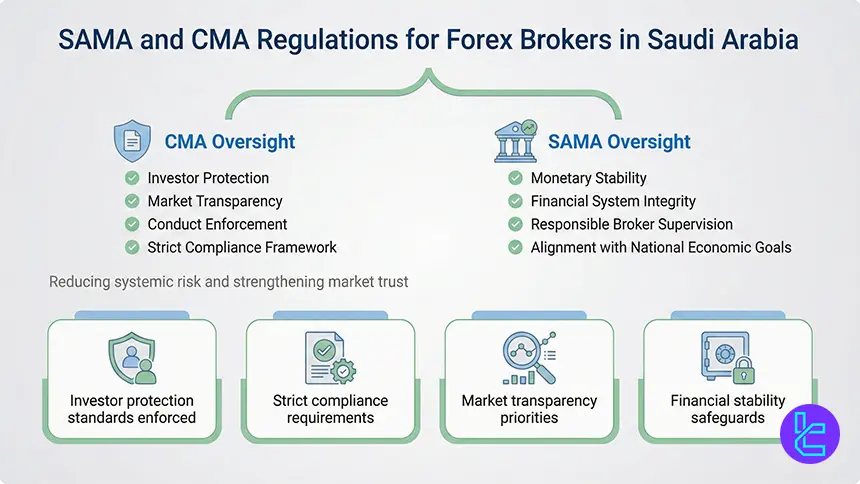

The Capital Market Authority (CMA) oversees capital markets and non-bank financial institutions, while the Saudi Central Bank supervises banking operations and currency stability. Together, these authorities establish the regulatory framework that governs financial activities within the Kingdom.

Although Forex brokers are not required to hold direct local licenses, Saudi traders rely on international regulatory bodies such as FCA, ASIC, and CySEC to ensure broker integrity. This dual framework balances global access with domestic financial stability.

What Are SAMA and CMA Regulations for Forex Brokers?

CMA regulations focus on investor protection, market transparency, and enforcement of financial conduct standards. Licensed institutions must follow strict compliance requirements that reduce systemic risk and enhance market trust.

SAMA supports monetary stability and financial system integrity, ensuring that brokers serving Saudi traders operate within responsible financial frameworks aligned with national economic goals.

- Investor protection standards enforced

- Strict compliance requirements

- Market transparency priorities

- Financial stability safeguards

SAMA and CMA Warning Lists for Online Traders

Saudi authorities actively publish warning alerts against unlicensed brokers and fraudulent schemes. These warnings form part of national investor protection initiatives that help traders avoid financial scams and misleading advertising practices.

Traders are encouraged to consult official registries and alerts before opening any trading account to ensure the broker meets recognized legal and ethical standards.

- Public warning systems active

- Anti-fraud investor campaigns

- Broker verification strongly encouraged

- Risk awareness initiatives

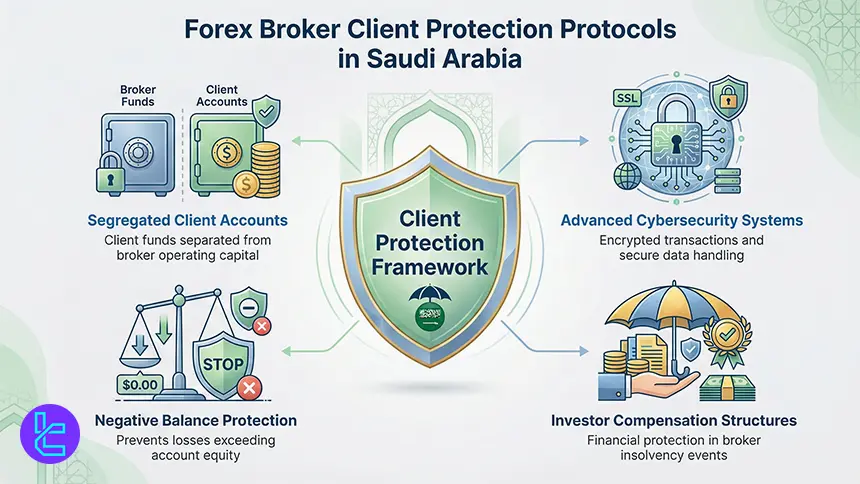

Forex Broker Client Protection Protocols in Saudi Arabia

Client protection mechanisms include segregated funds, encrypted transactions, two-factor authentication, and negative balance protection. These safeguards prevent misuse of client capital and protect traders from catastrophic losses during extreme market events.

Such protections are now considered fundamental requirements for brokers serving Saudi retail clients in international markets.

- Segregated client accounts

- Advanced cybersecurity systems

- Negative balance protection

- Investor compensation structures

How to Start Forex Trading in Saudi Arabia?

Traders begin by selecting a regulated broker, opening an account, completing identity verification, and funding their account. Most brokers offer demo accounts that allow practice without financial risk before live trading begins.

Education, discipline, and risk management form the foundation of sustainable trading success.

- Choose a regulated broker;

- Open and verify account;

- Practice with demo trading;

- Apply risk management

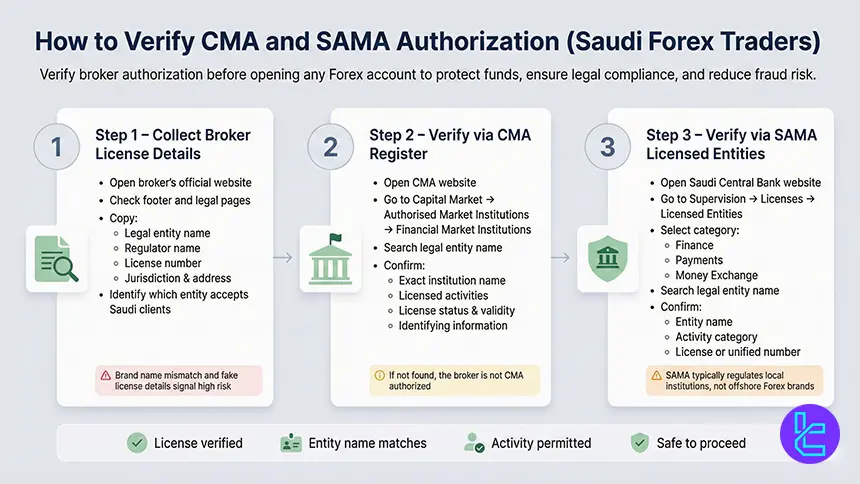

How to Verify CMA and SAMA Authorization?

Before opening any Forex trading account in Saudi Arabia, verifying a broker’s regulatory status is a critical safety step.

Confirming authorization through the Capital Market Authority (CMA) and the Saudi Central Bank (SAMA) ensures that the company operates under recognized financial oversight, protects client funds, and reduces the risk of fraud, misrepresentation, and unlicensed activity.

Step 1: Collect the broker’s official license details first

Before anything, you must check the broker’s website for regulation details by following these steps:

- Open the broker’s official website.

- Scroll to the footer, then open pages like Regulation, Legal Documents, About, or Terms.

- Copy these items exactly:

- Legal entity name (not just the brand name)

- Regulator name

- License number

- Registered jurisdiction and address

- If the broker lists multiple entities, note which entity accepts clients from Saudi Arabia.

Tip: Many scam pages copy a real broker’s brand, but the legal entity name or license number does not match.

Step 2: Check CMA authorization using the CMA register

Use this when a broker claims it is CMA licensed, or when you want to confirm a Saudi licensed institution.

- Open the CMA website;

- Navigate to Capital Market, then Capital Market Authorised Market Institutions;

- Open Financial Market Institutions;

- In Institution Name, type the legal entity name you copied from the broker’s website;

- Run the search, then open the matching result;

- Confirm these fields match the broker’s disclosure:

- Institution name spelling

- Activities permitted

- License status and validity details

- Any listed contact or identifying information

If the name does not appear, the broker is not CMA authorized, even if the marketing claims it is.

Step 3: Check the SAMA listing using the Licensed Entities section

Use this when a firm claims to be licensed by the Saudi Central Bank, or when you want to confirm a local financial company. SAMA commonly lists banks, finance companies, payment firms, and money exchange centers.

- Open the Saudi Central Bank website;

- Go to Supervision, then Licenses, then Licensed Entities;

- Choose the relevant category in the left menu:

- Finance

- Payments

- Licensed Money Exchange Centers

- Use the search box on the list page to search the legal entity name;

- Open the matching entity and verify:

- Entity name

- Category and activity type

- Licensing number or unified number

- Any other identifiers shown on the listing

Note: If a broker claims SAMA regulates its Forex brokerage, treat that claim cautiously. SAMA listings typically relate to local financial institutions, not offshore trading brands.

Saudi Arabia Tax Policy on FX/CFD Trading

Saudi Arabia imposes no personal income tax or capital gains tax on individual Forex traders, allowing profits to remain untaxed. This policy significantly increases the long-term profitability of active traders.

Corporate taxation applies to business entities, while Saudi nationals pay Zakat on eligible wealth.

What Are Leverage Caps for Forex Brokers in Saudi Arabia?

Saudi Arabia does not impose direct leverage caps. Leverage availability depends on the broker’s regulatory jurisdiction. Offshore brokers may offer leverage exceeding 1:1000, while European and UK regulators restrict retail leverage to 1:30.

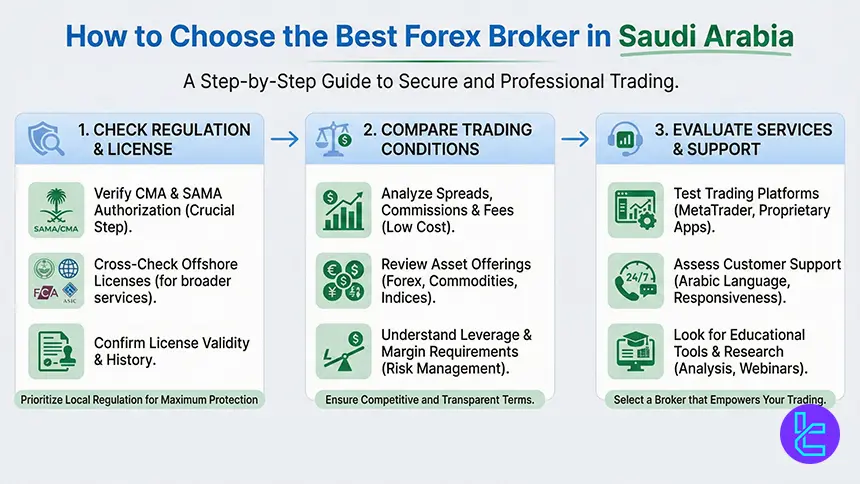

How to Select the Best Forex Broker in Saudi Arabia

Choosing the right Forex broker in Saudi Arabia directly affects capital security, execution quality, and long-term profitability. Saudi traders primarily rely on internationally regulated brokers under authorities such as FCA (UK), ASIC (Australia), and CySEC (EU) because local regulators do not directly license most global FX firms.

An optimal broker for Saudi traders combines regulatory credibility, competitive pricing, fast execution, Islamic account availability, Arabic support, and local-friendly funding options. Brokers offering transparent fee structures and strong risk controls consistently outperform less regulated competitors in trader satisfaction and retention.

Key Selection Factors

- Tier-1 regulation (FCA, ASIC, CySEC)

- Islamic swap-free accounts

- Low spreads and commissions

- Arabic customer support

- Local deposit and withdrawal options

- Fast execution and reliable platforms

Islamic Forex Accounts in Saudi Arabia

Islamic Forex accounts remove interest charges from overnight positions to comply with Sharia principles. All transaction costs are structured upfront, ensuring full religious compliance for Muslim traders.

These accounts remain a cornerstone of Forex trading across Saudi Arabia’s financial community.

Negative Balance Protection in Saudi Arabia Brokers

Negative Balance Protection (NBP) ensures retail traders cannot lose more money than their account balance. After the 2015 Swiss franc crash, regulators worldwide reinforced this protection. Brokers regulated under FCA, CySEC, and many offshore authorities must provide NBP to retail clients.

For Saudi traders, NBP is one of the most critical safety mechanisms. It prevents catastrophic debt during high-volatility events and shields traders from margin calls exceeding deposited funds. However, many brokers remove NBP for professional account holders.

What Are Popular Forex/CFD Trading Platforms in Saudi Arabia?

Saudi traders predominantly use MetaTrader 4, MetaTrader 5, cTrader, and advanced proprietary platforms. MT4, launched in 2005, remains the industry standard with over 40 million users worldwide, valued for technical analysis, Expert Advisors, and automated trading.

MetaTrader 5 extends functionality with additional order types, timeframes, and asset coverage. cTrader is favored by high-frequency traders for advanced charting and execution transparency. Most modern platforms provide seamless desktop, web, and mobile integration.

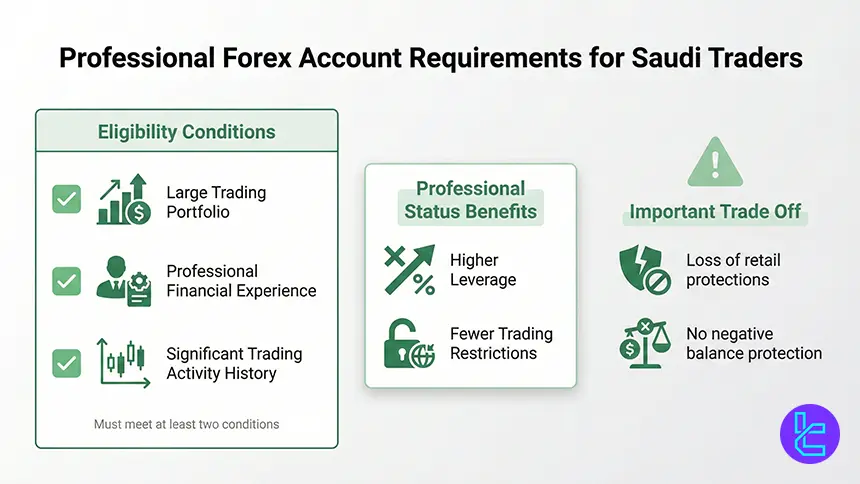

Professional Forex Account Requirements for Saudi Traders

Professional status requires meeting at least two of the following: a large trading portfolio, professional financial experience, or significant trading activity history. This status unlocks higher leverage and fewer trading restrictions.

However, professional accounts often lose retail protections such as negative balance protection.

Helpful Links for Forex Traders in Saudi Arabia

Saudi traders benefit from a network of regulatory bodies, financial institutions, and educational resources that support responsible trading practices, market transparency, and long-term financial development.

- Saudi Central Bank (SAMA): Official website of the Saudi Central Bank providing monetary policy updates, financial supervision frameworks, licensed entities information, and national banking system oversight;

- Capital Market Authority (CMA): Saudi Arabia’s official capital markets regulator overseeing securities activities, licensed financial institutions, investor protection programs, and market transparency initiatives.

Forex Trading in Saudi Arabia vs Other Countries

Saudi Arabia’s Forex market, regulated by the Saudi Central Bank (SAMA) and Capital Market Authority (CMA), offers traders flexible conditions with no fixed national leverage cap and broad access to international brokers.

Compared with the UAE, India, and Singapore, Saudi traders benefit from higher leverage freedom, mandatory client fund segregation, and growing regulatory transparency.

In contrast, the UAE enforces a 1:50 leverage cap under DFSA oversight with tax-free trading, India applies strict SEBI and RBI controls with 1:50 leverage and limited broker access, while Singapore’s MAS framework restricts leverage to 1:20 but provides very high investor protection and global market access.

Comparison Factor | Saudi Arabia | |||

Primary Regulator | Saudi Central Bank (SAMA), Capital Market Authority (CMA) | Dubai Financial Services Authority (DFSA), Dubai International Financial Centre (DIFC) | Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI) | Monetary Authority of Singapore (MAS) |

Regulatory Framework | National regulatory framework under SAMA and CMA | National framework | National regulation under SEBI | National framework under MAS (non-EU) |

Retail Leverage Cap Forex Majors | No fixed national cap | 1:50 | 1:50 | 1:20 |

Investor Protection Level | Medium | High | Moderate to high | High (prudential & conduct-based) |

Negative Balance Protection | Mandatory | Not mandatory; applied by many brokers | Mandatory | Not mandatory; applied by many brokers |

Client Fund Segregation | Mandatory | Mandatory | Required for SEBI-regulated brokers | Mandatory under MAS rules |

Broker Transparency Requirements | market transparency under SAMA and CMA | Transparent risk disclosures | Strict disclosure for SEBI-regulated Firms | Strict disclosure, capital, and reporting standards |

Broker Availability | Local and international brokers | DFSA-regulated and international | Limited to SEBI-regulated brokers on NSE and BSE; offshore brokers are widely used | MAS-licensed local and global brokers |

Access to International Brokers | Yes | Yes | Moderate to high | High (regional financial hub) |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView | MT4, MT5, TradingView, cTrader | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Depends on broker policy and regulatory entity | Entity-dependent | Cannot lose more than the deposit | Entity-dependent |

Tax Treatment of Forex Profits | Capital gains tax of 10 percent via FIRS | Tax-free | Taxed as business income or capital gains under Indian tax law | Taxable as income depending on activity (IRAS rules) |

Conclusion and Final Words

Saudi Arabia’s Forex market now operates within a strong regulatory environment supported by international broker access, advanced platforms like MT4, MT5, cTrader, and TradingView, plus widespread availability of Islamic accounts, negative balance protection, and segregated client funds, strengthening overall market confidence.

Saudi traders benefit from flexible leverage structures, zero personal income and capital gains tax on individual profits, expanding educational resources, and advanced security standards. These combined factors continue positioning Saudi Arabia as one of the most attractive and rapidly developing Forex trading destinations worldwide.

“Top-performing Saudi Arabia brokers are selected through TradingFinder’s analytical Forex methodology, focusing on verifiable performance metrics such as low trading expenses, reliable spreads, high-quality execution, and stable trading platforms.”