The France trading activities fall under the rules of the EEA and MiFID II. Traders in this country, with a 1.9% share of the global market equal to $242B+ of turnover, are protected by the local financial authority, Autorité des Marchés Financiers (AMF), established in August 2003 by the Financial Security Act.

Forex brokers looking to offer services in France must be supervised by either the AMF or another reputable regulator in the European Union, such as the CySEC, BaFin, EFSA, etc.

Best France Brokers

| FXCM | |||

| OctaFX | |||

| FP Markets | |||

| 4 |  | Blackbull Markets | ||

| 5 |  | City Index | ||

| 6 |  | XM Group | ||

| 7 |  | Fusion Markets | ||

| 8 |  | Eightcap | ||

| 9 |  | HFM |

Forex Brokers for Trading in France with Trustpilot Scores

The list here is handpicked as the best choices for an average Forex trader residing in France, considering important factors such as costs, account types, number of instruments, platforms, and more.

The table below demonstrates the Trustpilot rating for each of the mentioned brands.

Broker | Trustpilot Rating (out of 5) | Number of Reviews |

BlackBull Markets | 4.8 ⭐ | 2,902 |

4.8 ⭐ | 9,733 | |

Fusion Markets | 4.8 ⭐ | 5,455 |

4.6 ⭐ | 814 | |

HFM | 4.6 ⭐ | 2,968 |

City Index | 4.2 ⭐ | 393 |

Eightcap | 4.1 ⭐ | 3,353 |

OctaFX | 4.0 ⭐ | 8,740 |

3.5 ⭐ | 2,823 |

What Forex Brokers Should I Choose with the Lowest Spreads?

Spreads can make the difference between optimized and unoptimized trading. Pay close attention to this parameter when choosing a broker.

Broker | Min. Spread |

BlackBull Markets | 0 Pips |

0 Pips | |

HFM | 0 Pips |

Exness | 0 Pips |

FxGlobe | 0 Pips |

0.5 Pips | |

Capital.com | 0.6 Pips |

XM Group | 0.6 Pips |

OctaFX | 0.6 Pips |

Forex Brokers for France with Low Non-Trading Fees

Non-trading costs, such as those involved with withdrawals or inactivity periods, should be taken seriously when choosing a broker.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Fx Grow | None | None | None |

| None | None | None | |

FP Markets | None | None | None |

| None | $5 | None | |

City Index | None | None | £12 |

FxGlobe | None | $25 for SWIFT | None |

XM Group | None | None | $10 |

Libretex | None | 1 EUR | 10 EUR |

FXCM | None | $40 for Bank Wire | Lower of 50 Units in the Account's Base Currency |

Number of Tradable Instruments in the France Brokers

There are some brokers with whopping amounts of tradable symbols in this country; look at the table below.

Broker | Number of Symbols |

Saxo | 71K+ |

FP Markets | 10K+ |

IC Markets | 2.2K+ |

XM Group | 1.4K+ |

HFM | 1000+ |

800+ | |

Fusion Markets | 250+ |

Exness | 200+ |

200+ |

Top 7 Best Forex Trading Brokers in France

Each broker is presented through a France-focused lens, with emphasis on the regulatory environment, trading conditions, and practical considerations that directly impact traders operating under France and EU financial frameworks.

FXCM

FXCM, founded in 1999 as Forex Capital Markets, operates as a multi-regulated broker under FCA, ASIC, CySEC, ISA, and FSCA. For traders in France, the relevant route is FXCM EU under CySEC oversight - with EU-style safeguards including segregated client funds and negative balance protection, plus coverage up to EUR 20,000 via the Investor Compensation Fund.

The broker supports MT4, TradingView, and TradeStation, and offers CFD, Active Trader, and Corporate accounts. Pricing is built around floating spreads from 0.2 pips with no commission, and trading starts from a $50 minimum deposit and 0.01 lot size. You can go through the FXCM rebate program to save some money while trading.

Leverage varies by entity; EU and EEA clients are capped at 1:30, while higher leverage applies outside Europe.

For a guide on account opening, check out our FXCM registration page.

Summary of Specs

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Maximum Leverage | 1:30 for European Clients |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

FXCM Pros and Cons

Here are some of the broker's important benefits and drawbacks.

Pros | Cons |

Over 20 years of experience in the forex industry | Bankruptcy record |

Diverse product range | $50 per year inactivity fee |

Regulated by top-tier authorities (FCA, ASIC, CySEC) | $40 withdrawal fee on bank transfers |

OctaFX

Octa EU is a CySEC-regulated forex and CFD broker operated by Octa Markets Cyprus Ltd in Limassol, Cyprus; licensed under CySEC 372/18 and designed for European clients, including traders in France. Client protection is built around segregated funds and negative balance protection, with coverage up to EUR 20,000 via the ICF.

Trading is offered through OctaTrader only; there is no MT4 or MT5 access. The broker lists Forex, commodities, indices, and crypto CFDs with a total of 48 instruments, and EU leverage is capped at 1:30.

Furthermore, there's an OctaFX copy trading feature available.

Accounts are limited to Standard and Demo, with a 50 EUR minimum deposit and EUR as the base currency. Pricing follows a spread model, with floating spreads from 0.8 pips on EURUSD and overnight fees as the main trading cost. Funding options include Visa-MasterCard, Skrill, Swissquote, BluOr Bank, and RIETUMU. Note that to access all of the broker's features, you need to pass the OctaFX verification.

If you have already picked up interest, go through our OctaFX registration tutorial to open an account.

Here's a table of broker details.

Account Types | Standard, Demo |

Regulating Authorities | CySEC |

Minimum Deposit | 50 EUR |

Deposit Methods | VISA, MasterCard, Skrill, BluOr Bank, RIETUMU, Swissquote |

Withdrawal Methods | VISA, MasterCard, Skrill, BluOr Bank, RIETUMU, Swissquote |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | OctaTrader |

OctaFX Pros and Cons

The broker's advantages and disadvantages are listed here:

Pros | Cons |

Regulated in the EU | Limited regulation compared to other top-tier brokers |

Competitive spreads starting from 0.6 pips | Limited range of tradable assets compared to some competitors |

No commissions on withdrawals | Regular changes in payment options |

Copy trading feature available | - |

FP Markets

FP Markets is an Australia-based Forex and CFD broker established in 2005 and regulated by several authorities, including ASIC and CySEC.

For traders in France, accounts are offered under the CySEC-regulated entity, which means access to EU-standard investor protections such as segregated client funds, negative balance protection, and eligibility for compensation up to EUR 20,000.

FP Markets positions itself as a pricing-focused broker with institutional-style execution and transparent cost structures. Furthermore, you can participate in the FP Markets rebate program to reduce your trading costs.

The broker provides two core account types - Standard and RAW. The RAW account features spreads from 0.0 pips with a fixed commission, while the Standard account offers commission-free trading with wider spreads. For opening an account, check out our FP Markets registration guide.

Both accounts support MetaTrader 4, MetaTrader 5, and cTrader, covering Forex, indices, commodities, shares, ETFs, and cryptocurrencies.

FP Markets requires a low minimum deposit of $50 and applies ESMA-compliant leverage of up to 1:30 for retail traders in France. Its combination of tight pricing, professional platforms, and strong regulatory structure makes it a practical choice for cost-sensitive Forex traders in the French market.

Remember that you should go through the FP Markets verification procedure to access all features.

The table below demonstrates a summary of the broker's specifics.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros and Cons

Here's an outline of the noteworthy advantages and disadvantages of the broker.

Pros | Cons |

Regulated by top-tier authorities | No proprietary trading platform |

Tight spreads | - |

Wide range of trading instruments | - |

Various trading platforms | - |

A diverse range of educational content | - |

City Index

City Index is a London-founded Forex and CFD broker established in 1983 and operating as part of the StoneX Group. For traders in France, City Index provides access through its EU-compliant framework, offering a regulated environment aligned with European standards on client fund segregation and retail protections.

The broker is known for its long operational history, strong capital backing, and a broad multi-asset offering that goes well beyond spot Forex.

City Index gives traders access to more than 13,500 markets, including Forex, indices, commodities, shares, bonds, and cryptocurrencies. Forex trading is commission-free, with floating spreads starting from around 0.5 points on the MT4 account.

Trading is supported via MetaTrader 4, TradingView integration, and City Index’s proprietary web and mobile platforms, covering both discretionary and technical trading styles.

For retail clients in France, leverage follows EU rules, while professional clients may qualify for higher limits. With a minimum deposit of around $150, City Index is suited to traders seeking deep market coverage, established regulation, and platform flexibility rather than ultra-low entry costs.

The table below demonstrates some of the important parameters related to the broker.

Account Types | Standard, MT4 account |

Regulating Authorities | FCA, ASIC, MAS |

Minimum Deposit | $150 |

Deposit Methods | Visa/MasterCard, Paypal, Bank wired |

Withdrawal Methods | Visa/MasterCard, Paypal, Bank wired |

Maximum Leverage | 1:30 in Europe |

Trading Platforms & Apps | MT4, proprietary platform |

City Index Pros and Cons

Here are some of the important pros and cons of working with the broker.

Pros | Cons |

Strong regulatory oversight | inactivity fees on dormant accounts |

Wide range of trading instruments (over 13,500) | High stock trading fees |

Competitive spreads | Web Trader has an old design and outdated design |

Comprehensive educational resources | - |

BlackBull Markets

BlackBull Markets is a New Zealand-based multi-asset broker founded in 2014 and operating under the oversight of the New Zealand FMA, with an additional offshore entity regulated by the Seychelles FSA.

The broker offers access to over 26,000 instruments across forex, equities, indices, commodities, and cryptocurrencies, with client funds held in segregated accounts and negative balance protection in place.

Trading is structured around three ECN account types [ECN Standard, ECN Prime, ECN Institutional] with spreads from 0.0 pips and leverage up to 1:500. Platforms include MetaTrader 4, MetaTrader 5, TradingView, and cTrader, alongside proprietary solutions such as BlackBull CopyTrader and BlackBull Invest.

With no minimum deposit on its standard account, 24/7 customer support, and advanced execution infrastructure, BlackBull Markets is positioned for experienced traders seeking deep liquidity and platform flexibility. For opening an account, you can use our Blackbull Markets registration walkthrough.

Summary of Specifics

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

Always pay attention to the benefits and drawbacks before making any investments in a broker.

Upsides | Downsides |

Extremely fast execution speeds | A $2,000 minimum deposit for the ECN Prime account |

Tight spreads starting from 0 pips and leverage up to 1:500 | Potential complexity for beginner traders due to the wide range of offerings |

Wide selection of over 26,000 tradable instruments | - |

Integration with popular trading platforms (MT4/5, cTrader, TradingView) | - |

Fusion Markets

Fusion Markets is a cost-focused Forex and CFD broker founded in 2019 and backed by Gleneagle Securities in Australia. The broker operates under ASIC and VFSC oversight, offering a transparent structure with segregated client funds held at top-tier banks.

For traders in France, Fusion Markets applies ESMA-aligned conditions through its regulated framework, including negative balance protection and retail leverage limits of up to 1:30.

Fusion Markets is built around low-cost execution. It offers Classic and Zero accounts, with the Zero account providing spreads from 0.0 pips and a fixed commission, while the Classic account combines commission-free trading with slightly wider spreads. There is no minimum deposit requirement, which lowers the entry barrier for active and systematic traders.

Trading is supported via MetaTrader 4, MetaTrader 5, cTrader, and TradingView, covering Forex, indices, commodities, metals, and share CFDs. With fast execution, simple pricing, and platform flexibility, Fusion Markets is suited to French traders who prioritize tight costs and execution efficiency over extensive educational or proprietary tools. Check out our tutorial for Fusion Markets registration to open an account with this broker.

The table below features a summary of specifications.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:30 for Retail Traders |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

The broker's most important pros and cons are listed here.

Pros | Cons |

Ultra-low trading costs | Limited range of educational resources |

No minimum Deposit | No proprietary trading platform |

Zero deposit fees | Relatively new broker (launched in 2019) |

Regulated by VFSC and ASIC | Limited financial instruments |

Copy trading capabilities through Fusion+ | Lack of investor protection fund |

Eightcap

Eightcap is an Australia-based Forex and CFD broker founded in 2009 and regulated by multiple authorities, including ASIC, FCA, and CySEC. For traders in France, accounts are provided under CySEC supervision, ensuring EU-level protections such as segregated client funds, negative balance protection, and eligibility for compensation up to EUR 20,000.

Eightcap offers three main account types - Standard, Raw, and TradingView. The Raw account features spreads from 0.0 pips with a fixed commission, while the Standard and TradingView accounts provide commission-free pricing with spreads from around 1.0 pip. Traders have the option to reduce commissions and fees by participating in the Eightcap rebate programs.

Trading is supported via MetaTrader 4, MetaTrader 5, and full TradingView integration, covering Forex, indices, commodities, metals, shares, and crypto CFDs. For retail traders in France, leverage is capped at 1:30 in line with ESMA rules.

With competitive pricing, modern platforms, and advanced trading tools, Eightcap suits traders seeking flexibility and multi-platform access rather than investment or copy-trading features.

EIghtcap Specifications

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

The table below demonstrates the broker's important benefits and drawbacks.

Pros | Cons |

Strong Regulation | Basic Educational Resources |

Third-Party Platform Integration | Platform Restrictions |

Competitive Spreads | High minimum deposit |

High Leverage | - |

What Factors and Parameters Are Considered in Selecting the Best Forex Brokers for France?

Selecting the best Forex brokers in France requires a structured, data-driven approach, as traders entrust regulated platforms with both capital and sensitive financial information.

To ensure accuracy and transparency, TradingFinder applies a comprehensive review framework designed to reflect the real conditions faced by French and EU-based traders. This evaluation model focuses on these 4 concepts:

- Egulatory compliance

- Trading performance

- Cost efficiency

- Overall service quality

At the core of our process is a 19-metric evaluation system that examines each broker from multiple operational and user-experience angles.

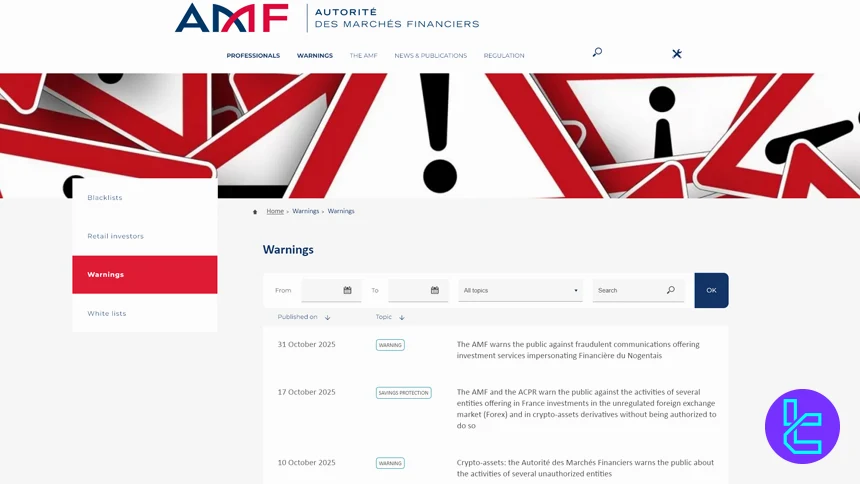

Regulatory status is assessed first, with special attention to oversight by authorities such as the AMF, ACPR, and other top-tier European regulators operating under MiFID II.

Broker background, including establishment year, corporate structure, and global office presence, is also reviewed to assess long-term stability and credibility.

Trading conditions form another key pillar of our analysis. This includes account type diversity, leverage structure for retail and professional clients, execution models, and the range of tradable instruments such as Forex pairs, CFDs, indices, stocks, and ETFs.

We also analyze trading costs in detail, covering spreads, commissions, non-trading fees, and deposit and withdrawal conditions through both documented data and hands-on testing.

Technology and usability play a crucial role as well. Platforms like MetaTrader 4, MetaTrader 5, cTrader, and mobile trading apps are evaluated for reliability, features, and ease of use.

Additional factors such as copy trading availability, educational resources, customer support responsiveness, Trustpilot ratings, scam alerts, and broker transparency are carefully reviewed.

How Can I Verify a Broker’s Regulatory License?

Before trading Forex or CFDs in France, verifying a broker’s regulatory license is a mandatory step to ensure legal compliance, investor protection, and fund safety.

French traders are primarily protected by the AMF (Autorité des marchés financiers), but brokers may also operate legally in France through EU passporting rights under regulators such as CySEC, BaFin, or FCA, in line with MiFID II regulations.

Verify Registration with the AMF (France)

The most reliable starting point is the official AMF register, known as REGAFI.

This database lists all financial institutions authorized to operate in France or provide cross-border services. Here are the links you can use:

Search using the broker’s legal entity name, not just the brand name. If the broker is authorized or passported into France, it will appear with details about permitted services.

Additionally, French traders should consult the AMF blacklist, which includes unlicensed Forex and CFD platforms explicitly warned against.

Check EU Regulators for Passported Brokers

Many brokers serving France are regulated in other EU countries and legally operate under MiFID II passporting rules:

Always match the license number and legal entity name shown on the broker’s website with the regulator’s official database.

Confirm Investor Protection Details

A valid license should also imply:

- Segregation of client funds

- Negative balance protection

- Access to an investor compensation scheme (where applicable)

Always match the license number and legal entity name shown on the broker’s website with the regulator’s official database.

Is Forex Trading Legal in France?

Forex trading is fully legal in France and operates under a well-defined regulatory framework designed to protect retail and professional traders.

As a member of the European Union, France follows EU-wide financial regulations, including MiFID II, while also enforcing national oversight through the Autorité des Marchés Financiers (AMF) and the Autorité de Contrôle Prudentiel et de Résolution (ACPR).

These authorities are responsible for supervising financial institutions, approving licensed brokers, and monitoring compliance with investor protection rules.

Any Forex broker offering services to residents of France must either be directly regulated by the AMF or authorized to operate under the EU passporting regime through another top-tier European regulator such as CySEC, BaFin, or the FCA.

French retail traders are also protected by ESMA regulations, which impose leverage limits, mandatory risk disclosures, and negative balance protection. As a result, traders cannot lose more than their deposited capital, even during periods of extreme market volatility.

In addition, marketing restrictions and warnings about the risks of CFD and Forex trading are legally required, reducing exposure to misleading promotional practices.

Is Leverage Capped in Forex Brokers for France-Based Traders?

Leverage is capped for France-based retail Forex traders due to European regulatory protections designed to limit trading risks.

France follows the ESMA framework, which applies across the EU and is enforced locally by the AMF.

These rules are part of broader investor-safeguarding measures under MiFID II that restrict how much leverage brokers can offer to retail clients.

Under ESMA guidelines, retail Forex traders in France are typically limited to a maximum leverage of 30:1 on major currency pairs. This cap is intended to reduce the likelihood of significant losses that highly leveraged positions can produce.

Lower leverage limits are also placed on other instruments based on their risk profile; for example, 20:1 for non-major Forex pairs and major indices, and smaller caps for commodities and other assets.

These restrictions apply only to retail traders. Traders who qualify as professional clients, based on trading experience, portfolio size, and market knowledge, may access higher leverage, sometimes up to industry norms such as 1:500. However, obtaining professional status requires meeting strict criteria set by the broker and regulator.

Because ESMA’s caps are adopted across all EU member states and enforced by national regulators like the AMF, leverage limits for French traders will remain consistent with other European jurisdictions unless future reforms occur.

For traders seeking different leverage conditions, some choose to work with non-EU or offshore brokers, keeping in mind this involves a different regulatory and risk profile.

Negative Balance Protection in France Forex Trading

Negative balance protection is a standard feature for retail Forex traders in France, designed to reduce the financial risk associated with leveraged trading.

In simple terms, this mechanism ensures that traders cannot lose more money than they have deposited into their trading account, even during periods of sharp market volatility or unexpected price gaps.

When negative balance protection is in place, any losses that exceed the available account balance are automatically absorbed by the broker. If a fast market move causes positions to close below zero, the account balance is adjusted back to zero, preventing the trader from owing additional funds.

This feature is especially important in the Forex market, where leverage can amplify both gains and losses in a very short time.

For France-based traders using EU-regulated brokers, negative balance protection is applied as part of standard retail trading conditions. It works alongside other risk-control tools such as margin close-out rules, which help limit exposure during volatile trading sessions.

From a practical perspective, negative balance protection offers peace of mind rather than restricting strategy. Traders can focus on position sizing, risk management, and execution without the concern of accumulating debt due to extreme market events.

This is one of the reasons many traders prefer brokers operating within the European trading framework rather than offshore alternatives with fewer built-in safeguards.

What Investor Protection Schemes Do Forex Brokers in France Offer?

Forex brokers that serve traders in France generally include several investor protection features aimed at safeguarding client funds and reducing risk exposure. These protection schemes help ensure traders can focus on strategy without unnecessary worry about operational failures or unexpected situations.

One common protection mechanism is segregated client accounts, where traders’ funds are kept separate from the broker’s operating capital. This setup means that if a broker encounters financial difficulties, client assets are not used to cover the broker’s liabilities and remain available for withdrawal.

Another level of security for France-based traders comes through the possibility of coverage under the French Deposit and Resolution Fund (FGDR).

Under this scheme, eligible clients may receive compensation up to a specified amount (often around €70,000) per person and per institution if a licensed investment provider fails and cannot return client assets.

For brokers licensed in other EU countries, similar investor compensation schemes may apply, typically offering coverage in the range of €20,000 to €100,000 depending on the jurisdiction.

In addition to these schemes, many brokers integrate risk-management tools directly into their platforms, such as negative balance protection and automated margin close-outs, which minimize the likelihood of excessive losses for traders.

How is Taxation in Forex Trading?

Forex trading profits in France are taxable and must be declared as part of the annual tax return. The way these profits are taxed depends mainly on how trading activity is classified and the trader’s overall income situation.

For most individual traders, Forex and CFD gains are treated similarly to other financial investment income.

Key points to understand about Forex taxation in France include:

- Flat tax (PFU): Most retail traders fall under the Prélèvement Forfaitaire Unique (PFU) system. This applies a total tax rate of around 30% on net trading profits, consisting of 12.8% income tax and 17.2% social contributions;

- Net profit calculation: Taxes are applied to net results, meaning profits can usually be reduced by eligible losses. In many cases, past trading losses may be used to offset gains before tax is calculated;

- Optional progressive tax scale: Traders may choose the progressive income tax scale instead of the flat tax if it results in a lower overall burden. This option depends on total household income and is generally fixed for the tax year once selected;

- Active or professional trading: Traders who operate frequently or rely on Forex trading as a primary income source may be classified differently. In such cases, profits can fall under categories like BNC, which follow different reporting and taxation rules;

- Foreign brokers and reporting: Profits earned through non-French or EU-based brokers are still taxable in France and must be reported accordingly.

Forex Trading in France Compared to Other Regions

France sits firmly within the EU’s investor-protection framework, offering a balanced environment where trading flexibility is paired with clear risk controls.

When compared to other major regions such as the UK, Germany, and South Africa, French traders benefit from consistent leverage caps, mandatory negative balance protection, and access to EU-wide broker passporting.

At the same time, non-EU markets like South Africa provide looser leverage conditions but rely more heavily on broker-level safeguards. The table below highlights how France compares across regulation, leverage, protections, and practical trading conditions.

Comparison Factor | France | |||

Primary Regulator | Autorité des Marchés Financiers (AMF) | Financial Conduct Authority (FCA) | BaFin (Germany) | Financial Sector Conduct Authority (FSCA) |

Regulatory Framework | EU MiFID II & ESMA compliance | National FCA framework (post-Brexit) | EU MiFID II & ESMA compliance | National regulation under FSCA (non-EU) |

Retail Leverage Cap (Forex Majors) | 1:30 | 1:30 | 1:30 | Not strictly capped; higher leverage common |

Investor Protection Level | Very high | Very high | Very high | High |

Negative Balance Protection | Mandatory | Mandatory (retail accounts) | Mandatory | Commonly applied by brokers |

Client Fund Segregation | Mandatory | Mandatory | Mandatory | Required under FSCA rules |

Investor Compensation Scheme | FGDR up to €70,000 | FSCS up to £85,000 | EdW up to €20,000 | No statutory compensation scheme |

Broker Availability | Broad EU access via passporting | FCA-authorized domestic & global brokers | Broad EU access via passporting | Mix of FSCA-licensed & global brokers |

Access to International Brokers | High (EU passporting) | High | High (EU passporting) | High (global brokers target ZA market) |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView, proprietary | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, proprietary |

Maximum Loss Protection | Cannot lose more than deposit (retail) | Cannot lose more than deposit (retail) | Cannot lose more than deposit (retail) | Often applied but entity-dependent |

Tax Treatment of Forex Profits | Flat tax (PFU) ~30% or progressive option | CGT or Income Tax (spread betting often tax-free) | Capital gains tax ~26% effective | Taxed as income or capital gains |

Conclusion

Trading in France is subject to the rules and the structure declared by AMF financial regulator in the country and the EU via MiFID II with negative balance protection, 1:30 leverage cap, and other measures.

France-based traders can also open account and work with offshore brokerages; they often have less protections and less stringent regulations in exchange for higher leverage caps.

For a detailed breakdown of our evaluation process, readers can explore our Forex methodology, which outlines the weight and importance of each metric in broker selection for the French market.