WebMoney is a universal payment system that has been active since 1998 and provides services to over 45 million traders. Many traders use this e-wallet to deposit and withdraw funds from their Forex broker with minimal costs (0.8% per transaction).

The list below contains the best available Forex brokers for traders who prefer using this payment method to top-up or cash-out funds from their trading accounts.

| Fusion Markets | |||

| PUPrime | |||

| IronFX | |||

| 4 |  | FxOpen | ||

| 5 |  | Trader’sway | ||

| 6 |  | Nord FX | ||

| 7 |  | FPMarkets | ||

| 8 |  | VT Markets |

WebMoney Forex Brokers Ranked by Trustpilot Reviews

Traders can check the trustworthiness of Forex brokerage by checking the scores and reviews of other traders in the Trustpilot website. Here are the ratings and number of reviews for the best Forex Brokers that offer WebMoney payments.

Broker Name | Trustpilot Rating | Number of Reviews |

FP Markets | 9800+ | |

5900+ | ||

Trader’s Way | 60+ | |

2200+ | ||

NordFX | 80+ | |

PU Prime | 1700+ | |

FxOpen | 400+ | |

IronFX | 700+ |

Forex Brokers Fees in WebMoney Payments

Traders must consider the top-up and cashout fees when using WebMoney in the top Forex brokers.

Broker Name | Deposit Fee | Withdrawal Fee |

Fusion Markets | $0 | $0 |

$0 | $0 | |

Tickmill | $0 | $0 |

TMGM | $0 | $0 |

XTB | 1% | 0$ for Withdrawals Above $50 |

$0 | $0 (%3 if you don’t place a trade) | |

FXTM | $0 | 2% |

eToro | $0 | $5 |

Forex Brokers WebMoney Deposit/Withdrawal Time

Based on the broker’s policies, the handling time for WebMoney transactions, differs from one broker to another. Here are the WebMoney processing times in the top Forex brokers.

Broker Name | Deposit Time | Withdrawal Time |

FXGlory | Instant | 1 to 24 hours |

Instant | 24 Hours | |

easyMarkets | Instant | 24 Hours |

ATFX | 30 Minutes | 24 Hours |

Go Markets | Instant to 1–2 hours | 24 Hours |

A Few Minutes | 48 Hours | |

Fibo Group | Instant | Up to 3 days |

IC Markets | Instant | 3-5 Days |

Minimum Amount for WebMoney Deposits/Withdrawals in Brokers

Understanding the minimum required amount to transfer your funds in and out of the Forex broker via WebMoney is an essential for all traders.

Broker Name | Min. Deposit Amount | Min. Withdrawal Amount |

Global Prime | $0 | $0 |

Pepperstone | $0 | $1 |

FBS | $5 | $1 |

XM | $5 | $5 |

$10 | $0 | |

$50 | $5 | |

VT Markets | $50 | $40 |

AvaTrade | $100 | $0 |

Top 6 Forex Brokers Supporting WebMoney

WebMoney is one of the most used methods to deposit and withdraw funds from Forex brokers. Here are the best brokers that offer WebMoney transfers in addition to low spreads, reasonable commissions, various tradable instruments, fast customer support and multiple account types.

Fusion Markets

Fusion Markets is a multi-asset online broker regulated by the Australian Securities and Investment Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

Founded by Phil Horner, the company operates through Gleneagle Securities Pty Limited and FMGP Trading Group Pty Ltd, providing services to international clients with specific regional restrictions.

Its regulatory setup combines Tier-1 and Tier-3 oversight, which affects leverage limits and client protections depending on the operating entity. These entities require traders to comply with the KYC and AML laws by completing the Fusion Markets verification process.

The broker offers access to over 250 tradable instruments, including Forex currency pairs, indices, US share CFDs, commodities, metals, energy products, and cryptocurrencies. Trading is supported on MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Fusion Markets provides three main account options: Zero, Classic, and Swap-Free. The Zero account features raw spreads from 0.0 pips with fixed commissions, while the Classic account applies wider spreads with no commission.

No minimum deposit is required after completing the Fusion Markets registration. Client funds are held in segregated accounts with institutions such as HSBC and National Australia Bank.

Additional services in the Fusion Markets dashboard include copy trading via Fusion+ and DupliTrade, MAM/PAMM solutions, VPS hosting, and multiple fee-free deposit and withdrawal methods. Educational content is available mainly through written materials, with a limited structured learning framework.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, VISA, MasterCard, PayPal, Skrill, Neteller, Crypto, PayID, Interac, Binance Pay, WebMoney |

Withdrawal Methods | Bank Wire, PayPal, Skrill, Neteller, Crypto, Interac, Local Bank Transfer, WebMoney |

Maximum Leverage | Up to 1:500 (VFSC), up to 1:30 (ASIC retail clients) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, TradingView (Desktop, Web, iOS, Android) |

Fusion Markets Pros and Cons

The table below provides a list of the most important benefits and drawbacks of Fusion Markets as a WebMoney supporting broker.

Pros | Cons |

Ultra-low trading costs with raw spreads from 0.0 pips | No Investor Compensation Scheme under ASIC or VFSC |

No minimum deposit requirement across all account types | VFSC regulation classified as Tier-3 oversight |

Support for MetaTrader 4, MetaTrader 5, cTrader, and TradingView | No proprietary trading platform developed by Fusion Markets |

Commission-free US Share CFDs and broad Forex coverage | Limited total asset coverage compared to multi-asset brokers (250+ instruments) |

FP Markets

FP Markets, legally known as First Prudential Markets, is a Forex and CFD broker founded in 2005 and supervised by multiple regulators, most notably ASIC in Australia and CySEC in Cyprus.

Additional oversight is provided through SVG FSA, Seychelles FSA, FSCA, CMA, and FSC, with entity-specific protections such as fund segregation, regular audits, and negative balance protection to protect trader funds after finalizing their FP Markets verification.

Under CySEC, retail clients may qualify for the Investor Compensation Fund (ICF) coverage up to €20,000, while leverage varies by jurisdiction, ranging from 1:30 in ASIC and CySEC entities to higher ratios such as 1:2000, 1:3000, or 1:400 under offshore or regional branches.

The broker offers two core account structures, Standard and RAW, each requiring a $50 minimum deposit after finalizing account setup via FP Markets registration.

Standard pricing starts from 1.0 pips with $0 commission, while RAW spreads can start from 0.0 pips with a $3 commission per lot.

FP Markets supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, and provides access to a wide instrument catalog of 10,000 plus markets including Forex, share CFDs, indices CFDs, commodity CFDs, ETFs, metals, and cryptocurrencies.

Leadership is linked to Craig Allison, Head of Europe, Middle-East and Africa at FP Markets.

Besides WebMoney, this broker supports Visa, MasterCard, Bank Wired, Paypal, Skrill, and Neteller for both funding and payouts. To learn about the details of each method, check the FP Markets deposit and withdrawal article.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSCA, FSC, FSA (Seychelles), FSA (SVG), CMA |

Minimum Deposit | $50 |

Deposit Methods | Visa, MasterCard, Bank Transfer, PayPal, Skrill, Neteller, WebMoney |

Withdrawal Methods | Visa, MasterCard, Bank Transfer, PayPal, Skrill, Neteller, WebMoney |

Maximum Leverage | Up to 1:500 (varies by entity and client classification) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader (Desktop, Web, iOS, Android) |

FP Markets Pros & Cons

Traders must consider the following advantages and disadvantage of trading with FP Markets before opening an account with this broker.

Pros | Cons |

Regulation under ASIC and CySEC with multi-jurisdiction coverage | Not available to U.S. residents due to regulatory restrictions |

RAW account with spreads from 0.0 pips and transparent $3 commission | No proprietary trading platform developed by FP Markets |

Broad market coverage with 10,000+ instruments across Forex, CFDs, ETFs, and stocks | Investor Compensation Fund applies only under CySEC entity |

Support for MetaTrader 4, MetaTrader 5, and cTrader platforms | Leverage limits vary significantly across entities and regions (1:30 in EU) |

PU Prime

PU Prime is a Forex and CFD broker operating since 2016 and offering access to 800 plus instruments across six asset classes.

The broker runs a multi-entity structure that includes PU Prime Trading Pty Ltd under ASIC (license 410681), PU Prime Limited under Seychelles FSA (SD050), and additional supervision via the Financial Services Commission of Mauritius and the FSCA in South Africa (No. 52218).

Client funds are held in segregated bank accounts and the broker states negative balance protection is available across its entities. Leverage is entity-dependent, ranging from 1:30 under ASIC to up to 1:1000 in offshore or non-Australian branches.

PU Prime provides access to four main account types: Standard, Prime, ECN, and Cent. Pricing varies by account, with floating spreads from 0.0 pips on Prime and ECN, while Standard and Cent typically start from 1.3 pips.

The minimum deposit starts from $20, and the PU Prime deposit and withdrawal methods include card payments, wire transfers, e-wallets, and cryptocurrencies, with fee-free processing on most routes.

Trading is available via MetaTrader 4, MetaTrader 5, and the PU Prime app, and investment features include copy trading and social trading.

Some jurisdictions, including the USA, appear on the restricted list and traders from this region can’t complete their PU Prime verification.

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | ASIC, FSA (Seychelles), FSC (Mauritius), FSCA (South Africa) |

Minimum Deposit | $20 |

Deposit Methods | Credit Card, E-wallets, Cryptocurrencies, Wire Transfer, Local Bank Transfer, WebMoney |

Withdrawal Methods | Credit Card, E-wallets, Cryptocurrencies, Wire Transfer, Local Bank Transfer, WebMoney |

Maximum Leverage | Up to 1:1000 (1:30 under ASIC) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, PU Prime app, WebTrader |

PU Prime Pros and Cons

Check the table below to before opening an account with the PU Prime broker to understand its pros and cons.

Pros | Cons |

Multi-regulation including ASIC, FSCA, FSC, and FSA entities | Mixed trust scores on review platforms such as ForexPeaceArmy |

Four account types including Standard, Prime, ECN, and Cent | Offshore regulation via FSA (Seychelles) and FSC (Mauritius) classified as Tier-3 |

Floating spreads from 0.0 pips on Prime and ECN accounts | Investor compensation schemes are limited or entity-dependent |

Support for MetaTrader 4, MetaTrader 5, and proprietary PU Prime app | Not available to residents of restricted jurisdictions such as the USA |

IronFX

IronFX is a Forex and CFDs broker founded in 2010 that serves clients across a broad international footprint, with stated availability in 180 countries and a track record of 150 plus industry awards.

The broker provides access to 500+ tradable instruments across six asset classes, including Forex, metals, indices, commodities, futures, and shares. Trading is delivered primarily through MetaTrader 4 (MT4) on desktop, web, and mobile.

IronFX operates through different entities, including Notesco Financial Services Limited regulated by CySEC (License 125/10) and Notesco (BVI) Limited regulated by the British Virgin Islands FSC.

Under the CySEC entity, eligible clients may be covered by the Investor Compensation Fund up to €20,000, while leverage is capped at 1:30, compared with up to 1:1000 under the offshore entity.

Account offerings include Standard, Premium, VIP, and Live Zero Fixed Spread, with fixed and floating pricing, and commissions that may apply on zero-spread structures for traders who complete IronFX registration.

Funding methods typically include Visa, MasterCard, Skrill, Neteller, WebMoney, crypto options such as BTC and USDT, and bank wire.

Account Types | Standard, Premium, VIP, Live Zero Fixed Spread |

Regulating Authorities | CySEC, FCA, FSCA, ASIC, FSC (BVI) |

Minimum Deposit | $100 |

Deposit Methods | Visa, MasterCard, Skrill, Neteller, Crypto, USDT, Bank Wire, WebMoney |

Withdrawal Methods | Visa, MasterCard, Skrill, Neteller, Crypto, USDT, Bank Wire, WebMoney |

Maximum Leverage | Up to 1:1000 (1:30 under CySEC entity) |

Trading Platforms & Apps | MetaTrader 4 (Desktop, Web, iOS, Android) |

IronFX Pros and Cons

The table below contains the most important benefits and limitations of trading with the IronFX broker.

Pros | Cons |

Regulation under CySEC, FCA, ASIC, and FSCA across multiple entities | No MetaTrader 5 platform support, limited to MetaTrader 4 |

Wide range of account types including fixed, floating, and zero-spread structures | Higher average spreads on Standard, Premium, and VIP accounts |

Access to 500+ tradable instruments across Forex, CFDs, metals, indices, and shares | Offshore entity regulated by FSC (BVI) classified as low-tier oversight |

Copy trading available via the TradeCopier platform | Historical client complaints and reputational controversies |

FXOpen

FXOpen is an ECN-focused broker that began in 2003 as an educational project and has provided online trading services since 2005.

Client safeguards vary by entity, with ICF coverage up to €20,000 under CySEC and FSCS coverage up to £85,000 under the FCA, while leverage ranges from 1:30 in EU and Australia to 1:500 under the international branch.

The broker supports ECN, STP, and Micro accounts, with pricing that can start from 0.00 pips and commission structures that depend on the account model.

FXOpen registration enables trading across Forex, commodities, indices, cryptocurrencies, ETFs, and shares, and supports MetaTrader 4, MetaTrader 5, TickTrader, and TradingView.

FXOpen deposit and withdrawal methods, include Bank Transfer, Visa/MasterCard, Instant Bank Transfer, and e-wallets like WebMoney.

Minimum deposit can start from $1, and the order suite includes market, limit, stop, stop-limit, OCO, and Iceberg orders. PAMM accounts are available for managed or allocation-based strategies.

Traders can lower trading costs by using the FXOpen rebate services provided by the TradingFiner IB.

Account Types | ECN, STP, Micro |

Regulating Authorities | CySEC, FCA, ASIC, The Financial Commission |

Minimum Deposit | From $1 |

Deposit Methods | Bank Transfer, Visa/MasterCard, Instant Bank Transfer, E-Wallets |

Withdrawal Methods | Easy Bank Transfer, Visa/MasterCard, Wire Transfer, E-Wallets |

Maximum Leverage | Up to 1:500 (up to 1:30 under CySEC and ASIC) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TickTrader, TradingView |

FXOpen Pros and Cons

Understanding the advantages and disadvantages of FXOpen allows you to choose FXOpen as your WebMoney supporting broker with peace of mind.

Pros | Cons |

Regulation under CySEC, FCA, and ASIC with entity-based client protection | Investor compensation schemes not available under FXOPEN MARKETS LIMITED |

ECN execution model with direct interbank access and deep liquidity | Inactivity fee applied after 90 days of no trading activity ($10 per month) |

Support for MetaTrader 4, MetaTrader 5, TickTrader, and TradingView | TradingView integration does not support crypto trading or automation |

Very low entry barrier with Micro accounts from $1 minimum deposit | - |

Trader’s Way

TradersWay is a forex and CFD broker that has operated since 2011 and is headquartered in the Commonwealth of Dominica under TW Corp LLC.

The broker provides access to core markets such as Forex, metals, energies, and cryptocurrencies, and supports three third-party platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Account options on the Trader’s Way dashboard are platform-mapped, including MT4.ECN, MT4.VAR, MT5.ECN, and CT.ECN, with pricing that ranges from floating spreads around 0.7 pips on MT4.VAR to spreads from 0.0 pips on ECN-style accounts.

The minimum deposit is $10 and the maximum leverage is listed at 1:1000, while the minimum order size starts from 0.01 lot for all traders who complete the Trader’s Way registration process.

From a safety and compliance perspective, this broker states it applies internal AML and KYC processes for all Trader’s Way verification and references client fund segregation, but it does not operate under a major financial regulator and does not provide negative balance protection.

Trader’s Way deposit and withdrawal methods include, cryptocurrencies, e-wallets (including WebMoney), bank transfers, and local transfers.

On review platforms, Trustpilot shows a 4.5/5 rating based on 50 plus reviews, indicating mixed but generally positive user sentiment.

Account Types | MT4.ECN, MT4.VAR, MT5.ECN, CT.ECN |

Regulating Authorities | None |

Minimum Deposit | $10 |

Deposit Methods | Cryptocurrencies, E-wallets, Bank Transfers, Local Transfer Methods |

Withdrawal Methods | Cryptocurrencies, E-wallets, Bank Transfers, Local Transfer Methods |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader |

Trader’s Way Pros and Cons

The following table provides multiple pros and cons of trading with the Trade’s Way broker.

Pros | Cons |

Low entry barrier with $10 minimum deposit and micro lot trading from 0.01 lot | No regulation by recognized financial authorities (unregulated broker) |

Support for MetaTrader 4, MetaTrader 5, and cTrader platforms | No investor protection fund or compensation scheme |

High leverage availability up to 1:1000 | Past compliance issue including a 2016 cease-and-desist order in the United States |

ECN-style accounts with spreads from 0.0 pips on MT4.ECN, MT5.ECN, and CT.ECN | - |

What is WebMoney?

WebMoney, operated by WM Transfer Ltd. and launched in 1998, is a long-standing digital payment system and e-wallet infrastructure with a global user base exceeding 45 million accounts.

The platform is built around proprietary digital units known as WM units, each linked to a specific fiat currency, such as WMZ for USD and WME for EUR, enabling multi-currency fund storage and transfers within a single ecosystem.

At a structural level, WebMoney functions as a prepaid electronic money system. Users manage balances through currency specific wallets and are identified by a unique 12-digit WMID, which acts as the core account identifier across all services.

Transactions cover peer to peer transfers, online payments, service fees, and internal currency exchange, with many operations completed without repeatedly submitting personal data.

Security is enforced through encrypted communication and a tiered certification and verification framework. Access is provided via the WebMoney Keeper applications on desktop and mobile devices, as well as a web based interface.

Most transactions incur a standard fee of 0.8%, subject to a minimum charge. WebMoney does not operate in the US market.

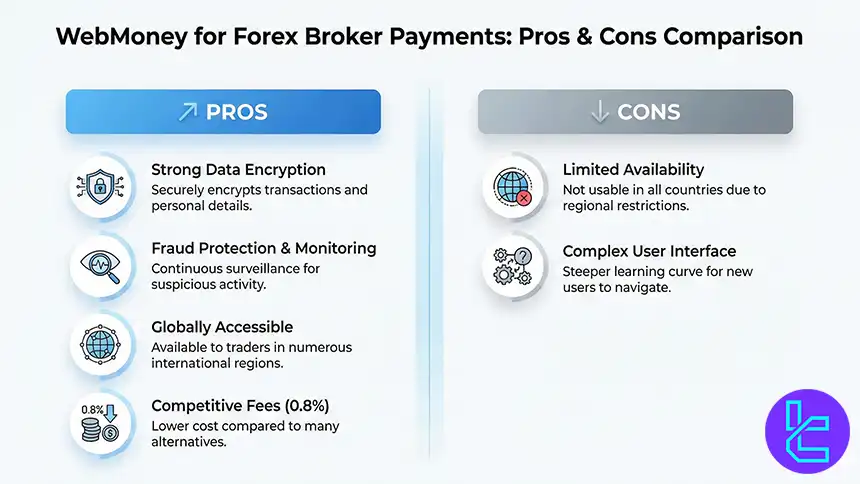

Pros and Cons of WebMoney

The table below offers a close look at the benefits and drawbacks of using WebMoney to transfer funds in and out of your trading account in a Forex broker.

Pros | Cons |

Safe Data Encryption | Geographical Restrictions |

Real-time monitoring and fraud protection | Complex user interface |

Global accessibility | - |

Low transaction fees (0.8% of the transfer amount) | - |

These advantages and disadvantages made WebMoney one of the most used payment methods in Forex brokers.

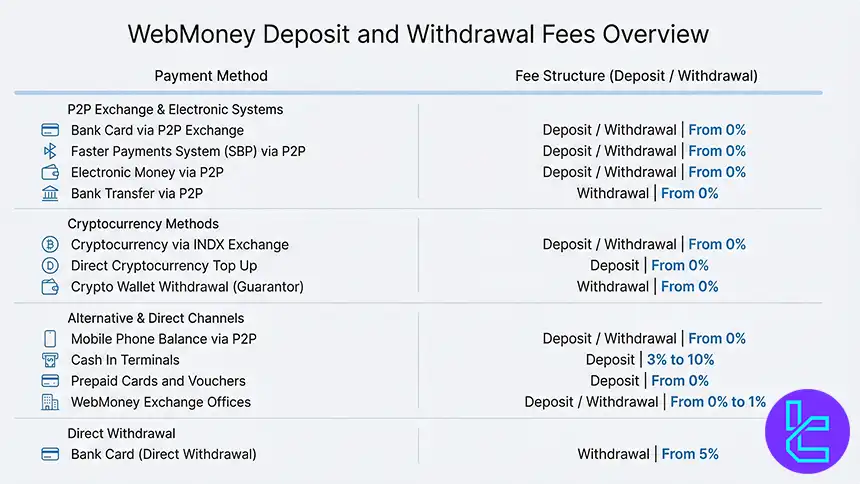

How Much WebMoney Charge Users for Making Transactions?

WebMoney applies a structured fee model for internal transfers, top ups, and withdrawals that directly affects traders using this payment system in Forex brokers. These charges are primarily based on transaction value, purse type, and the selected funding or withdrawal channel.

At the system level, WebMoney charges a standard commission of 0.8% per transaction, with a minimum threshold of 0.01 WMZ. This fee applies to most internal transfers.

However, transfers between identical purse types under the same WM identifier or WebMoney Passport may be exempt from this commission. In addition to core system fees, extra charges may apply when transactions require mobile phone confirmation.

Credit related operations involving D type purses are subject to a separate fee of 0.1%, with a minimum of 0.01 WMZ, which mainly affects users engaged in credit-based transfers.

Beyond internal commissions, deposit and withdrawal costs depend on external payment agents, including bank cards, P2P exchanges, electronic money providers, cryptocurrency gateways, terminals, and exchange offices.

These agents determine their own pricing structures, resulting in variable fees across different funding and payout methods.

Payment Method | Transaction Type | Fee Range |

Bank Card (via P2P Exchange) | Deposit / Withdrawal | From 0% |

Faster Payments System (SBP) via P2P | Deposit / Withdrawal | From 0% |

Electronic Money via P2P | Deposit / Withdrawal | From 0% |

Cryptocurrency via INDX Exchange | Deposit / Withdrawal | From 0% |

Direct Cryptocurrency Top Up | Deposit | From 0% |

Mobile Phone Balance via P2P | Deposit / Withdrawal | From 0% |

Cash In Terminals | Deposit | 3% to 10% |

Prepaid Cards and Vouchers | Deposit | From 0% |

WebMoney Exchange Offices | Deposit / Withdrawal | From 0% to 1% |

Bank Card (Direct Withdrawal) | Withdrawal | From 5% |

Bank Transfer via P2P | Withdrawal | From 0% |

Crypto Wallet Withdrawal (Guarantor) | Withdrawal | From 0% |

It’s important to note that all these fees are for WMZ transactions.

How Long Do WebMoney Deposits and Withdrawals Take?

Transaction processing times in WebMoney vary depending on the selected funding or withdrawal channel, intermediary agents, and verification status.

While some methods provide near instant execution, others require additional validation and settlement procedures, which may extend processing duration.

Understanding these timelines helps Forex traders manage liquidity, plan fund transfers, and avoid operational disruptions during active trading periods.

Payment Method | Transaction Type | Processing Time |

Bank Card via P2P Exchange | Deposit | Up to 1 day |

Faster Payments System (SBP) via P2P | Deposit | Up to 1 day |

Electronic Money | Deposit | Up to 1 day |

Cryptocurrency via INDX Exchange | Deposit | Around 1 hour |

Direct Cryptocurrency Top Up | Deposit | Around 1 hour |

Mobile Phone Balance via P2P | Deposit | Up to 1 day |

Cash In Terminals | Deposit | Online processing |

Prepaid Cards and Vouchers | Deposit | Online processing |

WebMoney Exchange Offices | Deposit | Online processing |

Bank Card (Direct) | Withdrawal | Up to 3 days |

Bank Card via P2P Exchange | Withdrawal | Up to 1 day |

Faster Payments System (SBP) via P2P | Withdrawal | Up to 1 day |

Bank Transfer via P2P | Withdrawal | Around 1 hour |

Crypto Wallet via Guarantor | Withdrawal | Around 1 hour |

Electronic Money via P2P | Withdrawal | Up to 1 day |

Mobile Phone Balance via P2P | Withdrawal | Up to 1 day |

Cryptocurrency via INDX Exchange | Withdrawal | Around 1 hour |

WebMoney Exchange Offices | Withdrawal | Online processing |

It is worth mentioning that the transaction times in various brokers differs based on the broker policies so traders must check the accurate data from the customer support of their chosen Forex broker.

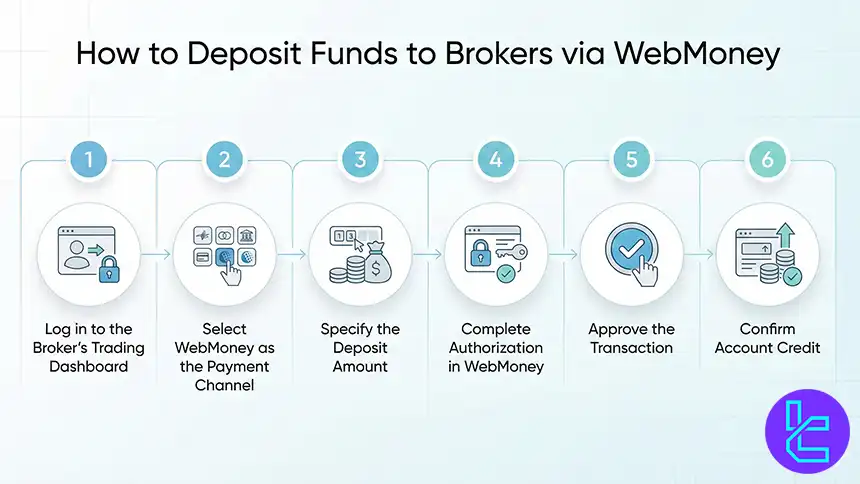

How to Deposit Funds to Brokers via WebMoney

Depositing funds through WebMoney allows traders to transfer capital to their Forex trading accounts through a secure digital payment infrastructure.

This process involves coordination between the broker’s client portal, the WebMoney Transfer system, and the user’s verified digital purse.

Before initiating a transaction, users should ensure that their WebMoney wallet, such as WMZ or WME, contains sufficient balance and is linked to a verified WebMoney Passport.

Here’s a step-by-step guide to fund your account via WebMoney:

- Log in to the Broker’s Trading Dashboard: Access your personal trading area through the broker’s official website and open the funding or payment management section;

- Select WebMoney as the Payment Channel: From the available deposit methods, choose WebMoney Transfer and confirm the wallet type that matches your account currency;

- Specify the Deposit Amount: Enter the desired funding amount and verify that your corresponding WebMoney purse, such as WMZ for USD based accounts, has adequate balance;

- Complete Authorization in WebMoney: You will be redirected to the WebMoney secure interface, where login credentials and security verification are required;

- Approve the Transaction: Review all transaction parameters and confirm the payment using SMS confirmation, E num authentication, or linked security tools;

- Confirm Account Credit: After successful verification, the transferred funds are processed and credited to the trading account, typically within a few minutes, subject to platform validation.

How to Withdraw Funds via WebMoney From Forex Brokers

Here’s how you can cashout funds via WebMoney from a Forex broker:

- Access the Trading Account Panel: Log in to your broker’s client portal and open the account management interface;

- Open the Withdrawal Section: Navigate to the finance, payments, or funds management area within the platform;

- Choose WebMoney as the Withdrawal Method: Select WebMoney Transfer and confirm the appropriate purse type, usually WMZ for USD denominated accounts;

- Provide Wallet and Amount Information: Enter the WebMoney ID, purse number, and the requested withdrawal amount;

- Submit and Verify the Request: Confirm the transaction and complete any required email, SMS, or platform-based verification;

- Wait for Broker Approval: Allow time for internal compliance checks and payment authorization procedures;

- Receive and Manage Funds: After approval, the funds are credited to the WebMoney wallet and can be transferred to banks, cards, or other supported services.

How to Choose the Best WebMoney Broker

Selecting a Forex broker that supports WebMoney requires careful assessment of regulatory status, transaction transparency, trading infrastructure, and operational reliability.

Traders should focus on licensed institutions that maintain clear compliance standards and integrate WebMoney Transfer within secure account funding systems.

Here are some of the key points to consider:

- Regulatory Oversight and Fund Protection: Prioritize brokers supervised by recognized authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), and Cyprus Securities and Exchange Commission (CySEC);

- Cost Structure and Payment Efficiency: Review both WebMoney’s standard 0.8 percent transaction fee and the broker’s internal deposit and withdrawal policies. Attention should be given to additional processing charges, conversion costs, and intermediary commissions;

- Trading Environment and Execution Model: Assess spreads, liquidity access, and execution frameworks, including ECN and STP models. Stable order routing and low latency infrastructure support consistent trade performance;

- Account Configuration and Risk Parameters: Compare minimum deposit requirements, leverage limits, margin policies, and account tier structures to ensure alignment with individual risk management strategies;

- Trading Platform: Confirm compatibility with widely used trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. Platform stability and third-party tool support contribute to operational efficiency;

- Market Reputation and User Feedback: Analyze independent reviews and performance records from sources such as Trustpilot, Forex Peace Army, and Myfxbook to identify recurring operational strengths or service limitations.

How Does WebMoney Compare to Other Payment Methods?

The table below helps traders understand the benefits and Drawbacks of using WebMoney for their broker transactions in comparison to other payment methods.

Parameter | WebMoney | Neteller | PayPal | Skrill |

Broker Acceptance | Limited; region-specific | Widely accepted, similar to WebMoney | Moderate; fewer Forex brokers support it | Widely accepted by Forex brokers |

Deposit Speed | Instant | Instant | Instant to same day | Instant to a few minutes |

Withdrawal Speed | Instant to same day | Same day to 24 hours | Fast, bank withdrawals may take longer | Same day to 24 hours |

Transaction Fees | Generally low | Low to moderate | Moderate to high in some cases | Low to moderate; broker-dependent |

Supported Currencies | Digital WM units (WMZ, WME, etc.) | Multiple fiat currencies | 25+ fiat currencies | 40+ fiat currencies |

Security & Compliance | Strong authentication, passport system | Strong KYC under Paysafe Group | High consumer protection, strong fraud control | Strong KYC, FCA-regulated provider |

Typical Forex Deposit Limits | Low minimums; depends on WM type | Low minimums; flexible limits | Often higher minimums and limits | Low minimums; broker-defined caps |

Regional Availability | Strong in Eastern Europe & CIS | Global, strong in Forex-friendly regions | Global but broker-limited | Global, strong in EU & Asia |

Conclusion

Based on our complete review of the best WebMoney brokers, Fusion Markets, FP Markets, PU Prime, VT Markets, NordFX, and IronFX offer the best services along-side WebMoney transactions.

Now traders must compare these brokerages, based on their trading strategy, risk/reward ratio, trading asset and finial vision to choose the best available option.

All brokers have been thoroughly evaluated based on TradingFinder Forex methodology considering broker’s regulations, spreads, commission, customer support, tradable assets and many more important factors.