SEBI (Securities and Exchange Board of India) is the regulatory body overseeing India’s financial markets since 1988. Its primary mission is to protect investors, promote transparency, and ensure fair trading practices. The SEBI-registered brokers are committed to maintaining a trustworthy trading environment by adhering to strict regulations.

With the rise in disposable income and growing interest in Forex trading, Indian traders increasingly rely on SEBI-regulated brokers. These brokers offer a wide range of currency pairs and comply with SEBI’s stringent guidelines. In the next section, we will review the best brokers that cater to the needs of algo traders in India.

| HFM | |||

| XM Group | |||

| alpari | |||

| 4 |  | fpmarkets | ||

| 5 |  | FXTM | ||

| 6 |  | FBS | ||

| 7 |  | instaforex | ||

| 8 |  | HYCM | ||

| 9 |  | GLOBAL PRIME | ||

| 10 |  | FXCM |

SEBI Brokers Ranked by Trustpilot

Trustpilot ratings provide a clear picture of customer satisfaction with SEBI-regulated brokers. Brokers with higher ratings, such as those scoring 4.7 and above, are recognized for their reliability and positive user feedback, which is essential for traders seeking trustworthy platforms.

On the other hand, brokers with lower ratings, around 2.4 to 2.6, may need improvements in customer service or overall user experience. In the following section, we will explore the top-rated SEBI-regulated brokers that stand out for their reliability.

Broker | Trustpilot Rating | Number of Reviews |

9,750 | ||

Global Prime | 408 | |

HFM | 3,179 | |

FXCM | 818 | |

FBS | 8,536 | |

2,940 | ||

FXTM | 1,078 | |

InstaForex | 464 | |

HYCM | 137 | |

No Alpari Trustpilot rating due to breach of guidelines | 301 |

SEBI Brokers’ Minimum Spreads

When choosing a SEBI-regulated broker, the minimum spread is a crucial factor for cost-effective trading. Brokers like FP Markets, HFM, and Alpari offer competitive spreads starting from as low as 0.0 pips, while others such as FXCM and Saxo have slightly higher spreads, offering traders more flexibility in choosing their ideal platform.

Broker | Min. Spread |

FP Markets | 0.0 Pips |

HFM | 0.0 Pips |

Alpari | 0.0 pips |

Vantage | 0.0 Pips |

0.0 Pips | |

FxPro | 0.0 Pips |

0.2 Pips | |

Saxo | 0.4 Pips |

XM Group | 0.6 Pips |

0.7 Pips |

Non-Trading Fees in SEBI Brokers

Non-trading fees, such as deposit, withdrawal, and inactivity charges, vary across SEBI-regulated brokers. Brokers like Global Prime and Saxo offer zero fees for deposits, withdrawals, and inactivity. However, other brokers may charge fees, such as 1% withdrawal fees or monthly inactivity fees ranging from $10 to $50.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Global Prime | $0 | $0 | $0 |

Saxo | $0 | $0 | $0 |

FP Markets | $0 | Up to 1% | $0 |

$0 | $0 | $10/month | |

Eightcap | $0 | $0 | $10/month |

XM Group | $0 | $0 | $10/month |

HYCM | $0 | $0 | $10/month |

IG | 1% charge for Visa and 0.5% charge for MasterCard | $0 | $18/month |

$0 | Up to 2.5% + $3.5 | €5/month | |

FXCM | $0 | Up to $40 | $50/year |

Number of Trading Instruments in SEBI Brokers

SEBI-regulated brokers offer a wide range of tradable instruments, from the forex market and stocks to commodities and indices. Brokers like Saxo lead with over 71,000 instruments, while others like Global Prime provide around 150. The variety of offerings allows traders to choose platforms that best match their trading strategies.

Broker | Tradable Instruments |

Saxo | 71,000+ |

IG | 17,000+ |

FXCM | 13,000+ |

FxPro | 2,100+ |

XM Group | 1,400+ |

Alpari | 750+ |

FBS | 550+ |

340+ | |

InstaForex | 340+ |

150+ |

Top 8 SEBI Forex Brokers

In India, SEBI (Securities and Exchange Board of India) regulation ensures that brokers adhere to high standards of fairness and transparency. Traders looking to operate in a secure environment often prefer SEBI-regulated brokers.

Below, we explore top brokers such as FP Markets, Global Prime, and FXTM, known for their strong regulatory frameworks, competitive spreads, and advanced trading platforms.

FP Markets

FP Markets, established in 2005, is an Australian-based Forex broker offering multi-regulated trading conditions. With oversight from top-tier authorities like ASIC and CySEC, FP Markets provides a secure and transparent environment for traders, offering access to a wide range of financial instruments.

The broker offers two main account types: Standard and RAW, catering to both beginner and experienced traders, both available after completing the FP Markets registration process.

With a low minimum deposit requirement of $50, FP Markets makes it accessible for traders to enter the market. The broker provides competitive spreads starting from 0.0 pips and offers leverage of up to 1:500. FP Markets deposit and withdrawal methods include credit cards, PayPal, Neteller, Skrill, and more.

FP Markets provides various trading platforms such as MT4, MT5, and cTrader, enabling users to tailor their trading experience. The broker also supports algorithmic and copy trading through platforms like Social Trading and Expert Advisors, offering flexibility for automated traders.

FP Markets is known for its commitment to client safety, with segregated funds, negative balance protection, and industry-leading regulatory compliance. The company also offers a diverse range of educational materials, catering to both novice and advanced traders seeking to enhance their market knowledge.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros and Cons

When evaluating a broker, understanding both its advantages and potential drawbacks is essential. FP Markets offers a solid array of benefits, such as top-tier regulation, low spreads, various account options, and a comprehensive FP Markets rebate program.

Pros | Cons |

Regulated by top-tier authorities (ASIC, CySEC) | Not available for U.S. clients |

Offers tight spreads from 0.0 pips | No proprietary trading platform |

Multiple account types to suit all traders | No significant bonuses or promotions |

Supports algorithmic and copy trading | Limited educational materials compared to competitors |

Global Prime

Global Prime, founded in 2010, is an Australian-based broker offering competitive trading conditions, including raw spreads from 0.0 pips and no commissions. Regulated by ASIC and VFSC, it ensures a secure trading environment with over 150 financial instruments available, catering to both novice and experienced traders.

With account types such as Standard and Raw, Global Prime allows for high leverage, up to 1:500, and offers a low minimum deposit requirement. The broker provides multiple payment methods, including crypto, PayPal, and bank transfers, ensuring seamless deposits and withdrawals with no commission fees, all available after completing the Global Prime registration process.

Global Prime utilizes the MetaTrader 4 platform for efficient market execution, supporting various trading strategies such as scalping and hedging. The broker also offers additional services like Autochartist trading signals and Social Trading via ZuluTrade, enhancing traders’ ability to follow market trends and share strategies.

Customer safety is prioritized through segregated accounts and negative balance protection. Global Prime offers 24/7 support through multiple channels, ensuring that traders can access assistance whenever needed. The broker’s global coverage, combined with its regulatory compliance, makes it a reliable choice for traders worldwide.

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | $0 |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

The broker offers many advantages such as low spreads, high leverage, the Global Prime rebate program, and solid regulation, making it an attractive option for traders. However, there are a few drawbacks, including limited platform options and restricted access for clients from certain countries.

Pros | Cons |

Regulated by reputable authorities (ASIC, VFSC) | MT4 is the only supported platform for now |

Competitive trading conditions and low spreads | Restricted access for traders from certain countries |

24/7 customer support | Relatively low maximum leverage (1:500) |

Segregated client funds for enhanced security | Lack of frequent trading bonuses or promotions |

FXCM

FXCM (Forex Capital Markets) is a global, multi-regulated Forex broker with over 20 years of experience. Regulated by authorities such as FCA, ASIC, CySEC, and FSCA, FXCM offers a secure trading environment with platforms like MT4, TradingView, and TradeStation.

It provides a wide range of financial instruments, including forex, CFDs, indices, commodities, and cryptocurrencies.

With account types tailored to various traders’ needs, such as CFD, Active Trader, and Corporate accounts, FXCM ensures flexibility. The broker offers high leverage options, up to 1:1000, and low spreads, starting from 0.2 pips, all available after completing the FXCM registration process. FXCM supports traders through advanced trading tools and a comprehensive range of educational resources.

The broker’s commitment to security is evident with segregated accounts, negative balance protection, and investor compensation under specific regulations. FXCM also offers various trading features, including demo accounts, Islamic accounts, and an affiliate program, ensuring an inclusive and well-rounded experience for all types of traders.

FXCM’s leadership under CEO Brendan Callan and its positive industry recognition further solidify the broker's position as a reliable choice in the online trading world. Despite facing regulatory setbacks, FXCM remains a strong presence in global markets.

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

FXCM Pros and Cons

FXCM offers significant advantages such as strong regulation, competitive spreads, the FXCM rebate program, and advanced trading platforms. However, there are a few downsides, such as a history of regulatory issues and high withdrawal fees. Here’s a breakdown of FXCM’s pros and cons:

Pros | Cons |

Multi-regulated with top-tier authorities (FCA, ASIC, CySEC) | History of regulatory issues (CFTC fine) |

High leverage up to 1:1000 and low spreads | Inactivity fee ($50 per year) |

Offers multiple advanced trading platforms | $40 withdrawal fee for bank transfers |

Diverse range of tradable instruments | Limited customer support availability (24/5) |

FBS

FBS is a well-established Forex broker with over 27 million users worldwide. Founded in 2009, the company is regulated by CySEC and the FSC, ensuring a secure and transparent trading environment. FBS offers more than 550 tradable instruments across Forex, commodities, stocks, and cryptocurrencies, catering to a wide range of traders.

The broker provides an intuitive mobile app with access to over 90 technical indicators for a seamless trading experience and a smooth FBS registration process. FBS offers floating spreads starting from 0.7 pips, with no additional trading commissions. It supports multiple platforms, including MT4, MT5, and its proprietary mobile app, making it accessible for both beginner and experienced traders.

FBS's commitment to customer safety is evident with features such as segregated accounts and negative balance protection. The company also provides a range of investment options, including automated trading and Islamic accounts, for a flexible trading experience. With 24/7 customer support, FBS is focused on providing reliable service to its clients worldwide.

Despite regulatory restrictions in some countries, FBS has successfully built a solid reputation, especially in Europe and Asia. The broker is known for its fast execution speeds, the comprehensive FBS dashboard, and a user-friendly platform, making it a preferred choice for many traders.

Account Types | Standard |

Regulating Authorities | FSC, CySEC |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfers, Skrill, Neteller, Sticpay, PerfectMoney, Fasapay, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Skrill, Neteller, Sticpay, Credit/Debit Cards |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

FBS Pros and Cons

FBS provides a robust trading environment with several advantages, including a low minimum deposit, the FBS rebate program, and strong customer support. However, there are some limitations, such as its lack of copy trading services and the restrictions in several countries. Here's a quick breakdown of the pros and cons:

Pros | Cons |

Low minimum deposit requirement ($5) | No copy trading services currently available |

Regulated by CySEC and FSC | Limited account types (only one option now) |

Fast order execution (0.01 seconds) | Restricted in certain countries (US, UK, EU) |

User-friendly mobile app with 90+ technical indicators | No major bonuses or promotions |

XM Group

XM Group, founded in 2009, is a well-established broker offering a wide range of financial instruments, including over 55 currency pairs and 1,200+ stock CFDs. With a global presence and regulation by top-tier authorities like CySEC, FSC Belize, and FSCA South Africa, XM ensures a secure and reliable trading environment for its 15+ million clients.

The broker offers a smooth XM Group registration process with access to several account types, such as Standard, Ultra Low, and Shares accounts, leverage options up to 1:1000 and a low minimum deposit requirement of $5. XM Group provides access to popular trading platforms like MT4, MT5, and its proprietary mobile app, making it accessible to traders across various devices.

XM Group’s commitment to security is evident with segregated client funds, negative balance protection, and regular audits. The broker also supports automated trading through Expert Advisors (EAs) and offers a variety of deposit and withdrawal methods, ensuring convenience and flexibility for clients around the world.

Known for its fast execution speeds, a feature-rich XM Group dashboard, and competitive spreads starting from 0.6 pips, XM Group provides traders with the necessary tools and features for a successful trading experience. Despite some country restrictions, XM continues to grow in popularity due to its strong regulatory framework and solid client support.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Seychelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Group Pros and Cons

XM Group offers significant benefits such as a low minimum deposit, the XM Group rebate program, high leverage, and a wide range of financial instruments. However, there are certain drawbacks, including inactivity fees and restrictions in several countries.

Pros | Cons |

Low minimum deposit requirement ($5) | Inactivity fee ($10/month after 3 months of inactivity) |

Wide range of trading instruments (1,400+ assets) | Restrictions in certain countries (e.g., USA, Canada) |

High leverage options up to 1:1000 | No proprietary copy trading service |

Multiple regulated entities (CySEC, FSC, DFSA) | Only 3 account types available |

FXTM

FXTM (ForexTime), established in 2011, is a highly regarded Forex broker known for its high leverage options and competitive spreads. Headquartered in Mauritius, FXTM operates globally, offering services to clients across more than 150 countries.

With over 1 million users, the broker provides a diverse selection of trading instruments, including 1,000+ assets, from forex pairs to commodities, stocks, and cryptocurrencies.

FXTM offers several account types, such as Advantage, Advantage Plus, and Stocks Advantage, catering to different trading styles and experience levels. The broker supports popular platforms like MT4, MT5, and its proprietary FXTM Trader App, enabling traders to access advanced trading tools and stay connected on the go.

With spreads starting from 0.0 pips and leverage up to 1:3000, FXTM is ideal for traders looking for flexibility and high-risk reward strategies. FXTM deposit and withdrawal methods include credit cards, cryptocurrencies, Skrill, and many more.

As a regulated entity under Mauritius’ FSC, FXTM provides a secure trading environment with segregated funds and a negative balance protection policy for some accounts.

While the broker’s offerings include copy trading and Islamic accounts, it has faced regulatory challenges, limiting its services in certain countries, including the USA, Japan, and Canada.

Despite these limitations, FXTM’s low minimum deposit of $200, fast execution, and a broad range of tradable instruments make completing the FXTM registration process a good option.

Account Types | Advantage, Stocks Advantage, Advantage Plus |

Regulating Authorities | FSC |

Minimum Deposit | $200 |

Deposit Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Withdrawal Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, FXTM Trader App |

FXTM Pros and Cons

FXTM provides several advantages, such as high leverage, competitive spreads, the FXTM rebate program, and a wide range of account types. However, some drawbacks include a lack of regulation in some regions and higher minimum deposit requirements compared to other brokers.

Below is a breakdown of FXTM’s pros and cons:

Pros | Cons |

High leverage options (up to 1:3000) | Only one regulation (FSC Mauritius) |

Competitive spreads starting from 0.0 pips | Limited cryptocurrency offerings |

Multiple account types for different traders | Higher minimum deposit compared to some brokers |

Copy trading and Islamic account options | No U.S. clients accepted |

HFM

HF Markets, also known as HotForex, is a globally recognized Forex broker with a strong reputation in the financial industry. Established in 2010, it operates under multiple licenses from respected regulators, including CySEC, FCA, and the FSCA.

HF Markets offers four account types, catering to various trading needs: Cent, Zero, Pro, and Premium, all available after completing the HFM registration process. These accounts come with competitive spreads, starting from 0.0 pips, and leverage options up to 1:2000, depending on the jurisdiction.

The broker also supports trading on popular platforms such as MT4, MT5, and its proprietary mobile app, ensuring flexibility and ease of use for traders on the go. Traders can also use the HFM copy trading service to trade alongside top players in the market.

HF Markets prides itself on providing a secure and transparent trading environment, with features like negative balance protection, segregated client funds, and a comprehensive suite of educational resources. With a minimum deposit as low as $0, the broker offers access to a diverse range of financial markets, making it an attractive choice for traders at all levels of experience.

The broker's global presence is further enhanced by its multiple offices in regions such as Cyprus, South Africa, Dubai, and Seychelles, serving a wide range of clients. However, some country restrictions do apply, and the broker is not available in markets like the U.S. and certain parts of Canada.

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Deposit | From $0.0 |

Deposit Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Withdrawal Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

HFM Pros and Cons

HF Markets offers a robust set of features, from competitive spreads to a wide array of trading instruments and a HFM rebate program. However, it does come with some limitations, such as country restrictions and occasional technical issues.

Pros | Cons |

Multi-regulated with licenses from CySEC, FCA, and FSCA | Geo-restrictions in certain countries |

Wide range of trading instruments and account types | Limited platform offerings compared to some brokers |

Competitive spreads and high leverage options | Reports of occasional technical issues |

Swap-free accounts and PAMM account options available | Limited customer support hours on weekends |

InstaForex

InstaForex is a global multi-asset broker that has been operational since 2007. Headquartered in St. Vincent and the Grenadines, the company is regulated by the British Virgin Islands Financial Services Commission (BVIFSC), offering services to millions of traders around the world.

Known for its early adoption of MetaTrader 4 and pioneering innovations like the PAMM system, InstaForex provides trading access to a wide range of markets, including Forex, stocks, commodities, cryptocurrencies, and indices.

With over 7 million clients and a reputation for competitive leverage of up to 1:1000, InstaForex caters to both new and experienced traders. It offers several account types, including Cent, Insta.Standard, Insta.Eurica, and Cent.Eurica accounts.

The broker provides flexible deposit and withdrawal options such as bank transfers, credit cards, and cryptocurrencies, all available after completing the InstaForex registration process. Despite its global presence, InstaForex operates under tier-3 regulation, which may be a consideration for traders seeking higher levels of regulatory oversight.

Account Types | Insta.Standard, Insta.Eurica, Cent.Standard, and Cent Eurica |

Regulating Authorities | BVI FSC |

Minimum Deposit | $1 |

Deposit Methods | Crypto, Bank Transfer, E-payment Systems, Credit/Debit Cards |

Withdrawal Methods | Crypto, Bank Transfer, Skrill, Neteller, Webmoney, Credit/Debit Cards |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

InstaForex Pros and Cons

InstaForex is widely recognized for its attractive promotions, including deposit bonuses and trading contests, and offers a range of educational resources to help traders improve their skills.

However, traders should be aware of certain restrictions in place for specific regions due to regulatory requirements.

Pros | Cons |

Wide range of trading instruments | No high-tier regulation |

Competitive spreads and high leverage | Limited platform offerings |

Multiple account types for different needs | Geo-restrictions in several countries |

Popular trading platforms (MT4, MT5) | No compensation scheme |

Swap-free accounts available | Limited customer support during weekends |

The Important Factors in Selecting the Best SEBI Brokers

When choosing the best SEBI Forex broker, it’s crucial to consider factors like regulation, customer service, trading platforms, fees, and available trading instruments.

SEBI-registered brokers are held to strict standards, ensuring client protection and transparency. A trusted broker will offer a wide range of tradable instruments, tight spreads, and leverage options while maintaining compliance with Indian regulations.

Another critical factor is the broker’s platform offerings. SEBI brokers typically support MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which cater to various trading styles. Additionally, the availability of different account types can help traders select an option suited to their needs, whether they are beginners or experienced traders.

- Regulatory Compliance: Ensure the broker is SEBI-registered;

- Platform Options: Look for MT4, MT5, or cTrader support;

- Account Types: Choose a broker offering various account options.

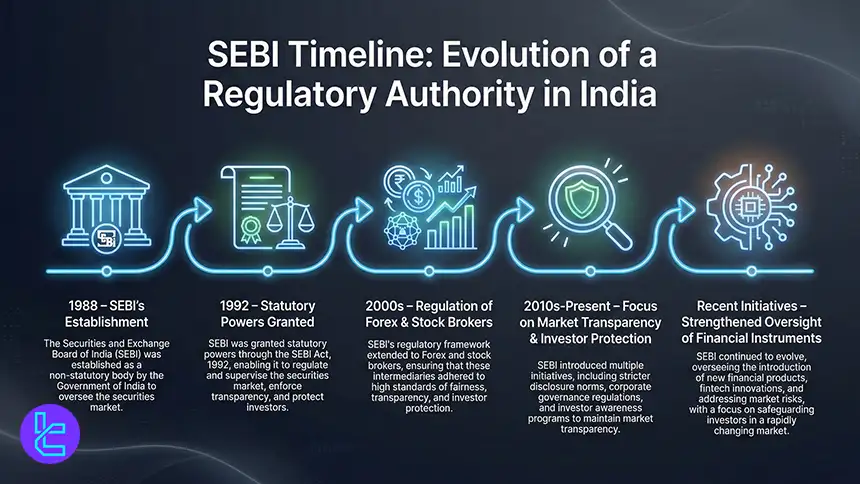

What is SEBI?

The Securities and Exchange Board of India (SEBI) is the primary regulatory authority overseeing the securities market in India. Established in 1988, SEBI was given statutory powers in 1992 to ensure investor protection, fair trading practices, and the development of the securities market.

The SEBI Act allows SEBI to regulate Forex and stock brokers in India, making it a crucial entity for Indian traders. SEBI’s regulatory framework aims to enhance market transparency and safeguard the interests of investors.

The authority has offices across India and is directly accountable to the Ministry of Finance. It oversees market intermediaries, brokers, and ensures that financial instruments are offered with full transparency to protect Indian investors in the financial markets.

What Are the SEBI Requirements for Forex Brokers?

Forex brokers in India are required to meet specific SEBI requirements to operate legally within the country. They must register as Foreign Institutional Investors (FII) or sub-accounts and adhere to the Foreign Exchange Management Act (FEMA).

SEBI also mandates that brokers offer only specific currency pairs involving the Indian Rupee (INR) for Forex trading. Additionally, SEBI-registered brokers must maintain transparency in their operations, ensuring proper disclosures of fees, commissions, and financial statements.

Compliance with these regulations ensures that traders are protected from fraudulent activities, and their funds are kept secure. SEBI’s oversight guarantees that brokers follow ethical practices in providing services to Indian traders.

- SEBI Registration: Brokers must be registered with SEBI as FII or sub-accounts;

- Currency Pairs: Only INR-based pairs and specific foreign currency pairs allowed;

- Transparency: Brokers must provide clear information on fees and commissions.

Does SEBI Mandate Negative Balance Protection?

SEBI’s regulations ensure that Forex brokers in India provide some level of protection to traders, including negative balance protection.

This important safety measure ensures that traders cannot lose more than the funds they have deposited into their trading accounts. Negative balance protection is especially crucial for traders using leverage in volatile market conditions.

However, it’s essential for traders to confirm that their chosen broker offers negative balance protection, as it may vary based on the account type and broker. This protection is a key factor in mitigating risk and safeguarding traders from incurring debts beyond their initial investments.

SEBI Safety Protocols for Forex Brokers

SEBI ensures that Forex brokers operating in India comply with stringent safety protocols. These protocols include segregating client funds from operational funds, which ensures that clients’ money is not used for broker expenses. This prevents any misuse of funds and provides traders with peace of mind that their money is secure.

Additionally, SEBI-regulated brokers must implement strong risk management practices and adhere to transparency standards in their operations. Regular audits and compliance checks ensure that brokers remain accountable and follow all legal and ethical guidelines. These practices provide a secure and transparent environment for traders.

- Segregated Accounts: Client funds are kept separate from operational funds;

- Risk Management: Brokers must adopt robust risk management practices;

- Regular Audits: Brokers undergo periodic audits to ensure compliance with SEBI regulations.

Are SEBI Registered Brokers Safe?

Yes, SEBI-registered Forex brokers are generally safe, as they must follow strict regulatory guidelines. These brokers are required to provide a secure trading environment, including features like segregated accounts, transparent reporting, and compliance with risk management standards.

Additionally, they are held accountable for their actions, offering a higher level of protection for traders.

However, it’s still essential to verify the broker’s SEBI registration and ensure they are compliant with the latest regulations. Traders should also evaluate the broker’s reputation, reviews, and history to ensure a smooth and secure trading experience.

Trading Tax for SEBI Regulated Brokers

In India, profits from Forex trading with SEBI-registered brokers are subject to income tax, classified as either business income or capital gains depending on the trading activity’s nature. While Goods and Services Tax (GST) is not levied on trading profits, it is applicable to brokerage services and related financial transactions.

Traders should also be aware of the possibility to offset trading losses against other capital gains, which can reduce the tax burden. It’s essential to keep track of your trades and consult with a tax professional to stay compliant with the latest tax regulations related to Forex trading.

- Income Tax: Forex trading profits are taxable under Indian laws;

- Offset Losses: Losses can be offset against other capital gains;

- Consult Tax Professional: It’s crucial to stay updated with changing tax regulations.

How Can I Check if a Broker is Registered with SEBI?

To check if a broker is registered with SEBI, look for their SEBI registration number, which is often listed on their website, usually in the footer or intermediary section. You can also visit SEBI’s official website to search the register of authorized brokers and verify their registration.

Traders should never sign up with a broker unless they have verified their SEBI registration. This ensures the broker complies with regulatory standards and provides a safe trading environment. Always verify the broker’s name and registration details to avoid potential fraud.

- SEBI Registration Number: Check for the number listed on the broker’s website;

- SEBI’s Register: Visit SEBI’s official site to verify the broker’s registration;

- Verify Before Trading: Always confirm the registration status before committing.

Tradable Markets in SEBI Brokers

SEBI-regulated brokers primarily offer trading in currency derivatives, stock CFDs, and a few select commodities. However, Forex trading in India is restricted to INR-based currency pairs and specific foreign currency pairs due to SEBI and RBI regulations.

SEBI brokers also offer trading in equities, indices, and a variety of financial instruments within the legal framework.

While traders have limited access to global Forex markets, they can still trade within SEBI’s guidelines through Indian exchanges. These brokers often offer additional services like trading signals, educational resources, and demo accounts to enhance the trading experience.

Is Crypto Trading Allowed in SEBI Forex Brokers?

Crypto trading is not permitted by SEBI for Forex brokers in India, as it remains a grey area in the country’s financial regulations. While SEBI regulates Forex and securities markets, cryptocurrencies fall under the jurisdiction of the Reserve Bank of India (RBI), which has issued advisories against trading them.

As such, SEBI-regulated Forex brokers do not provide cryptocurrency trading. However, traders can explore international brokers that offer cryptocurrency services, although caution is advised when using offshore platforms.

- No Crypto Trading: SEBI-regulated brokers do not offer cryptocurrency trading;

- RBI Restrictions: The RBI restricts cryptocurrency trading within India;

- Offshore Brokers: Some international brokers offer crypto trading options.

SEBI vs Other Regulatory Authorities

SEBI is India’s primary regulatory body, but it differs from other global financial regulators like the FCA (UK), ASIC (Australia), and CySEC (Cyprus) in its focus on Indian market compliance. SEBI regulations cater specifically to Indian investors, limiting leverage and tradable Forex pairs, while other authorities may offer broader market access and higher leverage.

While SEBI ensures investor protection in India, international regulators may allow more flexibility for global traders. It’s important for traders to consider these differences when selecting a broker.

Parameter | SEBI (India) | MAS (Singapore) | CySEC (Cyprus) | ASIC (Australia) |

Minimum Capital Requirement | ₹1M | $1 million SGD | €750,000+ depending on firm type | Between AU$500,000 and AU$1,000,000 |

Client Fund Segregation | Required | Required | Required | Required |

Compensation Scheme | No | No | Investor Compensation Fund (~€20,000) | Investor Compensation Fund (AU$10,000) |

Leverage Limits | 1:50 | 1:30 | Set under MiFID (often 1:30 for retail in EU) | 1:30 |

Negative Balance Protection | Required | Required | Often required | Required |

Reporting & Audits | Ongoing financial reporting | Ongoing financial reporting | Ongoing financial reporting | Ongoing financial reporting |

Conclusion and Expert Suggestions

SEBI-regulated Forex brokers offer a secure and transparent trading environment for Indian traders. These brokers adhere to strict regulatory guidelines that ensure investor protection and promote market fairness. With brokers like FP Markets, FXCM, and HFM offering competitive spreads, high leverage, and robust trading platforms, traders are well-equipped to engage in Forex trading with confidence.

Traders should consider various factors when choosing a SEBI-regulated broker, including fees, customer service, and available trading instruments. Platforms offering MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader are particularly favored for their advanced trading capabilities.

To assist in selecting the best brokers, TradingFinder's Forex Methodology evaluates and ranks brokers based on their regulatory compliance, platform features, spreads, and customer feedback. This comprehensive methodology helps traders make informed decisions, ensuring a secure and successful trading experience with the best SEBI brokers.