![ATR Channel Indicator MetaTrader 4 Download - Free - [Trading Finder]](https://cdn.tradingfinder.com/image/94386/13-3-en-atr-channel-mt4-1.webp)

![ATR Channel Indicator MetaTrader 4 Download - Free - [Trading Finder] 0](https://cdn.tradingfinder.com/image/94386/13-3-en-atr-channel-mt4-1.webp)

![ATR Channel Indicator MetaTrader 4 Download - Free - [Trading Finder] 1](https://cdn.tradingfinder.com/image/92427/13-3-en-atr-channel-mt4-2.webp)

![ATR Channel Indicator MetaTrader 4 Download - Free - [Trading Finder] 2](https://cdn.tradingfinder.com/image/92429/13-3-en-atr-channel-mt4-3.webp)

![ATR Channel Indicator MetaTrader 4 Download - Free - [Trading Finder] 3](https://cdn.tradingfinder.com/image/92428/13-3-en-atr-channel-mt4-4.webp)

The ATR Dynamic Channel indicator is an advanced technical analysis tool. This highly MT4 volatile indicator is used to identify market volatility and detect price trends.

By combining adaptive algorithms and creating dynamic price channels, this indicator enables more precise market analysis. One of the features of the ATR Channel indicator is its ability to identify optimal buy and sell points while reducing trend identification errors.

Indicator Specifications

Indicator Categories: | Price Action MT4 Indicators Volatility MT4 Indicators Bands & Channels MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Range MT4 Indicators Trend MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Fast Scalper MT4 Indicators Scalper MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Indices Market MT4 Indicators Commodity Market MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

ATR Channel Indicator Overview

TheATR Channel Indicator creates three higher and three lower channels from the moving average, giving traders access to dynamic and adaptable channels that fit market volatility.

These channels continuously adapt and update as market conditions change. With this tool, traders can adjust Stop Loss and Take Profit points more accurately, leveraging sudden market shifts.

Uptrend Conditions

In a 4-hour time frame Bitcoin (BTC) chart during an uptrend, the ATR Channel Indicator confirms the strength and stability of the upward trend by forming price channels above the moving average.

In this scenario, the price consistently approaches the top of the channel, indicating the market's tendency to move upwards. The widening gap between the channels and the price suggests increasing buying power in the market. This indicator helps identify optimal Entry points for buy trades during the uptrend.

Downtrend Conditions

In the 1-hour time frame EUR/USD chart during a downtrend, the ATR Channel Indicator forms price channels below the moving average, indicating market weakness and selling pressure.

In this case, prices continually move toward the bottom of the channels, signaling the market's inclination to decline further.

The narrowing gap between the channels and the price indicates increased selling pressure and decreased buying power. This indicator helps analysts identify optimal Exit points from buy trades or Entry points into sell trades.

Settings

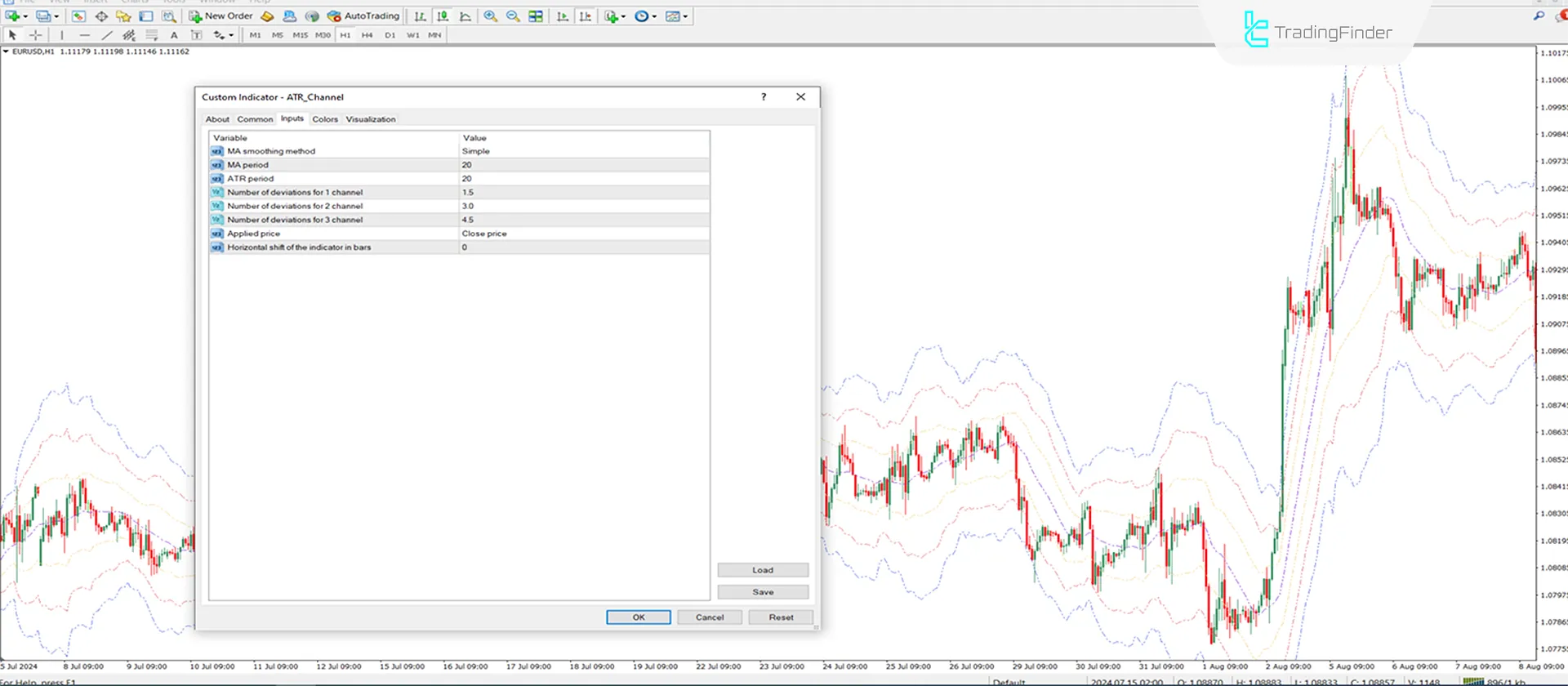

- MA smoothing method: Here, you can change the type of MA;

- MA period: The number of candles in the moving average calculation is set to 20;

- ATR period: The number of candles used to calculate the Average True Range is 20;

- Number of deviations for 1 channel: The width of channel 1 is set to 1.5;

- Number of deviations for 2 channels: The width of channel 2 is set to 3.0;

- Number of deviations for 3 channels: The width of channel 3 is set to 4.5;

- Applied price: The indicator's calculations are based on the closing of candles;

- Horizontal shift of the indicator in bars: The horizontal shift of the indicator is disabled;

- Theme: Theme settings in the indicator.

Conclusion

The ATR Dynamic Channel indicator, by providing accurate analysis and adapting to different market conditions, is an effective trading tool for identifying entry and exit points. In general, using the ATR Channel can help analysts and traders improve their performance in financial markets.

ATR Channel MT4 PDF

ATR Channel MT4 PDF

Click to download ATR Channel MT4 PDFWhich time frame does the ATR Channel Indicator work best in?

This indicator performs well in all time frames with no limitations.

Which market is the ATR Channel Indicator best suited for?

This indicator is applicable and functional in all markets.