- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

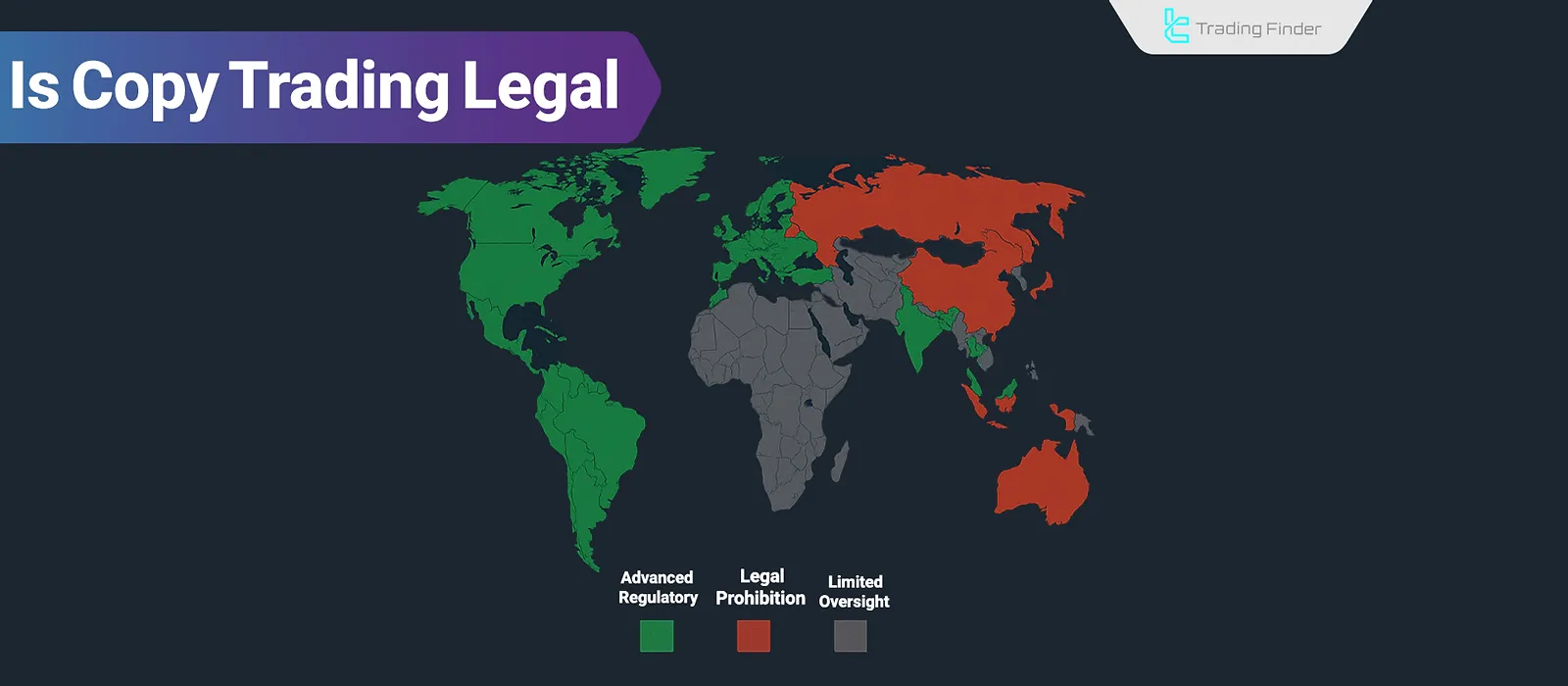

Is Copy Trading Legal? Global Overview of Copy Trading Legal Status

The legal status of copy trading varies from one country to another. For instance, in the United States, copy trading is only...

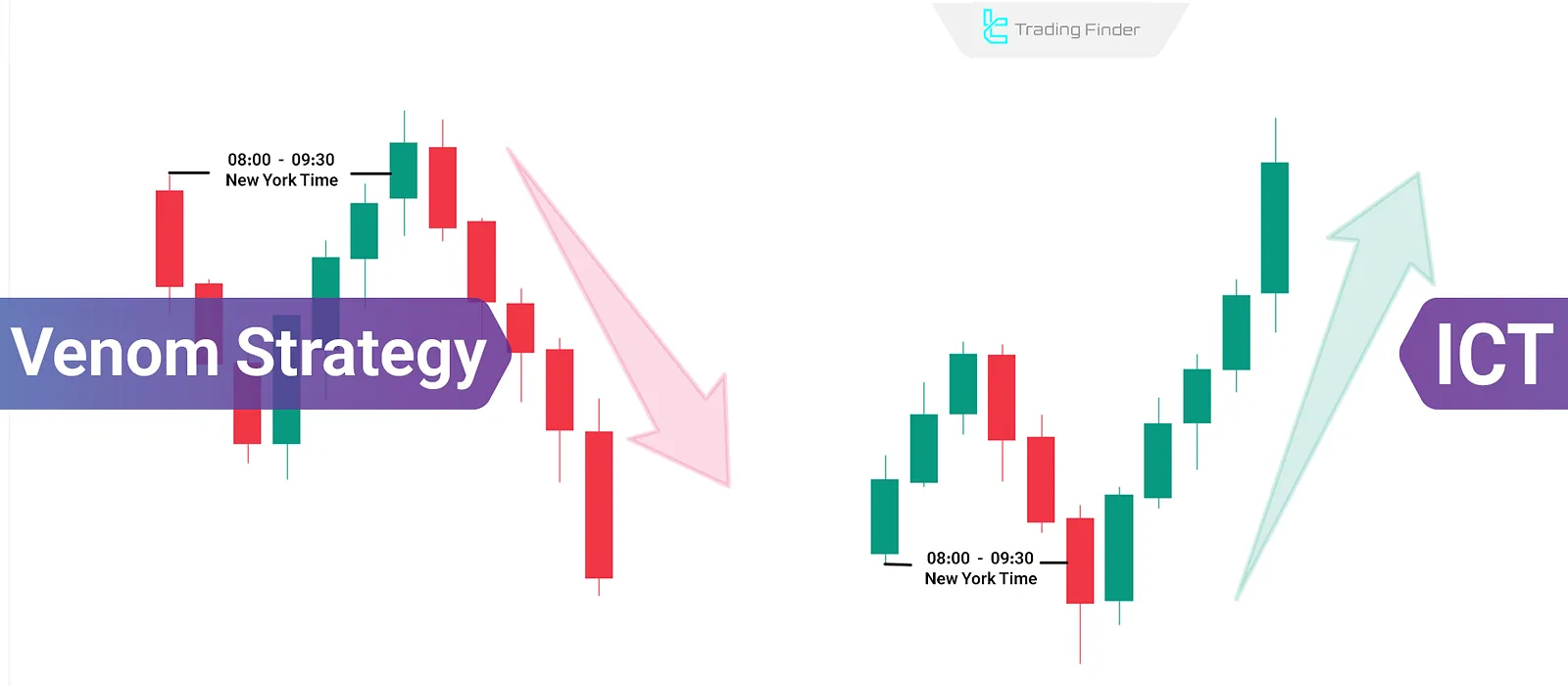

Venom Strategy in ICT Style; Intraday Trading on US Stock Indices

The Venom model (ICT Venom) is an advanced strategy in the ICT style, built upon three critical concepts of Liquidity, Time,...

What Is Copy Trading? Review and Introduction to the Best Copy Trading Platforms

Copy Trading is a branch of social trading that allows novice traders and investors to automatically replicate the trades of a...

Spread in Forex [BID and ASK Prices]; Fixed vs Floating Spread and Their Impact

In the Forex market, one of the trading costs that directly impacts the performance of trading systems is the Spread. The...

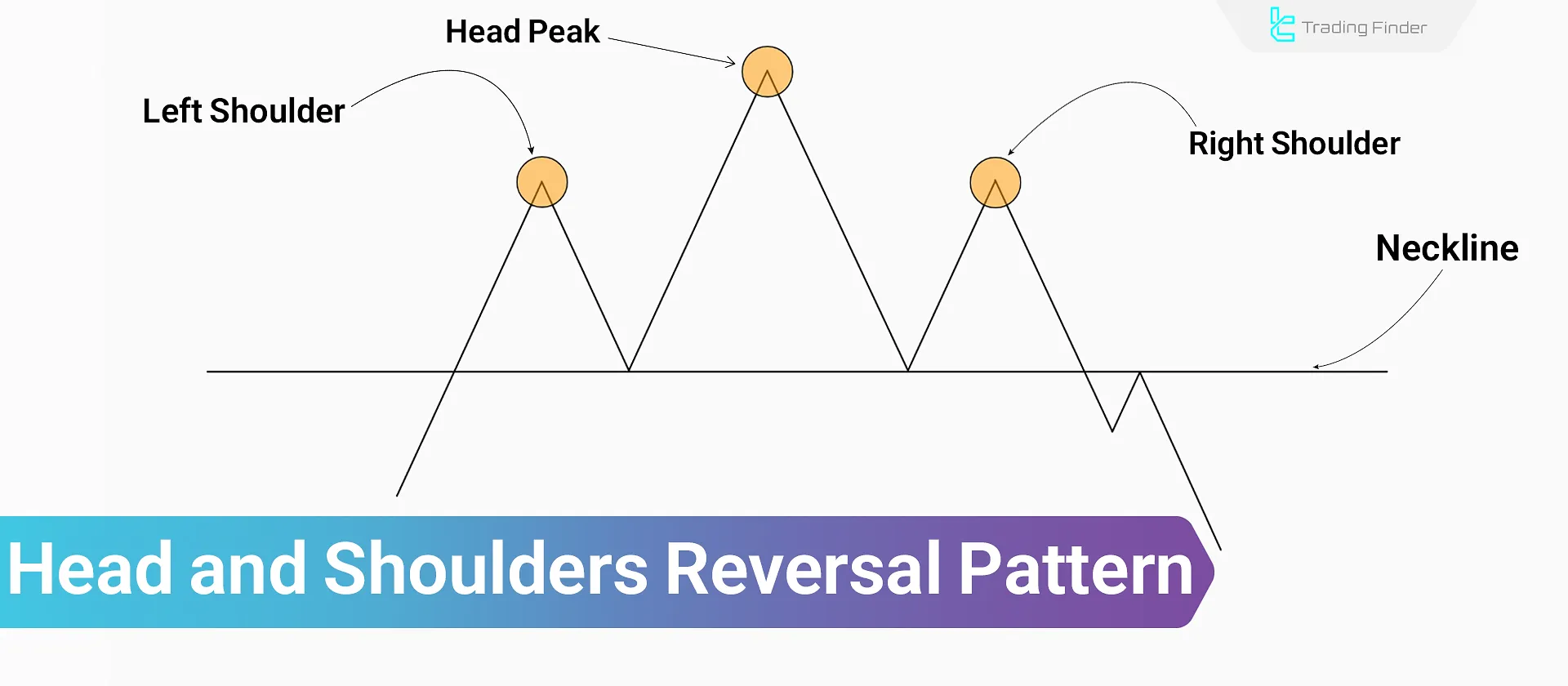

Head and Shoulders Pattern – A Combined Trading Strategy Using RSI Indicator

The head and shoulders pattern is among the classic reversal patterns that reflects shifts in supply and demand sentiment. This...

What Is Stop Loss and Take Profit? – Role in Risk and Capital Management

Placing stop loss and take profit orders on the trading platform helps determine the right time to exit a trade under...

Order Block with FVG Confirmation Strategy in ICT [SMC]

When traders miss the initial entry point and aim to enter in the middle of a trend, the ICT approach recommends re-entry...

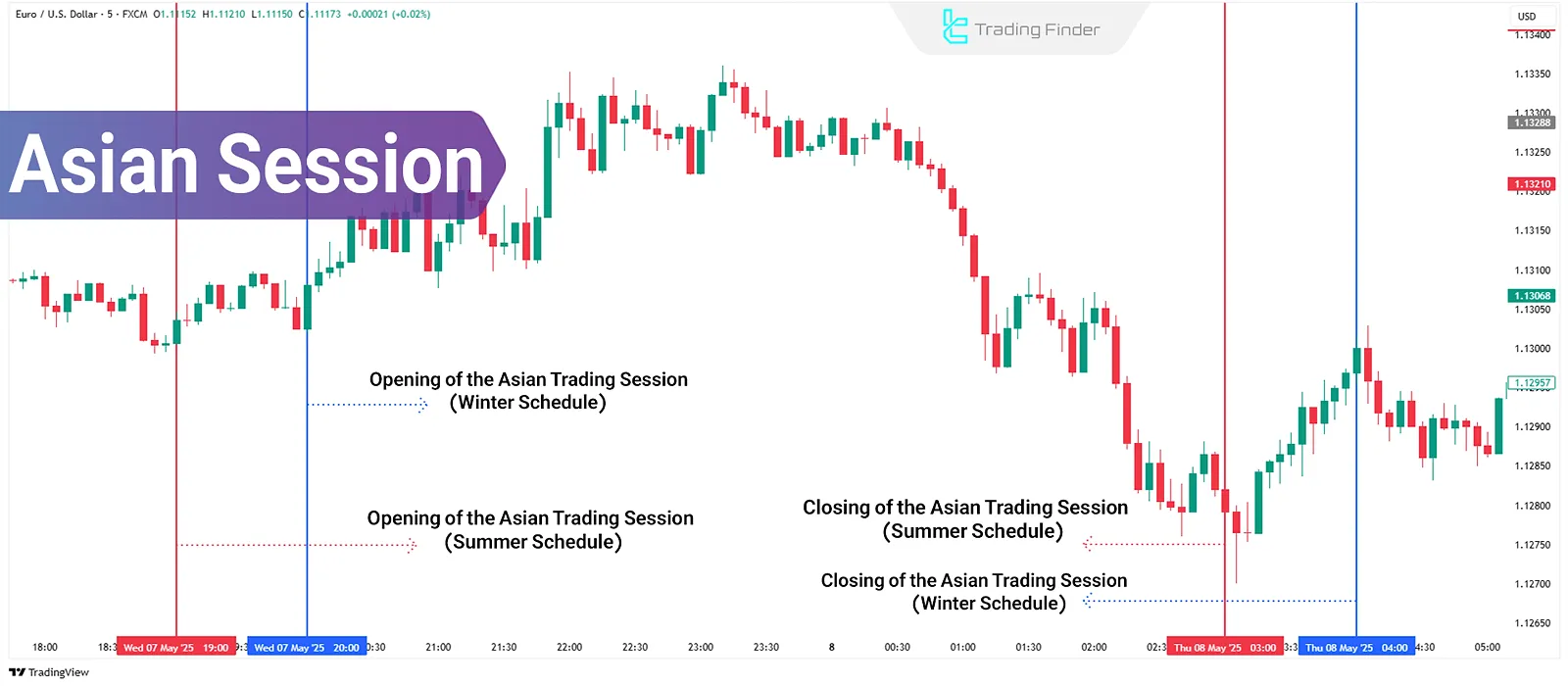

Asian Session Training; The First Active Phase of the Forex Market in 24 Hours

The Asian session sets the initial course of the market with the start of the trading day. Although the volume is lower...

Forex Market Hours: Best Trading Times & Days

The Forex market is a global marketplace for currency trading that operates 24 hours a day, five days a week (Monday to Friday)....

Trading Position: Types of Positions Based on Trade Direction and Holding Time

In financial markets, a position refers to an open trade an investor holds in a financial asset this trade can take the form...

What is CFD Contract? [Features of CFD Contracts on Stocks, Forex, and Crypto]

By using CFD contracts (Contract for Difference), traders can profit from price fluctuations without the need...

Leverage in Forex: Calculation Formula + Use in Scalping & Swing Strategies

Leverage in the Forex market allows traders to open larger positions using a small portion of their own capital, thereby...

![Spread in Forex [BID and ASK Prices]; Fixed vs Floating Spread and Their Impact](https://cdn.tradingfinder.com/image/410131/7-82-en-what-is-spread-01.webp)

![Order Block with FVG Confirmation Strategy in ICT [SMC]](https://cdn.tradingfinder.com/image/402972/06-11-en-trade-continuations-using-order-blocks-1.webp)

![What is CFD Contract? [Features of CFD Contracts on Stocks, Forex, and Crypto]](https://cdn.tradingfinder.com/image/391918/16-026-tf-en-what-is-cfd-01.webp)