The foreign exchange (Forex) market represents the highest-liquidity financial marketplace globally, processing an average daily turnover of approximately 9.6 trillion USD.

Every trading session involves a vast network of institutions, liquidity providers, brokers, and retail participants executing transactions across currency pairs. The table below offers a list of the best international brokers that traders can choose.

| IC Markets | |||

| XM | |||

| Exness | |||

| 4 |  | HFM | ||

| 5 |  | Eightcap | ||

| 6 |  | FxPro | ||

| 7 |  | Fusion Markets | ||

| 8 |  | FXTM | ||

| 9 |  | TMGM | ||

| 10 |  | AvaTrade |

Trustpilot Ratings of International Forex Brokers

The following tab provides the Trustpilot ratings of the top Forex brokers that provide services in various regions. This shows how trustworthy is each brokerage based on genuine user reviews.

Broker | Trustpilot Rating | Number of Reviews |

4.8/5⭐️ | +49500 | |

Fusion Markets | 4.8/5⭐️ | +5500 |

Exness | 4.8/5⭐️ | +25500 |

4.7/5⭐️ | +11500 | |

HFM | 4.6/5⭐️ | +2500 |

Eightcap | 4.1/5⭐️ | +3000 |

TMGM | 3.9/5⭐️ | +800 |

FxPro | 3.8/5⭐️ | +800 |

XM | 3.4/5⭐️ | +2500 |

FXTM | 2.6/5⭐️ | +1000 |

Minimum Spreads of Forex Brokers in Spain

Traders across the global have access to a wide range of brokers that offer Zero spread accounts allowing traders to perform fast execution strategies with minimal spreads.

Brokers | Minimum Spreads |

From 0.0 Pips | |

PU Prime | From 0.0 Pips |

From 0.0 Pips | |

Pepperstone | From 0.0 Pips |

From 0.0 Pips | |

XTB | From 0.1 Pips |

City Index | From 0.1 Pips |

OctaFX | From 0.6 Pips |

IG Markets | From 0.6 Pips |

Plus500 | From 0.8 Pips |

Non-Trading Fees in Forex Brokers of Spain

Besides the main spread and commissions, International traders must consider the brokers non-trading fees, including deposit, withdrawal, and inactivity which directly effect the overall trading costs.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

FBS | $0 | $0 | $0 |

Go Markets | $0 | $0 | $0 |

EC Markets | $0 | $0 | $0 |

BlackBull Markets | $0 | $5 | $0 |

Vantage | $0 | Varies | $0 |

$0 | Varies | $5 | |

$0 | $0 | $10 (in certain jurisdiction) | |

$0 | $0 | $15 | |

Forex.com | $0 | Varies | $15 |

Pepperstone | $0 | $20 | $0 |

Number of Tradable Instruments in Forex Brokers of Spain

The table below provides an in-depth look on how diverse is the amount of tradable assets and markets in the top international Forex brokers.

Broker | Number of Tradable Assets |

IG Markets | +17000 |

FP Markets | +10000 |

Capital.com | +6000 |

XM Group | +1400 |

+1250 | |

Vantage Markets | +1000 |

Eightcap | +800 |

AMarkets | +550 |

+150 | |

Global Prime | +100 |

Top 8 Forex Brokers in the World

The best brokers in the world often offer low spreads (from 0.0 pips), reasonable commissions in RAW accounts (about 4 to 5 dollars per lot), and have strong regulatory supervision my multiple financial authorities such as the FCA, CFTC, CySEC, ASIC, ESMA, etc.

The list below are the best international brokers that traders can choose to trade Forex, commodities, indices, cryptocurrencies, stocks, and more.

IC Markets

IC Markets is a multi-asset brokerage founded in 2007 with global operations and regulatory coverage under ASIC (Australia), CySEC (Cyprus), and FSA (Seychelles).

The broker supports over 2,250 tradable instruments spanning Forex CFDs, Stock CFDs, Index CFDs, Commodity CFDs, Bond CFDs, and Crypto CFDs, offering infrastructure designed for both retail and professional market participants.

Clients can choose from Standard, Raw Spread, and Islamic accounts, with a minimum deposit of $200 and base currencies including USD, EUR, GBP, AUD, JPY, CHF, SGD, NZD, HKD, and CAD.

Trading execution follows a market execution model with spreads starting from 0.0 pips on Raw Spread accounts and commissions from $1.5 per lot on average. Leverage reaches up to 1:500, subject to regulatory jurisdiction.

Trading costs can be lowered by using the IC Markets rebate program vis the TradingFinder IB.

IC Markets integrates multiple professional trading platforms including MetaTrader 4, MetaTrader 5, cTrader, cTrader Web, and the proprietary IC Markets Mobile App, supporting automated trading, expert advisors, and advanced charting systems.

Client funds are held in segregated accounts with top-tier banks, supported by negative balance protection and investor compensation schemes under CySEC of up to €20,000, reinforcing institutional-grade risk management and operational transparency.

Account Types | Standard Account, Raw Spread Account, Islamic Account |

Regulating Authorities | ASIC (Australia), CySEC (Cyprus), FSA (Seychelles) |

Minimum Deposit | $200 |

Deposit Methods | Bank Wire Transfer, Credit/Debit Cards (Visa, MasterCard), PayPal, Skrill, Neteller, UnionPay |

Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, UnionPay |

Maximum Leverage | Up to 1:500 (jurisdiction dependent) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, cTrader Web, IC Markets Mobile App |

IC Markets Pros and Cons

The table below lists the core benefits and drawbacks of trading with IC Markets.

Pros | Cons |

ECN-style execution model with deep liquidity sourced from tier-1 banks and non-bank liquidity providers | No proprietary web trading platform comparable to TradingView Web or eToro WebTrader |

Ultra-low spreads from 0.0 pips on Raw Spread Account with average commission from $1.5 per lot | Cryptocurrency CFD coverage is smaller than Forex and indices selection |

Supports over 2,250 instruments including Forex CFDs, Stock CFDs, Index CFDs, Commodity CFDs, Bond CFDs, Crypto CFDs | No built-in copy trading network like ZuluTrade |

Full support for MetaTrader 4, MetaTrader 5, cTrader, cTrader Web, IC Markets Mobile App | - |

Exness

Exness is a global multi-asset brokerage established in 2008, operating under the EXNESS Group with leadership from Petr Valov and Igor Lychagov.

The broker maintains regulatory coverage across several high-trust jurisdictions including FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CMA (Kenya), CBCS (Curaçao), and FSC (BVI). All entities require traders to complete the Exness verification procedure.

The trading ecosystem supports Forex, Indices, Stocks, Commodities, Cryptocurrencies, and CFD instruments.

Exness offers +200 tradable symbols and flexible account structures including Standard, Standard Cent, Pro, Raw Spread, and Zero. These accounts can be chosen during the Exness registration process.

Entry requirements begin at a $10 minimum deposit, with spreads from 0.0 pips and commissions ranging from $0.2 to $3.5 depending on account configuration.

Exness provides a multi-platform environment through MetaTrader 4, MetaTrader 5, Exness Terminal (web), and the Exness Trade mobile application, supporting algorithmic trading, social trading, and copy trading integration, all available to download in the Exness dashboard.

Additional features, includes Negative Balance Protection, segregated client funds, Exness VPS hosting, and fast execution under both market execution and instant execution models.

Account Types | Standard, Standard Cent, Pro, Raw Spread, Zero |

Regulating Authorities | FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CMA (Kenya), CBCS (Curaçao), FSC (BVI) |

Minimum Deposit | From $10 (depends on account type & payment method) |

Deposit Methods | Bank Transfer, Visa, MasterCard, Skrill, Neteller, Perfect Money, WebMoney, Cryptocurrency Payments |

Withdrawal Methods | Bank Transfer, Visa, MasterCard, Skrill, Neteller, Perfect Money, WebMoney, Cryptocurrency Withdrawals |

Maximum Leverage | Up to 1:2000 (jurisdiction & instrument dependent) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Exness Terminal (Web), Exness Trade Mobile App |

Pros and Cons of Exness

The table below helps traders have a clear picture of the benefits and limitations of trading with Exness broker.

Pros | Cons |

Broad regulatory coverage under FCA, CySEC, FSCA, FSA, CMA, CBCS, FSC, offering multi-jurisdiction compliance | Regulatory conditions differ by region, creating variation in leverage and protections |

Very low entry barrier with minimum deposit from $10 and flexible account structures | Limited proprietary research content compared to institutional brokers |

Diverse account types: Standard, Standard Cent, Pro, Raw Spread, Zero | - |

Tight spreads from 0.0 pips with transparent commission models | - |

XM Group

XM Group is a global multi-asset brokerage established in 2009, operating for over 15 years with a client base exceeding 15 million traders and processing nearly 14 million trades daily.

The broker maintains a diversified regulatory structure across major jurisdictions including CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSC (Belize), FSC (Mauritius), and FSA (Seychelles), providing cross-regional compliance under multiple supervisory regimes.

The trading ecosystem delivers access to over 1,400 CFD instruments, spanning Forex (55+ currency pairs), Stocks (1,200+ share CFDs), Indices, Commodities, Cryptocurrencies, Precious Metals, and Turbo Stocks.

Account offerings after completing the XM Group verification include Micro, Standard, Ultra Low, Shares, and Islamic (swap-free) structures, with entry thresholds starting at $5 and leverage reaching 1:1000 depending on the entity and instrument.

XM supports professional execution through MetaTrader 4, MetaTrader 5, and the proprietary XM Mobile App, featuring market and instant execution, MQL5 signal services, XM Group copy trading infrastructure, negative balance protection, and segregated client funds.

Additional infrastructure includes 24/7 multilingual support, advanced educational programs, and global liquidity access, positioning XM as a scalable brokerage framework for both retail and advanced traders.

Traders must note that opening an account with via the TradingFinder IB in this broker, makes them eligible to earn rebates (up to $37.5) via the XM Group rebate program.

Account Types | Micro, Standard, Ultra Low, Shares, Islamic (Swap-Free) |

Regulating Authorities | CySEC (Cyprus), ASIC (Australia), FSCA (South Africa), DFSA (Dubai), FSC (Belize), FSC (Mauritius), FSA (Seychelles) |

Minimum Deposit | $5 |

Deposit Methods | Bank Wire Transfer, Credit/Debit Cards (Visa, MasterCard), Skrill, Neteller, WebMoney, Perfect Money, Local Payment Solutions |

Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, Skrill, Neteller, WebMoney, Perfect Money |

Maximum Leverage | Up to 1:1000 (depending on regulatory entity and instrument) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), XM WebTrader, XM Mobile App (iOS & Android) |

XM Group Pros and Cons

The following tables indicates the pros and cons of trading with the XM Group broker for international traders.

Pros | Cons |

Regulated by multiple top-tier authorities including CySEC, ASIC, FSCA, DFSA, FSC Belize, FSC Mauritius, FSA Seychelles | No proprietary trading platform outside MT4, MT5, and XM WebTrader |

Very low entry barrier with $5 minimum deposit on Micro and Standard accounts | Leverage restrictions under CySEC and ASIC entities (up to 1:30) |

Wide variety of account structures: Micro, Standard, Ultra Low, Shares, Islamic Swap-Free | - |

High maximum leverage up to 1:1000 (jurisdiction dependent) | - |

HFM

HFM, also known as HF Markets, operates as a multi-asset CFD broker with global regulatory coverage spanning CySEC in Europe, FCA in the United Kingdom, DFSA in the UAE, FSCA in South Africa, and FSA in Seychelles.

All broker entities require traders to complete the HFM verification process to comply with AML and KYC laws.

The broker supports several account models including Cent, Zero, Pro, and Premium, accommodating different trading styles and cost preferences.

Pricing is structured around floating spreads that begin from 0.0 pips on the Zero account, while standard accounts maintain competitive spread levels without commission on most forex pairs.

HFM delivers market access through MetaTrader 4, MetaTrader 5, and its proprietary mobile application, enabling trading across Forex, Metals, Energies, Indices, Stocks, ETFs, Bonds, and Cryptocurrencies.

Additional infrastructure such as VPS hosting, Autochartist integration, economic calendars, trading calculators, and SMS market alerts are all accessible in the HFM dashboard.

With over 1,000 tradable instruments, HFM copy trading services, PAMM accounts, Islamic account support, and extensive educational resources, this broker positions itself as a comprehensive trading ecosystem rather than a single-product brokerage.

Account Types | Cent, Premium, Pro, Zero, Islamic (Swap-Free), Copy Trading, PAMM |

Regulating Authorities | FCA (UK), CySEC (Cyprus), DFSA (Dubai), FSCA (South Africa), FSA (Seychelles) |

Minimum Deposit | $0 for Cent, $100 for Premium, $500 for Pro, $0 for Zero |

Deposit Methods | Bank Wire Transfer, Credit/Debit Cards, Skrill, Neteller, Perfect Money, Fasapay, Crypto Payments, Local Bank Transfers |

Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, Skrill, Neteller, Perfect Money, Fasapay, Crypto Wallets |

Maximum Leverage | Up to 1:2000 (depending on regulatory entity and account type) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, HFM Trading App (iOS & Android), WebTrader |

HF Markets Pros and Cons

Traders must consider the following pros and cons of trading with the HF Markets broker.

Pros | Cons |

Multi-jurisdiction regulation under FCA, CySEC, DFSA, FSCA, and FSA Seychelles providing layered investor protection | Higher minimum deposit on Pro account ($5000) compared with entry-level accounts |

Broad account architecture including Cent, Premium, Pro, Zero, Islamic, PAMM, and Copy Trading accounts | Leverage restrictions for EU and UK clients |

Very high leverage availability up to 1:2000 under offshore entities | Crypto CFD range smaller than some dedicated crypto brokers |

Extensive market coverage across Forex, Metals, Energies, Indices, Stocks, ETFs, Bonds, and Cryptocurrencies | - |

Eightcap

Eightcap is an Australian-founded CFD broker established in 2009 in Melbourne, operating under a multi-jurisdiction regulatory framework that includes ASIC in Australia, FCA in the United Kingdom, CySEC in Cyprus, and SCB in The Bahamas.

This regulatory structure enables Eightcap to serve clients across major financial regions while enforcing core protections such as segregated client funds and negative balance protection.

The broker offers three primary live account models: Standard, Raw, and TradingView, alongside a Demo account.

Trading conditions are structured with spreads from 0.0 pips on the Raw account and commission-free pricing on Standard and TradingView accounts, except for share CFDs.

Traders can benefit from up to $3.6 cashbacks via Eightcap rebate in this Forex broker.

Market access spans over 800 instruments across Forex, commodities, metals, indices, shares, and more than 200 cryptocurrency CFDs, all delivered through MetaTrader 4, MetaTrader 5, and full TradingView integration.

Eightcap enhances its trading environment with Capitalise.ai for code-free automation, FlashTrader for precision order execution, and an AI-powered economic calendar.

Funding and withdrawals are supported via bank transfer, cards, e-wallets, PayPal, and cryptocurrencies. With 24/5 customer support, Eighcap insists on providing top-tier services to all traders who complete the Eightcap registration.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC (Australia), FCA (UK), CySEC (Cyprus), SCB (Bahamas) |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, Cryptocurrency Payments |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, Cryptocurrency Withdrawals |

Maximum Leverage | Up to 1:500 (jurisdiction and instrument dependent) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView Platform Integration |

Pros and Cons of Eightcap

Check the table below before opening an account with Eightcap to ensure you know all its pros and cons.

Pros | Cons |

Strong regulatory coverage under ASIC, FCA, CySEC, and SCB providing high compliance standards | No proprietary standalone trading platform |

Deep integration with TradingView alongside MetaTrader 4 and MetaTrader 5 | Crypto CFD offering restricted under some regulatory jurisdictions |

Over 800 instruments including Forex, Indices, Commodities, Shares, and 200+ Cryptocurrency CFDs | - |

Competitive pricing with spreads from 0.0 pips on Raw account | - |

FxPro

FxPro operates as a multi-asset brokerage infrastructure that has been active since 2006, combining global regulatory coverage with a broad trading technology ecosystem.

The broker maintains licenses from major supervisory authorities including the FCA, CySEC, FSC, and SCB, establishing a layered compliance framework across multiple jurisdictions.

Clients gain access to more than 2,100 financial instruments spanning Forex, equities, indices, metals, energy contracts, futures, and cryptocurrency CFDs.

The broker supports various trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, FxPro WebTrader, and the proprietary FxPro mobile application.

Execution models integrate both market execution and instant execution, while trading features include Expert Advisors, scalping, copy trading via FxPro CopyTrade, negative balance protection, and optional Islamic account structures.

All features become available after completing the FxPro verification process.

Pricing architecture varies by account structure, with Standard, Raw+, and Elite configurations offering different spread and commission models. Traders can lower trading costs up to 30% in this Forex broker via the FxPro rebate program.

Funding operations in the FxPro dashboard utilize payment networks such as Visa, Mastercard, Skrill, Neteller, PayPal, and international bank transfers, with most deposits and withdrawals processed without broker fees under standard conditions.

Account Types | Standard, Raw+, Elite |

Regulating Authorities | FCA (UK), CySEC (Cyprus), FSCA (South Africa), SCB (Bahamas) |

Minimum Deposit | $100 |

Deposit Methods | Bank Wire, Visa, Mastercard, Skrill, Neteller, PayPal |

Withdrawal Methods | Bank Wire, Visa, Mastercard, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:30 (retail EU/UK), up to 1:500 (professional / offshore) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, FxPro WebTrader, FxPro Mobile App |

FxPro Pros and Cons

Consider the following advantages and disadvantage when opening an account with the FxPro broker.

Pros | Cons |

Regulation by FCA, CySEC, FSCA, and SCB, providing multi-jurisdiction compliance and investor protection | Retail leverage limited to 1:30 under FCA and CySEC regulation |

Wide platform ecosystem including MetaTrader 4, MetaTrader 5, cTrader, FxPro WebTrader, and FxPro Mobile App | Inactivity fee applied after prolonged account dormancy ($15) |

Advanced execution model with No Dealing Desk infrastructure and deep liquidity from tier-1 providers | - |

Availability of professional accounts with leverage up to 1:500 for eligible clients | - |

Fusion Markets

Fusion Markets operates as a multi-regulated online brokerage supported by oversight from ASIC and VFSC, with corporate registration under Gleneagle Securities Pty Limited in Vanuatu and Australia.

The broker provides access to major financial markets, including Forex, Indices, Share CFDs, Commodities, Metals, Energy, and Cryptocurrencies. Traders can access each symbol contract specification in the Fusion Markets dashboard.

Client funds are held in segregated accounts with HSBC and National Australia Bank, enhancing operational security and financial transparency.

The trading environment is built around MetaTrader 4, MetaTrader 5, TradingView, and cTrader, all available across desktop, web, and mobile.

Account structures include Zero, Classic, and Swap-Free, each tailored to different cost models and execution preferences.

All account types become available after completing the Fusion Markets registration process.

Fusion Markets maintains ultra-low spreads starting from 0.0 pips, offers commission-free options, and supports advanced services such as VPS hosting, Copy Trading, MAM, PAMM, and Fusion+.

Before accessing all the available features, traders must complete the Fusion Markets verification process in 3 simple steps.

With maximum leverage reaching 1:500 and no minimum deposit requirement, the broker accommodates a wide range of trading profiles. Its infrastructure emphasizes fast execution, flexible funding methods, and professional risk management tools.

Account Types | Classic Account, Zero Account, Swap-Free (Islamic), Demo Account |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu) |

Minimum Deposit | $0 |

Deposit Methods | Bank Transfer, Credit/Debit Cards (Visa, Mastercard), Skrill, Neteller, PayPal, Crypto Payments |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, PayPal, Crypto Wallets |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, WebTrader, iOS App, Android App |

Fusion Markets Pros and Cons

The table below offers a list of the benefits and drawbacks of trading with the Fusion Markets broker.

Pros | Cons |

Ultra-low spreads starting from 0.0 pips on Zero Account with institutional-grade liquidity providers | Not regulated by Tier-1 regulators in all regions outside Australia |

Strong regulation under ASIC combined with additional global coverage via VFSC | Educational content is relatively basic for advanced algorithmic traders |

Full platform suite including MetaTrader 4, MetaTrader 5, cTrader, and TradingView integration | - |

No minimum deposit requirement, suitable for beginners and micro-account strategies | - |

TMGM

TMGM, also known as TradeMax Global Markets, operates as a multi-jurisdictional forex and CFD broker with a regulatory structure anchored by ASIC in Australia and extended through VFSC (Vanuatu), FSC (Mauritius), CMA (Kenya), and FSA (Seychelles).

All traders must complete the TMGM verification process to comply with Anti-Money laundering and Know Your Customer rules.

Client fund protection includes segregation of funds, negative balance protection under the ASIC entity, and professional indemnity insurance coverage of up to AUD 10 million, supplemented by Financial Commission membership for dispute resolution and compensation.

The broker delivers access to more than 12,000 tradable instruments across Forex, Indices, Commodities, Stocks, Energies, and Cryptocurrency CFDs.

Trading is supported on MetaTrader 4, MetaTrader 5, the IRESS institutional platform, and the proprietary TMGM Mobile App. All platforms are available for download via the TMGM dashboard.

Account structures include Edge (ECN), Classic, and multi-tier IRESS accounts, with spreads from 0.0 pips on Edge and commissions of $3.5 per lot. Maximum leverage reaches 1:1000 depending on regulatory jurisdiction.

TMGM integrates copy trading via ZuluTrade HUBx, provides Islamic accounts, supports automated trading through Expert Advisors, and offers global liquidity with execution speeds averaging below 30 milliseconds.

Funding is facilitated through diversified TMGM deposit and withdrawal methods including Visa, MasterCard, WISE, Skrill, Neteller, UnionPay, bank transfer, and stablecoin deposits via USDT and USDC.

Account Types | Edge (ECN), Classic, IRESS Standard, IRESS Platinum, IRESS Premier, Islamic Account |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu), FSC (Mauritius), CMA (Kenya), FSA (Seychelles) |

Minimum Deposit | $100 for Classic & Edge accounts, higher tiers for IRESS accounts |

Deposit Methods | Bank Transfer, Visa, MasterCard, Skrill, Neteller, UnionPay, WISE, USDT, USDC |

Withdrawal Methods | Bank Transfer, Visa, MasterCard, Skrill, Neteller, UnionPay, WISE, USDT, USDC |

Maximum Leverage | Up to 1:1000 (varies by regulation and account type) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), IRESS, TMGM Mobile App, ZuluTrade HUBx |

Pros and Cons of TMGM

The table below offers a detailed look into the pros and cons of trading with TMGM.

Pros | Cons |

Multi-regulation by ASIC, VFSC, FSC, CMA, and FSA providing diversified regulatory oversight | Offshore regulation entities such as VFSC and FSA offer lower investor protection compared to Tier-1 regulators |

Advanced trading infrastructure with MetaTrader 4, MetaTrader 5, and professional-grade IRESS platform | IRESS platform access requires significantly higher minimum deposits |

Ultra-low latency execution via Equinix NY4 and LD4 data centers with ECN pricing on Edge accounts | - |

Broad asset coverage including Forex, Indices, Commodities, Shares, Cryptocurrencies, and Futures CFDs | - |

Is Forex Trading Legal?

Forex trading is considered a lawful financial activity in many jurisdictions, but its legality is determined by national regulatory systems rather than by the global market itself.

Although the foreign exchange market operates without a central authority, participation is subject to strict domestic oversight.

The legal framework of forex trading is generally built on the following pillars:

- broker licensing and registration with recognized financial authorities

- investor protection mechanisms such as negative balance protection and compensation schemes

- leverage limitations designed to reduce systemic risk

- capital adequacy and financial reporting requirements for brokers

- taxation rules governing trading profits

- anti-money laundering and know-your-customer compliance procedures

Different regions apply these principles through their own regulatory bodies. In the European Union, oversight is coordinated under MiFID II and enforced by national regulators.

In the United States, retail forex activity falls under the supervision of the National Futures Association. The United Kingdom relies on the Financial Conduct Authority, while the Australian Securities and Investments Commission performs a similar role in Australia.

Several Asian jurisdictions, including Japan and Singapore, operate under tightly controlled regulatory environments.

As a result, forex trading remains legal when conducted through properly authorized brokers and in full compliance with local financial laws.

Which Financial Authorities Regulate International Forex Brokers?

The table below offers a list of top financial regulatory bodies that regulate Forex brokers.

Country | Regulatory Authority | Name Abbreviation |

United States | CFTC | |

United Kingdom | FCA | |

Australia | ASIC | |

Germany | BaFin | |

Japan | JFSA | |

Switzerland | FINMA | |

Canada | CIRO | |

Singapore | MAS | |

Cyprus | CySEC | |

Hong Kong | SFC |

Traders can see a more complete list of these entities in the TF score page.

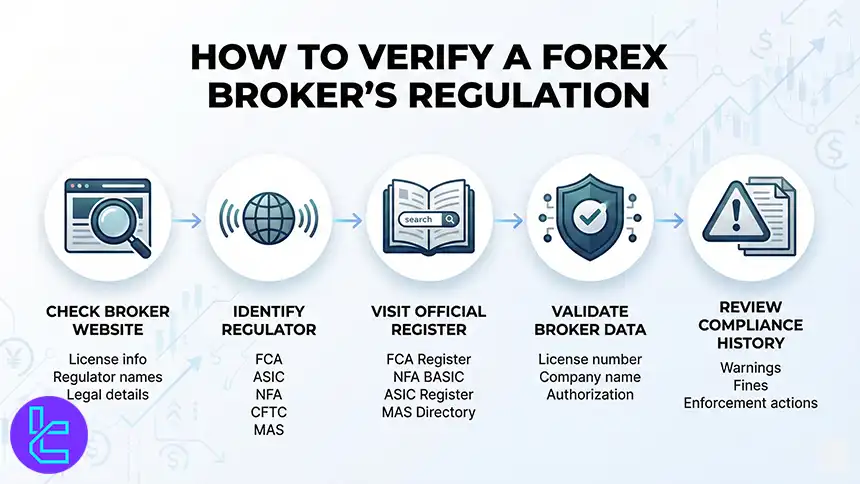

How to Verify Forex Broker Regulations

Before opening any trading account, verifying a broker’s regulatory standing is a critical risk-control procedure. The following structured process allows traders to confirm legitimacy using official regulatory databases and documented compliance records.

Verification Process:

- Review the Broker’s Official Website: Locate the broker’s legal information section, typically found in the footer or “About Us” page. Identify regulatory disclosures, license numbers, and supervisory authorities such as FCA, ASIC, NFA, CFTC, or MAS;

- Determine the Supervisory Authority: Match the broker’s declared regulator with recognized global financial authorities including: FCA in the United Kingdom, ASIC in Australia, NFA and CFTC in the United States, MAS in Singapore, and similar Tier-1 institutions;

- Access the Regulator’s Official Registry: Navigate directly to the regulator’s primary database such as FCA Register, NFA BASIC, ASIC Register, or MAS Financial Institutions Directory;

- Conduct Database Validation: Search using the broker’s legal company name or license number. Confirm registration status, approved financial activities, and operational permissions for forex trading;

- Evaluate Compliance History: Examine any enforcement actions, warnings, fines, or disciplinary records issued by the authority. Verify that authorized services align with the products the broker offers.

Here are the risks you should monitor while verifying broker licenses:

- Missing license data

- Inconsistent corporate details

- Refusal to provide regulatory documentation

- Absence from official regulatory databases

This verification framework significantly reduces exposure to fraudulent platforms and unlicensed intermediaries.

Do I Pay Taxes for Trading Forex?

Traders who trade Forex in regulated environments in different countries must pay taxes to the main authority of their place of residence. The taxation rates heavily depends on country you trade in.

- United Kingdom: Forex trading gains are taxed by HM Revenue & Customs (HMRC) either as Capital Gains Tax at 10% to 20% or as trading income taxed progressively from 20% to 45% depending on classification;

- Spain: Forex and CFD profits are taxed as savings income under IRPF and collected by the Agencia Tributaria, with progressive capital gains rates of 19% up to €6,000, 21% to €50,000, 23% to €200,000, 27% to €300,000, and 30% above €300,000;

- Germany: Forex profits are taxable investment income administered by Bundeszentralamt für Steuern and subject to 25% capital gains tax plus 5.5% solidarity surcharge, resulting in an effective rate of about 26.375%, higher if church tax applies;

- France: Forex profits are taxable and handled by Direction Générale des Finances Publiques (DGFiP), typically under the PFU flat tax regime at a total rate of about 30% including income tax and social contributions;

- Canada: Forex gains are taxed by the Canada Revenue Agency (CRA) either as capital gains where 50% of profit is taxable, or as business income taxed at full marginal rates which vary by province and can exceed 45%;

- Russia: Forex income is taxable personal income supervised by the Federal Tax Service of Russia, generally at a flat 13% for residents and 15% for high incomes, with local brokers often acting as tax agents;

- South Korea: Forex profits are included in taxable income and collected by the National Tax Service (NTS) with progressive combined tax rates including local surtax ranging approximately from 6.6% up to 49.5%;

- India: Forex trading profits are taxable under Indian income tax law and administered by the Income Tax Department of India, with personal income tax rates ranging from 5% to 30% plus applicable surcharges and cess;

- United Arab Emirates: Individual forex trading profits are currently tax-free with 0% personal income tax under Federal Tax Authority (FTA) rules, while corporate trading activities may fall under the 9% corporate tax regime;

- Singapore: Forex profits may be taxable as personal or business income depending on trading behavior, administered by IRAS, with progressive personal income tax rates from 0% up to 22%;

- Cyprus: Corporate forex profits are taxed at 12.5% and regulated by the Cyprus Tax Department, one of the lowest rates in the European Union;

- South Africa: Forex profits are taxed as income or capital gains and enforced by SARS, with personal income tax brackets ranging from 18% to 45% and effective capital gains rates up to about 18%;

- Australia: Forex trading profits are treated as taxable income and collected by the Australian Taxation Office (ATO), with personal tax rates ranging from 0% to 45% plus Medicare levy;

- United States: Forex profits are taxable and reported to the Internal Revenue Service (IRS) under Section 988 (ordinary income) or Section 1256 (capital gains, if elected);

- Cyprus: Corporate forex profits are taxed at 12.5 percent and regulated by the Cyprus Tax Department.

What is the Maximum Trading Leverage in International Forex Brokers?

The maximum trading leverage offered by Forex brokers heavily depends on the regulatory framework under which they operate. In the European Union and Australia, retail leverage is capped at 1:30. In the United States, the maximum allowable leverage for major currency pairs is 1:50. In offshore jurisdictions with fewer regulatory restrictions, leverage can extend as high as 1:5000.

Below are international brokers that provide some of the highest leverage options in the global Forex market:

Broker | Maximum Leverage |

Exness | 1:Unlimited |

JustMarkets | 1:3000 |

AMarkets | 1:3000 |

HFM | 1:2000 |

RoboForex | 1:2000 |

FBS | 1:2000 |

LiteFinance | 1:1000 |

NordFX | 1:1000 |

PU Prime | 1:1000 |

AvaTrade | 1:400 |

What Are the Best Forex Trading Platforms to Trade in International Brokers?

There are many trading platforms that international traders can use to trade currency pairs in Forex brokers but these are the best available options:

MetaTrader 4 (MT4)

MetaTrader 4 is the most widely used Forex trading platform, supporting advanced charting, technical indicators, Expert Advisors, and automated trading via MQL4. It integrates with ECN and STP brokers, offers fast execution, VPS compatibility, and supports hedging, scalping, and algorithmic strategies.

MetaTrader 5 (MT5)

MetaTrader 5 extends MT4 with multi-asset trading, Depth of Market, economic calendar, and multi-threaded Strategy Tester. Built on MQL5, MT5 provides improved order management, faster execution, and native support for netting and hedging systems.

TradingView

TradingView is a cloud-based trading and charting platform featuring institutional-grade charts, Pine Script automation, social trading, real-time data, and direct broker connectivity.

Its browser-based architecture enables seamless trading across devices with professional analytics tools.

NinjaTrader

NinjaTrader specializes in advanced order flow analysis, volumetric indicators, and futures-focused execution.

With NinjaScript automation, professional analytics, and high-performance infrastructure, it serves quantitative and proprietary traders through international brokers.

cTrader

cTrader is an ECN trading platform offering Level II pricing, low-latency execution, FIX API connectivity, advanced charting, and automated trading via cAlgo. It is optimized for brokers delivering institutional-grade execution and liquidity access.

Forex Trading Comparison in Various Countries

The table below offers a detailed look at the Forex trading conditions of well-established countries.

Comparison Factor | ||||

Primary Regulator | Federal Financial Supervisory Authority (BaFin) | Comisión Nacional del Mercado de Valores (CNMV) | CFTC and NFA | Australian Securities and Investments Commission (ASIC) |

Regulatory Framework | EU-wide MiFID II and ESMA compliance | National CNMV framework aligned with EU MiFID II and ESMA | Commodity Futures Trading Commission and National Futures Association | National regulatory framework under ASIC |

Retail Leverage Cap (Forex Majors) | 1:30 | 1:30 | 1:50 | 1:30 |

Investor Protection Level | Very high | Very high | High | High |

Negative Balance Protection | Mandatory | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Mandatory | Mandatory under CySEC / MiFID rules | Mandatory | Required under ASIC rules |

Broker Transparency Requirements | Strict EU disclosure rules | Strict EU disclosure rules (CNMV advertising restrictions 2023) | Strict reporting, disclosure, and conduct standards | Licensing and conduct rules under ASIC |

Broker Availability | Broad EU access via passporting | CNMV-licensed brokers plus EU brokers via MiFID II passporting | Domestic brokers | ASIC licensed brokers |

Access to International Brokers | High via EU passporting | High via EU passporting | No | Yes |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView, NinjaTrader | MT4, MT5, cTrader, TradingView, NinjaTrader | MT4, MT5, TradingView, proprietary apps | MT4, MT5, cTrader, TradingView, NinjaTrader |

Maximum Loss Protection | Cannot lose more than deposit | Cannot lose more than deposit | Mandatory for retail traders | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Capital gains tax with limited offsets | Capital gains tax under IRPF progressive system | Variable, up to 37% | Generally treated as assessable income, reported to ATO |

Conclusion

TradingFinder experts reviewed the best international Forex brokers and have concluded that IC Markets, HFM, Exness, TMGM, Fusion Markets, FxPro, and Eightcap are the best available options.

Traders now must compare the account types (Standard, Raw, ECN, etc.) spreads (from 0.0 pips), commissions, deposit and withdrawal methods, and customer support to choose the best broker based on their trading needs.

All brokers have been thoroughly evaluated based on Forex methodology.