![Anti Alternate Shark Harmonic Pattern Indicator MT4 - [TradingFinder]](https://cdn.tradingfinder.com/image/371105/2-63-en-anti-alternate-shark-harmonic-pattern-mt4-1.webp)

![Anti Alternate Shark Harmonic Pattern Indicator MT4 - [TradingFinder] 0](https://cdn.tradingfinder.com/image/371105/2-63-en-anti-alternate-shark-harmonic-pattern-mt4-1.webp)

![Anti Alternate Shark Harmonic Pattern Indicator MT4 - [TradingFinder] 1](https://cdn.tradingfinder.com/image/371106/2-63-en-anti-alternate-shark-harmonic-pattern-mt4-2.webp)

![Anti Alternate Shark Harmonic Pattern Indicator MT4 - [TradingFinder] 2](https://cdn.tradingfinder.com/image/371094/2-63-en-anti-alternate-shark-harmonic-pattern-mt4-3.webp)

![Anti Alternate Shark Harmonic Pattern Indicator MT4 - [TradingFinder] 3](https://cdn.tradingfinder.com/image/371107/2-63-en-anti-alternate-shark-harmonic-pattern-mt4-4.webp)

On July 2, 2025, in version 2, alert/notification and signal functionality was added to this indicator

The Anti Alternate Shark Harmonic Pattern Indicator is one of the advanced tools developed based on harmonic patterns in technical analysis, designed with a focus on deep reversal zones and overextended price behavior.

Unlike the classic Shark pattern, this version relies on structural changes in wavelength and direction to offer more precise reversal zones.

Anti Alternate Shark Harmonic Pattern Specifications Table

The features of the Anti Alternate Shark Harmonic Pattern Indicator are presented in the table below.

Indicator Categories: | Price Action MT4 Indicators Harmonic MT4 Indicators Candle Sticks MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Trend MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Intraday MT4 Indicators |

Trading Instruments: | Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Indicator Overview

The Anti Alternate Shark Harmonic Pattern Indicator typically forms at the end of strong market price movements and signals a potential trend reversal.

To confirm the pattern structure, the following Fibonacci ratios must be evaluated:

· XA and AB: Wave AB should retrace 1.13 to 1.618 of wave XA;

· BC: This wave should extend 1.618 to 2.24 times wave AB;

· CD: Point D, the potential reversal zone, is usually found at a 0.886 to 1.13 retracement of wave XA and is considered the key entry point.

Uptrend Conditions

In the 1-minute Bitcoin Cash price chart, the formation of a bullish Anti Alternate Shark Harmonic Pattern is identified when point D lies within the 0.886 to 1.13 Fibonacci range of wave XA.

If the price stabilizes within this zone, it indicates a strong reversal area, with the potential for a bullish correction toward levelsCand A.

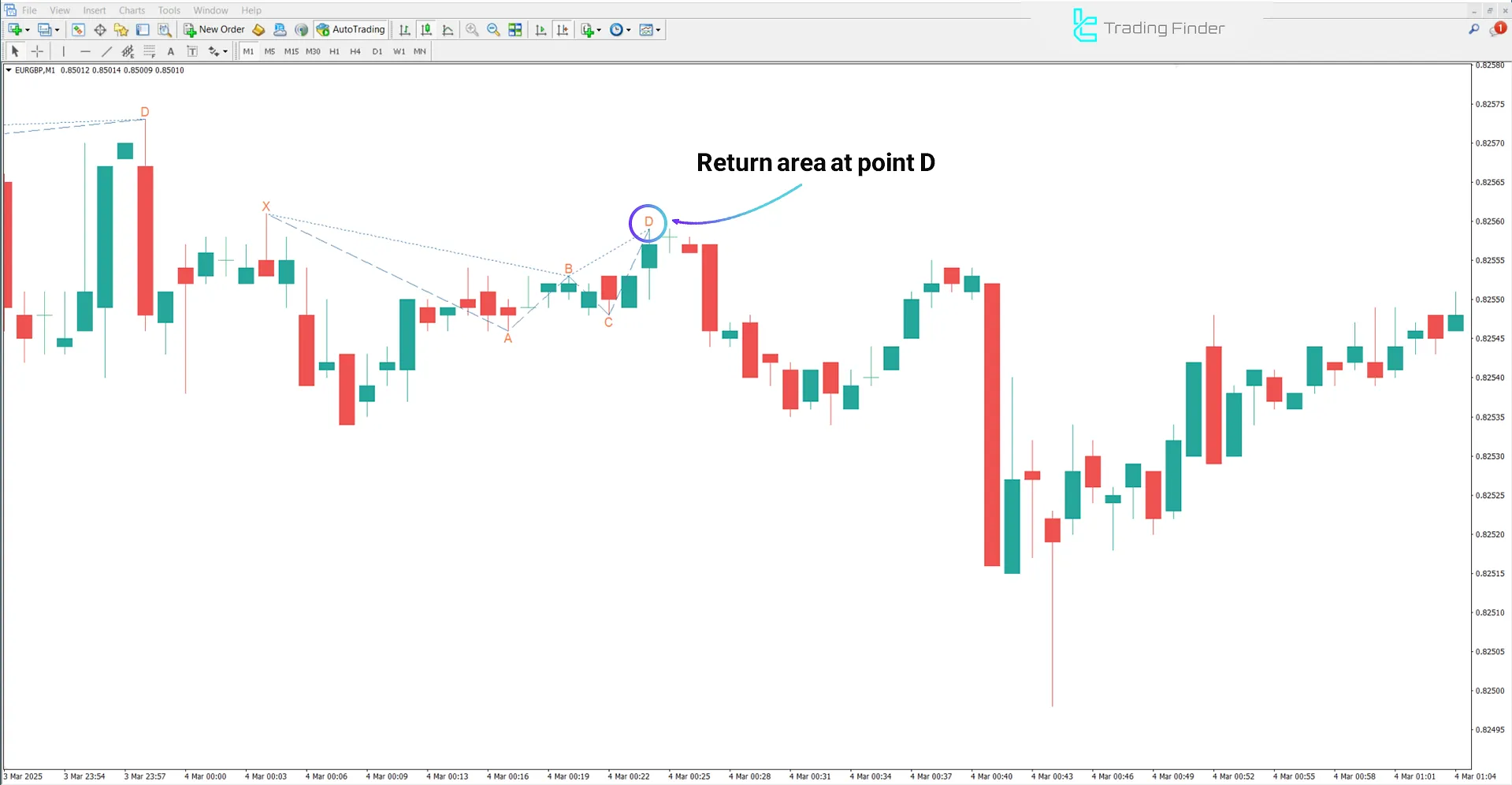

Downtrend Conditions

When the bearish Anti Alternate Shark Harmonic Pattern is applied to the EUR/GBP chart on a 1-minute timeframe, point D similarly appears in the 0.886 to 1.13 Fibonacci range of wave XA.

This area is identified as a reversal zone and a valid entry point for sell positions on the upward path.

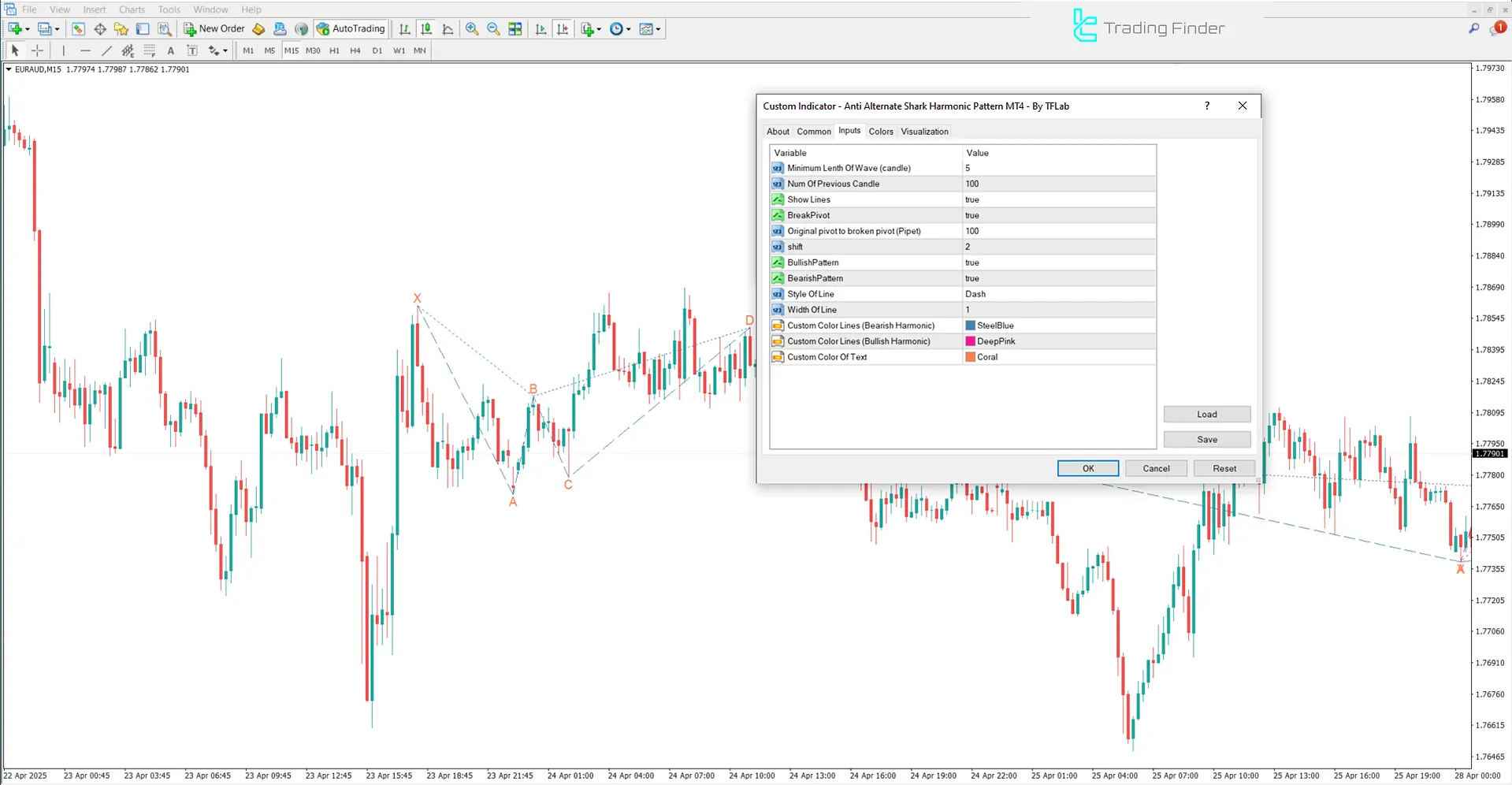

Anti Alternate Shark Harmonic Pattern Indicator Settings

The image below shows the customizable settings of the Anti Alternate Shark Harmonic PatternIndicator:

- Minimum Length Of Wave (candle): Minimum wavelength (in candles)

- Num Of Previous Candle: Number of previous candles to analyze

- Show Lines: Display pattern lines

- Break Pivot: Pivot breakout

- Original pivot to broken pivot (Pipet): Distance between original and broken pivot

- Shift: Horizontal shift

- Bullish Pattern: Enable bullish pattern detection

- Bearish Pattern: Enable bearish pattern detection

- Style Of Line: Line style

- Width Of Line: Line thickness

- Custom Color Lines (Bearish Harmonic): Custom color for bearish harmonic lines

- Custom Color Lines (Bullish Harmonic): Custom color for bullish harmonic lines

- Custom Color Of Text: Custom color for on-chart labels

Conclusion

The Anti Alternate Shark Harmonic Pattern Indicator is a tool for identifying market reversal zones based on Fibonacci ratios within the XABCD structure.

Once the harmonic pattern is fully formed and point D is plotted, the indicator defines the reversal area, which serves as a technical basis for entry or exit in both bullish and bearish scenarios.

Anti Alternate Shark Harmonic MT4 PDF

Anti Alternate Shark Harmonic MT4 PDF

Click to download Anti Alternate Shark Harmonic MT4 PDFHow is this indicator different from the classic Shark pattern?

The main difference lies in the Fibonacci ratios used and the position of point D relative to wave XA.

Can false signals be filtered?

Yes, you can avoid entering weak or invalid positions by focusing on point D and ensuring the XABCD structure is fully formed.