- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

Regular Divergence in Technical Analysis; Bullish and Bearish Normal Divergence

Regular Divergence in technical analysis is one of the methods used to identify potential trend reversal points. This concept uses...

What Is the COT Report? [Monitoring Hedge Fund and Market Maker Positions]

In sentiment analysis (market sentiment evaluation), the COT (Commitments of Traders) report is one tool that provides data on...

Trading with Divergence in Technical Analysis: Regular and Hidden Divergence

Divergence in technical analysis is a tool used to identify potential changes in price trends. It utilizes indicators to detect...

Economic Recession - Causes, Early Signs, Market Impact

Recession is a phase in the economic cycle characterized by rising unemployment rates and weak consumer demand....

Price Action Training: Trend Analysis, Key Levels, Chart Patterns, and Candlesticks

Price Action analyzes price movement without the use of indicators. It focuses on raw price behavior to provide a clear,...

Support and Resistance Levels: Reversal Zones in Technical Analysis

Support and resistance are foundational concepts in technical analysis used in markets like Forex Market, stocks, Cryptocurrency, and...

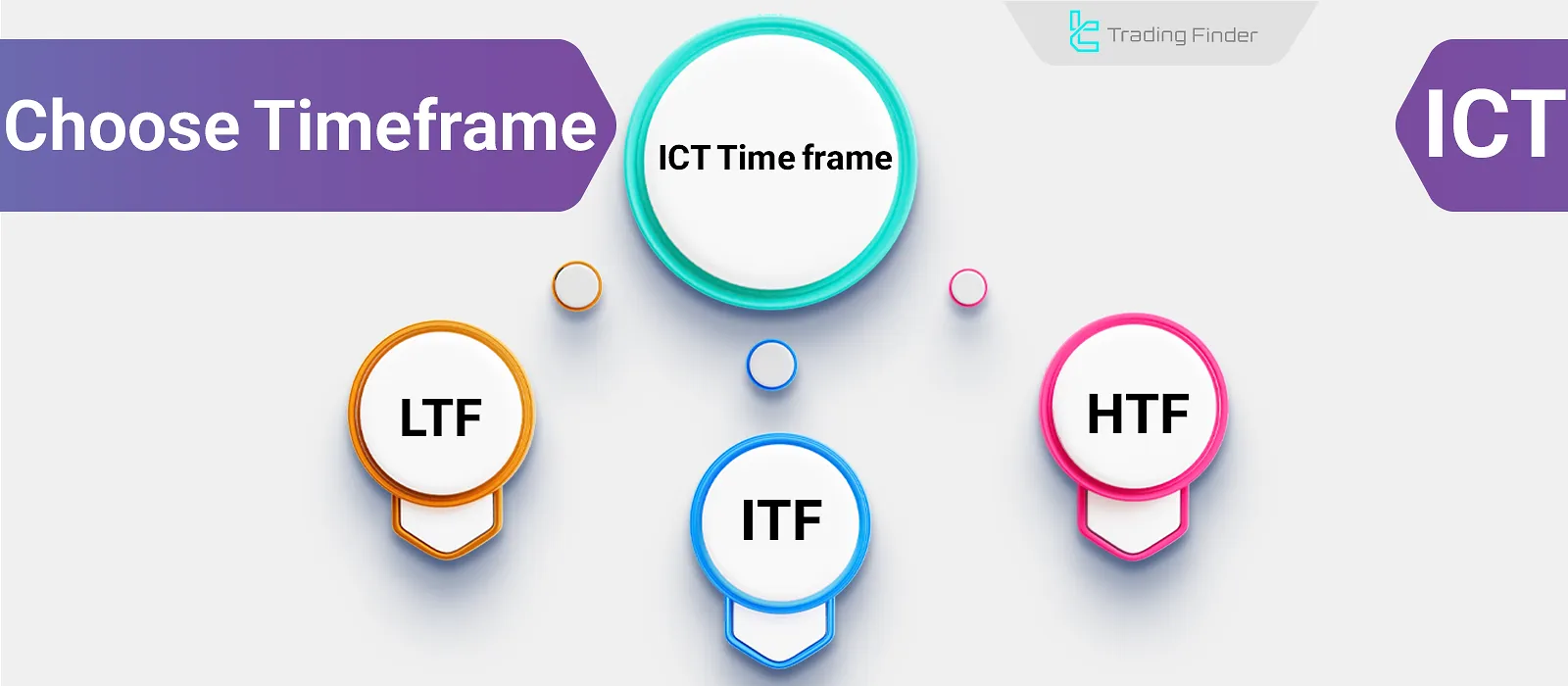

Choose Timeframe in ICT - Right Timeframes for Swing, Position, and Scalping

Market analysis based on ICT style is built upon a multi-timeframe approach; in this method, the trader first examines the Higher...

The Role of Expectations in Financial Markets: How Expectations Shape Prices

Expectations in financial markets are a key driver of price volatility before the actual data is released. In fact, traders buy...

Keltner Channel Indicator – The Use of the Keltner Channel in Technical Analysis

The Keltner Channel Indicator (KC) is constructed using the Exponential Moving Average (EMA) as the middle line, with the channel...

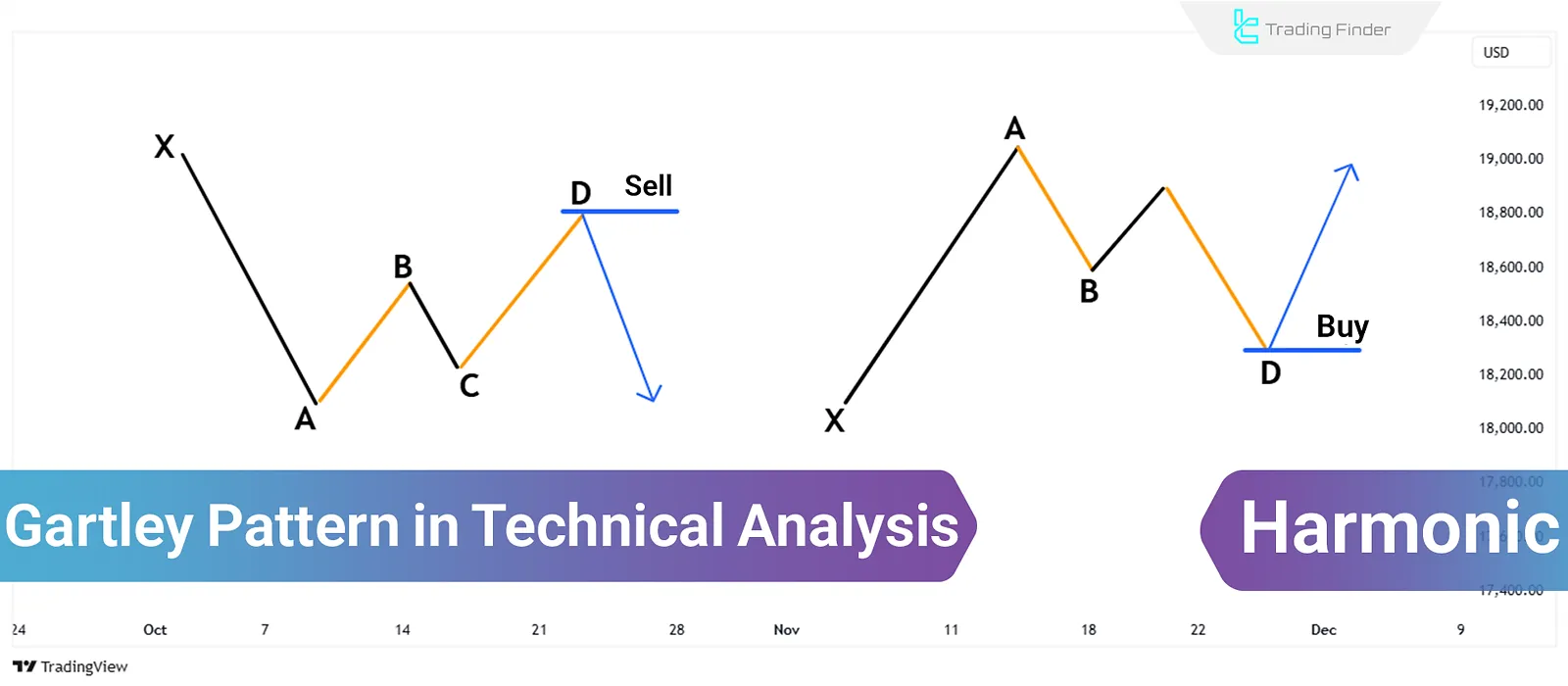

Gartley Harmonic Pattern; Four Price Movements Based on Fibonacci Ratios

The Gartley harmonic pattern in Forex Markets, introduced by Harold “McKinleyGartley”, identifies potential reversal points in...

Currency Correlation in Forex: Correlation Tables & How to Trade Using Them

Some currencies have positive or negative correlations with other assets due to their risk-on or risk-off nature. Currency...

Forex Trading Sessions: The Ultimate Guide to Asian, London & New York Markets

The operational hours of financial markets are broadly categorized into four sessions of Sydney, Tokyo, London, and New...

![What Is the COT Report? [Monitoring Hedge Fund and Market Maker Positions]](https://cdn.tradingfinder.com/image/343298/16-021-tf-en-what-is-cot-report-01.webp)